Cash on Delivery Explained: The Pros and Cons of COD

- 19 min read

This article covers what cash on delivery is, how it works for sellers, its pros and cons, examples, how automation software helps you streamline it, and more.

Despite the prevalence of digital payments, cash on delivery stubbornly refuses to bow out. A recent report into ecommerce purchasing trends showed that close to 20% of consumers consider cash on delivery as a key purchase driver.

In the business-to-business (B2B) world, industry norms and tricky customer credit situations prolong cash on delivery's existence. This payment paradox begs the question—is the picture of field sales reps, order forms in hand, and collecting payments on the spot still relevant?

In this article, we'll break down what cash on delivery is, how it works, and when offering it makes sense for your business. And if you're already offering CoD, we'll show you how to streamline your process and squeeze more efficiency out of it.

Table of contents

What is cash on delivery?

Cash on delivery—sometimes referred to as collect on delivery—is a method of collecting payment that requires customers to pay for goods at the time of delivery. Despite its name, cash on delivery can refer to check or electronic payments too.

For instance, sales reps can collect card payments in the field through a mobile card machine. Even though the payment mode here is digital, the fact that customers pay immediately after receiving goods makes it a cash on delivery order.

How does cash on delivery work for sellers?

A customer's CoD payment terms will typically be outlined in their purchase agreement with their supplier. When a CoD customer places an order—online or through other means—they will select cash on delivery as their payment method.

When their order arrives, the customer will pay the amount owed, usually to a shipping or logistics partner working with the supplier. After deducting any handling charges, the partner will then direct the funds to the supplier. And just because cash on delivery customers aren’t paying on credit doesn’t mean the supplier won’t have to generate invoices for those clients. When deliveries arrive, a printed invoice will usually be attached.

From the seller's perspective, CoD can pose some challenges depending on which payment methods a customer uses:

Cash payments — Sellers have to wait for their order fulfillment partners to deposit cash after collection fees.

Checks — Sellers have to collect checks and deposit them in bank branches physically.

Digital channels — Sellers have to wait for payment to clear after processing fees.

While digital payment channels help you capture payments seamlessly, cash and check payments bring inefficiencies due to manual processes. For instance, Forrester Research highlights the experience of a company's check collection process before adopting Versapay's Mobile Check Deposit solution.

"Before we had a mobile deposit solution," the company's credit manager said, "our stores would receive checks and cash at the store level, and we would limit them going to the bank once a week."

This created longer-than-desirable DSO times despite customers paying quickly. Thanks to technology, however, this customer increased its cash on delivery process' efficiency without changing anything its customers experienced.

Which industries benefit the most from cash on delivery?

The following industries benefit the most from offering cash on delivery to their customers:

Retailers — Retailers collect payment on the spot, whether for household goods or food. Even food delivery services benefit from offering CoD, especially for first-time orders.

eCommerce — Like food delivery, new distributors or manufacturers with eCommerce sites—or industries that generally accept eCommerce payments—can build trust by offering CoD to new customers in a bid to stand out from the competition.

Wholesalers — B2B companies like wholesalers can cater to companies with poor or insufficient credit by offering cash on delivery.

Types of cash on delivery payment methods

As we mentioned before, cash on delivery includes payment methods other than cash. Here are the most common ones sellers accept:

Checks — Field reps in some industries, as was the case with Würth Canada, collect checks from customers and deposit them in bank branches.

Mobile POS — Sales reps armed with mobile card readers can collect card payments after delivering goods.

Electronic bank transfers — Companies can collect payments by bank transfer after verifying goods delivery.

Digital currencies — Some sellers collect payments in digital and cryptocurrencies to minimize payment processing fees.

Emerging trends in cash on delivery

Cash on delivery is evolving to meet the modern demands of sellers and buyers. Here are three key trends reshaping the landscape:

Digital integration — CoD is embracing mobile and crypto wallet payments, as well as options to pay through eCommerce accounts—like Amazon Pay—blending traditional and digital methods.

Secure authentication — To enhance security and reduce fraud, CoD transactions now often involve delivery one time passwords (OTPs) or biometric scans for verification.

