Online Payment Portals: Strategies for Winning Your Customers Over

- 19 min read

Customer payment portals give customers a self-service option for making payments online. Paired with AR automation, they can help eliminate tedious manual workflows for your team.

But, that's only the case if customers are actively using the platform. In this blog, you'll learn tips for getting customers to use—and—love your online payment portal.

Accounts receivable (AR) teams looking to become more efficient are setting up customer payment portals. These centralized, cloud-based systems let your customers access invoices, check account status, and pay when, where, and how they prefer.

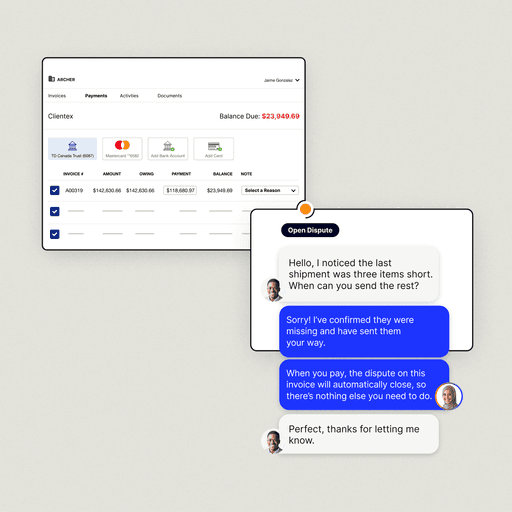

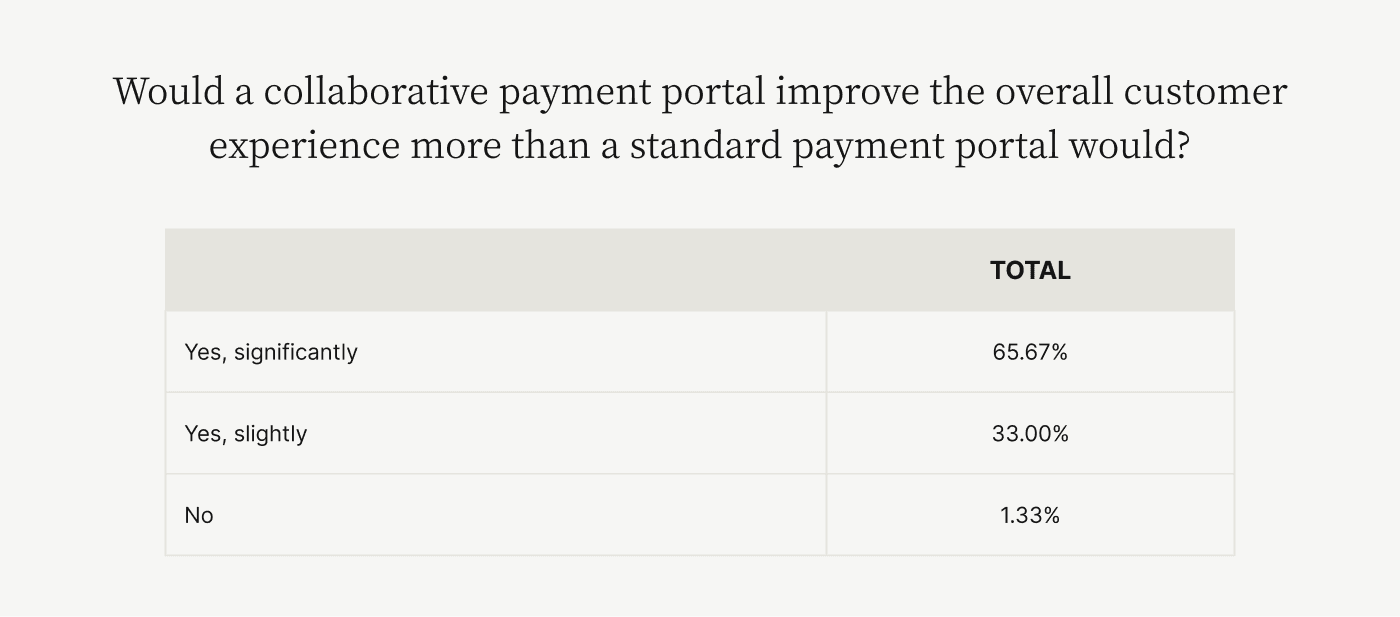

Standard payment portals offer basic payment functionality but are missing an important feature that more advanced systems have—a layer of two-way communication and collaboration that allows your customers and your AR team to leave questions and comments directly on invoices.

