What is Bank Reconciliation? Why it’s Important and How to Perform One

- 10 min read

Bank reconciliation helps you maintain accurate financial information; it also provides accurate financial information, improves cash flow management, and enables fraud detection.

Every business needs accurate bookkeeping, and one of the core activities that goes into maintaining accurate books is periodic bank reconciliation. A foundational part of accrual accounting, bank reconciliation is the process of making sure all of a business’s recorded transactions match those in the accounts.

Bank reconciliation not only helps you maintain accurate financial information, it also provides a range of benefits like providing accurate financial information, improving cash flow management, and enabling fraud detection. Bank reconciliation also helps you prevent problems. An underappreciated effect of the process is the increased ability to accelerate collections due to surfacing information about late payments.

Let’s take a closer look at everything you need to know about bank reconciliation, including:

- Bank reconciliation definition

- Why it’s important to reconcile a bank statement

- How to find and understand discrepancies that bank reconciliation uncovers

- How to reconcile accounts and record reconciliations

- How often to perform bank reconciliations

- Common problems that bank reconciliation catches

- The benefits of an automated bank reconciliation process

- How bank reconciliation accelerates collections

What is bank reconciliation?

Bank reconciliation involves comparing bookkeeping records for a given time period with all accounts that handle business transactions, including bank accounts, credit cards, PayPal accounts, and others. Bank reconciliation is one among several types of account reconciliation. Other types of reconciliation include customer reconciliation, vendor reconciliation, intercompany reconciliation, and business-specific reconciliation.

This comparison allows you to identify any discrepancies between the transactions on record and the transactions in your accounts, which enables you to catch accounting mistakes and ensure that your company’s money is being handled correctly. Some common discrepancies that bank reconciliation identifies include:

- Outstanding checks,

- Deposits in transit,

- Duplicate transactions, and

- Bank fees

A bank reconciliation should only be prepared if you use the accrual accounting method since accrual accounting involves recording some transactions before they are reflected in your accounts. This means that your books can easily include transactions that were never cleared, which will cause discrepancies between your books and your accounts.

By contrast, the cash basis method of accounting has you record transactions when they are reflected in your accounts, which means your records should match your accounts.

Who is responsible for bank reconciliations?

Whomever handles your books is responsible for doing bank reconciliations. If you run a small business in which you’re a jack-of-all-trades, you’re responsible for reconciling your records with your accounts. If you have a dedicated bookkeeper, doing so is part of that person’s responsibilities.

In mid-market enterprises and other larger companies that maintain teams of accountants, these professionals are consistently checking their books against the company’s accounts. Companies that automate this process can exercise oversight while digital tools do the hard work accurately and quickly.

Why is it important to reconcile your bank statements?

Bank reconciliation is more than just an accounting exercise. It provides benefits that help businesses run smoothly, stay secure, and pursue missing revenue. Here are four reasons bank reconciliation is important

1. Bank reconciliation ensures accurate financial information

With accrual accounting, your books may well reflect revenue that you don’t yet have in your account. They also may have errors, such as duplicate listings of transactions, missing entries, or transcribed numbers. Banks can make (rare) errors too, such as erroneous fee charges. You need to reconcile your bank statements to figure out an accurate financial picture.

2. Bank reconciliation promotes good cash flow management

Accurate financial information helps you avoid spending money you don’t actually have. It also can show you any problem patterns in your spending, such as making late payments or overdrawing your account, which can help you take action to improve your cash flow and avoid bank service fees.

3. Bank reconciliation enables fraud detection

Bank reconciliation helps you catch any suspicious activity in your accounts quickly, which allows you to ensure that all participants in your business are acting with integrity. Businesses that use paper checks—instead of eChecks—are particularly vulnerable to fraudulent activity, such as check forgery, check washing, and check kiting. Check out our guide to digital payment fraud to learn more.

