Cash Flow Statements 101: How to Make, Read, and Understand Them

- 8 min read

Cash flow statements provide insight into a company’s stability, health, and growth potential. In this article, you’ll learn why they’re important, what comprises them, how to make a cash flow statement, how to calculate them (with examples!), how to read them, and more.

Cash flow statements are essential to business financial management, as they provide insight into a company’s stability, health, and potential for growth. Businesses should use these calculations to inform financial decisions and identify issues early so they can address them before they worsen.

Let’s take a look at everything you need to know about cash flow statements, from what they are to how to read them to why automating some of your accounting processes can help.

Jump to a section of interest:

- What cash flow statements are

- Why cash flow statements are important

- What comprises cash flow statements

- How to calculate cash flow statements

- Cash flow statement example

- How to read a cash flow statement

What is a cash flow statement?

A cash flow statement is a record of how much money flows into and out of a business during a particular period. By understanding cash flow statements, financial managers and business leaders know where cash is coming from and why it’s leaving the company’s coffers—information that helps with both daily operations and future planning.

Why are cash flow statements important?

Cash flow statements support good business management by allowing business leaders to keep an eye on cash flows, spot problem areas such as overspending or sluggish payment processing, and fix issues to optimize resources and ensure company health. Cash flow statements also help with financial planning, such as cash forecasting and identifying potential cash shortfalls.

Information that creates a clear picture of the cash available to a business enables informed decision-making about investments, financing, and dividend payments. It can also help in analyzing business health since it allows insight into the liquidity in the business.

Creating cash flow statements is often necessary forcompliance purposes, since regulatory bodies such as the Securities and Exchange Commission typically require cash flow statements from businesses that are looking to raise capital or maintain public status.

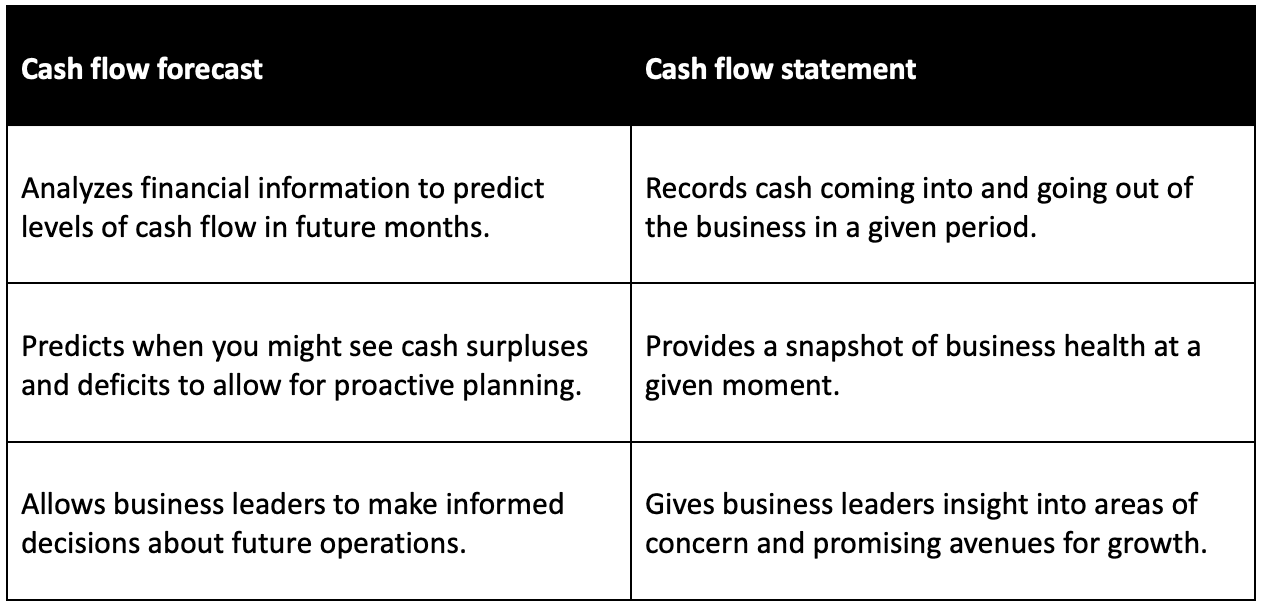

Cash flow statement vs. cash flow forecast

Another commonly used calculation in business is a cash flow forecast. Cash flow statements are different from cash flow forecasts in that they record cash inflows and outflows that have already happened, as opposed to predicting how they will occur in the future.

