5 Ways NOT Accepting Virtual Credit Cards Can Hurt Your Business

- 8 min read

Virtual credit card use is growing among your buyers. Not accommodating their preferences by not accepting virtual cards can be catastrophic (not hyperbole).

In a business world increasingly defined by digital transactions, adoption of virtual credit cards (VCCs)—primarily by buyers; more slowly by sellers—is an exploding trend. The number of virtual card transactions globally will grow 340% from 2022 to 2027, from 28 billion to more than 121 billion, according to a study from Juniper Research.

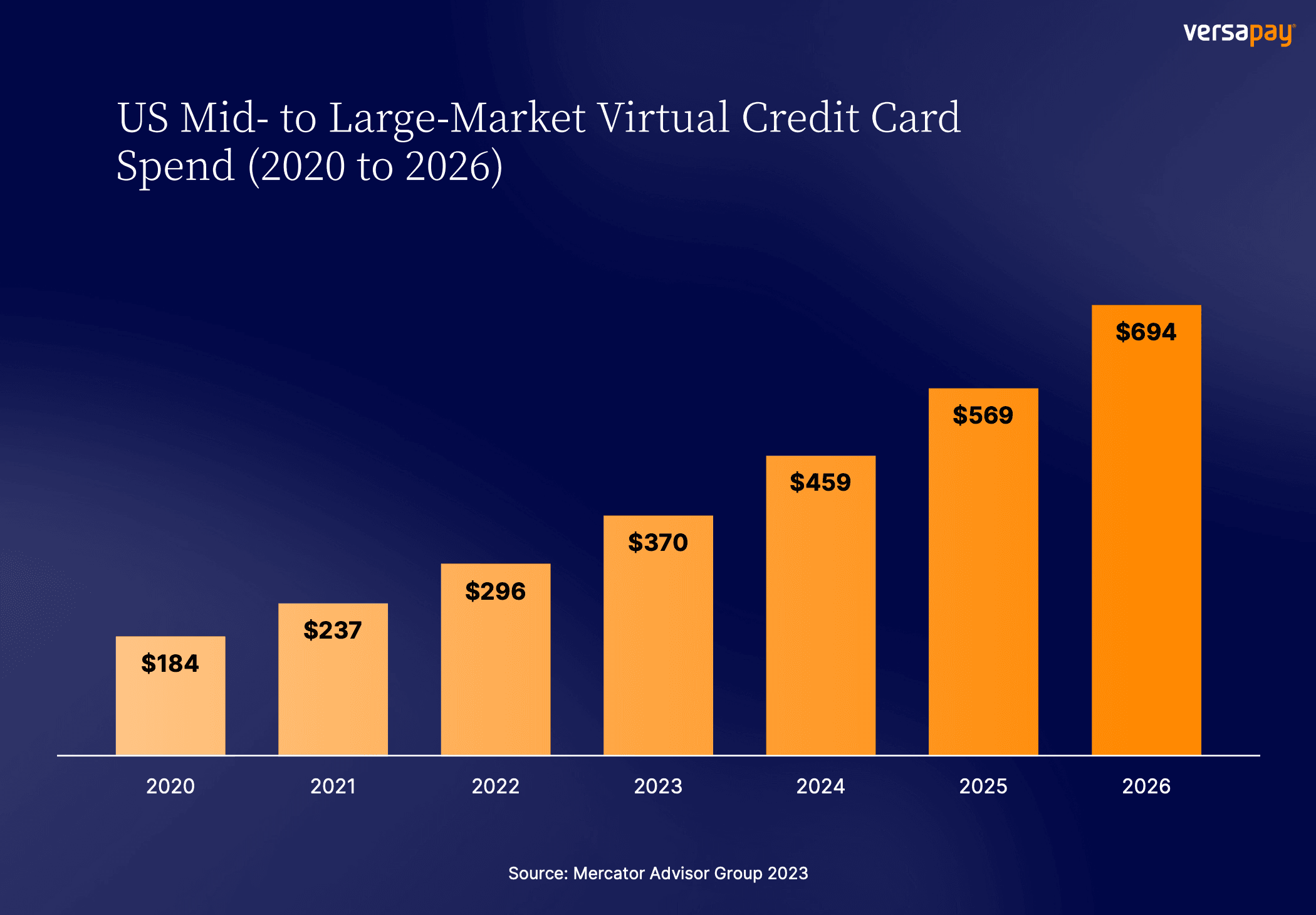

And when looking exclusively at US mid- to large-market virtual card spend, that too is expected to grow. Here’s what it’ll look like mid-decade:

Business buyers increasingly prefer VCCs because they want payment solutions that provide certainty and immediacy. Virtual cards help buyers feel confident about security and control, while they benefit sellers with faster payments and more robust analytics.

