Cash Flow Forecasting Woes? Automating Cash Application is Your Key to Accurate Forecasts

- 9 min read

By improving how you apply cash, you can in turn dramatically improve your cash flow forecasting.

In this article, you’ll learn 4 critical ways that automating cash application leads to more accurate cash flow forecasts.

Cash flow forecasting is an intricate process that relies on cash visibility. The better you understand your cash flow, the easier it is to predict. You can improve your forecasts by consolidating your data sources, building better cash flow projections, and running better flux analyses.

No amount of improving cash projection techniques, however, can help you predict cash flow if you don’t know when cash is coming onto your books. If you face delays when applying cash to open invoices—the fundamental part of cash flow forecasts—fixing those downstream processes won’t do much.

Automated cash application is the key to unlocking more accurate cash flow forecasts.

This article explores four ways. Jump ahead to a section of interest:

1. Automated cash application gets cash on your books faster

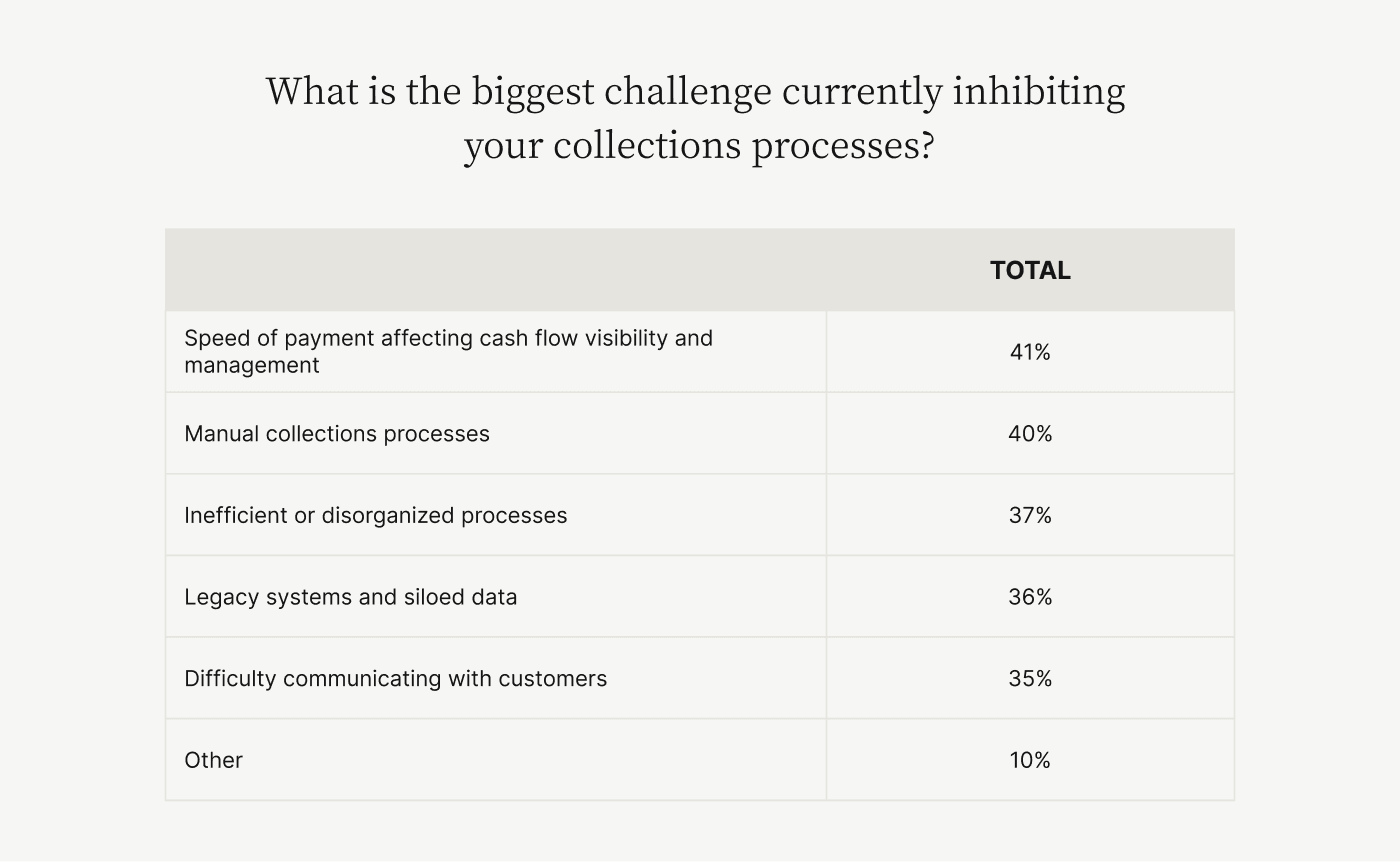

Cash flow visibility is a major component of projecting cash accurately. And in a survey we recently ran—of 103 finance leaders that dug deeper into the reasons companies lack cash flow visibility—we found that 41% of respondents noted that the speed of payment is a limiting factor.

