How Automated Cash Application Reduces Bad Debt Expenses Caused by Manual Collections

- 10 min read

The impact poor, manual cash application processes have on unpaid invoices and bad debt expense is significant.

Learn how automation plays a pivotal role in accelerating cash flow and reconciling unpaid invoices.

Every accounts receivable manager (AR) knows that poor collections processes disrupt cash flow in their company. And most AR professionals will be quick to point to manual processes and poor organization as the primary cause of inefficient collections.

Few, however, think of slow cash application as a driver of poor collections. Yet the impact poor cash application has on unpaid invoices and subsequent bad debt expenses (BDE) is significant.

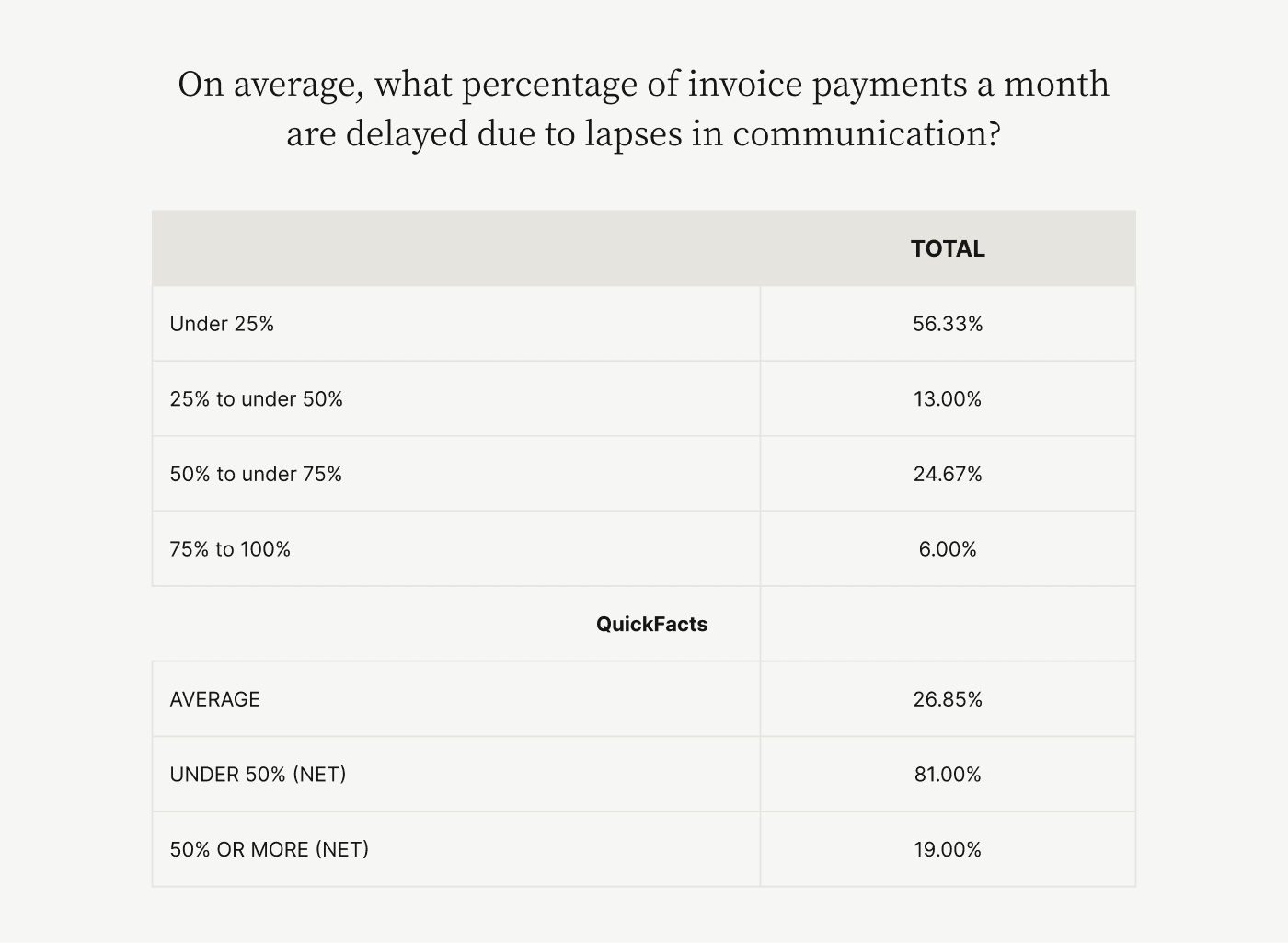

Our research shows that small to upper-midsized companies have an average of $4 million in unpaid invoices monthly, due to poor communication. A significant number of these invoices were likely paid but went unrecognized, creating needless BDE. Here's a look at how automated cash application plays a role in reducing unpaid invoices and lowering bad debt expenses.

Table of contents

How manual collections create unpaid invoices that hamper cash flow

Manual collections processes are inefficient and create unpaid invoices that your company could otherwise avoid. Here are a few reasons why manual collections give rise to such inefficiencies:

1) Manual collections cause poor communication

2) Manual collections reflects a lack of tools

3) Manual collections overburden accounts receivable

Let's dive into these in more detail.

1. Manual collections cause poor communication

