How Cash Application Automation Drives Cash Posting Efficiencies

- 8 min read

Discover the key ways that cash application automation software speeds up cash posting for maximum efficiency and better cash processing.

Cash application, also called cash posting, is an essential element of running a successful business. But the process can be complex, time-consuming, and inefficient when done manually.

The act of matching payments and remittances with invoices is integral to accelerating cash flow, yet the process is typically clunky, confusing, and slow. Not only does inefficient cash posting bog down cash flow, it also requires many hours of work that accounts receivable staff could apply to higher-value tasks.

Cash application software significantly reduces the time required for cash posting and provides a wealth of benefits that can help businesses thrive and grow.

Table of contents

Manual cash application: A drain on your business

The problems with manual cash application go far beyond minor inefficiencies. This process can weigh your business down in ways that range from errors in your books to poor customer experience. Here are a few of the possible consequences of handling cash posting manually.

Manual cash application is inefficient and error-prone.

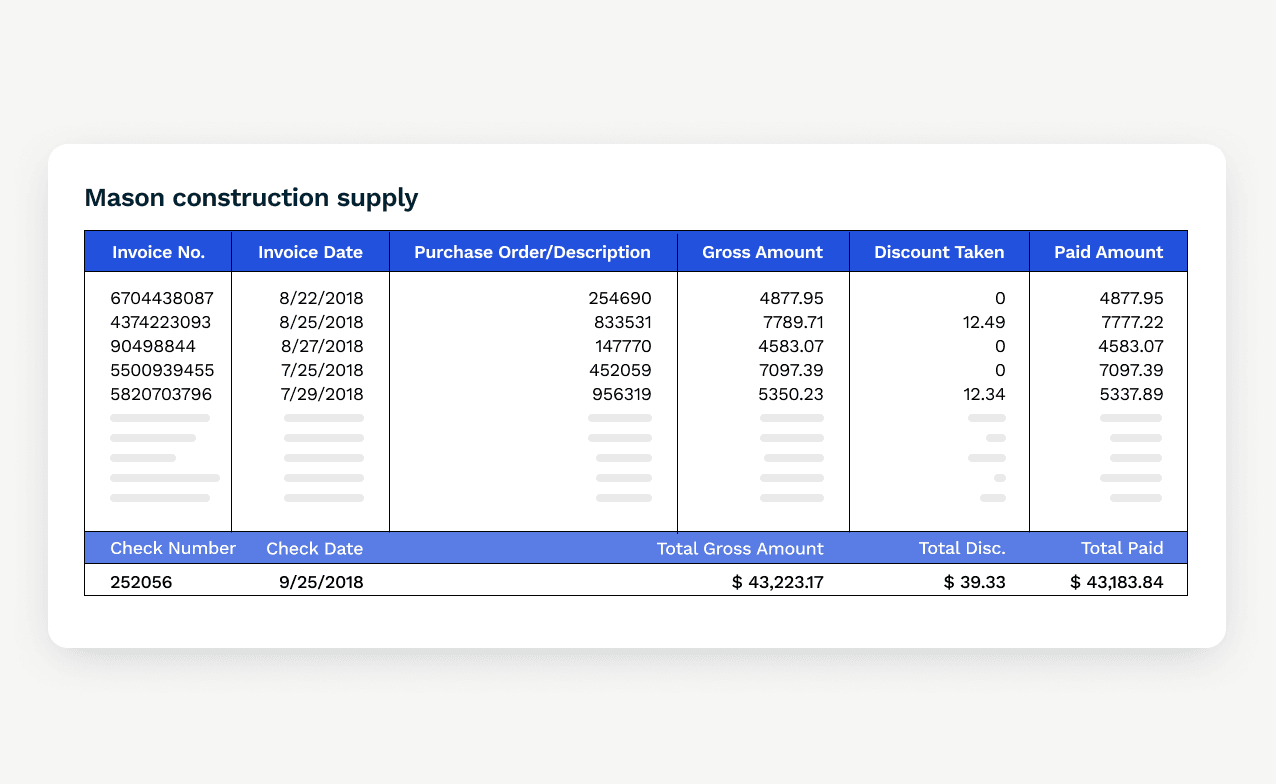

Matching payments with invoices often takes detective work for which your accounting team has little time or patience. For example, if a check arrives from a given client, the accounts receivable team must do research to discern the link between the payment and an open invoice, which takes time and sometimes proves impossible.