With such a tailwind behind virtual cards, businesses can no longer afford to delay setting up the capability to accept these payments. Lacking this payment option risks leaving customers unsatisfied and losing revenue when they seek out competitors, among other problems.

Table of contents

Why B2B customers prefer paying with virtual credit cards

To drill down on this fast-developing shift in the payment landscape, we recently surveyed 400 finance leaders on virtual credit card use and acceptance. Our survey respondents confirmed the trend that is evident elsewhere.

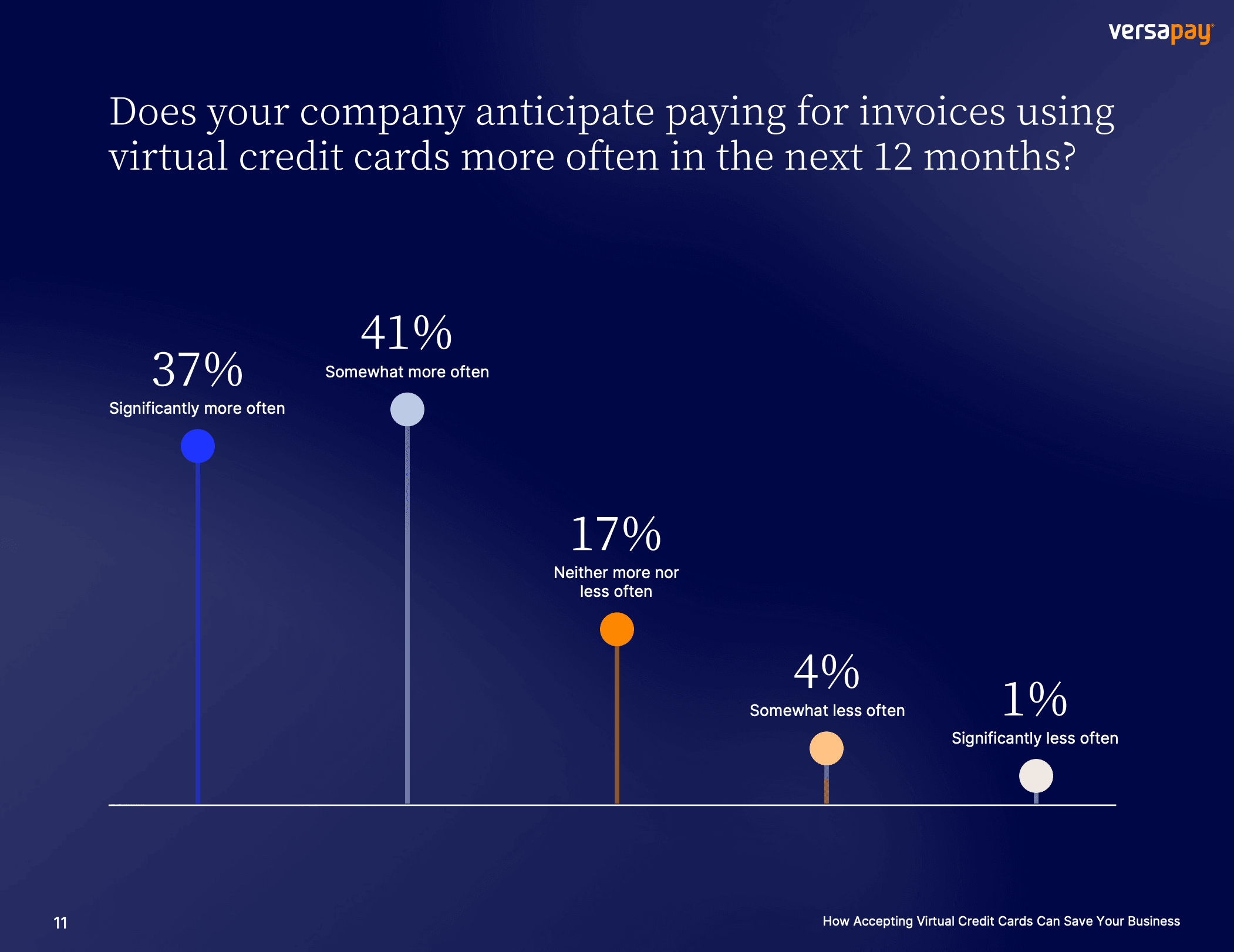

They reported that they overwhelmingly anticipate paying their invoices with virtual credit cards more often over the next year, with 37% saying they will do so significantly more often, and 41% saying they will somewhat more often.

