A Guide to Choosing the Best Accounts Receivable Software

- 11 min read

Our in-depth guide reveals how to evaluate and select the best accounts receivable software to streamline your AR processes and fulfill your business needs.

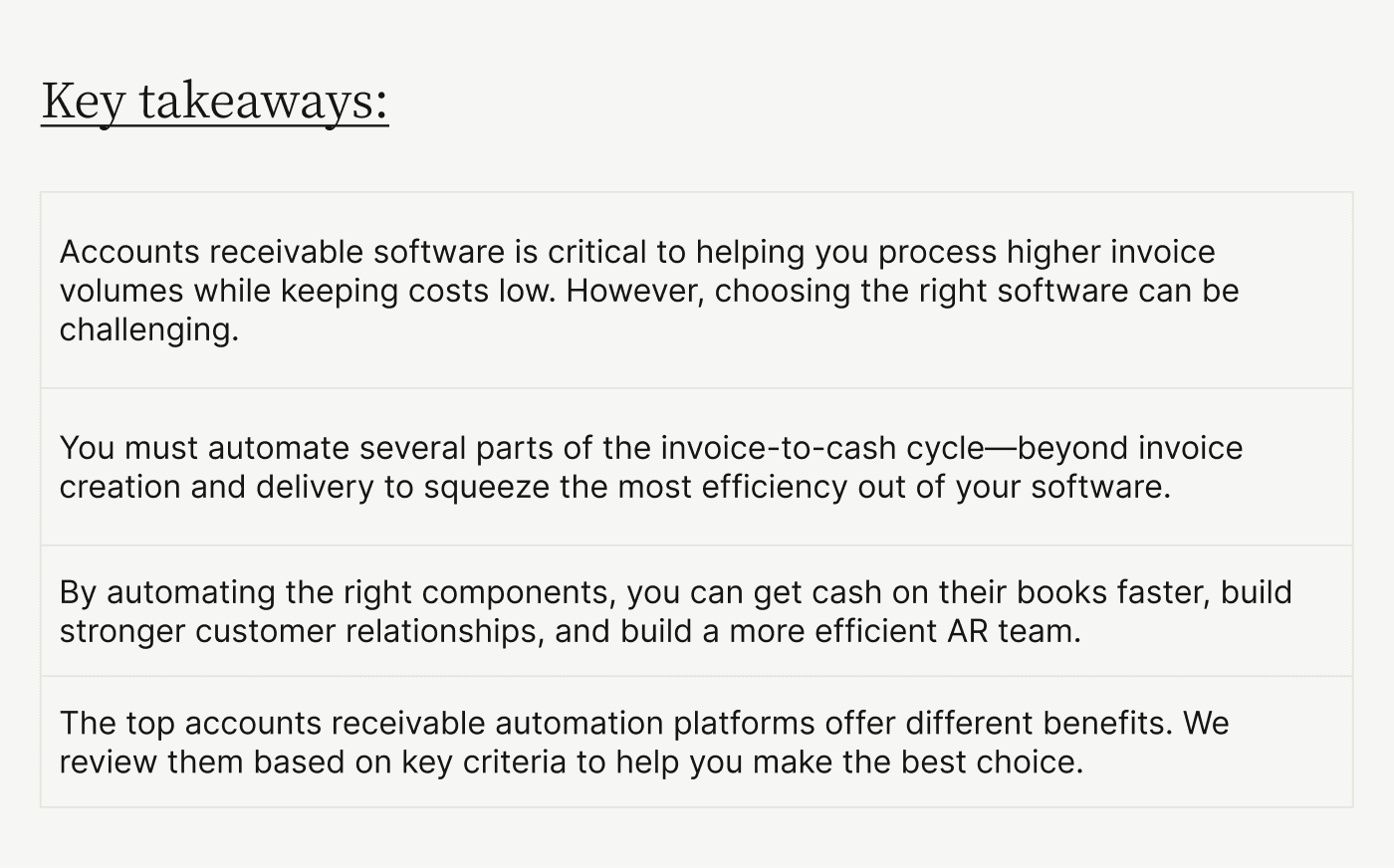

As economic conditions and a talent shortage push companies to do more with less, accounts receivable is quietly emerging as a difference-maker. Companies that build efficient processes with accounts receivable automation software can save money, deliver exceptional customer experiences, and process higher invoice volumes despite running lean AR teams.

But how do you choose from the top accounts receivable software platforms? In this article, we look at the criteria you must evaluate and review four top AR automation software platforms.

