How to Choose the Best Online Invoicing Software

- 11 min read

Our article walks you through the steps to assess and select the best online invoicing software to automate and improve your business’s accounts receivable tasks.

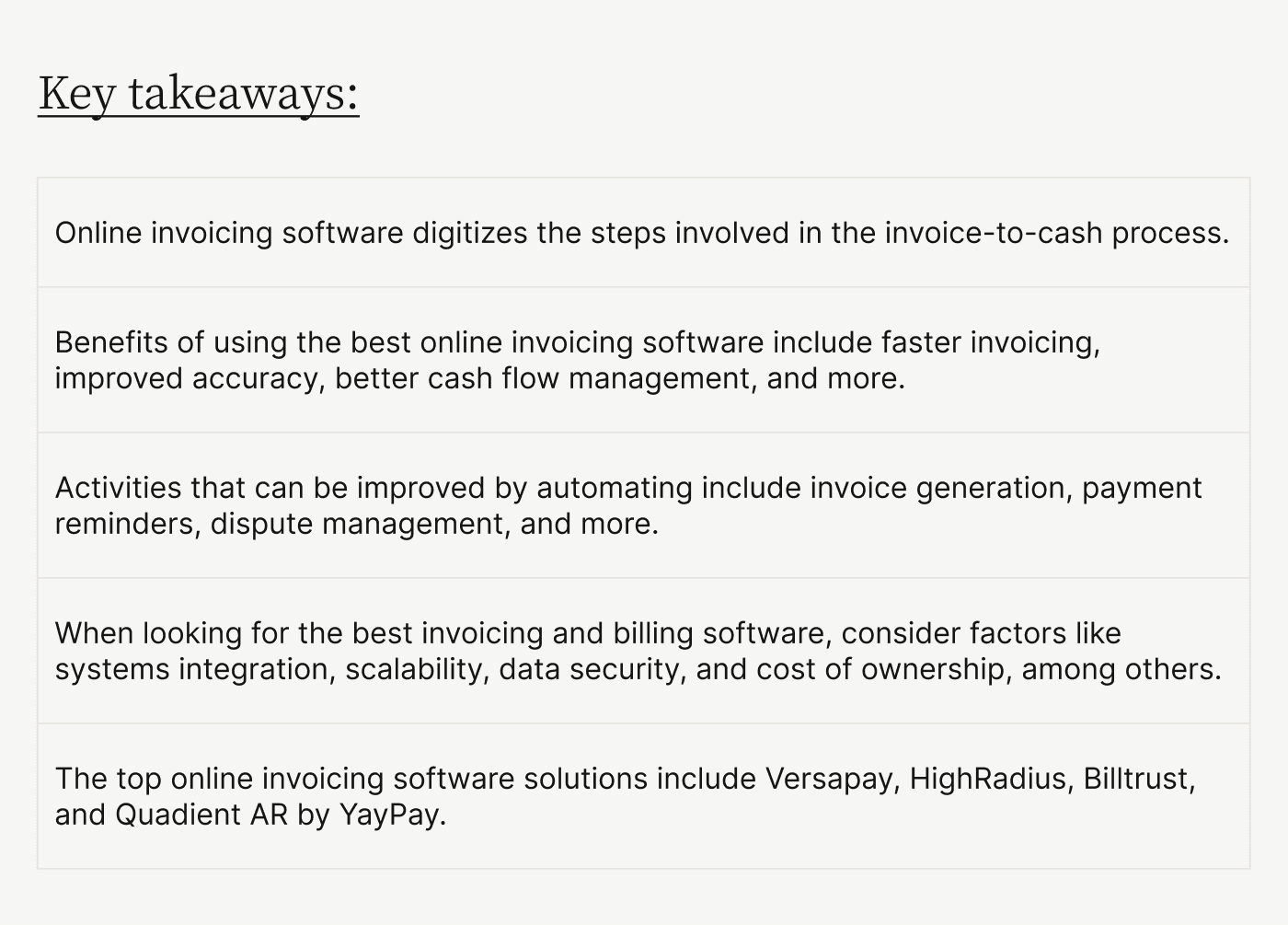

Online invoicing software digitizes the steps involved in the invoice-to-cash process, automating such tasks as invoice creation and delivery, payment-due reminders, and cash application. Your AR team can get invoices out and payments in faster, more accurately, and with fewer resources expended. This streamlined workflow benefits your team, your customers, and your business as a whole.

