Why Collaborative Payment Portals Deliver the Biggest CX Returns and Create Happier Customers

- 10 min read

Customer experience is your biggest business driver.

In this blog, learn how collaborative payment portals transform manual invoicing processes and deliver exceptional CX by solving the communication gap between your AR team and your customers’ AP teams.

Key takeaways

Accounts receivable teams at mid- to upper-midsized businesses and their customers’ AP teams suffer a disconnect due to poor communication and infrastructure.

Conventional accounts receivable payment portals fail to address the root cause—a lack of collaboration stemming from the customer communication gap.

Collaborative AR payment portals boost customer experience—the most important business driver in a mid- to upper-midsized enterprise—far beyond what standard payment portals or traditional invoicing processes could ever achieve.

Clear communication channels, enhanced transparency, and tailored invoicing and payment experiences are hallmarks of a software that delivers great customer experience—all pillars of a collaborative AR payment portal.

—

Customer experience (CX) is a mid- to upper-midsized company's biggest business driver. Great CX ensures customers trust a company more, leading to repeat business and a financial buffer in challenging economic conditions.

C-suite executives agree. Our Impact of Customer Experience on B2B Payments report revealed that customer experience is a top priority for the C-suite, with 93% of CEOs and 90% of CFOs agreeing that a C-suite is only as good as the CX their company offers.

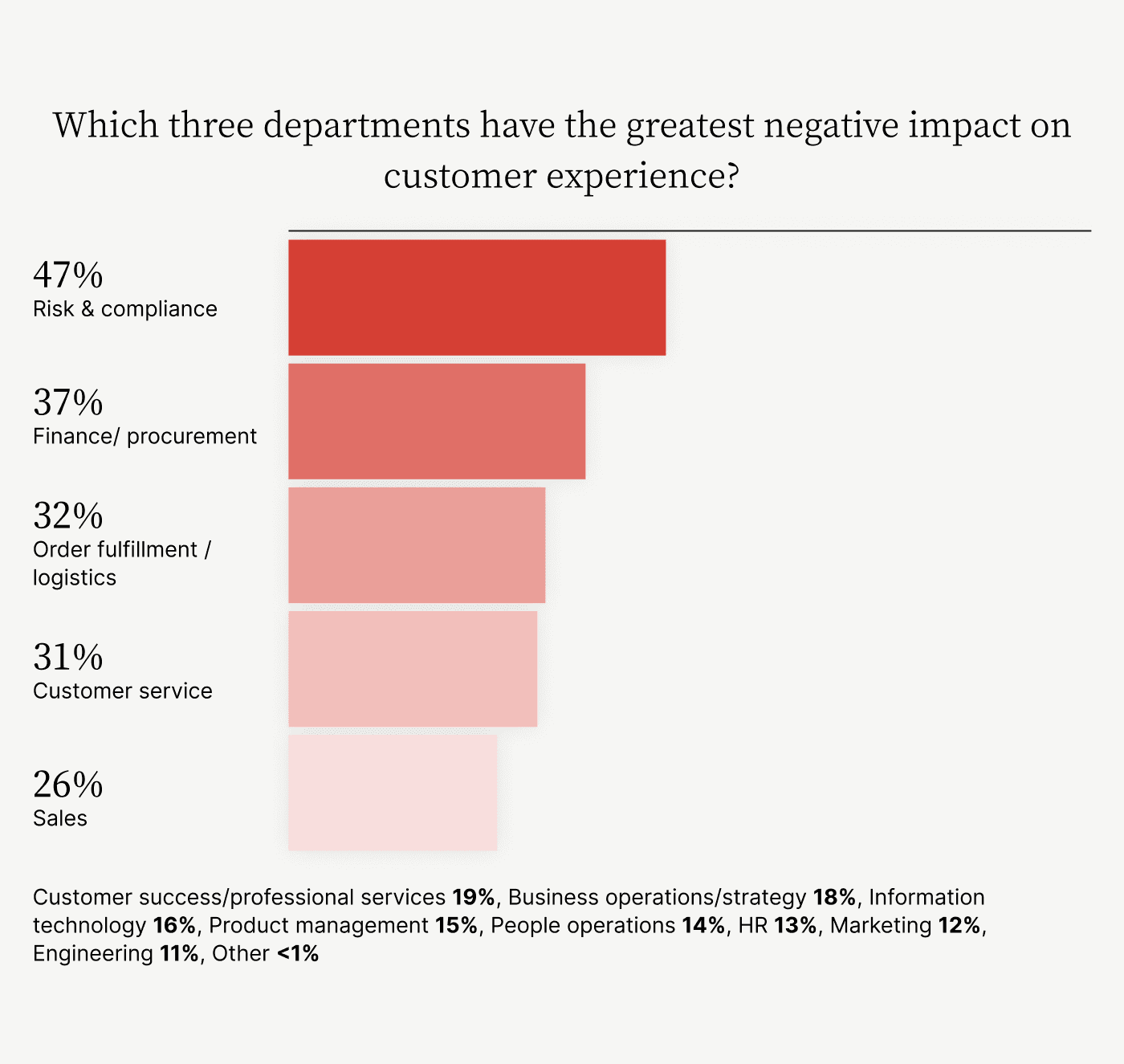

Unfortunately, executives also note that finance departments do not positively contribute to customer experience.

One reason for this underperformance is the toolsets finance and accounts receivable teams use. Standard accounts receivable payment portals and manual invoicing processes detract from CX, leaving AR teams misaligned with customers.

Standard AR portals—electronic portals that prioritize simple automation—are letting organizations down in their goal to improve CX as the data in this article will show. These solutions are missing a critical link—collaboration. In this article, we’ll examine the results of our research and explain:

CFOs’ software preferences revolve around customer needs

Traditionally, CFOs at mid- to upper-midsized organizations prioritized direct ROI—cost, time, and labor-savings—when evaluating software choices. However, our survey of 300 CFOs at these companies reveals a shift in thinking.

CFOs are aware of the critical need to deliver great customer experiences and have identified their existing software stacks as a roadblock. Their priorities are shifting as a result. The overwhelming majority of respondents believe their AR teams need a CX-boosting injection and collaborative software is the key to achieving this goal.

