How to Improve the Cash Application Process

- 13 min read

An efficient cash application process matters, because in accurately and quickly applying payments with their respective invoices, you effectively ensure your business has a right to those funds sooner.

The traditional cash application process, however, is broken, and needs improving. Learn why that is, and how to improve the cash application process through automation.

Does this sound familiar?

After weeks of pursuing several overdue invoices from a customer, you finally receive payment in the form of a bank transfer. Hurray! But hold on… Maybe your celebration is premature.

You must still match the payment with its remittance information, correct open invoices, and customer accounts, then post the payment to your accounting system to close everything out. Essentially, you still have the cash application process to complete.

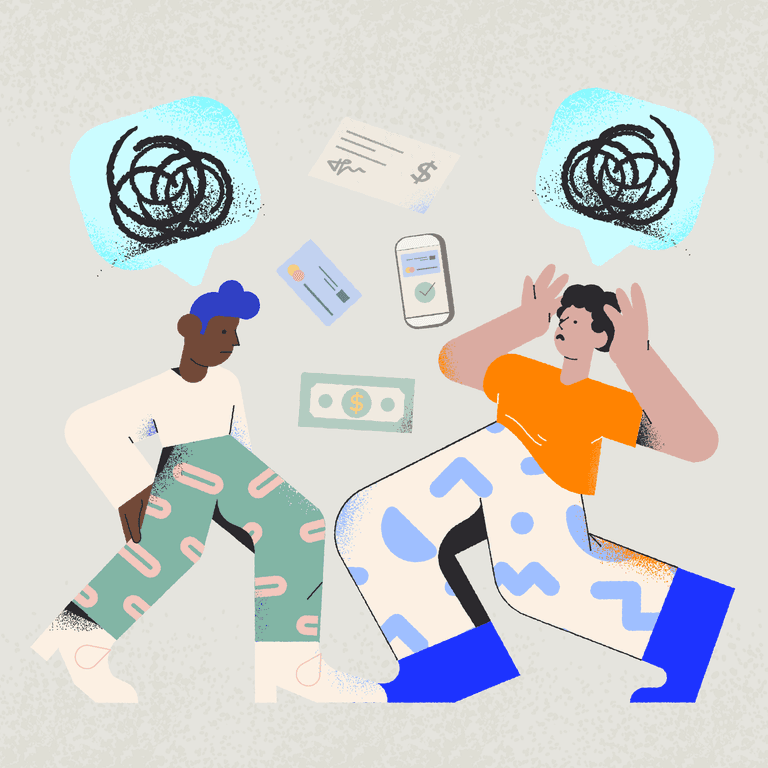

But imagine that payment covers multiple invoices, half of which had discounts applied to them. Or the accompanying remittance advice fails to match your standardized formatting (if you even receive one).

Because of these all-too-common disruptions, the cash application process is often overly complex and time-consuming, with specialists frequently spending hours matching and applying payments to invoices. Multiply this process for the dozens of (if not more) payments received daily, and this workload quickly becomes unmanageable for an accounts receivable (AR) team of any size.

If your cash application process remotely resembles what we’ve described, then there’s room for improvement. And you’re certainly not alone. Eighty-four percent of business and finance leaders surveyed stated that their AR team manually matches payments and remittance data at least some of the time. A further 19% percent responded that their team always does so.

Jump to a section of interest:

What is cash application?

The cash application process involves you recording revenue once you’ve received a payment. This includes matching incoming payments to the correct remittance information, invoices, and customer accounts so you can deduct the amounts from your remaining unpaid receivables.

