Credit Card Basis Points 101

- 6 min read

This blog covers everything you need to know about basis points and how they're used in accounting and financial services industries (particularly in credit card processing).

Basis points (bps) are an essential concept in the world of accounting. They apply to many different financial products and tools, particularly in credit card processing. The term is used widely—often as “bips” or bps—yet many outside of accounting and finance (and even folks within these industries) aren’t familiar with the idea.

For those looking to learn, the concept of basis points is rather simple: A basis point is a tiny portion of a total used to calculate fees or charges on financial transactions. Basis points are referred to as whole numbers (as in 1 bp or 5 bps) but can be expressed and calculated as percentages or decimals too.

Basis points provide a common language for professionals and consumers across financial industries to use when talking about fees, charges, and changes in value. Basis points are especially useful when discussing changes in interest rates.

Read on to learn everything you need to know about basis points and how they’re used in the accounting and financial services industry. This article covers:

What is a basis point?

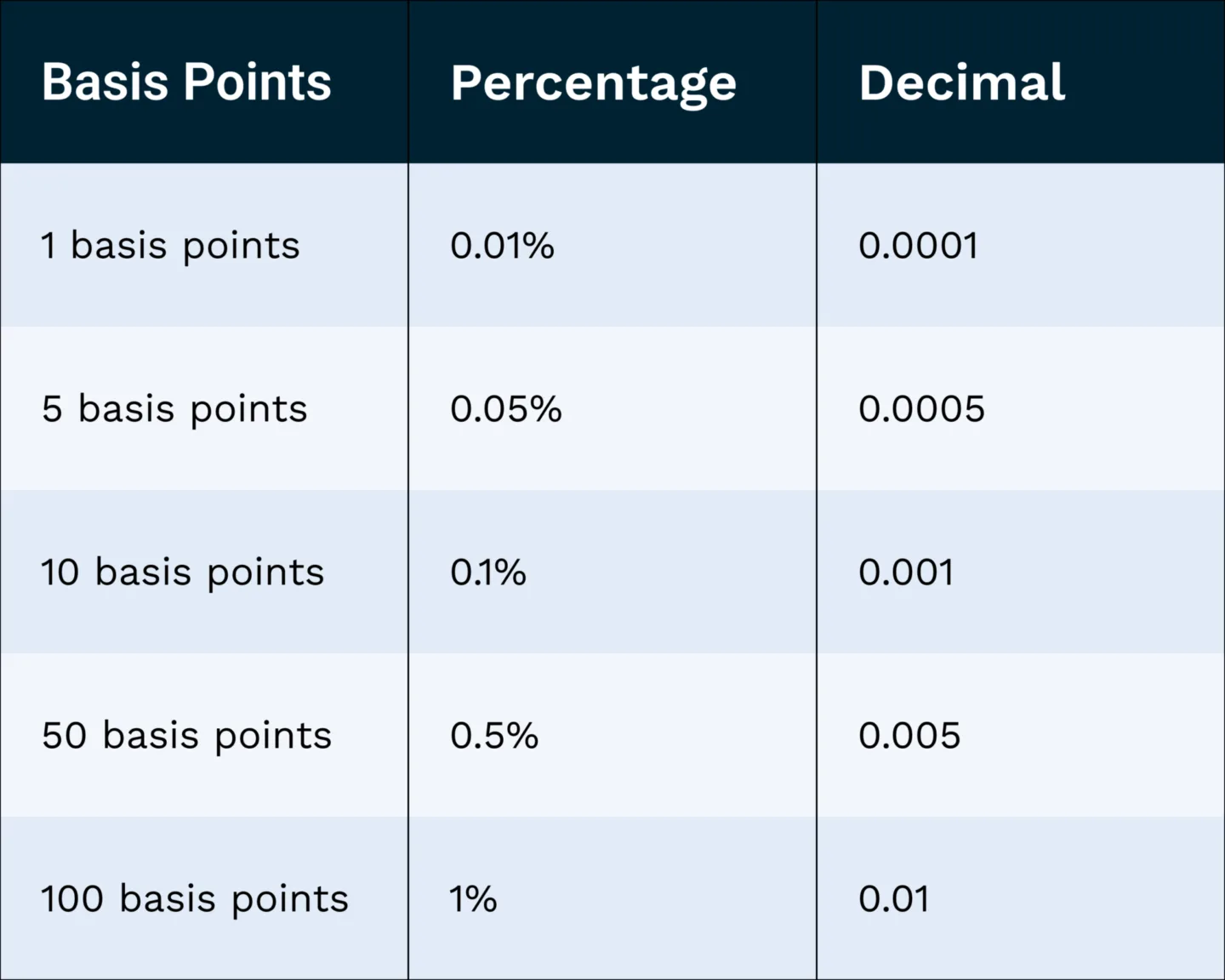

A basis point is a unit of measurement, specifically 1/100 of one percent. This means that 1 basis point is 0.0001 of a total. 100 basis points equals 0.0001 x 100, or 0.01, otherwise known as 1%. Accordingly, 50 basis points = 0.005, or 0.5%.

How do basis points work?

Basis points are most often used in instances where tiny percentages define fees, charges, and rates. They may apply to a range of financial instruments, including corporate and treasury bonds, credit and interest rate derivatives, debt and equity securities, and credit card processing fees.

Here are some common uses of basis points in analyzing financial transactions:

Calculating value as interest rates change

As interest rates change, basis points can be used to track an asset’s change in total value. A single basis point change in an interest rate can have a significant impact on the value of investments, so it’s important for analysts to use this tiny percentage when calculating these changes.

Comparing fees of different funds

Financial instruments like mutual funds and exchange-traded funds each have their own fees that contribute to the total cost of owning a share of the fund. As such, basis points can be applied to calculate what percentage of the total cost an investor will be paying in fees for each fund. This allows an apples-to-apples comparison of costs among disparate funds.

Processing credit card fees

For calculating credit card processing fees, basis points are particularly important in an interchange plus pricing model. In this pricing model, the payment processor separates the various processing costs for transparency and to ensure each transaction qualifies for the lowest possible rate (a practice called interchange optimization).

In this context, credit card basis points refer to a payment processor’s markup on each transaction. Other pricing models are fixed rate, which sets the fees as a fixed percentage, or tiered pricing, which assigns rates for fees based on tiered categories for payments.