Research from Wakefield shows that collaborative payment portals make a big difference.

In fact, nearly all CFOs (98%) surveyed agree that accounts receivable payment portals are more useful when they provide a way for their AR teams to collaborate with customers and make relevant information—like invoices, supporting documentation, conversation threads, payments, and dispute logs—readily available.

Read on to learn more about the benefits of customer payment portals and how to ensure the highest adoption rate possible among your customers.

Jump to a section of interest:

What is a customer payment portal?

A customer payment portal—or an accounts receivable payment portal—is a centralized system shared by your accounts receivable team and your customers’ accounts payable teams. Each customer has their own secure account, where authorized users can:

Receive electronic invoices

Make digital payments by eCheck, credit card, virtual card, digital wallet, etc.

Access relevant supporting documentation like sales orders

Ask questions about invoices, balances due, discount terms, and other aspects of their account

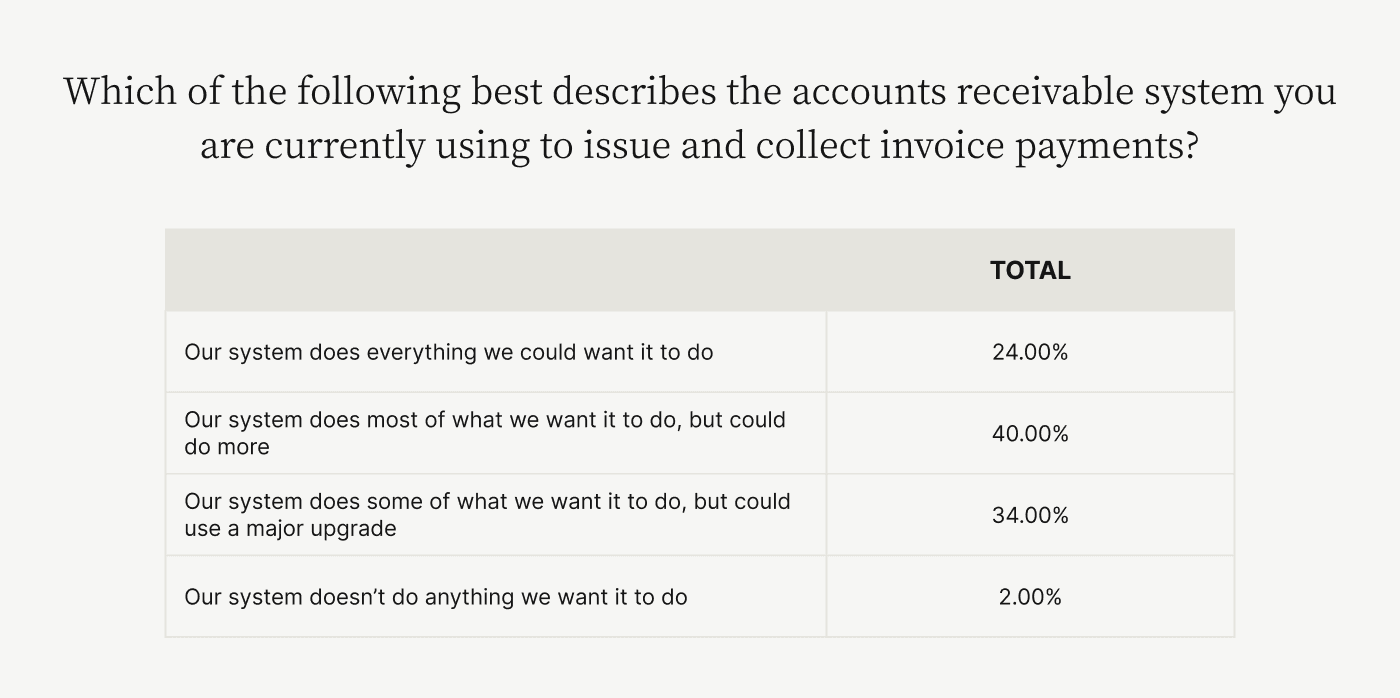

In the Wakefield study, a resounding 76% of CFOs say their current accounts receivable payment portals aren’t living up to expectations, with more than a third (34%) expressing a desire for a major upgrade to something that enables receivables and payables teams to work together to accelerate payments and resolve disputes faster.