Payment speed, or the velocity with which cash enters your books, has two components to it.

First, customers need to pay you quickly. You can influence this with payment reminders and broader automation solutions. But that is just half of the equation.

The second determinant of payment speed is how soon you apply cash to your books. This you can directly control. Apply cash quickly, get it onto your books faster, and your cash flow projections become more accurate.

Automated cash application is the solution to removing common roadblocks in the payment matching and application process:

Automation eliminates easily avoided errors—Most companies use manual processes to apply cash. Automated solutions capture and ingest remittance data (structured or otherwise), match them to invoices, and apply cash to your books, all without human intervention.

Automation clarifies exceptions quickly—Cash application technology quickly helps you identify short payments (or single payments covering multiple invoices), tag these with reason codes, and facilitate customer communication to resolve open invoices.

Automation uses advanced technology to adapt to any payment channel—Customers pay you through different channels, and matching remittance data from each is tedious. Advanced technology like optical character recognition (OCR), AI and machine learning helps finance teams scan written checks, capture important data, and automatically apply it to open invoices

The result of these features is more time for your receivables team to solve disputes that need personalized attention—which helps you unlock even more cash flow.

Automated cash application technology (when paired with an AR automation solution) also gives you a dashboard with real-time visibility into collection statuses, boosting accounts receivable visibility. This is how our client, RPT Realty, boosted visibility into their cash flow.

No longer having to worry about outdated aging reports or manual data reconciliation processes, RPT can project cash flow more accurately and in real time.

2. Automated cash application creates a single place for you to manage payment data

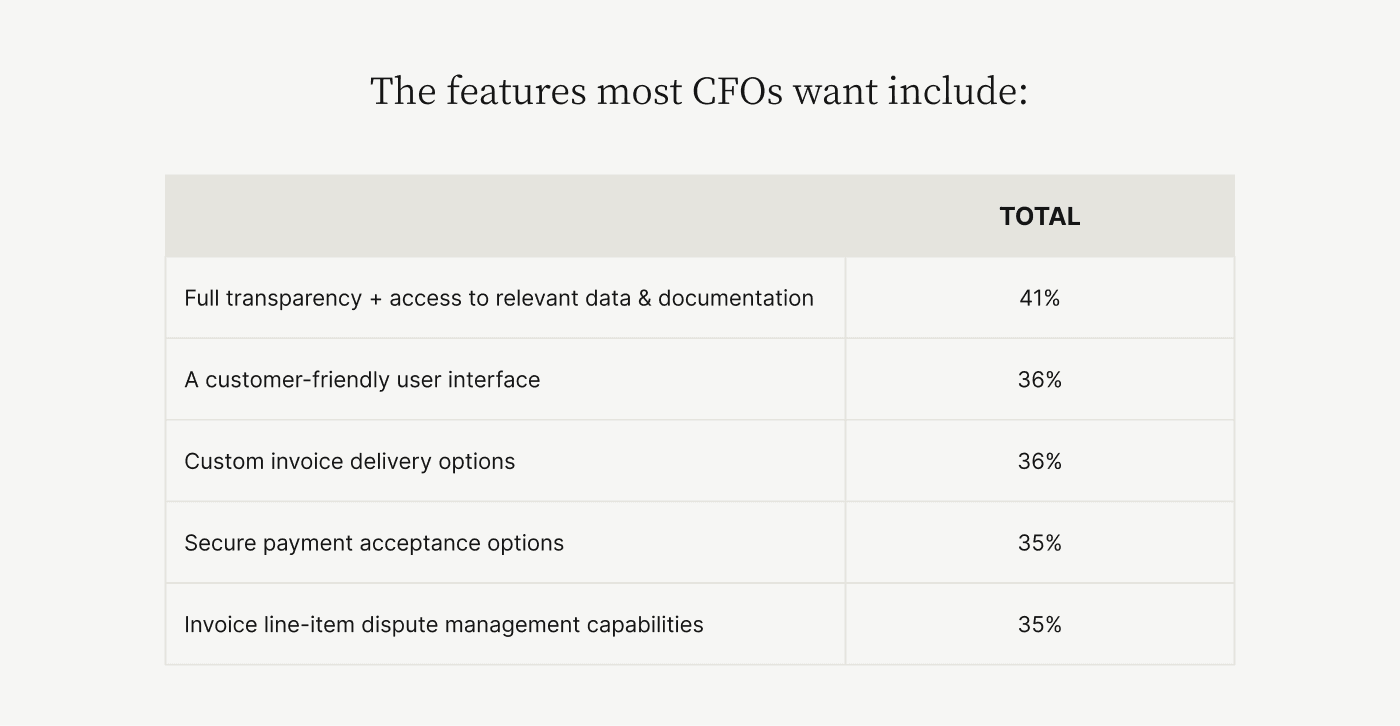

The lack of financial data transparency is a major sticking point for CFOs. Our research on better invoicing practices revealed that CFOs want full transparency and access to relevant data.