“Business buyers are increasingly turning to virtual cards to make faster, more efficient payments while giving them flexibility and better cash-flow management,” says, Colleen Taylor, president of global merchant services for the U.S. at American Express. “Suppliers are benefiting from these faster payments.”

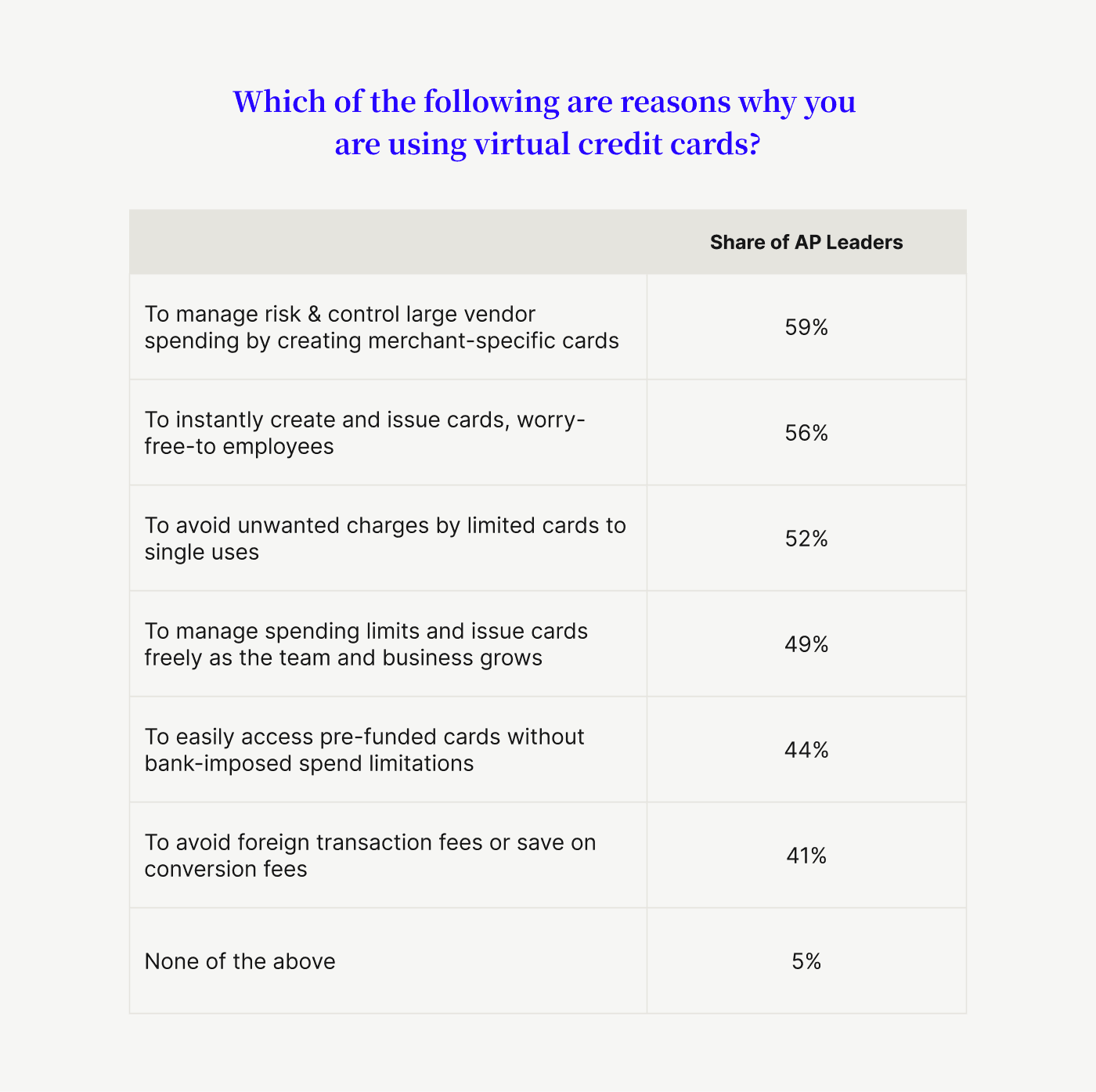

B2B customers prefer virtual credit cards for a number of reasons. The most prominent is to manage risk and control large vendor spending (59% of respondents), followed closely by the ability to instantly create and issue cards to employees without worry (56%) and the avoidance of unwanted charges by limiting cards to single uses (52%). They also like that VCCs allow them to manage spending limits, easily access pre-funded cards, and avoid foreign transaction fees.

