What Is an ACH Payment? Benefits of ACH Payments, ACH Meaning, and More

- 13 min read

ACH payments are electronic money transfers between banks, processed through the ACH network. In this guide, we’ll explain:

- The definition of ACH payments

- How ACH payments work

- The benefits of ACH payments

- And more

ACH stands for Automated Clearing House and ACH payments are a digital payment method. They are electronic money transfers between banks that are processed through the ACH network. NACHA—the National Automated Clearing House Association and the governing body responsible for these transfers—defines the ACH network as a group of processing systems that financial institutions—like banks—use to combine ACH transactions for processing.

ACH payments are growing in popularity in business-to-business (B2B) circles, owing to their low cost and high convenience. In this guide, we’ll explain what ACH payments are, how ACH payments work, the benefits of ACH payments for customers—and for sellers—so you can determine if it makes sense for your business to accept them, and more.

Jump to a section of interest:

ACH payment meaning: what is an ACH payment?

An ACH payment is an electronic funds transfer made over the Automated Clearing House network, which connects all the banks in the United States. It’s a transfer of funds between accounts at two different banks.

The ACH network is managed by the National Automated Clearing House Association, Nacha, a non-profit that operates under the Federal Reserve.

International ACH transfers—payments between a US financial institution and an agency outside the US—are possible but not frequent due to the ease of wire payments for this purpose. Other countries like Canada have their own payment clearing systems for domestic payments.

If you live in the US and pay your electricity bill, rent, or car insurance through a pre-authorized debit, you’re more than likely using ACH. The ACH payment method is less ubiquitous for B2B transactions, although it’s continuing to grow in popularity.

