Cash application software helps finance teams match incoming payments to outstanding invoices automatically—eliminating manual work and reconciliation delays. By automating this process, businesses gain greater control over their cash flow and bring much-needed clarity to the accounts receivable reconciliation process.

Reconcile payments automatically

AI-powered cash application automation software matches payments to invoices, no matter how customers remit. Say goodbye to manual matching and hello to improved payment reconciliation and working capital.

See it in action

Tour Versapay's cash application software

Matching payments should be automatic, not investigative

Stop manually hunting down data across inboxes, lockboxes, and stacks of paper. Our automated cash application software uses AI to streamline your entire accounts receivable reconciliation process—giving your team clarity, control, and time back.

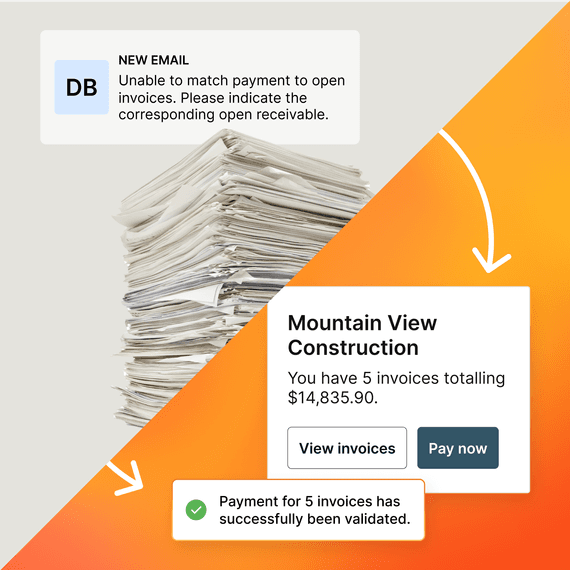

Cash application powered by artificial intelligence

Versapay reads digital and paper transactions—wire transfers, ACH and checks—and easily and accurately reconciles those payments with your bank using AI and machine learning.

- Reconcile different payment formats into a single source

- Collaborate to resolve payment discrepancies faster

- Tailor payment matching logic and workflows

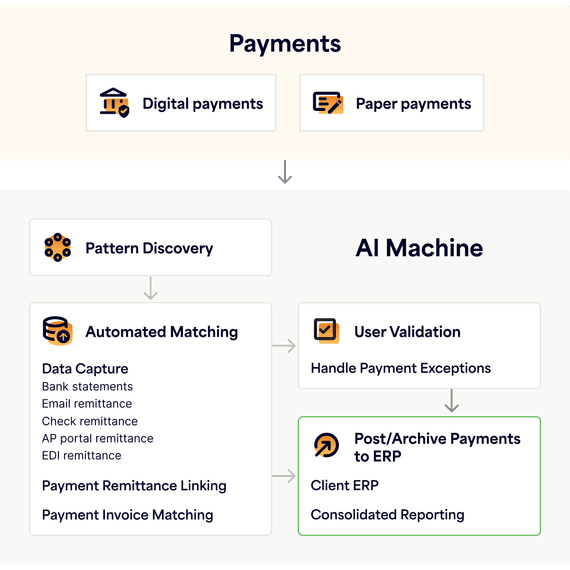

- Eliminate manual data entry with OCR

Automation that clears your payment reconciliation bottlenecks

Reclaim control with automated cash application software that removes delays from matching payments to invoices. Get real-time visibility, fewer exceptions, and accelerate cash posting.

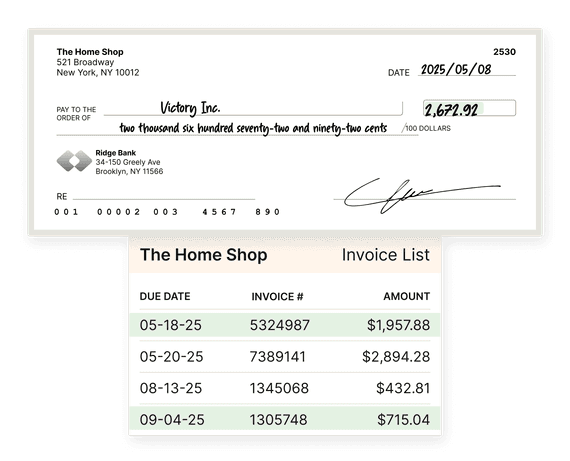

Capture payments and remittances from any source

Extract critical data with OCR

Reassociate remittance details with external payments

Smarter matching and posting

• Match payments to open invoices with AI and ML

• Resolve unmatched payments with routing

• Schedule AR posting to your cash GL account

Seamlessly connect with your systems

• Works alongside your existing bank lockboxes

• Generate reports to track performance

• Integrates with your ERP and workflows

"A more streamlined and accurate cash application process has drastically improved our ability to perform critical financial functions like cash flow forecasting and budgeting"

