How To Calculate Cash Collections From Accounts Receivable

- 5 min read

Managing cash collections more effectively is an essential goal of every accounts receivable (AR) team. In this blog, you’ll learn how to calculate cash collections and gain strategies to help your company get paid faster.

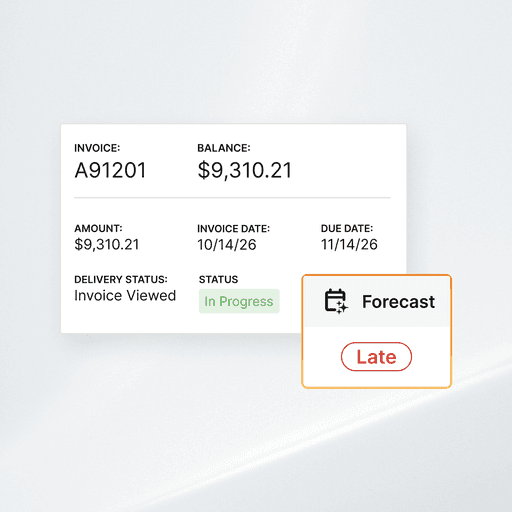

To effectively forecast how much cash the company will have at a given time, it’s important for accounts receivable (AR) departments to be able to predict how much of their receivables they can confidently expect to collect.

Calculating cash collections from accounts receivable can help you better understand your current cash position and avoid potential shortfalls before they happen.

How to calculate cash collections

Simply put, cash collections is the process of collecting on debts owed to your company. These may be payments owed by an individual or another business and can include both current accounts with an outstanding balance and past-due accounts. You may also hear this called payment collections.

Cash collections can come from two places: cash sales and collections on accounts receivable. Cash sales refers to the proportion of sales you make where customers pay you right away rather than on credit. The invoices that customers don’t pay right away will be collected on accounts receivable.

The cash collections formula

Expected cash collections = cash sales + projected collections from accounts receivable

To calculate your total expected cash collections, you’ll add the revenue you anticipate will come from cash sales to the revenue you anticipate will come from accounts receivable. You can estimate cash sales from the year’s previous trends.

To calculate cash collections from accounts receivable, you’ll first want to deduct any receivables you know to be uncollectible. This will leave you with your estimated collectible accounts receivable.

You’ll then need to determine the proportion of receivables you typically collect for each aging bucket: with 30 days, 30 to 60 days, 60 to 90 days, and over 90 days. Running an AR aging report will help you determine your customers’ average payment history.

Once you have an estimated collection rate for each aging bucket, multiply that by the current receivables balance you have for each group.

For example if we look at businesses in the non-residential construction industry, data from Dun & Bradstreet and the Credit Research foundation found that on average, in Q3 of 2021:

55% of their receivables were paid within 30 days

1% of their receivables were paid within 30 to 60 days

2% of their receivables were paid within 60 to 90 days, and

42% of their receivables were paid after over 90 days

For one of these businesses, calculating their estimated cash collections from accounts receivable might look like this:

0.55 x [balance for receivables < 30 days old] = estimated cash collections for 30 day receivable group

0.01 x [balance for receivables between 30 and 60 days old] = estimated cash collections for 30 to 60 day receivable group

0.02 x [balance for receivables between 60 and 90 days old] = estimated cash collections for 60 to 90 day receivable group

0.42 x [balance for receivables < 90 days old] = estimated cash collections for 90+ day receivable group

Once you’ve determined your estimated cash collections for each receivables bucket, you’ll add this to your projected cash sales to get your total estimated cash collections.

—

Staying on top of calculating cash calculations is critical. Learn how Versapay helped our clients improve one of the most important ones, achieving a 305% ROI.

How to improve accounts receivable collections

In the example we shared of construction companies’ collections, almost half of their receivables were being paid severely late. A high degree of late payments can signal that there are some inefficiencies in your collections processes.

The collections process traditionally involves a high degree of manual work for AR teams, which is why many companies turn to automation to help streamline those processes. But, to truly transform your AR processes, automation alone won’t do the trick.

Making a broken system more efficient doesn’t necessarily get at the core of what’s broken. The truth is that the way we’ve historically done AR collections just doesn’t work very well for today’s world.

Why replace traditional collections processes?

Here are just a few of the problems that frequently occur with traditional accounts receivable collections processes:

Customers are given minimal access to their payment history and account information

AR team members must initiate follow-up calls to remind customers of upcoming and overdue payments, taking time away from other priority work

AR teams are likely not speaking with customers in real-time, leading to miscommunications that result in excessive payment delays

With collections activities happening across multiple channels, accounts receivable teams have no clear audit trail

Manual processes make it difficult and time-consuming to generate reports, which become quickly become stale anyway due to a lack of real-time data reconciliation

Intelligent collections: a better option

Are these problems you and your AR team are currently facing as part of your collections process? If so, there is a better option. When you communicate with your customers over the cloud using collaborative AR automation software, you’ll find that many of these difficulties are solved. Plus, you’ll give customers a much smoother payment experience and speed up your cash flow.

For instance, when DeVere Insulation’s credit management team automated their collections with Versapay, they cut manual collections activities–like phone calls–by 75%. And now, 90% of their customers are making secure payments online in Versapay’s self-service customer portal.

Learn more about how you can streamline your AR processes with intelligent collections here.

About the author

Nicole Bennett

Nicole Bennett is the Senior Content Marketing Specialist at Versapay. She is passionate about telling compelling stories that drive real-world value for businesses and is a staunch supporter of the Oxford comma. Before joining Versapay, Nicole held various marketing roles in SaaS, financial services, and higher ed.