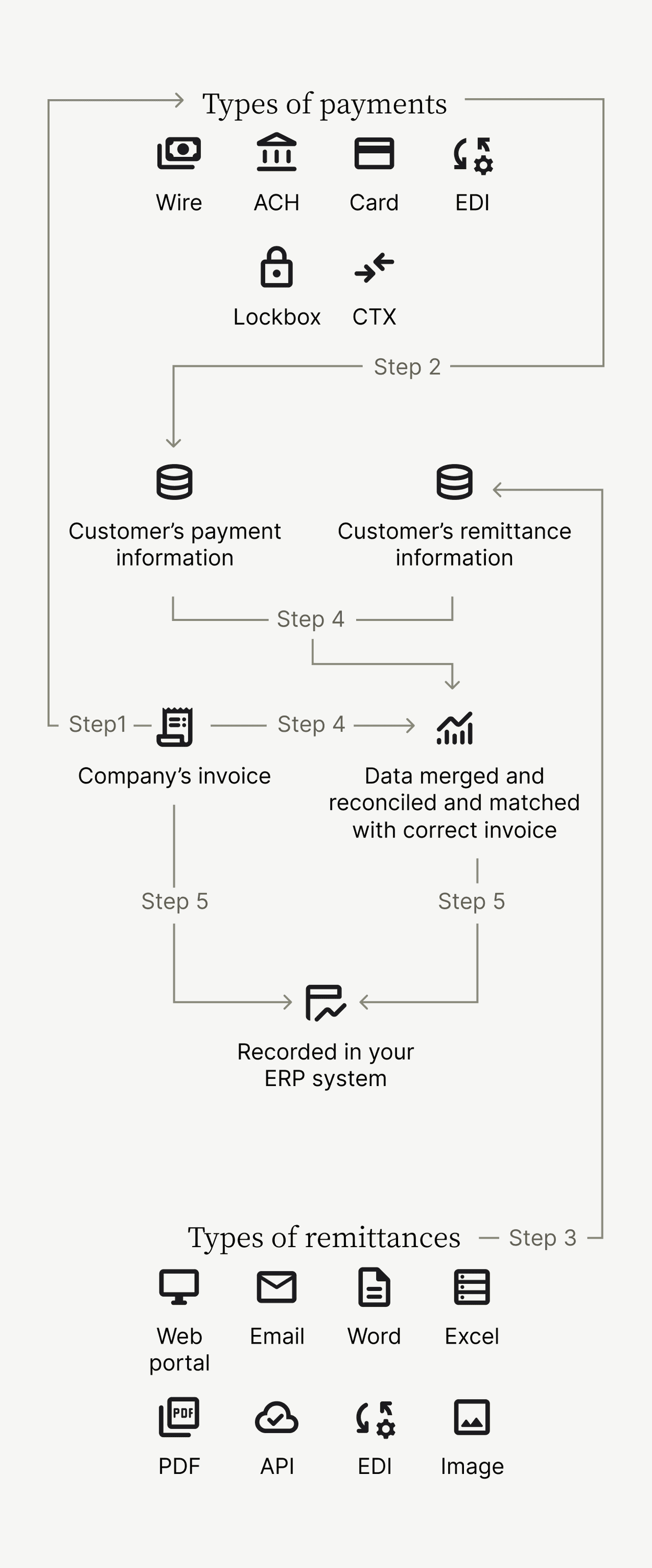

However, not all payments are equal. Your business might receive payments through a combination of wire transfers, ACH, credit and debit cards, checks and lockboxes, or other electronic funds transfers such as corporate trade exchange (CTX).

Meanwhile, the associated remittance advice—letting you know what invoice(s) a payment is for—might arrive in the form of an email, image or PDF, Excel sheet, web portal (such as an accounts payable system), or electronic data interchange (EDI). Or, it might not arrive at all.

As your business grows and you accept more payments from more channels, the cash application process becomes harder to scale. This is especially the case if your processes are highly manual.

