A Guide to Allowance for Doubtful Accounts: Definition, Examples, and Calculation Methods

- 12 min read

Allowance for doubtful accounts helps companies account for unpaid invoices. It’s an important part of the overall AR process since it helps businesses develop a clear picture of their cash flow.

Business is unpredictable. As much as you would love to collect on every invoice you issue, that doesn’t always happen. Problems such as disputes, miscommunications, and customer insolvency make achieving a 100% collection rate challenging.

An allowance for doubtful accounts (AFDA) helps you account for these risks and present a realistic picture of accounts receivable (AR) on your balance sheet. More importantly, AFDA helps AR teams provide data that their CFO can use to create accurate cash flow projections.

Jump to a section:

- What is allowance for doubtful accounts and why is it important for finance teams?

- Allowance for doubtful accounts industry benchmarks

- How to calculate allowance for doubtful accounts

- How to record an allowance for doubtful accounts journal entry

- What is bad debt expense

- The differences between bad debt expense and allowance for doubtful accounts

- How to calculate bad debt expense

- More frequently asked questions

What is allowance for doubtful accounts and why is it important for finance teams?

Allowance for doubtful accounts is a dollar amount companies deduct from their receivables to account for unpaid invoices or debt. AFDA is also called a bad debt reserve.

Accountants list allowance for doubtful accounts on the balance sheet as a contra-asset. A contra-asset decreases the dollar amount of the asset with which it is paired. In AFDA's case, it is paired with accounts receivable and reduces its value on the balance sheet.

On a company's books, AFDA is paired with bad debt expense. When collecting an invoice seems unlikely, AFDA is credited, and bad debt expense debited.

Allowance for doubtful accounts is essential for finance teams because, in the course of business, companies face multiple risks. Customers might short pay their invoices, raise disputes that delay payments, declare bankruptcy, etc.

AFDA acts as a margin of safety for companies. It helps them acknowledge the risks inherent in collecting on account and present more realistic AR figures. In turn, these figures help CFOs efficiently project budgets and plan working capital needs.

Modeling complex business scenarios becomes challenging when underlying data is inaccurate, which in turn can hamper business growth. Incorrect AR data also cripples accrual accounting processes, leading to false revenue and cash flow figures.

What are the industry benchmarks for allowance for doubtful accounts?