Basis points vs. percentages

Basis points are expressed as whole numbers, such as 1 bp, 5 bps, or 10 bps. But, these numbers correspond both to a percentage and a decimal. Either can be used to calculate basis points.

What if you wanted to know how many basis points is 1 percent, for example? Converting basis points to percentages simply requires dividing the points by 100. To convert a percentage into basis points, do the opposite: multiply by 100. Alternatively, you can use an online basis point calculator or a handy chart like the one below.

How to calculate basis points

Calculating basis points is very straightforward. Since 1 basis point can be expressed as 0.0001, calculating 1 basis point requires multiplying a total by this figure.

For example, 1 bp of a $100 transaction will require the following calculation:

- $100 x 0.0001 = $0.01, or 1 cent

Applying 50 bps to the same total will look like this:

- $100 x 0.005 = $0.50, or 50 cents

What are the benefits of basis points?

Basis points make it easy to calculate the cost of transacting in a certain way or owning a particular financial product. This calculation allows consumers to know what they’re paying for and compare a range of financial products.

The common language basis points provide help professionals discuss fees, charges, and changes in value, including when comparing relative to absolute interest rates.

If an interest rate rises from 5% to 6%, an absolute calculation method will identify a 1% increase. Using a relative calculation method, you might say the interest rate has increased by 20% (because 1% is 20% of the original 5% rate). Using basis points prevents confusion about which method you are using. It’s a given that basis points align with the absolute method of calculation. In this example, you would say the rate has gone up by 100 basis points, which equals 1%.

What are basis points in credit card processing?

Credit card transaction fees are usually calculated via credit card basis points, especially in the interchange plus pricing model. This model involves breaking transactions down by authorization fee, transaction fee, assessment fee, and interchange fees. Merchants and consumers can use this information to figure out the most cost-effective way of facilitating transactions.

Payment processors that support interchange optimization allow merchants to tweak the conditions of each transaction to lower their interchange rates—which comprise the largest portion of the processing fees. This involves sending additional data with every transaction to qualify for lower rates.

Basis points are the reference point for discussions around reducing interchange fees. Merchants who want to cut down on their interchange fees will look at basis points reduction as a way to assess the savings they’re achieving.

Basis points in action

Now that we’ve explained basis points and the role they play in credit card processing, you can feel more confident in your understanding of how processing fees work.

Armed with this knowledge and the right payment processing software, you can automate payments, speed up cash flow, and boost revenue by accepting more digital payments.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.