Improve Bill Collections with These 6 Collections Email Templates

- 13 min read

Get your hands on six real-life, friendly collection email samples for collecting accounts receivable that will improve your cash flow and customer service.

No one likes asking customers for money when it’s overdue, but if you do it right you can maintain a healthy cash flow and go a long way towards improving your customer relationships.

Using a friendly tone in your collection emails will give your more absent-minded customers a much better experience paying their bills. For example, a simple "We hope you're doing well" opening can set a positive tone for the entire interaction. That’s important when you consider that, in a study conducted by Wakefield for Versapay, 73% of C-level executives say the invoice-to-cash cycle is a frequent source of customer dissatisfaction.

Using timely and professional collections email templates, your accounts receivable team can strengthen customer relationships and spend less time chasing money that’s owed to you. Instead of using time-consuming methods such as mailing dunning letters, drafting individual emails, or trying to reach customers by phone, your collections team can use templates to proactively notify customers of approaching and missed payment dates. A simple reminder sent three days before a due date, for example, could help a customer avoid a late payment altogether, fostering goodwill and improving cash flow simultaneously.

In addition to prompting your customers to pay you faster, standardized collections email templates reduce the need for management intervention by cutting down the number of disputes and misunderstandings. As a result, your AR team can more convincingly advocate for further digitization and automation, leading to even greater improvements in efficiency and customer satisfaction.

Table of contents:

What are accounts receivable collections email templates?

Accounts receivable collections email templates are pre-written messages that help your collections staff efficiently remind customers to pay on time. Because you only have to write them once (barring minor personalizations), these templates can streamline your collections work, reduce errors, and ensure consistent communication.

They save time by eliminating the need to craft individual messages for each customer, minimize mistakes that can occur in rushed, one-off emails, and maintain a professional tone across all interactions. This standardization not only improves efficiency but also enhances your company's image and can lead to faster payments.

While you could create many variations of your collections email templates, the following six are typically sufficient to effectively manage the process (we’ve included examples of each below):

Template 1: Payment Reminder Before Due Date

Template 2: Payment Reminder 15 Days Past Due

Template 3: Payment Reminder 30 Days Past Due

Template 4: Payment Reminder 60 Days Past Due

Template 5: Final Payment Reminder

Template 6: Autopay Promotions

How email collection templates make accounts receivable more efficient

By leveraging optimized email collections templates, you stand to make your AR processes significantly more efficient, accurate, and cost-effective. Here are three specific benefits you'll enjoy.

1. Better use of staff time and lower costs

Using antiquated outreach methods—like email or phone—to keep the collections process moving demands intensive staff time, preventing collections professionals from working on higher-value tasks such as resolving legitimate disputes and instituting further process improvements.

Dedicating so much of the team’s time to tasks that could be done more efficiently drives up operational costs as well. Collections email templates are an easy solution that will give your accounts receivable team their valued time back.

2. Improved customer experiences

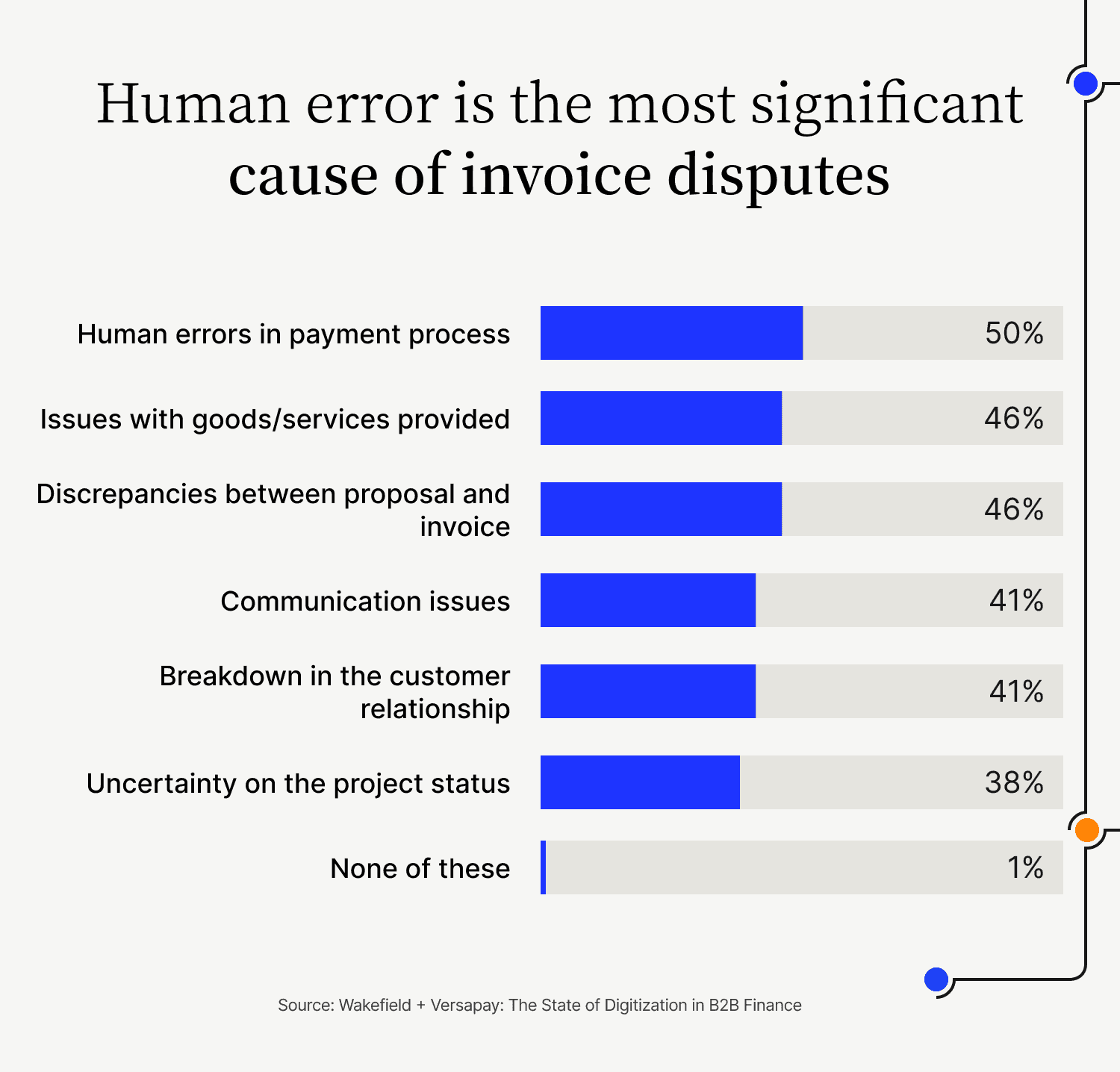

Human error in the payment process is the most frequently cited cause of invoice disputes, according to 50% of executives in the Wakefield-Versapay study. This is more than any other source, including issues with goods or services, communication issues, or a breakdown in customer relationships.