Here’s where CFOs stand on payment portals, and why collaboration is so strongly correlated with customer experience:

CFOs recognize collaboration and customer experience are correlated

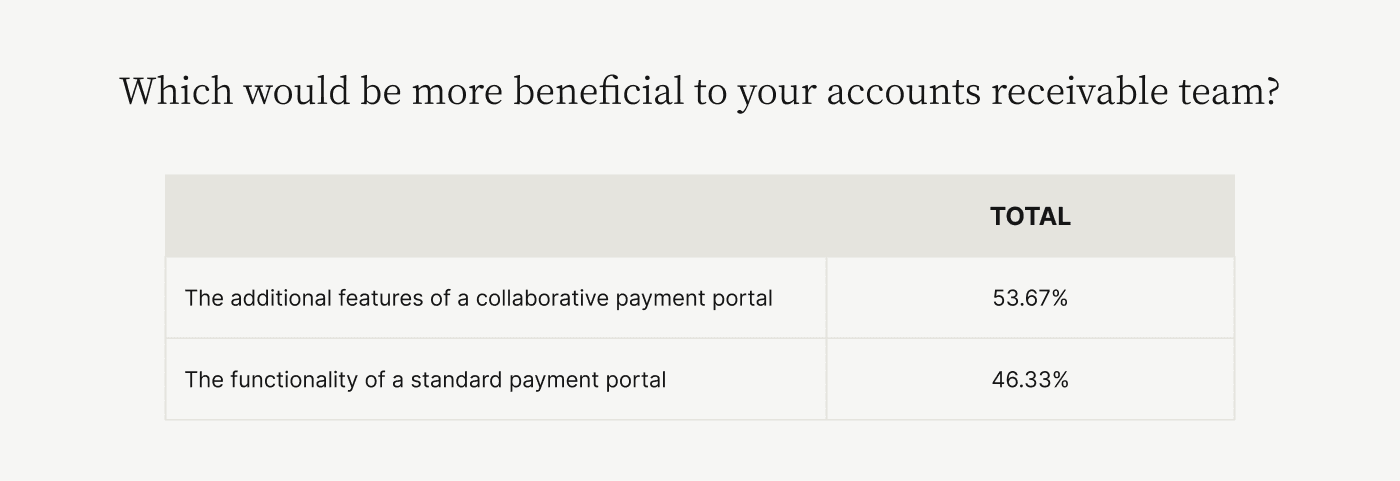

We asked 300 CFOs at mid- to upper-midsized companies whether they preferred—and which would be more beneficial to their AR team—the functionality of a standard payment portal or the additional features of a collaborative one. Fifty-four percent of respondents preferred the latter.

This preference makes sense when examining the additional features a collaborative payment portal offers. Collaborative portals bring transparency to invoicing processes by putting customers directly in touch with AR and sales teams.

Adopting collaborative portals delivers customer-centricity and organizational alignment as a result—goals that a standard AR portal cannot deliver.

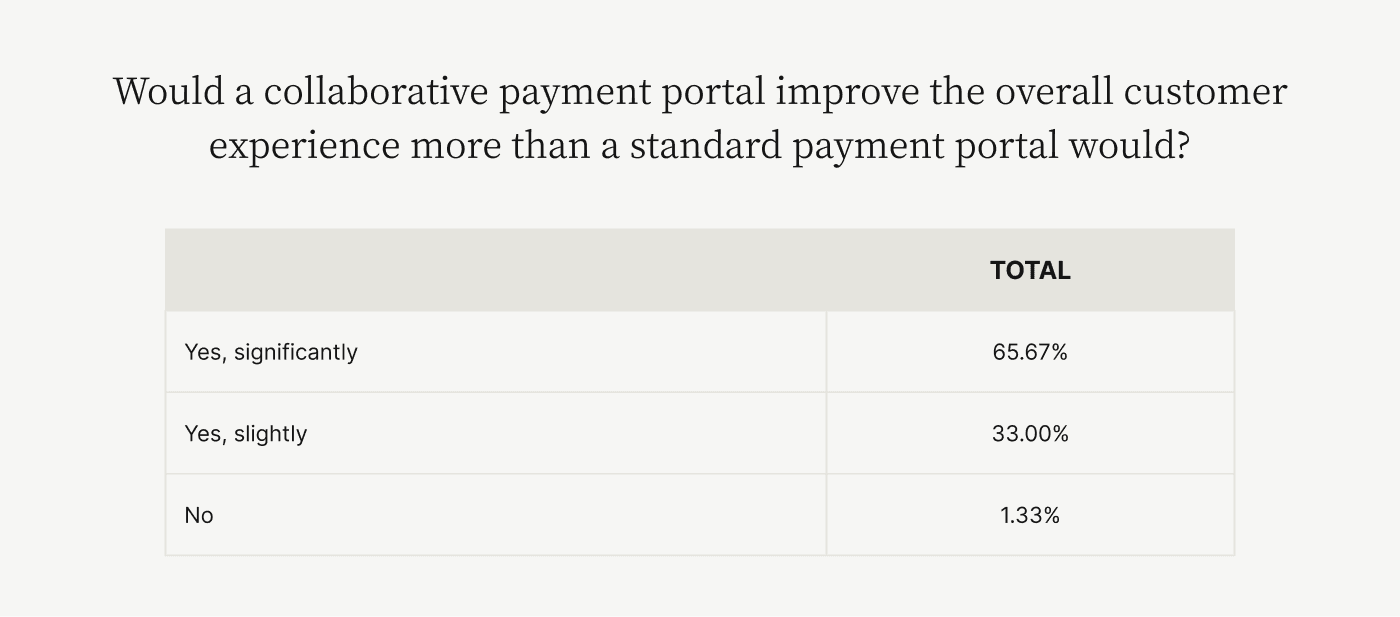

CFOs at upper-midsized companies earning more than $250 million in revenues are emphatic—72% believe (compared to 66% broadly) collaborative portals would significantly boost CX, compared to 58% of CFOs at companies recording less than $250 million in revenues annually.

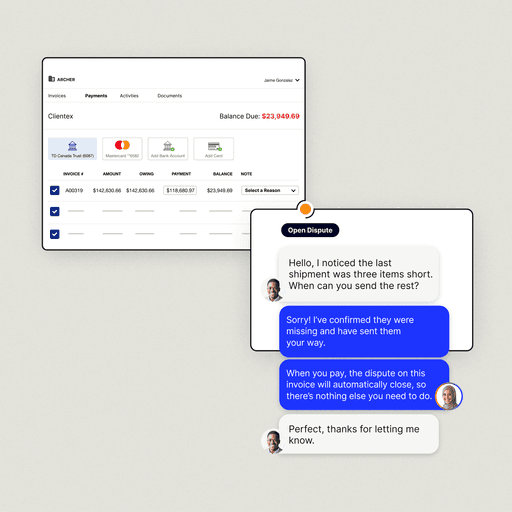

Collaborative portals give accounts receivable teams the ability to easily communicate with customers and centralize data—preventing AR from constantly contacting customers for more information when resolving disputes. Smooth customer communication results in an accounts receivable team that’s aligned around customer issues, producing great CX.

