How a Leading Cybersecurity Enterprise Eliminated 50+ Hours of Manual Labor per Month While Tripling Revenues

- 7 min read

Learn how a leading cybersecurity enterprise transformed their manual invoicing processes to re-allocate 50 hours per month to high-impact work using Versapay's accounts receivable automation software.

—

For privacy and security reasons, we are unable to share the name of the company featured, however, the story and accompanying statistics and testimonials are factual.

From non-scalable processes to cash flow machine

Company snapshot:

- ERP: NetSuite

- Industry: Cybersecurity

- Invoices per Month: 3,000

A leading computer and network security solution provider in the United States delivers the technology, services, and research organizations require to securely grow their business. They help security teams reduce vulnerabilities, monitor for malicious behavior, investigate and shut down attacks, and automate routine tasks.

In this case study, we’ll explore how this company transformed their highly manual invoicing processes to re-allocate 50 hours per month to high-impact work, and breakdown the steps they took to automate their accounting operations, drive an influx of digital payments, and triple company revenues without adding additional headcount.

Endless manual work preventing sustainable growth and cash flow

Before Implementing Versapay:

- $100,000: The minimum value collectors focused on due to resource constraints

- 3%: Percentage of invoices paid by credit card

- 50+: Hours per month spent manually preparing invoices and collecting payment

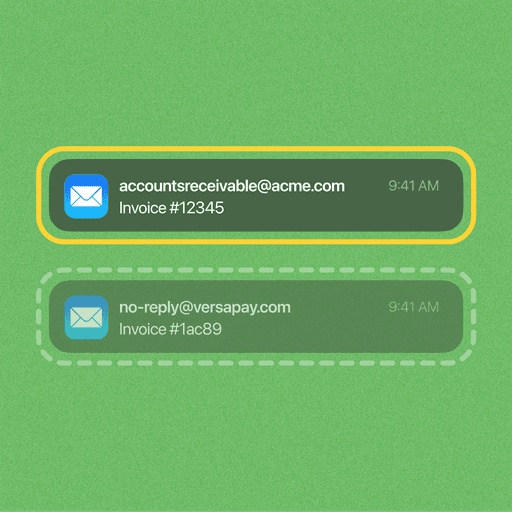

In 2018, this company was looking to increase the volume of credit card transactions they received on a monthly basis as a faster means of collecting payment on invoices. With card transactions accounting for just 3% of all their payments, it was imperative they partner with a robust solution capable of not only accepting digital payments but also automating the tedious and manual processes associated with sending and receiving invoices.

At the time, this company’s manual invoicing processes were inefficient and unsustainable. The procedures required considerable time and effort, and the accounts receivable professionals they’d hired to perform strategic, impactful work, were instead tasked with manually transferring data between systems, reconciling payment information, and preparing and mailing physical invoices.

With nearly 3,000 invoices being sent on a monthly basis, along with daily dunning notices—not to mention the reports they ran manually that became outdated as soon as payment was made—this company found themselves compensating by focusing their collection efforts solely on invoices in excess of $100,000.

Due to their exceptionally time-consuming processes, they spend upwards of 50 hours per month manually preparing invoices and collecting payment. Just think, that’s more than an entire work week of someone's time. Because of these constraints, anything less than six figure balances was considered marginally important, meaning often, significant sums of money were never accounted for.

Beyond recognizing the need to automate and improve accounts receivable productivity to drive cash flow, this company felt that in continuing to communicate with customers and collect sensitive card information over the phone, they were doing their customers a disservice—especially given they’d built a reputation on promoting and maintaining the highest standards of security.

Cash flow was compromised, processes were manual and unrewarding, and major improvements to efficiency were needed. The decision to dramatically change their approach and transform the accounts receivable department was an easy one.

