How to Choose Between Automating and Outsourcing Accounts Receivable

- 12 min read

The finance talent shortage is increasing workloads on incumbent professionals.

This article walks through the key ways to determine whether you should automate or outsource accounts receivable to make the best choice for your business, and do more with less.

As the talent shortage increases workloads on incumbent professionals, company executives are viewing accounts receivable (AR) in a new light. Given its critical contribution to cash flow efficiency, outsourcing accounts receivable can offer your company several benefits but is not the only way to increase AR efficiency. Automation is an equally great choice.

But which option should you choose?

As a rule of thumb, choose the option that positively impacts customer experience (CX) the most since CX and invoice-to-cash (I2C) efficiency are linked.

In this article, we explore situations where outsourcing accounts receivable makes sense and ones where automation is a better solution.

Table of contents

- 6 situations where outsourcing accounts receivable is the right solution

- 5 situations where automation is the right solution

- How accounts receivable automation helps you do more with less

6 situations where outsourcing accounts receivable is the right solution

Outsourcing accounts receivable is a great way to build efficiency in your AR processes. With efficient receivables, you can bring cash onto your books quickly and get a clear picture of your working capital. Here are a few situations when outsourcing AR can help you realize these benefits and create a positive customer experience:

Your accounts receivable department is small (1 to 2 employees)

You often have to reallocate staff to other financial roles

You do not want to assume technological costs

Your business has extreme seasonal invoicing peaks

You need specialized services within accounts receivable

You want to test the waters before scaling accounts receivable

1. Your accounts receivable department is small

Small accounts receivable departments tend to wear multiple hats. For example, an AR team member might process invoices while handling accounting and growth projections.

With their time stretched thin, these professionals might not have the space to prioritize delivering exceptional customer experiences through receivables activities, leading to disputes and additional busy work. By outsourcing accounts receivable, you can give your small team more time to focus on activities outwardly tied to revenue.

In the background, an outsourced AR services provider will ensure cash is getting onto your books efficiently and that easily avoided disputes caused by overwork do not hamper customer relationships.

