Top 6 Digital Payment Solutions for B2B: Your Guide to Finding the Right Fit

- 13 min read

Learn how to evaluate the top digital payment solutions and choose the right one for your business.

Included is a solution assessment checklist, and an analysis of today's top digital payment solutions.

Over the past two decades, digital payments have evolved from a niche option to a critical component of B2B financial operations. The rise of credit cards, electronic funds transfers, and more recently, digital wallets and real-time payment systems, has dramatically expanded payment options for customers. This has compelled businesses to accept new payment methods or risk losing sales and efficiency gains.

Digital transactions are already staggering in scale, with estimates projecting a total value of $11.55 trillion worldwide in 2024. This figure is set to climb even higher in coming years, underscoring the critical importance of digital payment solutions. Companies that have embraced digital payment platforms are reaping benefits such as faster cash flow, reduced processing costs, and improved customer satisfaction.

Conversely, those slow to adapt find themselves at a competitive disadvantage.

Selecting the right digital payment software is a strategic decision that impacts your business' efficiency, customer satisfaction, and financial health. The ideal digital payment platform balances utility and value, making things easier for your customers and optimizing your accounts receivable processes.

This article will guide you through the process of selecting the best digital payment provider for your business. You’ll receive a solution assessment checklist, while learning a strategic approach to evaluating your options. At the end, we’ll compare top providers in the market, including Versapay, to help you make an informed decision based on your specific needs.

Table of contents:

What are digital payment solutions?

Before looking into the benefits of digital payment solutions, it's important to understand what they are and how they function within B2B companies.

Digital payment solutions, also known as electronic payment systems, are software-based platforms that enable businesses to receive payments electronically from customers. These solutions accommodate a wide range of payment methods and technologies from credit cards to electronic funds transfers, moving beyond traditional cash and paper checks to provide faster, more secure, and more efficient ways of receiving payments against invoices.

Key components of digital payment solutions include:

Payment gateway — Front-end technology that securely captures payment information from customers and transmits it to payment processors.

Payment processor — Back-end systems that communicate with banks and credit card networks to facilitate the movement of funds.

Payment facilitator — An entity that enables businesses to accept payments without setting up their own merchant accounts, often providing a faster, simpler onboarding process and aggregating transactions across multiple merchants.

In B2B, digital payment software often has additional capabilities that streamline transactions and automate tedious tasks. These include:

Invoice management — Tools for creating, sending, and tracking invoices electronically.

Recurring billing — Systems for handling subscription-based or regular payments automatically.

Cash application — Automated systems for matching incoming payments with outstanding invoices.

ERP integration — Capabilities to seamlessly connect with enterprise resource planning systems for streamlined financial management.

Advanced security — Encryption, tokenization, and fraud detection tools are important for protecting sensitive financial information. Security should be certified to the highest payment industry standards (PCI DSS Level 1).