Table of contents

What is accounts receivable automation software?

Accounts receivable automation software automates the most tedious and repetitive tasks in the AR process, helping companies apply cash to their books faster, build better customer relationships, and scale their accounts receivable teams.

Here is a breakdown of what is AR automation software and what is driving companies to automate their accounts receivable workflows.

The benefits of AR automation software

Accounts receivable automation software offers the following benefits:

1. Reduces manual labor

AR automation software gives your team its time back by automating rote tasks. The result is greater attention to value-added tasks that increase cash flow insights and build customer relationships.

2. Accelerates cash flow

With less time spent chasing paper, your accounts receivable team can focus on analyzing cash flow, applying cash to open invoices, and solving complex disputes. You will bring cash onto your books faster, reducing your day sales outstanding (DSO).

3. Eliminate easily avoided errors

Automation software pulls data to create invoices, sends them to customers, and automates payment reminders. With fewer disputes caused by fatigue and stress, your AR team can focus on delivering memorable customer experiences and processing more invoices.

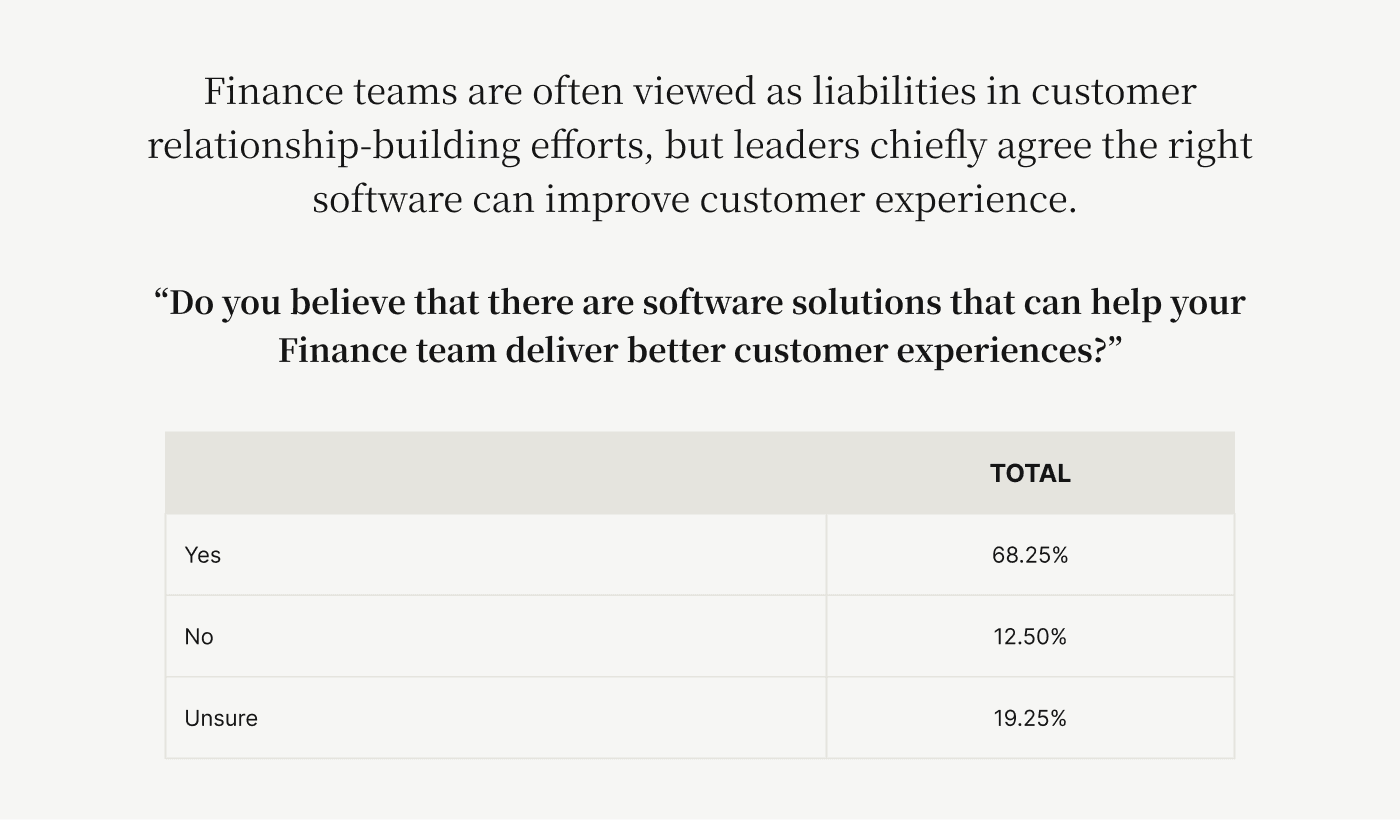

4. Deliver memorable CX

AR automation software centralizes all your pertinent and supporting data. As a result, your accounts receivable team can refer to and cite relevant documentation when communicating with customers, clarifying information, and solving disputes quickly.