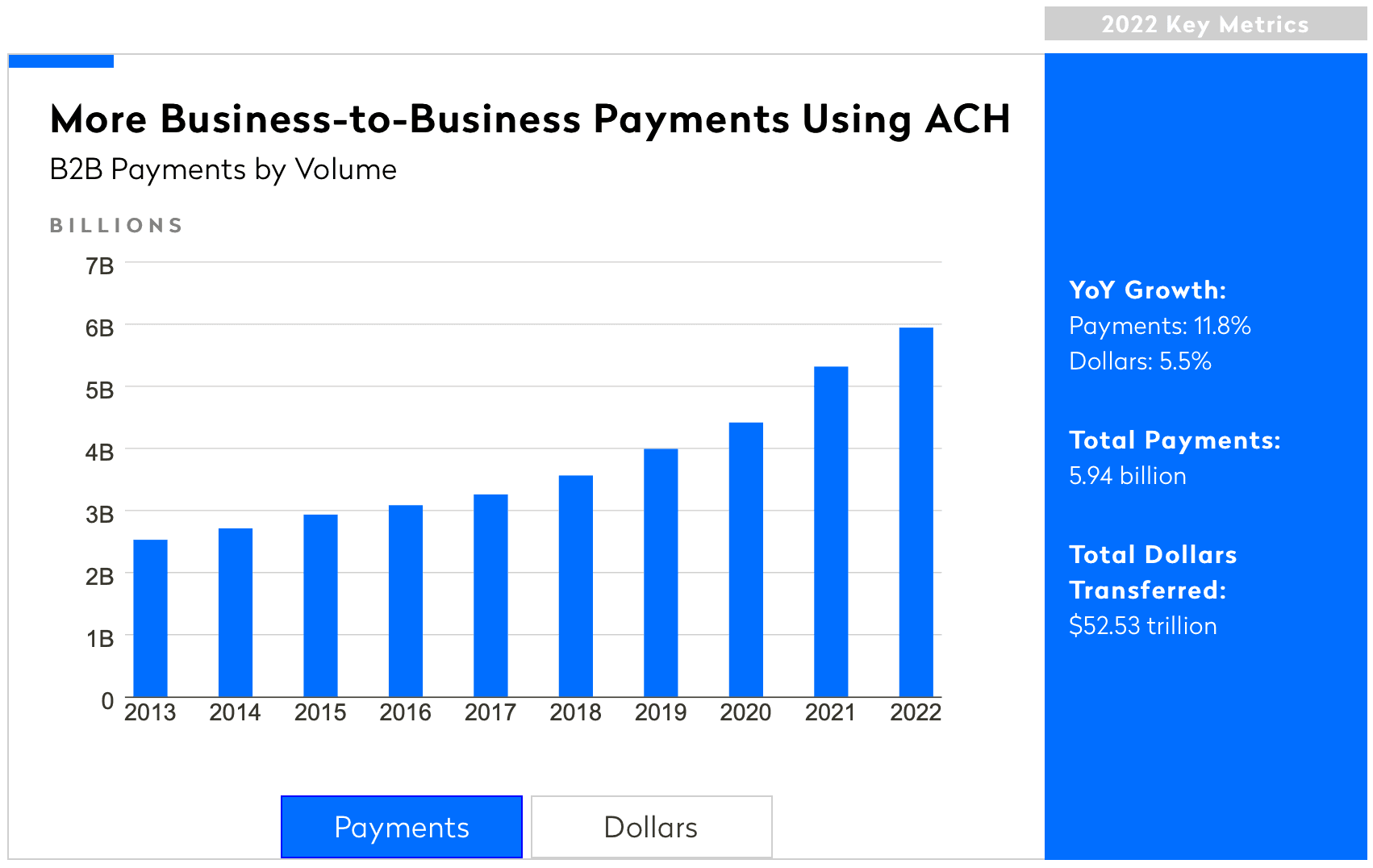

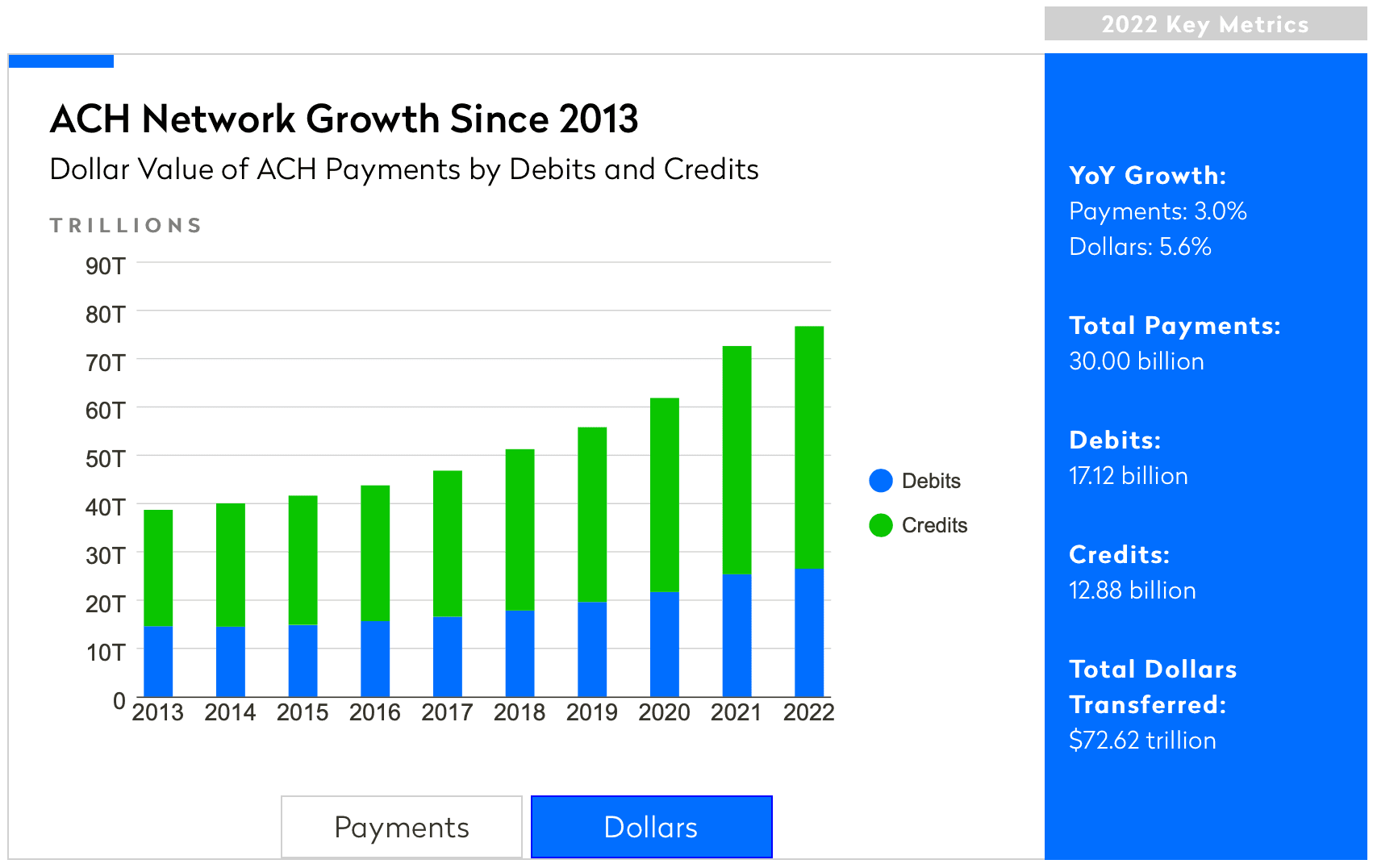

The share of B2B payments made through the Automated Clearing House network grew 11.80% year-over-year in 2022, totaling 5.94 billion payments with a collective value of $52.53 trillion.

In fact, although B2B ACH payment volume (the number of payments made) on the ACH network is much lower than that of consumer payments, B2B ACH payments represent the biggest share of actual dollars flowing through the network (72.34% in 2022). This is because B2B payments tend to be much bigger than consumer payments.

What is an ACH transaction? Examples of ACH payments

There are two distinct categories of ACH transactions: direct deposits and direct payments.

- A direct deposit refers to ACH payments made from businesses or the US government to consumers. The most prominent examples of this are payroll, government benefits, and tax refunds.

- A direct payment refers to ACH payments between individuals and organizations, where funds can be sent in both directions between payers and payees. Examples of this include recurring bill payments like rent and insurance.

Throughout the remainder of this article, we’ll specifically be discussing direct payments, as they’re the type of ACH payment you would use to collect from customers.

In the category of direct payments, there are two types of ACH transactions to speak of: ACH credit and ACH debit. The difference lies in who is initiating the transaction.

- An ACH credit is known as a “push” payment, because the customer is the one initiating the transaction, thereby “pushing” the funds from their account to the seller's.

- An ACH debit is known as a “pull” payment, because the seller is the one initiating the transaction, thereby “pulling” the funds from the customer’s account.

ACH vs wire transfer vs eCheck: what are the differences?