A more standardized and efficient accounts receivable process provides a better experience for customers due to speed, reduced errors, and clearer communication. It follows that reducing human error by standardizing communications, leveraging collections email templates, and automating processes can immediately improve the customer experience.

3. Reduced problems and risks

Poor communication in the AR process often leads to problems such as disputes, angry customers, and the threat of litigation. In fact, 78% of executives say that customer communication in AR is a problem, and 85% say that poor communication has led to nonpayment. And almost all surveyed executives (98%) report that upper management must get involved in payment issues or dispute resolution at some point.

Using collection email templates can spare management the need to step in because standardization and efficiency reduce disputes and other problems in the AR process. As management sees how much less attention AR requires with standardized approaches in place, AR staff can more easily make an effective case for further digitizing the process.

How to write collections email templates that get results

The last thing you want to do is write a collections email template that’s threatening or aggressive. The less emotional you can be about your payment reminders, especially in the beginning, the more effective they’ll be. In fact, with the right language, your customers will likely appreciate your reminding them.

Well-crafted reminders often prompt fast action on payments that might have been overlooked due to work pressures, personal matters, or time off. Follow these guidelines to create effective collections email templates:

1) Be professional, clear, and concise: Even your subject line should convey the purpose of your communication.

- 2) Use personalization: Even though collections email templates are essentially form letters, they should be addressed to individual customers at the correct email address. (Be sure to white label or send them from a personal email address, too.)

- 3) Provide complete and accurate information: Make it as easy as possible for your customers by providing relevant information, such as the invoice number, date, amount due, due date, how many days overdue, and what goods or services the invoice was for. Attach relevant documentation, if necessary.

4) Explain consequences respectfully: If there are repercussions for delayed payment, state them factually without using emotionally-charged language.

5) Provide clear payment instructions: Ideally, a single, obvious payment button will enable your customers to pay immediately. Be sure to detail available payment methods and options, such as payment plans, and provide full contact information for questions or discussions.

6) Be courteous: Thank your customer for their business and tell them you appreciate them. Acknowledge that the missed payment might be an oversight.

- 7) Be consistent: Regular follow-ups will show late-paying customers that you’re serious. For habitually late payers, the paper trail of your follow-up collections emails can support productive conversations between your sales teams and your customers.

6 example collections email templates (from Versapay customers) you can use right now

Versapay clients use a wide variety of custom collections email templates to maintain healthy cash flow. See below for some specific templates (from real Versapay customers; anonymized for confidentiality purposes) that have proven effective in the six scenarios mentioned above. Feel free to use them as is or modify them to fit your specific circumstances.

Keep in mind that your approach may vary depending on the customer relationship. For example, you might craft a different message for a new customer compared to a long-standing client. A good rule of thumb is to put yourself in the recipient's shoes: if reading the message makes you uncomfortable, it's probably best to revise it.

Template 1. Payment reminder before due date

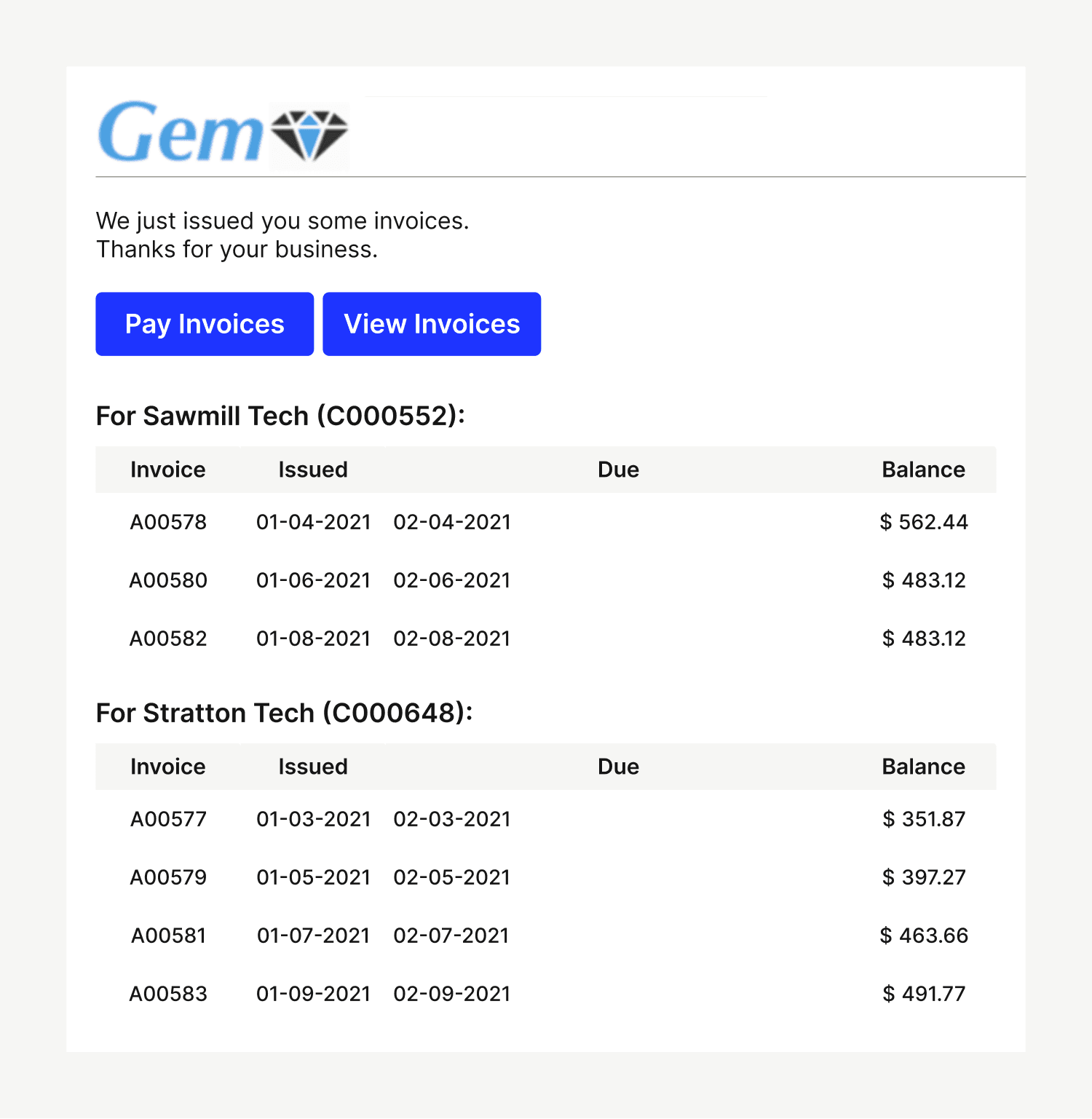

This friendly, gentle notification informs the customer right away that invoices have been issued:

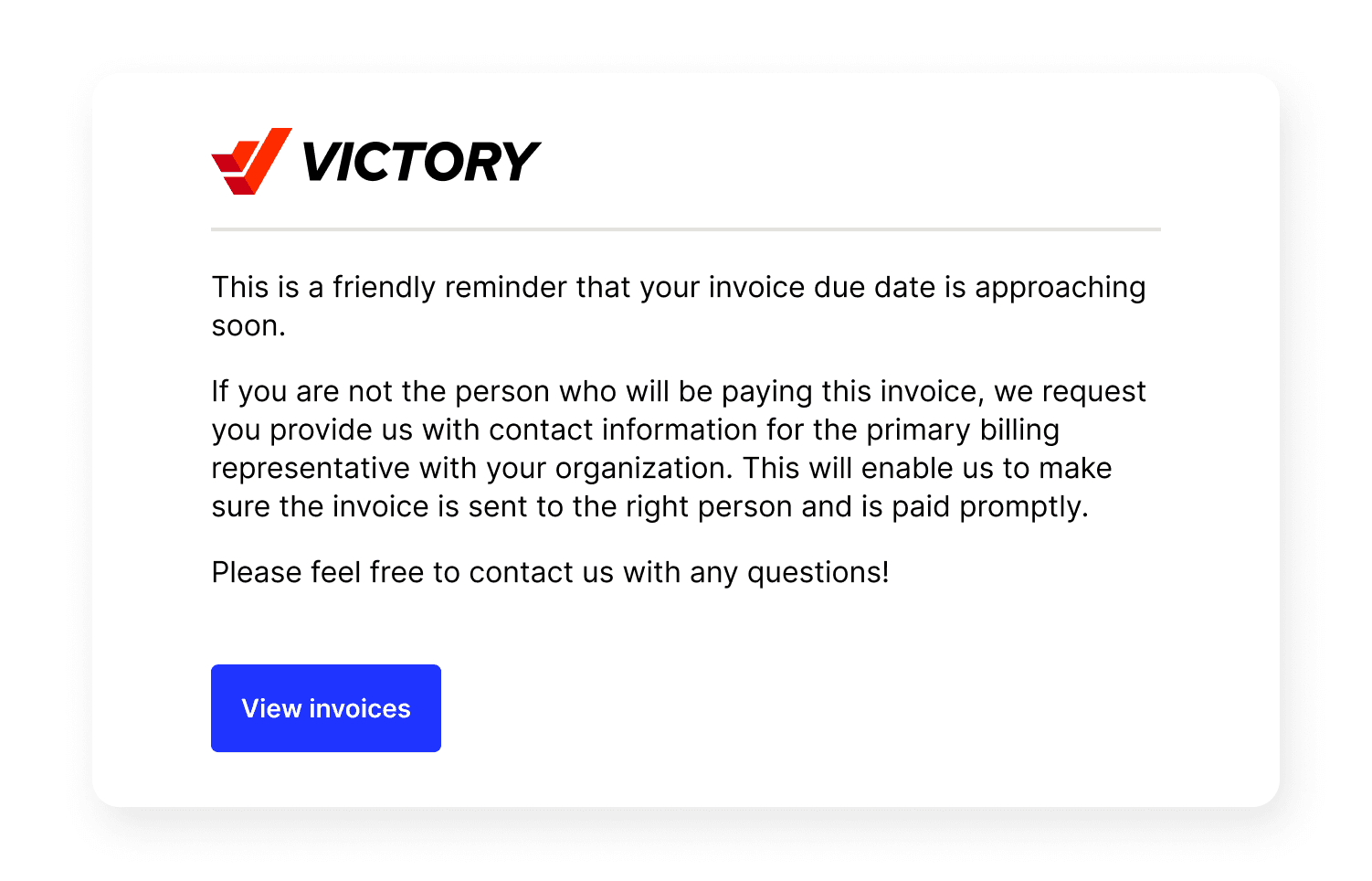

This short and sweet template informs the customer that a due date is approaching soon and provides a link to detailed info:

Template 2. Payment reminder 15 days past due

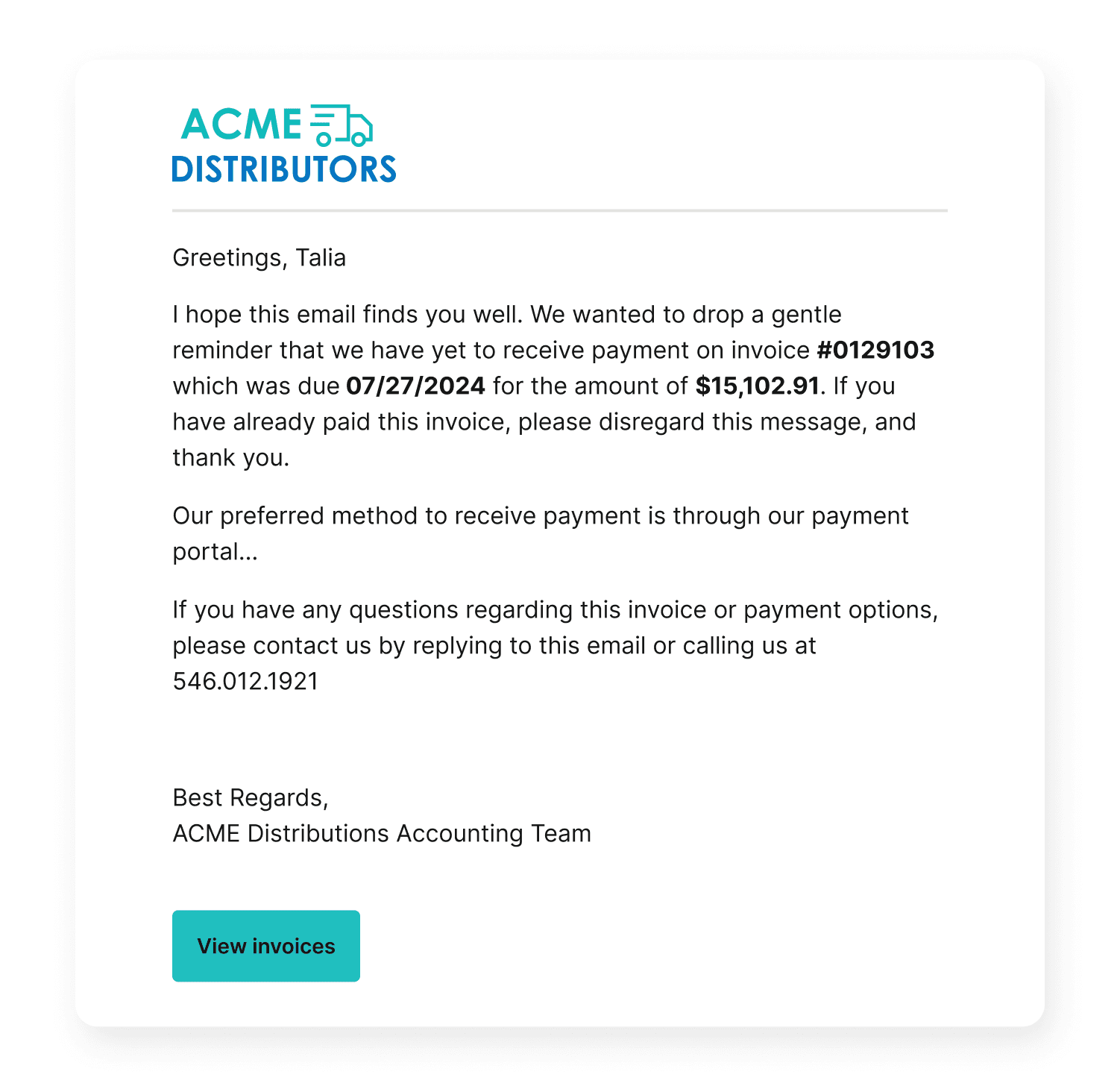

This reminder strikes the right tone and includes detailed information:

Here’s another template that provides helpful information for the customer (in this particular example, the email sent was for an invoice that was 90 days overdue; but it could be adjusted for 15 days overdue):

Template 3. Payment reminder 30 days past due

Here’s another short template with a link to detailed information. The tone is slightly more firm, but providing contact information keeps it on the friendlier side:

Template 4. Payment reminder 60 days past due

This template shows appreciation for the customer while outlining the consequences of continued payment delays:

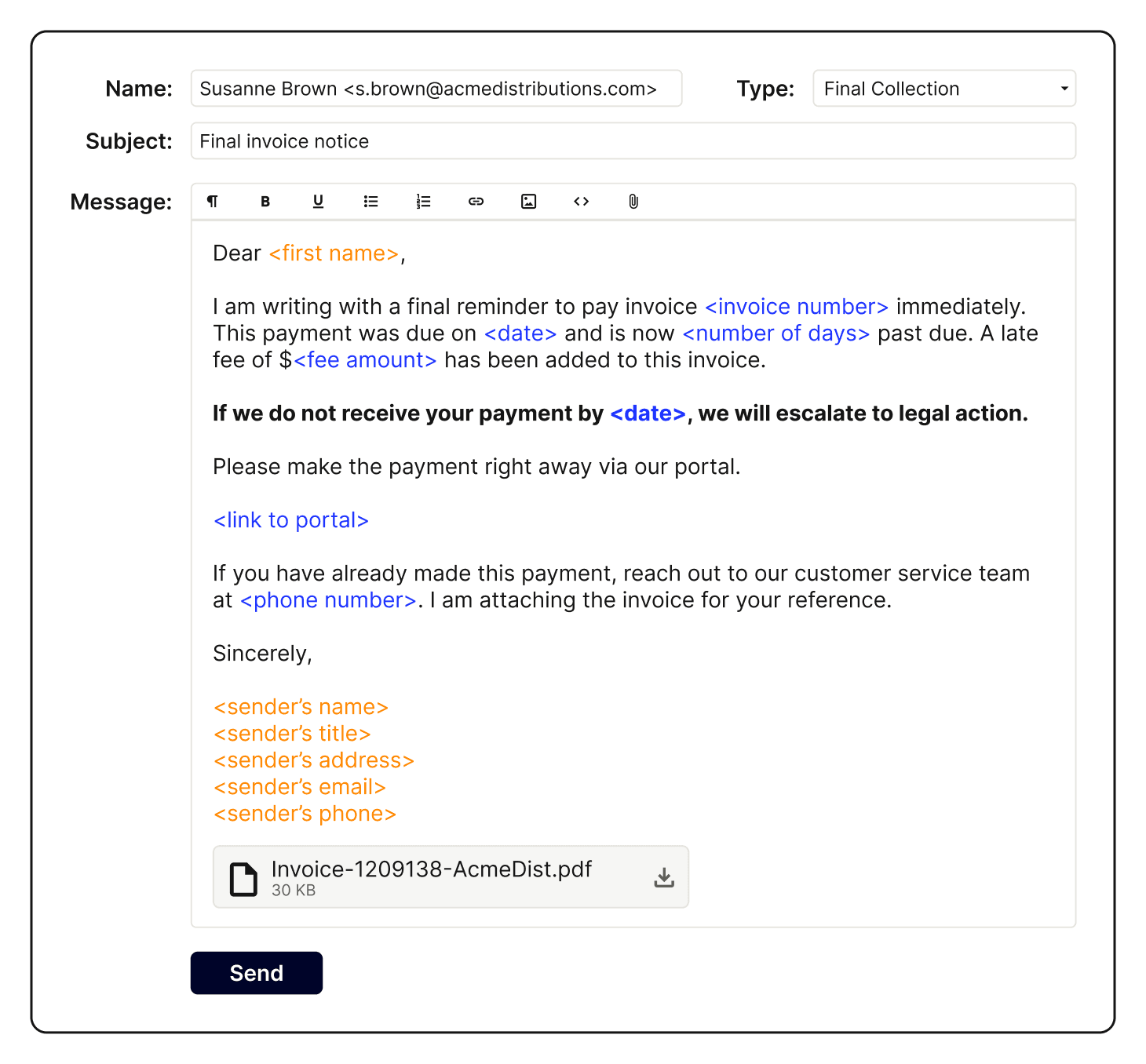

Template 5. Final payment reminder

While these templates threaten suspension of service, they’re still written respectfully:

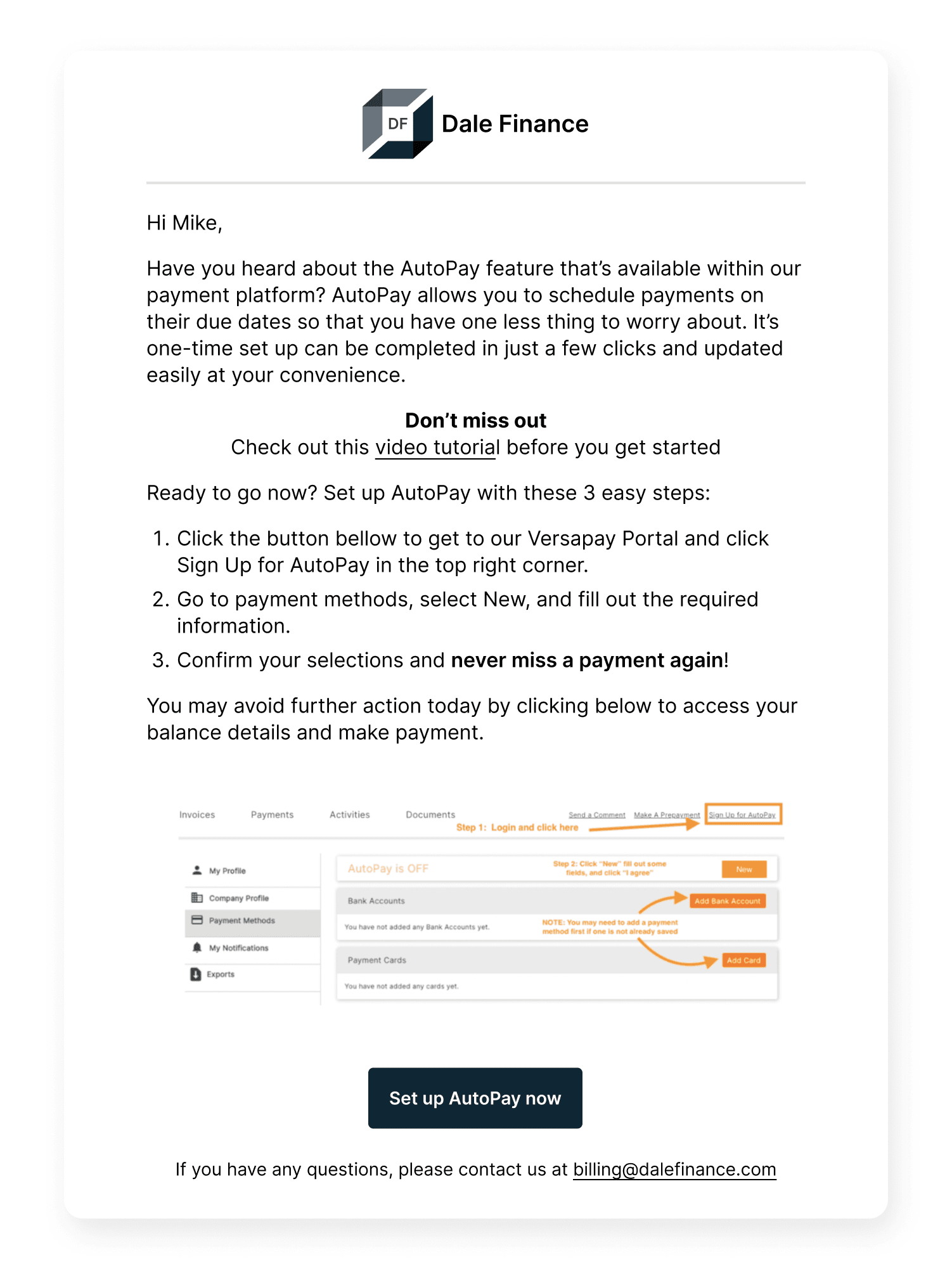

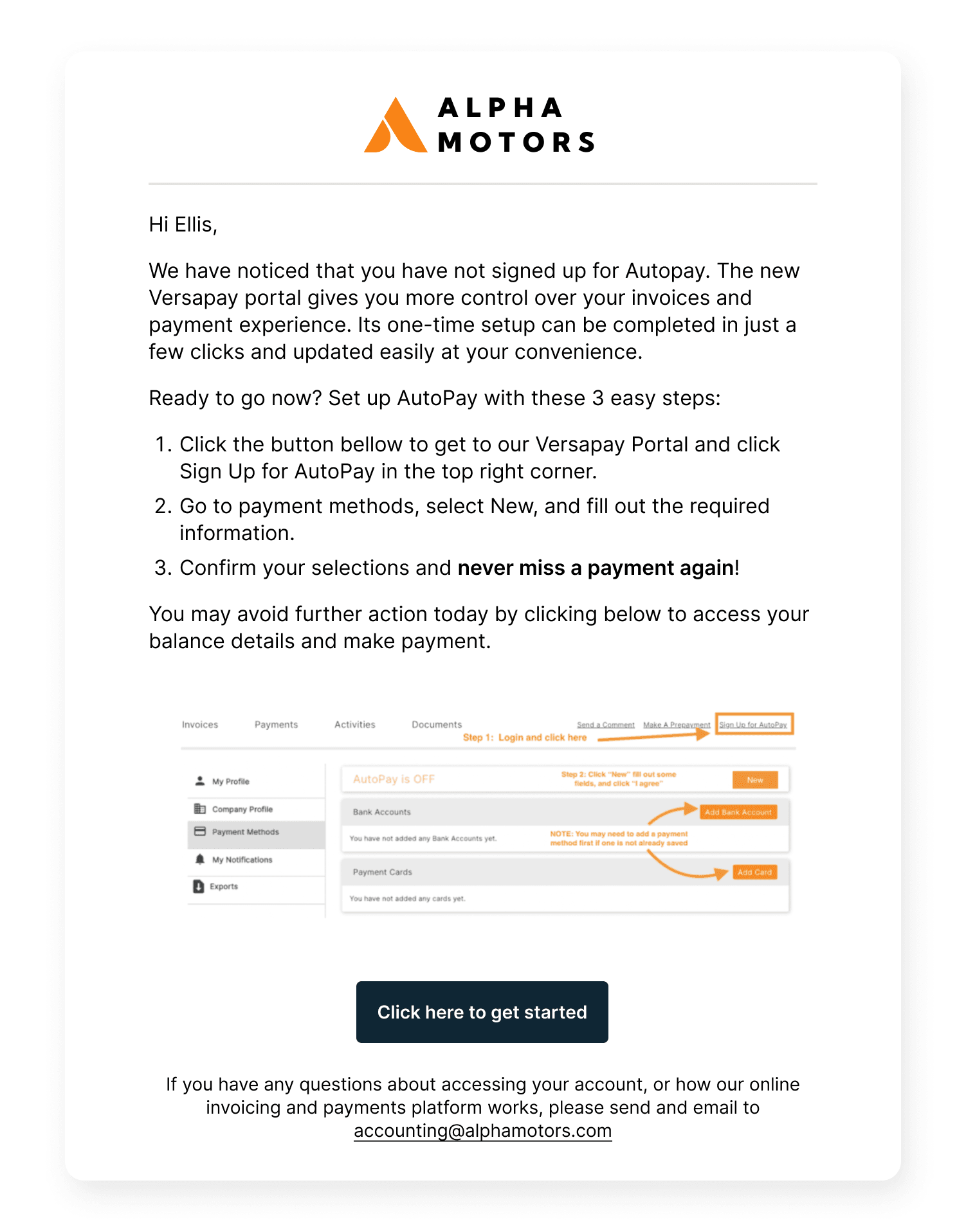

Template 6. Autopay promotions

These templates position automated recurring payments as a benefit to the customer:

5 bonus example collections email templates

The above six templates are real-world examples our customers are actively using to collect on outstanding invoices. However, those aren’t the only usable templates. Here are 5 additional collections email templates that the Versapay team has written that you could incorporate into your processes today.