There are a number of considerations to take into account when launching an AR automation project and looking for the best invoicing software. You’ll want to look at factors such as systems integrations, scalability, data security, and cost of ownership, among other things.

Let’s look at the benefits and impacts of top online invoicing software. We’ll then review what to consider when choosing among the best online invoicing solutions, which include Versapay, HighRadius, Billtrust, and Quadient AR by YayPay.

Table of contents

8 benefits of online invoicing software

Online invoicing solutions help AR teams with a lot of tasks, leading to a slew of benefits that are a boon not only to your finance department but to your entire company. Here are eight benefits that the best billing and invoicing software can offer.

1) Faster invoicing: Automation allows for accelerated invoice generation and delivery, speeding up not only the pace at which invoices go out but also the speed at which revenue comes in.

2) Invoice personalization and modification: These digital tools allow AR teams to efficiently personalize invoices and modify them when needed, a functionality that enables better customer relationships, satisfaction, and loyalty.

3) Improved accuracy: Online invoicing software minimizes the errors associated with manual data entry, increasing the accuracy of the invoicing process and reducing the number of questions, problems, and disputes due to incorrect information.

4) Enhanced efficiency: Manual invoicing is tedious and time-consuming, so automating the many repetitive invoicing tasks leads to increased efficiency and productivity for the accounts receivable team.

5) Better cash flow management: Online invoicing software enables real-time visibility into invoice status and payment reminders, allowing the finance team to have a more accurate, up-to-date picture of projected cash flow.

6) Faster cash application: Automated cash application functionality accelerates cash flow and boosts the bottom line by getting revenue on the books faster and more accurately.