CFOs realize customers love collaborating with suppliers

This shift in CFOs’ preferences has likely emerged from customer feedback around standard AR portals. While this type of software automates manual tasks, its focus is inward. Standard accounts receivable payment portals don’t always take customer preferences—such as custom invoice delivery, for instance—into account.

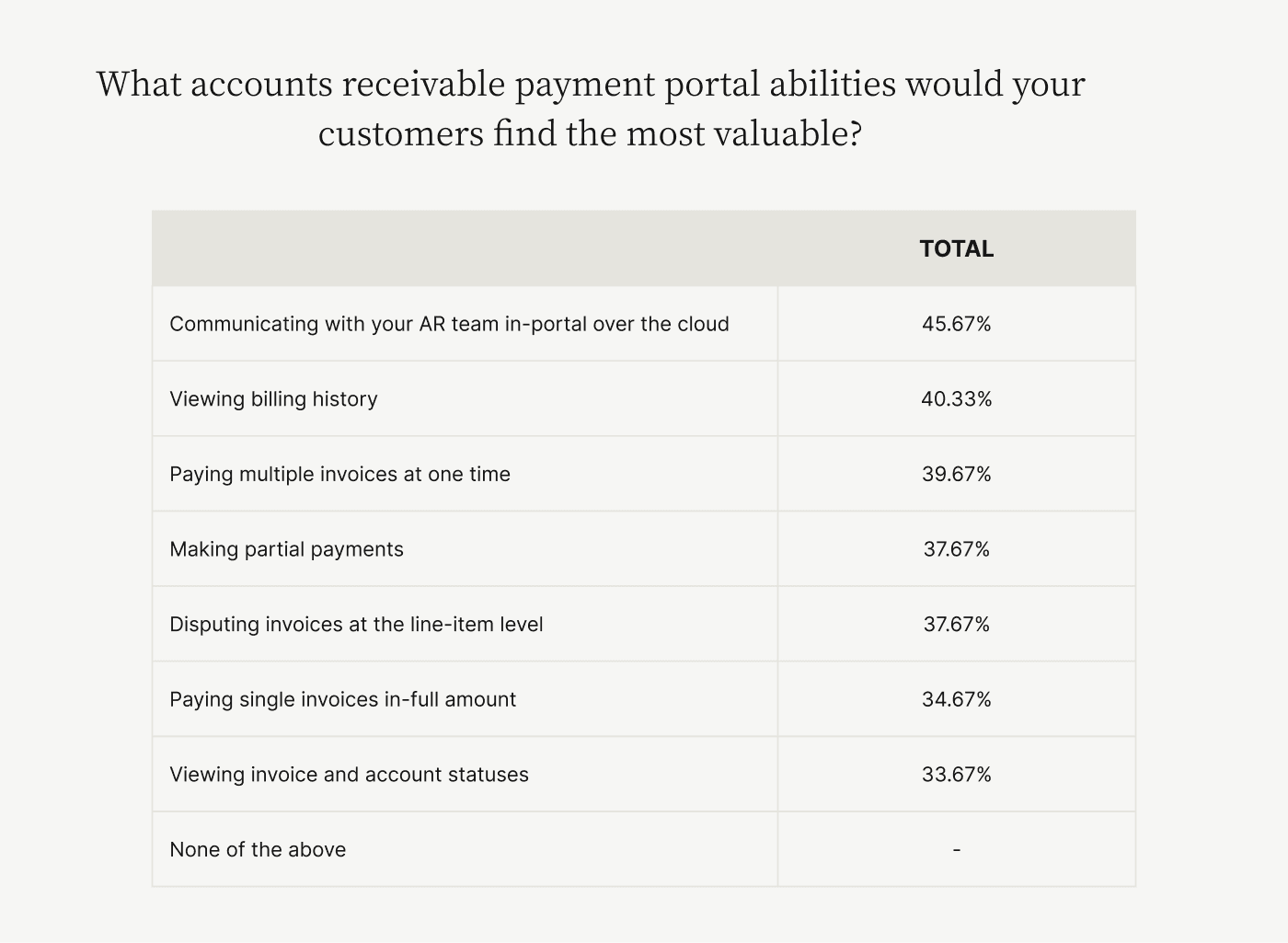

The lack of collaborative features in existing AR tech stacks is reflected in our survey results. Forty-six percent of CFOs believe that communicating with a supplier's AR team—a collaborative feature—over the cloud is the most valuable software feature their customers would love.

Communication helps customers clarify questions quickly and increases their visibility into payment statuses. It helps customers understand the context behind an AR team’s actions, strengthening the customer-supplier relationship

Collaborative AR payment portals solve the AR Disconnect

CFOs' preference for more collaboration in their accounts receivable software is a symptom of malaise plaguing AR teams. And unfortunately, simply automating accounts receivable hasn't delivered the goals companies hoped for.