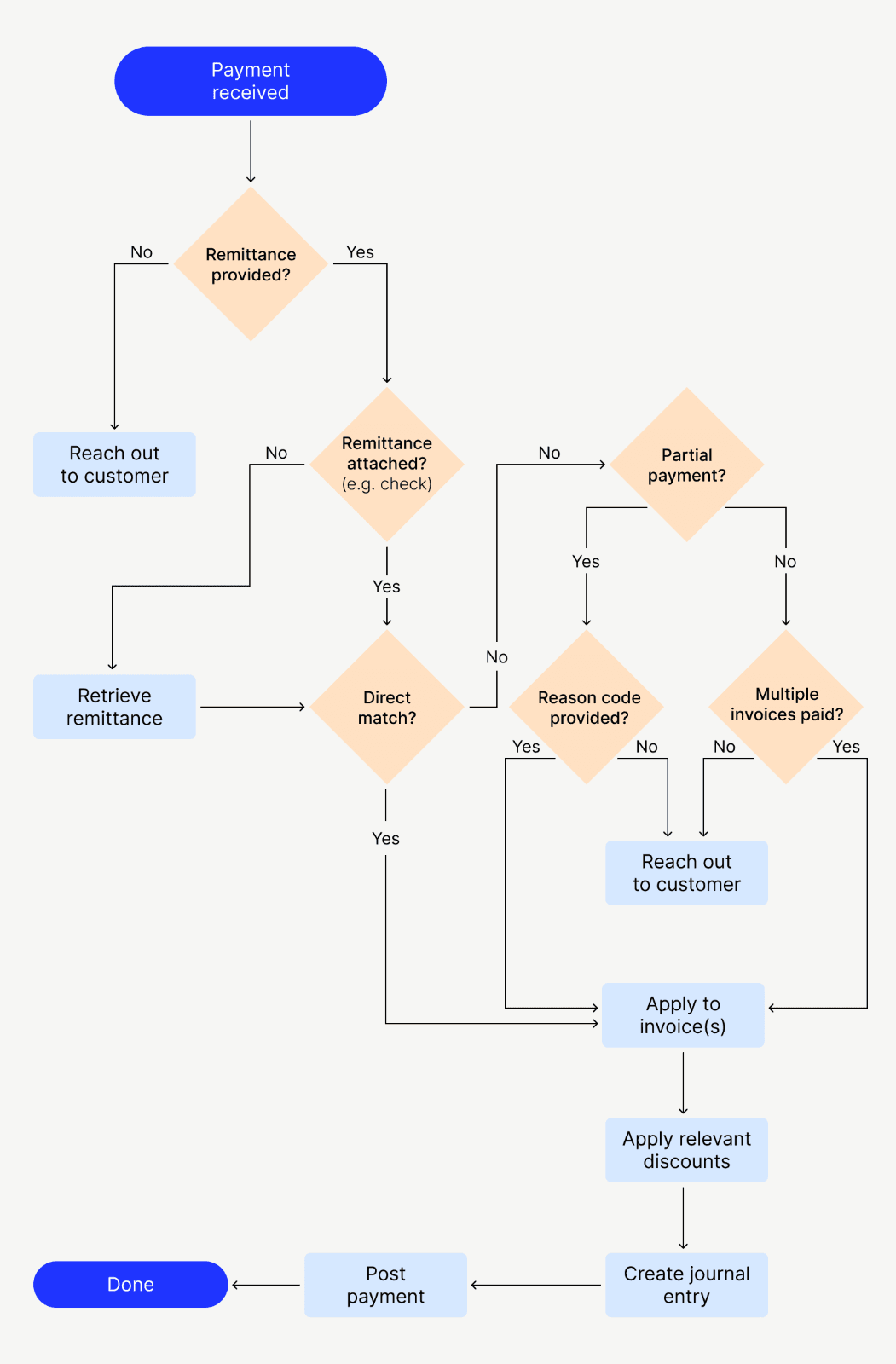

The cash application process flowchart

The cash application process steps vary by company, as each varies in size, customer volume, invoice quantity, and delivery and payment method. However, the steps in the cash application process remain fairly consistent and common to most (we define those steps below the flowchart image):

Step 1. You receive the payment and remittance (sometimes separately)

