The Impact of Customer Experience on B2B Payments

See why C-suite executives find that customer experience is the biggest obstacle to securing payments.

The Impact of Customer Experience on B2B Payments

WAKEFIELD + VERSAPAY

September 9th, 2022

In collaboration with Wakefield Research, Versapay surveyed 1,000 C-level executives at companies with a minimum annual revenue of $100m USD on their accounts receivable (AR) digital transformation efforts.

Download the free report and see why on the cusp of a recession, C-suite executives find that customer experience (CX) is the biggest obstacle to securing payments.

Here's what you can expect:

- Discover the major issues facing executives as a recession looms

- Learn why CX should be a top priority for securing payments

- Explore how AR digitization is critical to capturing payments more quickly

- See why AR digitization is crucial to improving CX

- Examine how prioritizing customer collaboration improves dispute resolution

- Learn what the AR Disconnect is (and how to close the gap on CX)

Plus, key insights on what the Collaborative AR Network is, and how connecting buyers with suppliers over the cloud creates greater AR efficiencies, accelerates cash flow, and drastically improves the customer experience.

Take a peek inside the report

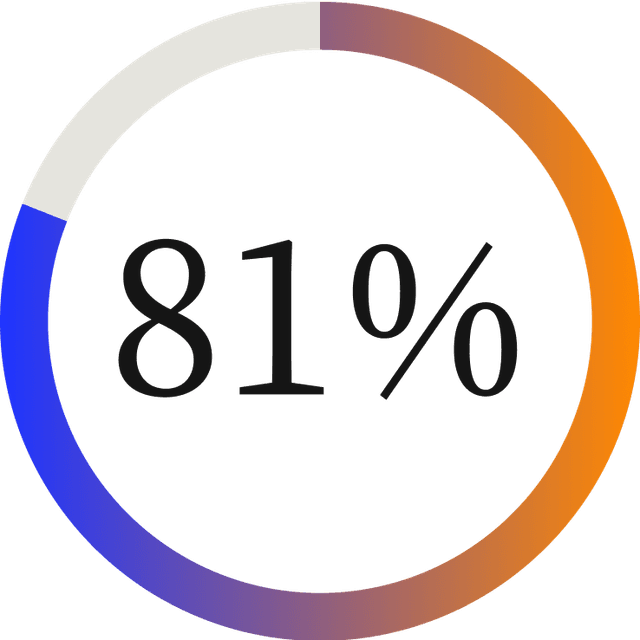

... of CEOs admit that accounts receivable processes can be a source of negative customer experience

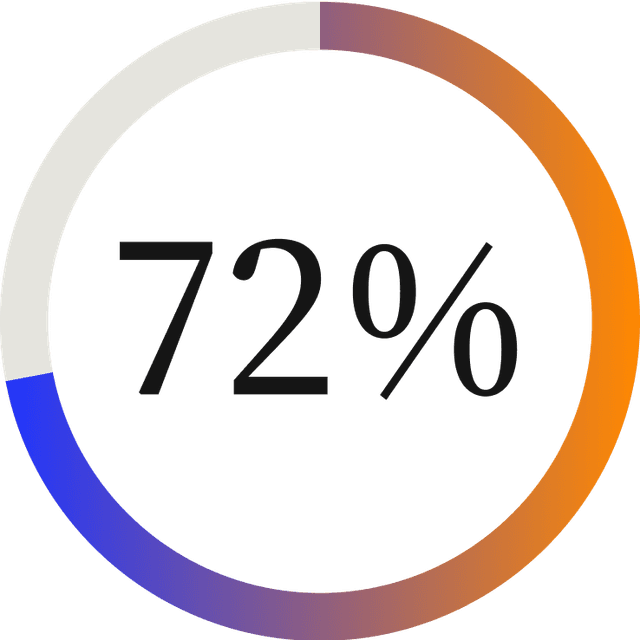

... of executives agree that their accounts receivable processes are not customer-oriented

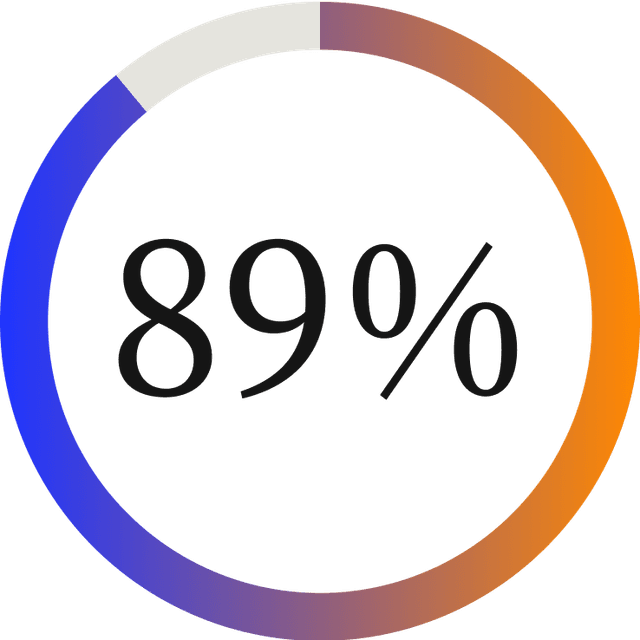

... of executives say poor communications led to payments received for less than owed

The Impact of Customer Experience on B2B Payments is just a few clicks away!