Empowered workers lead the transformation of accounts receivable processes

After Implementing Versapay:

- 99%: Percentage of customers using the new payment portal

- 3x: Increase in revenue since implementing Versapay's AR solution

- 50+: Hours per month saved manually preparing invoices and collecting payment

This company knew that to truly address and resolve the underlying causes of their problems, they needed a solution that would improve back-office efficiencies while simultaneously benefiting their customers. As a company, they were growing fast while their accounting processes lagged. Customer loyalty and cash flow were on the line, and with Versapay’s support, their goals were finally in reach.

Here’s how this leading cybersecurity firm leveraged Versapay’s accounts receivable automation software to eliminate manual tasks and streamline their processes:

1. Viewing the status of invoices in real-time using a self-serve online portal

The accounting team lacked visibility into whether an invoice was received—let alone opened. Their customers also lacked visibility into what they owed, and if they possessed outstanding credits, deductions, or other charges. This was grounds for a complete transformation. To successfully drive credit card payments and eliminate the need for paper-based invoicing processes, they needed to re-think how they were delivering invoices.

"Having customers be able to login and view and pay their own invoices, and us having visibility into the status of an invoice and knowing whether a customer has even opened it—that alone was worth the cost of Versapay." Head of Enterprise Automation

With their newfound ability to generate an invoice from a sales order and send and display it directly within Versapay’s accounts receivable automation platform, this company was able to onboard 99% of their customers to the online payment portal. This effectively allowed them to transition to more data-driven processes and provide their customers with self-service tools to better manage their accounts.

Now, beyond having heightened visibility into what they owe, their customers can connect their bank accounts, define payment plans and cadences, and make payments as soon as their invoices are posted.

"Our customers are completely independent! They're logging into Versapay, adding their credit cards and payment details, and making payments themselves." Manager, Credit and Collections

2. Increasing revenue and AR productivity without increasing headcount

Since implementing Versapay, this company’s overall revenues have tripled. During this period of rapid growth, they significantly increased the volume of invoices sent, and the quantity of payments received. However, in that time, the total number of collectors and accounts receivable specialists they employed remained the same.

This was important, as this company’s accounting department had dealt with higher-than-expected turnover rates, given that prior to using Versapay, manual, yet important, processes led to tedious and unrewarding work. Advancement opportunities rarely presented themselves for AR employees, as the need for filling process-heavy roles was too much of a priority for the business. In shifting their approach and automating the manual tasks that weren’t as fulfilling, they were able to simultaneously enhance efficiencies and free up their employees to focus on tasks of higher value.

"Prior to Versapay, we were constantly having to hire more people to help with processing orders. Now, we are scaling up with the number of invoices and the number of payments we're accepting, but we've not had to hire anyone." Head of Enterprise Automation

Company growth can often outpace the capacity of an accounts receivable department. This typically leads to invoicing and collection problems that can compromise the cash flow needed to fund continued expansion. In leveraging Versapay, and automating the majority of collections tasks, this company was able to maintain existing headcount while increasing AR productivity.

"If you asked me to project a year from now how many more people we'd need to assist with sending invoices, I'd tell you zero. And that's because we've been able to automate our processes." Head of Enterprise Automation

3. Embracing automation to reduce manual labor and better allocate resources

Since Implementing Versapay:

- 0: Number of new AR employees hired to effectively manage growth

- 0: Number of support desk inquiries related to invoicing

One of the biggest challenges this cybersecurity firm faced was improving their processes for sending invoices and payment reminders. Prior to implementing Versapay, their accounts receivable specialist would manually send upwards of 100 custom emails daily—including dunning notices, invoices, renewal notifications, and more. This process was unsustainable and a key deterrent to ensuring all customers were followed up with in a timely manner.

Through automation, this problem has been eliminated. Now, every invoice they send gets the same level of attention and collections effort. Using the comprehensive tagging system available in Versapay, this company can better segment their customers and focus their efforts on the most at-risk accounts. And, in one click, all invoices—newly generated or outstanding—and notifications, can be sent to customers, based on whichever parameters are set.