Data transparency plays an important role in cash flow forecasting, too. The quality of your forecasts will increase if you give your team a single, centralized location that houses all important financial data. For most companies, this is their enterprise resource planning (ERP) system.

A lack of integration, however, between accounts receivable processes and ERP systems creates a data lag, and shrouds pertinent information in an impenetrable cloud. Simply put, manual cash application delays the arrival of important data into your ERP, leading to poorer cash flow forecasts.

Worse, manual processes introduce errors into your data because account balancing takes time and fatigues your receivables employees. Comparing numbers, amounts, invoice statuses, and transforming data for ERP uploads is tedious work. Over time, the negative effects of fatigue compound, giving you error-filled cash flow data.

Here’s how automated cash application helps you overcome those challenges:

Automation pushes data directly to your ERP—Automated cash application platforms integrate with your ERP systems, helping to automatically post payments back to it. This ensures journal entry accuracy and gives you a real-time view of your cash flow picture.

Automation centralizes cash flow data—Automated cash application platforms can centralize collections data, giving your teams a single place to work from. No more hopping between systems or jumping between spreadsheets to retrieve key information.

Automation transforms data by default—Your ERP accepts data in predefined formats, something an automated cash application system accounts for by default. Specify your data format templates and you'll receive accurate and up-to-date cash flow data directly in your ERP, as soon as payments are made and automatically matched to their corresponding invoices.

Accounts receivable and cash application automation have another upshot. Unlike manual collections processes that penalize you for growth, automation rewards you for it. One of our customers, a healthcare services provider, discovered this fact when customer invoice amounts increased due to high demand. The company's cash application team wouldn’t finish applying cash for the day until 10:00 PM.

Automation helped this company speed up cash application, deliver journal entries to its ERP, and speed up its processes. Growth no longer creates a cash flow projection bottleneck.

3. Automated cash application gives you cash flow clarity

Customers pay through different channels (phone, POS, eCommerce, etc.) and this creates problems in a manual cash application process. For instance, to manually consolidate payments from checks, echecks, ACH transfers, and cards, your AR team must comb through different pieces of remittance advice.

Each payment channel (and method) generates remittance information in different formats, forcing receivables team members to context-switch constantly. The result is data entry errors and a lack of clarity when figuring out your cash flow sources.

Automated cash application helps you capture payment information quickly—leading to improved cash flow forecasts—in two ways.

Automated cash application platforms help you capture payments through different channels—By offering customers payment channels and payment methods of their choice, you can remove hurdles to fast payments, increasing cash flow velocity. For instance, TrimaxSecure's customers wanted to pay digitally, but the company's manual AR processes could only support physical checks, delaying cash flow. After implementing Versapay, TrimaxSecure decreased its days sales outstanding (DSO) by 10 days, increasing the speed of cash flow onto its books.

Automated cash application connects invoicing to journal entry creation—Straight-through processing (STP) is a reality with automated cash application. In addition to reducing DSO, TrimaxSecure reduced staff time spent on collections by 25% largely because staff no longer have to switch systems to update invoice statuses after applying cash. Once invoices are posted, they automatically reach customers, and once paid, statuses update automatically. By integrating this workflow with your ERP, you can capture real-time cash flow levels, increasing projection accuracy.

While cash application might seem like a small portion of the accounts receivable process, it often holds up cash flow recognition. Automating this process gives you the visibility you need to create accurate cash projections.

4. Automated cash application reduces customer churn

Churn estimates are a key cash flow projection input and a low, constant number simplifies your projections. Unfortunately, a bad payment experience (of which cash application is a part) leads to poor customer experiences (CX) that create unpredictable churn rates.

Finance, especially payment and collections processes, are significant contributors to churn-inducing CX.