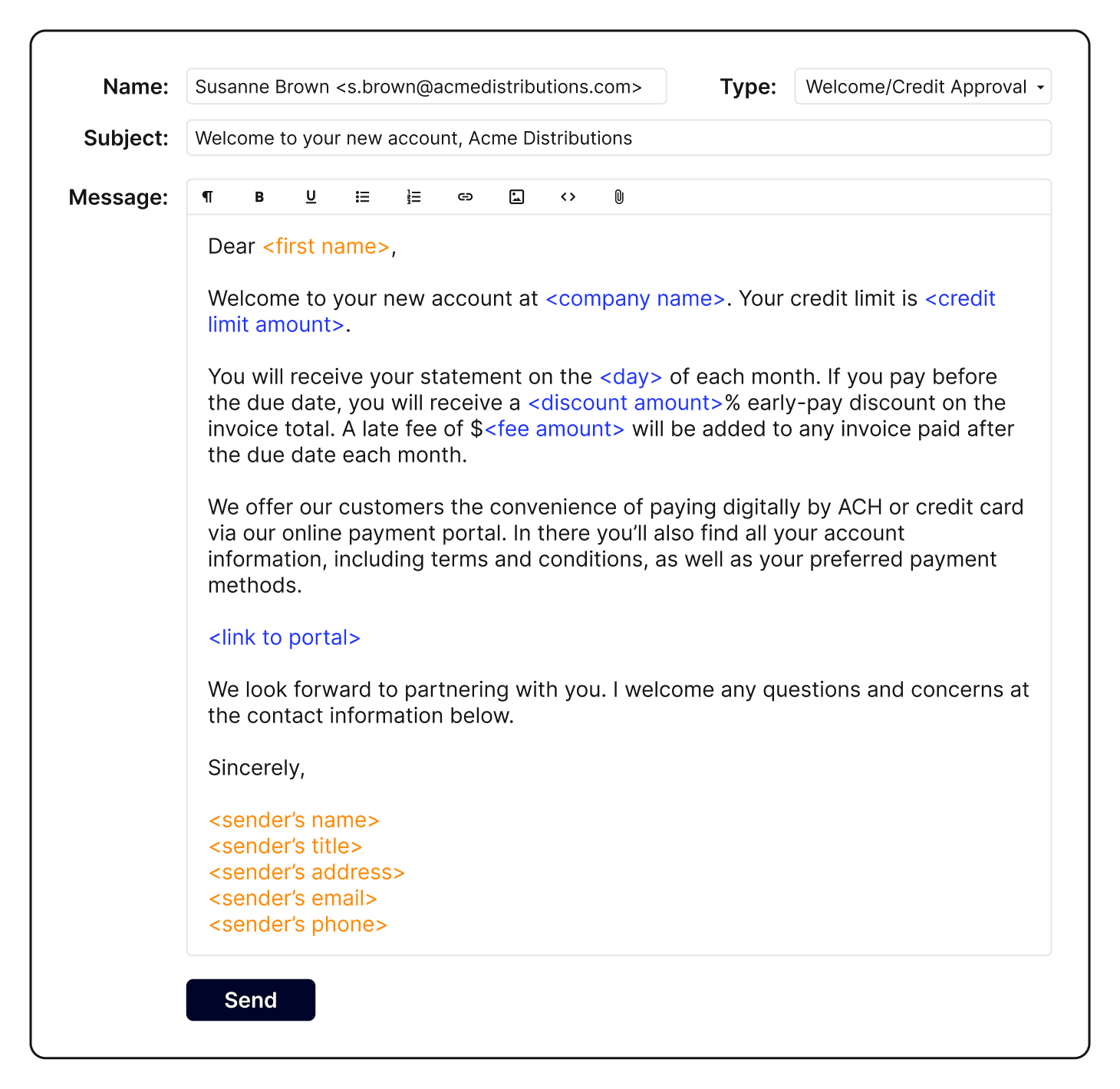

Bonus template 1. Welcome / credit approval

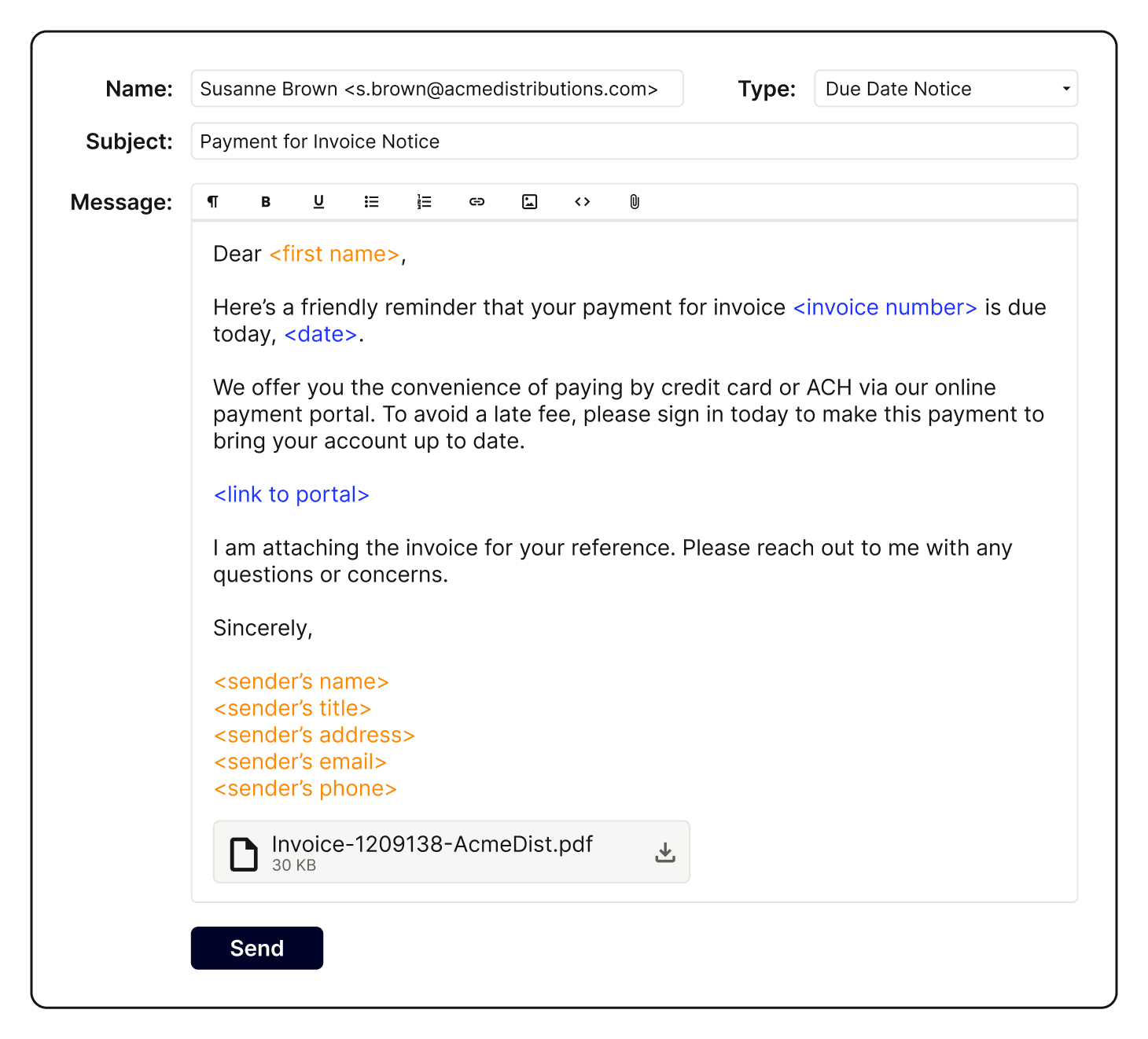

Bonus template 2. Due date notice

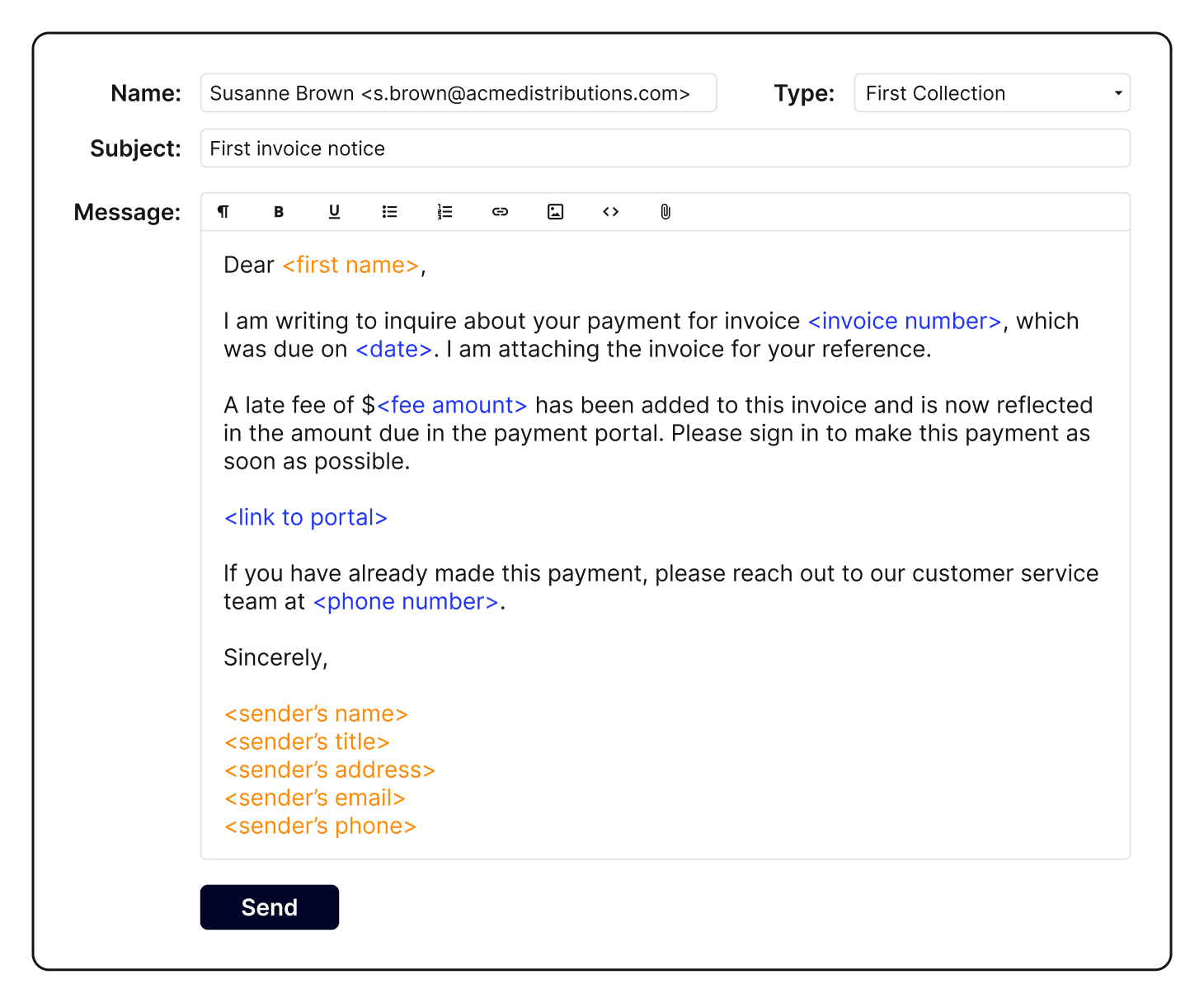

Bonus template 3. First collection email

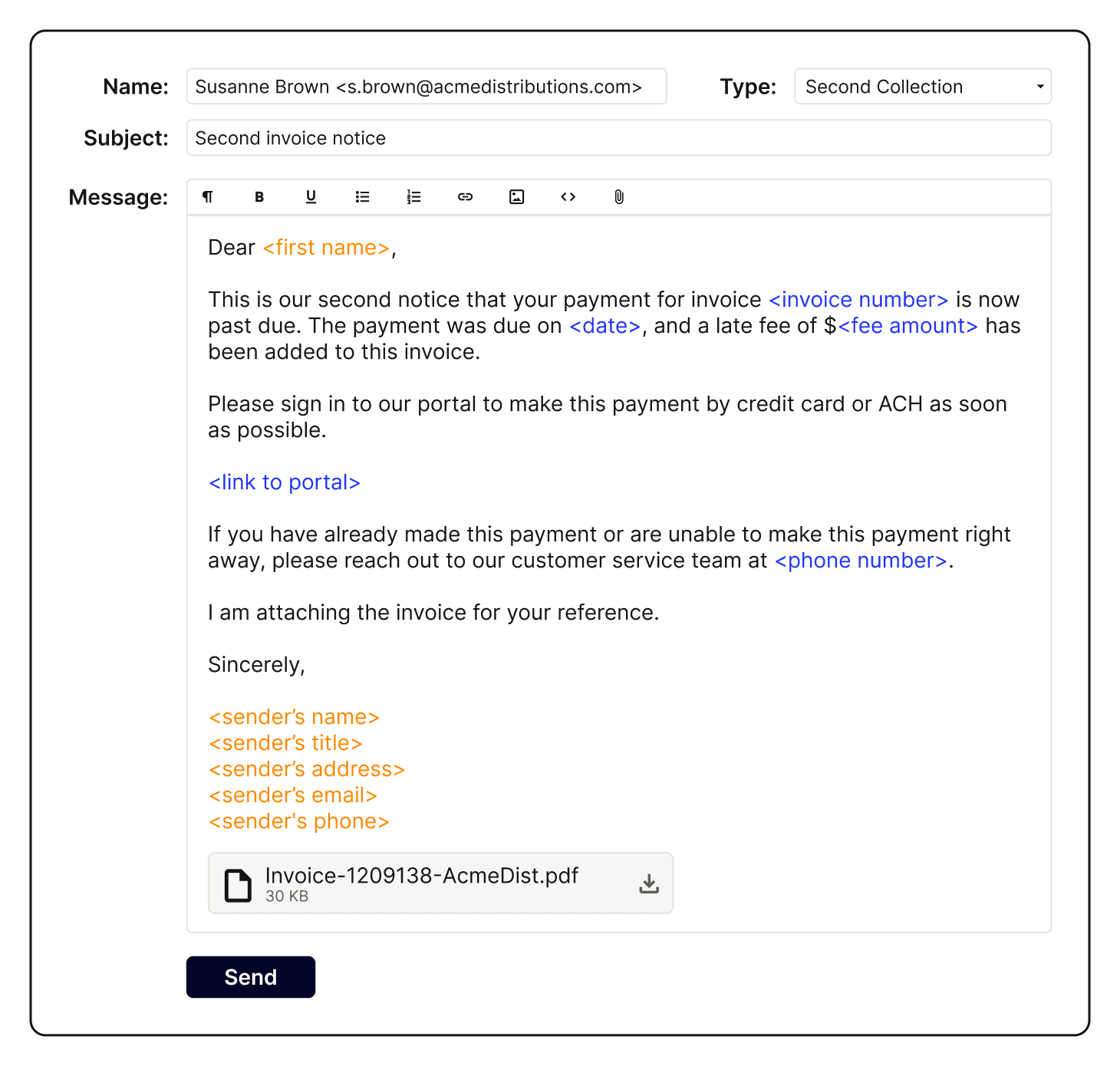

Bonus template 4. Second collection email

Bonus template 5. Final collection email

Transform your collections process beyond email templates

While collections email templates are a powerful tool, they're just the beginning of what's possible in modern accounts receivable management. By embracing comprehensive AR automation software, you can revolutionize your entire collections process and achieve results far beyond what templates alone can offer.

Imagine a world where:

Your customers have 24/7 access to their invoice information through a secure online accounts receivable payment portal