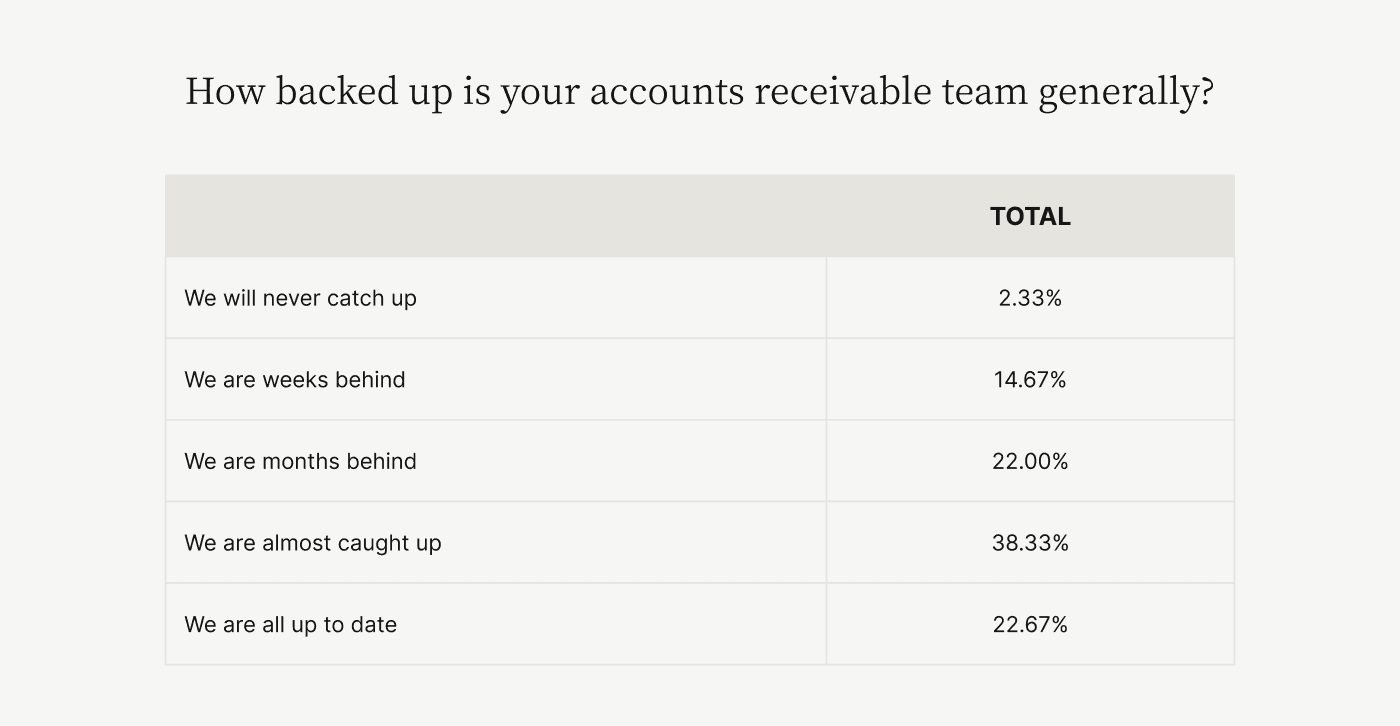

Our research shows that 71% of CFOs at upper-midsized companies believe their AR teams are at least a few weeks behind, with a few even reporting they'll never catch up.

Standard AR portals automate workflows but cannot help accounts receivable teams customize invoice delivery. They don't bridge communication gaps—causing easily-avoided disputes (like incorrect prices or credit terms on invoices)—or eliminate the endless back-and-forth between AR and customers.

We call this the AR Disconnect—the communication gap between AR teams and their customers' AP teams that leads to poor customer experiences. Collaborative AR payment portals solve this disconnect by:

Bridging communication gaps between AR and customer AP teams

Eliminating data silos that create endless back-and-forths

Giving AR more time to focus on solving complex customer issues

1. Collaborative AR portals bridge AR and AP communication gaps

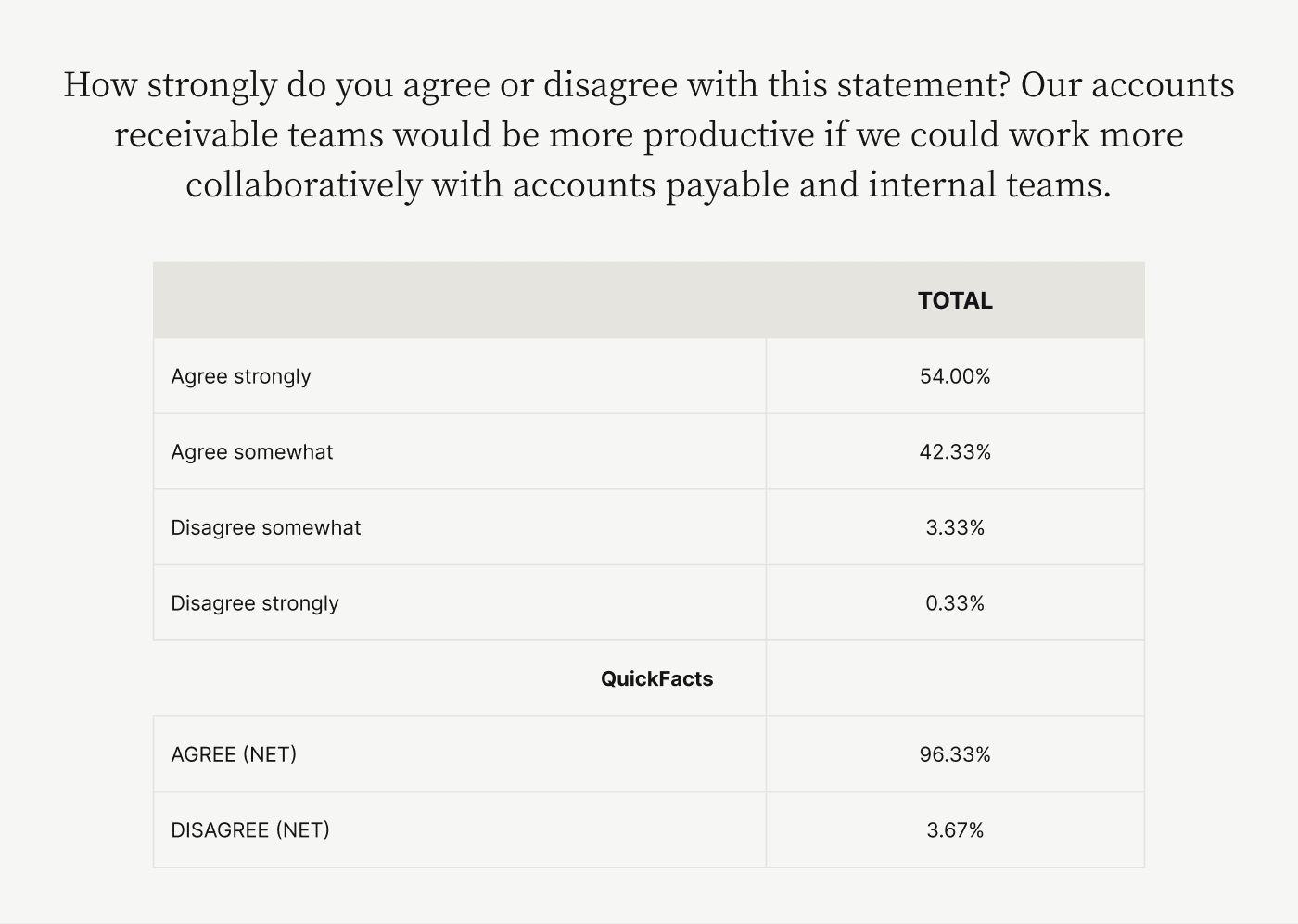

An overwhelming percentage of CFOs we surveyed agree that collaborating with customer AP teams would make their AR teams more productive, with 54% strongly agreeing.