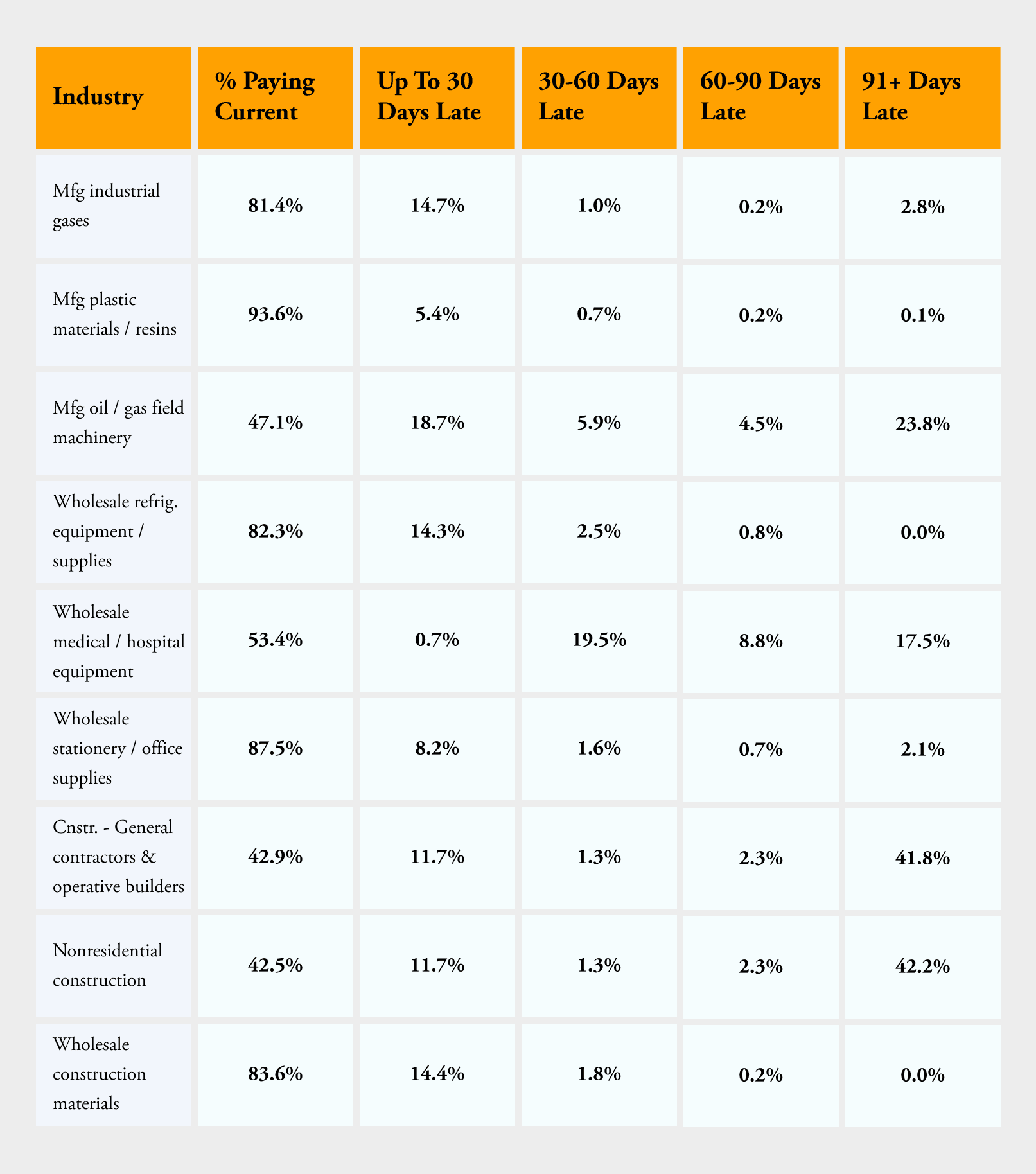

Every business is unique, and AFDA standards are not widely available. However, Days Sales Outstanding (DSO) benchmarks offer insight into AFDA standards. As a rule of thumb, the longer your collection cycle is, the greater your allowance for doubtful accounts must be to account for increased risks.

How you determine your AFDA may also depend on what’s considered typical payment behavior for your industry.

Research from Dun & Bradstreet in Q3 2021 suggests that the industrial manufacturing sector, for example, generally collects 70% or more invoices on time. The wholesale trade sector also experiences on-time payments for the most part, with some exceptions like medical product distribution. Construction is notorious for lengthy credit cycles, and collection cycle data reflects this reality.

Here are the accounts receivable collection benchmarks for selected industry sectors:

How to calculate allowance for doubtful accounts

You can use three methods to calculate an appropriate allowance for doubtful accounts. Each of these methods suits different businesses and one is not necessarily better than the other.

Method 1: Historical percent of credit sales or total AR

Using historical collections data to estimate AFDA makes a lot of sense. Some companies choose to look solely at credit sales (since cash sales have a 100% collection rate,) while others look at the percentage of total AR collected.

If your company relies primarily on credit sales, either number makes sense. If you have a significant amount of cash sales, determining your allowance for doubtful accounts based on percentage of accounts receivable collected will give you a higher margin of safety. However, this number might be too conservative and decrease your AR to unrealistic levels.

The historical percentage method is simple to implement. Here's an example. Let's say you review historical collection data from the last year and discover that you write off 5% of your invoices on average.

Here's how you would determine the current period's AFDA:

- Total AR or credit sales in this scenario: $15,000,000

- Historical default rate: 5%

When should you use this method? The historical percentage method works best if you have a relatively small customer base and straightforward billing cycles. For instance, if all of your customers stick to similar credit cycles, the historical percentage method will help you calculate a realistic allowance for doubtful accounts.