Here is a summary of the differences between these types of financial tools:

3 components of a cash flow statement

The three main components of a cash flow statement are operating activities, investing activities, and financing activities.

1. Operating activities

Operating activities are the day-to-day operations of a business. Cash flows in this case are things like sales revenue, payments to suppliers, payroll, taxes, and interest payments. Operating cash flow allows finance leaders to assess profitability and liquidity.

2. Investing activities

Investing activities are purchases or sales of long-term assets such as property or equipment. Cash flows here come from buying or selling these assets, and from investing in other companies. Cash flow from investing activities can help businesses make informed plans for growth and expansion.

3. Financing activities

Financing activities relate to obtaining and repaying capital. Financing cash flows come from issuing stocks or bonds and from repaying loans or dividends to shareholders. This cash flow reveals a business’s ability to meet its financial obligations.

How to calculate cash flow statements

There are two main methods of reporting cash flows from operating activities: direct and indirect. The direct method relies on the cash accounting method and reports how much cash entered and left the business from operating activities during the period. The indirect method relies on the accrual accounting method, and involves starting out with net income and then adjusting for non-cash items and changes in current assets and liabilities. Each cash flow report meets the requirements of generally accepted accounting principles (GAAP).

Whichever method you use, you’ll follow these steps to calculate a cash flow statement:

Prepare your balance sheet

Determine the net income

Calculate cash flows from operating activities

Calculate cash flows from investing activities

Calculate cash flows from financing activities

Consolidate cash flow information

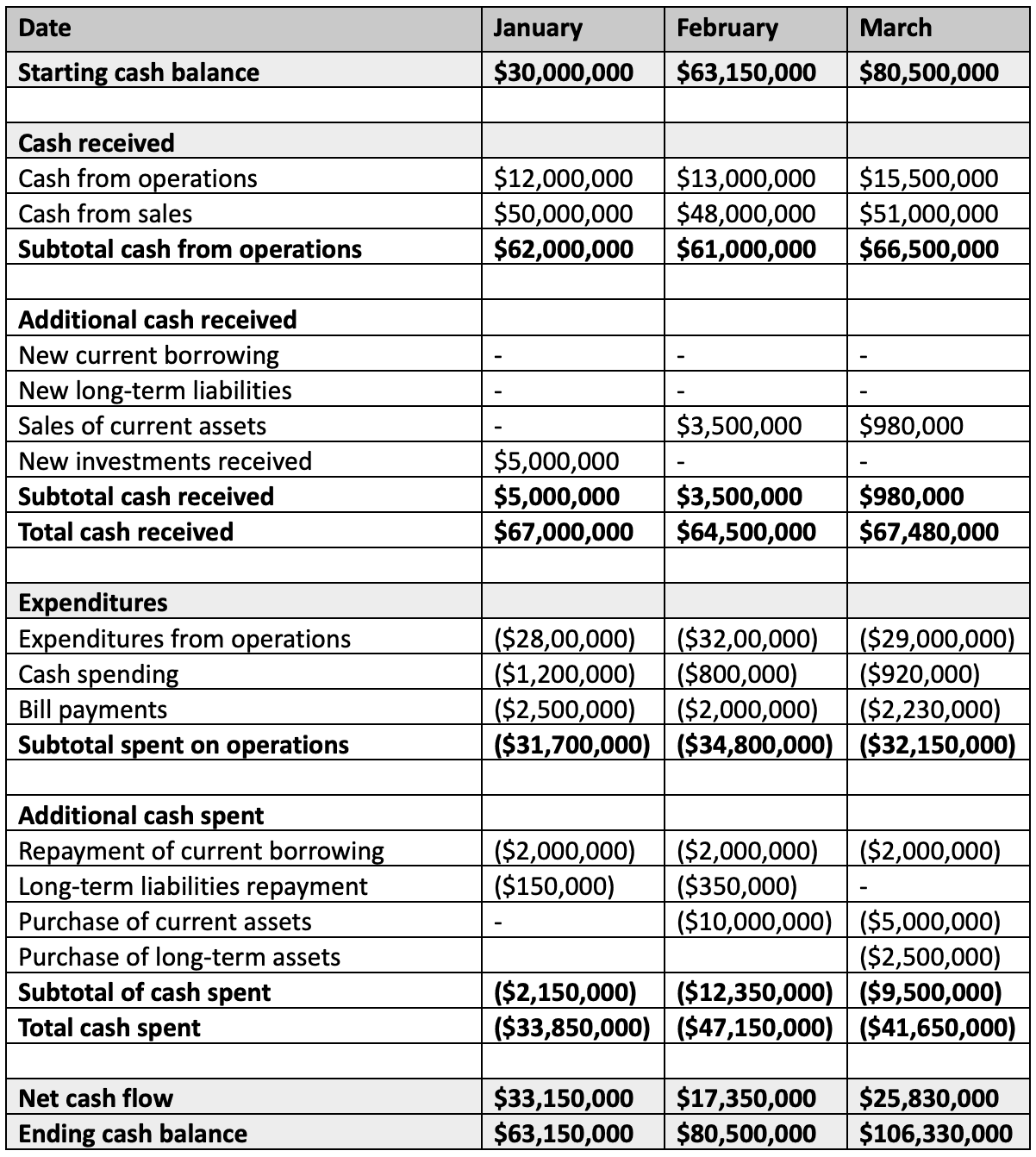

Cash flow statement example

Here’s a cash flow statement example for a company that’s doing very well in managing its money. This statement covers the first quarter of a particular year.

How to read a cash flow statement

A cash flow statement begins with the starting cash balance for the period in question; this is the amount of cash the company had on hand at that time. Below that, it lists positive cash flows, also called cash received, and negative cash flows, also called expenditures.

Positive and negative cash flows

Positive and negative cash flows from operations are listed separately, as this shows the cash that the company's core business operations are generating or losing, an indication of the relative financial stability of the company.

Cash from investing shows how much the company is investing in new projects or assets, and in this case a high negative cash flow may reflect an aggressive investment posture or possibly poor decision-making. Cash flow from financing shows whether the company is taking on debt; a high negative cash flow here may suggest that the company’s debt burden is too high.

Main takeaways:

Positive cash flows are sources of cash into the company, such as payments from customers, investments in the company, and proceeds from the sale of assets.

Negative cash flows are places where cash is being directed, such as payments to suppliers, employee wages and benefits, or debt repayments.

Cash flow ratios

A cash flow ratio is an indication of a company’s financial health. There are several cash flow ratios that businesses can analyze.

Cash flow margin ratio measures the company’s cash flow from operations as a percentage of revenue, which indicates the ability of core business operations to make money.

Operating cash flow ratio indicates whether the company's operations can cover its current liabilities.

Cash flow coverage ratio assesses the company's ability to bring in enough cash to cover its debt payments.

Automation can help with cash flow—and cash flow statements

Cash flow statements are key to maintaining good business financial health. But creating these documents manually can be time-consuming and can introduce errors. Automation can help. Specifically, automating some of your accounting processes can assist you in producing accurate cash flow statements easily and gaining better insight into cash flows.

Accounts receivable automation software that encourages faster payment and better relationships with customers can improve your cash flow, leading to cash flow statements you’ll be happy to produce. Check out Versapay’s guide to accelerating collections to learn more about how automation can boost your cash flow and help you create better cash flow statements.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.