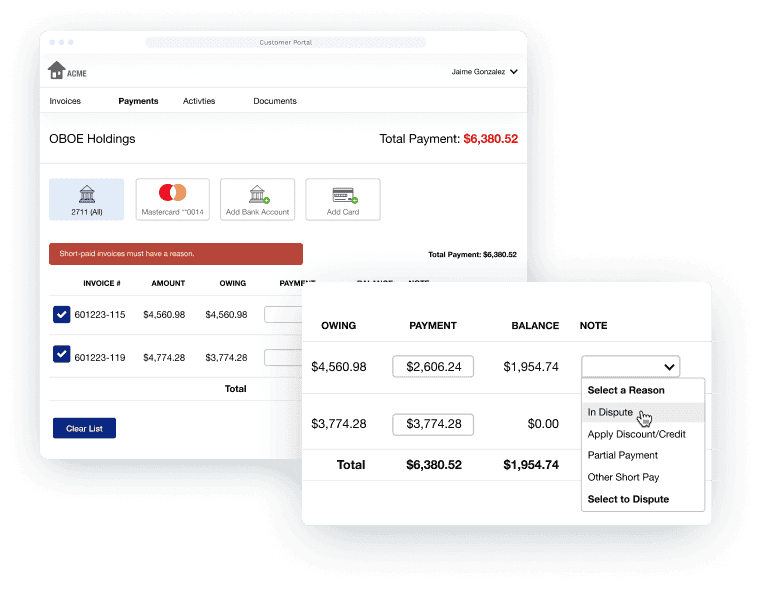

Collaborative portals help accounts receivable teams quickly understand customer preferences and deliver invoices in their preferred channels. For example, collaborative AR payment portals connect to customer AP portals, helping AR deliver invoices on time and automatically. They also speed up dispute resolution by helping AR and AP teams communicate in real-time.

When combined with the benefit of having all invoice-related data in a central platform, real-time communication goes a long way towards removing any hurdles in the dispute resolution process.

Features like these boost CX and remove communication hurdles between companies and their customers.

2. Collaborative AR portals eliminate data silos

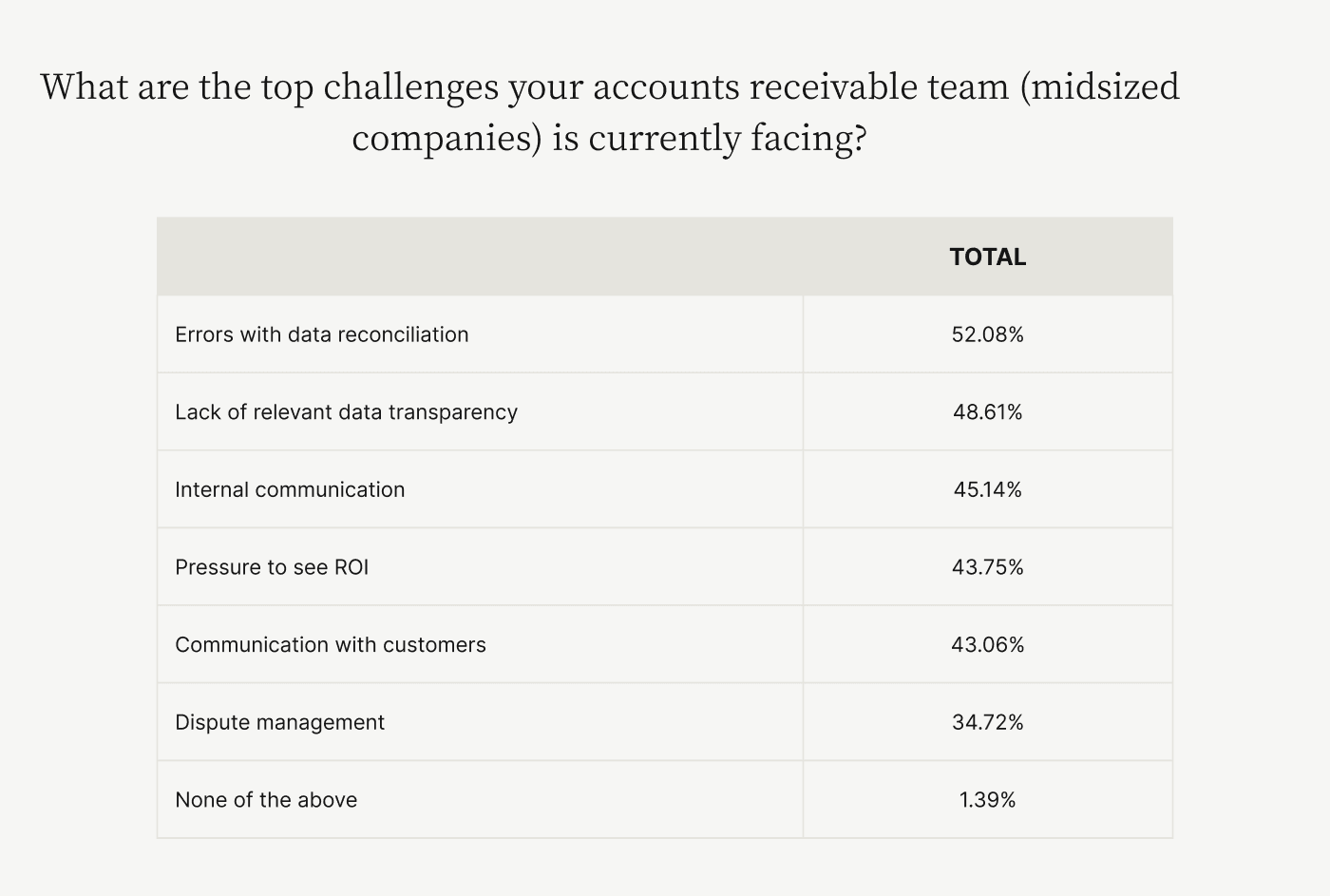

CFOs at mid-sized companies with less than $250 million in revenues struggle with data transparency—understanding where financial data is stored and the impact it might have on their organization. Forty-nine percent of respondents to our survey report struggling with it, and 52% report struggling with errors in data reconciliation.

Data silos are the underlying cause. Companies store sales contracts, order fulfillment, and invoice data—not to mention communication logs—in separate systems, leading accounts receivable teams to constantly hunt for information when solving disputes. Any errors in data entry compound, creating a needless time sink.