Method 2: Accounts receivable aging

AR aging reports help you summarize where your receivables stand based on which accounts have overdue payments and how long they’ve been overdue. They also help you identify customers that might need different payment terms, helping you increase collections.

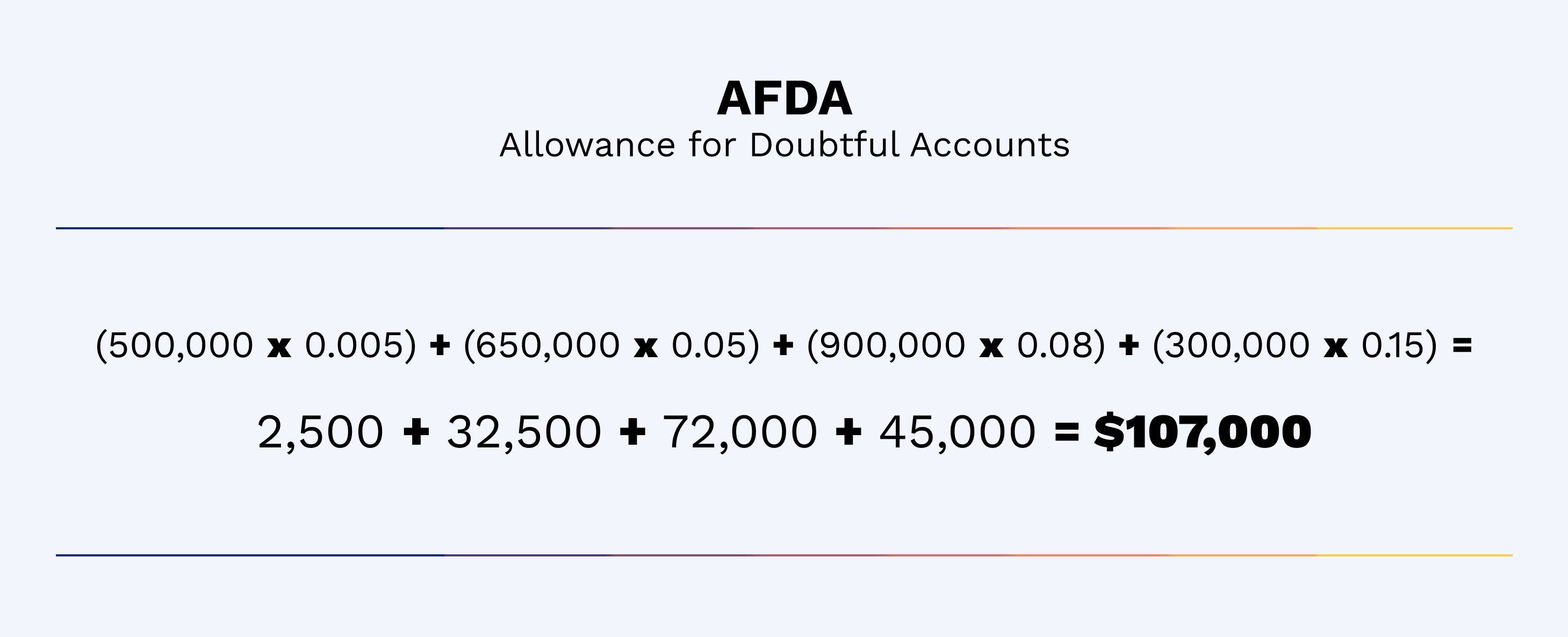

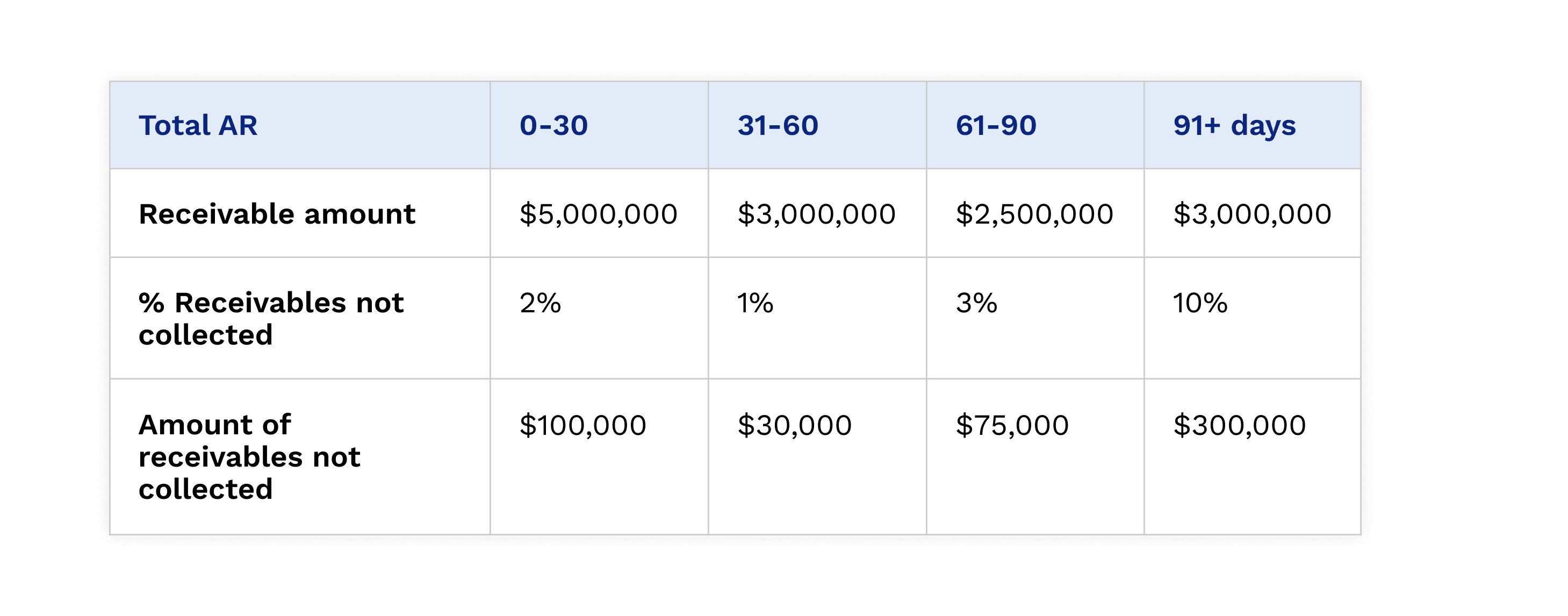

You can use your AR aging report to help you calculate AFDA by applying an expected default rate to each aging bucket listed in the report.

For example:

When should you use this method? The AR aging method works best if you have a large customer base that follows multiple credit cycles.

Method 3: Customer risk classification

In the AR aging method of calculating AFDA, you assign a default risk percentage to each AR aging bracket. In the customer risk classification method, you instead assign each customer a default risk percentage. You can examine historical payment collection data for a customer and calculate the percentage of invoices on which they tend to default.

For example, let's consider the following data for two customers, A and B:

When should you use this method? The customer risk classification method works best if you have a small and stable customer base following similar credit cycles. If your customer base grows, consider adopting one of the previous methods since they'll be easier to implement.