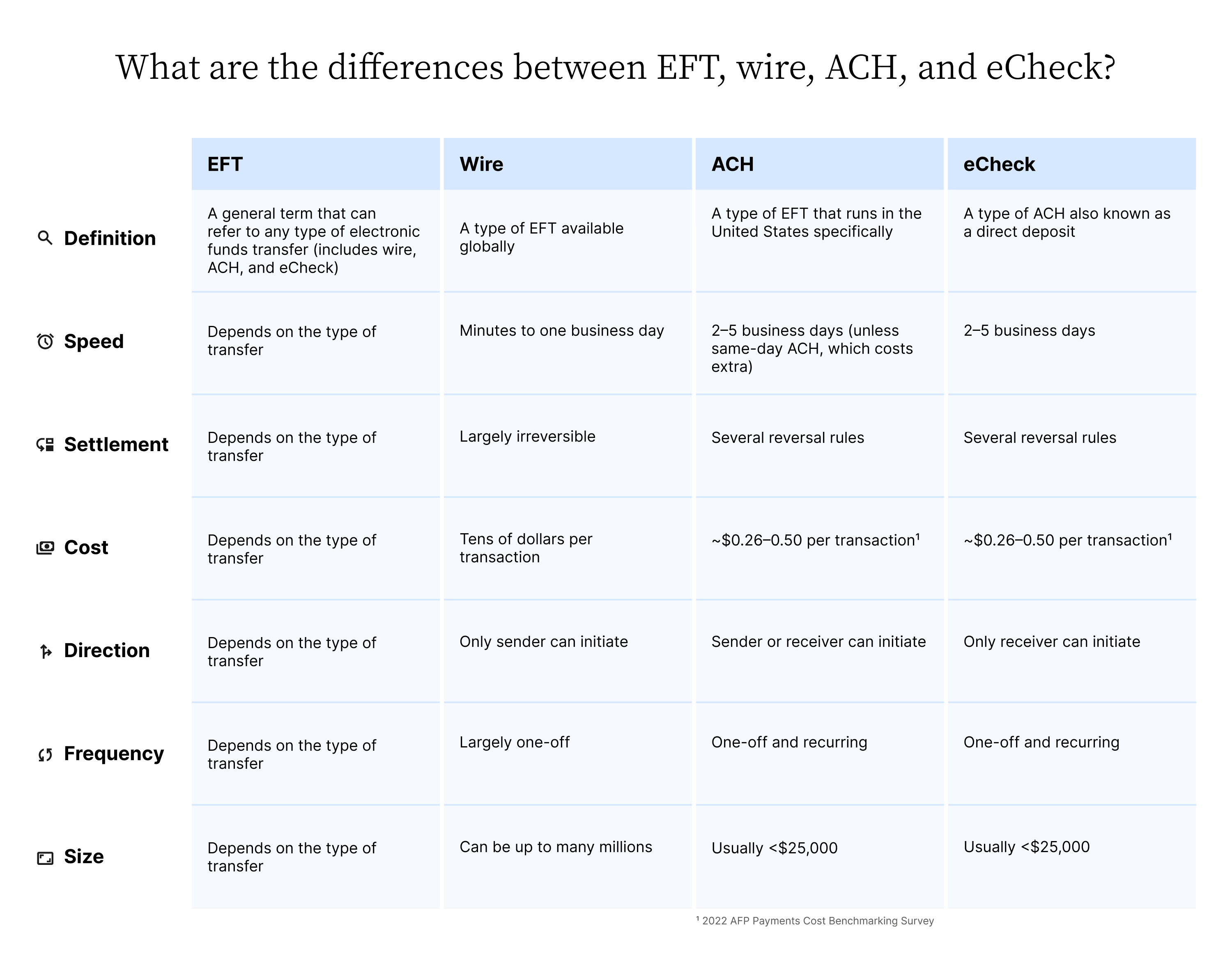

The terms Electronic Funds Transfer (EFT) and ACH are often used interchangeably. There is a difference, however, in that EFT is a general term that can refer to several kinds of electronic transactions including ACH payments and wire transfers.

There are some notable differences between ACH payments and wire transfers. The ACH network processes payments in batches three times a day, whereas wire payments get processed pretty much immediately. That means wire payments will settle in a matter of minutes or hours, whereas ACH payments take an average of three business days to settle. The tradeoff for speed, however, is cost, as ACH payments are much cheaper to accept than wire transfers.

You may also be familiar with the term eCheck—or electronic check—which is a type of ACH payment used for online payments. The critical difference between an ACH and an eCheck is that all eChecks are ACH payments, but not all ACH payments are eChecks. Electronic checks are specifically ACH debit payments (“pull” payments).

Below is a chart summarizing ACH vs wire transfer vs eCheck:

How does ACH processing work?

To accept ACH payments, you’ll either go through your bank directly or work with a third-party payment processor. You’ll also need to have an ACH merchant account, which your payment processor can help you set up.

Here are all the parties involved in processing ACH transfers:

- Originator: The individual or business submitting the instruction to initiate the transaction.

- Originating Depository Financial Institution (ODFI): The bank initiating the transaction.

- Receiving Depository Financial Institution (RDFI): The bank receiving the request.

- Nacha: The non-profit organization responsible for managing the ACH network.

- ACH operator: The entity that moves the ACH transactions through the ACH network. There are two in the US: the Federal Reserve Banks’ Automated Clearing House (FedACH) and the Electronic Payments Network (EPN).

- Third-party payment processor: The technology provider that coordinates the collection of the ACH payment details and initiation of the transaction.

- Receiver: The individual or business receiving the credit or debit to their bank account, who has authorized the Originator to initiate the transaction.

Let’s say, in this case, a customer is paying your business for a recurring monthly invoice and it’s an ACH debit (a “pull” payment).

- Step 1: You request authorization from your customer and get their bank routing and bank account number. You can do this through an authorization form (can be online or in paper format).

- Step 2: If you’re working with a third-party payment processor, they’ll submit the customer’s payment details and the transaction request to the ACH network.

