AR Automation Software: A Complete Guide to Choosing Automated Accounts Receivable Systems

- 20 min read

This guide has everything you need (yes, even checklists!) to confidently choose the best accounts receivable automation software.

Table of contents:

Introduction: why automate accounts receivable now?

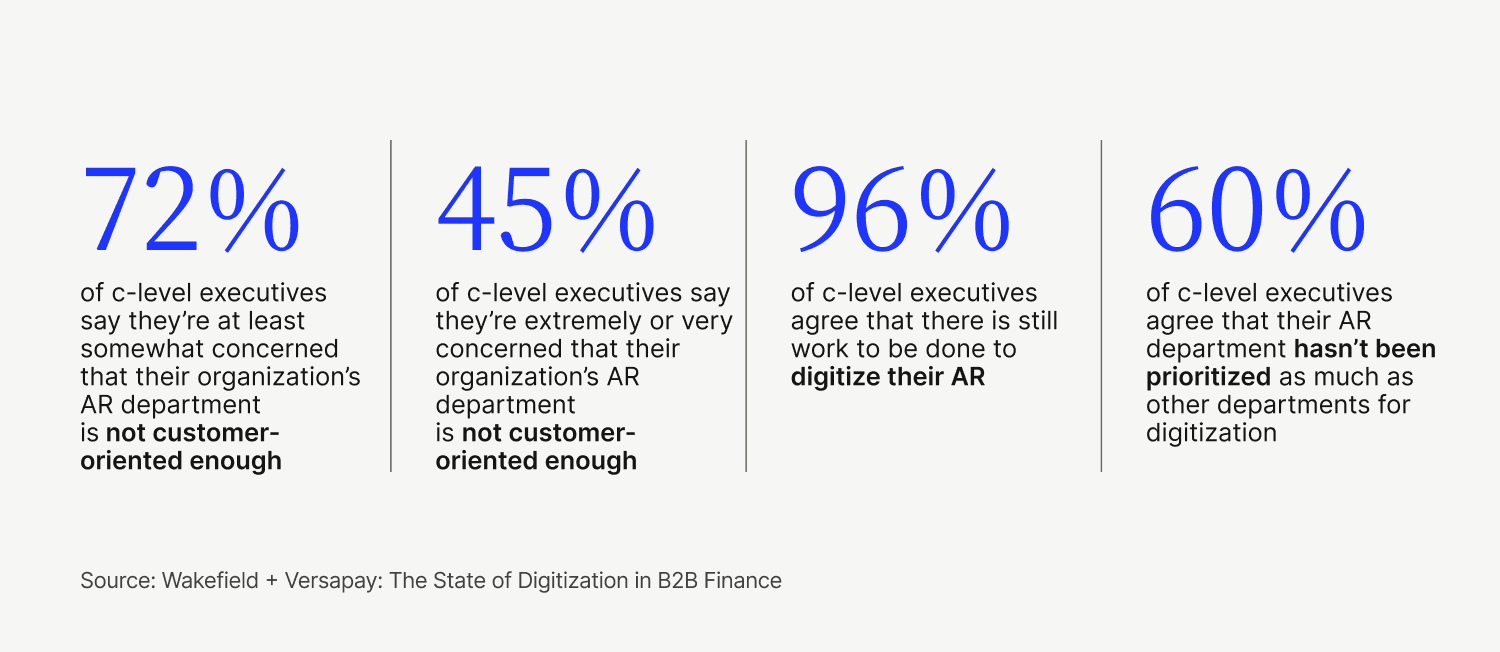

Of the 1,000 C-level executives we recently surveyed, 96% agreed that there's still work to be done to digitize their accounts receivable (AR).

For businesses looking to do more with less while remaining relevant, gaining that coveted competitive edge, and positioning themselves for sustained growth, many are turning to digital transformation projects—and rightfully so. There’s a wealth of benefits to be gained through modernizing your infrastructure, optimizing existing business processes, focusing on delivering exceptional customer experiences, and freeing your workers to prioritize more strategic, impactful work.

However, it’s only now that accounts receivable is getting its moment in the sun.

Why? Well, up until recently, it simply has been deprioritized in favor of other, more-seemingly lucrative digitization projects—as evidenced by the 60% of executives who agree that their company’s AR departments haven’t been prioritized as much as other departments for digitization.

And since AR digitization is still fairly new, most businesses looking to automate accounts receivable understandably have many questions that need answering.

And that’s why we’ve written this guide! To teach what value there is in AR automation and how to choose the best accounts receivable automation software. Buckle up—and save this to your bookmarks!—because this guide has everything you need, and then some, to help you confidently automate accounts receivable.

What is accounts receivable automation software (and why do you need it)?

Accounts receivable automation software is software—typically deployed on-premises or in the cloud—that helps you streamline how you perform common accounts receivable processes, like:

Generating invoices

Delivering them to your customers

Accepting and processing payments

Matching and applying those payments to open invoices

Ensuring financial reporting accuracy

These solutions will ease your burden of manual, administrative tasks so your AR team can operate with greater efficiency. Watch this video for a crash course on automated receivables:

As for why businesses automate accounts receivable? It’s because they want to reduce manual labor or accelerate their cash flow. Yes, there are other reasons—including the benefits we list below—but these are the most common objectives. This is important, because organizations today face some of the most challenging headwinds in decades—not hyperbole.

99% of executives in that same survey agree that forces outside of their control are creating major headaches for their business. This is increasing the pressure on their AR department’s performance to close the gap. Automated accounts receivable software is swiftly becoming a necessity.

What are the challenges of manual accounts receivable collections?

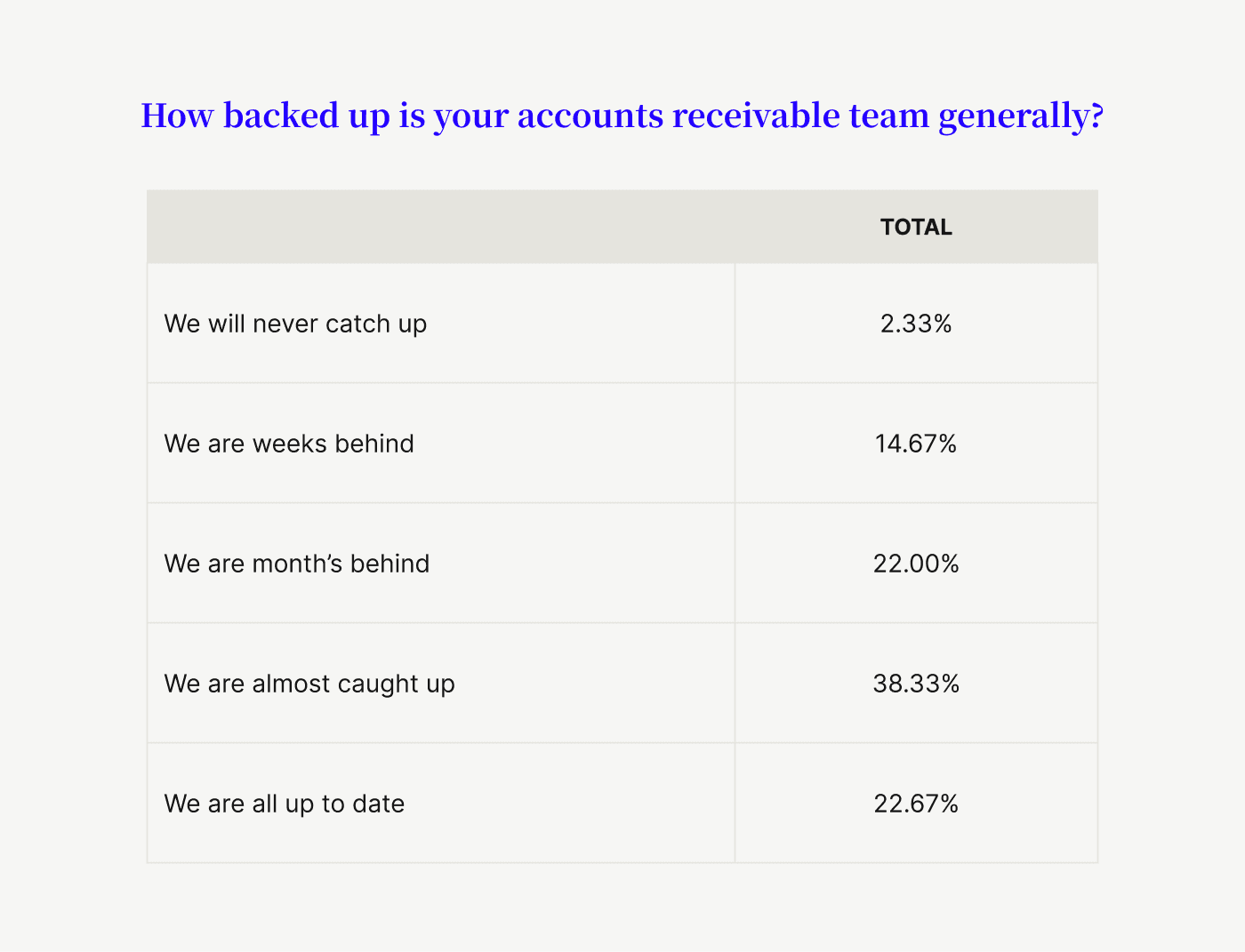

Maximizing accounts receivable performance requires a deft combination of elite efficiency, productivity, and yes, even customer service. Unfortunately, performing your collections activities manually makes finding that combination near impossible—as evidenced by the 77% of collections teams that aren’t up-to-date.