2. You have to reallocate staff to other financial roles

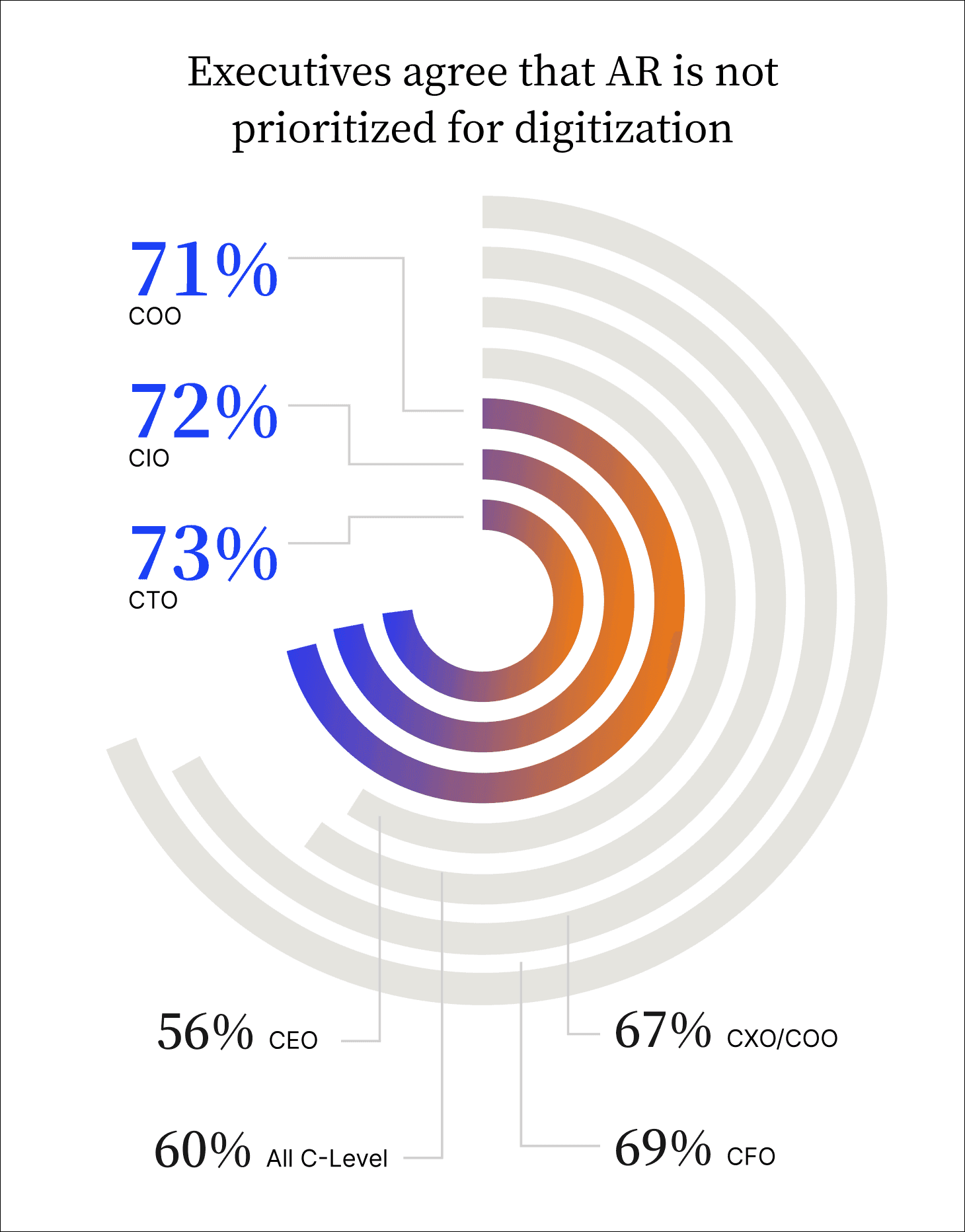

Accounts receivable is a key business driver. However, companies in different growth stages prioritize other departments. For instance, fast-growing companies need help modelling growth and prioritize financial planning and analysis (FP&A) over AR. But generally the issue is pervasive, with 60% of C-level executives recently revealing that they’d not yet prioritized upgrading accounts receivable as part of their digital transformation initiatives (regardless of which growth stage they’re in).

In such situations, outsourcing accounts receivable is a great way to reduce the burden on finance teams. An outsourced AR services provider can issue, track, and collect invoices on your behalf, ensuring you maintain optimal cash flow.

3. You do not want to assume technological costs

The degree of technological investment you're prepared to make is a factor that helps you decide between outsourced accounts receivable and automation. Whether due to budget constraints or a lack of trust in technology, outsourcing accounts receivable makes sense in such instances. Some technological solutions can take time to implement and you will have to train your staff to operate those platforms.

An outsourced accounts receivable service provider can help you avoid those challenges and seamlessly plug into your workflow.

4. Your business has extreme seasonal invoicing peaks

If your business faces extreme variations in sales throughout the year, an outsourced services provider offers a cost-efficient way of executing AR.

Instead of maintaining an accounts receivable department throughout the year, you can handle lighter invoice loads during the low season and leverage a service provider for the bulk of your invoices when sales peak. You will keep costs low and bring cash onto your books efficiently.

5. You need specialized services within accounts receivable

Not every outsourced accounts receivable service provider is created equal. Some providers specialize in niches like credit management or collections. If your company faces issues in specific areas within AR and cannot leverage staff to handle them, using these specialized service providers makes sense. You can rely on their expertise to outsource the troublesome portions of your workflow while you execute the parts you have expertise in.

Dani Sandler, VP of BPO Accounting Services at ScaleNorth offers this perspective on outsourcing accounts receivable:

"Outsourcing accounts receivable gives a company access to professionals that bring leading practices to bear. Some of these practices are a methodology providing internal quality control, automation where available, and improved/consistent communication with end customers. Implementing these leading practices increases accuracy of payment application, reduction of errors and generally provides a better payment experience."

6. You want to test the waters before scaling accounts receivable

Companies must think twice before scaling their AR teams. Scale too fast, and you will increase expenses disproportionately to revenue. Scale too slow, and you'll create CX issues since your receivables team will struggle to cope with the larger volume of customer issues.