The reason? Mid- to upper-midsized businesses without collaborative payment portals must manually resolve nearly $3.7 million worth of invoices monthly, which compounds payment delays and has a negative impact on cash flow. In contrast, businesses using collaborative portals automatically resolve more invoice challenges, freeing up 44% more cash flow each month without manual intervention.

4 benefits of accounts receivable payment portals

Online payment portals provide numerous benefits to sellers and buyers. For sellers, a customer payment portal delivers greater accounts receivable efficiency, speedier payments, and healthier collections and cash flow. Buyers appreciate the convenience of having account documentation at their fingertips and the ability to make payments in one place.

Here are four primary benefits:

Greater accounts receivable efficiency

Happier customers

Speedier payments

Automated cash and account reconciliation

1. Greater accounts receivable efficiency

With an accounts receivable payment portal, your collections team can eliminate the hassles of dealing with paper invoices and paper checks. Using a platform that includes collaboration functionalities, you can streamline collections further by eliminating the traditional back-and-forth over email and phone when questions and disputes arise.

Only 14% of CFOs currently using collaborative accounts receivable payment portals experience daily challenges arising with invoices that their current payment processing system can’t resolve, compared to 25% using standard payment portals. This frees up skilled AR teams to focus on higher-value, strategic work instead of manual tasks.

2. Happier customers

With a self-service payment portal, buyers can pay their invoices using their preferred payment methods easily and securely. They can also stay on top of their outstanding invoices with real-time updates and reminders. With 85% of B2B buyers valuing the purchasing experience as much as the products and services they buy, a superb payment experience can lead to higher customer lifetime value for sellers.

3. Speedier payments

Traditional billing and payment processes are slow and inefficient, resulting in high days sales outstanding (DSO). Customer payment portals speed up collection times because buyers can’t misplace invoices and can settle accounts via credit card or ACH payment with just a click. Plus, tools that enable short payments and make it easy to address inquiries and disputes accelerate payments even more.

4. Automated cash and account reconciliation

Because buyers select the invoices they want to pay, payments made through customer payment portals are automatically applied to their respective invoices. This saves time for your accounts receivable team by eliminating lots of unwanted detective work and manual matching and reconciliation.

