4 Ways Automation can Improve Your Accounts Receivable Process

- 11 min read

Learn how automation can streamline your business’s accounts receivable process, improve cash flow, and strengthen customer relationships.

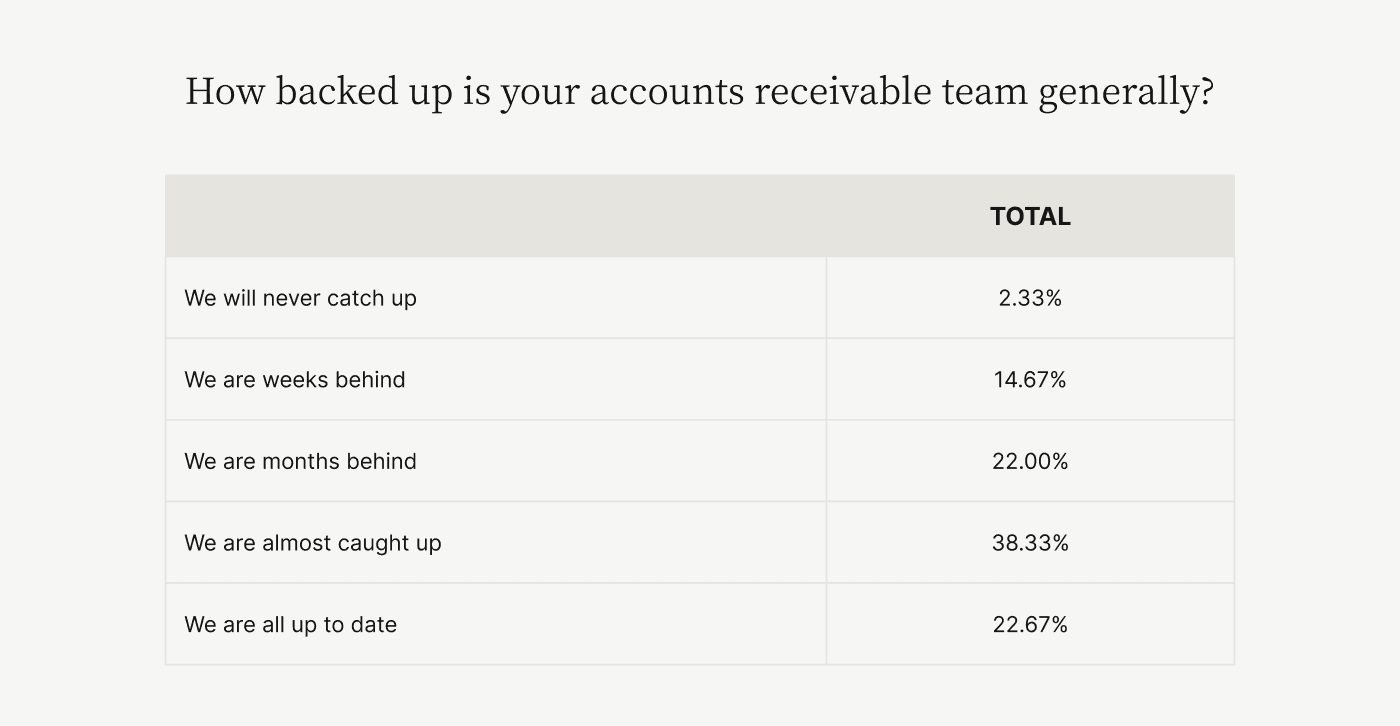

If you're responsible for managing cash flow, you can't afford to be behind in receiving payments. Unfortunately, that's where most accounts receivable (AR) departments find themselves.

According to a survey of 300 CFOs we conducted with Wakefield Research, 77% of AR teams are behind the 8-ball when it comes to collections. The typical mid- to upper-midsized company (revenues of $250+ million) struggles with about $4 million worth of unpaid invoices each month. Nearly two out of five CFOs (39%) are so underwater they believe they’re months or weeks behind, or that they’ll never catch up.

Delayed payments can severely impact a company's liquidity, hampering its ability to meet financial obligations, invest in growth, and maintain healthy financial performance. Manual accounts receivable management processes create unnecessary bottlenecks at every stage, from invoicing to cash application, leading to delays, errors, and customer dissatisfaction.

“The period of lazy capital is over,” says Versapay CFO Russell Lester. “Companies can no longer afford the labor-intensive workflows that slow down cash flow.”

Accounts receivable automation is the transformative solution you need to overcome root-cause accounts receivable roadblocks. Below are four key ways automation can optimize your invoicing, facilitate B2B payments, streamline cash application using AI, and improve customer satisfaction.