Most collections teams rely on a veneer of electronification that unfortunately creates more problems than it solves. For instance, email often becomes the default communication channel, leading AR to constantly having to trawl through email chains for relevant documents.

This repeated (not to mention, inefficient) searching results in needlessly poor customer communications that delay almost a quarter of invoice payments.

Accounts receivable struggles to accurately match payments to open invoices because of these delays, resulting in cash flow disruptions. Handling complex payment scenarios, where customers either pay several invoices with a single payment or pay line items in different invoices while raising disputes with others, are impossible to handle. In such scenarios, endless communication cannot help AR mix and match payments to invoices any faster.

In short, instead of working with customers to solve payment bottlenecks, collections teams are busy performing clerical work and waiting endlessly for clarifications from customers. Poor communication of this sort creates a bad impression with customers apart from delaying cash entering your books.

2. Manual collections reflects a lack of tools

Manual processes exist due to a lack of appropriate software and this creates an additional burden on AR. Without the appropriate technologies in place, AR teams are forced to rely on outdated manual processes that soak up time and cost money in the long run. For instance, even a routine task like checking account statuses is cumbersome without the right tool.

AR has to manually scan different spreadsheets, verify information, and hope data is accurate before figuring out an account’s status. The time spent conducting this clerical work could be better spent on solving more complex customer issues.

