5 Reasons for AR to Support Accounts Payable with Payment Automation

- 12 min read

You can help your customers streamline their accounts payable workflow using payment automation.

This blog explores how, and why payment automation further optimizes your internal processes, improves your customer relationships, and gets you paid faster.

With inflation reducing purchasing power, raising costs, and impacting interest rates, effective cash flow management has never been as important as it is today. Companies that don’t accept digital payments are doing themselves a disservice, while frustrating their customers at the same time.

Forward-thinking accounts receivable professionals are realizing that making life easier for their counterparts in accounts payable makes their own lives easier, too.

When you offer your customers a digital payment experience, they ultimately get a more convenient way to receive, approve, and pay their invoices. Their payments are automatically applied to their outstanding invoices, and reconciled automatically, too, which means fewer delays and disputes—and better cash flow for you.

This blog post explains how helping your customers streamline their accounts payable workflow through payment automation can help you optimize your own internal processes, improve relationships with your customers, and get paid faster.

Jump to a section of interest

What is payment automation?

Simply put, payment automation makes it possible (and easy) for your customers to pay your invoices by credit card, ACH, virtual card, and other preferred digital methods.

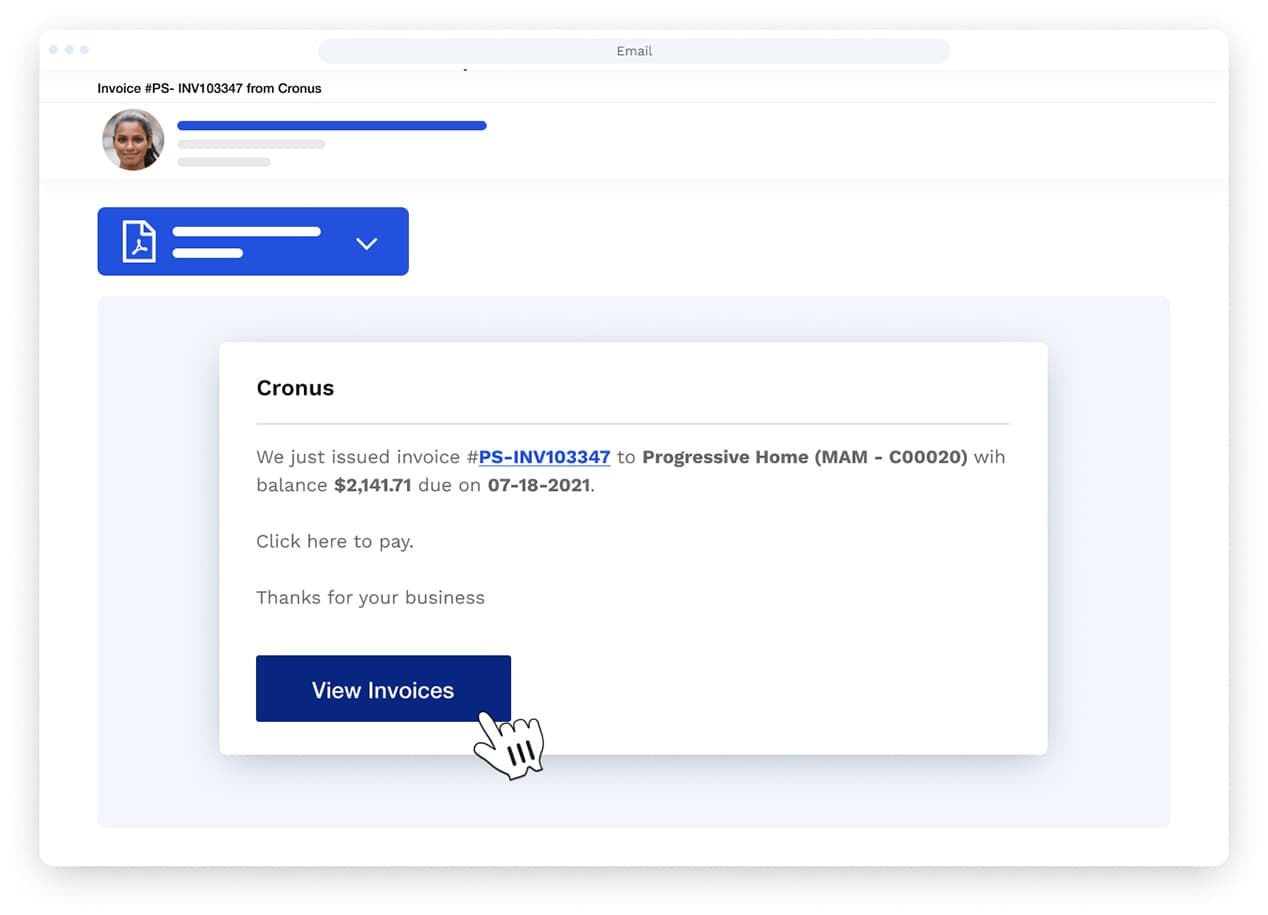

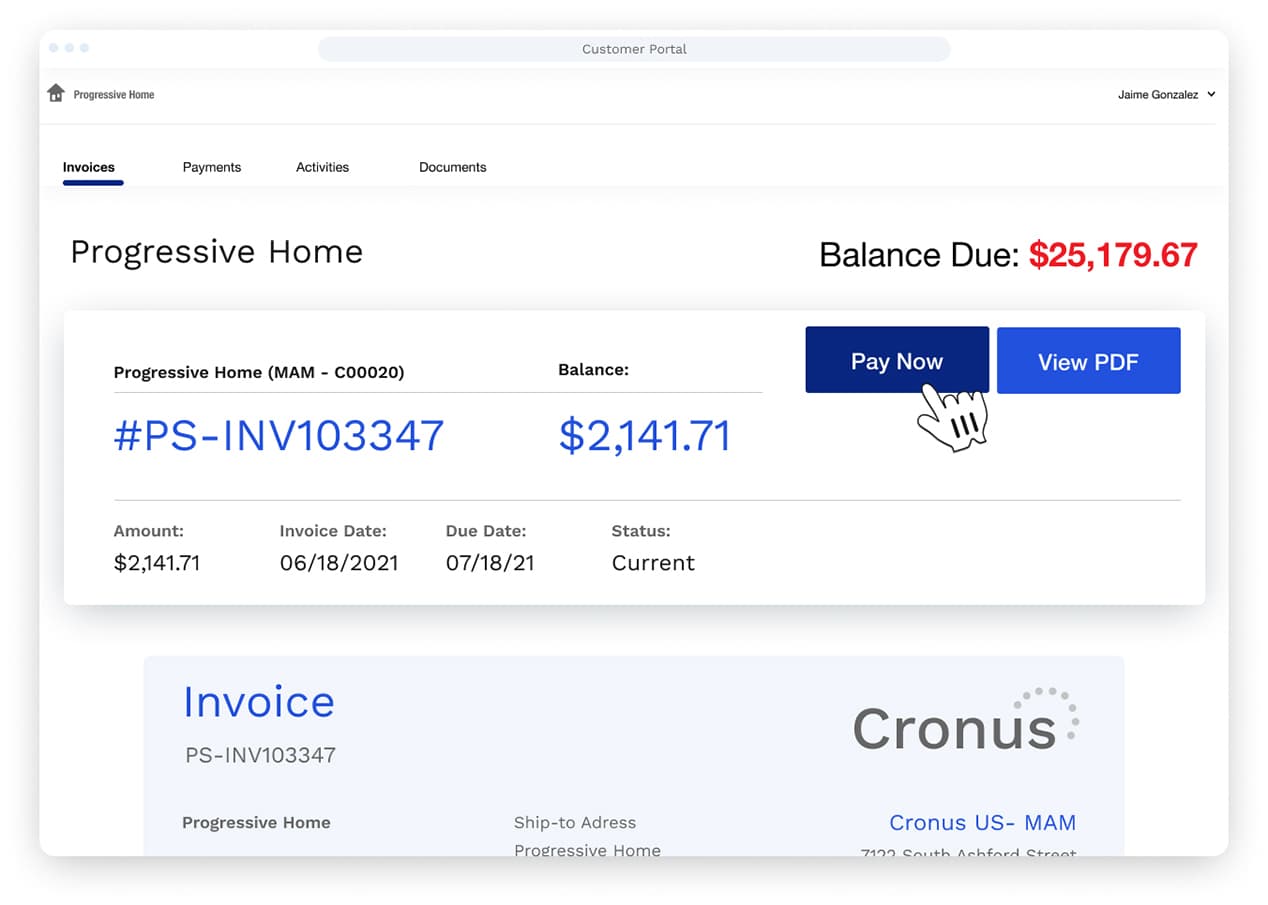

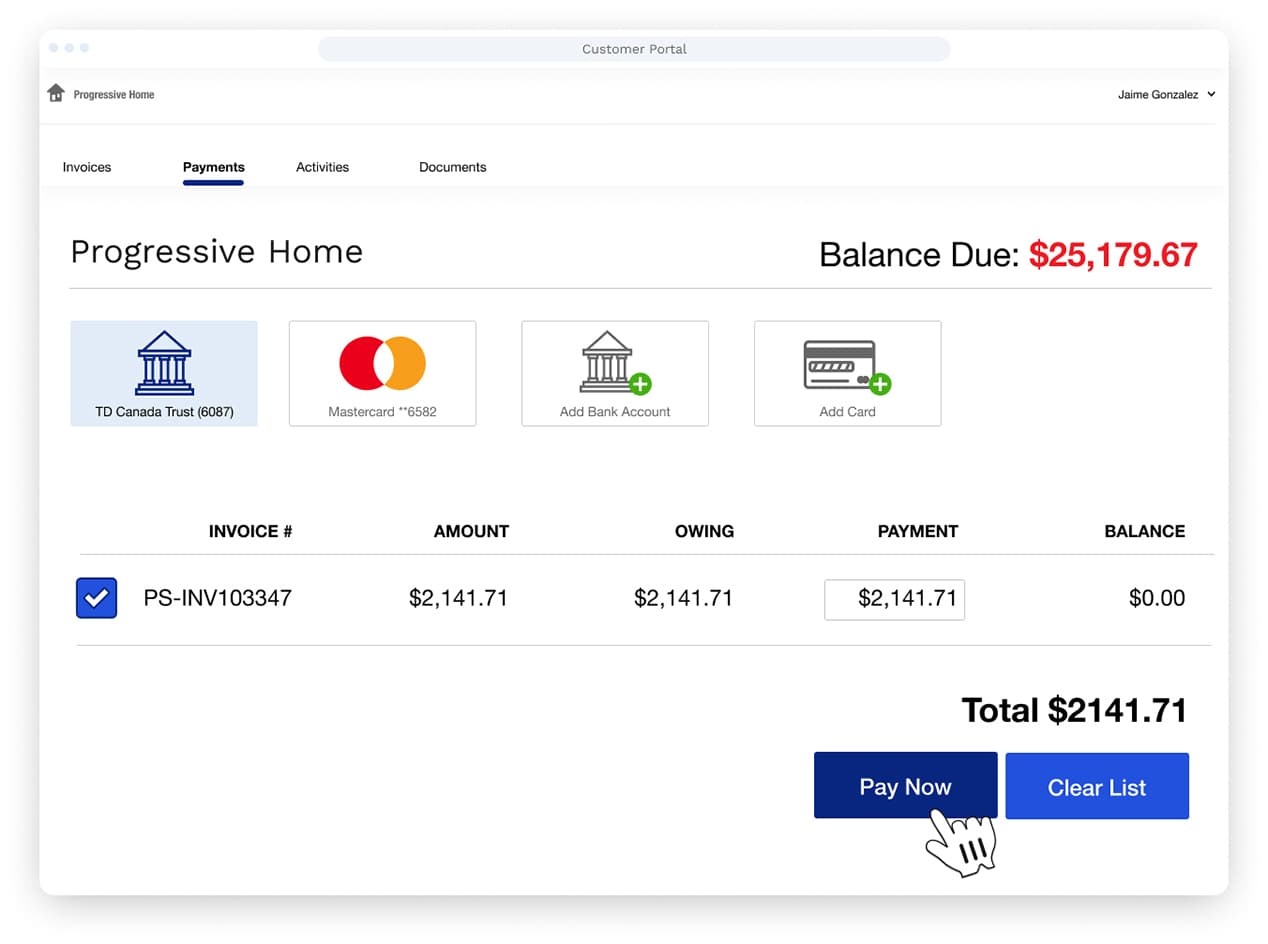

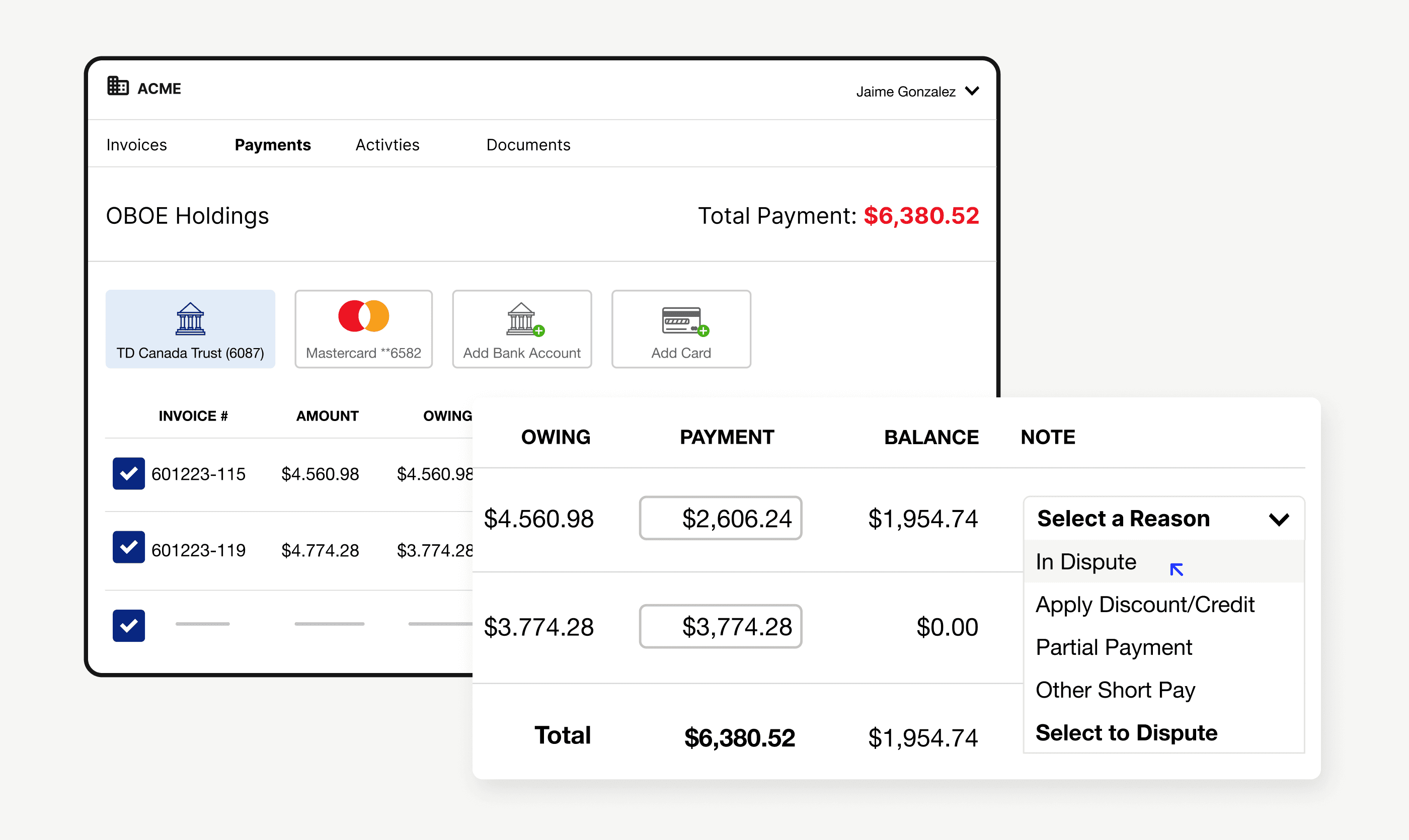

With payment automation, you enable your customers to pay you directly by clicking on an electronic invoice, or accessing a secure payment portal where your team centralizes documentation for quick invoice approval and payment.