“A lot of people forget that the accounts receivable department is critical to the cash flow for a company,” Lester says. “If you can arm your AR team with tools that allow them to be very fast with insights that puts them in a position of being a strategic advisor.”

By optimizing your accounts receivable process and implementing accounts receivable management best practices, you can improve accounts receivable collections and manage your cash flow more effectively.

Jump to a section of interest:

1. How accounts receivable automation optimizes your invoicing →

2. How accounts receivable automation facilitates B2B payments →

3. How accounts receivable automation streamlines cash application →

4. How accounts receivable automation opens communication and collaboration channels →

1. Accounts receivable automation optimizes your invoicing

Inaccurate invoicing is a significant pain point for many businesses, leading to delayed payments, customer disputes, and a longer cash conversion cycle.

Automation reduces the risk of human error—the most significant cause of invoice disputes—and ensures that invoices are generated accurately and consistently.

How automated invoicing improves accounts receivable processes

By eliminating manual data entry, reducing human errors, and streamlining invoice delivery, automated invoicing transforms cumbersome accounts receivable processes into well-oiled collection machines. Here's how automated invoicing makes a powerful impact:

Seamlessly integrates with your existing accounting software or enterprise resource planning (ERP) system, eliminating the need for manual data entry as data syncs bi-directionally.

Automatically populates invoices with up-to-date customer information, product details, and pricing (as well as branding and other personalizations), ensuring accuracy and compliance.

Schedules recurring invoices (and enables instant payments, right on the invoices) for predictable revenue streams, reducing the administrative burden on AR.

No matter your customers’ preferences, it instantly distributes invoices through multiple channels, such as email, customer portals, or electronic data interchange (EDI), ensuring timely delivery.

[Case Study] The construction crew that crushed manual collections

For the credit management team at a major construction company, the daily grind was a relentless battle against paper mailings, customer calls, and manual collections—a tedious trifecta that consumed 75% of the team’s time.

But then came the game-changing arrival of digital invoicing, payment reminders, and other accounts receivable automation tools. With a few keystrokes and the click of a button, the team switched more than 90% of their customers to timely, online payments.

2. Accounts receivable automation facilitates B2B payments

Because an average of 50% of all B2B invoices issued in the US are paid late, it’s important to do everything you can to ensure timely payments. Every late payment hurts your cash flow, and B2B companies write off 8% of invoices that are past due by more than 90 days.

Automating B2B payments is one of the key accounts receivable management best practices to improve collections and optimize the accounts receivable process.