If the team can’t establish the connection, they might allocate the funds elsewhere until they find the link, which can add days onto processing time and lead to errors in your books if the funds are never applied properly after all.

Manual cash posting slows down cash flow.

Manual cash application inefficiencies make getting incoming payments on the books slow—in general—and extremely slowly when problems crop up.

Whether the team is at work manually matching payments to invoices or logging into the bank daily to extract payment information from lockboxes and post each check to each customer account, the result is inevitably sluggish cash flow.

For instance, a healthcare services provider was often spending nearly a full staff person’s day to post one single check. Sometimes the AR team had to work until 10:00 PM to finish applying cash. This style of working was unsustainable and led to slower cash flow than the company could afford.

These slow downs in cash flow can have profound downstream impacts on your business functioning and ability to grow. For example, companies struggling with slow cash flow may have to borrow working capital to buy inventory or make payroll, which increases the amount they spend on interest payments. Lack of on-hand funds also may prevent them from investing in initiatives that could spur growth and improve their business.

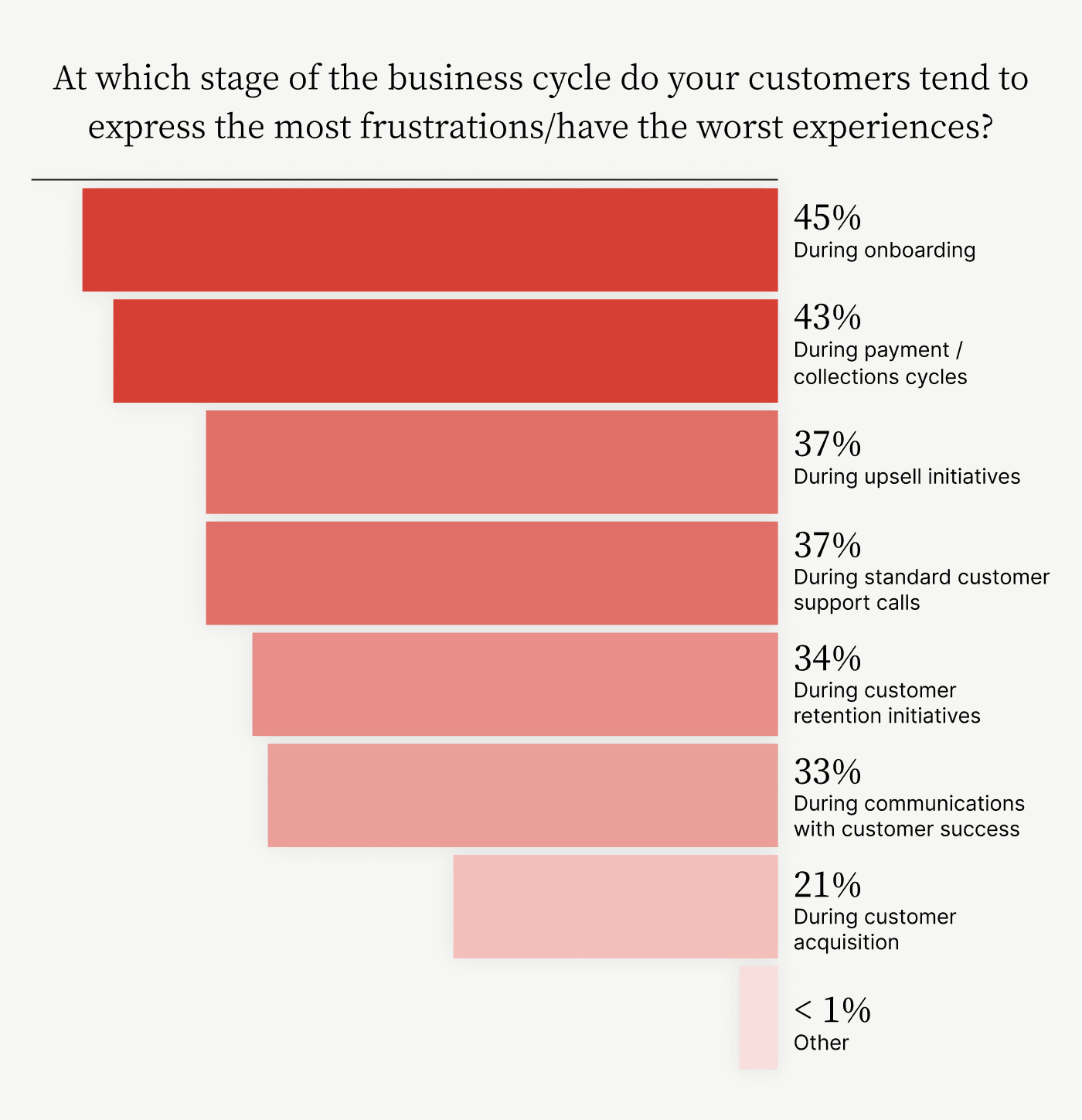

Manual cash posting can damage customer experience.

Prompt and accurate cash posting to customer accounts ensures that account balances and statements are updated. This transparency and accuracy builds trust, minimizes billing disputes and reduces the risk of strained relationships due to payment-related issues.

Unfortunately, errors in or confusion about matching payments to invoices can lead to faulty follow-ups for non-payment, which annoys customers. It can also result in the seller placing incorrect credit holds on accounts, which bothers customers since it prevents them from buying what they need. Meanwhile, overworked AR staff with high manual workloads can inadvertently take their stress out on customers, leading to poor customer experiences.

How automation speeds up cash application

Automation speeds up cash processing by facilitating remittance capture. Remittance capture is the act of crediting a payment to a customer’s account after receiving that payment and related information through one of many various B2B payment channels. Cash application is an integral part of remittance capture, and the faster your accounts receivable team can match incoming payments to invoices, the faster they can capture that income in the company’s books.

Intelligent, AI-powered cash application automation software continues to learn as it practices recognizing the format of remittances and payments you receive, how you apply those payments, and other aspects of the process. As the AI that powers the system makes these connections, the automation engine works increasingly quickly. This is particularly true with complex payment matching, which can be extra difficult and slow to do manually.