5 biggest problems with not accepting virtual credit cards

With the vast majority of buyers now desiring and even expecting the option to pay via virtual credit card, sellers can end up hurting themselves—in some ways, very significantly—if they don’t accept these payments. Here are five ways this can negatively impact your business:

1) Damage to customer expectations and satisfaction

2) Poor competitive positioning

3) Operational inefficiency

4) Problems with security and fraud

5) Financial loss

1. Damage to customer expectations and satisfaction

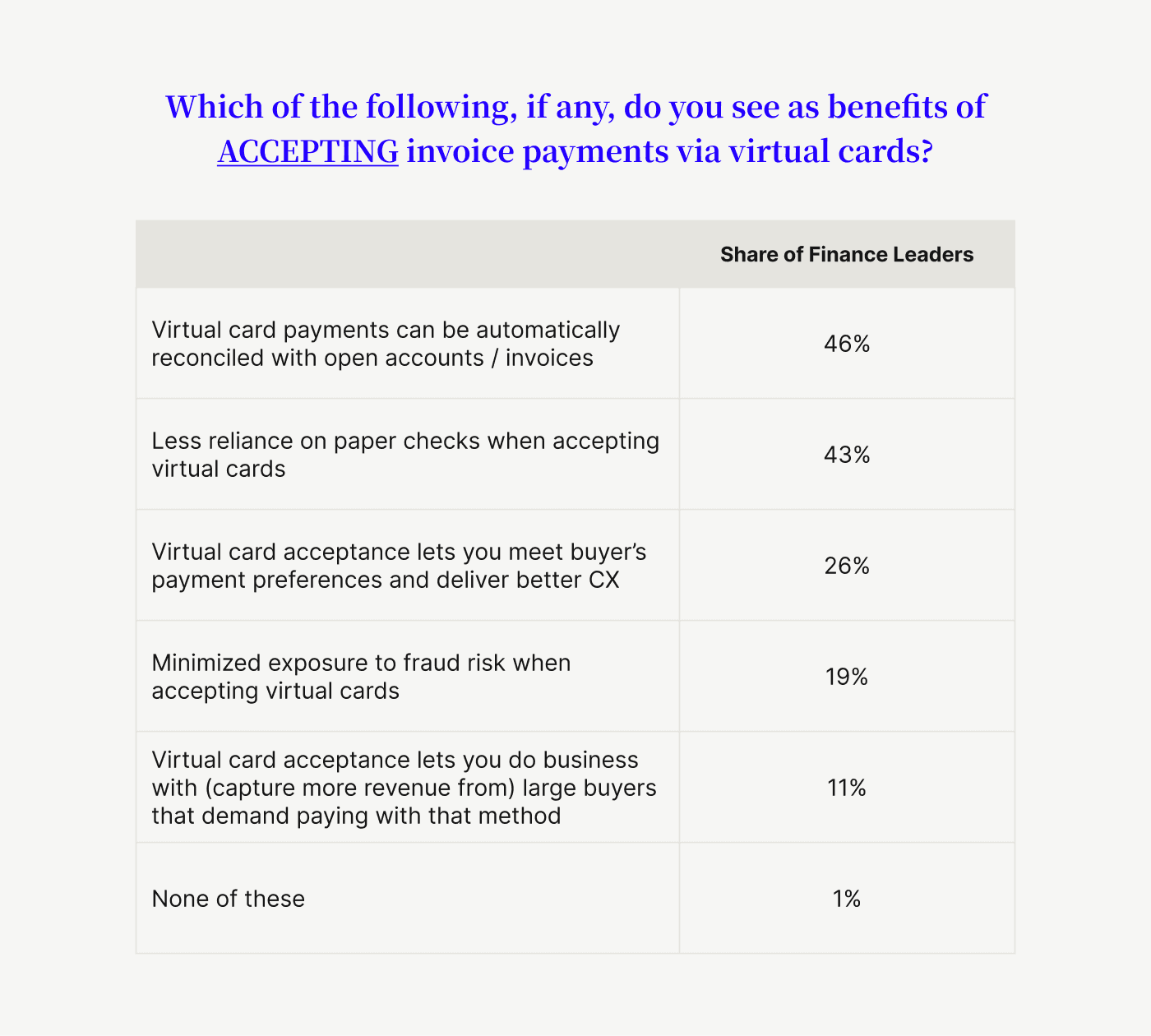

Not accepting virtual cards can disappoint customers who want to use this payment method, reducing their satisfaction with your company and potentially lowering their loyalty to your brand. Our recent study of finance leaders found that 26% of respondents said that a top benefit of using virtual credit cards was delivering better customer experiences.