This is because when accounts receivable processes are strictly manual, they compound the difficulties your collections team deals with day in and day out.

While there are innumerable issues with manual accounts receivable—here’s a breakdown of the most common problems faced today—most fall within these four categories:

Outdated processes that create errors and delay payments

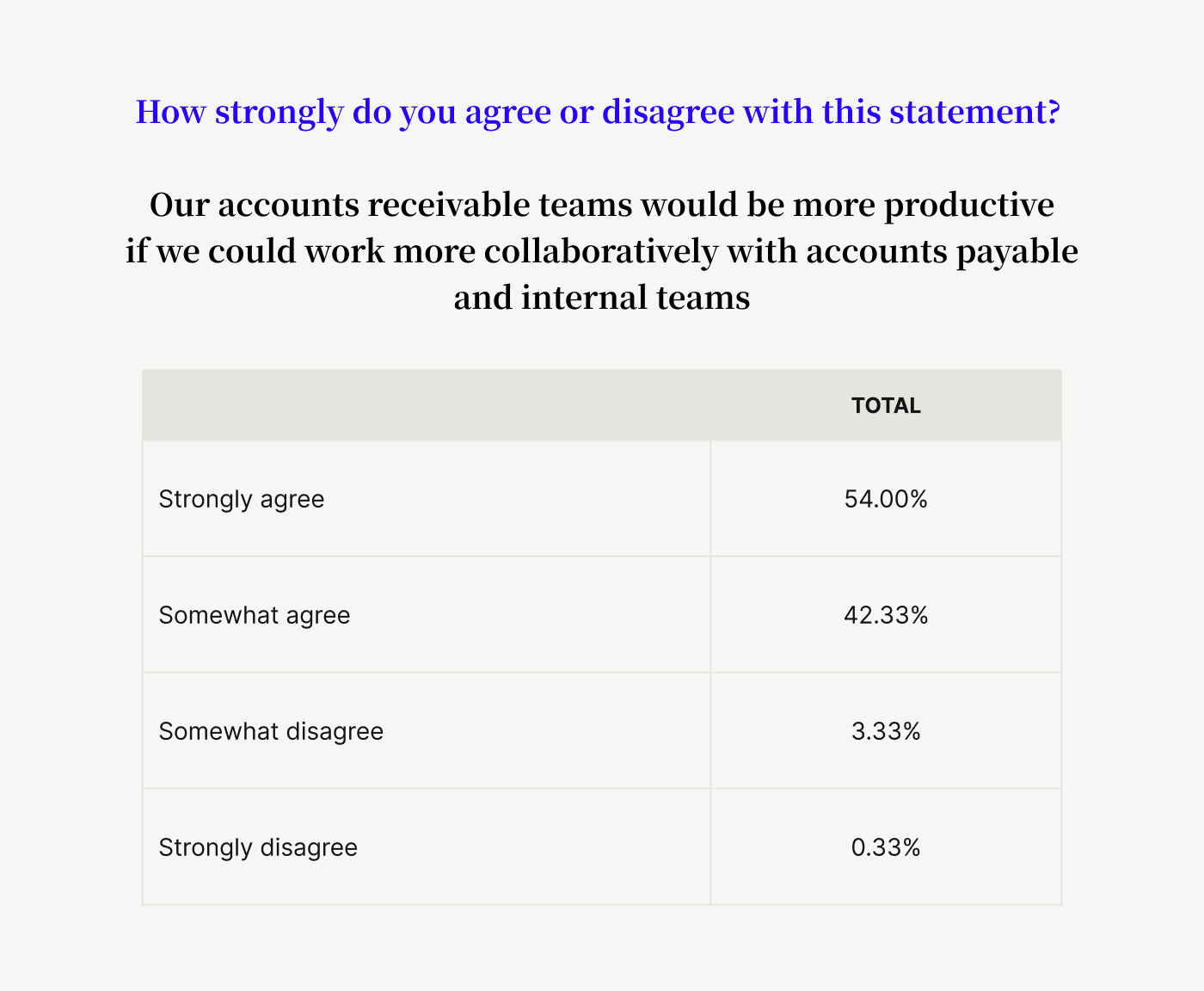

A lack of collaboration that creates inefficiencies and frustrates customers

Insufficient resources that create burnout and take people from higher-value work

Inconsistent policies that create misalignment across departments

Resource constraints, system limitations, and inconsistent policies and procedures can all impact your team’s ability to operate at a level that approaches perfection. Luckily, automated accounts receivable systems make overcoming these challenges easy.

4 benefits of accounts receivable automation software

We teased earlier the rationale behind businesses choosing to automate accounts receivable, but the list of benefits is truly astounding. We've consolidated the benefits of accounts receivable process automation for you into the key points below. Feel free to watch this 3-minute video instead:

AR automation benefit 1. Accelerated cash flow

Healthy cash flow is worth its weight in gold—or checks... or credit cards... or wire transfers? But actually having more cash flowing in than out—the essentials of sustainability—is easier said than done. Many businesses routinely burn through cash more rapidly than they bring it in—especially those in growth mode, or in the face of a tumultuous economy.

The ugly truth is money and expansion are not forever (only diamonds are), and not having positive cash flows means not having enough cash on hand to capitalize on lucrative opportunities when they arise. Even business as usual can be compromised when cash flows are stagnant.

Here’s where accounts receivable automation can be used as a strategic lever. How quickly you collect cash hinges on the efficacy of numerous accounts receivable activities. Unfortunately, as we now know, manual processes hamper all critical receivables activities like invoicing, payment acceptance and processing, and collections management.

In choosing to automate accounts receivable, businesses can more accurately assess the state of receivables and gain considerable advantages over those still reliant on antiquated processes.

AR automation benefit 2. Increased efficiencies and visibility

Efficiency is deceptively simple. It is, after all, just a measure of productivity. Your collections staff, however, will forever struggle to maximize their productivity if they’re constrained and burdened by manual accounts receivable processes. Doing more with less should be on every business’ to-do list. For by doing so, they:

Lower days sales outstanding

Decrease billing and invoicing errors

Allocate more hours to strategic work

Lower employee turnover rates

With automated AR tools, complete digitization of virtually all routine accounts receivable tasks—those processes that slow down your ability to collect payments—is achievable. For example, here’s how automating accounts receivable can positively impact three crucial collections activities:

1) Payment acceptance — a digital payment process helps you quickly collect billing information and encourages your customers to pay securely using their preferred methods.

2) Invoicing — automated accounts receivable will allow you to satisfy the invoicing needs of your customers and save you immense time manually preparing and delivering invoices.

3) Cash application — acquiring the ability to automate payment matching will allow you to capture and reconcile payment data and eliminate data entry errors.

AR automation benefit 3. Easier to attract and retain talent

We surveyed 162 finance leaders to understand how automated accounts receivable software enables long-term remote work and equips staff with what they need to add the greatest value to their companies. Respondents resoundingly agreed (75%) that by automating accounts receivable, they can increase bandwidth for their accounting and finance teams to take on strategic initiatives. Another 73% cited an improved ability to attract and retain accounting and finance talent as a benefit.

For CFOs, AR automation software can be the solution to their talent attraction and retention woes. Specifically, it aids CFOs in the following ways:

Digitizing billing and payment processes helps staff maintain continuity while working from home. The ability to send invoices, request payments, and communicate more effectively with customers from anywhere crucially allows accounts receivable teams to embrace an operating model that’s more desirable than ever.

Through automated accounts receivable, you eliminate much of the tedium from the collections process. Many mundane tasks—like printing invoices and stuffing envelopes or manually processing card details over the phone—become obsolete, making for more enjoyable days.

Once no longer burdened by administrative mundanities, accounts receivable automation software empowers AR professionals to take on more strategic work, enriching their involvements and opening opportunities for career advancement.

AR automation benefit 4. Better customer experiences

Your customers are the lifeblood of your business. So, it should come as no surprise that C-level executives widely agree that customer experience is an important component of their AR process. Interestingly, those same executives have clearly identified that the invoice to cash process—when gone unchecked—can negatively impact CX.