Outsourcing AR before scaling is a good way to figure out what your invoice volumes look like and how many professionals you need to process them. Essentially, you can dip your toes in the water before jumping in. This is a cost-effective way of scaling your AR team without breaking the bank.

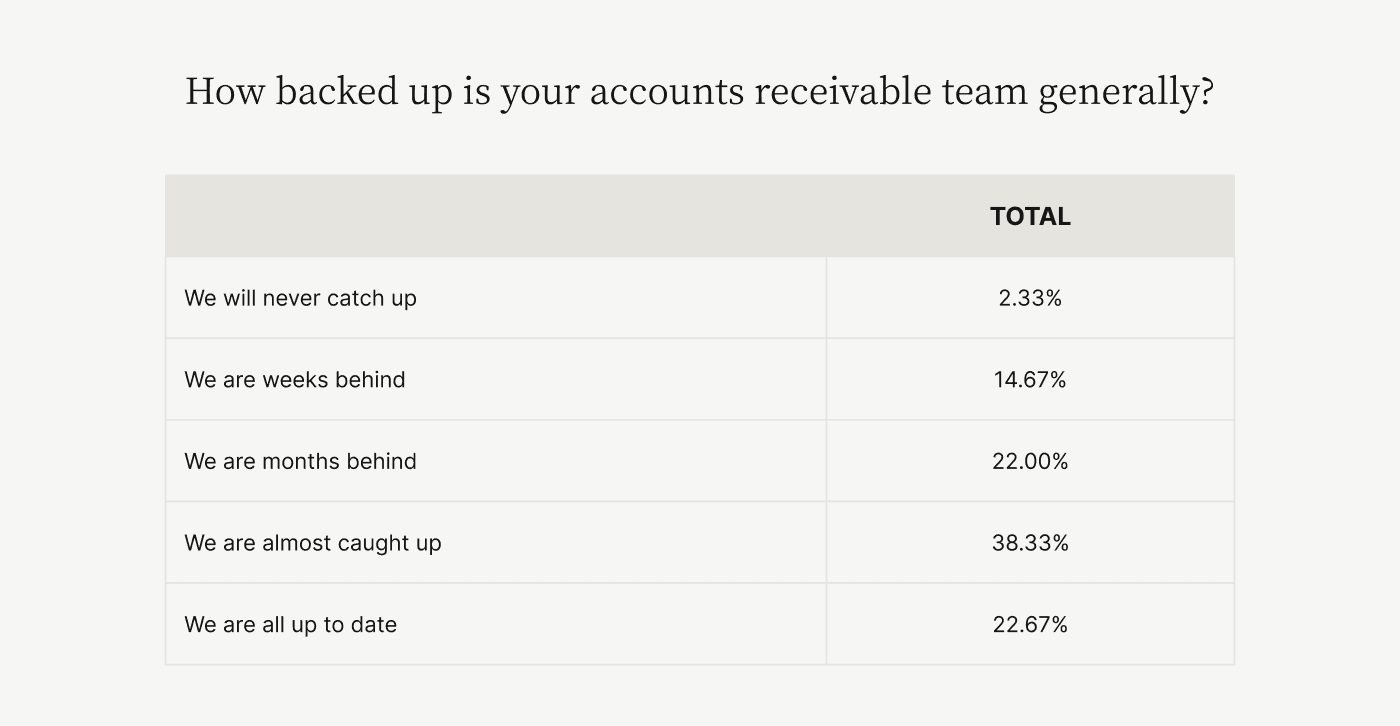

That said, most accounts receivable teams are under water. So, regardless of if you choose to stem the tide through outsourcing, you’ll likely want a solution that unburdens your team:

5 situations where automation is the right solution

As great as outsourcing accounts receivable is, it isn't always the right option. Sometimes what's required is a combination of outsourcing and automation, which Dani suggests blends the best of both worlds:

"AR automation tools, coupled with outsourcing, helps sellers optimize AR activity by leveraging best in breed people, process and technology. The results are improved timeliness, accuracy, compliance and client satisfaction around the payment process.”