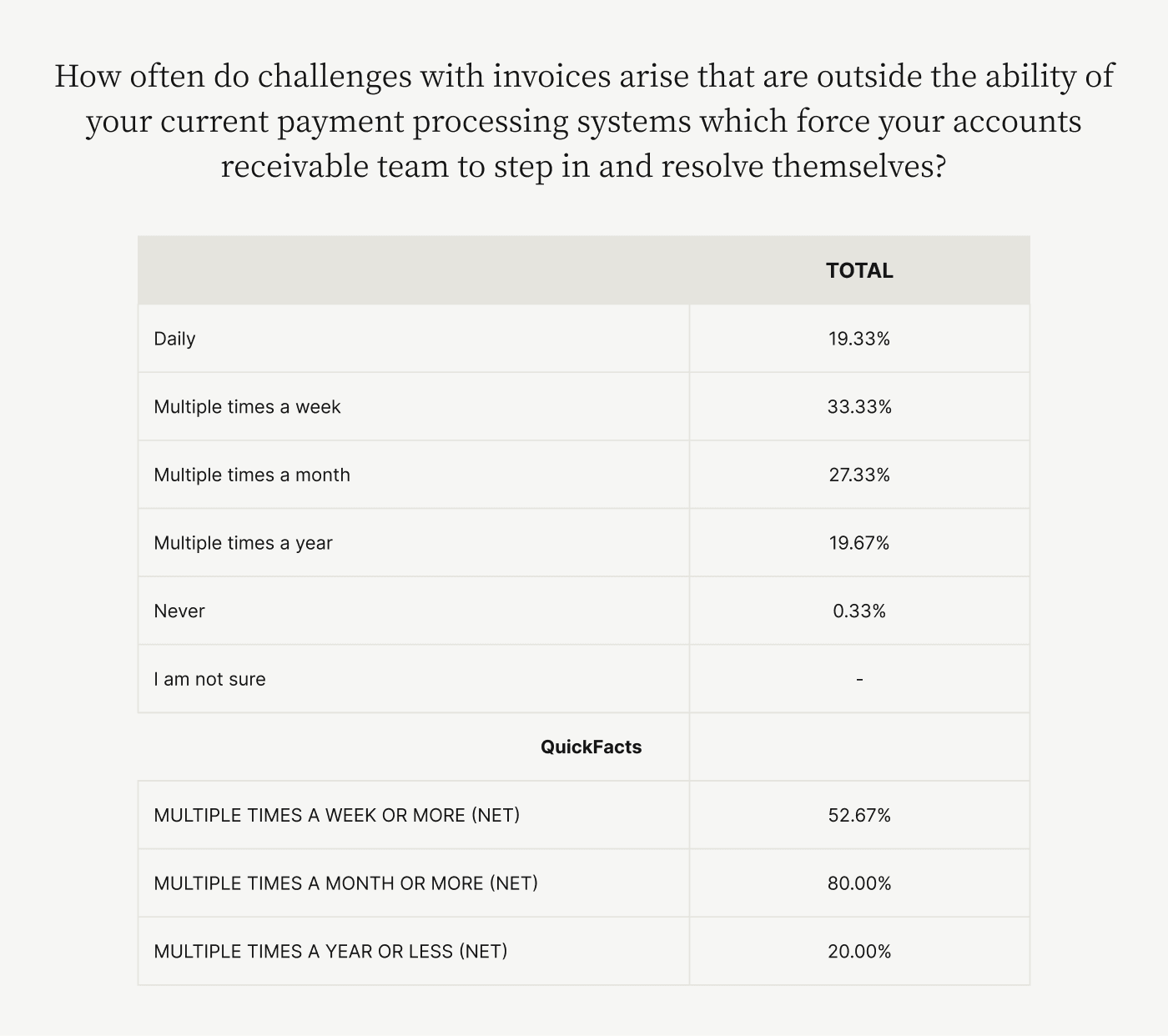

Our research shows that most AR teams deal with software-related limitations frequently.

For instance, manually figuring out what percentage of its invoices a customer has paid might involve cross-referencing multiple spreadsheets and hoping they’re error-free. As a result, AR could mistakenly follow up and try to collect a paid invoice, unnecessarily annoying customers.

A lack of capable collections software also hamstrings accounts receivable from understanding which open accounts they must prioritize. Your upcoming cash flow needs might need accounts receivable to clear smaller invoice amounts first quickly. Or, a large number of outstanding receivables two months down the road might need preparatory collections work (like payment reminders) right now.

When technology lets you down in this respect, the result is critical invoices remaining unpaid or unrecognized. Worse, your collections team could be chasing the wrong customers and payments, wasting valuable time and money.

3. Manual collections overburden accounts receivable

Manual processes or a lack of suitable tools make life difficult for AR teams. Highly qualified employees are reduced to executing clerical work that creates stress and overburdens them.

Executing complex cash application tasks like matching one payment to several invoices or handling line-item level payments takes too much time, resulting in efficiency loss. It also creates a vicious cycle of additional work and stress that creates employee attrition.

These problems get worse with scale as law firm Cole, Scott, and Kissane discovered. The company's accounts receivable team was tasked with manually depositing checks and entering information into its accounting system. As customer payments grew more sophisticated, their collections team simply could not keep up (and adding headcount was off the table), creating time-consuming errors.

Worse, their accounts receivable teams followed up excessively with customers who had already paid, creating even more frustration.Cash application automation eventually rid Cole, Scott, and Kissane of these issues, helping it cope with growth and scale.