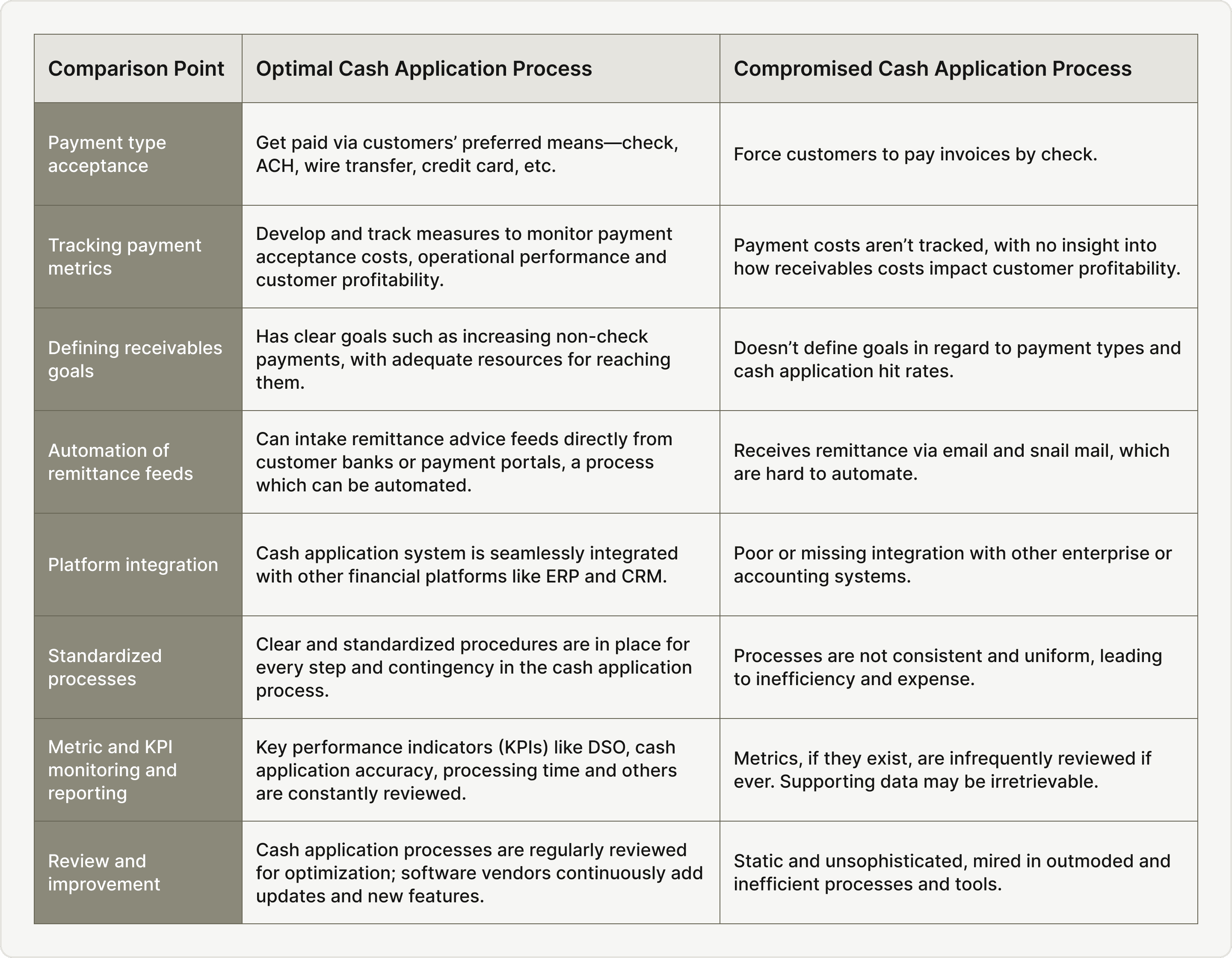

Here’s a side-by-side exploration of what an optimal cash application process—one that leverages automation—looks like, compared to a manual—or compromised—one:

How cash application software helps you do more with less

Many resource-strapped finance teams need to find efficiencies wherever they can. Staff shortages mean that workers are in danger of burning out unless they can find ways to do more efficient payment posting. This may mean turning to automation instead of taking on the expense of hiring a new team member.

“Many law firms are experiencing a five-day delay in cash application, which would be very frustrating. We had the option to either hire a new staff member or implement [Versapay] Cash Application. The solution has helped us improve and process payments more efficiently” — Director of Revenue and Treasury Management, Legal Services Company (Anonymous)

Cash application automation software such as Versapay is capable of saving accounts receivable teams 11 hours of staff time daily in cash posting activities, more than an entire worker’s daily workload. As illustrated in the chart below, this team—a composite organization using Versapay, as defined by Forrester Consulting in their analysis of Versapay Cash Application—saved 2,860 hours yearly from automating this function.

With 251 working days in the year, that totals around 11 hours saved every work day.

AI and machine learning capabilities speed up the auto-matching rate so that the system more intelligently matches payments with remittances over time. As your accounts receivable automation system becomes better at cash application, it brings increasing benefits to your business.

Real customers share the benefits of efficient cash application

