How to Enable Credit Card Payments for Invoices (And Why You Should Encourage Digital Payments)

- 14 min read

Helping your customers pay invoices using credit cards is a good decision: it leads to faster payments, less manual work, and a better customer experience.

In this blog, you'll learn how to enable credit card payments for customer invoices.

The demand for efficient and flexible payment options is growing rapidly. According to a survey of CFOs we conducted, 87% of respondents believe their buyers are ready to pay their invoices using digital payments; and use physical payment methods like checks, less often.

More and more buyers are asking, "Can I pay this invoice with a credit card?" And if you're not already offering digital payment options for your customers, you’re missing out on an opportunity to improve your customer relationships, cut down on manual labor, and get paid faster.

Now, as a seller, you might have reservations about credit card transaction fees or changing your established payment processes. Those are valid arguments, however, the advantages of enabling credit card payments for invoices extend far beyond customer convenience. From accelerating cash flow and reducing processing costs, to enhancing security and acquiring valuable insights, the benefits of accepting credit cards—and other digital payments—are many and multifaceted (more on this below).

In this article, we'll explore why allowing customers to pay invoices with credit cards is a smart business decision that can benefit your company’s overall financial health.

Table of contents:

Why enable credit card payments? Because of the many challenges with B2B payments today

Let's take a moment to consider the current state of B2B payments. Check and cash transactions demand considerable manual processing by the seller. And this can delay the completion of B2B payments by weeks or even—as painful as it is to contemplate—months.

Businesses rely heavily on these traditional payment methods—wire transfers included—and while they do still have their place, they often come with a host of challenges. These include:

1) Slow payment cycles — Manual processes can drag out payment cycles due to factors like mail delays, processing time, and manual data entry errors. This can negatively impact cash flow and working capital.