—

Learn more about the benefits of AR automation and the risks of not digitizing your accounts receivable workflow.

The 4 accounts receivable processes you must automate

Before reviewing the top accounts receivable software, take the time to understand which AR processes you must automate. This is because different software platforms automate processes to varying extents.

Evaluating software becomes much easier once you understand which processes you must automate. Here are the four AR processes you must automate to build an efficient AR workflow:

Invoice presentation and account management

Payment acceptance and processing

Collections

Cash application

Invoice presentation and account management

Invoice creation is a no-brainer when choosing which receivables processes to automate. Manual invoice creation often results in easily avoided errors that drain your AR team's time. Look for tools that incorporate electronic invoice presentment and payment (EIPP).

[Callout: EIPP solutions enable online electronic delivery and receipt of invoices, and facilitate secure payment transactions. Learn more →]

Instead of manually fixing errors like incorrect prices or missing PO numbers, use automation software that pulls data from your order management and ERP systems to populate invoice templates.

Aside from creation, look for accounts receivable automation platforms that help your customers self-serve status requests. Instead of emailing your AR team for updates, help customers view their account statuses, take remedial action, and view upcoming payment due dates.

And use automated payment reminders to encourage faster payments. This prevents your AR team from chasing emails and constantly pinging customers about past-due payments. More importantly, this gives your AR team more time to analyze the reasons behind late payments and fix loopholes that cause them, reconciling accounts quickly.