Automated analytics help you effortlessly track and predict key metrics like days sales outstanding (DSO) and aging across your customer portfolio

Intelligent automation guides your collection strategies and priorities, personalizing approaches for different customer segments

Machine learning algorithms identify potential payment delays before they occur, enabling proactive intervention

Your accounts receivable team spends less time on manual tasks and more time on strategic customer relationships and initiatives

This isn't a far-off dream, it's the reality for businesses leveraging an advanced AR automation solution like Versapay. We can help you implement and optimize automated collection email templates as part of a comprehensive strategy to streamline your entire AR workflow.

Talk with a Versapay expert today to learn how we can help boost your efficiency, improve customer communication, and improve cash flow.

Bonus: Collection email template best-practices checklist

Craft a clear subject line: Ensure the email's purpose is immediately apparent.

Open with key information: Start with the invoice details, amount due, etc.

Personalize wherever possible: Tailor the message to the specific customer relationship.

Keep it concise: Aim for brevity while including all essential information.

Maintain professionalism: Use courteous language throughout the communication.

Detail payment methods: Clearly explain all available options for settling the invoice.

Provide necessary documentation: Include relevant financial records as attachments.

Outline potential consequences: Tactfully explain any implications of delayed payment.

Close on a positive note: Express gratitude for the customer's prompt attention.

Establish a follow-up schedule: Plan for timely, consistent reminders if needed.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.