Other times automation alone is the best solution. The scenarios below expand on situations where automation offers you the best choice:

You want to position accounts receivable as a key business driver

You want to align your teams around customers

You want more visibility over cash flow

You need to ensure data privacy and confidentiality

You want accounts receivable to scale with your business

1. You want to position accounts receivable as a key business driver

While greater accounts receivable efficiency does not instantly spring forward as a CX driver, customers deal with accounts receivable almost as much as they interact with sales. And unfortunately, AR and finance are not doing a great job.

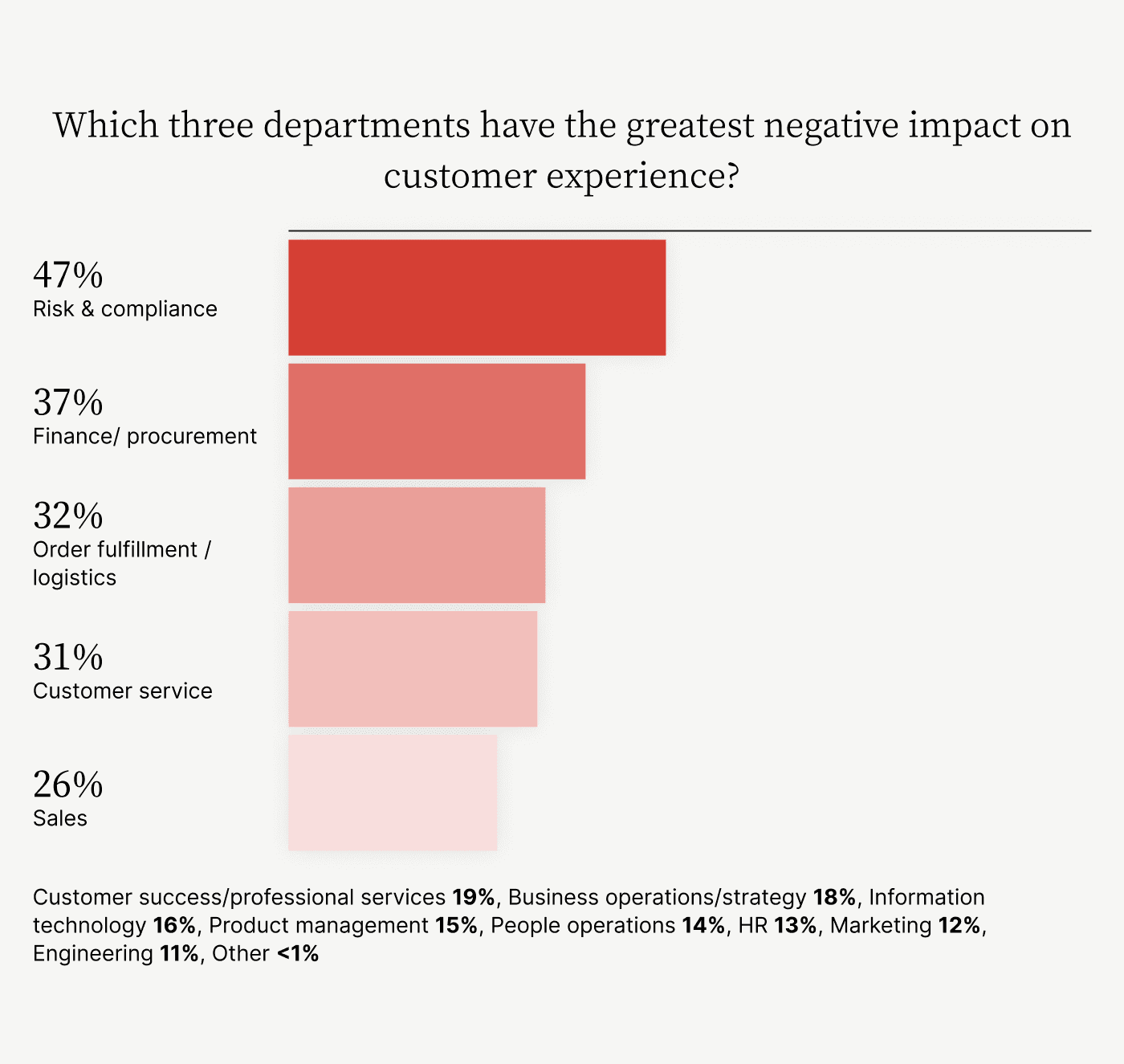

Our survey on Gartner's Peer Community platform revealed that 37% of CFOs believe finance has a negative CX impact, with compliance occupying the top spot (a finance-adjacent function).