Mobile check deposit — Delivery personnel can now instantly process paper checks using apps, streamlining the CoD process for both businesses and customers.

5 examples where offering cash on delivery makes sense for your business

Wondering if cash on delivery is right for your business? Let's explore 5 popular scenarios where CoD can be a game-changer:

1. A customer has bad credit

Cash on delivery can be a valuable tool for wholesalers when dealing with customers with poor or no established credit history. With CoD, you can mitigate risk while still conducting business and building relationships with these clients.

As customers consistently fulfill their CoD obligations, you gather crucial data on their payment reliability. Ultimately, CoD serves as a proving ground, potentially paving the way for more flexible payment arrangements as the business relationship matures.

2. A customer prefers paying after physically receiving goods

In some industries, cash on delivery aligns perfectly with customer expectations and operational norms. Consider the wholesale food distribution industry, where the quality and condition of perishable goods are paramount.

Here, CoD isn't just a preference—it's often the standard operating procedure. It allows customers to inspect their deliveries before payment, ensuring they're satisfied with the product quality. If your business operates in a similar context where customers expect to verify goods before payment, offering CoD is a strategic necessity.

3. You’re entering a new market

When entering a new market, cash on delivery can be a powerful tool to differentiate your business and build trust with potential customers.

For example, imagine you're a new entrant in the office supply distribution sector. By offering CoD, you allow potential clients to inspect products before payment, reducing their perceived risk of trying a new supplier. This approach can be effective in markets where established relationships dominate, as it demonstrates confidence in your products and willingness to prioritize customer satisfaction.

4. Order fulfillment is cheaper than payment processing fees

For highly localized businesses, cash on delivery is a cost-effective alternative to traditional payment methods. This approach is particularly beneficial when the proximity to customers allows for direct, in-house delivery.

Consider a local bakery that supplies fresh pastries to nearby cafes and restaurants. By handling deliveries and collecting cash payments on the spot, they can avoid logistics and even payment processing fees—assuming customers pay cash.

For small, local businesses where margins matter, eliminating payment processing and order handling fees through CoD can make a significant difference to the bottom line, all while maintaining a personal touch in customer interactions.

5. Cash on delivery is the industry norm

Cash on delivery is the norm in some industries. For example, Würth Canada operates in the automotive, trucking, manufacturing, and construction industries where customers typically pay by check. In such cases, going against industry norms is not an option. While processing paper checks was expensive, Würth was not in a position to ask its customers to switch to new payment channels.

Technology helped Würth offer cash on delivery to its customers while reducing backend processing costs.If you're in a similar industry, offering CoD is a no-brainer.