How to record an allowance for doubtful accounts journal entry

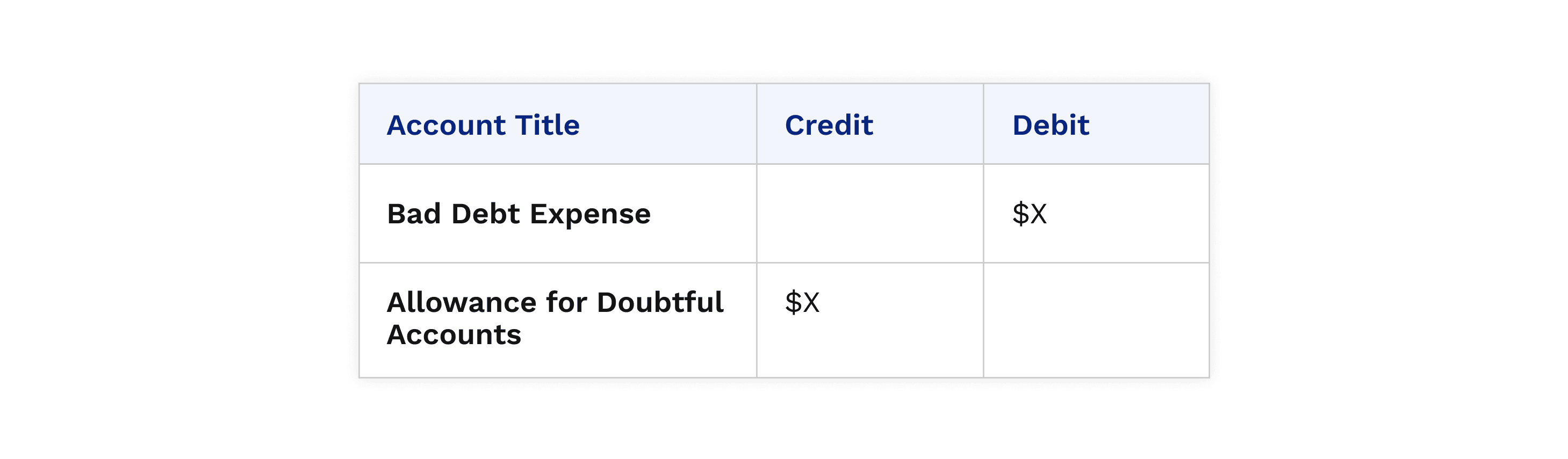

Recording allowance for doubtful accounts under the correct journal entries is just as important as calculating it correctly. AFDA is paired with bad debt expense in your books. That means, you must debit the latter when you record AFDA. You will deduct AFDA from the overall AR balance when calculating the total asset value of AR on your balance sheet.

For example, let's assume your business made $15,000,000 in sales during the current accounting period. You estimate that 5% of these sales will be bad debt, giving you a bad debt expense of (15,000,000 * 0.05) $750,000.

You will enter the bad debt expense of $750,000 as a debit and offset it by crediting AFDA with the same amount.

What is bad debt expense?

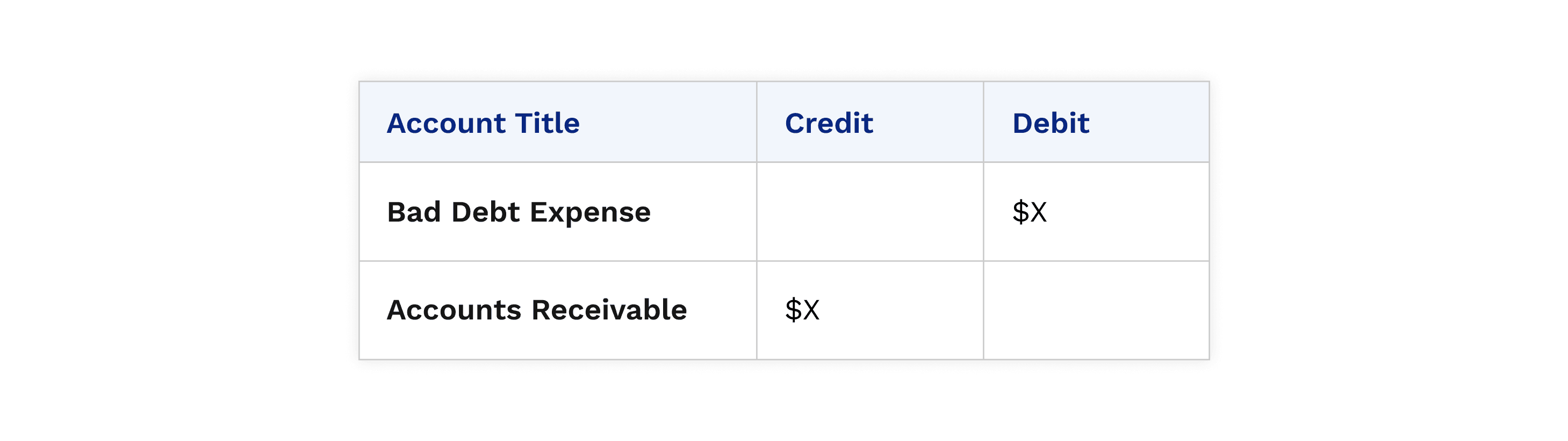

Bad debt expense (BDE) is a record of unpaid receivables. BDE is a debit entry paired with a credit to the AR entry.