- Step 3: The ODFI (in this case, your bank) takes this request and sends it to an ACH operator.

- Step 4: The ACH operator forwards the request to the RDFI (the customer’s bank).

- Step 5: The customer’s bank will confirm that there are sufficient funds available in their account and communicate this back to your bank.

- Step 6: If there are sufficient funds in the customer’s account, the transaction is processed, and the funds are pulled from the customer’s account.

- Step 7: Your bank deposits the funds into your bank account.

5 benefits of ACH payments for customers and sellers

1. Lower cost compared to checks and credit cards

There are benefits of ACH payments over checks. Compared to paper checks and credit cards, ACH transactions are inexpensive to process. According to Bank of America, it costs on average $4–20 USD to process a single check (this includes shipping costs and the time it takes accounting teams to write, mail, collect, and reconcile the check). Credit card processing fees are 2% of every transaction on average, which makes it especially costly for sellers to support this method for high-value payments.

In contrast, an ACH payment costs mere cents to initiate. According to AFP’s 2022 Payments Cost Benchmarking Survey, the median cost of initiating and receiving an ACH payment is between $0.26–0.50 USD. These ACH fees might vary based on the volume of payments you accept (businesses with high payment volumes can get discounted rates) and any additional third-party processor fees you’ll have to pay.

📚 Paper check alternatives: in this blog, we unpack the issues surrounding paper checks, explore alternatives to paper checks, and offer tips for easing your transition to digital payments.