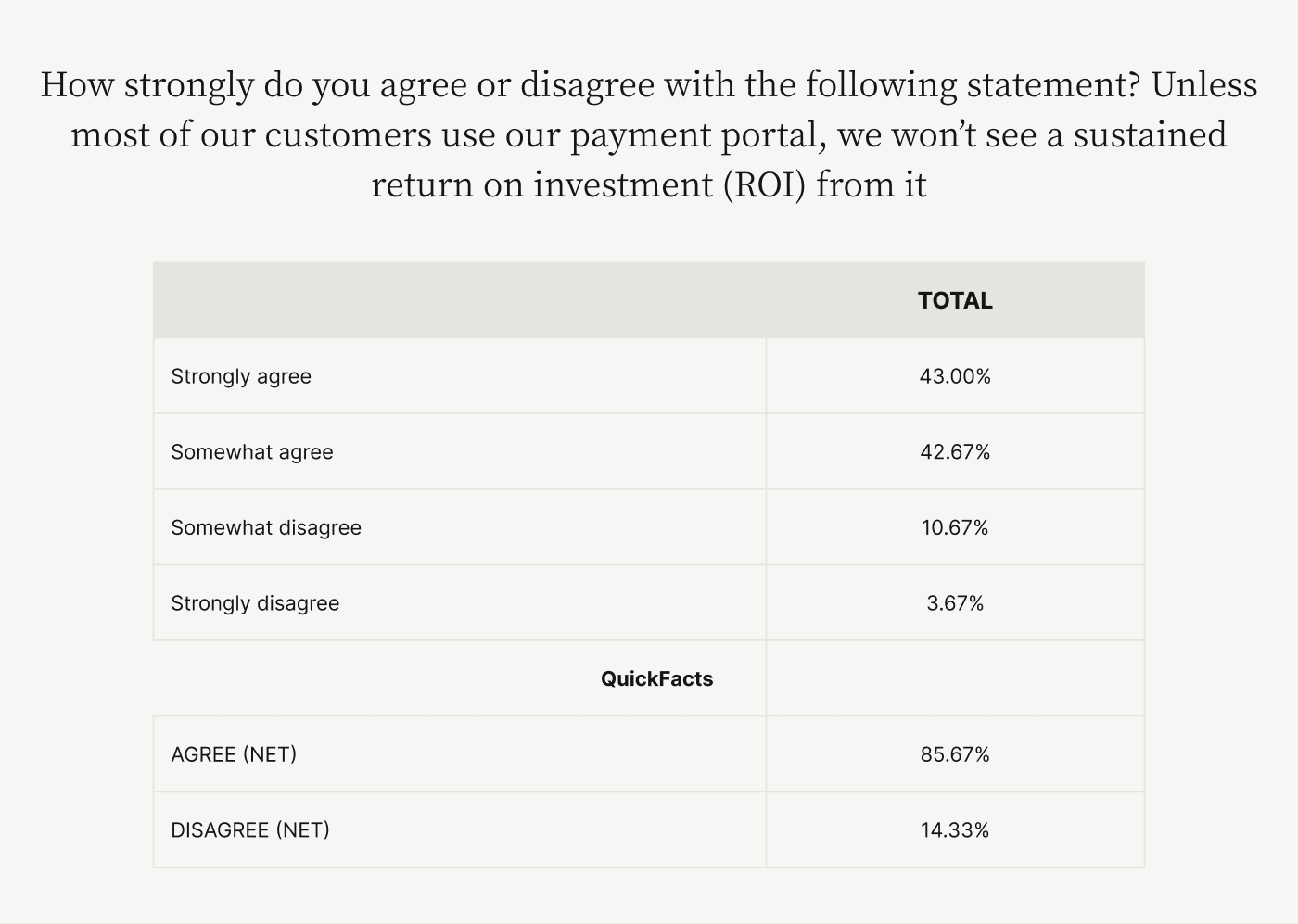

The importance of customer payment portal adoption

While the benefits of customer payment portals make them a must-have for modern accounts receivable teams, they only accrue if your customers use your payment portal. Eighty-six percent of CFOs agree that customer adoption is the most critical variable for seeing sustained ROI from payment portals.

