How Cash Application Automation Software Drives Payment Depositing Efficiencies

- 12 min read

Payment depositing doesn't have to slow you down.

This article looks at how cash application automation quantifiably improves efficiency, reduces payment processing times, and speeds up the availability of funds.

Despite most payment activity having gone digital, plenty of companies still receive payments by check and continue to process these using a fully manual process.

Compared to managing new payment alternatives that accelerate cash handling, physically dealing with deposits is time-consuming. The process may include writing up deposits, making copies, driving to the bank, sending and keying-in supporting documents, and doing cash application by hand.

This slow and laborious payment deposit procedure is the reality for many companies even though it eats up staff time and slows down cash flow.

But payment depositing doesn’t have to be like this. Today’s accounts receivable (AR) automation—and cash application automation—platforms can digitize and automate the process of handling deposits. Automation can significantly improve efficiency, reducing processing times and accelerating the availability of funds.

Table of contents

How a manual payment deposit process slows you down

Imagine a hardworking accounts receivable department that gets all—or most of—its payments by check.

Once a week, an employee collects all the checks that have arrived, puts them in an envelope, and drives them 15 minutes to the local bank branch. They spend half an hour at the bank depositing them, then drive back—having spent an hour on the task of getting these payments into the company’s account.

The credit manager of a consumer goods distribution company—a Versapay customer, recently interviewed by Forrester Consulting—describes the disadvantage of this situation succinctly: “Every store has been spending an hour per week doing bank deposits, leaving the facility and unable to do any other work, which cut into their productivity.”

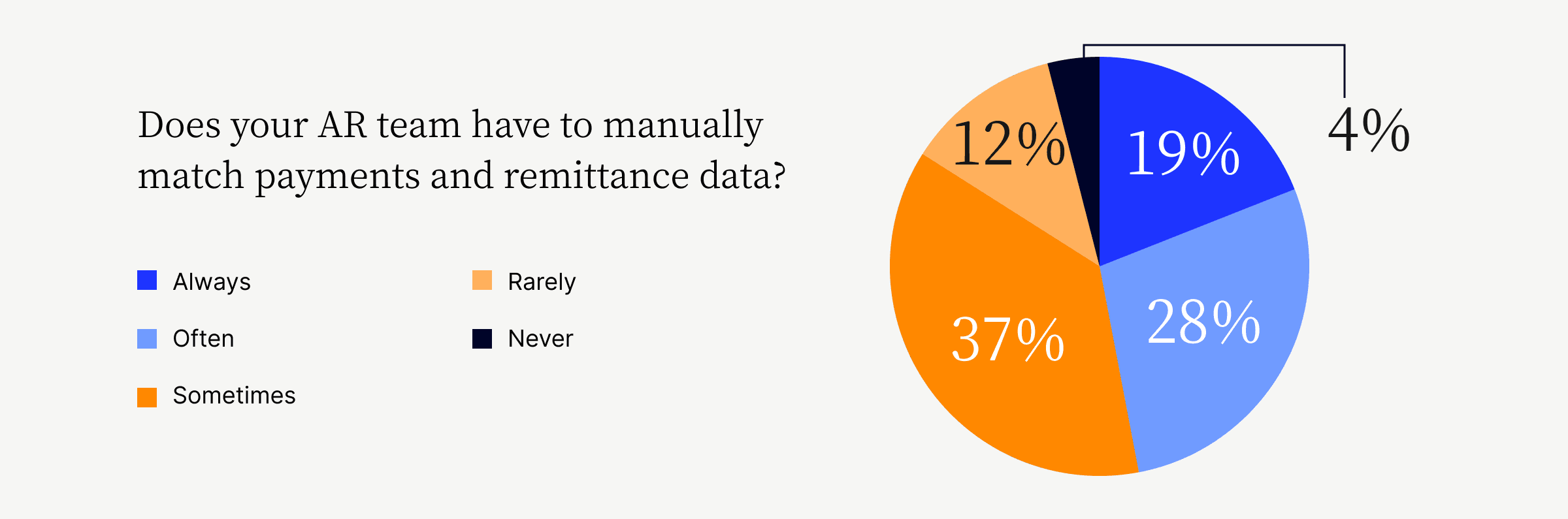

Since going to the bank takes time, managers must limit how many of these trips workers take. This slows down how fast deposits can get into the company’s accounts. And once the employee is back at the office, the task of manually matching all of these posted payments to the correct invoices in the accounting system begins—another process that takes far longer than it needs to. This takes up a lot of staff time, further precluding their work on other tasks.