2. Highly secure

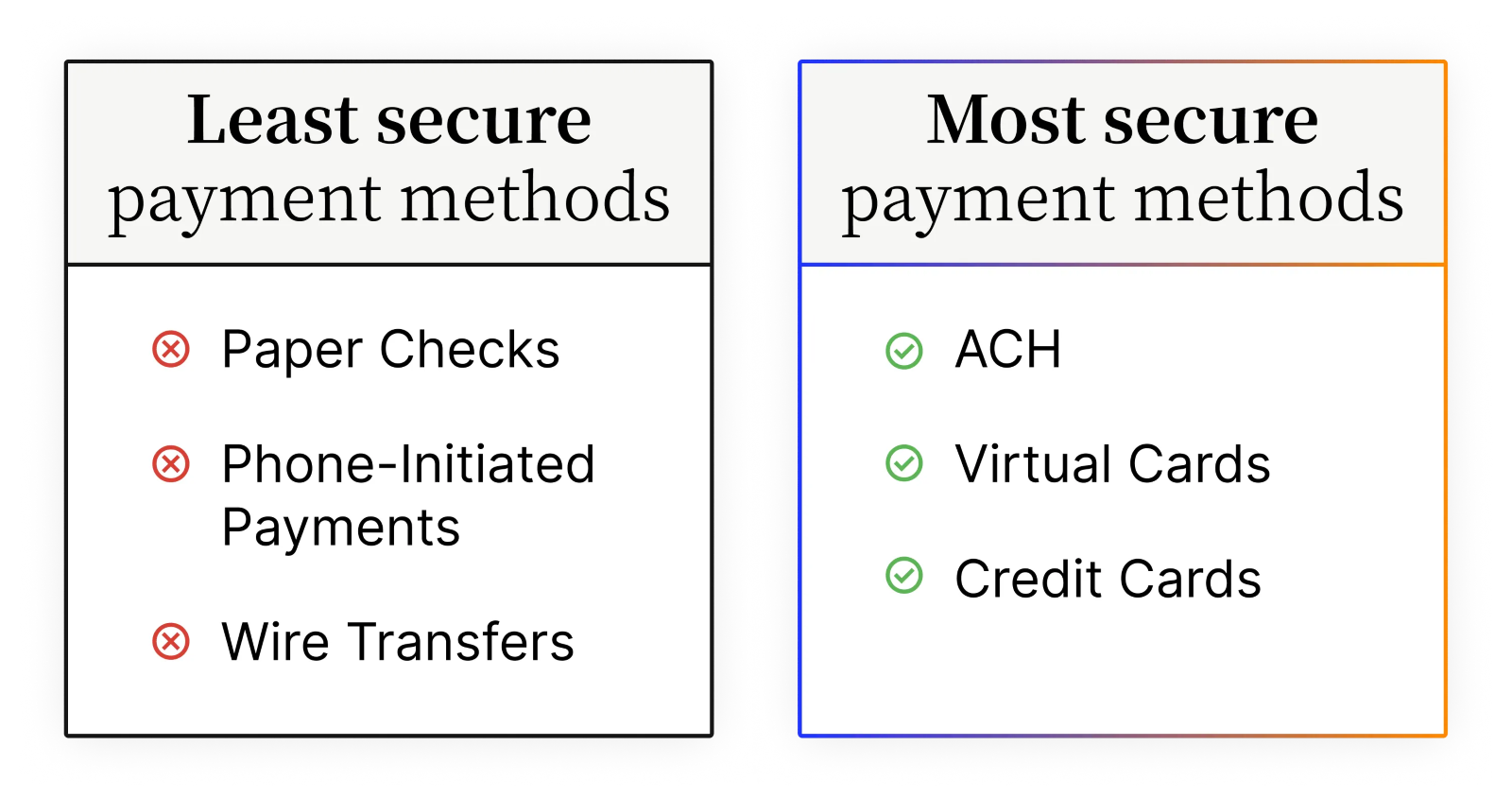

With cybercrime and internet safety a growing concern for businesses, avoiding payment fraud should be a top priority. ACH payments are among the most secure payment methods, since every transaction that passes through the ACH network is encrypted.

And unlike wire transfers, which are largely irreversible, ACH transfers can be reversed if caught soon enough (no later than five business days after settlement). This makes them less likely to be used for fraudulent schemes.

3. Convenient for your customers

Another benefit of ACH payments for customers is convenience. ACH payments lend themselves well to recurring payments, because you only have to request customers’ authorization once. With their consent, you can arrange for payments to go out on an automated basis. This is especially helpful if your business operates on a subscription model, or your customers pay repeated monthly charges (like rent).