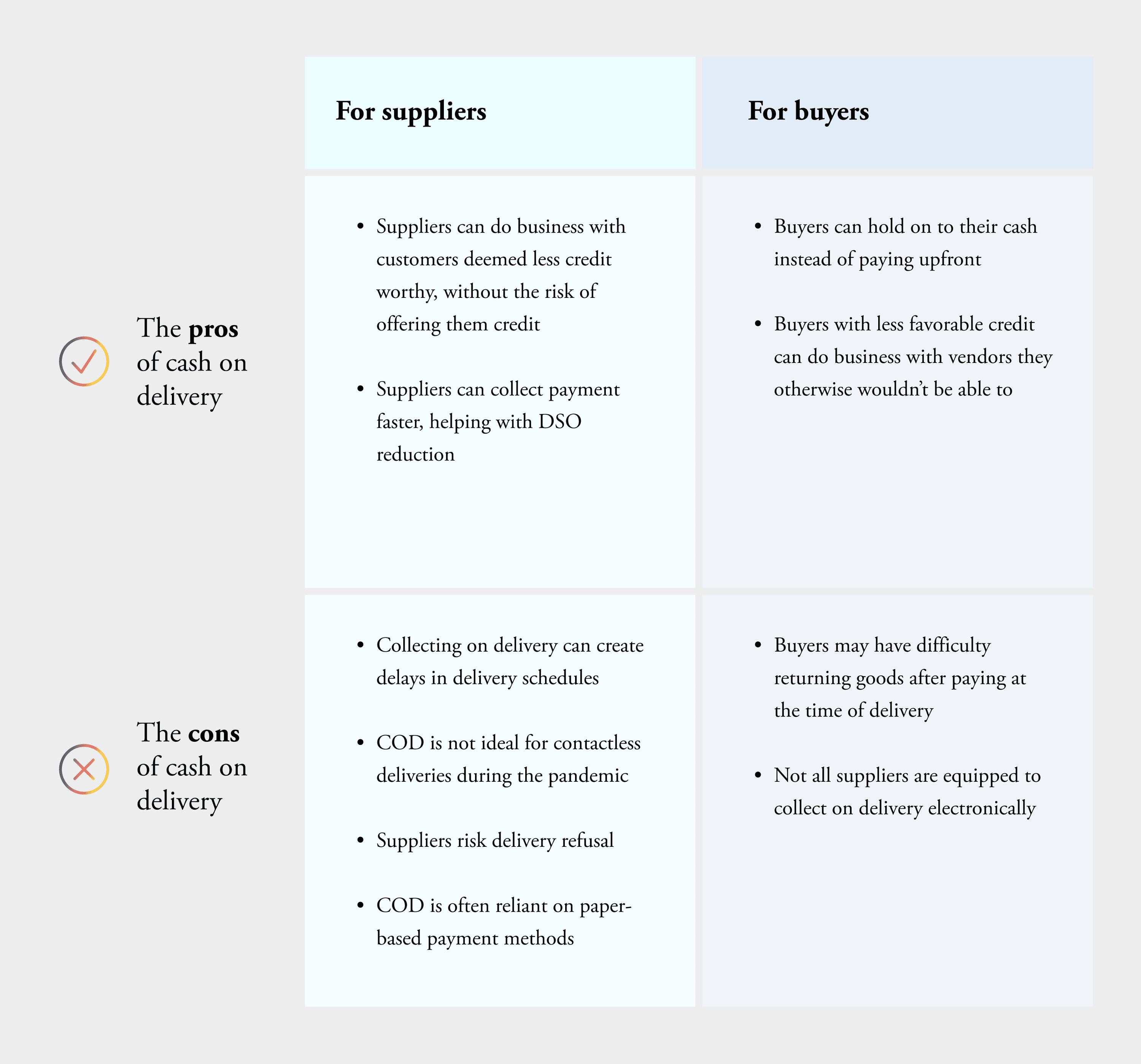

The pros and cons of cash on delivery

The benefits of cash on delivery for suppliers

Suppliers benefit from accepting cash on delivery as it allows them to increase sales by doing business with customers they would not otherwise extend credit to. Rather than taking the risk of offering credit to those customers from the get-go, CoD lets suppliers give them an opportunity to build their credit history and still get serviced.

By requesting payment at the time of delivery instead of on accounts receivable (AR), suppliers also benefit from shorter payment cycles, helping reduce days sales outstanding (DSO) and boost cash flow.

The downsides of cash on delivery for suppliers

However, there are several reasons why collect on delivery is not an ideal payment method for suppliers. First, having to wait for customers to make their payments can cause drivers to get delayed when making deliveries. During the onset of the COVID-19 pandemic, many suppliers may have halted CoD terms

altogether to limit contact between customers and delivery staff.

With CoD, there's also a higher risk of delivery refusal. This can be especially disastrous when suppliers are transporting perishable goods. When this happens, suppliers lose profit on returned or spoiled goods and may have to pay CoD shipping return fees.

Finally, because collection on delivery so often relies on offline payment methods like cash and checks, facilitating CoD creates a lot of manual work for accounting teams.

A delivery person must keep track of various checks, then provide them to the supplier’s accounting staff, who will then manually process and reconcile the payments with the right customer accounts. This clumsy process ultimately spells trouble for suppliers’ cash flow.

The benefits of cash on delivery for buyers

Whereas most ecommerce sales require that customers pay upfront before receiving a product, CoD allows customers to manage cash flow by paying at the time of delivery. Cash on delivery also allows customers with minimal or less favorable credit histories to do business with vendors they would otherwise not be able to.