How automated cash application reduces unpaid invoices and BDE

Automated cash application reduces the number of unpaid invoices your accounts receivable team has to handle. By removing invoices (by automatically pairing payments to open invoices) customers have already paid from the collections queue, AR can focus on real cash flow blockages.

Here's how automated cash application gives accounts receivable teams more of their time back, reduces bad debt expenses, and minimizes unpaid invoices:

1) Automated cash application reduces AR burden

2) Automated cash application eliminates errors

3) Automated cash application improves visibility

1. Automated cash application reduces accounts receivable burden

Automated cash application removes all clerical or rote cash posting work. For instance, cash application software automatically scans remittance advice, matches it to open invoices, and applies cash by automatically posting journal entries back in your ERP.

No matter how complex your customers' payments are, cash application automation software can match them to the line item level. For instance, optical character recognition (OCR) technology can scan paper checks or electronic remittance advice and match payments with remarkable accuracy.

The result is greater efficiency in the invoice-to-cash (I2C) process.Carter Lumber automated cash application and could centralize its I2C process in an easily accessible location instead of separately processing payments across several regional offices. The company's field personnel can now collect payments via paper checks, scan copies, and automatically apply payments to open invoices.

2. Automated cash application eliminates errors

Manual collections processes breed errors that create time sinks. In turn, these time sinks keep AR from quickly matching payments and applying cash. These errors occur due to a few reasons:

Employee fatigue

A lack of centralized data

Disjointed legacy accounts receivable systems forcing tab switching

Automated cash application software doesn't suffer from fatigue or make errors in clerical tasks. It frees up your team's time to address critical cash flow barriers and helps them communicate with customers better. Centralized, shared payment portals (which often accompany cash application solutions) give AR firm ground when informing customers of invoice statuses.

Through these transparent, always accessible solutions, customers receive answers quickly and know their account statuses at all times—and aren’t equally burdened by accounts receivable teams’ attention being spent elsewhere.

Forrester Consulting's research on the Total Economic Impact of Versapay Cash Application highlights an example of increased efficiency. Cash application automation software helped a custom fabrication company quickly identify past-due invoices and take prompt action to address them.

“We have a report that indicates which invoices need to be closed, and we run those payments with just two clicks of a button," says a financial planning accountant at the company. "Versapay has streamlined our invoice-to-cash process, and there is less risk of human error.”

3. Automated cash application improves visibility

Forrester's report also shines a light on the lack of accounts receivable visibility most companies have due to outdated systems. Automated cash application software helps AR teams understand upcoming cash flow hurdles thanks to centralized data and heightened transparency.

A law firm highlighted in Forrester's report reaped this benefit. “Law firms like us measure the aging of invoices and will drill down to ‘aging buckets,’ like what's in the 30-, what's in the 90-, what's in the 120-day buckets, and what's over a year old?," says the firm's Director of Revenue and Treasury Management. "Attorneys must reach out to their clients directly to initiate collections, and if they have a year-old invoice, that’s a problem.”

Madison Resources faced similar issues with visibility before automating cash application. Its accounts receivable staff spent significant time correcting cash posting errors and tracking down erroneous payments. Automating their cash application processes helped Madison Resources process higher invoice volumes as it grew, without adding headcount to its collections or cash application teams. And it did all this without burn out or sacrificed visibility.

Automated cash application saves you money

Automated cash application has an impact far beyond automating rote tasks. It reduces the number of unpaid invoices by helping your AR team focus on critical cash flow-enabling tasks, making collections more efficient.