4. Bank reconciliation improves accounts receivable management

A common discrepancy between books and accounts is due to the books reflecting payments that have not yet been received in the accounts. Bank reconciliation is essential to addressing timing differences, identifying outstanding invoices, and allowing for prompt follow up on delinquent payments.

How to find and understand discrepancies that bank reconciliation uncovers

Update your books before reconciling your accounts. Then check your cash balances in your business accounts against the cash account portion of your books for a given time period. It is common for them not to match exactly, as there are many non-suspicious reasons for discrepancies. These might include:

- Bank service charges and wire transfer fees that you haven’t yet recorded in your books

- Outstanding checks or withdrawals that are recorded in your books but that have not cleared from your account

- Outstanding deposits and receipts (also called deposits in transit), which are incoming payments that the books reflect, but which the bank has not yet processed

If you discover discrepancies during the bank reconciliation process, the following steps should be taken:

- Check the bank statement and transactions for inaccurate dates, amounts, missing transactions, and duplicate entries

- Collect relevant, supporting documentation such as check stubs, invoices, receipts, and banking details

- Update your accounting system with the correct balance, ensuring that it aligns with the bank statement balance

- Maintain a record of your findings that include the source of the discrepancy, the correction that was made, the transaction amount, and the date

- Identify and report suspected fraudulent activity

How to reconcile accounts and record reconciliations

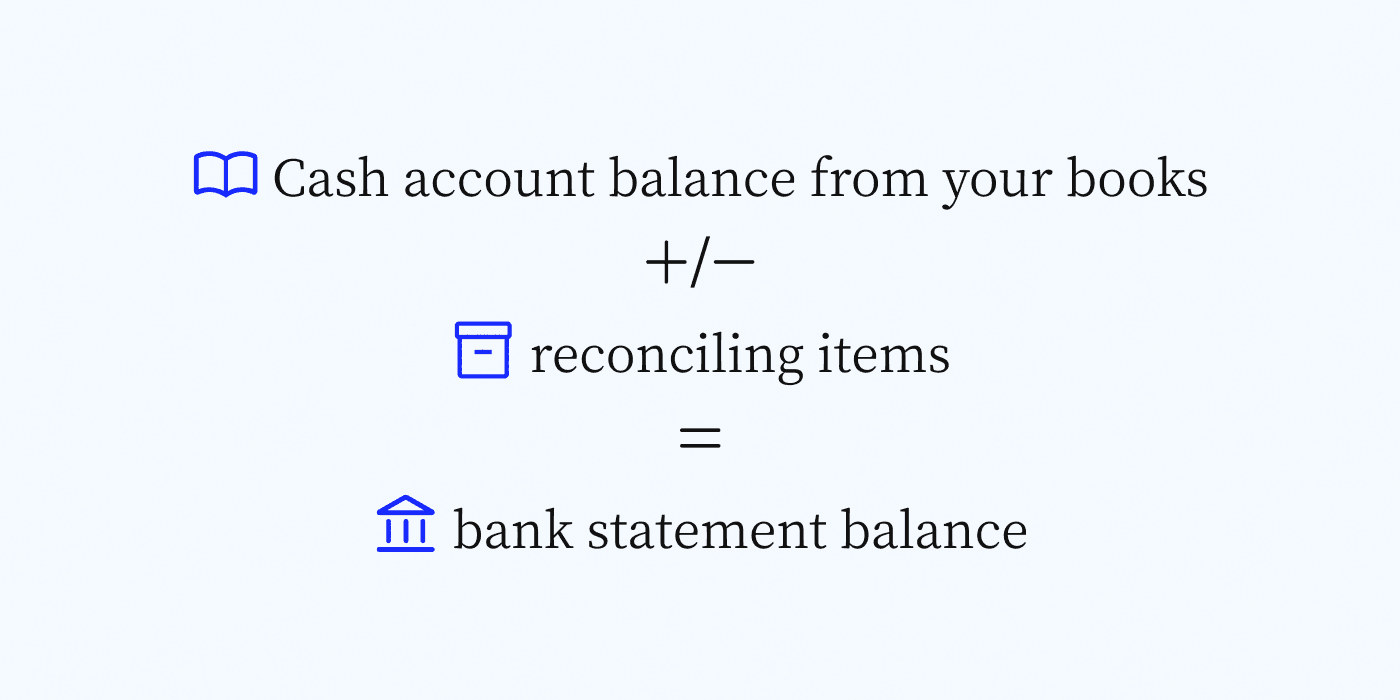

Reconciling your book records and account balances can be done with a simple formula:

- Cash account balance from your books +/- reconciling items = bank statement balance

For example, say you find that the ending balance for February in the company’s bank account is $500,000, while the ending balance on the books is $480,000. You also find that two customers haven’t yet paid a total of $20,000 for transactions that the company processed in February, and reconcile the books with the following formula: $480,000 + $20,000 = $500,000

There are two options for recording such bank reconciliations:

- Adjusting journal entries: Make a note in your general ledger explaining the discrepancy between your bank statement and your ledger.

- Bank reconciliation statements: Put the explanation of the discrepancy in a separate document that is not recorded in a journal entry, called a bank reconciliation statement.

Which method you choose depends on your preference and which best matches your accounting procedures. The priority is to make sure the information is clear and available to others.

How often you should perform bank reconciliations

How often you should reconcile your accounts depends largely on your transaction volume. Businesses that do a high volume of daily transactions may want to reconcile at the end of each day to stay on top of the process and to catch problems promptly. Businesses that do a lower volume of or have more irregular transactions may reconcile once a week or even once a month.

Regardless of how often you reconcile, be vigilant: It is easy to fall behind on bank reconciliation, and the more behind you get, the more difficult it is to catch up.

6 common problems that bank reconciliation catches

Bank reconciliation is so important because it catches a whole range of potential problems for your business.

- Bank reconciliation prevents internal fraud —There are many ways people can sneak money out of your accounts, and bank reconciliation is your first line of defense against such malfeasance.

- Bank reconciliation finds missing ledger entries — Transactions can be left out of the ledger by accident, and such oversight is rarely caught until the transaction clears in the bank account.

- Bank reconciliation eliminates errors of reversal — When a transaction is accidentally posted as a debit instead of a credit, it is difficult to catch without matching the books to the bank account.

- Bank reconciliation helps identify duplicate payments — You may have mistakenly paid someone twice or vice versa, and either one will cause a discrepancy that bank reconciliation can catch.

- Bank reconciliation pinpoints cash flow problems — Unexpected bank fees and charges can indicate that you have overdrawn your account, bounced a check, or suffered another cash flow issue.

- Bank reconciliation highlights very late payments — Discrepancies due to payments that haven’t yet been received are common, but very late payments should prompt follow-up action.

The benefits of automating your bank reconciliation process

Doing bank reconciliation manually is a common frustration for finance departments considering that the task is tedious, time-consuming, and prone to errors that must be found and fixed. There are benefits to automating your reconciliation process where you can. These benefits include:

- Speed—Automating the bank reconciliation process makes it faster than reconciling manually.

- Accuracy—Automation eliminates human error, making reconciliation more accurate.

- Protection—With better speed, accuracy, and frequency, automated reconciliation can detect fraud more quickly so you can take action sooner.

- Worker satisfaction—Automation means that staff can forego the laborious manual reconciliation process, allowing them to work on higher-value tasks.

How bank reconciliation can accelerate collections

By now it’s clear that bank reconciliation is a necessary and beneficial activity for businesses that do accrual accounting. The bank reconciliation process can help you ensure your money is properly managed, your cash flow is optimized, and your collections process is as thorough as possible.

The latter is an important benefit that is often overlooked. Bank reconciliation helps you identify payments that are on the books but have not yet appeared in your account—including those that should have appeared already. This is extremely valuable information, as it serves as a guide for taking action to recoup delinquent payments.

Check out our Guide to Accelerating Collections to learn more about how accelerating collections is key to improving business operations.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.