The downsides of cash on delivery for buyers

If a buyer wants to return any goods after having paid for them at the time of delivery, however, this can be a challenge as the supplier might not be under any obligation to accept the return.

And if suppliers are only equipped to collect on delivery via cash or check, this could limit buyers’ ability to pay electronically, particularly for those who are aiming to pivot their payment operations away from manual and paper-based methods.

5 things suppliers must avoid when offering cash on delivery

While cash on delivery offers several benefits, it's not without its challenges for suppliers. Here are five key things suppliers must avoid when offering CoD.

1. Not limiting purchase value

Setting a limit on cash on delivery orders is crucial for suppliers to mitigate financial risks. By implementing a CoD limit, suppliers can reduce their exposure to the financial impact of returned or rejected orders.

This is especially important for perishable goods, where returns often result in total loss. If a customer insists on paying for a high-value order via CoD, consider collecting part of the payment as a deposit.

This reduces your financial risk and the likelihood of the customer reneging on the order's terms.

2. Not verifying purchase intent

Verifying purchase intent is a critical step for suppliers offering cash on delivery services, particularly for smaller orders. This process helps reduce the risk of non-serious buyers and potential fraud.

Implementing a verification system—such as a confirmation call or one-time password—adds an extra layer of security to CoD transactions. This additional step not only confirms the customer's commitment to the purchase, but also provides an opportunity for suppliers to address any last-minute questions or concerns.

Extra actions like this help suppliers decrease the likelihood of order cancellations or rejections upon delivery, reducing potential losses.

3. Overreliance on fulfillment partners

Overreliance on third-party fulfillment partners for cash on delivery transactions can lead to significant challenges for suppliers. When logistics companies handle CoD payments, delays in cash deposits and reconciliation errors can accumulate over time, potentially causing cash flow issues and accounting headaches. And this is before you consider the hefty cash handling fees these companies charge.

To mitigate these risks, consider implementing payment capture systems that incorporate cash on delivery, similar to the approach Würth Canada took.This type of automation not only reduces the likelihood of errors but also provides real-time visibility into transactions, allowing for better cash flow management and reducing dependency on external partners.

4. Not adding a cash on delivery surcharge

Offering cash on delivery services often comes with additional costs, particularly when using fulfillment partners who typically charge substantial commissions for handling CoD transactions.

To maintain profitability, use a CoD surcharge. By adding a reasonable surcharge to CoD orders, you can offset some or all of these extra expenses. When using a surcharge, be transparent with customers about the additional fee, explaining that it covers the costs of the CoD service. This transparency maintains customer trust while protecting your business's bottom line.