With a powerful payment processing solution in place, your customers can save time and money, communicate with you more efficiently, and reduce the errors and frustrations that can arise from manual data entry, fragmented email threads and voicemails, and the cumbersome process of sending physical checks or providing credit card details over the phone.

Accounts payable teams face many challenges without payment automation—and so do you

Without the convenience of payment automation, AP teams face many challenges that ultimately affect YOUR business’s cash flow. These include:

Increased time and cost to make check payments by mail or through lockboxes

The need to repeatedly input banking information manually

The need to call you for credit card payments

The need to send remittance information separately

Increased disputes when remittances don’t align

Just think about what it takes to process manual invoices and payments. The very nature of the process introduces the risk of inaccurate invoice amounts, incorrect check amounts and recipient information, and other errors and inefficiencies that lead to payment disputes, credit holds, and even a loss of trust between you and your customers.

Because the manual payment process is completely dependent on uncontrollable variables such as mail delivery and the availability of key people to handle physical documents, it can often take several weeks to complete. Here are all the steps involved in a typical manual payment process:

Receiving the invoice: This can typically take several days, depending on mail delivery time and your client’s process for distributing incoming mail.

Verifying the invoice: The time it takes to review an invoice for accuracy and legitimacy can vary widely. It may take a few days if all the necessary information is readily available, or longer if discrepancies exist or your client needs additional information.

Recording the invoice: Recording the invoice in your customer’s accounting system can generally be done within a day or two, assuming your customer has the necessary details.

Obtaining approval: Approvals may take a few days or longer, depending on whether the appropriate individuals are available for review and authorization.

Preparing the payment: Once the approval is obtained, preparing the payment can typically be done within a day or two, assuming all the necessary information is available.

Printing the check: Checks can usually be printed within a day, assuming the necessary details are pre-filled and check printing software is available.

Reviewing and signing the check: The time it takes to review, sign, and date a check depends on the availability of the authorized individual.

Matching the check with the supporting documents: Matching checks with corresponding invoices and other documents can be done within a day, assuming all discrepancies have been resolved and additional information has been obtained.

Mailing the check: The time it takes to mail a check to you can vary depending on the mail service used and your customer’s location. It may take a few days for regular mail or less time if a secure mail service is used. Sending checks to a lockbox can add even more time to the process, too.

From the accounts payable perspective, it’s often difficult to know if an invoice is waiting for them, or whether the checks they’ve sent have been received, deposited, and cleared. Credit holds, whether placed on accounts because of delayed checks or confusion about which payments are applied to which invoices, can strain your customer relationships and prevent them from buying more from you.

On the accounts receivable side, the process can be just as frustrating. Once you receive a check in the mail, you have to:

Record the payment

Deposit the check

Reconcile the payment with the corresponding invoice

Post the payment to your customer’s account

Send a payment receipt

These additional steps add anywhere from a few days to a week or more to the entire payment process: Not very efficient or effective when it comes to cash flow!

What’s more, if you don’t receive a check by the time you think you’re supposed to, you may put an unfair credit hold on an account or reach out to your customer asking for payment, only to get an exasperated “I’ve already paid” in response.