Manual payment deposits are also often accompanied by manual reconciliation, which involves having to physically key data back into the enterprise resource planning (ERP) system. This—you guessed it!—slows down the process even further, delaying cash availability.

Basically, at every step of a manual payment depositing process is something slowing you down.

4 disadvantages of a slow, manual payment depositing process

There are a range of issues that an inefficient, manual payment-handling process creates for a business.

1) Less cash on hand and higher borrowing costs

2) More errors and poor CX

3) Less employee time and satisfaction

4) Higher security risks and reputational harm

1. Less cash on hand and higher borrowing costs.

Slow cash processing burdens your company’s cash flow, reducing the amount of capital you have on hand at any given time. Insufficient working capital may spur a need for you to borrow more money than you would if cash flow were faster. Borrowing comes with interest payments, which is money that you could otherwise spend on priorities for business growth.

2. More errors and poor customer experience

Manually processing paperwork and doing cash application introduces a higher likelihood of errors, which can slow down cash processing when mistakes must be investigated and corrected. These mistakes can also drive higher dispute volumes, and damage customer experience; especially when they cause misguided communication about payments that customers have already submitted.

3. Less employee time and satisfaction

Employees tasked with physically depositing checks, manually updating information, and doing cash application by hand are unable to spend their time on other potentially higher-value tasks that could contribute to business improvement and growth. Manual payment processing tasks are also often tedious, which can erode staff job satisfaction.

4. Higher security risks and possible reputational harm

There are security risks associated with taking money to the bank physically—it could get lost or stolen, representing a financial loss to your company. Loss or theft of your financial resources can also cause frustration, dissatisfaction, or fear in your employees, as well as reputational harm if the circumstances are publicized. None of that is good for business.

How automated cash application helps make payment depositing more efficient

Automated cash application is the solution to all of these payment depositing problems created by manual payment processing.

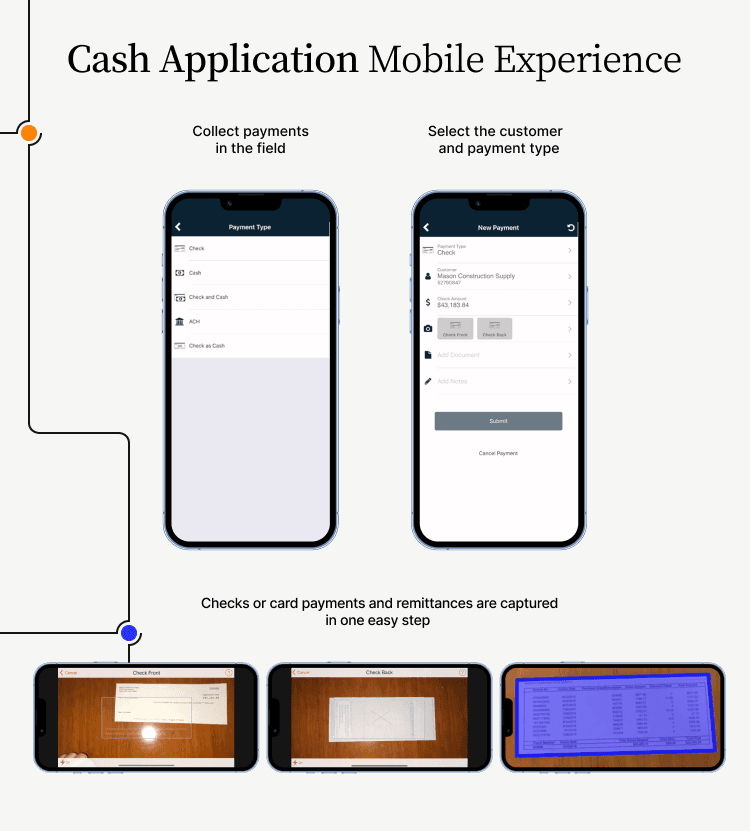

Mobile check deposit—in particular—is a notable feature of cash application automation systems that supports payment depositing. This capability allows managers to deposit cash remotely, which significantly reduces processing times and accelerates the availability of funds. This capability is especially useful for companies that accept cash on delivery as a regular part of their business.