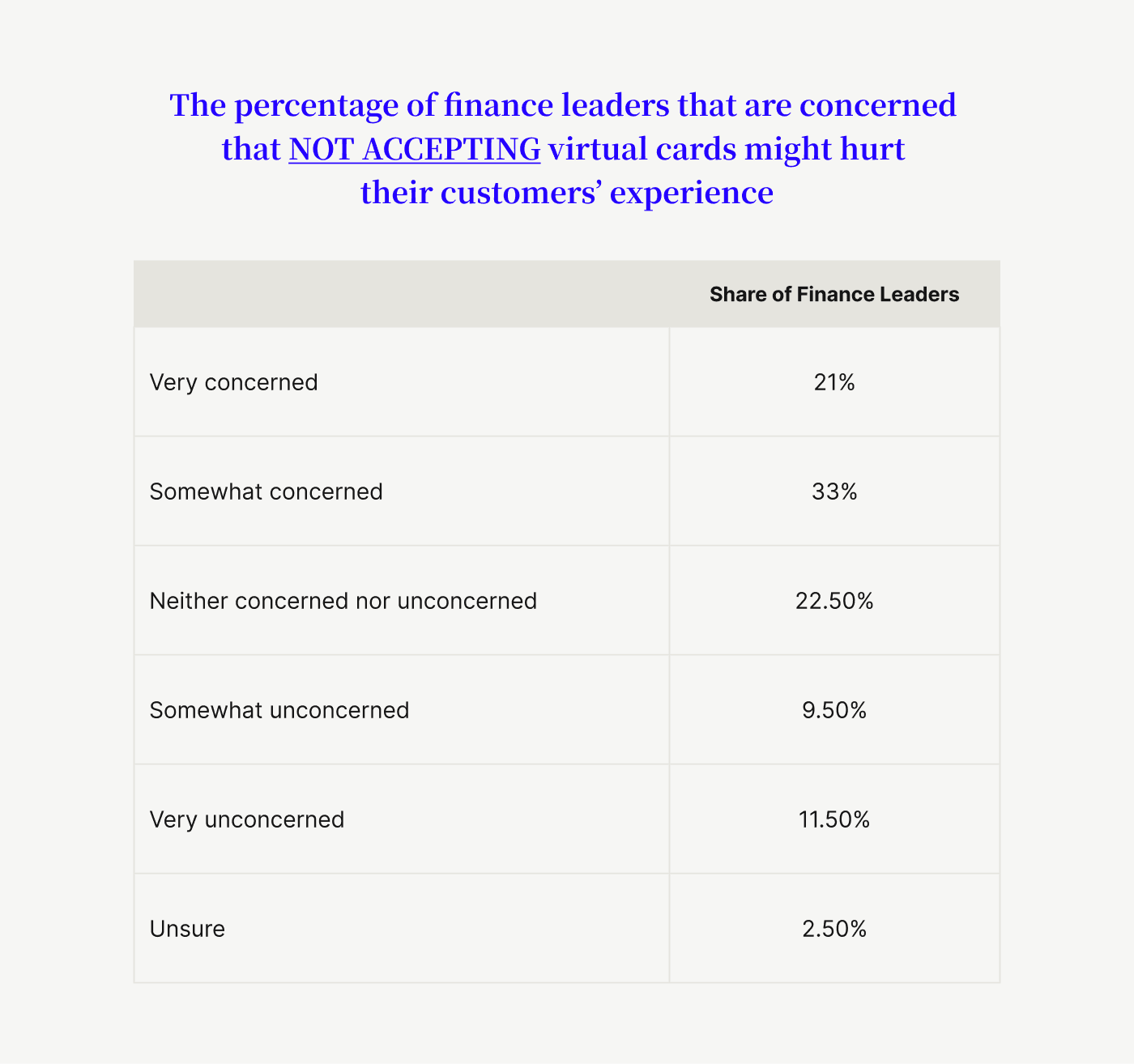

On the reverse, 54% of respondents said they are at least somewhat concerned that not accepting virtual credit cards could harm their customers’ experience with their company.

