The Impact Automating Cash Application has on AR Management and Working Capital

In collaboration with Versapay, The Hackett Group explores how the cash application process fits within the broader order-to-cash infrastructure.

The Impact Automating Cash Application has on AR Management and Working Capital

THE HACKETT GROUP

October 26th, 2022

In collaboration with Versapay, The Hackett Group explores how the cash application process fits within the broader order-to-cash infrastructure.

In this infographic you'll:

- Discover the benefits of cash application automation

- Understand the cash application automation rate top performers are targeting

- Learn how the cash application cycle time measurement is evolving

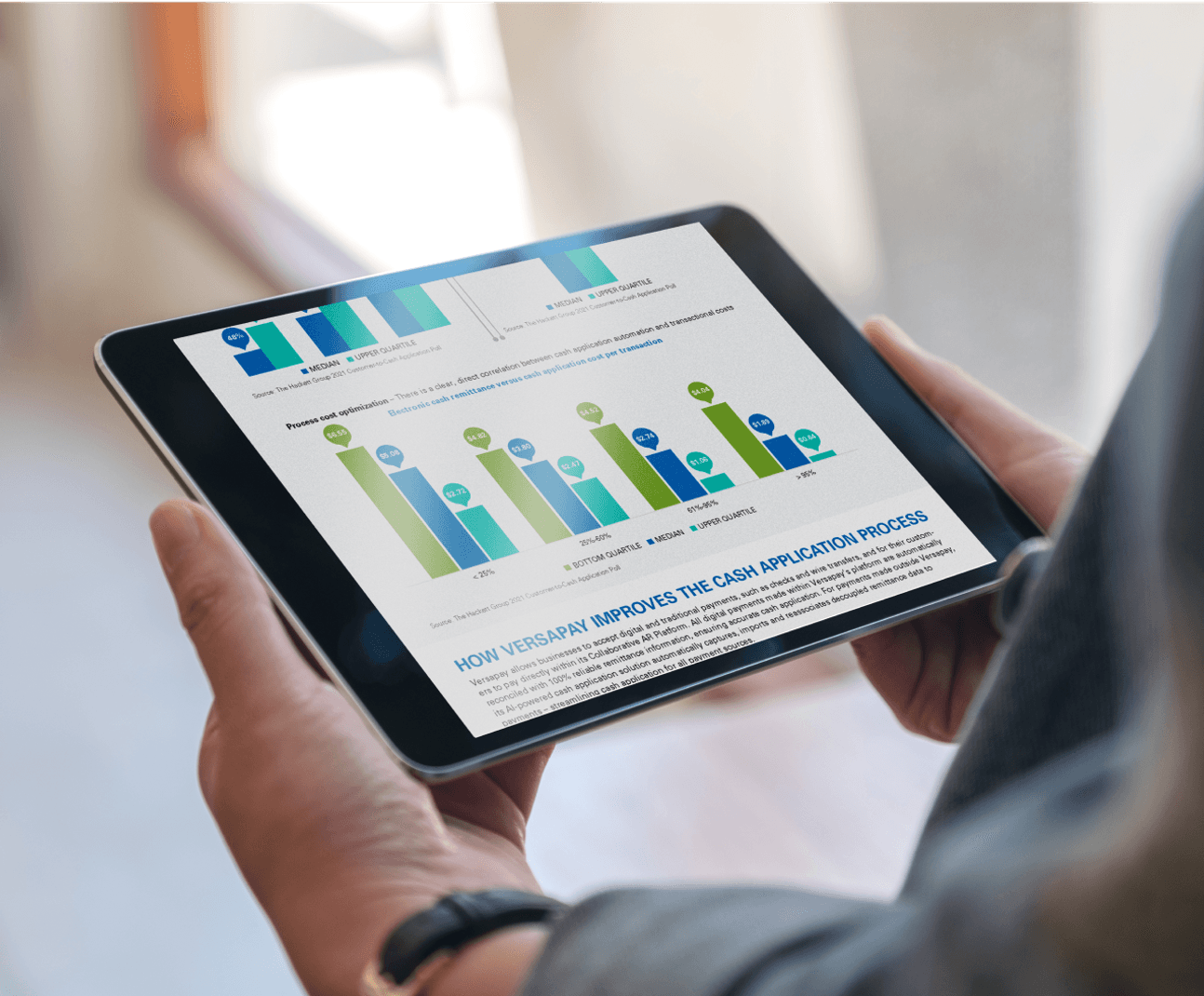

- Explore the correlation between cash application automation and transactional costs

Plus, learn how Versapay improves the cash application process by automatically reconciling all digital payments with 100% reliable remittance information.