Through digitization, accounts receivable professionals can eliminate errors in invoicing, offer quick answers to customer questions, attach relevant documents in dispute-related communication, and give customers visibility into account statuses.

In short, automation transforms accounts receivable from a back-office function to a critical CX driver.

2. You want to align your teams around customers

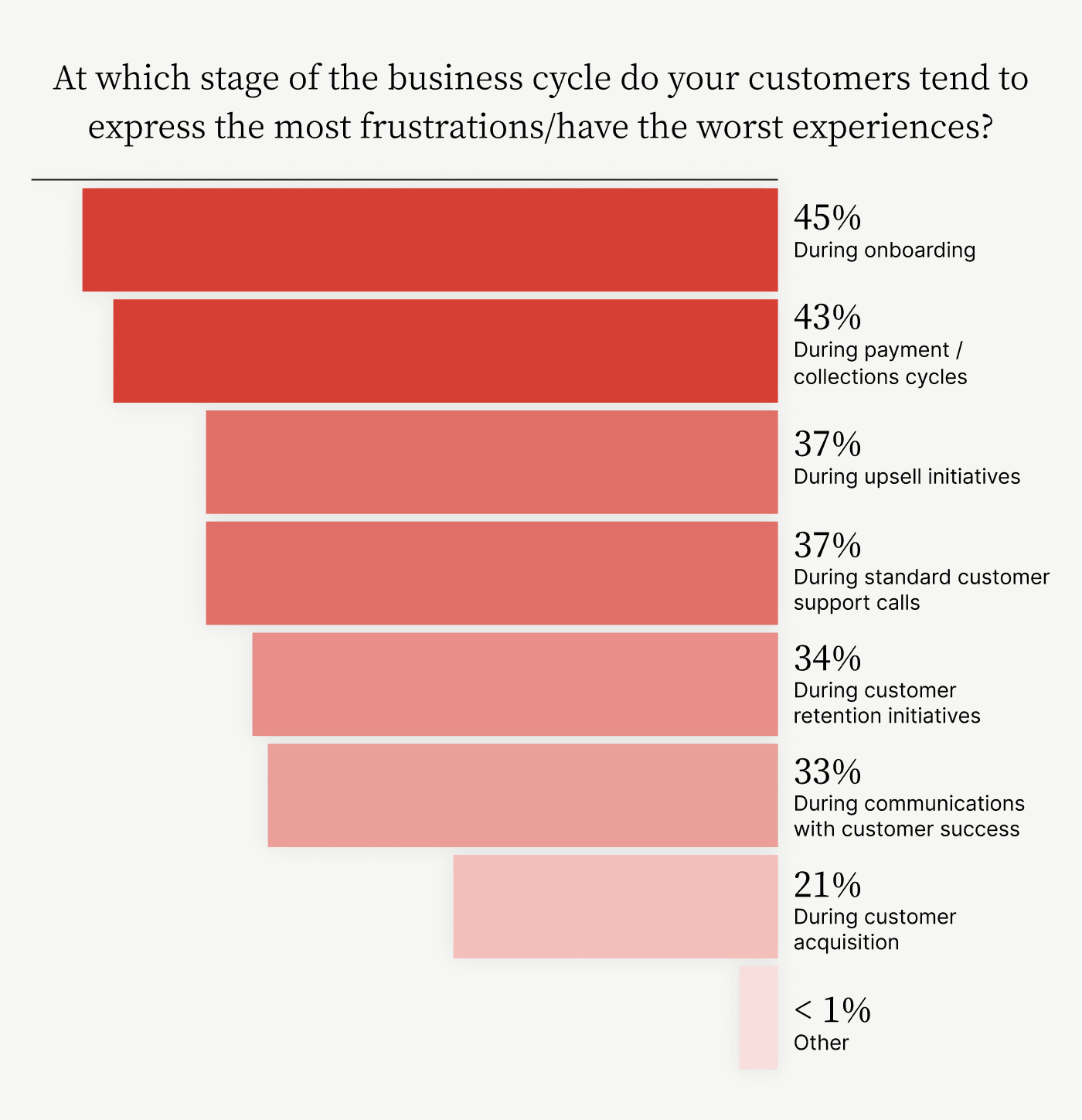

Payments are one of the most frustrating portions of the business experience. That same study with Gartner’s Peer Community bears this out:

What causes frustration at this point? Here are a few reasons:

Basic invoicing mistakes like incorrect pricing or wrong order quantities.