Ed Aguero, CFO, Cole, Scott & Kissane

Lower AR costs by 50% with automated online payments

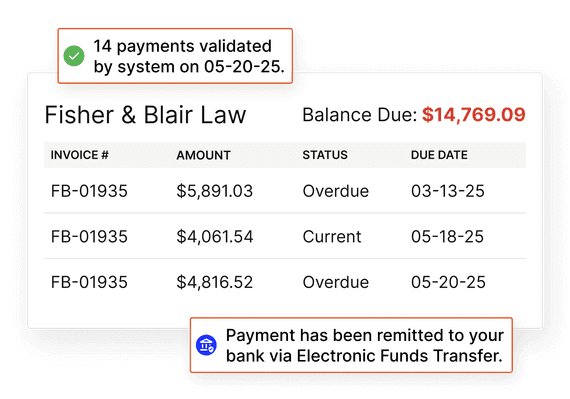

Online payments made through our cloud-based payment portal are matched automatically to invoices—100% of the time.

- Fully automated and accurate cash application

- Payments carry remittance data and application instructions

- Payments are posted back to your ERP automatically

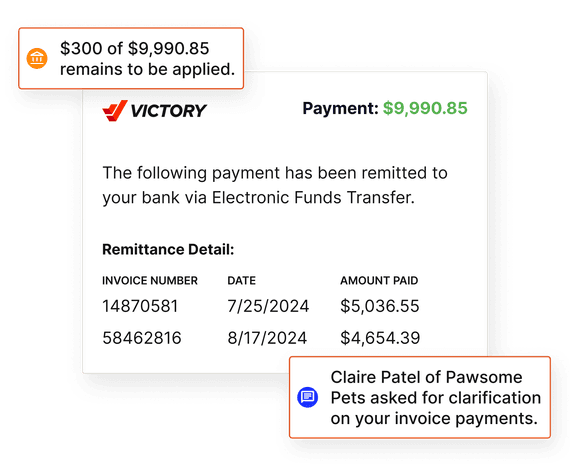

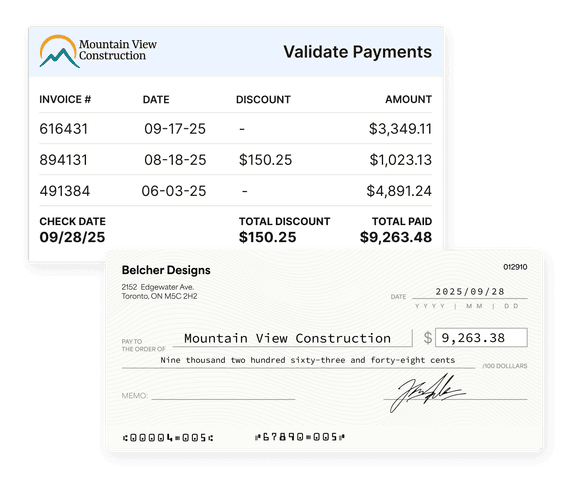

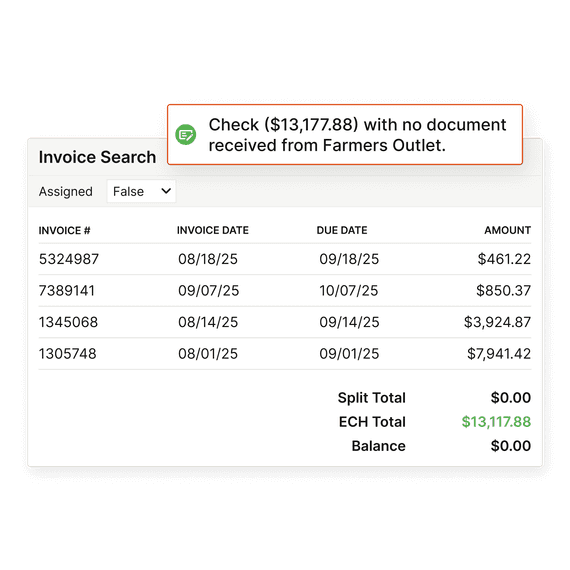

Extract and normalize remittance data from any format

Remittance data doesn’t always play nice. Use OCR and machine learning to digitize and standardize remittances—whether they arrive by email, PDF, EDI file, AP portal, or lockbox—so your team spends less time tracking, downloading, and decoding.

- Automatically pull useful data from portals, emails, and PDFs

- OCR and document scraping normalize unstructured data

- Eliminate data entry errors and increase match rates

Cut costs tied to lockboxes, banks, and manual entry

Lockbox services and manual processes come with hidden costs—and real risks. Versapay cuts those out with direct automation that works alongside your banking infrastructure.