A bad debt expense occurs when a customer does not pay their invoice for any of the reasons we mentioned earlier. It allows companies to report their income accurately. This figure also helps investors estimate the efficiency of a company's accounts receivable processes. BDE is reported on financial statements using the direct write-off method or the allowance method.

Under the direct write-off method, a business will debit bad debt expense and credit accounts receivable immediately when it determines an invoice to be uncollectible. In contrast, under the allowance method, a business will make an estimate of which receivables they think will be uncollectable, usually at the end of the year. This is so that they can ensure costs are expensed in the same period as the recorded revenue.

Typically, accountants only use the direct write-off method to record insignificant debts, since it can lead to inaccurate income figures. For instance, if revenue is recorded in one period but expensed in another, this leads to an artificially high revenue number for that first period.

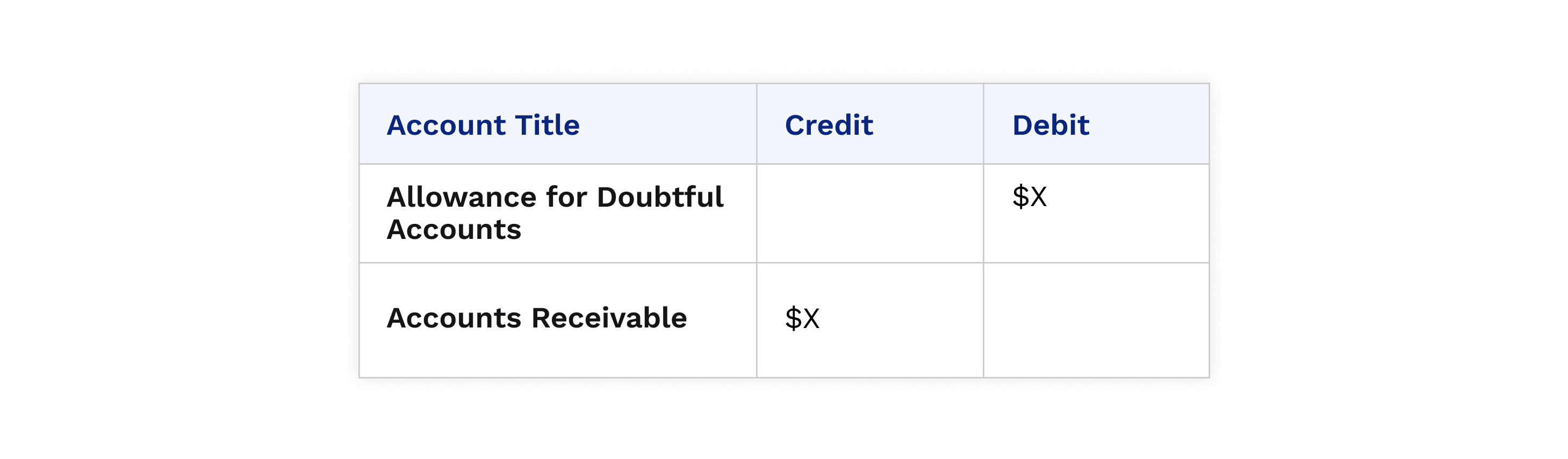

When an account defaults on payment, you will debit AFDA and credit the accounts receivable journal entry.

What are the differences between bad debt expense and allowance for doubtful accounts?

While both bad debt expense accounting and allowance for doubtful accounts signify the same thing from a business perspective, the accounting world treats them very differently. Allowance for doubtful accounts is a balance sheet account and is listed as a contra asset. It has a credit balance on financial statements.