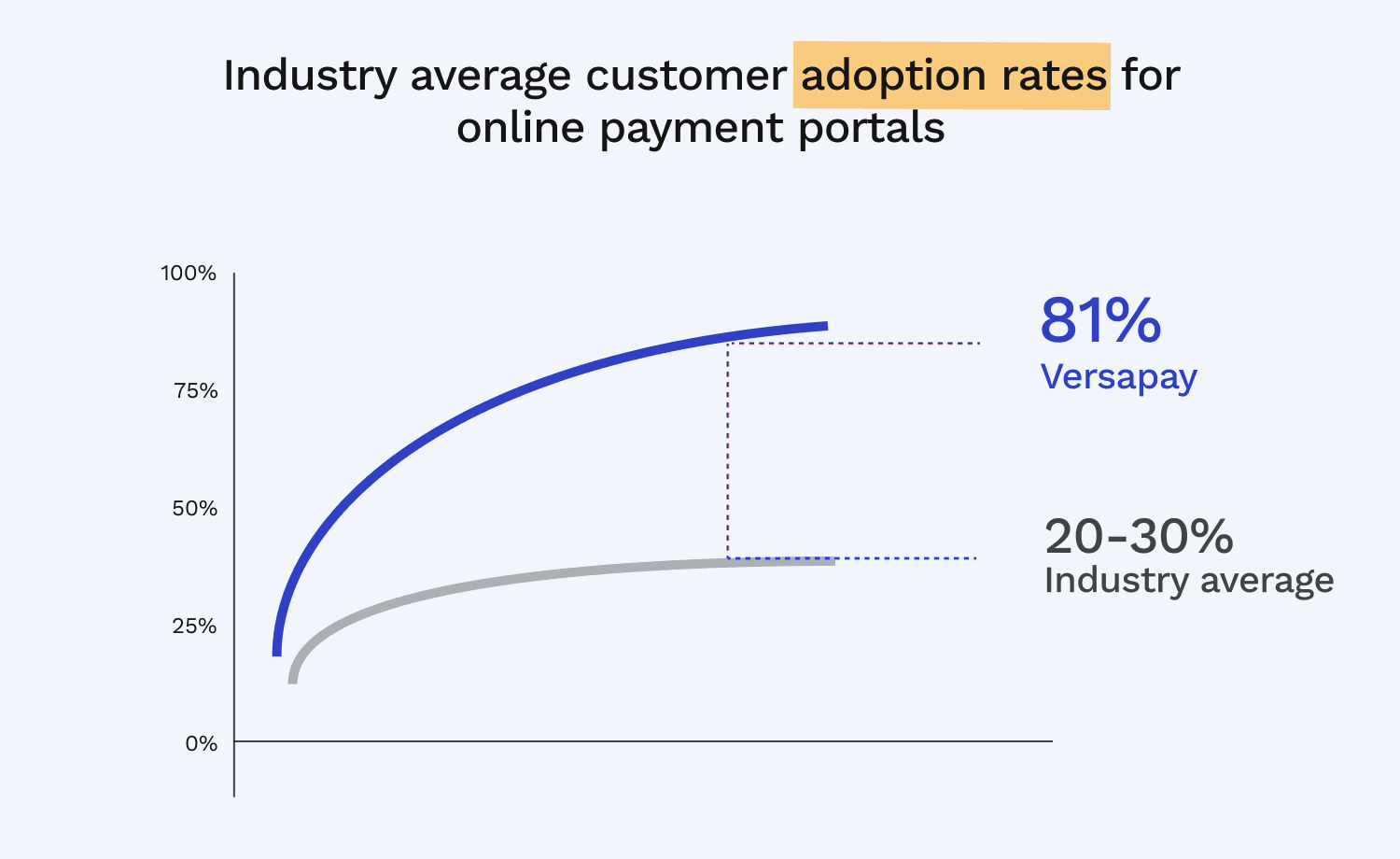

Unfortunately, current payment portal adoption rates leave a lot to be desired. The industry average is only between 20% and 30%. Versapay’s collaborative payment portal, however, boasts the highest customer adoption rate in the marketplace at 81%, far above the industry average.

To gauge the success of your online payment portal, you’ll want to track customer adoption rates to identify areas for improvement and ensure your customers are getting the most value from your platform.

Here are three key metrics to focus on:

Platform adoption rate

Payment adoption rate

Net promoter score (NPS)

1. Platform adoption rate

Platform adoption rate measures the percentage of customers who are actively using your payment portal, whether it's to pay invoices, view account information, or communicate with your team. To calculate this metric, divide the number of customers using your platform by your total number of customers.

2. Payment adoption rate

While platform adoption rate gives you a general idea of how many customers are using your payment portal, the payment adoption rate metric specifically measures the percentage of customers who are using it to actually make payments. To calculate payment adoption rate, divide the number of customers paying through your portal by your total number of customers.

If you notice that your payment adoption rate is lower than your platform adoption rate, it may indicate some customers are using your portal for informational purposes but still prefer to pay through other channels. In this case, you may need to educate customers about the benefits of paying through your customer payment portal.

3. Net promoter score (NPS)

NPS is a widely used metric that measures customer loyalty and satisfaction. It's based on a single question: "On a scale of 0 to 10, how likely are you to recommend our payment portal to a friend or colleague?"

Customers who give a score of 9 or 10 are considered "promoters," while those who give a score of 0 to 6 are considered "detractors." Customers who give a score of 7 or 8 are considered "passives."

To calculate your NPS, subtract the percentage of detractors from the percentage of promoters. For example, if 60% of your customers are promoters, 20% are passives, and 20% are detractors, your NPS would be 40 (60% - 20%).

A high NPS suggests that your customers are satisfied with your payment portal. A low NPS may indicate a need to improve the user experience, address customer concerns, or enhance the features and functionality of your platform.