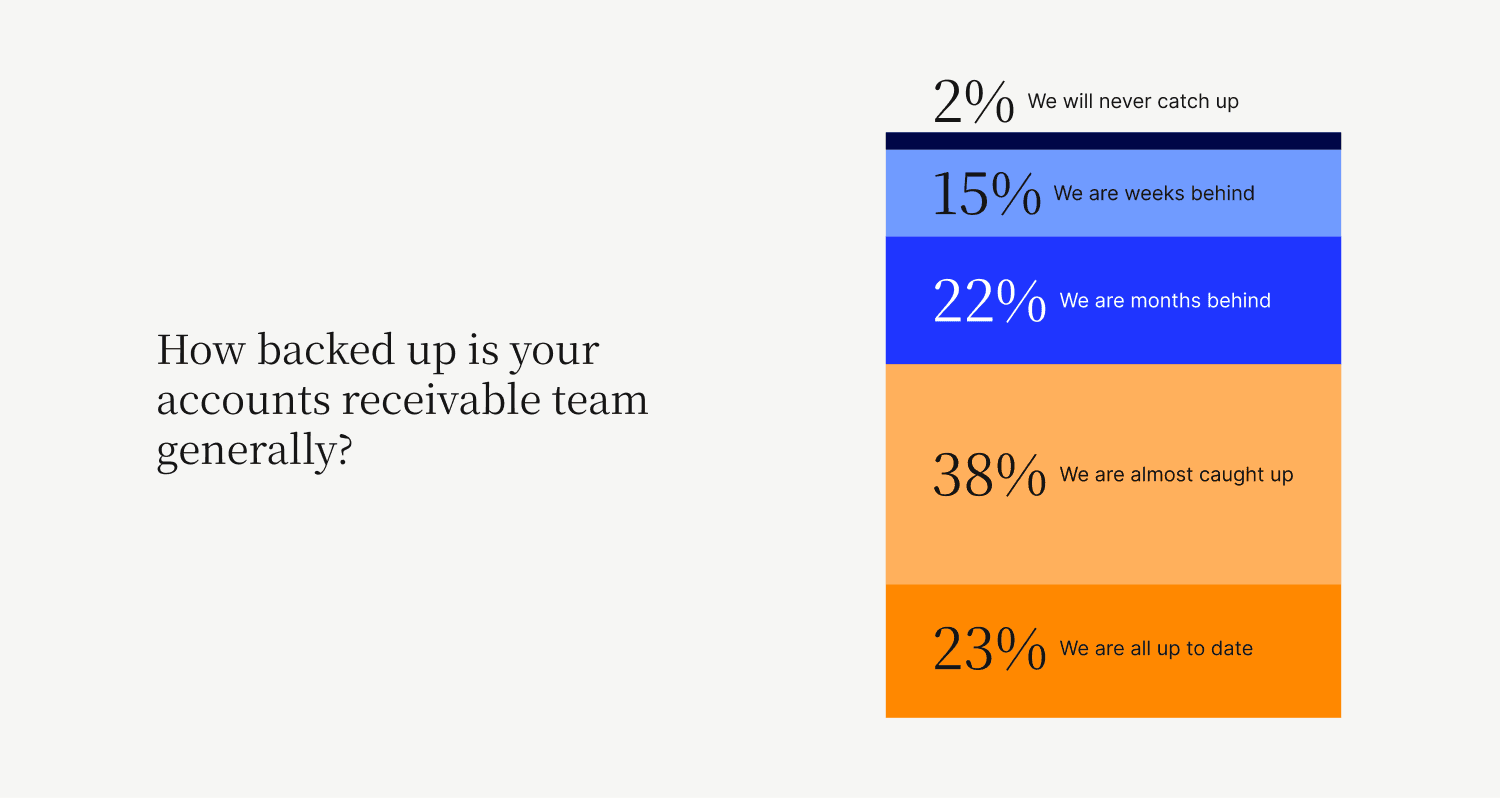

2) Receivables backlogs — Late payments stemming from manual methods and acceptance processes create a domino effect, impacting cash flow and financial planning. In fact, we recently found that 77% of CFOs’ receivables aren’t up to date:

3) Increased costs — The hidden costs of printing, preparing, and mailing invoices, and then processing paper checks add up quickly.

4) Human errors — Manual data entry and payment processing are prone to mistakes that require time to correct, taking staff away from high-value activities. Not to mention, frequent errors and delays can injure customer relationships and increase administrative burdens

5) Limited visibility — Tracking payment statuses of physical payments can be complex, and poorly timed follow ups and payment reminders can annoy customers who’ve already paid. Plus, limited visibility hinders cash flow management and forecasting.

6) Security risks — Paper checks and manual data handling expose businesses to security risks such as fraud, loss, or theft.

7) Poor customer experiences — Outdated payment methods can frustrate modern buyers, especially those who want the ease and convenience of electronic invoices and digital payments.

8) Staff dissatisfaction — Repetitive, manual tasks associated with processing antiquated payment methods can lead to decreased job satisfaction among your accounts receivable team.

Digital payment solutions counter these challenges, making transactions between businesses faster and more efficient. And that’s precisely what sellers are looking for in their payment acceptance solutions. They want to enable their customers to pay invoices using credit cards, they just don’t have the right technologies to accommodate that… yet.

6 reasons why sellers should accept credit card payments

Enabling credit card payments for invoices offers numerous benefits for both your business and your customers. So, if overcoming the challenges of accepting and processing traditional payments isn’t reason enough to accept credit card payments, maybe these additional reasons will convince you:

1) Accelerated cash flow

2) Enhanced security and fraud prevention

3) Improved customer experience

4) More efficient payment processing

5) Data-driven insights

6) Lower costs

1. Accelerated cash flow

One of the most important benefits of accepting credit card payments is the speed at which you receive funds. Unlike checks that can take days or weeks to clear, credit card and other digital transactions are typically processed within a few hours. Rapid turnaround reduces your days sales outstanding (DSO), improving your overall cash flow and financial stability.

2. Enhanced security and fraud prevention

Credit card networks come with built-in fraud detection systems that go far beyond what most businesses can implement for check or cash transactions. Real-time authorization, for example, instantly verifies card validity and available funds, while Address Verification Service (AVS) checks if the billing address matches the one on file with the card issuer. Card Verification Value (CVV) ensures the physical card is in the customer's possession, adding an extra layer of security.