Versapay automates the cash application process to bring customers powerful results. That same study commissioned from Forrester found that Versapay Cash Application increased companies’ efficiency by 69%. Some of our customers have seen a 6 – 8x reduction in time spent on payment processing and cash application.

A financial planning accountant in the custom fabrication industry was eager to let us know what a big difference our system made: “We're seeing the time drop from about three to four hours per day pre-Versapay to about half an hour post-Versapay. We are saving time on processing credit card payments and on cash application.”

As Versapay’s cash application software learns, it works increasingly quickly and is able to automatically match more and more payments with their invoices. A financial planning accountant’s experience provides details: “Soon after going live, we had a 74% auto-matching rate, and it took me 22 minutes to validate 26 transactions. One day later, we had a 78% auto-matching rate, and it took me five minutes and 43 seconds to validate 37 transactions. Three weeks later, we had our first day of 100% matching, where we didn't have to manually touch any transactions.”

There are many other satisfied customers where those came from. A law firm reduced its cash application times from two or three days to same-day processing using Versapay. And a bank used Versapay's remote deposit capture features to reach 100% readability on scanned checks, vastly improving and accelerating cash application.

—

You can be the next company enjoying the benefits of fast, accurate, automated cash application. Download the Forrester study to learn the many ways that Versapay Cash Application can benefit you.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.