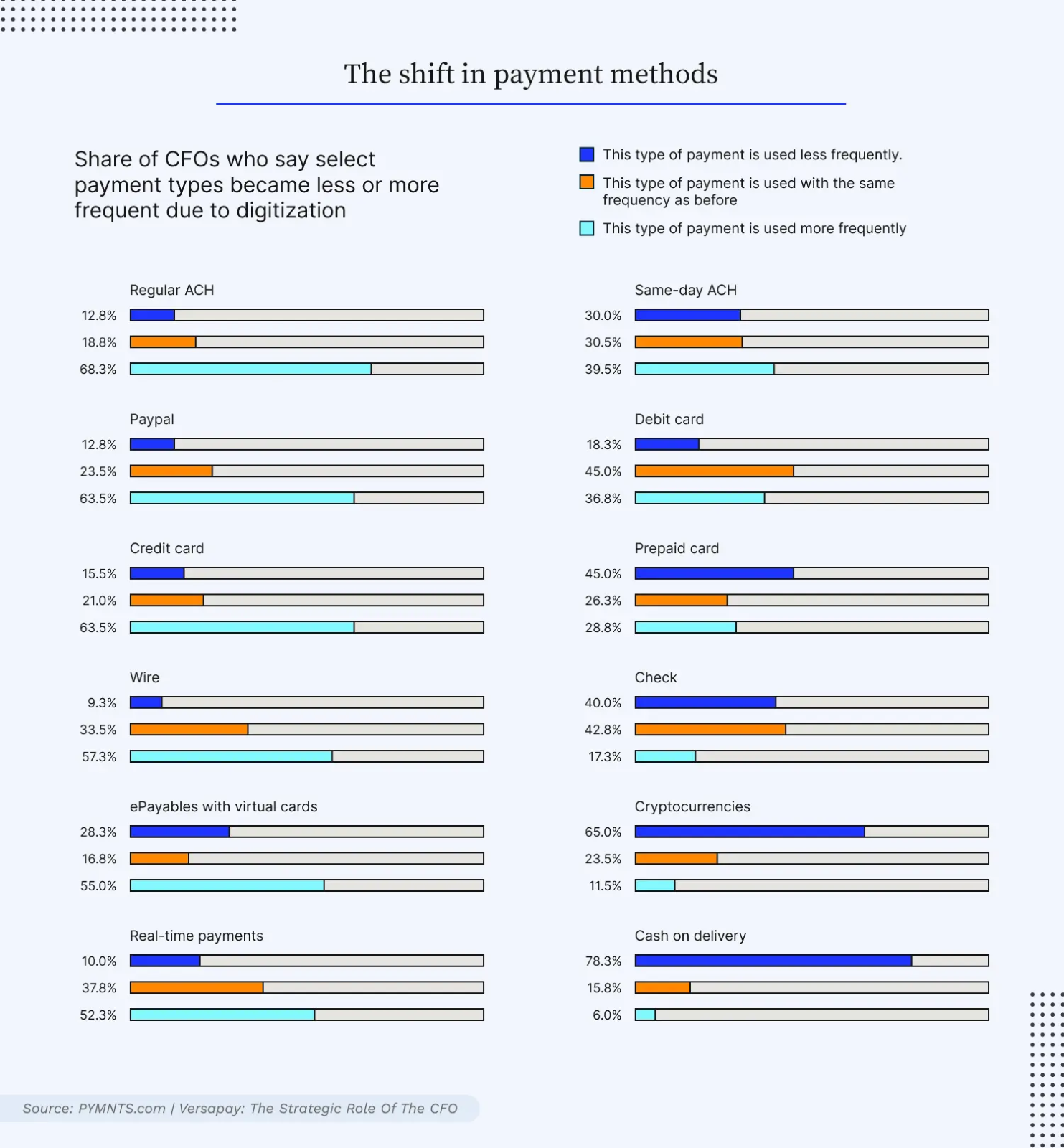

Customers like this because they don’t have to worry about missing a payment. B2B customer preferences are also trending towards electronic payments, largely due to the spike in digitization caused by the pandemic. In a survey we ran of 400 CFOs, 40% of respondents said they’re using checks less often than they were before the pandemic.

4. Convenient for you

Signing customers up to pay automatically with ACH payments also means your accounts receivable (AR) team is spending less time chasing after overdue payments. Automatic payments mean invoices get paid on or before their due date, avoiding the need to trigger any collections outreach.

When customers can pay invoices digitally, there’s also no need for your team to physically go to the office to retrieve paper checks or to manage lockboxes.

By spending less time following up on overdue payments and processing paper checks, your AR team can focus on higher-value work like analyzing reporting.

📚 Speaking of reporting, the Accounts Receivable Performance Toolkit can teach you how to take raw data, interpret it, and effectively communicate what it means for your business.

5. Less frequent payment failure

Bank account numbers change far less frequently than credit card numbers. This creates less opportunity for payments to fail due to expired payment information.

This is especially helpful when it comes to recurring payments. When customers don’t update their credit card details on file before they expire, this can cause scheduled payments to fail. Your AR team then has to get in contact with the customer to request an updated payment method. The time it takes to wait for a response from the customer further slows down the payment—and your cash flow.

4 downsides of ACH payments

1. Slower processing time compared to other payment methods

Compared to card payments and wire transfers where you can receive the funds the same day the payment was made, the ACH payment processing time can feel slow. It takes a few days (between two to five business days) for an ACH payment to reach your account.

Nacha does offer same-day ACH payments, but they cost more to initiate than regular ACH.

2. Can’t process payments on weekends

The ACH network relies on banks, which typically only operate on business days. This means ACH payments can’t be processed on weekends.

This can delay your receipt of a payment by a few days. If a customer initiates an ACH payment on a Friday, for instance, those funds won’t reach your account until the following Wednesday at the earliest.

3. Penalty fees for rejected payments

If a payee’s account has insufficient funds to cover the ACH payment, it won’t go through. But because it takes about 48 hours for the bank to confirm whether an account has sufficient funds, the payment can appear to go through initially but then get rejected (known as a “return”).

If an ACH payment gets rejected (for non-sufficient funds or another reason such as an error in the bank details provided), then your business could receive a penalty fee. For ACH debits, Originators must keep returns under a certain threshold (overall returns must stay below 15%) or risk being fined.