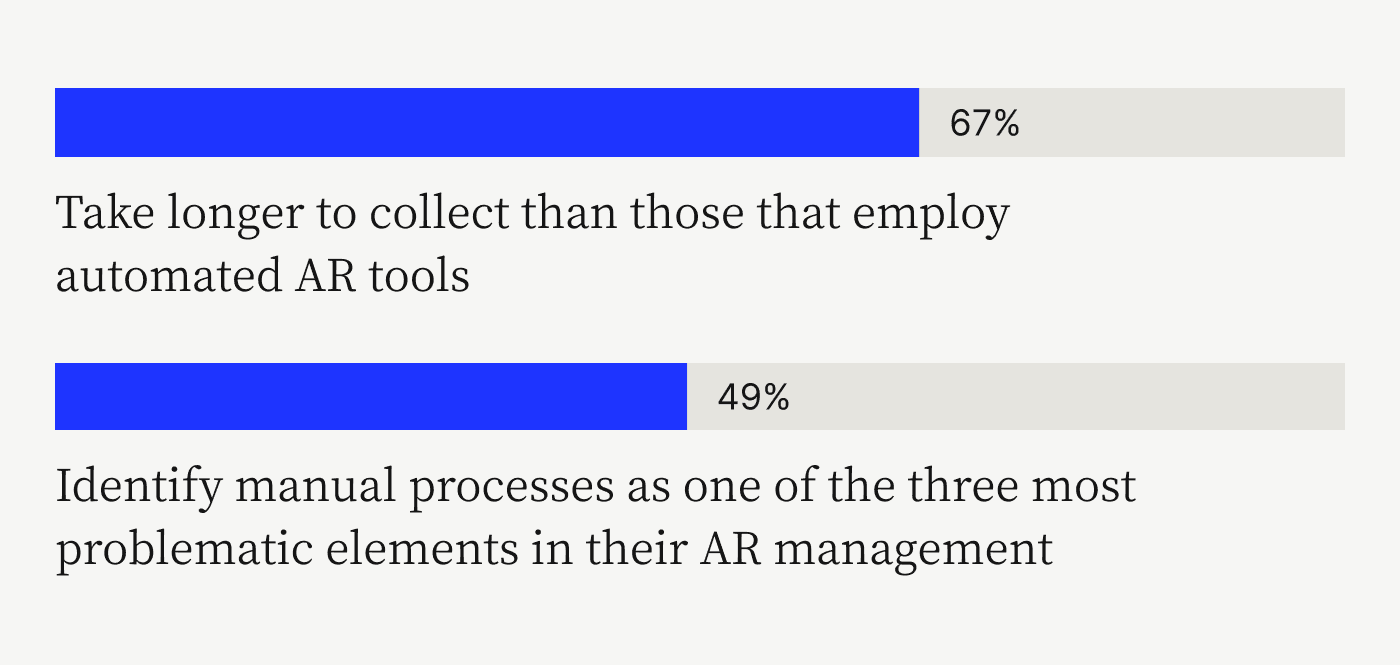

A study by PYMNTS.com and American Express concurs: Companies using manual accounts receivable processes take 67% longer to collect than those that employ automated AR tools. Nearly half of firms (49%) identify manual processes as one of the three most problematic elements of AR management.

B2B payment processes can be complex, involving various payment methods, currencies, and terms. By providing a centralized platform for customers to view and settle their outstanding invoices, automating B2B payments is one of the most effective ways to improve accounts receivable collections.

How B2B payment automation improves accounts receivable processes

By eliminating the complexities of accepting and processing multiple payment methods across multiple payment channels, B2B payment automation simplifies the entire collections process. Here are just some of the ways it can improve your accounts receivable processes:

Offers customers a secure self-service payment portal, enabling them to conveniently view and pay invoices online without the need for manual follow-ups.

Caters to customer preferences for multiple payment methods, including credit cards, ACH/EFT, and wire transfers, reducing the risk of delayed payments.

Automatically reconciles incoming payments with outstanding invoices, minimizing the risk of human error and ensuring accurate cash application.

Provides customers with flexible payment options, such as partial payments, payment plans, or early payment discounts, improving customer satisfaction and cash flow.

[Case Study] RPC slashed past-due invoices by 70%

The Research and Productivity Council (RPC) was drowning in a sea of overdue invoices, with a staggering $800,000 worth of unpaid bills lingering for more than 90 days. Trapped by their inability to support diverse payment methods, RPC turned to accounts receivable automation from Versapay.

The technology empowered RPC to unlock a whole new world of payment options for their customers, paving the way for a 70% reduction in overdue accounts.

3. Accounts receivable automation streamlines cash application

The cash application process, which involves matching incoming payments to outstanding invoices, can be time-consuming and error-prone when done manually. Automation leverages advanced technologies, such as artificial intelligence (AI) and machine learning, to streamline this process, ensuring accurate and timely cash application.

According to Versapay’s VP of Engineering, Doug Hathaway, AI is revolutionizing cash application and other accounts receivable processes. “AI lets you get right to the information you need,” he says. “All you have to do is ask.”

How automated cash application improves accounts receivable processes

Leveraging advanced technologies, automated cash application tackles the time-consuming and error-prone task of matching payments to invoices. This intelligent approach revolutionizes the AR process by:

Automatically matching payments to invoices based on predefined rules or patterns, reducing the need for manual intervention.

Using machine learning algorithms to learn from historical data and improve the accuracy of cash application over time.

Automatically handling many exceptions, such as short payments or overpayments, reducing the need for manual intervention and ensuring accurate accounting.

Integrating with bank feeds to automatically import and reconcile incoming payments, eliminating the need for manual data entry.

[Case Study] Cash application specialists reclaimed their nights (and days)

Accounts receivable automation saved the day for one healthcare service provider. Manual cash application processes often kept the team at work until 10:00 p.m., just to post a single check.

With a Versapay cash application automation solution in place, cash application is 75% faster. The team gained a day and a half each month processing credit cards and reclaimed 4.5 hours from their daily grind. What’s more, 96% of incoming payments were automatically matched with open receivables, ushering in a new era of efficiency and productivity.