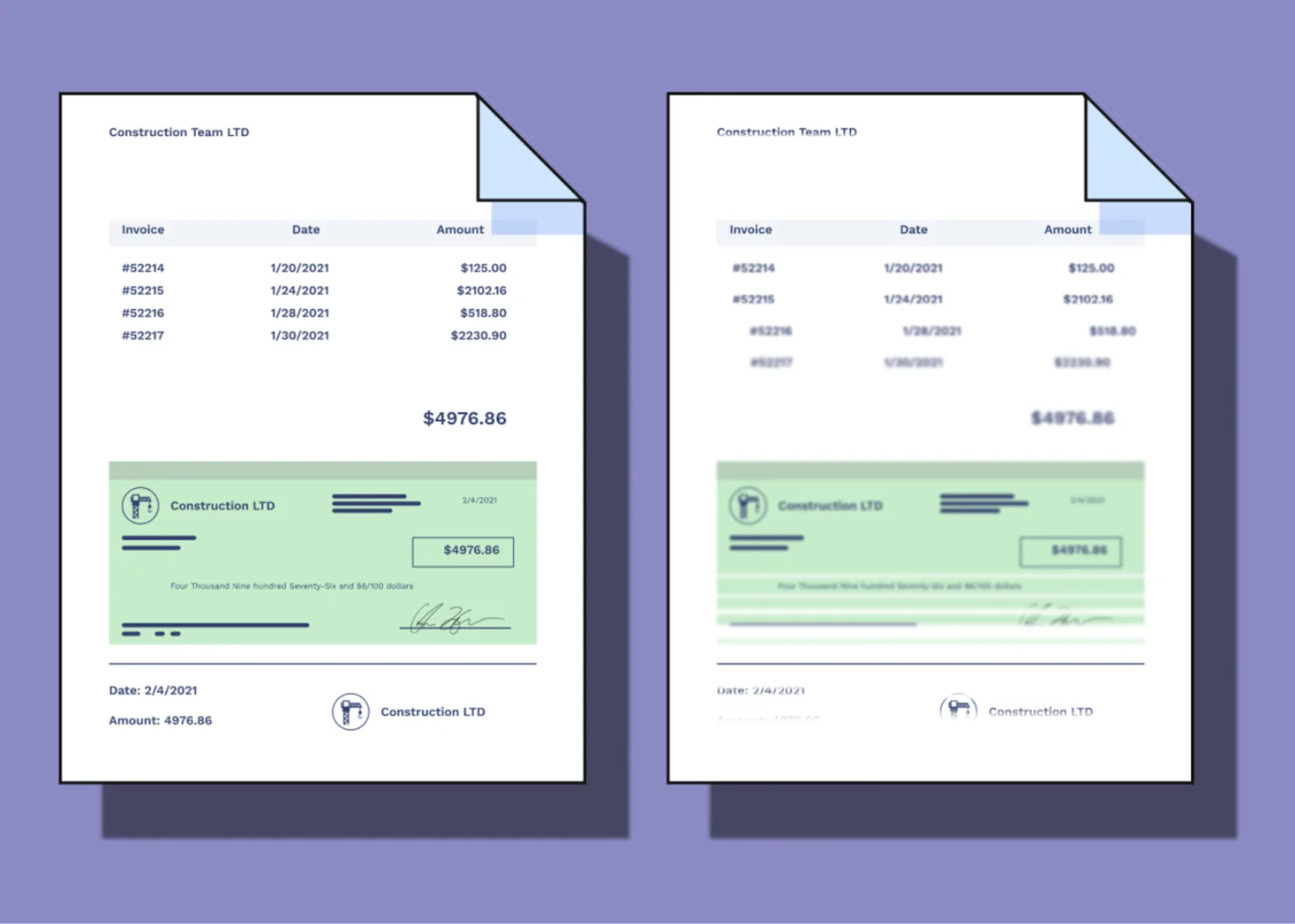

When you receive a customer’s payment, you’ll usually also receive some form of remittance advice. This lets you know which invoice(s) the payment is for. Checks might include remittance information in the memo line or in an accompanying document (usually attached to the check).

Electronic payments, however, are less straightforward. With ACH, EFT, wire transfers, and virtual credit cards, the remittance advice will arrive separately in an array of possible formats. And because buyers aren’t technically required to send remittance advice (although it is courtesy), a payment might come in without an associated remittance.