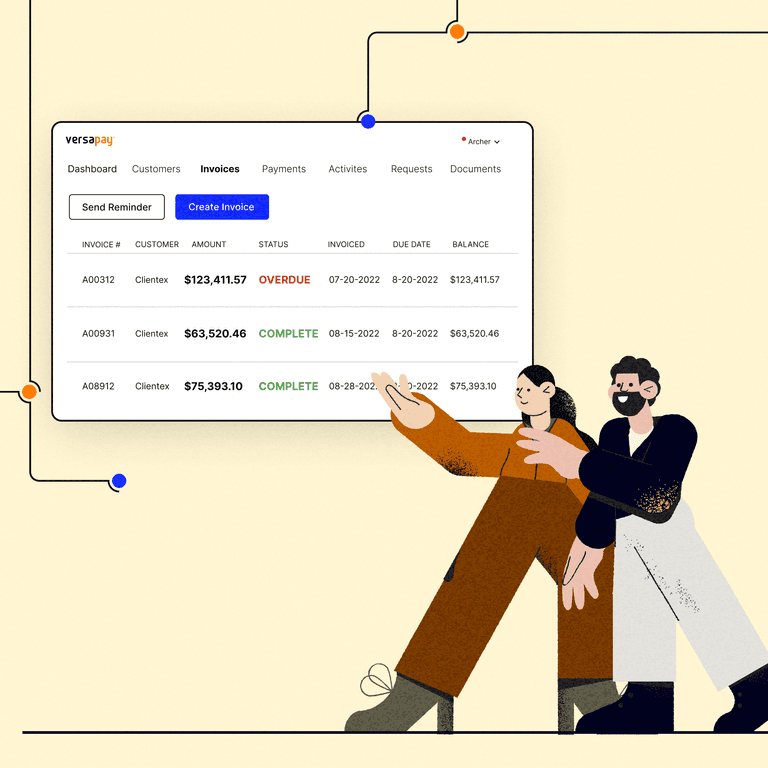

Collaborative portals centralize all invoice-to-cash data, presenting AR, sales, customers—and any other pertinent stakeholders—with an intuitive dashboard. Data transparency increases, and customers trust their suppliers more due to this visibility into invoice payment statuses.

3. Collaborative payment portals free accounts receivable to focus on complex issues

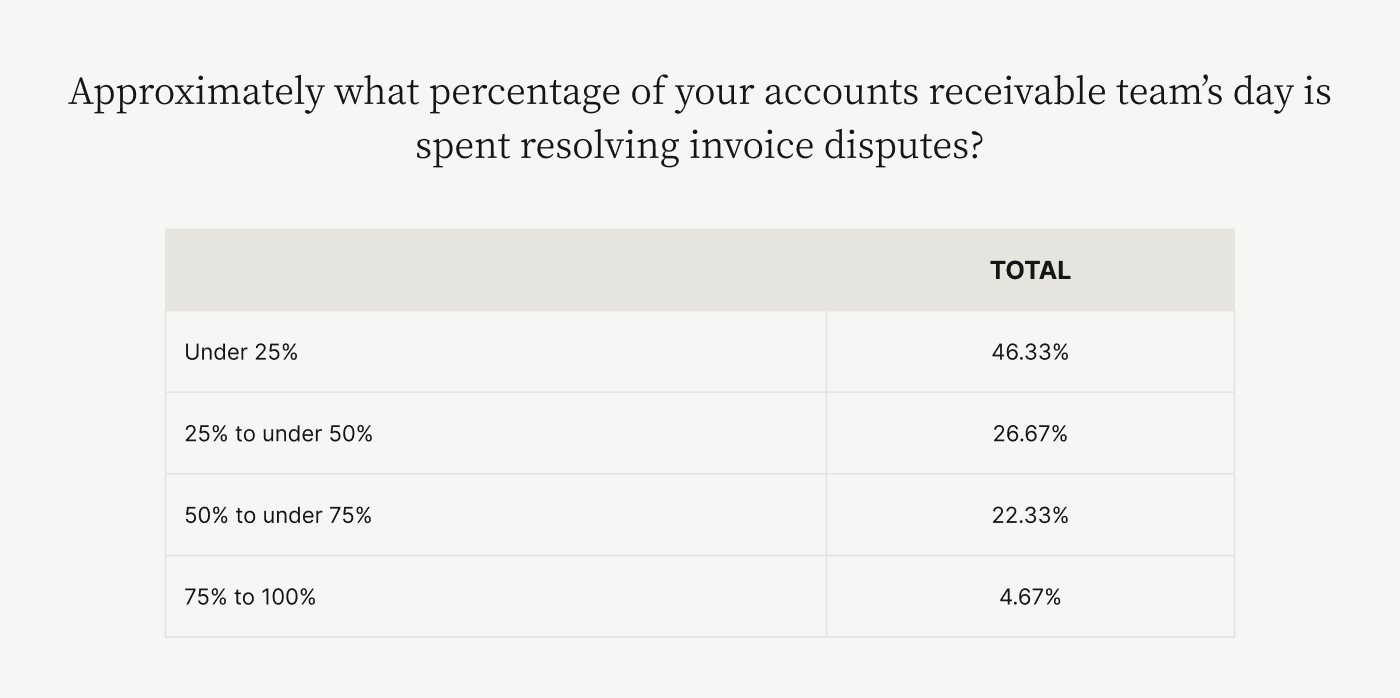

Data silos and poor communication channels are pushing AR into spending most of its time resolving disputes. Fifty-four percent of CFOs we surveyed reported that their accounts receivable team spends at least a quarter of the day resolving customer disputes, with 27% reporting AR spends more than half its day.

The more time AR spends fighting fires, the less time it has to solve complex customer issues that need deep analysis. Collaborative AR payment portals eliminate common instances of invoicing errors like incorrect prices or wrong credit terms, reducing the number of disputes AR teams have to address, and giving them more time to focus on strategic collections initiatives.

Thanks to direct communication channels, collaborative AR portals give AR teams time to focus on issues that need highly personalized attention and analysis, resulting in great CX.