Accounts receivable automation solutions are known to strengthen customer relationships and simultaneously contribute to improved CX across the invoice to cash process. It can do so, by bridging the AR Disconnect—the chasm that forms between you and your customers during the payment process. Manual AR processes tend to lack transparency into receivables and are rife with ineffective communication methods. By automating accounts receivable—with the right tools—you can circumvent this disconnect and deliver better experiences.

Features to look for in accounts receivable automation software [checklists included]

All accounts receivable automation software works differently. There are a lot of vendors; each touting different capabilities; each specializing in something unique; each promising something different. It’s important you find an accounts receivable automation solution that fits your exact needs.

And, assuming you intend to grow and evolve your business, it’s vital you partner with an AR automation vendor that’s capable of growing with you, too. The last thing you want is to have to compromise on your digitization goals because the solution you ultimately select is incapable of supporting them.

Below are 12 evaluation criteria buckets designed to help you cut through the noise when choosing accounts receivable automation software. Each has its own checklist, so you know just what features to look for during your search.

Click on the evaluation criteria to jump straight to it:

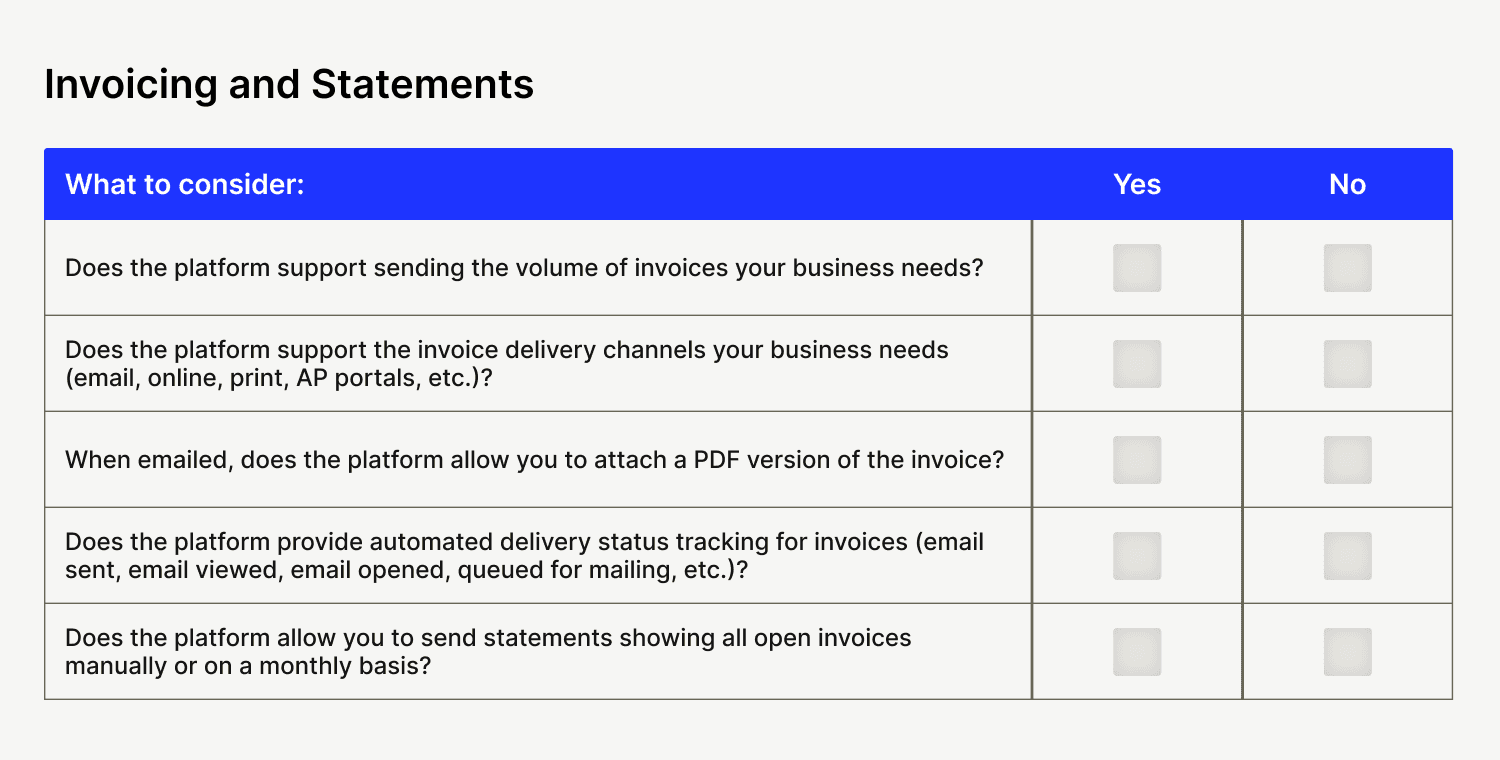

1. Invoicing and statements

Looking to automate invoice delivery across all channels? Here’s what you should look for:

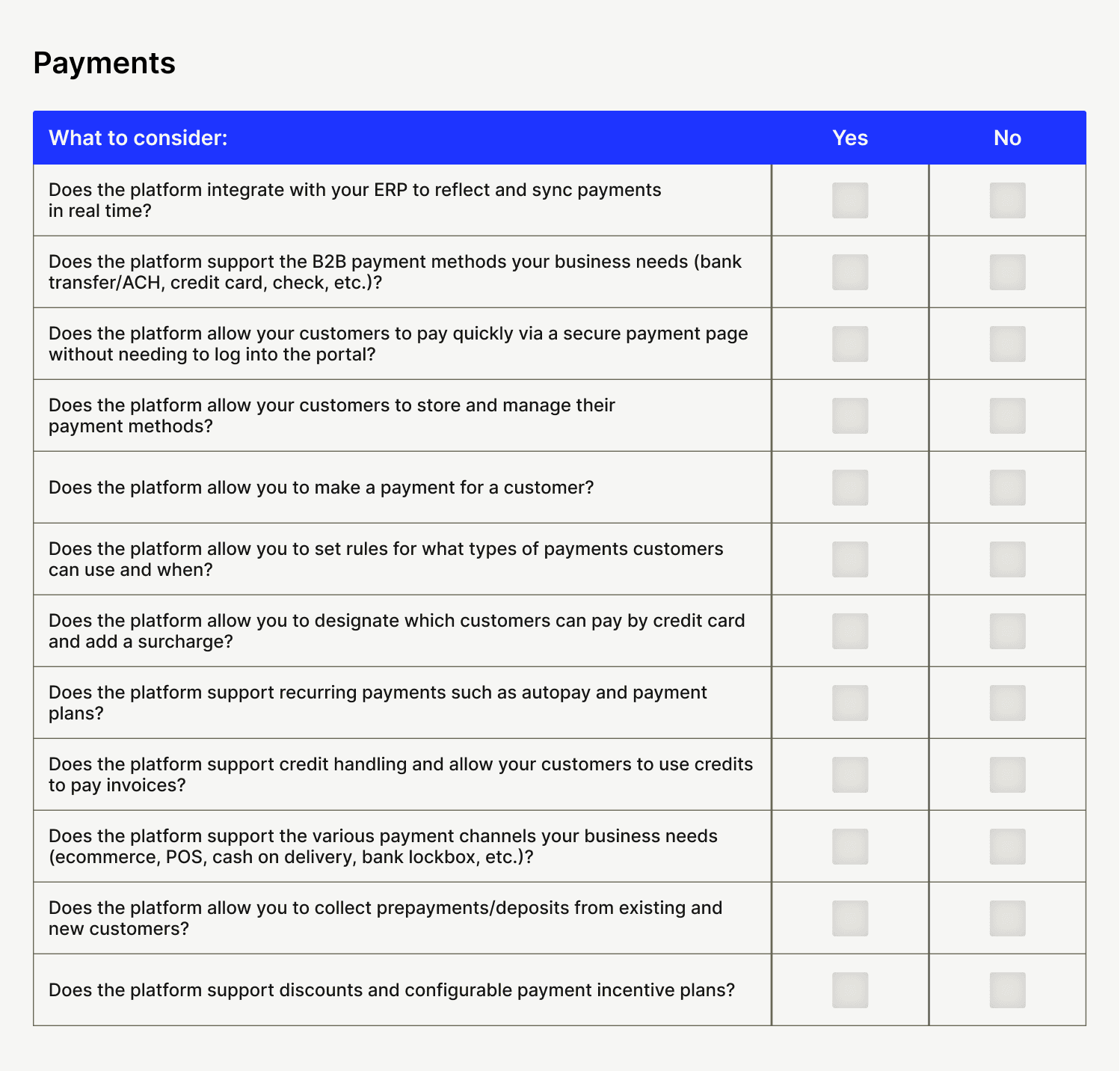

2. Payments

Looking to easily facilitate business-grade online payments and give your customers the convenient payment experience they expect? Here’s what you should look for:

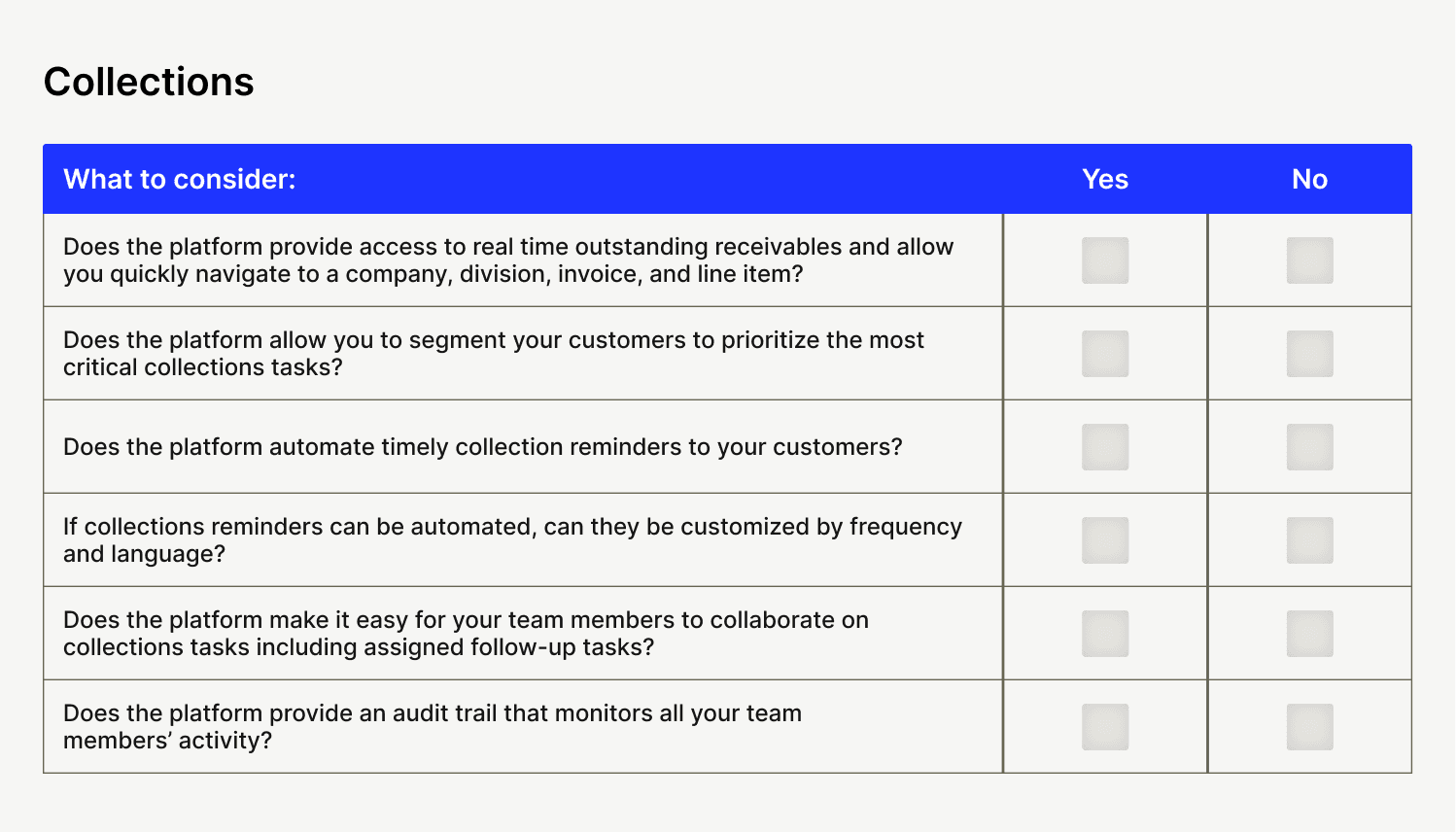

3. Collections

Looking to take the work out of accounts receivable collections? Here’s what you should look for:

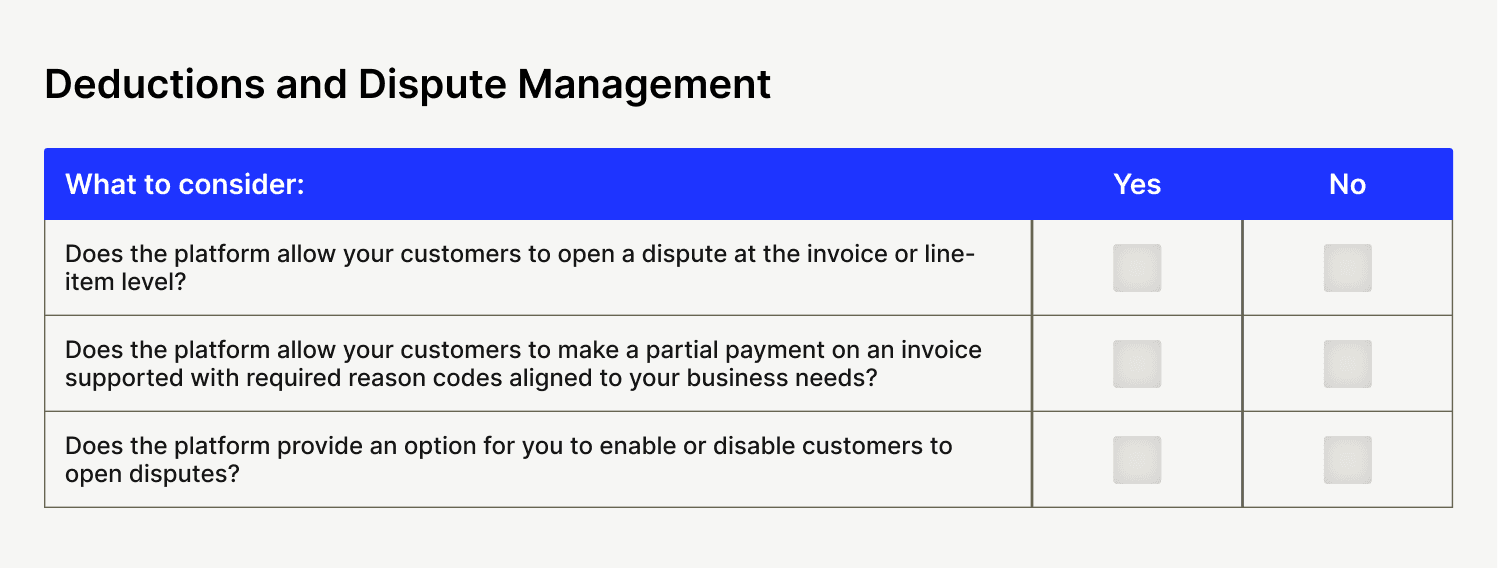

4. Deductions and dispute management

Looking to track, manage, and resolve disputes more efficiently and capture more revenue? Here’s what you should look for:

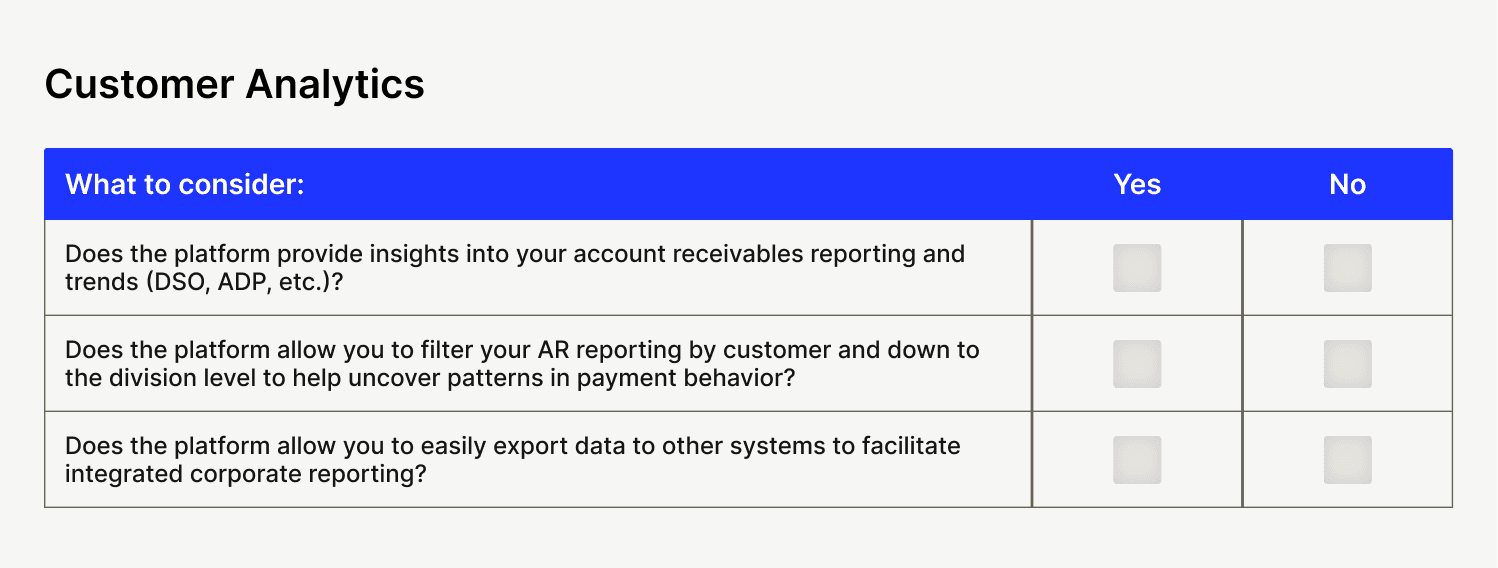

5. Customer analytics

Looking to understand your accounts receivable successes and performance and find new areas for improvement? Here’s what you should look for:

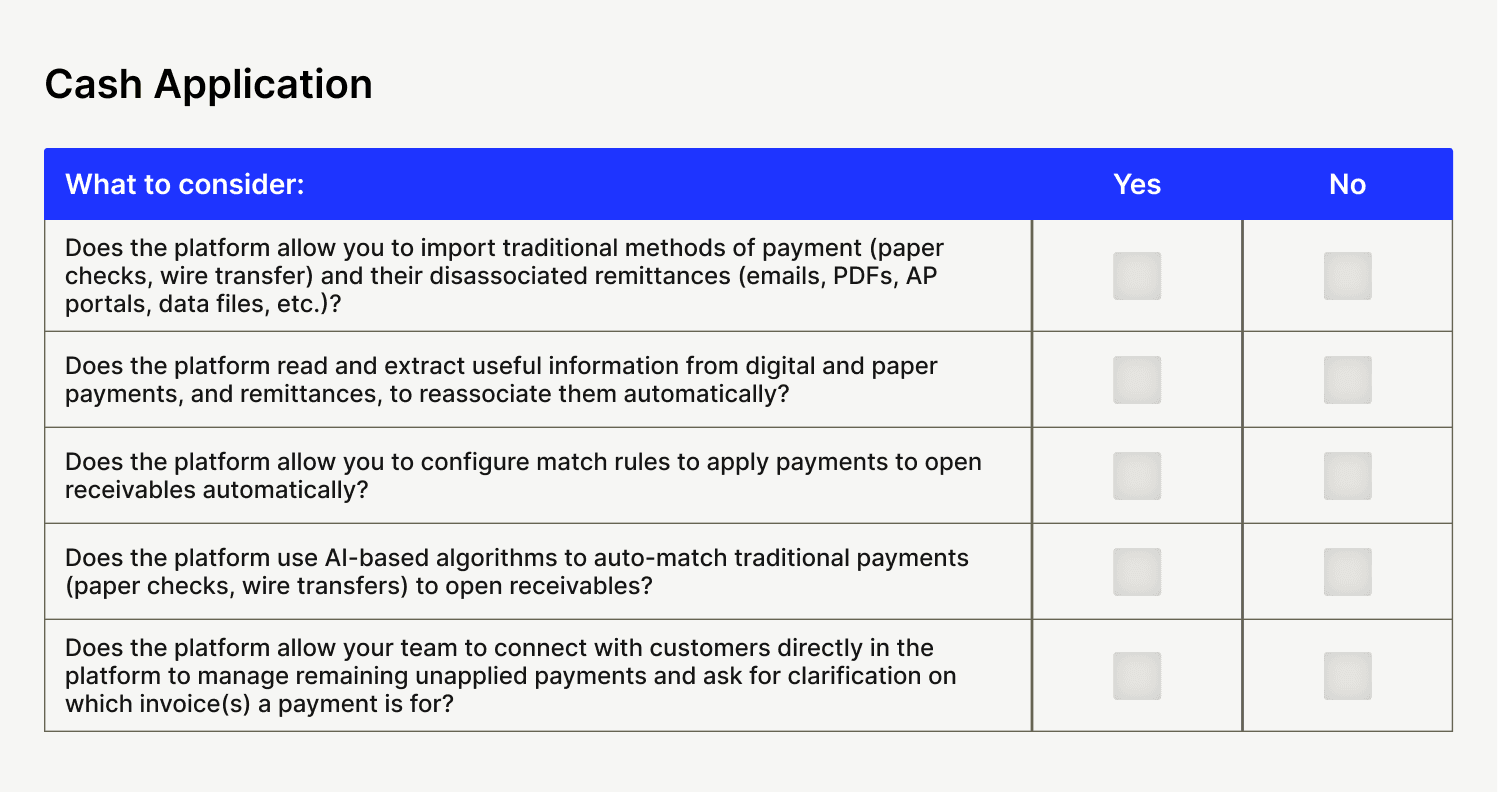

6. Cash application

Looking to automate your cash application process, easily capture and reconcile payment data, eliminate data entry errors, and speed up cash flow? Here’s what you should look for:

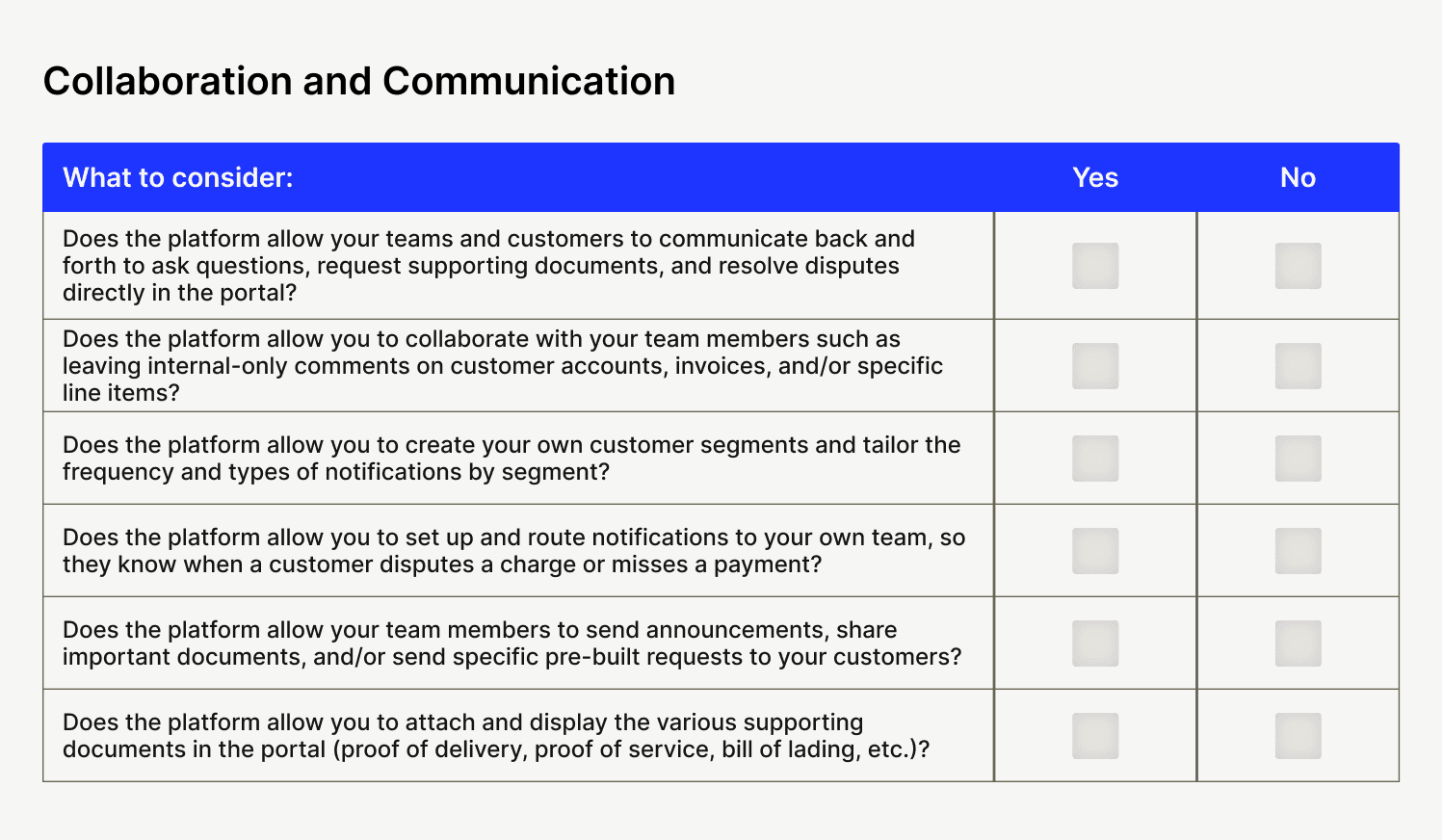

7. Collaboration and communication

Looking to engage your customers and work more collaboratively with them to accelerate payments and build extraordinary customer experiences? Here’s what you should look for:

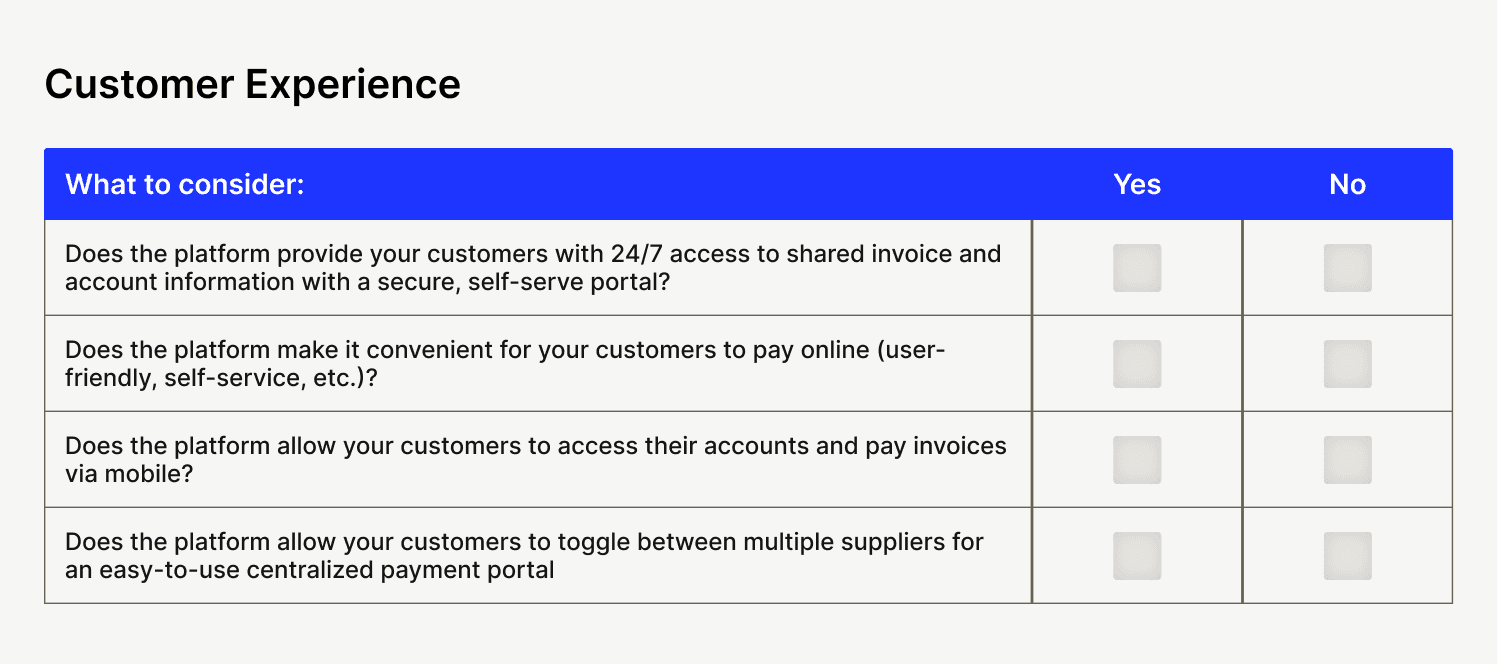

8. Customer experience

Looking to give your buyers better billing and payment experiences? Here’s what you should look for:

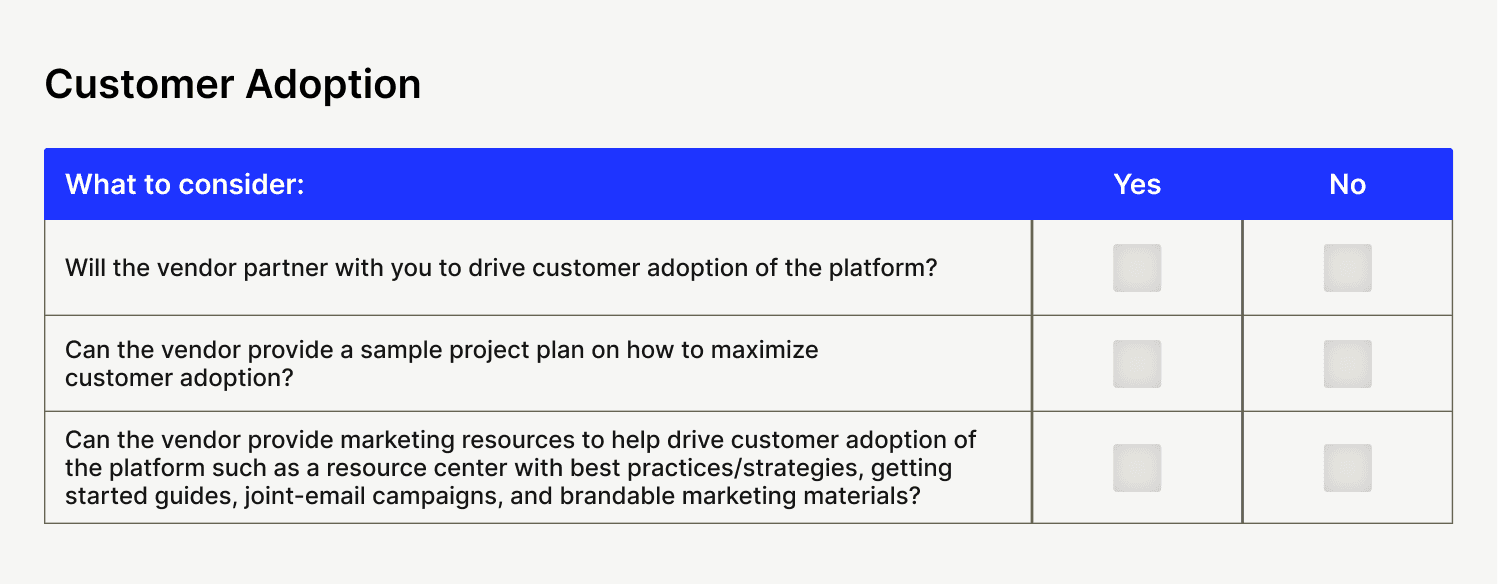

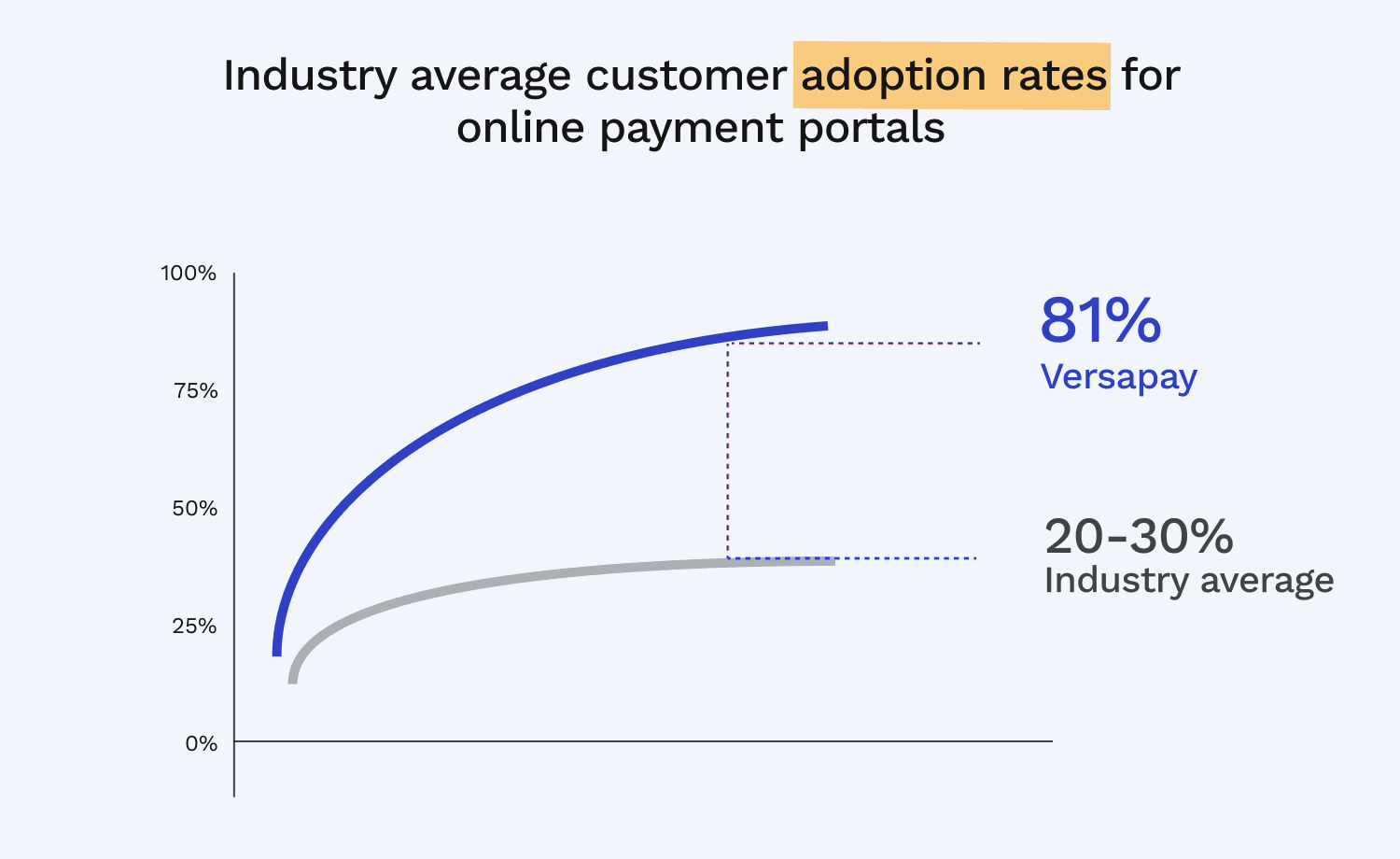

9. Customer adoption

Looking to implement an AR automation solution that’s actually used by your customers? Here’s what you should look for:

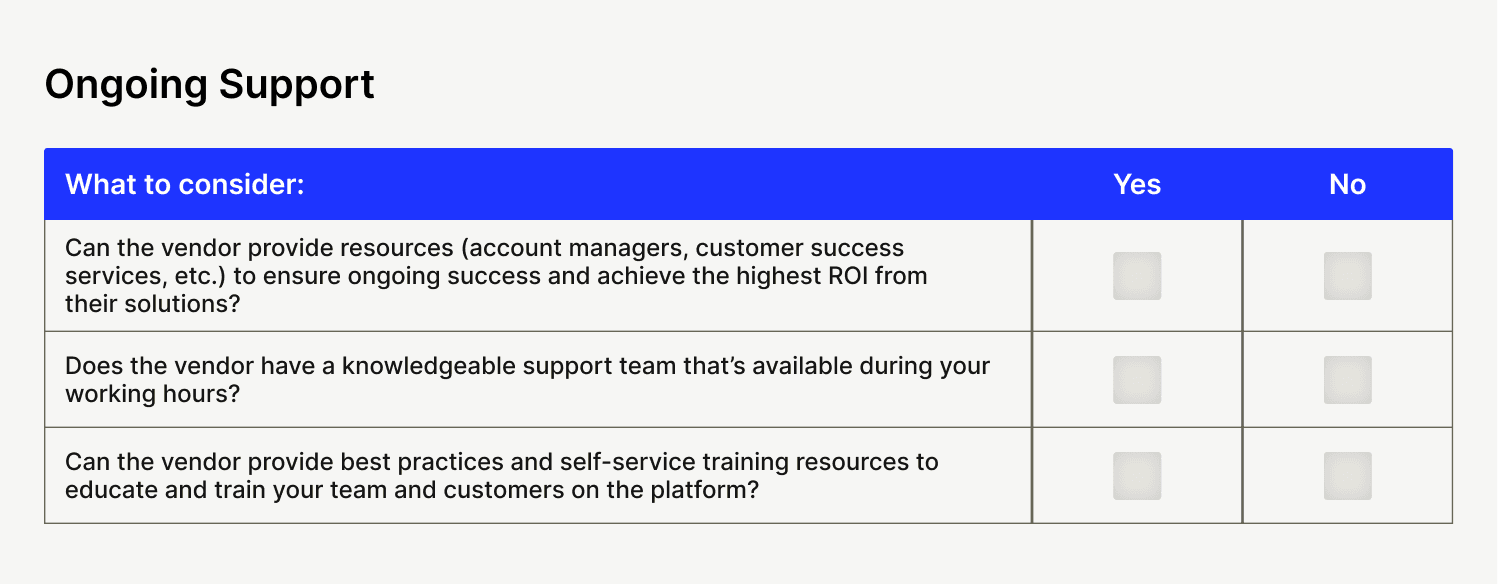

10. Ongoing support

Looking to partner with a vendor that’s committed to helping you successfully transform your accounts receivable? Here’s what you should look for:

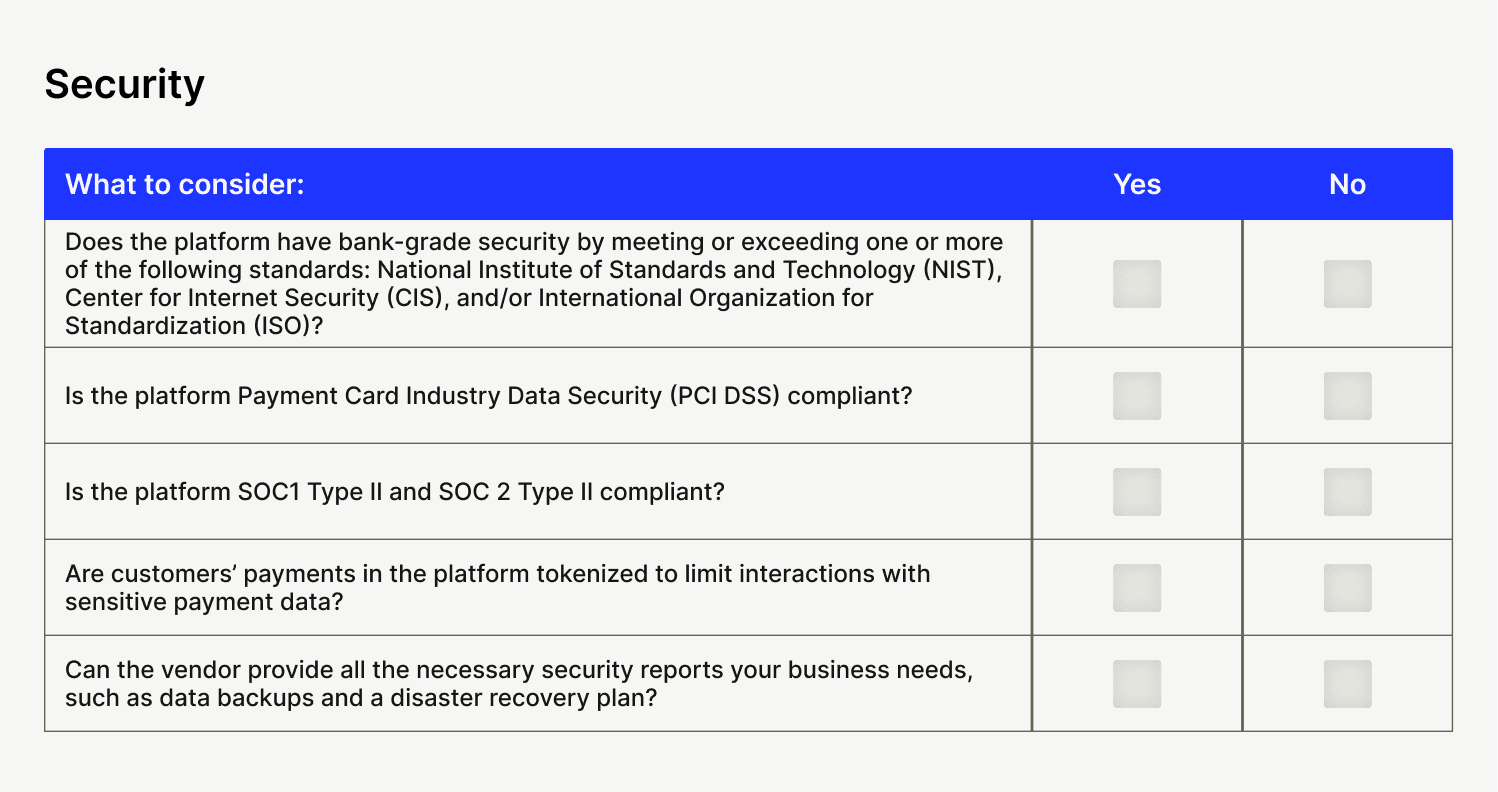

11. Security

Looking to partner with a vendor that takes security as seriously as it does AR automation? Here’s what you should look for:

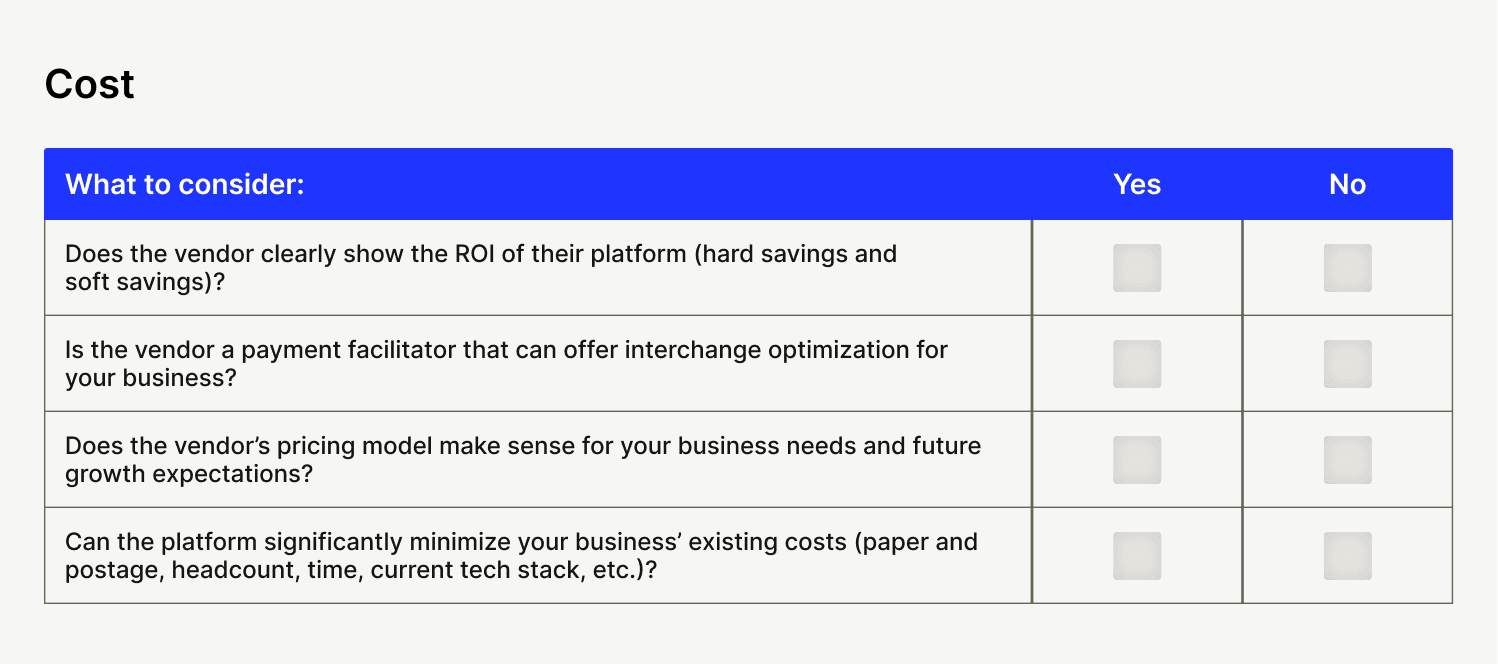

12. Cost

Looking for a solution that delivers substantial return on investment across the board? Here’s what you should look for:

6 steps to evaluate accounts receivable automation software

Now that you know what to look for when automating collections, it’s time to evaluate accounts receivable automation solutions—pro tip: share the checklists above with your team and use them as you work through your evaluation.

Here’s our suggested course of action for determining which solution is best suited to your unique needs. Click on each bulleted step to jump directly to its section:

Step 1. Talk to your team

Step 2. Define your challenges and goals

Step 3. Identify the vendors that can meet your requirements

Step 4. Determine what post-implementation success looks like

Step 5. Get demonstrations of your shortlisted software

Step 6. Get stakeholder buy-in and make a final decision

Step 1. Talk to your team

Before you even consider firing up another tab to search furiously for all accounts receivable automation vendors, take some time to connect with your team members whose work would be directly impacted by an AR automation tool.

Use this time to understand their modus operandi, and home in on the source of their frustrations. Work to disseminate opportunities, but also to ensure you don’t embark on a journey that’ll ultimately result in you duplicating what may already be in place.

Questions to consider asking during this step:

What are the issues we would like to resolve?

What are the risks of not making any changes?

Are these issues due to gaps in our technology stack, knowledge, or headcount?

Which internal stakeholders should we include in the evaluation process?

Step 2. Define your current challenges and future goals

A principal factor in determining which AR automation tool you ultimately choose should be how well it addresses your unique challenges and future goals. After all, it does you no good if your specific objectives cannot be achieved during your digital transformation journey.

Now, before you can find a solution to your troubles you need to first identify the gaps that exist within your current accounts receivable processes. Only once you’ve defined those will you understand where you have room to grow. A personalized accounts receivable transformation assessment will help you immensely at this step.

Questions to consider asking during this step:

Which of our AR processes are currently under-optimized, and where can we streamline to relieve pain around wasted time, under-utilized talent, and delayed cash flow?

Which AR processes do we believe are ripe for transformation (and what can we improve so that it’s hyper-efficient, drives sustainable positive cash flow, and plays a pivotal role in creating exceptional experiences for customers and vendors)?

Step 3. Identify which accounts receivable automation vendors can deliver what you need

Now’s the time to get your hands dirty! Cast a wide net and quickly build your shortlist using the checklists above. Not all the information you need will be publicly available—I.e., on the vendor’s website—so, you might need to get crafty.

Visit review sites and reputable third-party domains to try and fill the gaps. For whatever you can’t easily find, be sure to request an answer if you decide to request a software demonstration. Be sure to compare accounts receivable automation solutions directly:

Step 4. Determine what post-implementation success looks like

While out-of-the-box capabilities are cool, it’s equally cool to be confident that the partnership you enter will be fruitful for many years. Some solutions will be plug-and-play; others, less so. One’s not necessarily better than the other, as what benefits you is highly circumstantial.

That said, if your needs are complex, it’s important you gauge during your evaluation how competent each AR automation solution is—or will be—at scaling to meet your demands. It’s important you work with a vendor who can deliver against a host of requirements, whether you need them now, or years down the road.

But perhaps most crucial—and most critical to long-term success—is determining upfront whether your customers will adopt your newly implemented software or not. Customer payment portals, for example, are common features of accounts receivable automation software. If the vendor you partner with is incapable of helping you drive adoption of it, that’s a red flag.

Questions to consider asking during this step:

Does the vendor provide the right amount of training for employees to master the new features within the system?

What support can the vendor offer us to ensure our ongoing success post-implementation?

Does the vendor have a strategy to encourage rapid adoption among employees and customers?

Step 5. Shortlist and request demonstrations of the software

Now the fun part! Once you’ve narrowed down your list of suitors, reach out and request a demonstration of each. This is the best way to get a feel for the software.

During this step, be sure to push the vendor to show you functionality that is hyper-relevant to your use case. A vendor that defaults to you showing you a generic demonstration might not be capable of delivering against your needs. Also, be sure to consider any customizations you may need, and factor in any additional costs that may come with them.

Questions to consider asking during this step:

Can you show me how your software helps me achieve this particular goal?

I have a particular problem. How can your software help me?

What other clients within my industry do you serve? Can you provide me with testimonials and case studies?

Step 6. Get stakeholder buy-in and make a final decision

Last—but certainly not least—you'll want to consolidate your findings and vendor analyses and share them with all stakeholders involved. Note that some of these stakeholders should be involved during the other stages, too—primarily the demonstration and other high-level discussions you find yourself having with vendors.

Then, request quotes and proposals from whichever vendor(s) you’re most satisfied with. And that is how you choose accounts receivable automation software.

Next steps for digital transformation

Now that you know what accounts receivable automation software is, the benefits of automated AR tools, and how to automate accounts receivable, it’s time to figure out which automated accounts receivable system is best suited for solving your unique challenges.

Alongside connecting customers with AR teams over the cloud to increase efficiency, accelerate cash flow, and deliver exceptional customer experiences, Versapay’s Accounts Receivable Efficiency Suite is designed for growth. Versapay offers a variety of solutions that can be purchased individually or together to meet your business’ unique needs, including:

Accounts receivable automation

Cash application

Payment processing

Virtual card acceptance

And more

Versapay is designed to scale your accounts receivable automation when you’re ready, however you need it to. You’ll never have to compromise on your goals—even if you haven’t yet defined them.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.