How Cash Application Automation Software Drives Interest Cost Savings

- 7 min read

This article explains how cash application automation software helps businesses reduce reliance on external financing to cover operational expenses, ultimately lowering yearly interest payments.

Cash application is a necessary financial process that keeps your business running. But this process isn’t always easy, especially when done manually. Just as often, it’s cumbersome and time-consuming.

Yet ensuring it goes smoothly is vital: The pace of cash flow depends on the speed of your cash application process. A slow and inefficient cash application process means less cash on hand to support your business and help it grow. And less available capital can lead to more borrowing — and the interest payments that entails.

Speeding up cash application can help your business reduce its dependence on external financing to cover operational expenses and investment needs, ultimately lowering the amount of interest you pay throughout the year. The best way to accelerate and improve your cash application process is through automation.

Table of contents

Signs of poor cash application: high DSO, slow cash flow, and low working capital

Companies with poor cash application processes face diminished working capital stemming from slow cash flow and high days sales outstanding (DSO). This is because it is a slow and manual process for the cash application team to match payments to invoices and reconcile them in the accounting system.

Having sufficient working capital is essential for companies looking to do more with less. The ability to finance a solution to an emergent problem, such as the shortage of finance talent, depends on having cash on hand. To remedy a shortfall of working capital, most businesses rely on external financing, leading to routine interest payments.