The inability to dispute a line item while clearing the rest of the invoice.

Multiple email threads involving accounts receivable and sales without cohesive information related to a dispute.

Poor transparency caused by accounts receivable working with incomprehensible spreadsheets.

Automation can solve all of these issues.

Instead of opening multiple spreadsheets and searching for relevant order data, AR teams can access it with a click of a button on a centralized platform. And instead of creating invoices manually, an AR automation platform can pull data from order management systems, populate invoice templates, send payment reminders, allow customers to open disputes flexibly, and post cash back to your ERP.

The result? Your accounts receivable team has more time to understand customer issues and solve complex problems. With AR teams aligned around customers, better CX is inevitable.

3. You want more visibility over cash flow

At first glance, you might think you have little control over how quickly cash gets onto your books. After all, you cannot control when your customers release payments. However, you can take several steps to increase the likelihood of an on-time payment.

For instance, you can remove manual cash reconciliation processes by using technology to scan remittance advice and apply payments to open invoices. When combined with other AR automation features such as automated invoice creation, you’ll reduce disputes, and experience better DSO and more efficient collections.

More accuracy in your cash flow projections is another—of many—added benefit of automating accounts receivable. By capturing cash accurately and quickly, your company can build projections on error-free datasets that offer as close to a real-time view of your cash positions as possible. For example, Versapay's client, RPT, automated collections and views progress via a real-time dashboard. In turn, this data powers real-time accounts receivable aging reports and invoice statuses.

4. You need to ensure data privacy and confidentiality

Companies concerned about customer data privacy and security will find automation a better option compared to outsourcing. Outsourced service provider systems are not in your control. In contrast, automated accounts receivable solutions are tailor-made to protect your data and are frequently updated to comply with the latest standards.

Every platform adheres to PCI-DSS regulations that protect customer data during payment cycles. This way, you can accept payments from different channels while always protecting your customers' sensitive information.

5. You want accounts receivable to scale with your business

Most automated accounts receivable platforms are built to serve companies of all sizes. This means the platforms scale with your business as invoicing volumes grow. Some of the ways accounts receivable automation platforms scale with you are:

Enabling asynchronous communication to account for remote work situations.

Scaling data storage needs automatically based on processing volumes.

Offering custom workflows to cater to changing needs.

Offering functionality like cloud-based payment portals, and enabling payment acceptance via different rails like ACH, credit and virtual cards, and eChecks.

Lastly, an automated platform will help you give more time back to your AR team despite processing volumes growing. In contrast, an outsourced services provider will lack the flexibility you need to cater to a large customer base's accounts receivable needs.