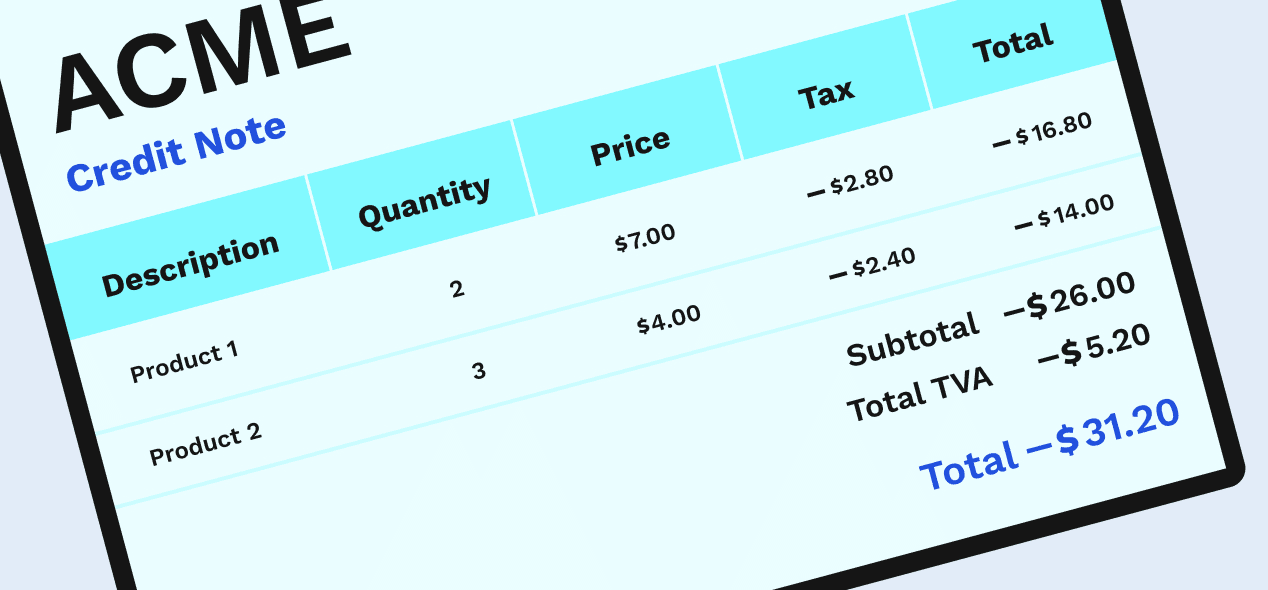

5. Not communicating refund policies

Communicating refund policies is crucial when offering cash on delivery services. Unlike electronic payments, where you can easily process refunds by clicking a few buttons, returning cash payments is almost impossible at scale.

Companies usually offer CoD refunds via a credit note. While this simplifies your processes, customers will likely feel cheated if you don't communicate this policy beforehand. After all, they’re unhappy with their order and a credit note forces them to buy once more from you.

By setting clear expectations about the refund process for CoD orders, you can prevent misunderstandings and customer dissatisfaction. Instead, you can use this as an opportunity to delight customers and potentially bring them back into the fold.

What are the alternatives to traditional cash on delivery?

While traditional CoD offers suppliers some cash flow advantages and protection from credit risk, it’s safe to say the downsides heavily outweigh the benefits of cash on delivery—especially when you consider that there are alternatives available for collecting from your CoD customers.

Here are two alternatives to traditional CoD transactions:

1. Enroll your customers in AutoPay

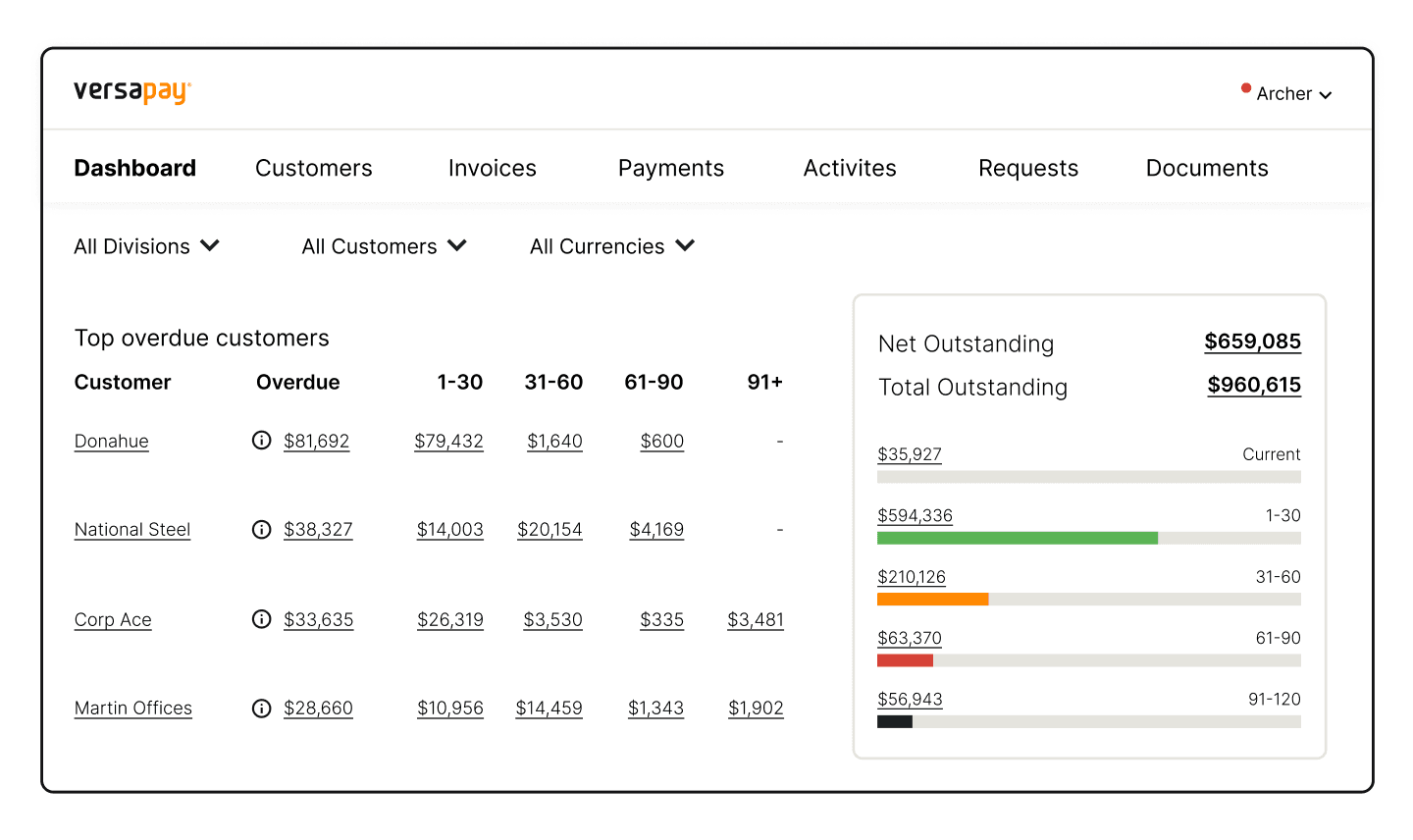

With an accounts receivable automation platform that supports automated payments, you can get your cash on delivery customers making online payments without needing to extend credit to them.

With Versapay, you have the option of enrolling customers in AutoPay, where they can time payments to go out (via credit card or electronic transfer) as soon as an invoice gets issued—before their order is on its way. This way, CoD buyers can still do business with you, and your team will save valuable time by no longer processing and applying manual payments.

In the Versapay platform, you can easily track which of your CoD customers have already paid via AutoPay, helping you avoid loading products onto trucks only to have them return to your warehouse.

2. Identify cash on delivery customers on track to being credit-worthy

By engaging with your CoD customers through a collaborative AR platform—whether they elect to pay through the platform or not—you also get a clearer audit trail of all your interactions with them. This will make it easier for you when assessing whether some of these customers are suitable to start paying on account.

In cases where your CoD customers aren’t interested in paying via AutoPay, you may be able to collect from those customers electronically (if deemed creditworthy) if paying with extended terms instead.

How accounts receivable automation software helps you streamline cash on delivery

Accounts receivable automation software can transform how you manage cash on delivery transactions. Let's explore how they streamline cash application, reduce DSO, and increase collection efficiency.

Automate cash application — Accounts receivable automation software significantly increases cash posting efficiency for CoD transactions. According to Forrester's Total Economic Impact report, you can save $527,333 over three years by moving away from manual cash application processes.

Reduce days sales outstanding — By streamlining the CoD process, automation reduces DSO. This improvement in cash flow is substantial, leading to fewer cash flow holes and less reliance on external financing.

Switch customers over to credit quickly using data — Automation tools centralize customer data, allowing you to make informed decisions about offering credit to reliable CoD customers. This data-driven approach enables a proactive transition from CoD to credit terms, delivering memorable CX.

Give accounts receivable more time back to remove cash flow bottlenecks — By automating routine tasks associated with CoD management, AR teams can focus on strategic activities that improve overall cash flow. This shift in focus can lead to identifying and resolving bottlenecks more efficiently, ultimately enhancing your financial health.

Cash on delivery remains a highly desirable payment channel for modern consumers. Yet modern cash on delivery does not necessarily mean cash exclusively, and this presents an opportunity to increase cash posting efficiencies. Automation is a great solution in this regard, helping you build trust with customers and deliver memorable CX.

Learn how Versapay's accounts receivable automation software simplifies your CoD invoice-to-cash process and gives your AR team more time to increase efficiency.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.