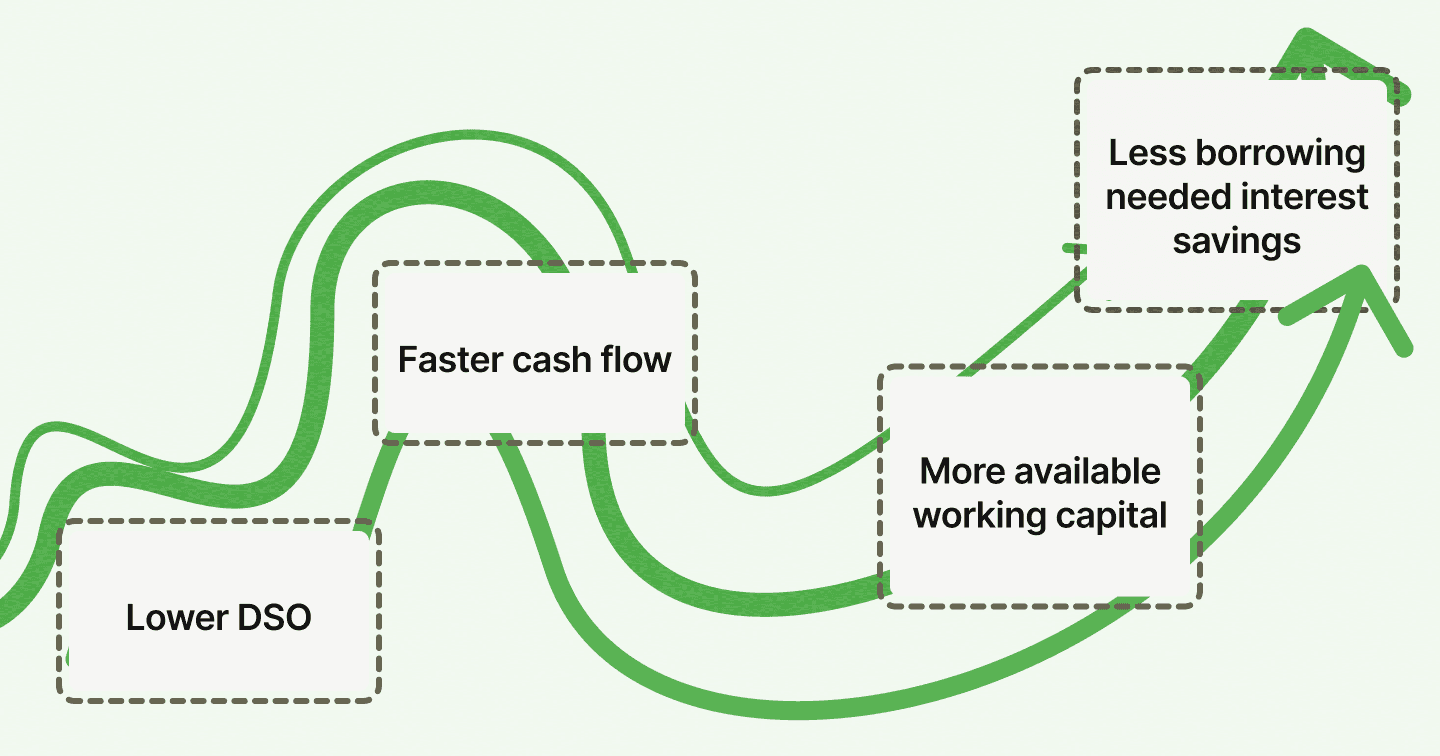

It follows that lower DSO leads to faster cash flow, which results in more available working capital, which means less expensive borrowing is required. The resulting savings on interest can be reinvested and promote growth.