4. Remittance advice arrives separate from the payment

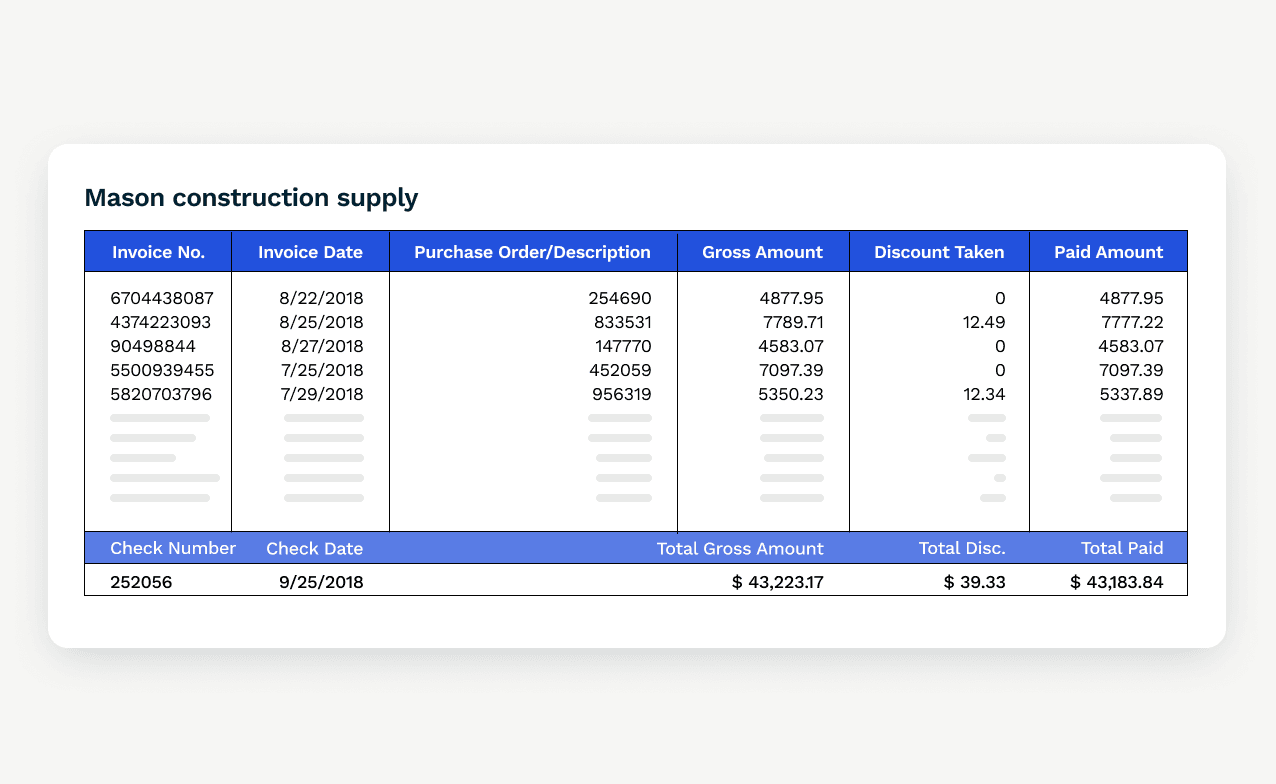

If your back-office accounting processes are especially manual, then accepting ACH payments may be a challenge since remittance advice arrives separately.

Completing cash application in a timely way becomes difficult because your AR staff must spend time retrieving the remittance instructions (which typically arrive through email for ACH transactions) and comparing them to bank statements to confirm the payment. Then, they must match the payment to the appropriate invoice(s) in your accounting system.

💡Fortunately, you can eliminate the manual work involved with posting ACH payments with accounts receivable automation software.

How to collect ACH payments with Versapay

Versapay lets you process customer payments from multiple sources, including ACH. We make the process of accepting and reconciling ACH payments easier for your accounts receivable team by:

- Letting you capture payments from all your sales channels, including ecommerce, point of sale, and on account.

- Seamlessly integrating with your enterprise resource planning (ERP) software so that you can automatically post payments as they come in.

- Applying payments with ease when you collect through Versapay’s Collaborative Accounts Receivable platform, as payments carry both payment instruction and complete remittance information.

- Retrieving and aggregating remittance information for you and matching it to the right invoices using artificial intelligence.

Want to learn more about digital payments and the ins and outs of B2B payment processing? Check out our additional resources.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.