How to choose a payment portal your customers will love

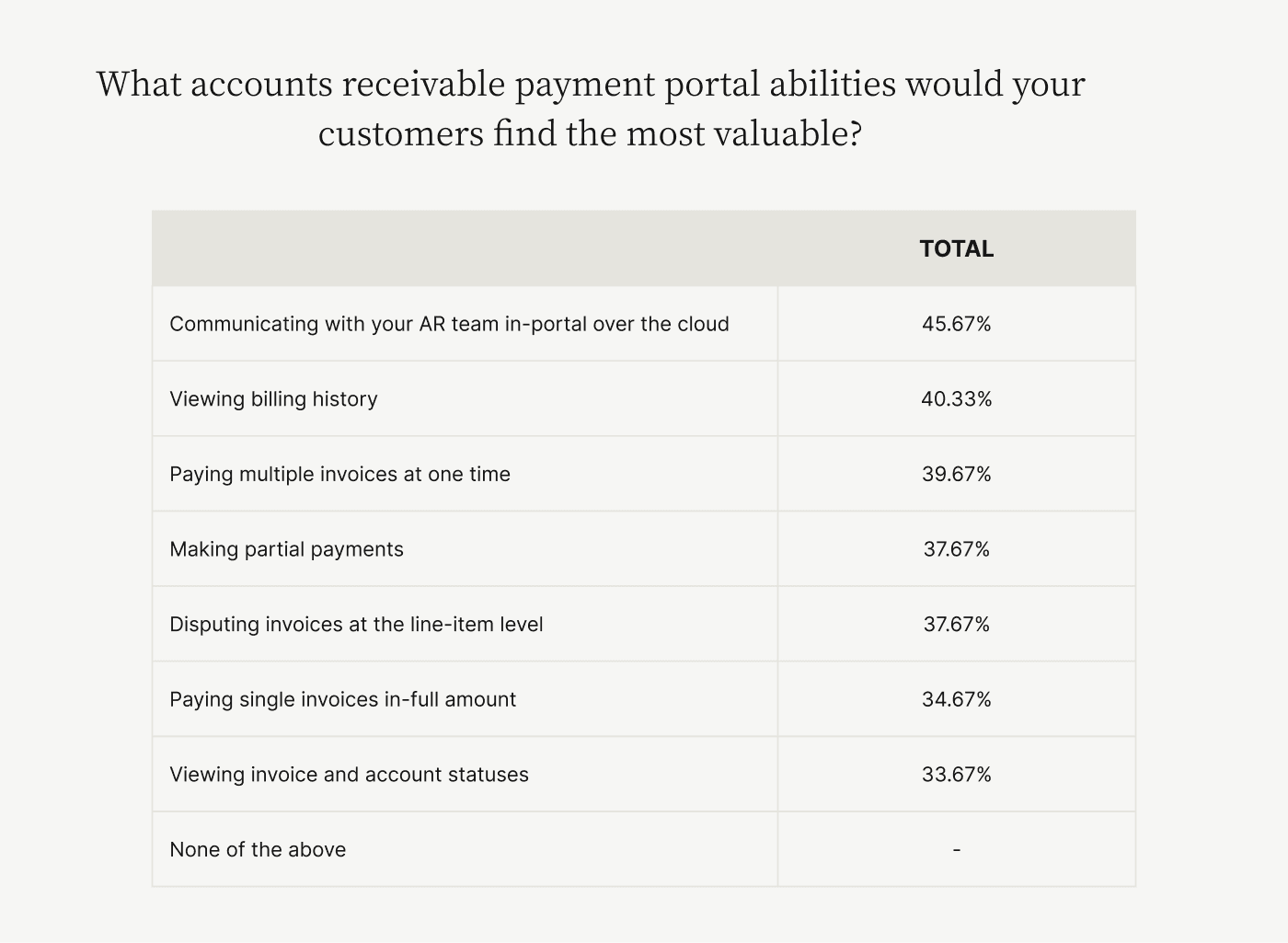

The first thing you can do to boost payment portal adoption rates is choose a customer payment portal with the features your customers want.

When asked what payment portal abilities their customers would find most valuable, all CFOs in the Wakefield study cited at least one of the features in the graphic below, such as the ability to ask billing-related questions, manage account information, and access associated documentation—all capabilities of collaborative payment portals. Only about one-third of CFOs said customers are likely to value the basic functionality (viewing invoices and account status) of standard portals.

Keep in mind that your internal accounts receivable team members will want features in a customer payment portal that make their lives easier, too. With greater efficiency in mind, look for a payment portal that offers the following features and functionality:

1. Seamless Integration

A payment portal that integrates with your existing enterprise resource planning (ERP) system allows for smooth data flow without the need for manual data entry.

2. Customizable workflows

Look for a solution that accommodates your unique requirements for getting approvals, sending notifications and alerts, and creating custom fields.

3. Robust security

Security is essential when dealing with financial transactions. Ensure that the payment portal you select employs industry-standard security measures, such as encryption, multi-factor authentication, and regular security audits.