Manual payments are on the way out

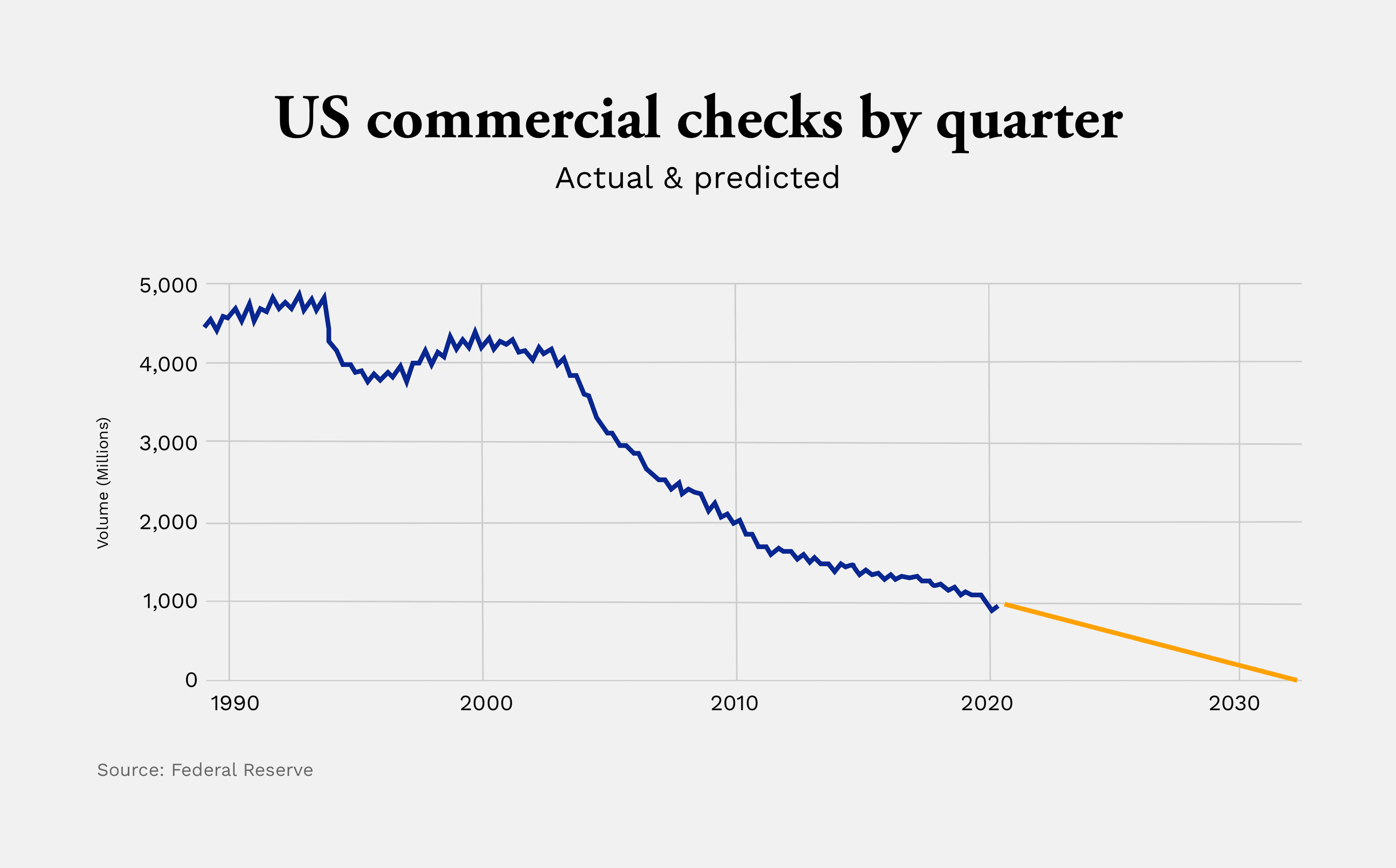

Despite the time and effort it takes to process checks and other manual payments, US businesses still process nearly a billion paper checks each year.

The good news is that manual payments have been steadily declining since the mid 1990s. And, if the trend continues, manual payments will be completely phased out within the next decade or so.

The benefits of payment automation

By offering more efficient and technologically advanced payment methods, you can help your customers overcome their manual payment challenges and optimize their AP workflows. This, in turn, benefits your business with faster, more accurate payments.

Here are the five main benefits of payment automation for your customers that ultimately lead to advantages for your business.

1. Enhanced accuracy and timeliness

Because payment automation solutions are integrated with your accounting or ERP software, invoice and other data is transferred accurately in real time. This eliminates the need for manual entry, reduces the risk of errors, and ensures that information for financial reporting and analysis is at everyone’s fingertips.