“Now, it takes them less than five minutes a day to deposit the checks,” says the credit manager of the consumer goods distribution company, which adopted Versapay Mobile Check Deposit.

A mobile deposit solution can seamlessly integrate with an organization’s ERP system, which can allow for automated reconciliation, further speeding up the cash application process. With the elimination of manual paperwork, managers can digitize the process, reducing the time and effort spent on paperwork.

“With the Versapay mobile deposit solution, the stores can deposit checks on the same day,” says the credit manager. “It’s not disruptive at all; it goes right into Versapay, and it’s a very fast process. The deposits are now immediately posted to the customer’s account.”

The ability to deposit payments quickly and accurately becomes more important as your business scales.

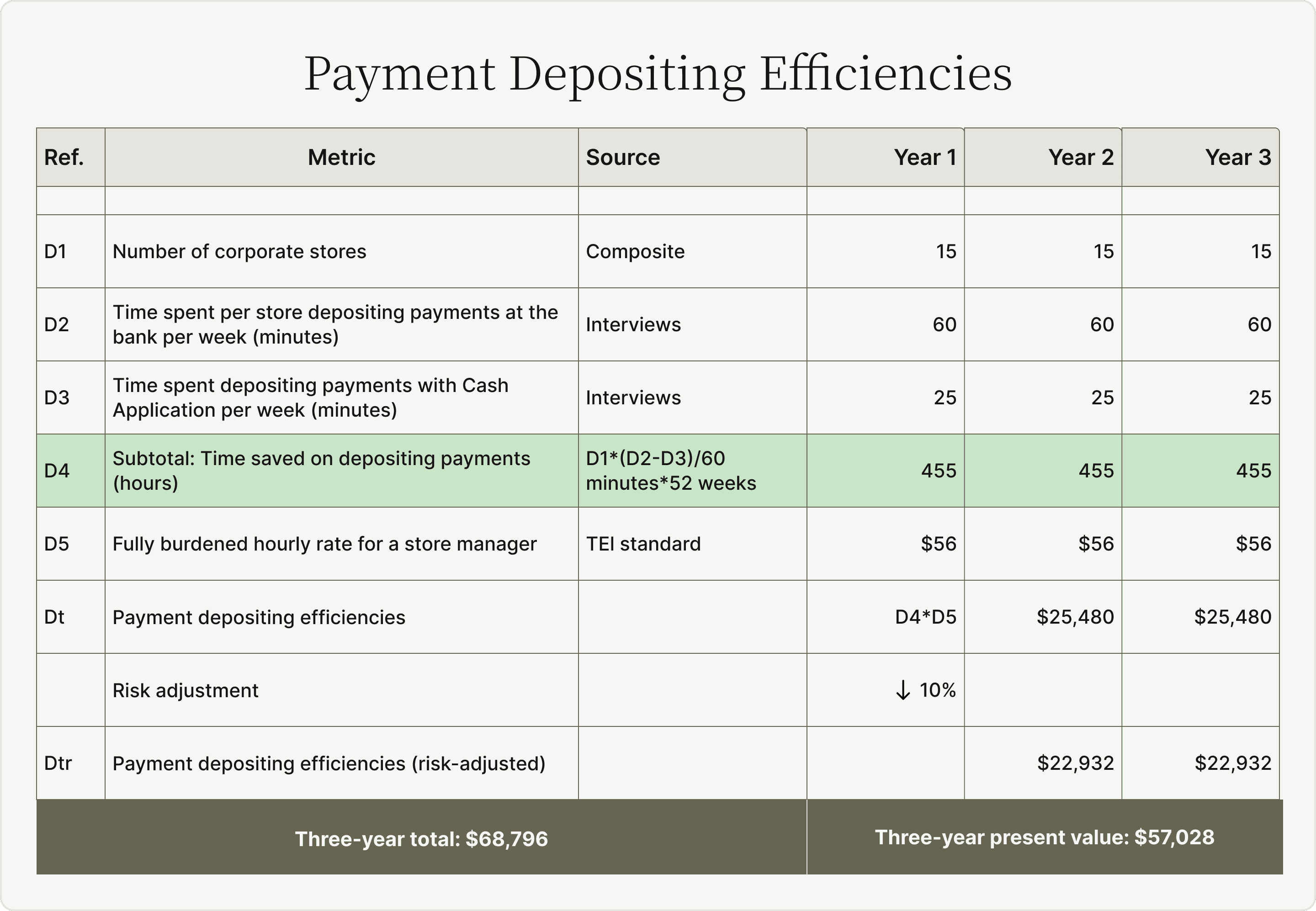

For example, a company with 15 corporate stores that each take 60 minutes per week depositing payments at the bank is spending 15 hours weekly on depositing payments. Automation cuts that number by more than half, down to 25 minutes per week per store, or around 6 hours per week for the entire company. This means that switching to automated cash application saves the company almost 9 hours per week and a total of 455 hours per year.

3 additional benefits of automating payment deposits

Beyond those major time savings, some additional advantages flow from a more efficient process for depositing checks and applying cash:

1) Ability to redeploy resources

2) Real-time visibility

3) Fewer human errors and better CX

4) Integration with other solutions

1. Ability to redeploy resources

Freeing up time with automation allows organizations to have workers take on more value-added and strategic work while still accomplishing the payment management needs of the business. This is what it means to “do more with less,” an increasingly important strategy in an economy where interest rates, inflation, and uncertainty remain stubbornly high.

The career progression of a financial planning accountant at a custom fabrication company—cited in that same Forrester Consulting study—illustrates this concept well:“I started as a staff accountant, and now my role is morphing into a financial planning and analysis position.”

2. Real-time visibility

Automated cash application solutions can provide real-time visibility into cash positions, outstanding invoices, and payment status. This helps organizations make informed decisions and maintain up-to-date accounts receivable reporting, such as for aging and cash flow.

In fact, cash application improvements through automation are critical to better cash flow forecasting. That’s because automation ensures cleaner flows of data, faster reconciliation, and greater data integrity; all resulting in cash being brought onto your books faster.