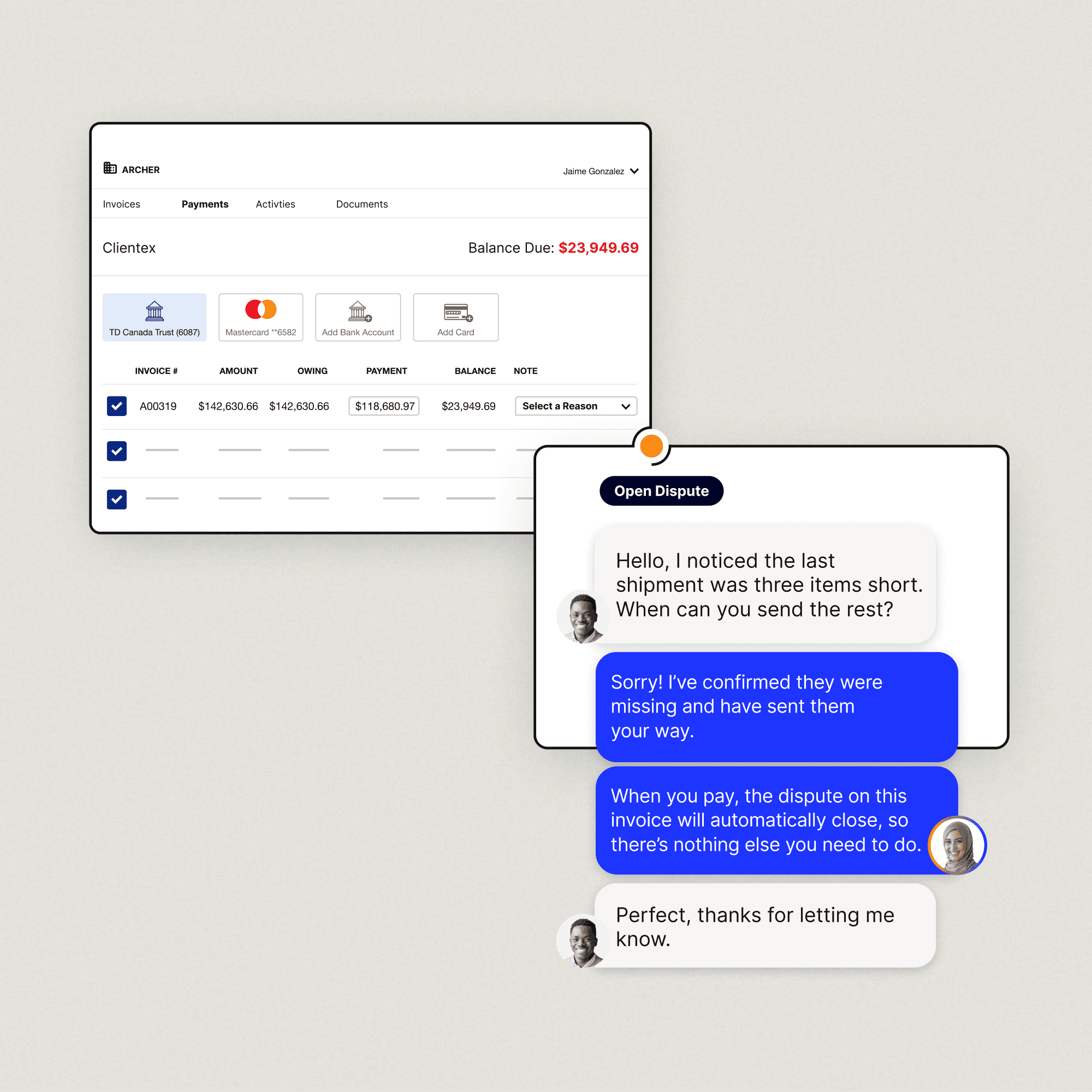

7)Strengthened customer experience: Top online invoicing solutions create a seamless billing experience for customers, who are able to pay using their preferred methods through a digital portal that provides excellent user experience.

8) Stronger collaboration: AR teams can collaborate with their customers over the cloud, in real-time, by commenting directly on digital invoices within the automation tool, enabling more efficient workflows and improved customer relationships.

8 activities improved by online invoicing

The best invoicing software can particularly help with certain components of the invoicing process. These are tasks that tend to be time-consuming, repetitive, tedious, or disorganized. Here are eight tasks that AR teams are especially happy to improve.