- Integrate with existing banking services, including lockboxes

- Digitize payment data to reduce costly keystroke fees

- ️Lower payment processing costs by up to 50%

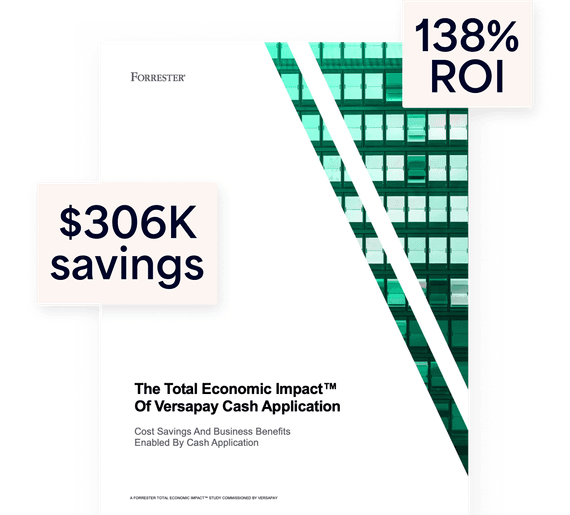

The total economic impact of Versapay

Cash application software that boosts efficiency 69%

Make matching payments to invoices easy, reduce costs, and improve efficiency. Get Forrester's study to see the potential ROI of Versapay on your enterprise. Learn how we delivered:

- 138% ROI

- $306K savings

- $200K reduction in interest payments

Implement and achieve ROI on your initial investment in as little as 60 to 90 days

Digitize the reconciliation process and reduce manual work

Matching payments to invoices should be easy. Versapay's AI-powered cash application automation software eliminates manual payment matching and accelerates the reconciliation process, no matter how or where your customers remit.

- Match payments with 90%+ straight-through processing

- Built-in machine learning gets smarter with each transaction

- Automatically apply ACH, wire, and check payments

- Post payments to your ERP anytime or on a custom schedule

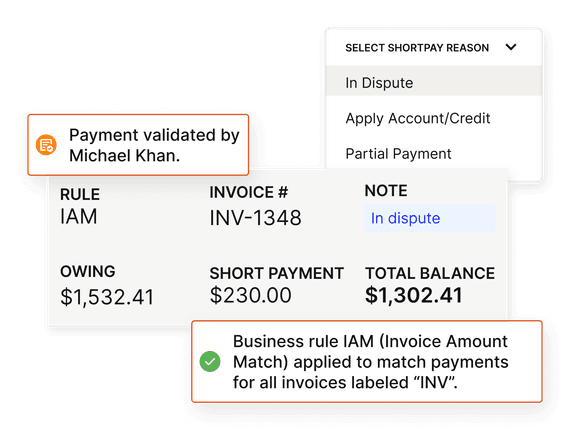

Manage and approve exceptions without slowing down

Incomplete or unexpected payments—like short-pays, discounts, or deductions—can derail your day. Resolve unmatched payments with built-in tools that route outliers to the right team member for validation, and get back to business.

- Automate routing and coding for short-pays and deductions

- Set match rules to manage complex payment scenarios

- Keep cash flowing without manual escalations or bottlenecks

Gain visibility and control over your cash application process

With Versapay, you always know what’s been applied, what’s unmatched, and what’s next. Our dashboards and audit trails give you full transparency into the cash application accounting process—so you can plan, optimize, and scale.

- Monitor performance and efficiency with end-of-day reports

- Handle high payment volumes seamlessly

- Integrate effortlessly with your ERP systems and workflows

- Command your accounts receivable reconciliation process

Save time and effort, improve cash flow, and fuel growth

Still have questions? We've got answers!

Versapay’s cash application automation software brings fluidity to your payment operations. It captures remittance and payment data—no matter the format—and applies advanced AI and OCR to automatically match them to open receivables. And when things get tricky (short-pays, disputes, missing details), our built-in exception workflows and collaborative tools keep your reconciliation moving without chaos.

While many solutions automate the basics, Versapay goes further by combining smart automation with collaborative accounts receivable capabilities. That means your team doesn’t just gain speed—they gain visibility and precision. With real-time dashboards, audit trails, and a shared digital workspace for resolving exceptions, you’re not just applying cash—you’re operating with total financial control.

Absolutely. Versapay supports reconciliation for any payment type—check, wire, ACH, or card. Even when remittances arrive separately, like with ACH or lockbox payments, our system connects the dots automatically. That means you eliminate manual matching and bank-related keystroke costs, restoring flow to your cash application process.

Yes—Versapay thrives in complexity. Whether remittance data lives in emails, PDFs, EDI files, spreadsheets, or vendor portals, our system brings it all together. Using OCR and intelligent extraction, we normalize data at scale so you have a clear, real-time view of what’s paid and what’s not—no more fragmented systems or guesswork.

Versapay brings automation and clarity to a traditionally manual process. By automating over 90% of the payment reconciliation process, you eliminate costly keystrokes, reduce exception resolution time, and cut down on labor-intensive matching tasks. The result? Accounts receivable teams operating with more precision—and at up to 50% lower cost.

Yes. Versapay’s automated cash application solution integrates with your ERP and works seamlessly alongside your banking and lockbox services. No disruption, no overhauls—just fast deployment and a direct path to smoother reconciliation and better data visibility..