Advanced techniques like tokenization replace sensitive credit card data with unique identification symbols, maintaining security without sacrificing convenience. Plus, smart algorithms work tirelessly to detect unusual spending patterns or potentially fraudulent activities, providing ongoing protection.

By accepting credit cards, you're leveraging these advanced protections to safeguard both your business and your customers. What's more, card payments create detailed digital trails, making them easily auditable and helping ensure compliance with modern financial regulations and standards like PCI DSS (Payment Card Industry Data Security Standard).

This comprehensive approach to security not only minimizes the risk of fraud but also instills confidence in your customers, potentially leading to increased sales and improved customer loyalty.

3. Improved customer experience

Offering credit card payments for invoices provides your clients with greater flexibility and aligns with their preferences for digital payment methods. The accuracy of digital processes also removes human error and minimizes disputes. Happy customers are more likely to pay on time and continue doing business with you.

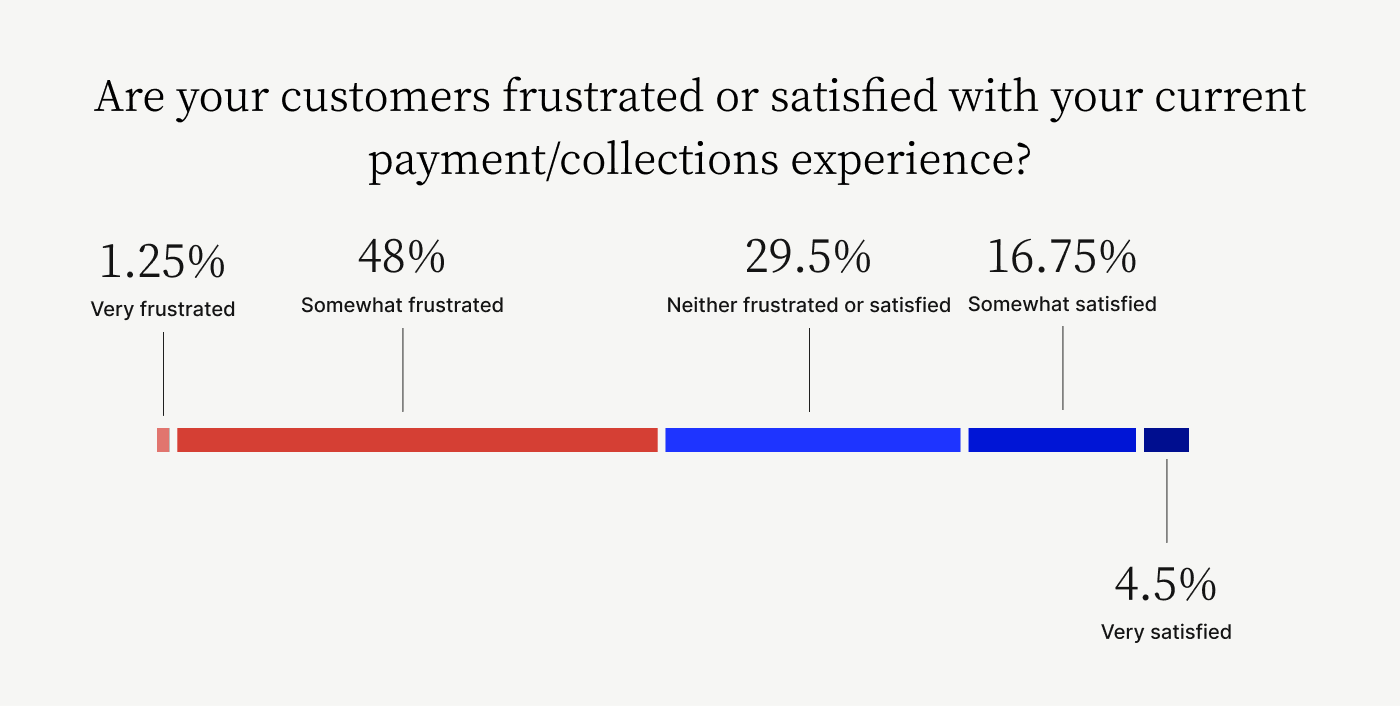

A recent study of 1,000 C-level executives at B2B companies with more than $100 million in accounts receivable found that more than 70% of respondents (including more than 80% of CFOs) expressed concern that their accounts receivable departments aren’t customer-oriented enough. Continuing to enforce antiquated payment rules will only further raise customers’ frustrations and dampen their overall payment experiences. Enabling credit card payments, on the other hand, will elevate them.