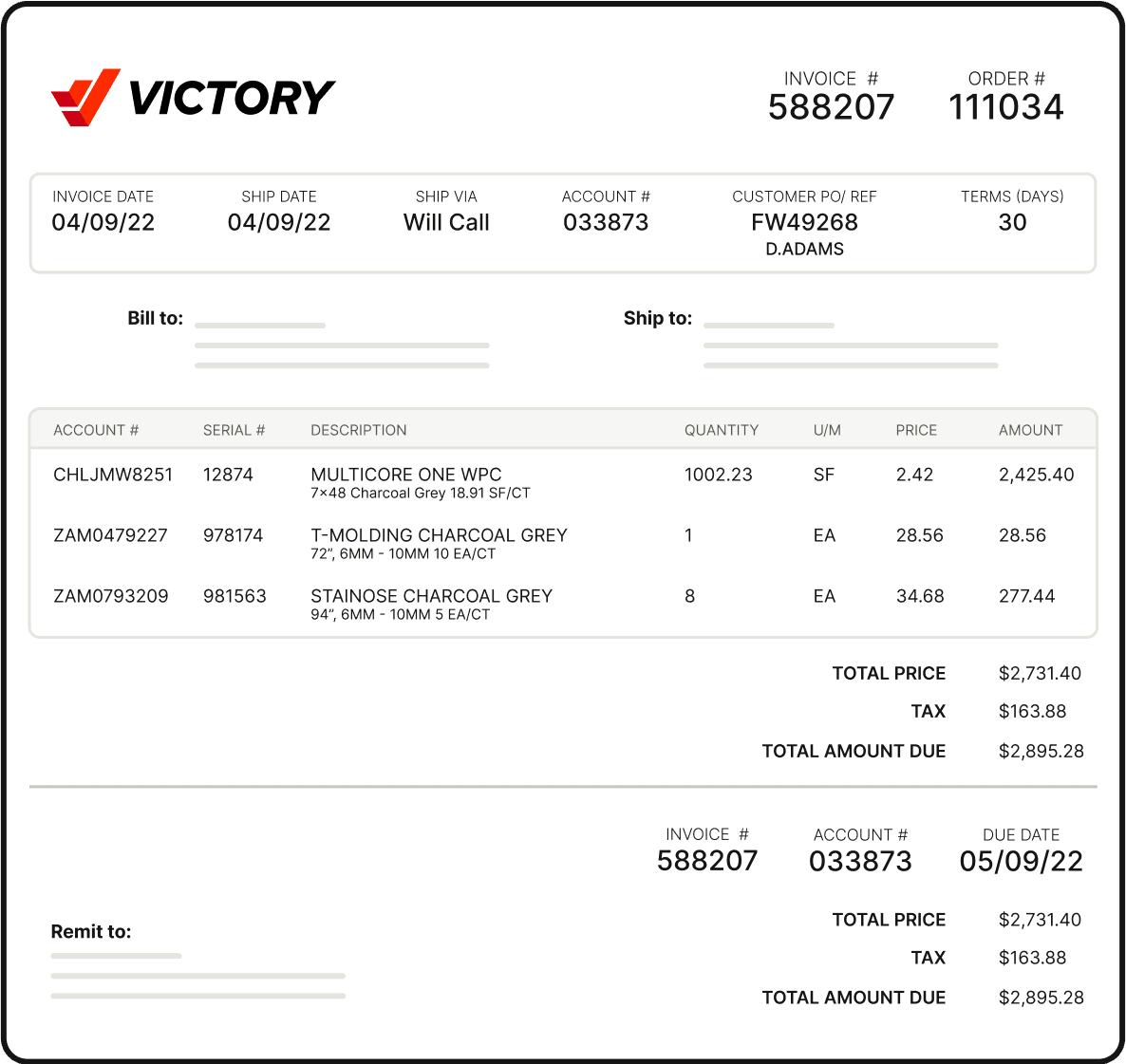

1) Invoice generation: Automation software can create invoices without human intervention, drawing the appropriate data directly from the linked enterprise resource planning (ERP) system. The best online invoicing software will natively connect with top ERPs like NetSuite, Intacct, and Business Central.

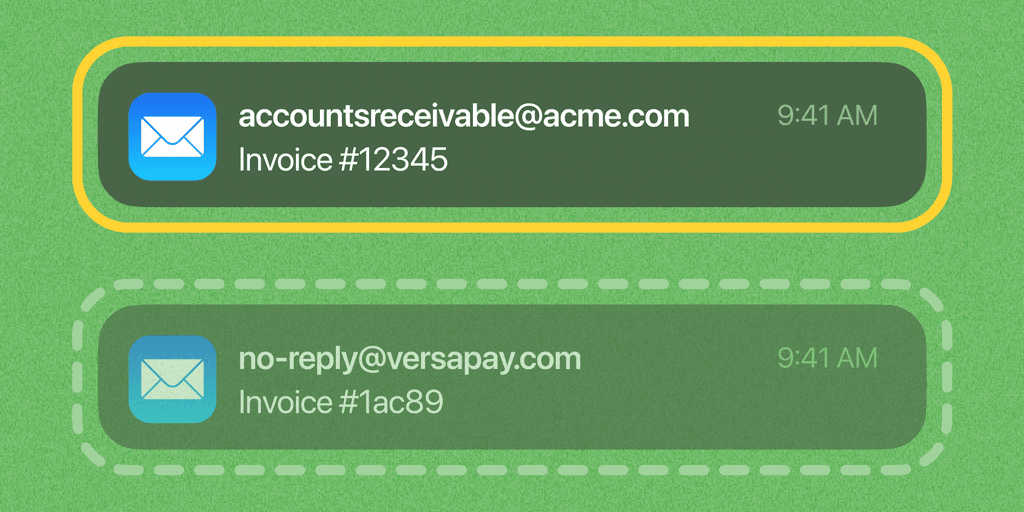

2) Invoice delivery: Online invoicing systems deliver digital invoices automatically, typically emailing a click-to-pay link to the invoice within the system’s customer-facing, cloud-based portal.