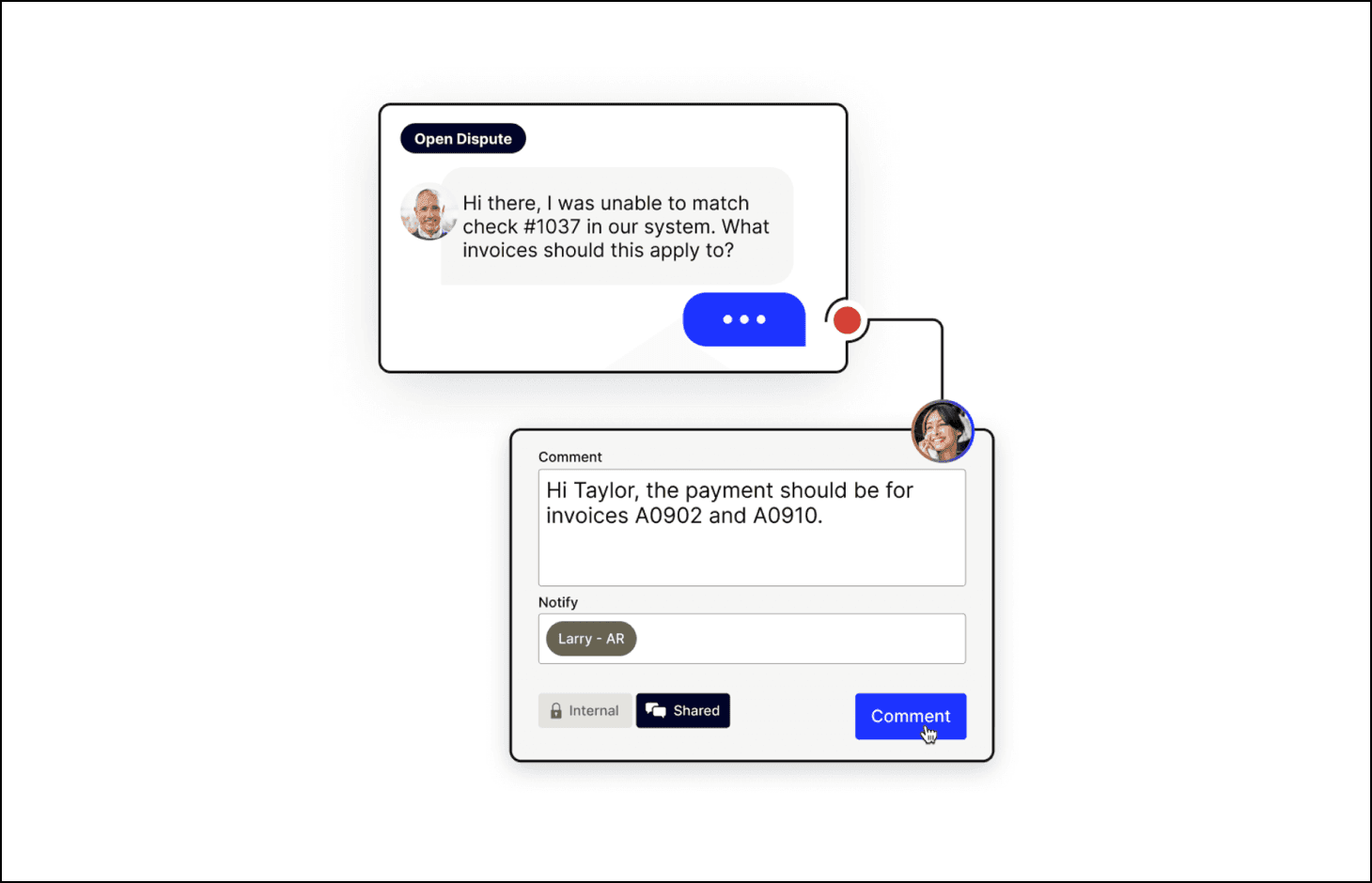

4. Accounts receivable automation opens communication and collaboration channels

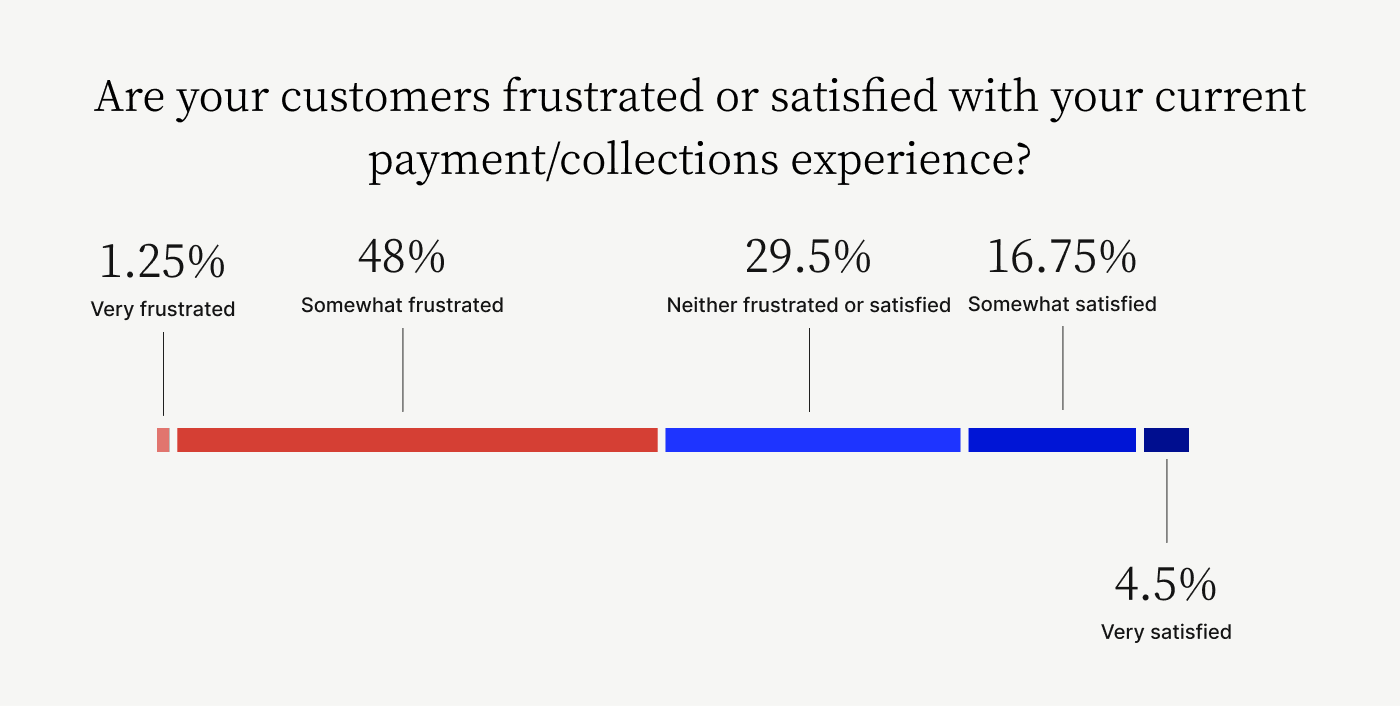

Effective communication and collaboration among AR teams, customers, and internal stakeholders are crucial accounts receivable best practices for resolving disputes and improving collections. But more than 80% of CFOs express concern that their AR departments aren’t customer-oriented enough. And research from Gartner’s Peer Community found that just 73% of company leaders believe the invoice-to-cash cycle is a frequent source of negative customer experiences.

That same Gartner study also found that only 21.25% of customers are satisfied with the payments / collections experience—what we believe largely stems from a communication gap.

Accounts receivable automation can improve communication by providing a centralized platform for collaboration. When everyone’s on the same page, you can build stronger relationships with your customers, resolve disputes more efficiently, and maintain a positive cash flow cycle.

How automated collaboration improves accounts receivable processes

Fostering strong customer relationships and internal alignment is key to an optimized accounts receivable process. Automation paves the way for frictionless collaboration through a unified platform that:

Provides customers with a secure online portal to view invoice history, access documentation, and submit queries, fostering transparency and improving customer satisfaction.

Enables internal collaboration by allowing AR teams, sales representatives, and other stakeholders to ensure alignment over deduction policies and quickly resolve any issues that come up.