4. More efficient payment processing

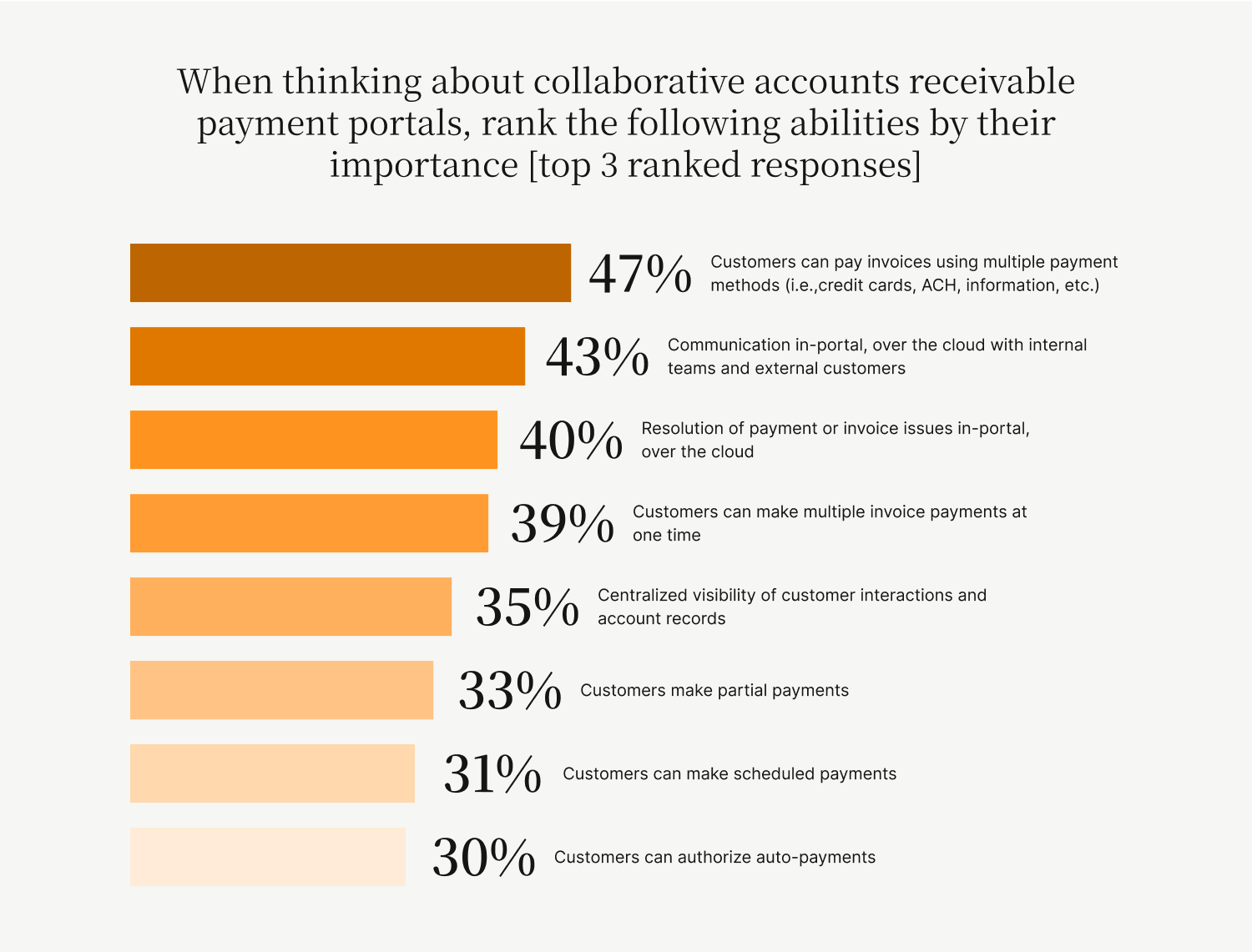

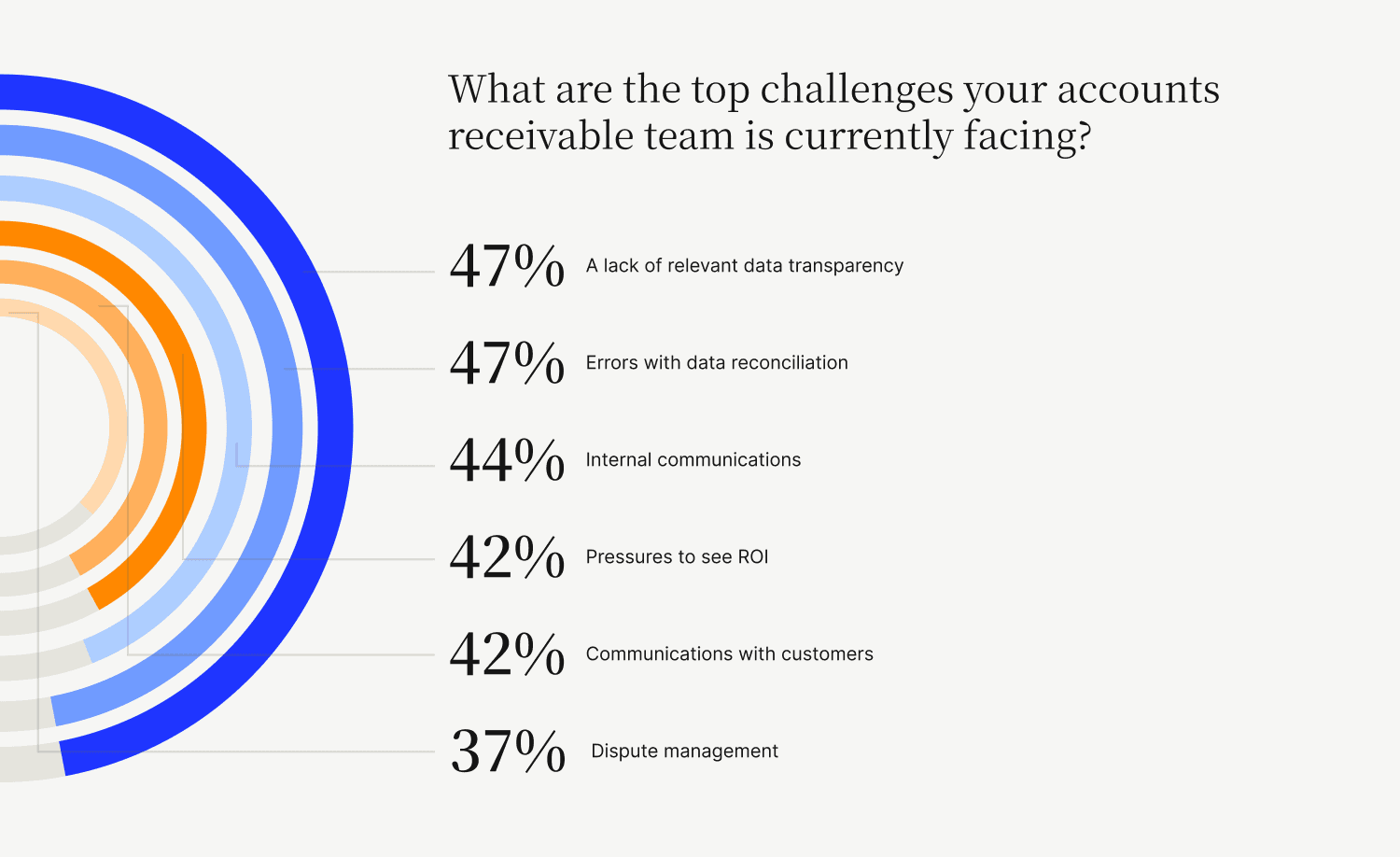

Automated credit card processing significantly reduces the manual work associated with payment collection, from acceptance through to reconciliation, which just so happens to be a top challenge accounts receivable teams face:

This efficiency gain translates to fewer errors, less time spent on data entry and reconciliation, and more time for your team to focus on strategic efforts that drive business growth.