Bad debt expense is an income statement account and carries a debit balance. It indicates how much bad debt the company actually incurred during the current accounting period.

Whereas AFDA is an estimate of accounts receivable that will likely go uncollected, BDE is a record of receivables that went unpaid during a financial reporting period. In other words, AFDA is an estimate while BDE records the actual impact of uncollectibles.

How to calculate bad debt expense

There are two ways you can estimate bad debt expense. They are the accounts receivable aging method and percentage of sales methods.

Method 1: Accounts receivable aging

Using an AR aging table, you can estimate the percentage of accounts likely to default based on previous bad debt and list them by age, as in the image below:

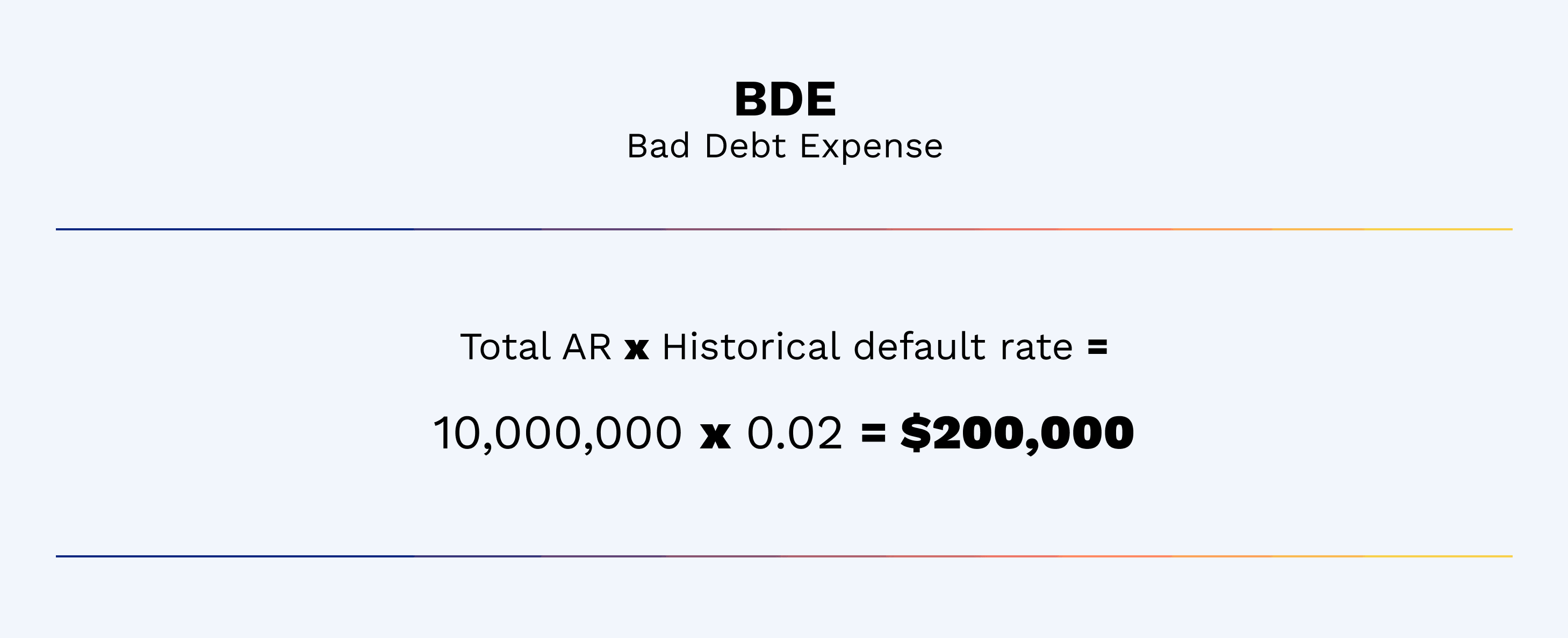

Method 2: Percentage of sales

With the percentage of sales method, you will estimate the number of invoices you are unlikely to collect using historical default data. Multiplying the default rate with the total AR will give you an estimate of bad debt expense.