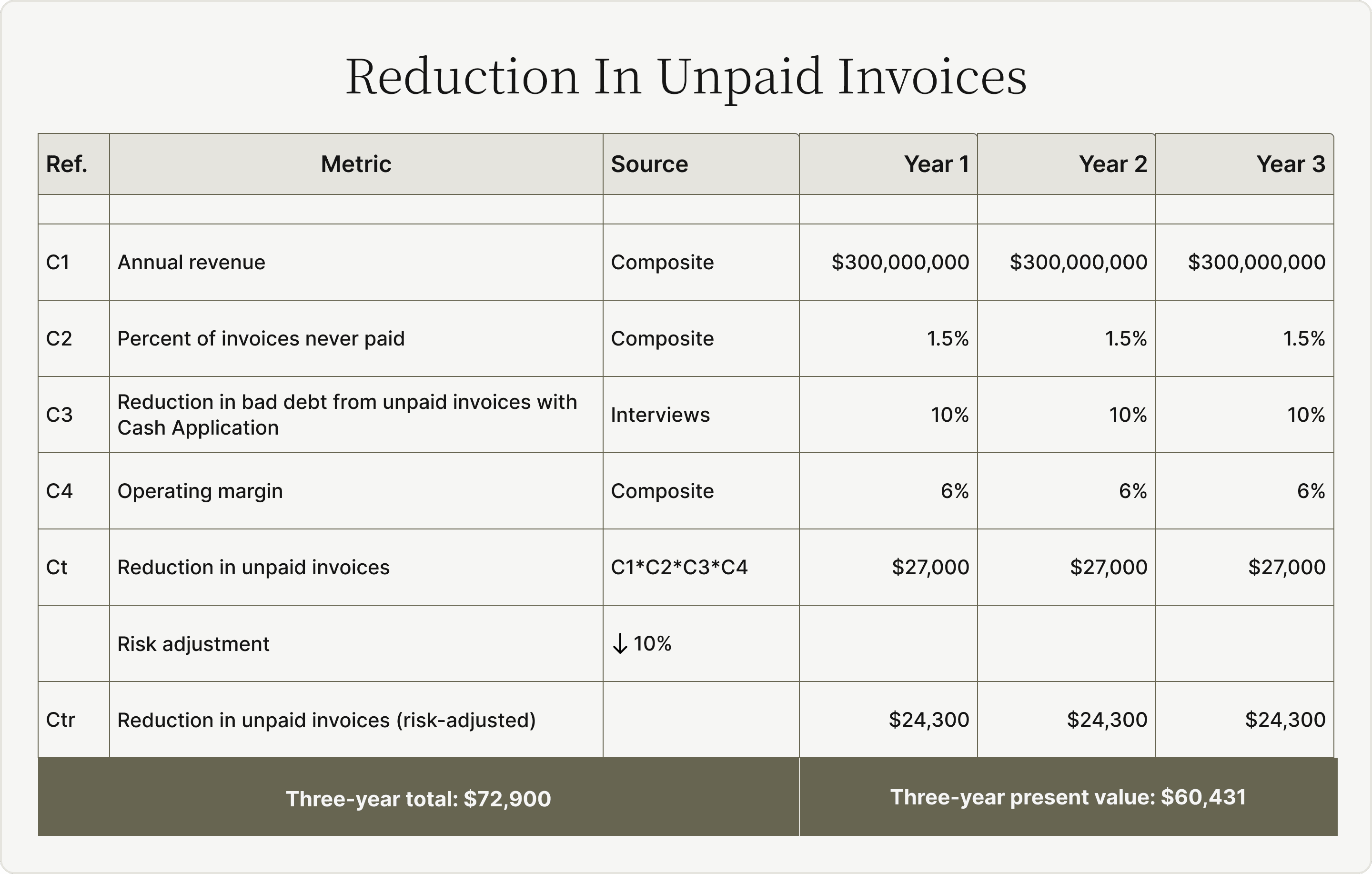

What is a reduction in unpaid invoices worth to your business? While every company differs, Forrester reckons a representative firm (annual revenues of $300 million with a strong online and physical retail presence) saves at least $60,431 over three years by streamlining cash application activities alone.

This number does not include the impact of better customer relationships, increased cash flow from accounts receivable recovering its time, or greater cash flow visibility.

Dive deeper into Forrester's Report on the Total Economic Impact of Versapay Cash Application to understand the method behind the numbers and learn how much money you could save.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.