Payment acceptance and processing

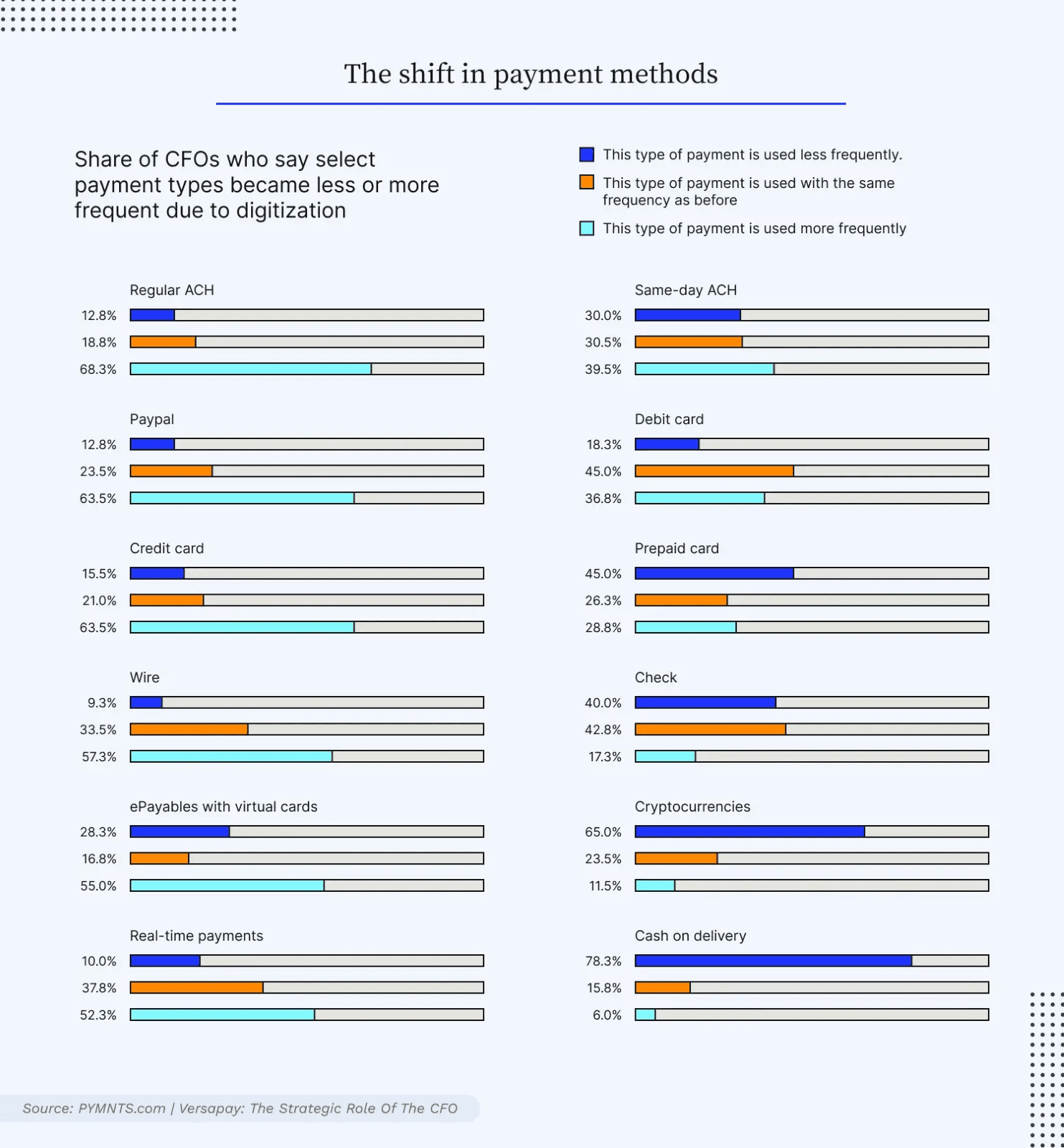

One of the keys to speeding up customer payments is making it as easy as possible for them to pay you. From offering several B2B payment methods (some of which are being increasingly popular due to digitization and changing consumer behaviors) to building flexibility, payment workflows are ripe for automation.

For instance, instead of forcing your customers to pay by check or by card over the phone, integrate your payment acceptance infrastructure with their AP portals. Or even just give them the option to pay digitally using their credit cards, through an online accounts receivable payment portal. Features like these reduce the work your customers must do to pay you, reducing the odds of a delayed payment.

Allowing customers to partially pay invoices and set up autopayments are examples of how flexibility in payments delivers great customer experiences. Automation can help you offer flexibility with minimal lifts from your AR and technology staff.

But do not limit automation to payment acceptance. Instead, extend it to processing too, by integrating payments with your ERP to automate accounting journal entry posting. By automating the payments chain, you'll remove roadblocks for your customers when they pay you and eliminate any need for your AR team to chase payments through endless follow-ups.

Collections

Most accounts receivable professionals will agree that collections are a bottleneck when reducing DSO and posting cash on books faster. Most problems occur when companies task their AR teams with manual collection processes.