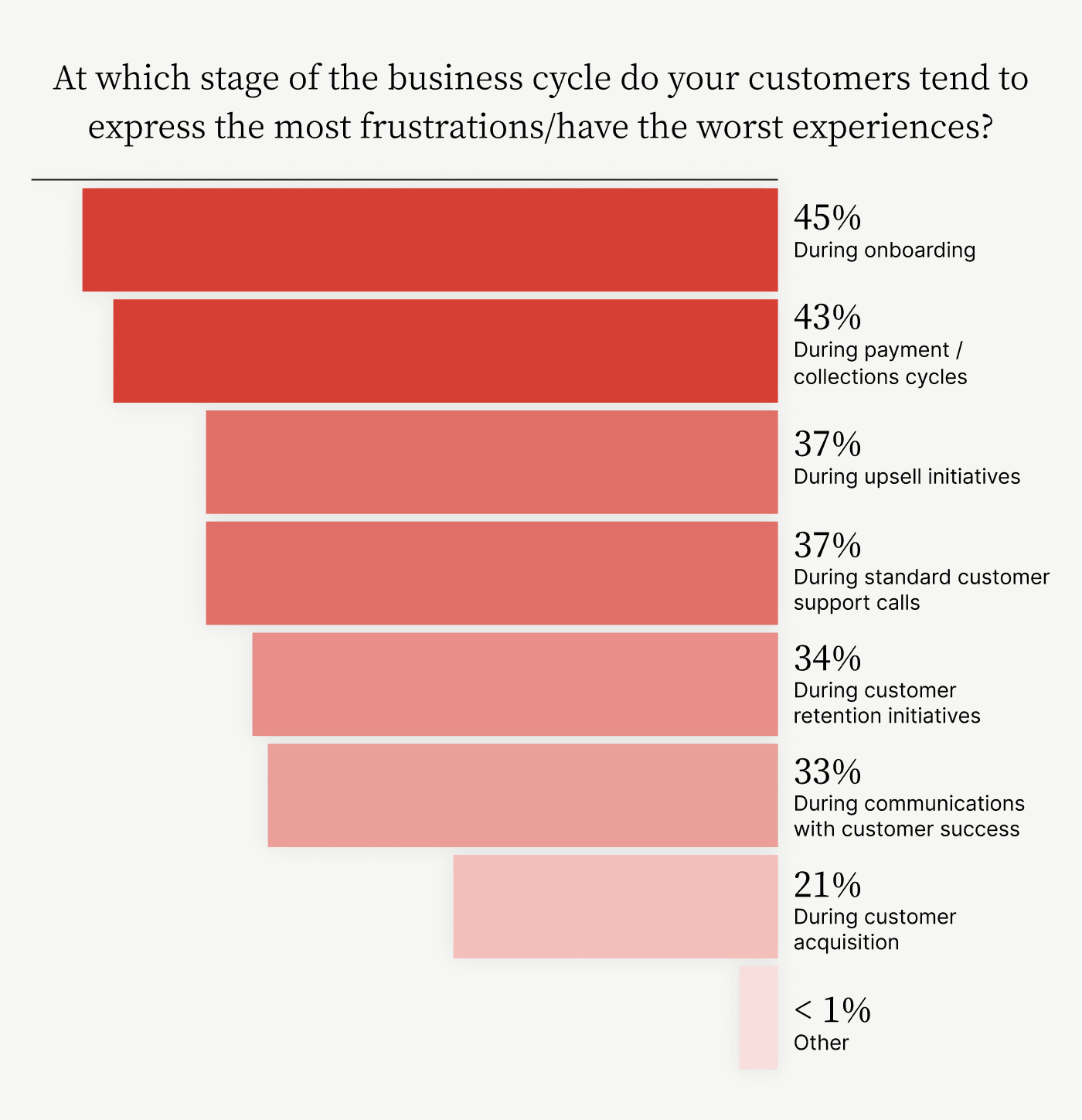

Our survey on Gartner’s Peer Community platform of 400 finance leaders bears this out:

Manual processes within accounts receivable are not designed to serve modern customer needs. Tasking an AR professional with manually creating an invoice, mailing it, updating invoice statuses constantly, and transparently communicating with customers is an impossible task—especially at scale.

Here’s how more effective cash application turns your collections team into a CX-driver:

Automated cash application platforms offer customers visibility—Thanks to every payment matched automatically to open invoices, every invoice will close accurately. With fewer unknown and error-free invoice closings, your customers will receive an accurate picture of payment statuses. In addition, automated cash application routes payment exceptions to the right people, ensuring your customers receive personalized attention when solving complex cases.

Automated cash application helps your AR team proactively tackle late payments—Advanced cash application systems use artificial intelligence and machine learning to match payments more quickly and accurately. With more consistent application, you’re able to better spot the probability of an invoice payment getting delayed. With this data, your AR team can proactively reach out to customers and design workarounds to preserve customer relationships. In turn, this reduces disputes and customer back-and-forth.

As customer experience improves, churn reduces, giving you a steady churn rate number you can rely on when projecting cash. Furthermore, less variation in your churn numbers helps you project cash faster, delivering insights quickly.

Improving cash application is your key to better cash flow forecasting

Cash application might not strike you as the first place to look when troubleshooting cash flow projections. It plays a critical role, however, in bringing cash onto your books. As an upstream factor in your cash projections, more efficiency and automation will ensure clean data, faster data transfer to your books, and data integrity.

Check out how our Accounts Receivable Efficiency Suite helps you drive efficiencies using AI-powered cash application automation software.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.