Step 2. You match the payment with the appropriate invoice

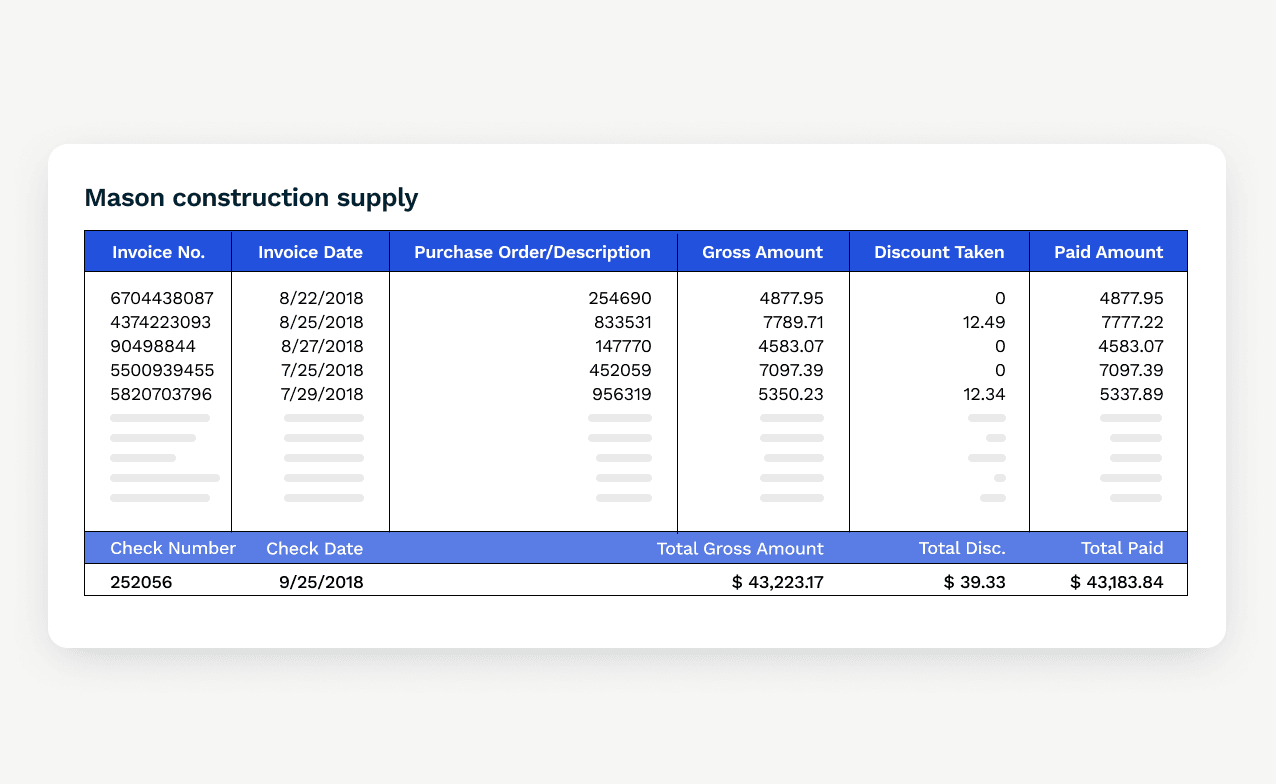

After you’ve received a payment from a customer, you’ll cross reference it with your accounting system to associate the correct payment with the correct invoice(s). Even when a payment arrives with the remittance attached, matching the right payment with the right invoice can still get complicated.

A single payment can cover multiple invoices—in some cases upwards of 40 to 50. Or you might find that the payment amount doesn’t match any invoice amount exactly. This usually happens because a customer has short paid due to a discount or an issue with their order. These scenarios require more investigation from your accounts receivable team.

Step 3. You post the payment to your ERP

The final mile of the cash application process involves posting payments to your ERP system or accounting software, signaling that the accounts receivable entry is no longer open.