Here’s an example:

- Total AR or credit sales in this scenario: $10,000,000

- Historical default rate: 2%

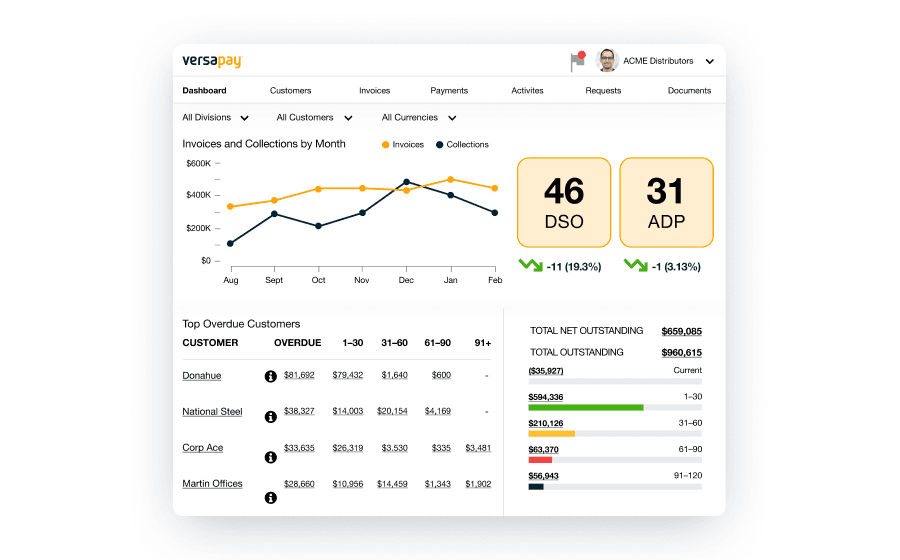

AR aging reports are complicated to compile and need input from a range of data sources. Creating this in Excel is a tedious exercise. Accounts receivable automation software simplifies this task by automatically pulling collections data and classifying receivables by age.

More frequently asked questions about allowance for doubtful accounts

Is allowance for doubtful accounts debit or credit?

Allowance for doubtful accounts is defined as a credit on financial statements (it’s listed as a contra-asset on balance sheets). It helps companies predict and prepare for bad debts by lowering accounts receivable on the balance sheet and forecasting uncollectible amounts. Companies also use allowance for doubtful accounts to uphold accurate financial records.

Is allowance for doubtful accounts an asset?

Allowance for doubtful accounts is an asset. It’s specifically classified on the balance sheet as a contra-asset. A contra-asset is an asset account with a negative (credit) or zero account balance that displays the real value of accounts receivable.

How does the allowance for doubtful accounts affect the income statement and balance sheet?

Allowance for doubtful accounts impacts the income statement by raising the amount of bad debt expense. This in return lowers a company’s total net income. In contrast, allowance for doubtful accounts is listed as a contra-asset on the balance sheet to lower the total accounts receivable balance and help companies estimate the value of accounts receivable that they’ll be unable to collect.

What happens if the allowance for doubtful accounts is overestimated or underestimated?

A company that underestimates its allowance for doubtful accounts will have a falsely high accounts receivable number on their balance sheet. This means they didn’t properly estimate their potential bad debts, resulting in overstated assets, inflated net income on the income statement, and an inaccurate understanding of their financial health.

Underestimating allowance for doubtful accounts can also make it difficult for companies to make necessary future adjustments, leading to greater potential bad debt expenses.

In contrast, if allowance for doubtful accounts is overestimated, net accounts receivable will be artificially low. Additionally, both net income and equity will be understated.

Prevent bad debt before it’s too late

Allowance for doubtful accounts helps you anticipate what proportion of your receivables will be uncollectible. As a result, CFOs can project cash flow and working capital more accurately.

But, you’ll want to do everything in your power to prevent receivables from becoming uncollectible before things get to that point.

Two likely culprits of unpaid invoices are dated accounts receivable processes and limited payment options, as they lengthen collection cycles.

An AR automation platform with intelligent collections capabilities can help you stay on top of your collections so that overdue invoices don’t go past the point of no return.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.