3) Payment reminders and follow-up: Online invoicing solutions track when reminders and follow-ups should be sent and deploy them automatically.

4) Client communication: The best invoicing and billing software can facilitate communication with customers at various levels, including the invoice level and line-item level.

5) Dispute management: Online invoicing solutions can help with tracking, managing, and resolving disputes, enabling collaboration and information-sharing in the process.

6) Payment acceptance and processing: The best online invoicing software automatically accepts and processes digital payments (like credit card or ACH) made on the electronic invoices posted within the solution. This removes the need to manually associate physical payments with physical invoices. Those digital payments are then automatically posted back to and reconciled in your ERP.

7) Cash application: Top online invoicing software automates the cash application process, making bookkeeping more accurate and efficient. And the best online invoicing software can deliver straight-through processing upwards of 95%.

8) AR analysis and reporting: Online invoicing solutions provide interactive dashboards making it easy to assess data and critical AR performance metrics at a glance, and generate insights and analysis.

Factors to consider in choosing online invoicing software

There are a number of factors to look at when choosing an online invoicing software. Use our handy evaluation checklists to see a comprehensive overview of everything you can inquire about when making your decision.

Read on to learn about some of the most important elements to consider.

1. System integrations

Ensure that the online invoicing software you choose can seamlessly integrate with your ERP and existing accounting software, as this interoperability is key to ensuring the full functionality of the invoicing solution.

2. Scalability and customization options

Look for an online invoicing solution that can grow with your company and includes robust personalization and invoice-delivery options. Ensuring that invoices are customized and delivered in a manner that works best for their recipients will strengthen customer relationships.

3. Data security and compliance

It is important that your online invoicing software maintain high standards of data security and compliance with any relevant regulations. Check that the system you are considering gives you confidence in this regard.