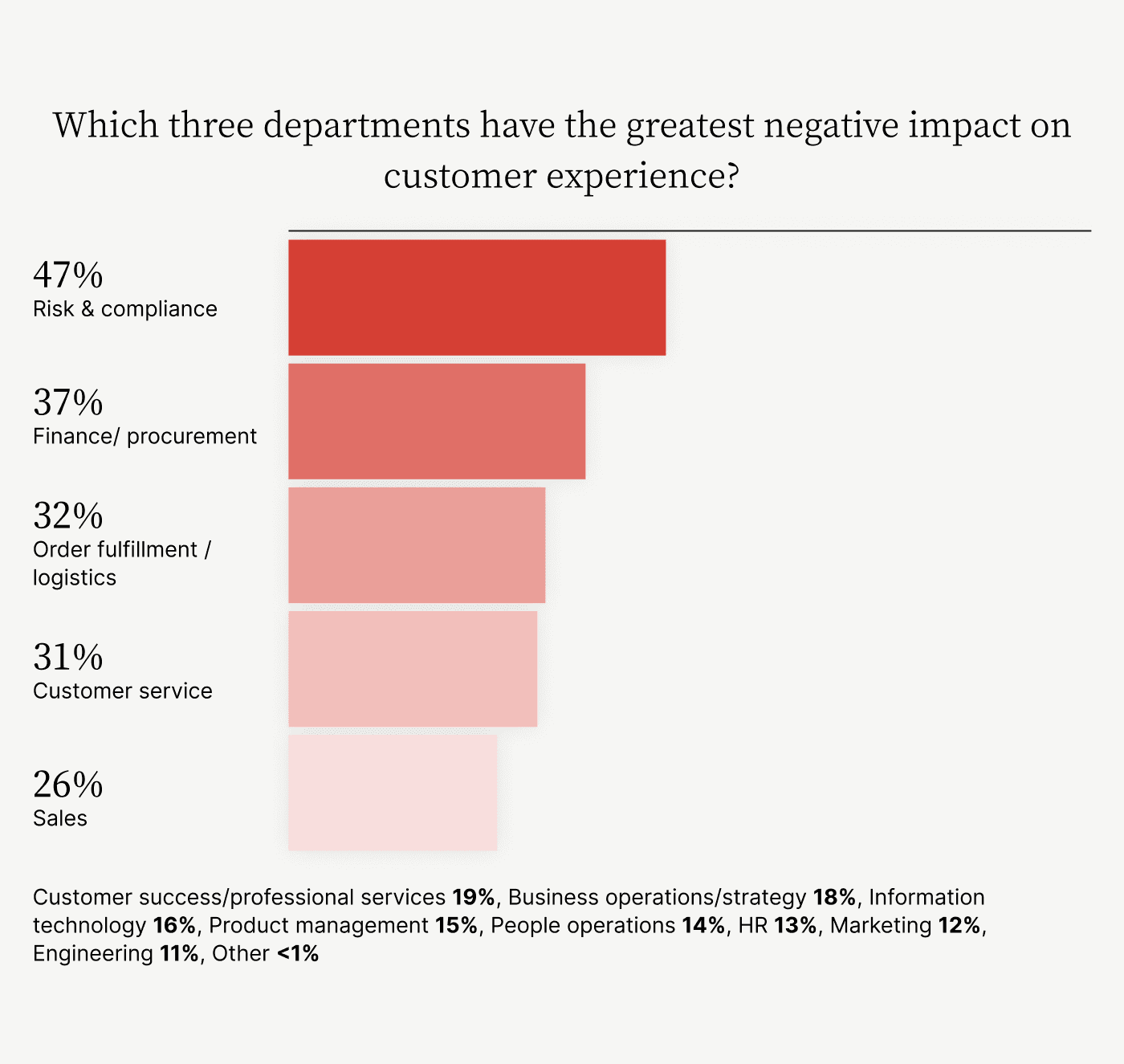

Finance teams can’t afford to forego anything that might bolster customers’ experience with the department. Tellingly, another study of ours showed that finance teams are among the top three departments that are seen as negatively affecting customer experience.

Making sure they accept virtual credit cards is one way finance teams can counteract this problematic reputation.

2. Poor competitive positioning

Staying current with payment technology trends is vitally important in a business arena where everything—including payments—is increasingly online and digital. Companies that stay as cutting-edge as they can benefit across the board: Research from A.T. Kearney shows that companies with robust and efficient digital platforms have revenue growth of 8% average per year, twice their competitors’ average.