4. Scalability and adaptability

As your business grows, your payment portal should accommodate increasing transaction volumes, new payment methods, and additional users. Consider each vendor's roadmap and commitment to innovation to future-proof your investment.

5. Comprehensive reporting and analytics

A payment portal with built-in tools for measuring financial metrics in real time can provide valuable insights into your accounts receivable performance and overall financial health.

6. Collaborative communication tools

Effective communication between your AR team and your customers’ AP teams is crucial for resolving disputes quickly, responding to inquiries, and maintaining strong relationships. In-app messaging, comment threads, and integrated email functionality (for notifications and reminders) are features that streamline communication and transparency.

CFOs overwhelmingly say that features enabling collaboration are the most valuable in a payment portal. Nearly all CFOs (98%) agree that accounts receivable payment portals are more useful when they provide a way for their AR teams to collaborate with customers.

Customer payment portal onboarding strategies

After choosing the right platform, the second thing you can do to ensure a high payment portal adoption rate is develop a well-planned and executed onboarding strategy. By following best practices before, during, and after the launch of your portal, you can set yourself up for success:

Pre-launch best practices

1. Engage and educate your internal teams

Involve your AR staff early in the process and work with them to identify which processes and daily activities will be impacted by the implementation. Schedule comprehensive training sessions for all team members who’ll be using the new system to ensure they’re comfortable and confident with the changes.

2. Verify customer contact information

To invite your customers to start using the payment portal, you'll need accurate email addresses. Take the time to review the contact information in your records, verify its accuracy, and gather any missing details.

3. Generate customer awareness

Before launch, send an introductory email to your customers to educate them about the new, simpler way to manage invoices and payments you’re offering them. Highlight the key features of the portal, explain how it benefits them, and provide a clear timeline for the rollout.

Most businesses have email filters in place to weed out potential spam. By advising customers of the emails they’ll receive from the new system ahead of time, you can get them to whitelist the sender so they don’t miss important communications.

Launch best practices

1. Send personalized invitations

When you're ready to launch, send your customers a personalized email invitation directly from the new platform. Make sure to include your company logo, emphasize the benefits of the portal, and provide a clear call-to-action with a link to activate their account. Consider enrolling customers in phases to allow time for troubleshooting, or invite everyone at once to prevent confusion among your staff.

2. Promote the payment portal across channels

To keep awareness of your new payment portal top of mind, consider adding a link to the portal in your email signatures, mentioning it during customer service calls, and highlighting it on your website and social media profiles.

3. Leverage email notifications

Work with your accounts receivable payment portal vendor to set up a variety of email notifications, such as payment reminders, payment confirmations, and other alerts, to keep your customers informed and engaged. Make sure your internal team members are also notified about important customer actions within the portal.

4. Offer adoption incentives

Consider implementing an incentive program to encourage customers to start using the portal right away. This could include offering discounts for early adopters, waiving certain fees for payments made through the portal, or providing additional payment options like AutoPay. If you plan to introduce any penalties for non-adoption in the future, be sure to communicate this clearly and update any relevant term sheets.

Post-launch best practices

1. Re-engage hesitant customers

If some customers haven't started making payments through your portal, reach out with a targeted message emphasizing how easy it is to set up their payment information and start paying online. Highlight features like scheduled payments and the ability to pay on their preferred due dates.

2. Motivate your internal teams

Keep your internal teams motivated to promote the payment portal by setting adoption targets and rewarding top performers. Celebrate milestones and recognize individuals who go above and beyond to support the success of the portal.

Foster a partnership mindset for payment portal success

A new online payment portal can be a significant change for your organization and your customers, so it's essential to position it as a tool you'll be using together to streamline your business relationship.

A great example of this partnership approach in action comes from TireHub, a distribution logistics company that successfully implemented a new collaborative online payment portal from Versapay. By involving their sales team, TireHub was able to get customers comfortable with the portal as a joint initiative rather than a mandate.

As former CEO Peter Gibbons explains, "We presented this not as something we decided to impose on the customer, but as an initiative we were doing that we wanted to make sure customers came alongside."

The key takeaway from TireHub's experience is that success comes from inviting customers to work with you in a new way, rather than telling them they need to change. By fostering a sense of partnership and collaboration, you can create a positive experience for everyone involved and achieve the high adoption rates for your online payment portal you deserve.

To learn more about Versapay’s collaborative customer payment portal, talk with an expert today.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.