3 critical CX-boosting features collaborative AR portals possess

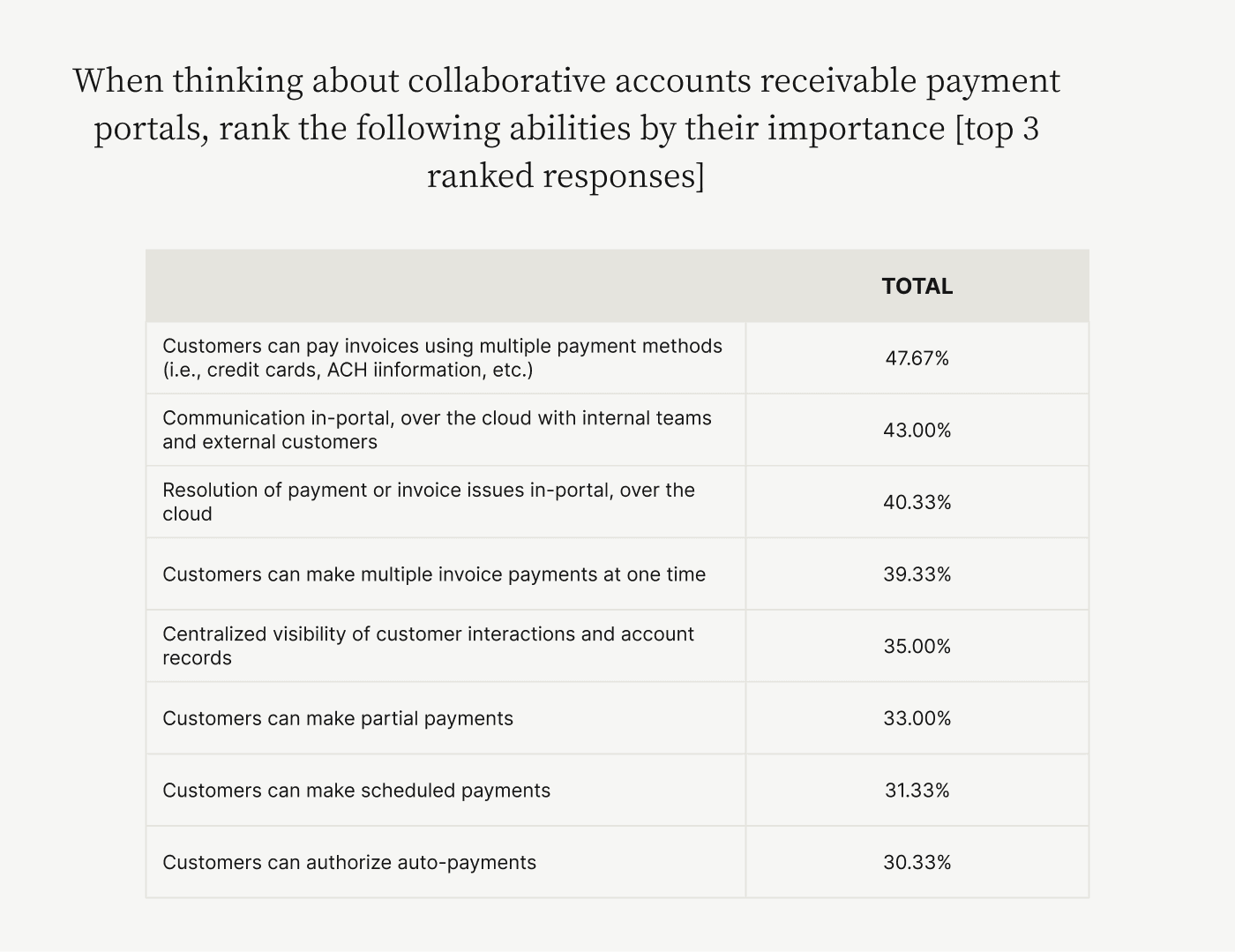

CFOs are prioritizing and evaluating software by their ability to boost customer experience instead of delivering ROI. This CX focus is apparent when examining the top features CFOs deem important when evaluating an accounts receivable payment portal's abilities:

- An AR portal must establish open communication lines with customers

- An AR portal must increase transparency in O2C processes

- An AR portal must help companies deliver a tailored customer experience

Standard AR portals let users view invoice and account statuses and pay single invoices in full, but do not possess collaborative features. Unlike collaborative AR payment portals, companies cannot rely on a standard portal to make these goals a reality.

Here are 3 critical CX-boosting features of collaborative payment portals:

1. Collaborative AR portals open communication lines

Collaborative AR payment portals simplify communication between AR teams and customers by helping them chat in real-time over the cloud via an intuitive UI. They also simplify internal communication by bringing all other stakeholders onto the same page, reducing needless back-and-forth.