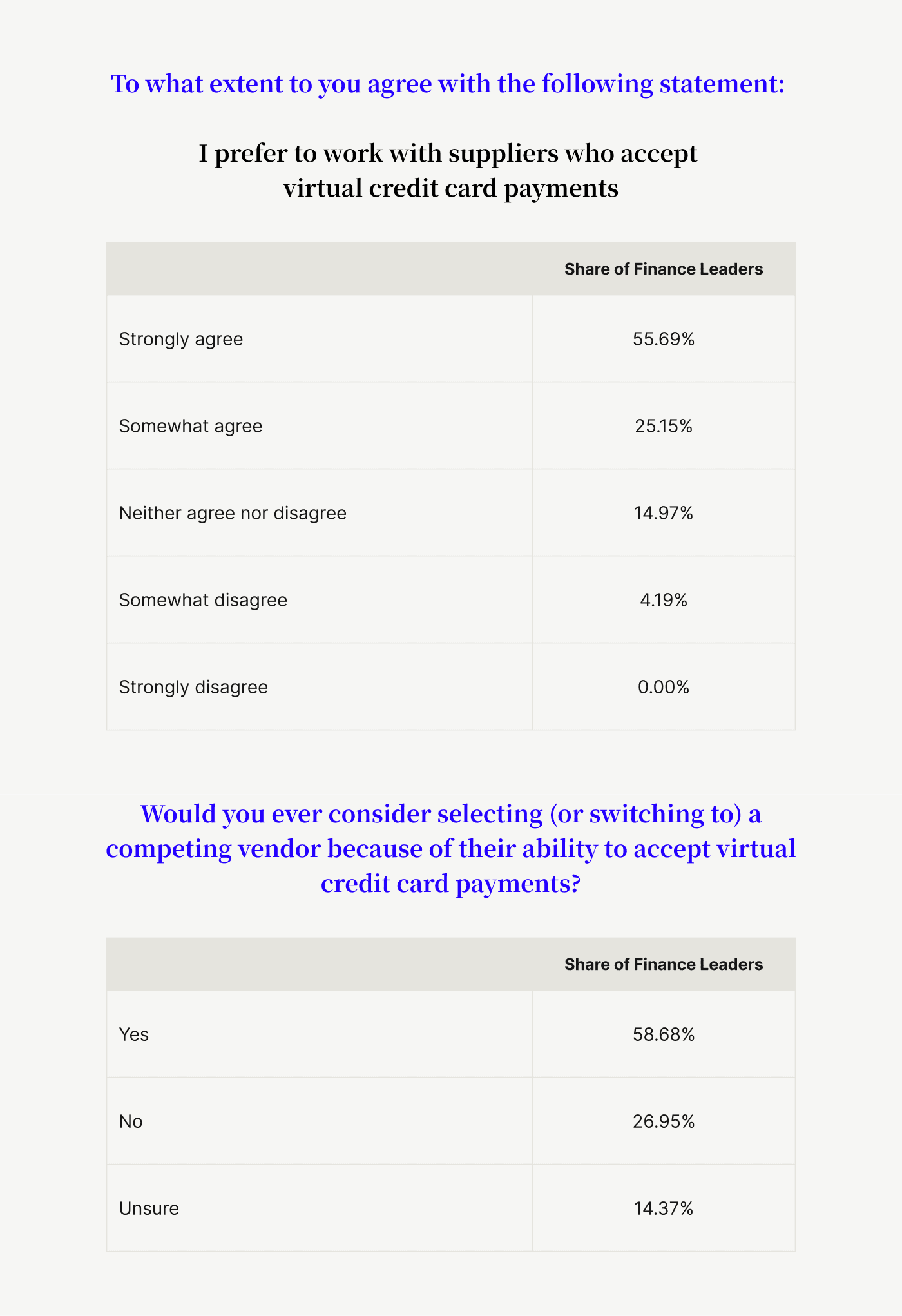

In this context, those who don’t accept virtual credit cards and frustrate customers lose an edge to those who accept these payments and satisfy customers. Our recent survey of finance and accounts payable leaders found that 80% of respondents strongly or somewhat agree that they would prefer to work with suppliers who accept virtual credit card payments. And nearly 60% said they would consider choosing or switching to a vendor specifically because they could accept VCC payments.

3. Operational inefficiency

An advantage of virtual credit card payments is their speed and efficiency, which means that running your business without accepting them slows down your average transaction and payment processing time.