"Do not take Versapay away from me." Accounts Receivable Specialist

The effects of this company’s manual processes were felt throughout the entire organization—especially by employees operating the support desk. They were on the receiving end of invoicing and accounts receivable-related questions and spent an unnecessary amount of time either sifting through and passing along emails to the AR department or answering questions they’d not been trained to. However, since embracing AR automation, the number of invoice-related inquiries support receives has dropped to zero.

"Versapay has become part of our everyday life." Head of Enterprise Automation

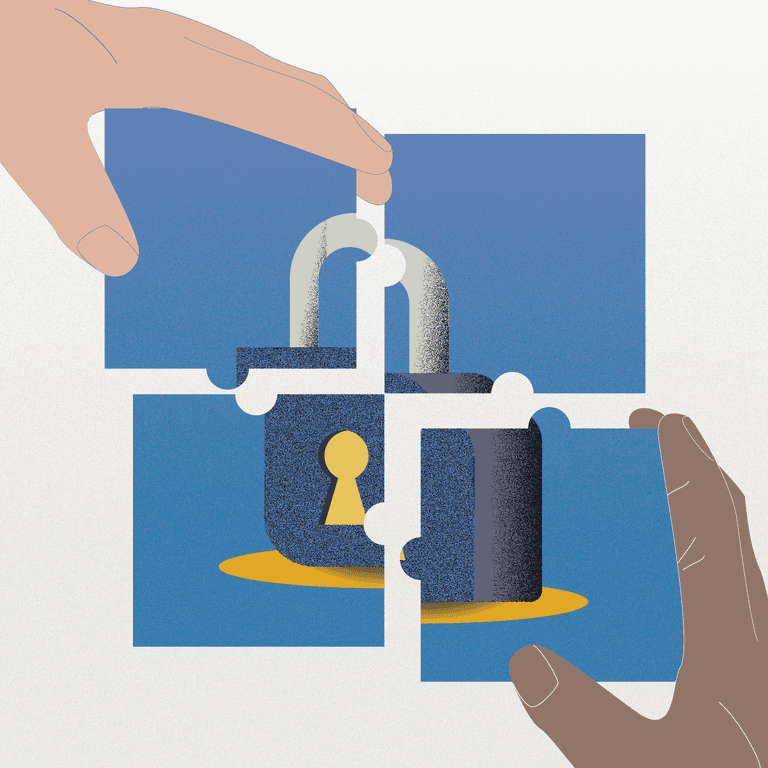

4. Reducing risk and guaranteeing a more secure payment experience

In collecting credit card information over the phone, this company took on a substantial amount of risk. In order to reduce PCI DSS—Payment Card Industry Data Security Standard—scope, they needed to physically destroy the information after it was appropriately inputted into their accounting systems.

By automating their payment processes and empowering their customers to pay online using a secure portal, this company tokenized card information, guaranteeing a more secure payment experience. Now, all payments, no matter how they are captured, are tokenized and securely stored, limiting this company’s teams’ interactions with sensitive payment data.

"We no longer have to answer the phone, manually collect and input credit card information into our ERP, and then destroy the information on the back-end to remain PCI compliant." Manager, Credit and Collections

Make accounts receivable scale with company growth

This leading computer and network security solution provider used to struggle with highly manual invoicing processes that cost their AR team countless hours per month—not to mention the hundreds of thousands of dollars left on the table due to a lack of collections resources. By ditching paper-based invoicing and manual collections, this company grew while scaling accounts receivable processes.

In leveraging Versapay’s accounts receivable automation and collaboration platform, they eliminated all their previously manual AR processes, onboarded 99% of their customers to a self-service online payment portal, freed up their employees to focus on tasks of higher value, and provided their customers a more secure payment experience.

Learn more about Versapay’s accounts receivable automation platform, and how you can increase AR productivity and accelerate cash flow as your business grows, here.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.