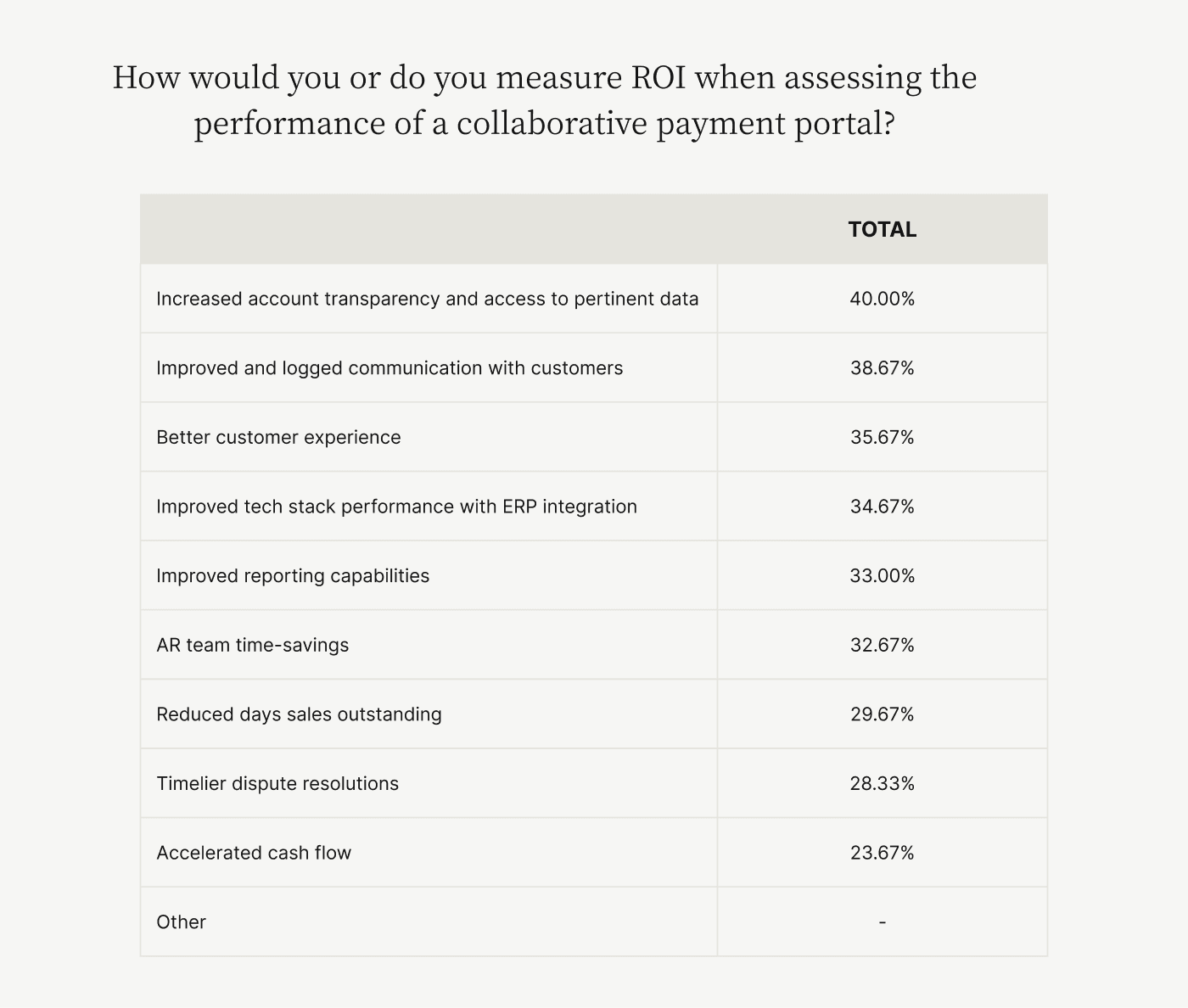

💡 By the way, thirty-nine percent of the CFOs identified "Improved and logged communication with customers" as a way of measuring a collaborative payment portal's ROI, further indicating the importance of CX over a purely financial measure when evaluating software.

2. Collaborative AR portals increase transparency

"Increased account transparency and access to data" was the only criterion that trumped communication in CFOs' eyes when measuring a collaborative portal's ROI.

Along with communication, a collaborative AR portal's ability to centralize data and gives customers visibility into invoice and dispute statuses immeasurably boosts transparency.

3. Collaborative AR portals offer tailored experiences

Collaborative AR payment portals help AR teams deliver personalized invoicing and payment experiences that customers love. They help AR deliver invoices in channels customers prefer, helping them in turn to pay using any option of their choice (ACH, credit cards, virtual cards, etc.) Whether enabling a card payment or delivering invoices to an AP portal, collaborative AR portals help companies remove payment hurdles for their customers.

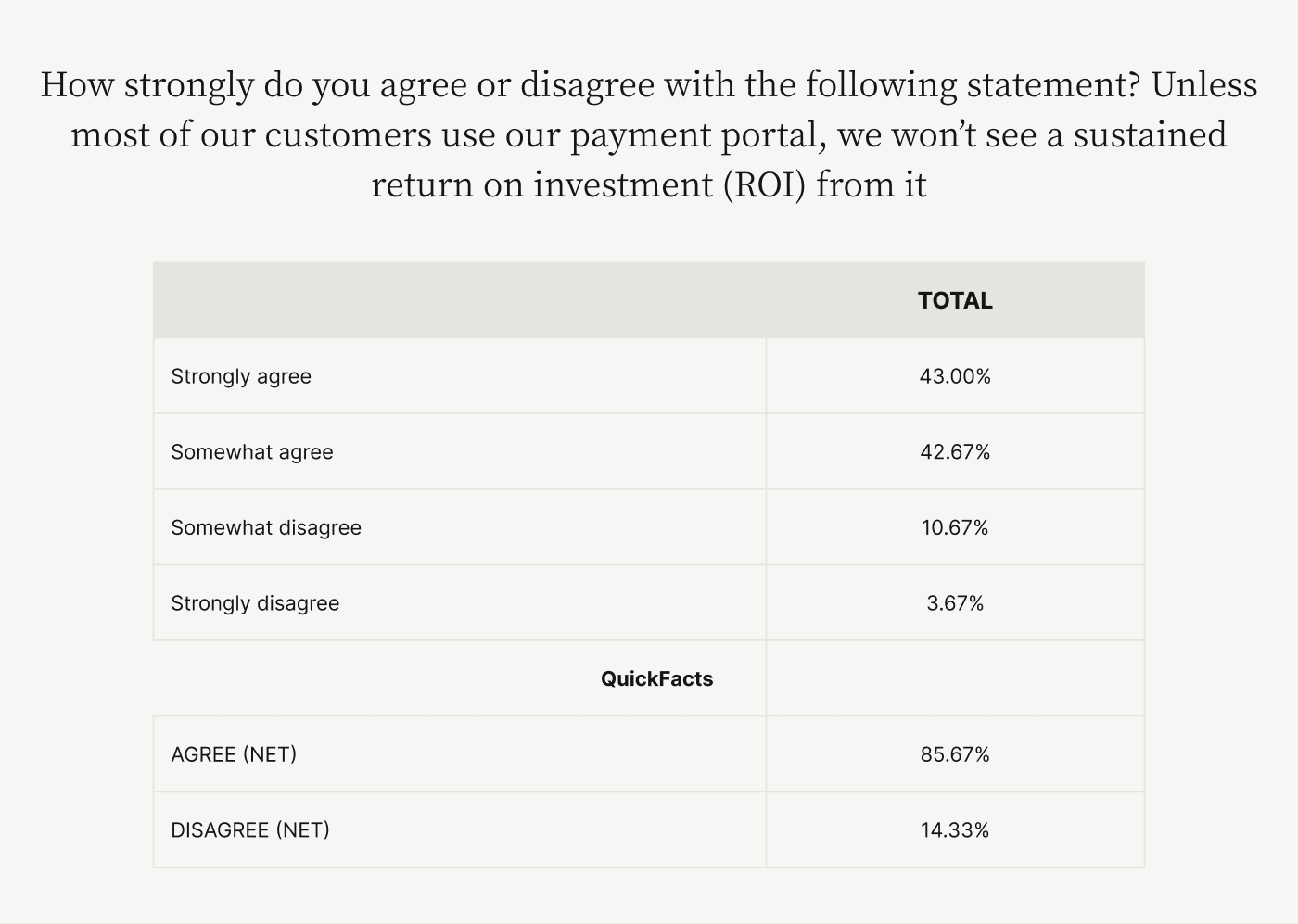

Giving customers a tailored experience is also critical in boosting adoption, something 86% of CFOs agree is the best way to measure an AR portal's ROI.

—

Conventional accounts receivable payment portals come packed with useful features but fall short on the most important count—customer experience. Collaborative AR portals deliver better communication, data centralization, and transparency.

By ensuring better CX, collaborative AR payment portals deliver immense ROI. Learn how Versapay can help you transform your AR through increased collaboration.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.