Automates reminder and follow-up communications, reducing the need for manual intervention and ensuring timely payment.

Analyzes communication patterns and customer behavior to identify areas for improvement and proactively address potential issues.

[Case Study] Sharp Canada eliminated 200+ monthly calls

Fielding more than 200 calls per month from credit card-paying customers, Sharp Canada's accounts receivable team was bogged down by unnecessary administrative work.

Implementing Versapay's accounts receivable automation solution transformed this communication bottleneck by providing a self-service payment platform for customers. Sharp's AR team saved 8-10 hours each month and enjoyed stronger customer relationships.

Improve your accounts receivable process today

By embracing automation and implementing accounts receivable management best practices, you can improve your accounts receivable process, optimize collections, and foster stronger customer relationships. This is especially important for growing businesses that need to accomplish more with less.

Versapay's Accounts Receivable Efficiency Suite simplifies the invoice-to-cash process from start to finish. We integrate natively with top ERPs, facilitate payments with a self-serve portal, and free your team to focus on strategic initiatives and rapidly resolve the biggest issues that automation alone can't.

Versapay offers responsive support, fast implementation, and the flexibility to start with what you need and add more as you grow. By embracing automation, you can streamline your accounts receivable process, improve your cash flow, and foster stronger customer relationships for sustained growth and long-term success.

For more information, talk with a Versapay expert today.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.