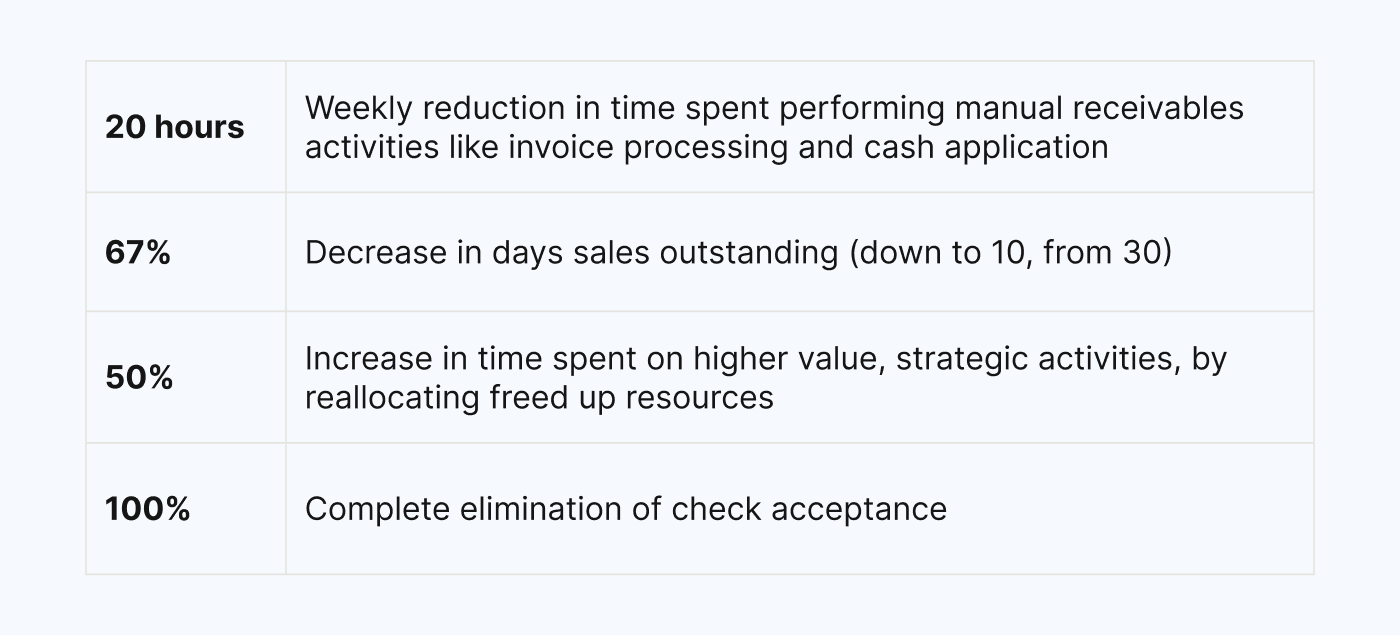

20 Hours Saved Weekly, 67% Lower DSO: How Gulf Coast Panama Jack Pulled it Off

- 7 min read

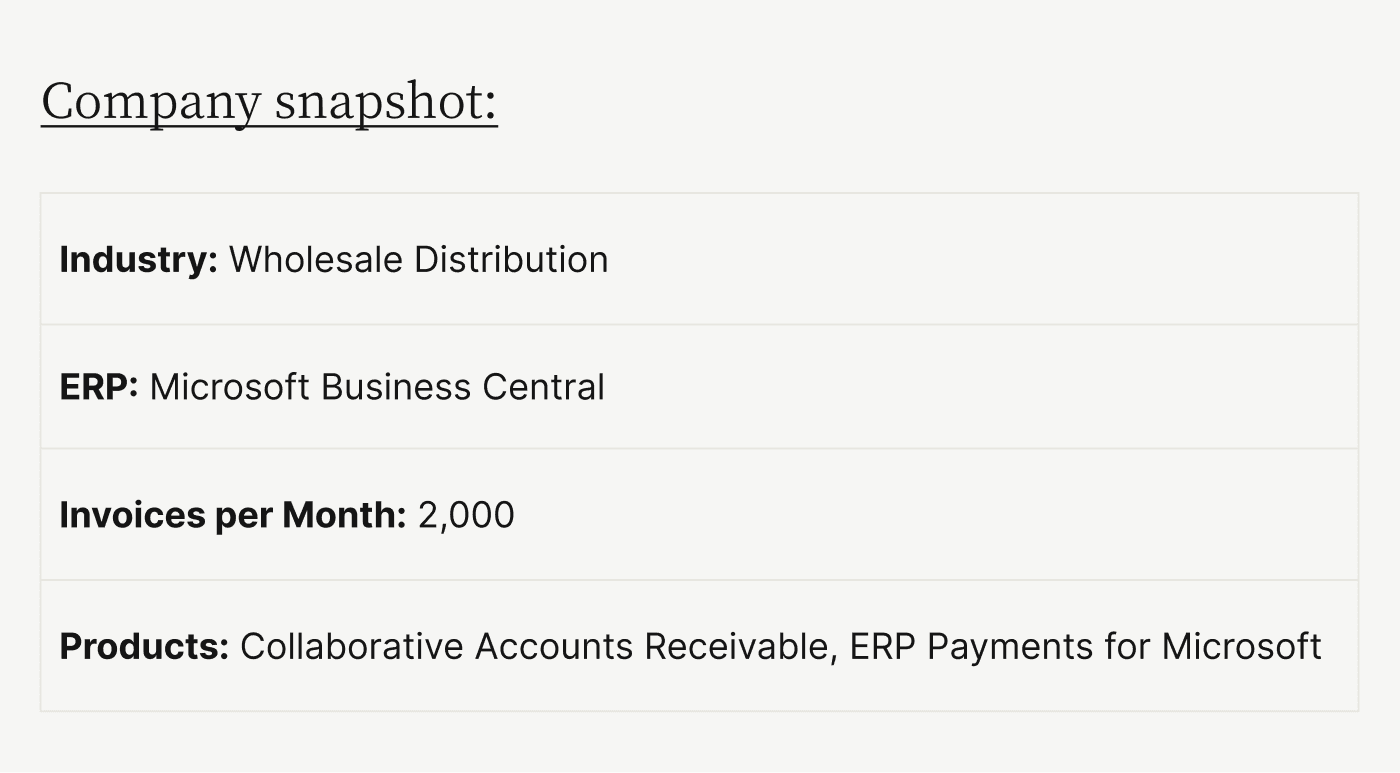

Gulf Coast Panama Jack integrated Versapay's accounts receivable automation solution with their Microsoft Business Central ERP.

Learn how this led to 20 hours saved weekly, a 67% decrease in DSO, the elimination of checks and more.

—

The challenge

Shirley Grimes, Accounts Receivable Supervisor at Gulf Coast Panama Jack (GCPJ), knew the company needed to digitize to better serve its customers. She was bogged down and held back by manual processes. Cash flow was slow, and inefficiencies led to significant time spent chasing and processing payments, preparing invoices and managing disputes, and poor customer experiences.

Shirley had four major objectives to drive efficiencies and modernize:

To generate and send invoices more quickly

To ensure payments are automatically processed and posted to her ERP

To make collecting payments easier and more convenient

To work with a dedicated partner, long-term

The integration with Microsoft Business Central works seamlessly and is very easy to use. Any changes are immediately updated on Versapay’s side, making our job significantly easier. We love the convenience of the integration.

The solution

Shirley evaluated five accounts receivable automation vendors and deeply examined three: Quadient AR by YayPay, HighRadius, and Versapay. Versapay’s breadth of functionality—from electronic invoicing to automated payment processing and cash application—stood out, but it was our commitment to customer service that sealed the deal.

Getting up and running with Versapay was seamless. The implementation process went incredibly smooth and knowing we had a dedicated person at Versapay to support us through it was huge. The Versapay team is phenomenal. They are a true example of what customer service looks like.

Knowing she could connect with someone real, and not rely on an automated ticketing system for support, was important to Shirley. Fast response times, thorough and consistent communication, and a dedicated point of contact put Versapay into a league of its own.

The results

While Versapay’s initial—and ultimately ongoing—support, assistance, and advice largely contributed to Shirley’s decision, the ability to accept online payments with ease didn’t hurt either!