If you’re not using any kind of integrated payment system that can update journal entries in your ERP as payments come in, then posting payments is probably a very manual exercise for your team. It might involve you flipping between multiple Excel spreadsheets and manually keying everything into your ERP. This is not only inefficient but also introduces more opportunities for error.

The process we’ve described here is a simplified view of the cash application cycle. More pragmatically, as you’ll see in this other cash application process flowchart below, applying payments to invoices involves several intervening steps like reaching out to the customer to request missing remittance information or clarify the reason for a discrepancy between the payment and the invoice(s).

Why is an efficient cash application process important?

Until you’ve recorded an incoming payment in your accounting systems, you can consider that cash non-existent. By applying payments to their corresponding invoices, you are ensuring the business has a right to those funds.

How fast you’re able to apply payments can have a direct impact on your potential sales, too. If you enforce credit limits, for example, then a delay in your cash application process could mean a customer’s credit won’t be replenished even though they’re up to date on their payments. This prevents customers from being able to make more purchases from you, which can have a domino effect on their businesses.

Before implementing Versapay, TireHub, a distribution logistics company, had this exact problem.

“We won’t release an order if the account is on hold,” said Matt Marin, TireHub’s Senior Manager of Financial Processes and Data Management. “If there’s a delay in us applying payment, that can impact our operations and ultimately the customer’s ability to serve their own customers.”

3 reasons why manual cash application processes are harmful

Odds are your cash application process is partially, if not fully, manual. This is fine, up to a certain point. That’s because relying on manual application practices will only get you so far. As your business grows, you’ll inevitably be asked to do more with less, preventing you from enlisting additional full-time employees to help.

Ask yourself how effective your cash application process is. How quickly are payments being applied? How much missing remittance information needs managing? How much time and effort is spent performing cash application activities? How often do delays in the cash application process impact other accounts receivable activities?

If your process is manual, you might not be able to positively answer those questions.

“In modern payments, there are myriad payment flows taking place. You’ve got checks and papers going back-and-forth, digital payments and remittance forms, lockboxes, invoices posted to AP systems, and remittances that are decoupled from payments,” Versapay’s Senior Vice President of Sales, Tim Stahl, told PYMNTS. “The more forms of payment flows that exist, the more complicated the cash application process becomes for AR teams.”

Here are 3 specific reasons why manual cash application processes are harmful:

They’re time-consuming

They’re error-prone

They slow down cash flow

1. They’re time-consuming

When done manually, the cash application process requires you to assign staff to painstakingly parse and enter remittance data—that is if it’s not omitted or hard to read. Many businesses prefer their customers pay them by check as the remittance advice is usually provided along with it. But, these documents aren’t always the most legible.

With electronic payments like ACH, the remittance information does not travel with the payment. As a courtesy, a customer will usually provide an additional document for the remittance advice, but this isn’t always the case.

Reaching out to customers to confirm how to apply their payment (because of split, illegible, or missing remittances) delays the whole process even further. It can frustrate your customer, too, damaging their payment experience.

2. They’re error-prone

Even the most detail-oriented staff will inevitably deal with data entry errors from having to manually key information into their systems. If a customer sees errors crop up more than once, you could be putting the relationship in jeopardy.

For instance, if delays or misapplied cash make it look like a customer’s balance is overdue even when they’ve already paid, this might lead your collections team to mistakenly contact them to inquire about the missing payment. This creates a frustrating experience for the customer and can even be enough for them to take their business elsewhere.

In our survey of over 1,000 C-level executives with Wakefield Research, 82% of respondents stated their company has lost work due to miscommunications in the payment process like this.

3. They slow down cash flow

With a manual cash application process, the time between a sale and the recording of a payment is longer, which can inflate your days sales outstanding (DSO).

Delays in the cash application process also make it difficult to get an accurate, up-to-date picture of your outstanding receivables. This compromises your ability to see which accounts are truly delinquent, and which ones simply haven't had their payments recognized yet.

All this ultimately slows down your cash flow, by keeping money trapped on the balance sheet and preventing you from being as proactive with your collections as possible.