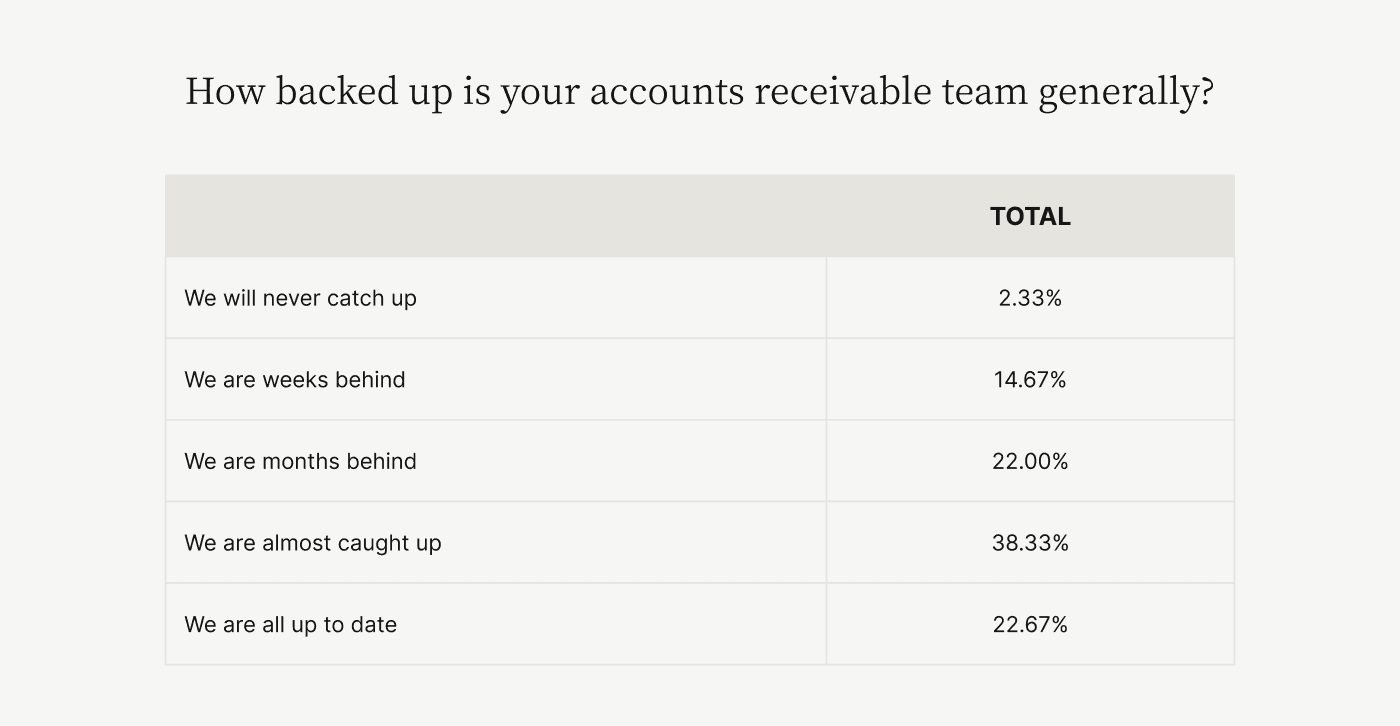

More importantly, they're a time sink. Our research shows that a significant number of AR teams are backed up, with 22% of them months behind schedule. Why?

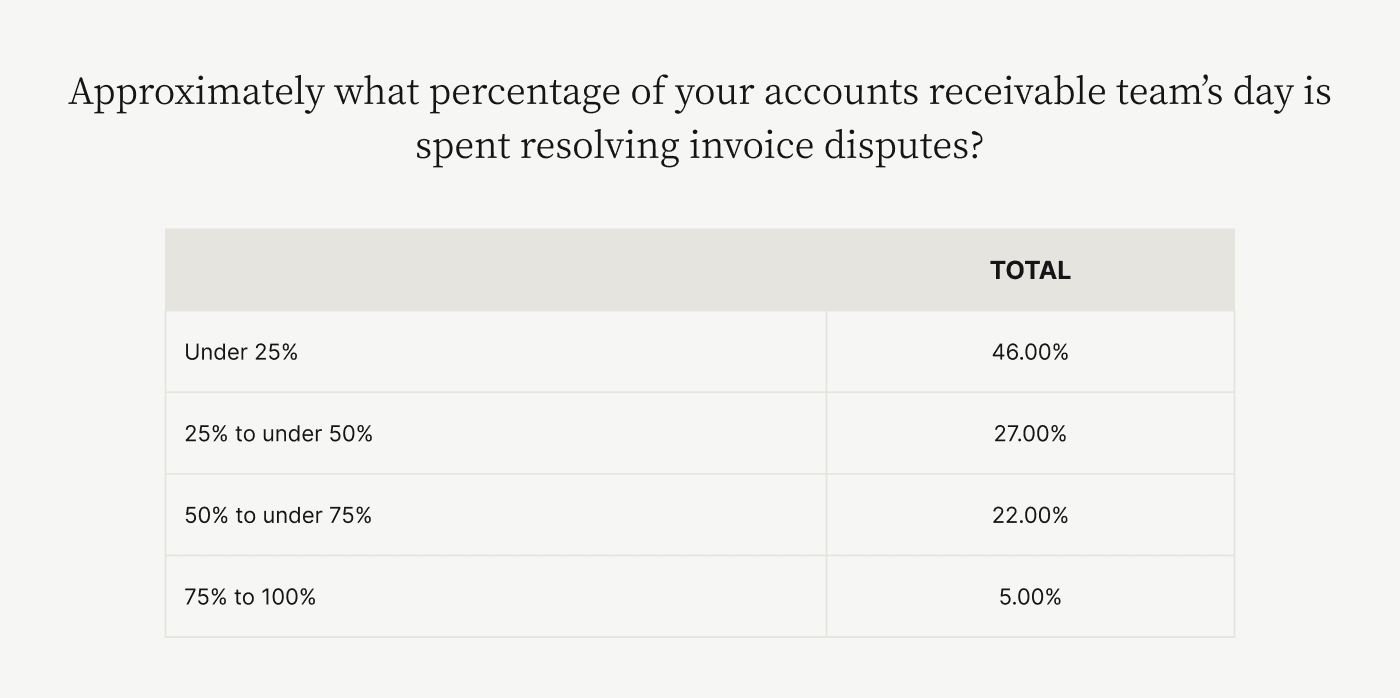

Because manual processes in their workflows are creating errors AR has to undo. More than a quarter of the AR teams we surveyed spend half their day resolving disputes, leaving little time for collections and applying cash to books.