While not originally on Shirley’s radar, Versapay’s PayNow click-to-pay invoicing solution made collecting payments a breeze, and helped drive early adoption—especially amongst her group of customers who were inherently laggards. Our native integration with Microsoft Business Central allows Shirley to automatically generate and deliver electronic invoices with instant payment links. This means:

Payment is simpler, and invoicing is always on brand

Customers can pay one or multiple invoices online, using credit cards or ACH

GCPJ can issue early pay incentives, accelerating payment

Payment reminders and notifications now drive action and boost CX

Online payments are automatically applied, removing the need for manual cash application

GCPJ’s days sales outstanding has plummeted, from 30 to 10 days

Shirley no longer accepts check payments

Customers want digital experiences, convenience, and fast processes. With Versapay, we are better able to meet our customers’ needs. For example, our reps turn in Proof of Deliveries in the field, and our customers get those proofs digitally and instantly.

Since debuting Versapay to her customers, Shirley has been a tour de force. Within the first month, 35% of Gulf Coast Panama Jack’s customer base was making payments through Versapay, and currently, 70% of their eligible customers are. Those who aren’t yet, are still receiving digital invoices.

And in digitizing her receivables processes, Shirley’s resourcing and labor pains have nearly evaporated. She saves 20 hours weekly, no longer performing manual receivables activities like invoice processing and cash application. Those extra time savings are put to good use, too, as Shirley is now prioritizing higher value, more strategic initiatives.

We appreciate Versapay making our lives easier, and for bringing our business to the 21st century.

About Gulf Coast Panama Jack

Gulf Coast Panama Jack, based in Panama City Beach Florida, is the official wholesale distributor of Panama Jack products from Louisiana through Mississippi, Alabama and Florida to the Everglades.

About Versapay

For growing businesses that need to accomplish more with less, Versapay’s Accounts Receivable Efficiency Suite simplifies the invoice-to-cash process by automating invoicing, facilitating B2B payments, and streamlining cash application with AI.

Owned by Great Hill Partners, Versapay’s employee base spans the U.S. and Canada with offices in Atlanta and Miami. With 10,000 customers and 5M+ companies transacting, Versapay facilitates 110M+ transactions and $170B+ in payments volume annually.