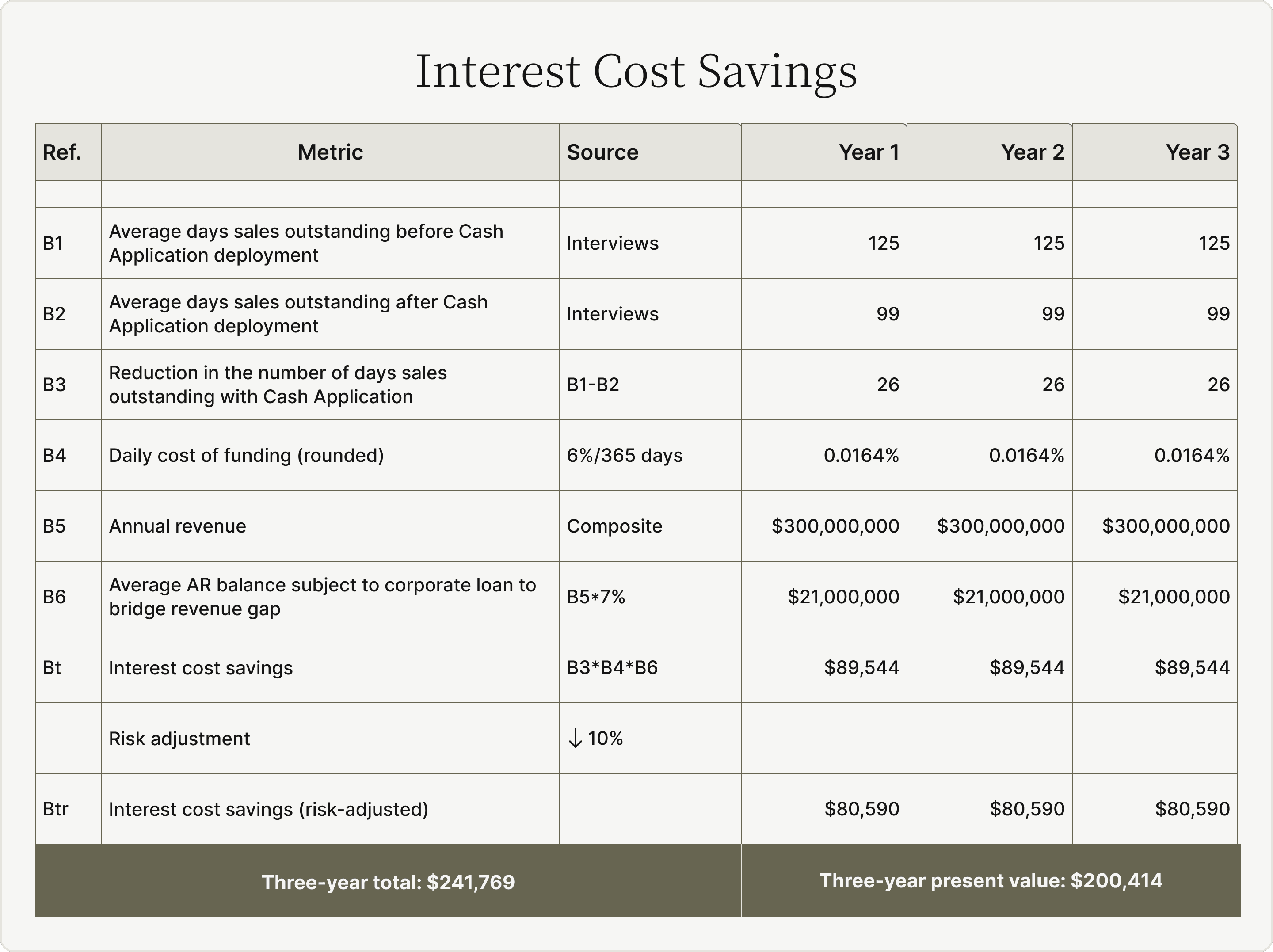

For example, imagine that a company has $21 million in outstanding accounts receivables, amounting to 7% of its $300 million annual revenue. Paying an interest rate of 6% (which equals roughly 0.0164% daily), the company pays $3,444 per day in interest to borrow as a result of the income shortfall.

If the average DSO for the company is 125 (which Forrester Consulting found as standard when determining the Total Economic Impact of Versapay’s cash application automation solution), that means the company is paying $430,500 yearly in interest to fund their operations while they wait for payments.

That’s a lot of unnecessary spending.

Reducing the DSO would allow them to reduce this interest amount. And having more working capital lets the company invest in itself to keep operations running smoothly as it grows.

How manual cash application leads to more interest payments

The manual cash application process tends to be slow and full of problems that bog down cash flow, leading to working capital shortfalls.