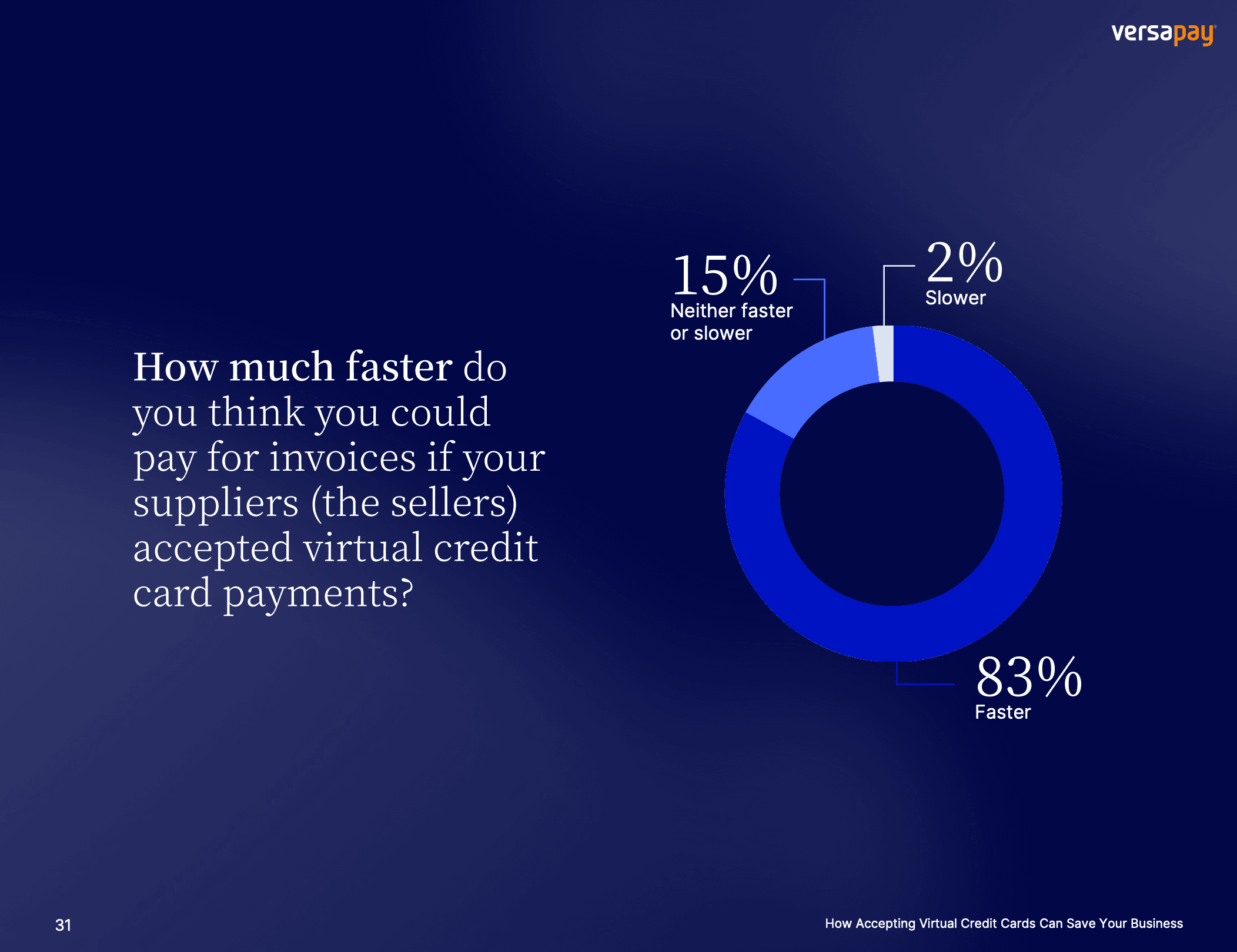

Our study found that 83% of buyers believe they could pay invoices faster if their suppliers accepted virtual credit card payments. The suppliers they would be paying could count on getting their payments more quickly, resulting in lower days sales outstanding (DSO) on open invoices and accelerated cash flow to help fund business operations and growth

4. Problems with security and fraud

Virtual cards have a unique advantage of being a particularly secure way to pay online. This is vital in an era of ever-growing fraud and security risks. According to the Association for Financial Professionals, 80% of organizations faced at least one payment fraud attack in 2023, an increase of 15 percentage points since 2022.

Virtual credit cards are among the most secure payment methods. They are close to impossible to defraud because the card numbers are only valid for a short period of time, and those numbers aren’t associated with any account or bank information. This means that accepting virtual card payments makes it easier for sellers to securely collect and store sensitive payment information to remain PCI compliant.

5. Financial loss

Businesses that resist accepting virtual cards are likely to lose revenue as a result of losing customers who prefer making virtual card payments. The numbers are stark: PYMNTS Intelligence found that companies that don’t use virtual cards have an average revenue loss of 4.6% due to payment uncertainties.

Not accepting virtual credit cards can also open the door to higher transaction fees and chargebacks. You aren’t able to lower processing costs if you favor payments being made by check. Other payment methods such as credit cards are more susceptible to chargebacks. These costs add up for businesses that don’t accept VCC payments.

How to move toward virtual card acceptance

In an ideal world, every business would instantly be able to accept virtual credit cards and get all the benefits that come with this capability. Adopting an automated virtual card acceptance solution like Versapay can get you on that path extremely quickly.

This type of tool can simplify virtual card payments processing and reconciliation with ease and increase efficiency to accomplish more. However, not every business is ready to dive into the world of virtual payments right away.

In the meantime, you can improve your digital payment profile and your customers’ satisfaction by accepting other commonly used digital payment methods like credit cards and ACH payments. The goal is to broaden the array of payment options you accept to better meet your customers’ needs. That customer-oriented broadening process will make clear the benefits of accepting virtual credit cards and delivering the most convenient and secure payment experience possible.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.