5. Data-driven insights

Digital payment solutions that enable credit card processing deliver reporting and analytics tools that help you better understand customer payment patterns, forecast cash flow more accurately, and make informed business decisions based on real-time data.

6. Lower costs

Digital transactions often incur lower fees than traditional banking or check processing services, and automating them means far less manual labor is needed.

How to enable credit card payments for customer invoices

Now that we've covered the 'why,' let's touch on the 'how.' Enabling credit card payments for customer invoices requires implementing a digital payment solution.

These systems—also known as electronic payment systems—are software-based platforms that enable businesses to receive payments electronically from customers. They accommodate a wide range of payment methods and technologies from credit cards to electronic funds transfers, moving beyond traditional cash and paper checks to provide faster, more secure, and more efficient ways of receiving payments against invoices.

Here are some key features to look for:

1) Integration capabilities — The solution you choose to enable credit card payments should seamlessly integrate with your existing accounting and ERP systems.

2) Strict security protocols — Your chosen digital payment software must include state-of-the-art encryption protocols and fraud detection tools. Compliance with standards like PCI DSS is non-negotiable for handling cardholder data.

3) Comprehensive reporting and analytics — Data-driven insights will transform how you approach payments and customer relationships. Ensure you can gain valuable insights—like payment behavior and trends, and transaction volumes—from your payment data.

4) Multi-payment method support — While we're focusing on credit cards, a versatile solution that supports various payment methods is ideal, like virtual credit cards, eChecks, and more.

5) Scalability and future-proofing — Your digital payment needs will likely evolve. Choose a solution that will scale with you, and handle increasing transaction volumes and payment methods without compromising speed or reliability.

A credit card payment solution only works if your customers use it, so another key feature to look for in a provider is efficient and effective onboarding. Versapay boasts an 80% adoption rate—the highest in the industry—because our solution is so easy to use.