4. Customer support and training

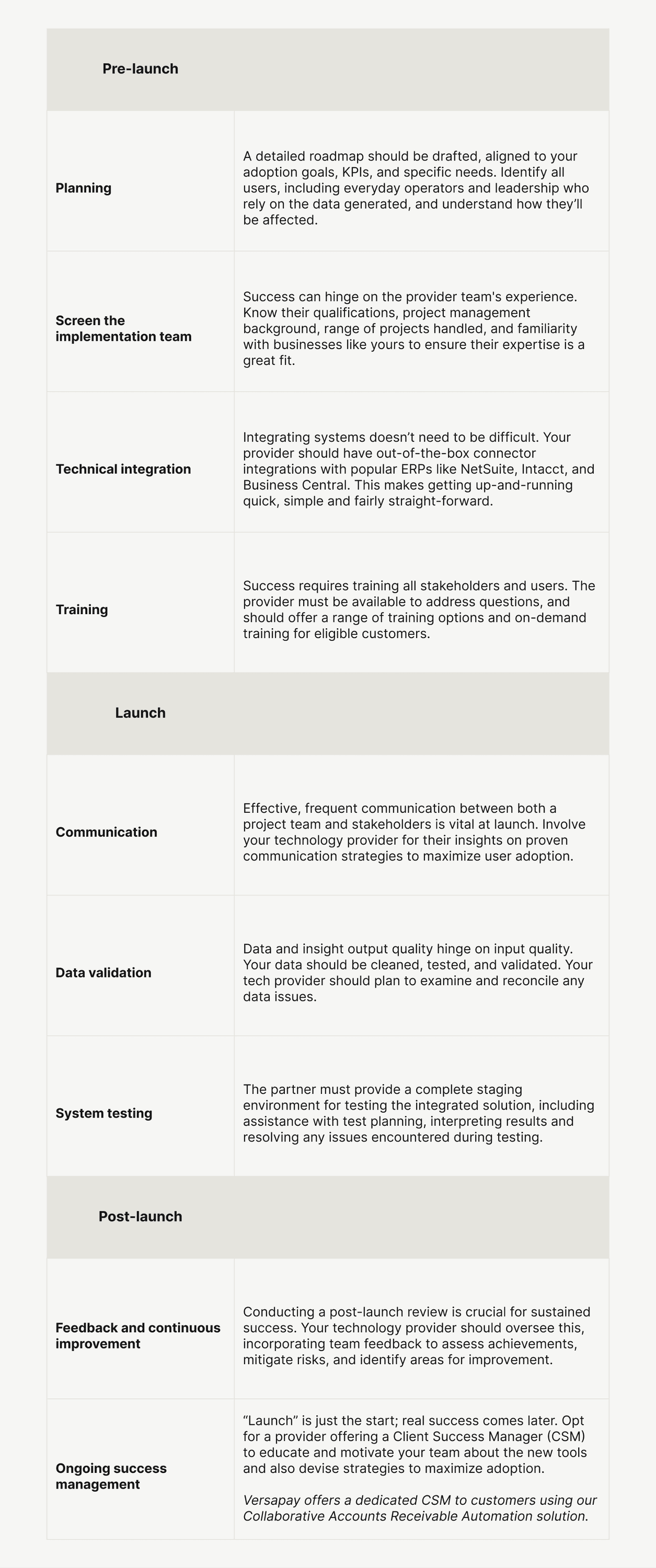

Seek out billing and invoicing software for enterprise that provides support and training for your accounts receivable team to ensure you get the most out of the software, and can get answers to any questions that arise as you integrate it into your workflows. Here are some high-level steps you should follow when implementing such a solution, and the expectations you should have of your provider:

5. Total cost of ownership

While it’s important that your initial investment in an online invoicing software be on budget, it’s also vital to determine cost of ownership more holistically, based on the software's potential impact across numerous categories like administrative savings, customer retention, and bad debt savings. Additionally, total cost of ownership must consider elements like license fees, payment processing fees, implementation costs, and ongoing support and training costs.

Leading online invoicing solutions

There are a number of high-quality providers in the online invoicing software market. Each solution offers unique strengths and caters to diverse business needs, ensuring there’s a suitable option for every organization. Here are four of the most popular:

Versapay

Versapay is focused not only on streamlining and automating most components of the invoice-to-cash process, but also on ensuring that this transformed process benefits your end-customers as well as your back office. Versapay facilitates and automates many tasks, including invoicing, B2B payments, and cash application. The platform also incorporates collaboration tools to enable more efficient workflows for your AR team and allow easier two-pay communication and info-sharing with customers.

HighRadius

HighRadius automates and facilitates many aspects of the invoice-to-cash process, including invoice creation, payment reminders, and cash application. The application’s focus on back office automation over emphasizing customer experience is reflected in the fact that while it offers credit management and deduction management, it lacks invoice-level dispute management and does not facilitate payment.

Billtrust

Billtrust’s software is focused on using automation to make cash collections faster and more efficient. This straightforward approach focuses on cash flow details but fails to include elements that can improve the customer's experience, which may be why it does not have a high customer adoption rate. Billtrust’s static, rule-based workflows limit how well AR teams can prioritize collector activities.

Quadient AR by YayPay

Quadient AR by YayPay’s online invoicing software helps speed up cash flow by automating key features of the invoice-to-cash process. But notably, the software lacks collaboration features that can markedly improve customer experience, and is not a PayFac. The system also cannot provide actionable insights into which customers require immediate attention and intervention.

Get more efficient accounts receivable staff and happier customers

Top online invoicing software can revolutionize your AR function and improve the invoice-to-cash experience for your team and your customers. The benefits accrue not only to those involved in the process but to your entire business in the form of faster cash flow, efficient use of resources, and happy customers.

Choosing the best invoicing and billing software is crucial to get the most out of this technology. Talk to an expert at Versapay and see a demo of how our online invoicing software can help your team transform your AR process and engage customers more effectively and efficiently.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.