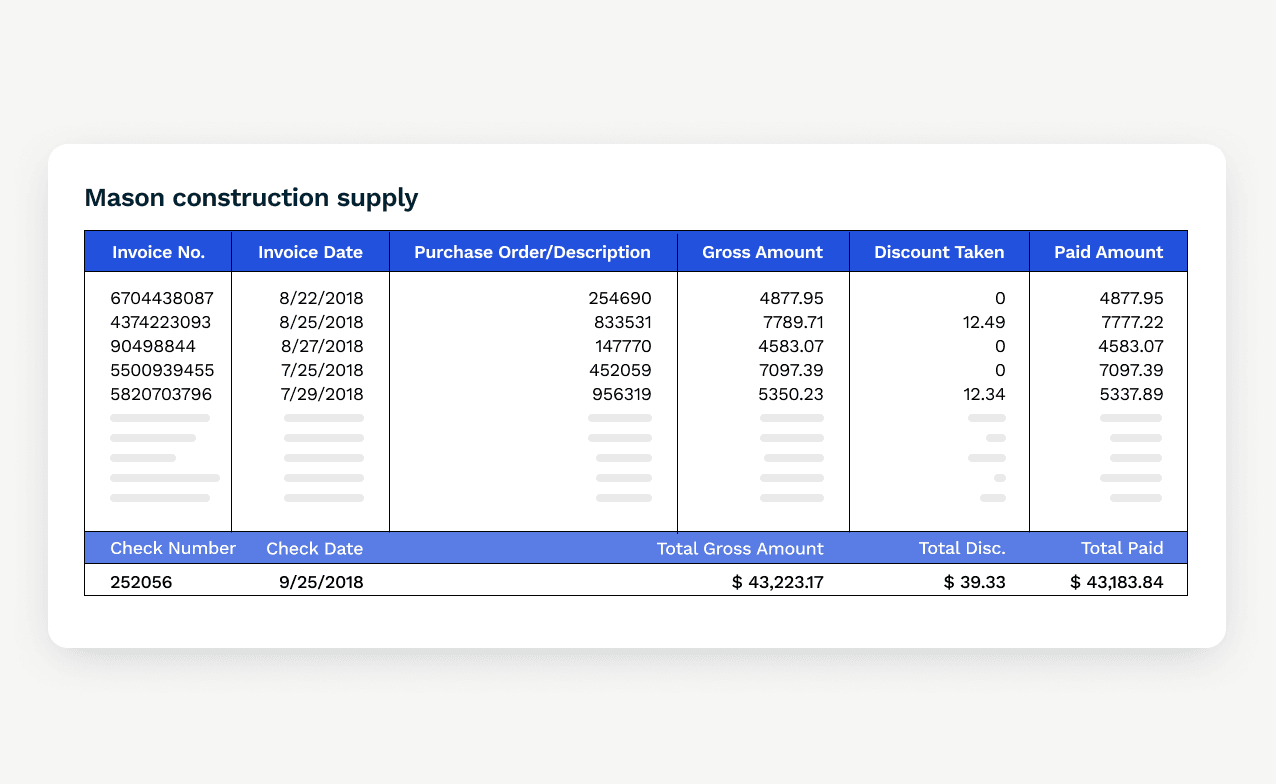

This is a labor-intensive process, requiring matching incoming payments to associated remittance information to outstanding invoices and customer accounts by hand. Manual reconciliation of complex payments is particularly time-consuming, further slowing the process.

In the case of one healthcare provider, extensive remittances in a high-growth time during the pandemic meant an overwhelming burden of manual work. Posting a single check could sometimes take a full day of work, and the cash application team was often at work until 10pm applying cash for each workday.

“The size of some of our regular customers’ invoices was tripling,” said the company’s senior manager of financial services. “A $200,000 check payment might be accompanied by 60+ pages of remittance. It simply wasn’t scalable.”

In addition to their slowness, manual cash application processes are prone to errors and discrepancies, which interrupt payments and force AR teams to take the time for remediation.

Manual cash application processes also make it difficult or impossible for accounts receivable professionals to have real-time visibility into cash positions and outstanding invoices, which can slow follow-up on late payments or other problematic cases.

With situations like this, it’s no surprise that manual processes often lead to delays in processing payments and updating financial records, which reduces the constant influx of working capital. Less working capital increases an organization’s inevitable reliance on external financing. More reliance on external financing means having to pay more interest charges, which add up over time to considerable amounts that the business can’t use for other purposes.

How cash application automation drives interest cost savings

Companies suffering from the drawbacks of manual cash application have an excellent option to drive time and cost savings: cash application automation.

Automated cash application systems can achieve same-day cash application and posting, enabling faster credit replenishment and improved DSO. Automated cash application also reduces errors that can lead to delays—and frustrated customers to boot.

Standardized, consistent cash application processes make for efficient cash processing and faster cash flow. And automated cash application systems use digital solutions (like AI and machine learning) to do this task faster and even increase its speed as it learns.

Automated cash application systems centralize all related processes, which makes the process more efficient and allows for better, easier oversight and management, further saving time. In the case of law firm Cole, Scott & Kissane (CSK), which adopted Versapay to speed up its cash application, the benefits include not only faster processing, but also more insight into real-time data.

“Prior to Versapay, it was not uncommon for it to take two to three days from payment receipt to apply cash,” says Lauren Polo, application system administrator at the firm. “While initially unsure about deviating from the traditional process, our cash appliers learned to use Versapay Cash Application quickly. Now, cash application at CSK happens same-day and data in our Aderant financial system remains accurate and up-to-date.”

All this efficiency and time savings translates to faster cash flow, which translates to more working capital and results in less need for external borrowing at high interest rates.

Let’s return to the example from the beginning of this piece—the company paying 6% interest, or $3,444 per day, on borrowing to fill capital shortfalls as they wait for payments. Reducing the company’s DSO by 20% on average, as is typical with Versapay Cash Application (according to Forrester Consulting), would save the organization around $90,000 annually.

That kind of savings can make a big difference in a company’s ability to pursue growth opportunities and move with agility as markets shift.

Reduce your reliance on external financing with cash application automation

Accelerating cash flow by optimizing cash application should be a strategic priority for any company that wishes to reduce its dependence on external funding for working capital. Less borrowing, after all, can cut down interest payments substantially.

And automating cash application using a solution like Versapay’s results in a much faster and more efficient process, which can help lower your interest payments throughout the year.

“Versapay is helping us accelerate cash flow by automating processes, reducing days sales outstanding, and improving working capital,” says the financial planning accountant at a custom fabrication firm.

Discover how Versapay Cash Application can increase productivity, accuracy, and cash flow, while lowering accounts receivable costs:

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.