Abstract

The area of the business most responsible for having an immediate impact on cash availability is the accounts receivable (AR) department, whose primary objectives are maintaining an efficient invoice-to-cash (I2C) cycle and ensuring liquidity is available to run a smooth operation.

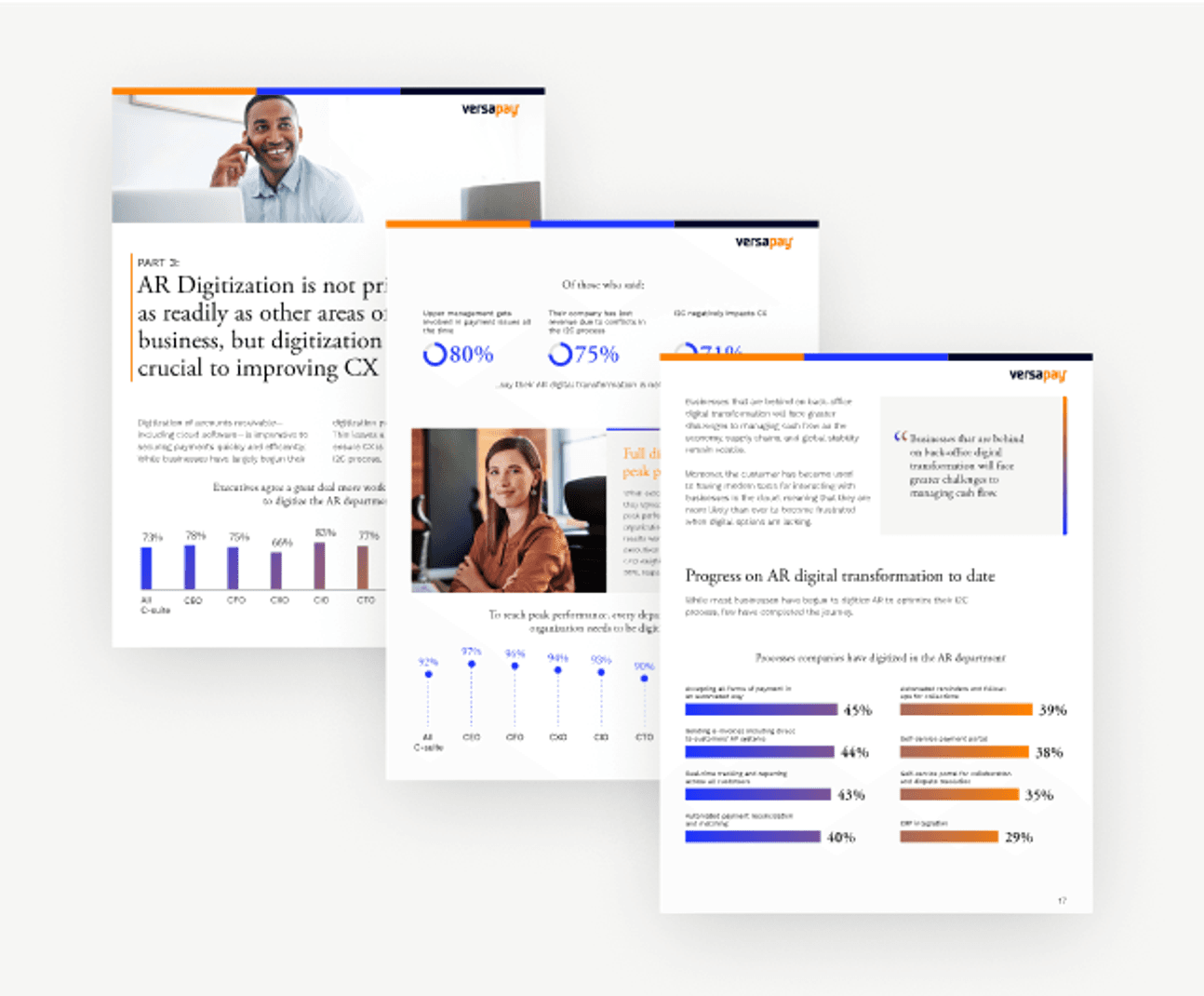

In the current economic environment, inflation is causing costs to rise and sales to fall. Paired with rising interest rates, the era of cheap money has ended. All of this adds urgency to the matter of securing payments quickly and efficiently. While digitization of the finance department is important, 52% of CEOs say they have a long way to go in digitizing AR.

Moreover, 81% of CEOs admit that AR processes can be a source of negative customer experiences (CX). In fact, across the C-suite, 72% of executives agree that their AR processes are not customer-oriented.

While digitization is critical for adding vital back-office efficiencies and cost savings, automation alone doesn’t account for the vital role customers’ payment experience has on a business’ ability to secure payments. As executives prioritize digital solutions for improving the I2C process, they must prioritize tools that focus on CX, too. Otherwise, they run the risk of investing in tools that don’t get the job done.