Versapay: The ideal solution for enabling credit card payments

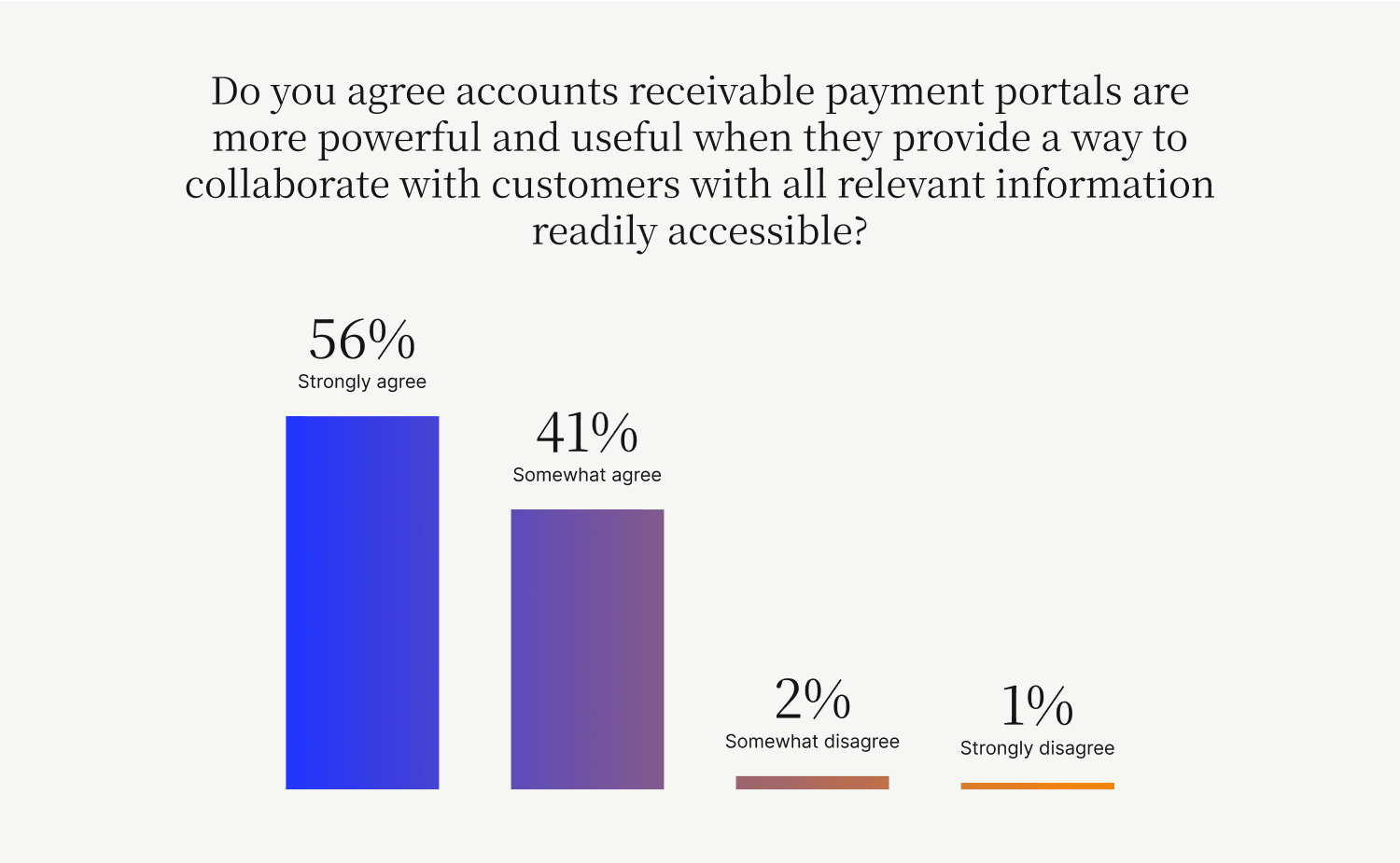

Versapay's ERP payments solutions and collaborative accounts receivable payment portal not only allows for seamless credit card processing but also provides a platform for better communication between you and your customers. With Versapay, you can:

Accept various payment methods—including credit cards, virtual cards, and ACH—across all sales channels like ecommerce or POS.

Reduce card processing fees and payment acceptance rates, by providing card networks with more transaction data.

Automate invoice creation and delivery, enable payments on e-invoices, reconcile and record payments, and store digital invoices.

Get real-time, 24/7 visibility into customer accounts, invoice statuses, and payment trends; and improve customer relationships through cloud-based communication and collaboration tools, and self-service functionality. (Which just happens to be something 97% of CFOs think is valuable.)

How accepting credit cards with Versapay helps companies across industries

Companies that offer credit card and other digital payment options to customers can expect good things. Here are just a few examples from satisfied Versapay clients:

1. Boston Properties

The largest publicly traded owner, manager, and developer of commercial real estate in the U.S., used payment automation to shift a greater volume of rent payments from cash and paper check to predictable and scalable digital payments.

Beyond saving $1,200 monthly by eliminating paper invoices and removing the need for full-time collection activities, Boston Properties collects 99% of its payments digitally and on time.

2. A leading U.S. computer and network security solution provider

The collections team only had enough resources to focus its collections efforts on the most seriously overdue payments—invoices in excess of $100,000. That meant that a great deal of additional debt was slipping through the cracks. After implementing Versapay, 99% of the company’s customers started paying on time, giving 50 hours monthly back to the accounts receivable team.

3. The Research and Productivity Council (RPC)

RPC had $800,000 worth of invoices more than 90 days overdue, in part because the company couldn’t support multiple payment methods. After enabling digital payments, RPC slashed the number of accounts with invoices 90+ days past due by 70%.

4. TireHub

Distribution logistics company, TireHub, had difficulty staying on top of its receivables. After encouraging digital payments through a customer payment portal, the company cut its overdue accounts in half and reclaimed 200 hours of paid contract support each week.

The key takeaway from TireHub's experience is that success comes from inviting customers to work with you in a new way, rather than telling them they need to change.

As former CEO Peter Gibbons explains, "We presented this not as something we decided to impose on the customer, but an initiative we were doing that we wanted to make sure customers came alongside." By fostering a sense of partnership and collaboration, you can create a positive experience for everyone involved and achieve high payment portal adoption rates.