How to improve the cash application process

The most effective way of improving the cash application process—and ultimately accelerating cash flow—is to leverage cash application automation software. These tools are crucial to helping reduce the amount of time, money, and resources previously needed to match payments with outstanding invoices.

The most advanced cash application process automation solutions are equipped with capabilities like machine learning, robotic process automation (RPA), optical character recognition (OCR), and artificial intelligence (AI). This helps you achieve high straight-through processing rates for incoming payments, as they can get matched to the right invoices without your cash application team having to intervene.

Cash application is complicated, and you can significantly improve the process by automating it. Here are 3 core benefits automated cash application offers accounts receivable teams:

Less time spent retrieving remittances from various sources

Payments automatically matched with invoices

No need to manually key data into your ERP

1. Less time spent retrieving remittances from various sources

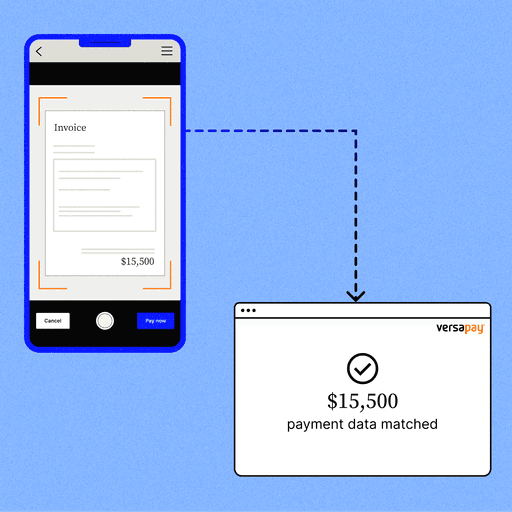

Cash application process automation software can aggregate remittances from various sources like lockboxes, AP portals, emails, and PDFs, saving you the trouble of rounding them up yourself. These platforms can also digest the data—using optical character recognition—to find invoice numbers, dates, and dollar amounts.

Cash application automation software can also analyze, normalize, and add structure to irregularly formatted remittance data.

What’s more, cash application automation software equipped with AI can remember those weird formatting issues and correct them on future payments. If you receive a payment without remittance advice but have been paid by that customer before, AI-powered cash application automation software can match it with the right account based on data like the numbers at the bottom of a check.

2. Payments automatically matched with invoices

With an automated cash application process, you’re empowered to match high volumes of payments and invoices—without needing to manually intervene. Cash application automation software has advanced significantly in recent years, allowing for match rates of over 90%, a significant improvement over manual match rates. (There are other trends, too, that are accelerating how these solutions boost cash flow and deliver exceptional customer experiences.)

In cases where a one-to-one match isn’t possible—as with payments covering multiple invoices—AI-powered software can correctly guess which invoices are being paid. It does this by working through potential invoice combinations, considering customers’ available credits as well.