Payment automation solutions can also be configured to route invoices for approval based on predefined workflows, ensuring that the relevant individuals or departments are notified promptly for timely review and approval.

2. Quicker invoice processing

By eliminating manual tasks and offering electronic payment options such as ACH transfers and credit card payments, payment automation solutions dramatically reduce the time it takes for invoices to be received, approved, and paid.

Payments can even be scheduled in advance, based on predefined due dates and vendor terms.

3. Improved visibility and reporting

Automated payment systems provide real-time visibility into the status of invoices, allowing you and your accounts payable counterparts to track and monitor the progress of each invoice. This visibility helps identify bottlenecks or delays and allows for timely follow-up to keep the process moving quickly.

What’s more, real-time integration with your ERP or accounting software ensures accurate and up-to-date information for financial reporting and analysis, so you can identify even more areas for cash flow optimization.

4. Reduced administrative costs

Payment automation systems eliminate the need for envelopes, postage, and other expenses related to paying by check. They also free up accounts payable and accounts receivable professionals to spend more time on higher-value activities.

Just listen to what our customer, Domonique Ford, has to say about how Versapay’s payment automation system enables her to re-deploy her skilled team to do more impactful work.

5. Strengthened vendor relationships

By offering payment automation to your customers and accepting electronic payments from them, you’ll play an active role in strengthening vendor relationships by improving communication, reducing frustrations, and building trust.

According to The Impact of Customer Experience on B2B Payments—a recent study of 1,000 C-level executives at B2B companies with more than $100 million in accounts receivable—more than 70% of those surveyed (including more than 80% of CFOs) expressed concern that their AR departments aren’t customer-oriented enough.

As more business buyers adopt more efficient payment methods (such as virtual cards, credit cards, and ACH) and continue automating their payables processes, it’s become even more important for their business partners to have similarly automated and efficient procedures in place to receive those payments.

Payment automation “reduces the slippage or the friction points that can occur in accounts receivable,” says Versapay CFO Russell Lester. “It’s also an opportunity for the AR team to be viewed as part of what can delight the customer and solve the ‘AR Disconnect’ that can lead to nonpayment or future loss of business.”

Payment automation in action

Companies that offer digital payments to customers get tremendous results. Here are just a few examples from satisfied Versapay clients:

Boston Properties, the largest publicly traded owner, manager, and developer of commercial real estate in the U.S., used payment automation to shift a greater volume of rent payments from cash and paper check to predictable and scalable digital payments. In addition to saving $1,200 per month by eliminating paper invoices and eliminating the need for full-time collection activities, Boston Properties collects 99% of its payments digitally on time.

The AR team at a leading U.S. computer and network security solution provider only had time to pursue overdue payments on invoices greater than $100,000, which left a lot of extra debt on the table. After implementing payment automation from Versapay, 99% of the company’s customers paid on time through a new digital, cloud-based payment portal, tripling revenues and giving 50 hours a month back to the accounts receivable team.

TireHub, a distribution logistics company, had a lot of problems staying on top of receivables. After encouraging digital payments through a customer portal, TireHub cut the value of severely overdue accounts in half and saved 200 hours of paid contract support every week.

The Research and Productivity Council (RPC) had $800,000 worth of invoices more than 90 days overdue, in part because the company couldn’t support multiple payment methods. After embracing payment automation, RPC slashed the number of accounts with invoices 90+ days past due by 70%.

The more you give, the more you receive

By creating a digital payment environment—with electronic invoicing and payment processing software—and by giving your customers more flexible ways to pay you, easier access to the documents they need, and fewer reasons to raise disputes, you’ll be a hero in their eyes. You’ll save them lots of time during their work day, and you’ll help them eliminate the direct and indirect costs associated with check payments and manual processing.

Perhaps even more importantly, you’ll also improve your own team’s efficiency by automating mundane tasks and opening more effective communication channels with your AP counterparts. Oh yeah, and you’ll improve your business’s overall cash flow!

It really is a classic case of the more you give, the more you receive: So let Versapay help you make the move to payment automation today. Contact us to schedule a demo now.

About the author

Ben Snedeker

Online Payments

Get learnings on how to integrate online payment acceptance into your AR.