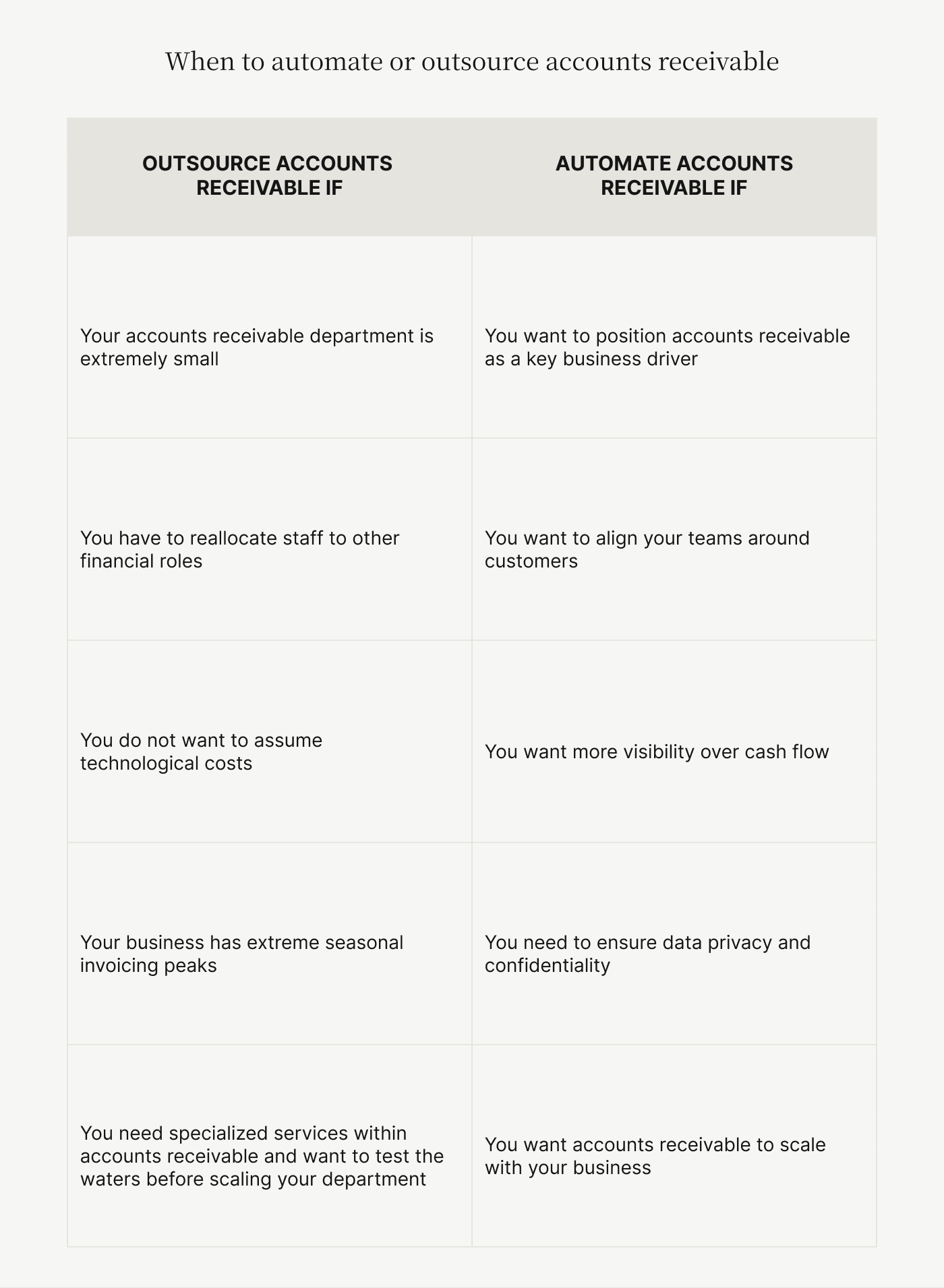

Here’s a handy cheat-sheet for when to automate or outsource accounts receivable:

How accounts receivable automation helps you do more with less

Despite the talent shortage in finance, you can do more with less. Automation technology in accounts receivable helps you remove tedious tasks from your workflows and helps your AR team build more efficiency in their daily tasks.

Here’s a highlight of a few ways accounts receivable automation can help your company:

Automate rote tasks—Manual tasks like creating invoices, matching remittance data, and sending collection follow-ups increase your expenses since you're tasking highly qualified AR professionals with them. Instead, automate them and let your AR team add value to your business. It's how North Atlantic International unlocked $10 million in revenue.

Reduce errors that produce more work—Manual workflows create easily avoided errors due to fatigue from overwork. These errors lead to disputes that soak precious time. Automation removes these errors and helps your AR team focus on tasks that move the needle.

Enable customer self-service—Instead of answering customer emails that need simple data retrieval like account statuses, what if you could help customers self-serve and view this data themselves? Cloud-based accounts receivable payment portals help you deliver account visibility to customers, build strong relationships, and help your AR team bring cash onto your books faster. You could save over 200 hours each week, as a result.

Versapay's automated accounts receivable platform helps you reduce errors, get paid faster, and build strong customer relationships. Learn how AR automation can take your workflows to the next level.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.