Allow your customers to pay invoices using credit cards today

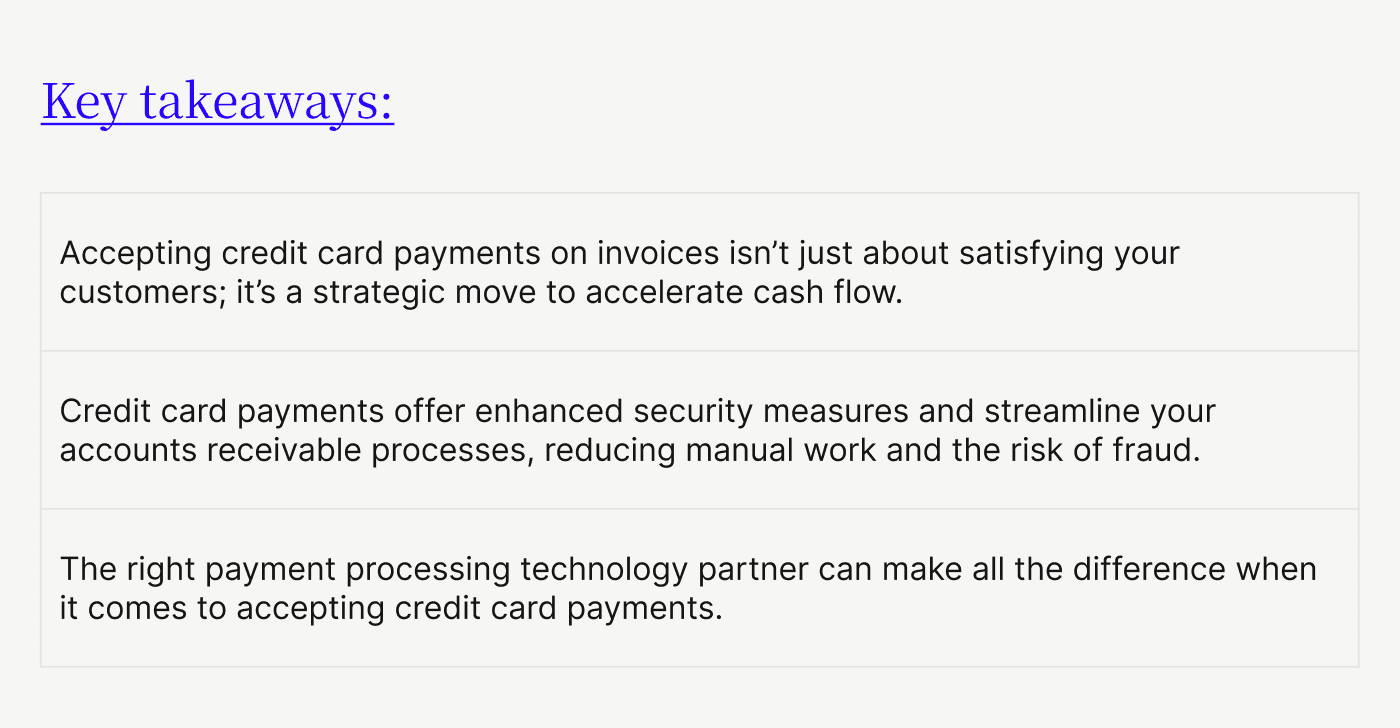

Enabling credit card payments for invoices is more than just a convenience—it's a strategic decision that can impact your business's financial health and customer relationships. By accepting credit cards and other digital payments, you're not only meeting the growing demand from your customers but also positioning your business to reap substantial benefits.

To recap the key advantages:

1) Accelerated cash flow through faster payment processing

2) Enhanced security and fraud prevention measures

3) Improved customer experience and satisfaction

4) More efficient payment processing, reducing manual work

5) Access to valuable data-driven insights for better decision-making

The future of B2B payments is digital, and credit card payments are an option more businesses and customers are willing to explore. By embracing this change now, you're staying ahead of the curve and gaining a competitive edge in your industry.

Don't let outdated payment methods hold your business back. Talk with a Versapay expert today to learn how we can help you seamlessly integrate credit card payments into your invoicing system, and start experiencing the benefits for yourself.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.