Instead of emailing or calling customers, automated collections can remove any need for such follow-ups in the first place. You can schedule and send payment reminders to customers and offer them self-service portals to view invoice statuses.

You can even create custom rules that introduce a human touch at the right time. For instance, you can automate how collections activities are prioritized by assigning collection calls to an AR team member when an account is past due, despite several reminders.

Automation helps you deploy your resources effectively like this, ensuring your AR team is focused only on the most important collections tasks.

Cash application

Cash application drains accounts receivable teams' time thanks to manual processes. It is also the source of most clerical work in the AR cycle. For instance, matching remittance advice to open invoices is a tedious task that few receivables professionals enjoy.

Instead of tasking highly qualified AR teams to this clerical task, automate it by using software to scan remittance advice, match it to invoices, and apply cash to them. You'll prevent errors caused by fatigue and avoid burning out your employees.

By automating cash application, you can also handle a common source of time sinks in AR—disputes connected to partial payments. Giving customers the ability to pay partially is one thing. However, handling disputes raised on other invoice line items is problematic without software assistance.

An automated platform can give your AR team the right data, down to line items, helping them understand dispute contexts and solve issues quickly.

A checklist to evaluate accounts receivable automation software

To quickly evaluate your accounts receivable automation software choices, we highly recommend using the interactive checklists found on pages 10 through 16 in this free-to-download eBook:

4 top accounts receivable software reviewed

Let's dive in and review the best accounts receivable software platforms you can choose from:

Versapay

HighRadius

Quadient AR by YayPay

Billtrust

Versapay

Versapay's accounts receivable software covers every portion of the invoice-to-cash cycle, automating everything from invoice creation to cash application. The platform takes automation to another level by offering collaborative tools that align your teams around customers, simplifying communication and CX.

A few key features of Versapay's software are:

Payment facilitation and fast onboarding

AI-powered cash application

Self-service account management for customers

Integration with ERP and customer AP portals

Set up customizable payment acceptance, matching, and recurring payment rules

HighRadius

A part of Forbes' Cloud 100, HighRadius is a well-established name in the AR automation space. Catering to large companies, HighRadius offers a customer portal to ease account self-service, integrations to AP portals for automated invoicing and payments, and automated cash application.

While the platform lacks payment acceptance flexibility, it more than makes up for it thanks to the following features:

Customer credit management

Deduction management

Automated collections

B2B Ecommerce integrations

Predictive collections analytics

HighRadius' biggest impact lies in streamlining cash application, with several customers reporting significant time and cost savings.

Quadient AR by YayPay

Quadient AR helps companies reduce DSO and automate the entire accounts receivable workflow. The platform offers cash flow forecasting ability, claiming a 94% accuracy rate. Other notable features of Quadient AR include:

Credit management

Deduction management

Automated cash application

AP portal integration to automate payments

Like HighRadius, Quadient AR is not a PayFac and does not offer quick payment acceptance integration that instead stretches implementation timelines. Other negatives include unintuitive reporting and dashboards. Despite this, the self-service customer portal and predictive cash flow add immense value to companies prioritizing these features.

Billtrust

A well-known provider of cloud-based AR automation software, Billtrust boasts many of the features its competitors do. Like Versapay, Billtrust is a payment facilitator and offers quick customer onboarding.

However, Billtrust doesn't yet offer invoice-level dispute management, something that hurts customer adoption rates. Also, the company’s limited geographic presence and North American-focused support is a limiting factor when companies need advanced implementation and service levels.

Despite these hiccups, Billtrust offers small to mid-sized companies helpful features like:

Customer credit management

AP portal invoicing integration

ERP integrations

Automated cash application

Deduction management

—

With budgets tightening and talent short in supply, companies must do more with less. Accounts receivable automation software like Versapay can help you build more efficient processes, give your AR team more time for value-added work, and solve cash flow woes.

Ready to transform your accounts receivable? Talk with an expert.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.