3. Fewer human errors and better customer experience

Automated depositing solutions eliminate human errors in cash application, which makes for fewer delays, disputes, and misunderstandings. Customers are happier when they experience fewer such problems, and accounting teams are more satisfied when they aren’t spending time unwinding mistakes.

4. Integration with other solutions

Collaborative accounts receivable automation solutions—the likes of which cash application tools (like remote payment capture) typically exist alongside or within—may also include an automated payment portal through which customers can post payments digitally.

Receivables teams benefit from using a comprehensive accounts receivable automation platform rather than just a standalone cash application solution. They can take advantage of features like the payment portal, as well as integrate this software with other solutions they already use, such as their ERPs and accounting systems, saving further effort in processing payments.

How Würth Canada transformed an old-fashioned deposit process [customer success story]

Despite being an established company on track to soon achieve $270 million (CAD) in sales, Würth Canada was relying on checks as their primary accepted payment method, receiving approximately 1,000 checks monthly.

Sales representatives would get checks from customers and send them via courier to their head office to be applied to customer accounts. Sending checks from a representative’s location to the head office for processing would cost anywhere from $10 – 50 (CAD). With 470 sales reps around the country, the company saw its courier costs add up fast.

Würth implemented Versapay’s mobile check deposit functionality. Being able to deposit checks remotely saved the company $10,000 – 15,000 (CAD) monthly in courier fees alone. The solution offered a range of other advantages as well.

“Once we got up and running, we realized there were so many other benefits to the solution, including highly accurate automated reconciliation, comprehensive reporting, intuitive querying, andincreased AR staff productivity,” says Michael Malone, credit manager and company compliance officer for Würth Canada. “Versapay made so much more of an impact than I expected.”

Versapay Cash Application: The solution for your efficiency needs

Automated payment processing and cash depositing can make a massive difference for companies that do much or all of this process by hand. This is particularly true at scale, as the benefits increase exponentially for companies with many locations and large payment volumes.

The benefits to automated cash application range from faster cash flow to less spending on interest to better customer satisfaction.Read our new study from Forrester Consulting to learn how Versapay Cash Application can boost a company’s efficiency by up to 69%.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.