Take a peek inside the infographic

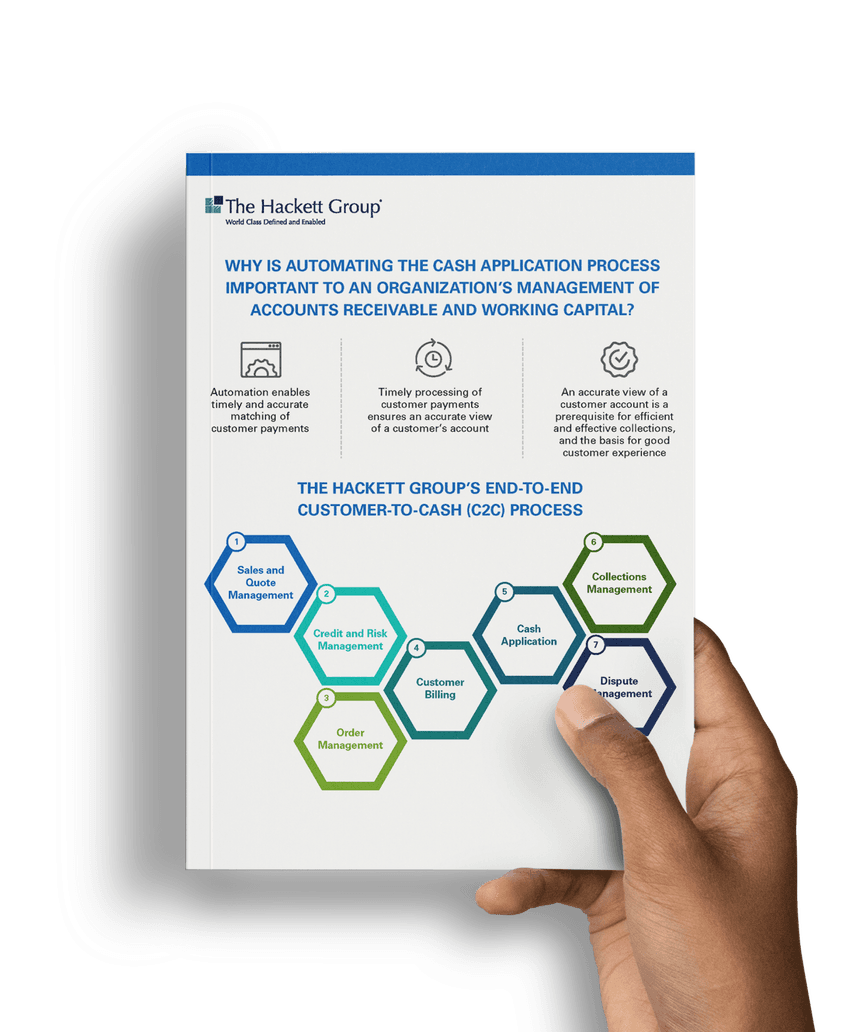

Why is automating the cash application prcess important to an organization's management of accounts receivable and working capital?

Automation enables timely and accurate matching of customer payments

Timely processing of customer payments ensures an accurate view of a customer’s account

An accurate view of a customer account is a prerequisite for efficient and effective collections, and the basis for good customer experience

The Impact Automating Cash Application has on AR Management and Working Capital is just a few clicks away!

How Versapay improves the cash application process

Versapay allows businesses to accept digital and traditional payments, such as checks and wire transfers, and for their customers to pay directly within its Collaborative AR Platform. All digital payments made within Versapay’s platform are automatically reconciled with 100% reliable remittance information, ensuring accurate cash application.

For payments made outside Versapay, its AI-powered cash application solution automatically captures, imports and reassociates decoupled remittance data to payments – streamlining cash application for all payment sources.