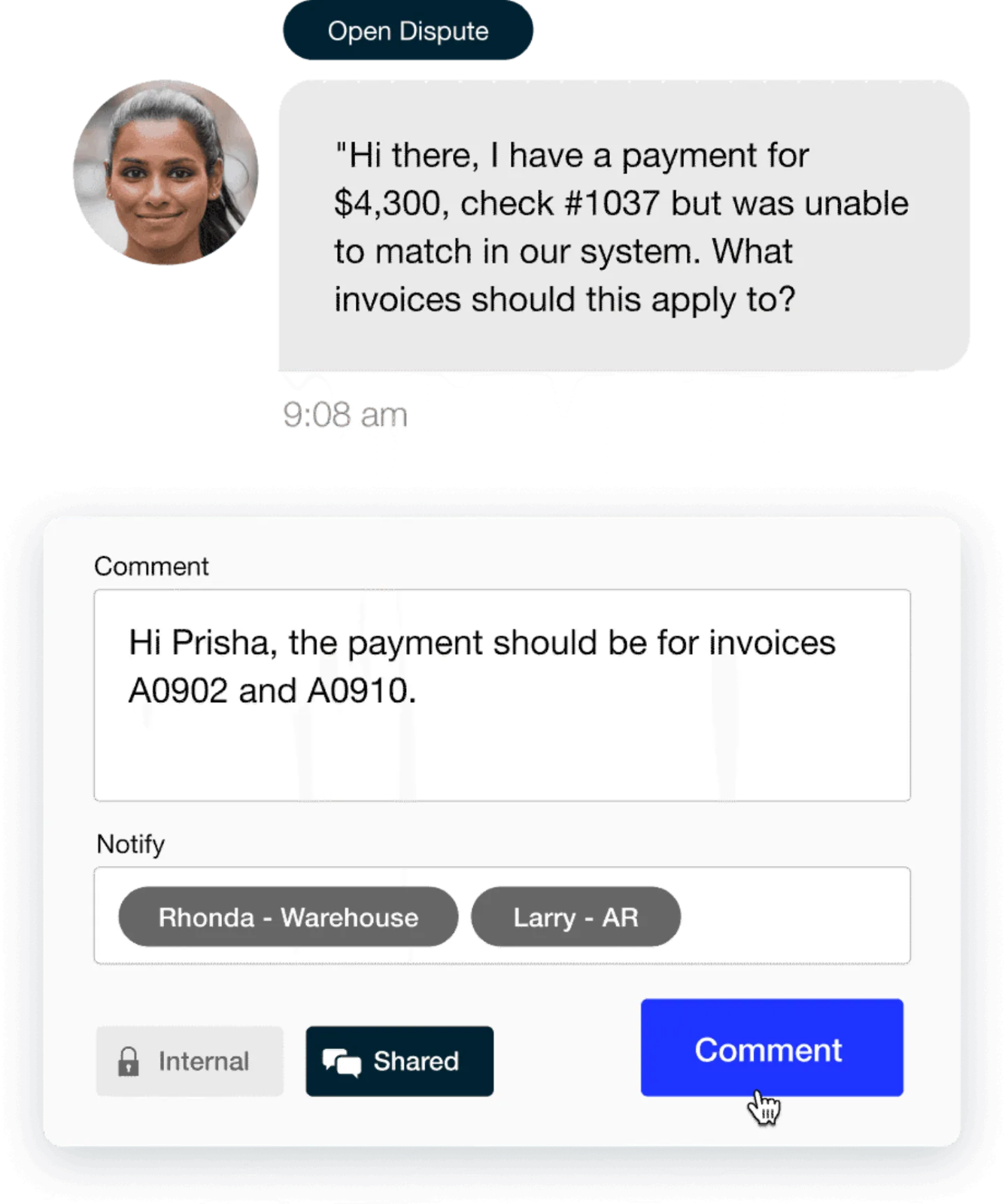

And when you still aren’t sure how to apply customer payments, the easiest way to request clarification is with automation software that offers in-platform collaboration. This allows you to leave a comment directly on an invoice for your colleague or customer to answer, avoiding disruptions to your workflow. No need to get on the phone or fire off an email.

3. No need to manually key data into your ERP

You can further improve the cash application process by implementing an automation solution that supports your ERP instance and can be closely integrated with it. This allows you to post payments automatically once they’ve been matched. Integrating with your ERP also allows the software to make guesses for matches based on data like current open invoices, payment history, and available credits.

ERP integrations help you to carry out the cash application process in one place. No more switching between countless open windows and no more manually keying in data for hundreds of invoices.

💡 Whether your cash application process is entirely manual; or you’ve some level of automation currently in place; or you’re looking to fully automate and transform it; be sure to read our top tips to automating your cash application process to get the best results.

—

Beyond the time savings and reduced chance of error, automated cash application also improves employee happiness. The work of manually matching payments and invoices is often gruelling and monotonous. On average, B2B businesses dedicate 15% of their staff to supporting cash application or reconciliation full time.

But with technology taking most of that work out of your team’s hands, accounts receivable staff can be freed up to work on more strategic—and personally fulfilling—work.

To learn more about how to improve the cash application process, check out our finance leader’s guide to AI-powered cash application, which includes our cash application automation software checklist:

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.