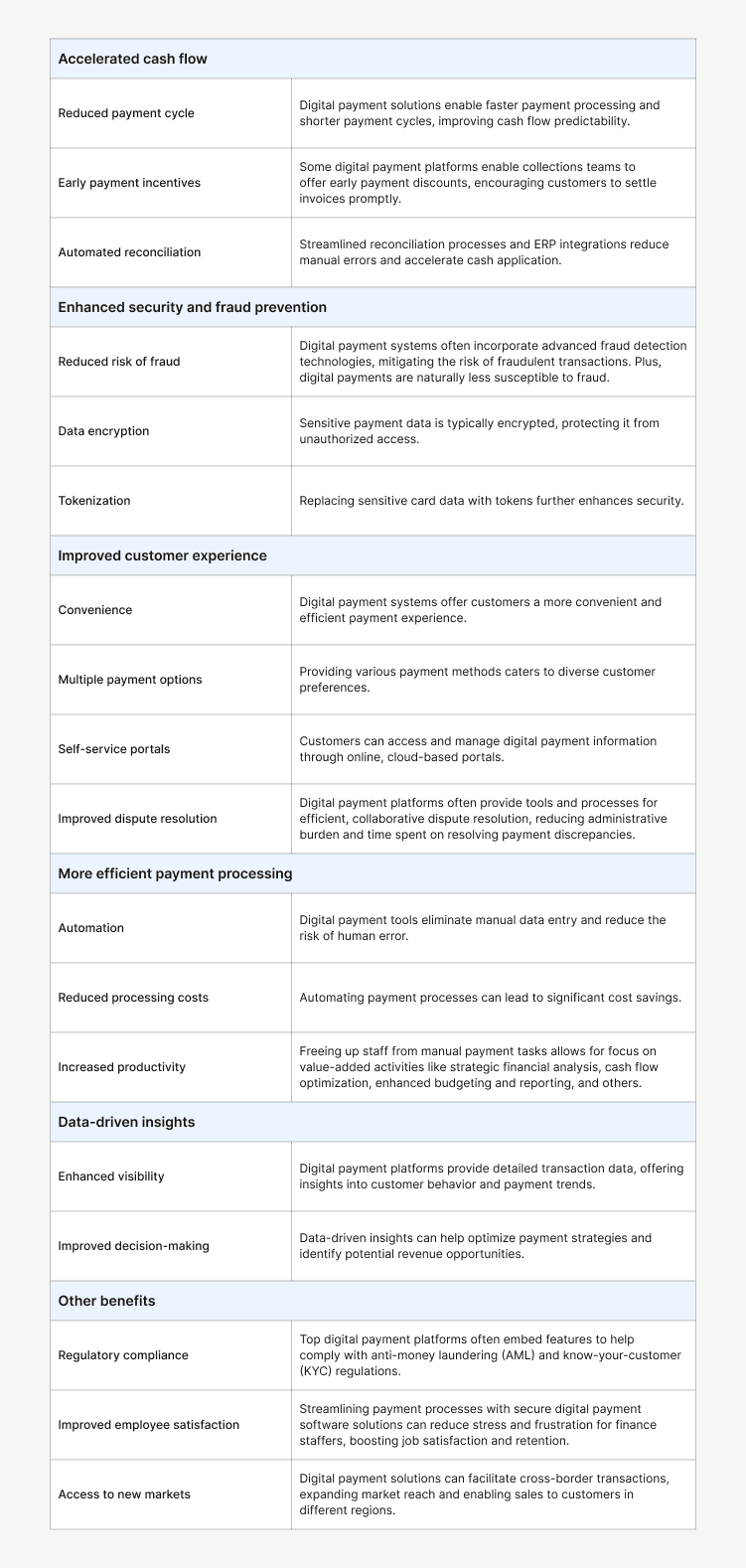

Key benefits of digital payment solutions

The main benefits of digital payment automation software fall under five broad categories:

1) Accelerated cash flow — Digital payment platforms reduce payment cycles through faster, more convenient invoicing and processing. They enable early payment incentives to encourage prompt settlements, open channels of communication to eliminate disputes, reduce manual errors, and speed up cash application.

2) Enhanced security and fraud prevention — Modern digital payment systems offer robust security features, including advanced fraud detection technologies, data encryption to protect sensitive information, and tokenization for replacing card data with secure tokens.

3) Improved customer experience — One often overlooked benefit of digital payment solutions is their ability to deepen customer relationships by eliminating friction in the payment process. Catering to customer payment preferences, sending friendly automated payment reminders, and offering centralized self-service payment portals all make your customers’ lives easier.

4) More efficient payment processing — By automating processes, digital payment solutions eliminate manual data entry, reduce processing costs, and increase productivity by freeing up staff for more strategic tasks.

5) Data-driven insights — With comprehensive reporting capabilities, the right digital payment solution can help you optimize payment strategies and identify revenue opportunities. The top solutions provide detailed transaction data and analytics, along with visibility into customer behavior and payment trends.

Beyond these five categories, digital payment networks can enhance regulatory compliance with anti-money laundering (AML) and know-your-customer (KYC) features. And they improve employee satisfaction in your accounts receivable department by automating manual tasks and enabling staff to reallocate efforts toward more strategic work.

5 features to look for in a digital payment system

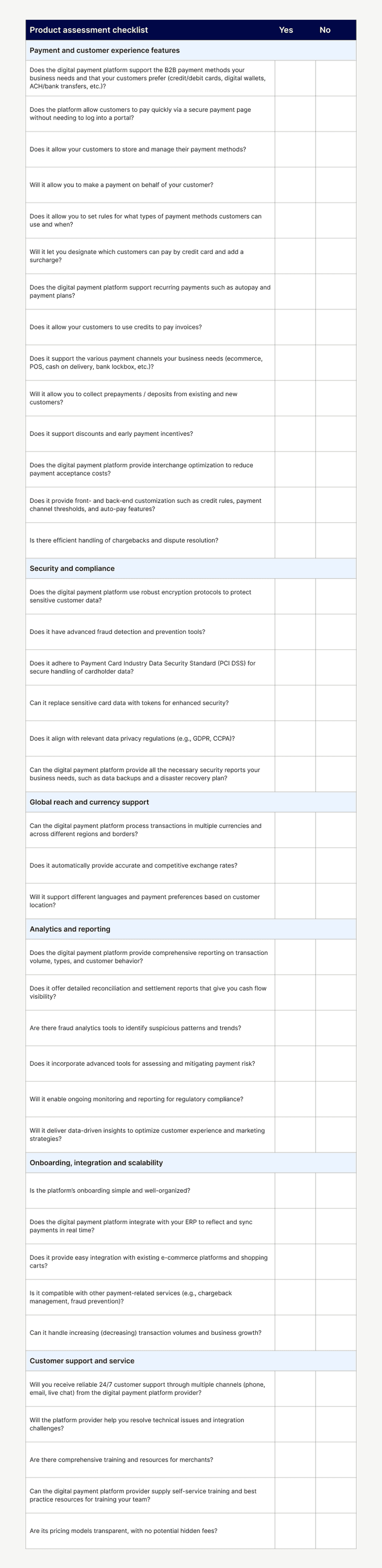

When evaluating digital payment automation software for your business, certain features may stand out as particularly important. While our comprehensive checklist—see below—covers a wide range of considerations, let's focus on five key areas that can significantly impact the effectiveness of your payment processes.

1. Versatile payment options and customer experience

Digital payment networks must process transactions quickly, efficiently, and conveniently. Look for solutions that support a wide range of payment methods, including credit cards, virtual credit cards, eChecks, and digital wallets.

They should also offer flexibility in how payments are collected and managed. For instance, Versapay lets you create secure payment pages where customers can pay quickly without logging into a portal. This feature, combined with the ability to store payment methods and set up recurring payments, is better for customers and can lead to faster payments.

2. Security and compliance measures

With cyber threats on the rise, security can’t be overstated. Your chosen digital payment software must include state-of-the-art encryption protocols and fraud detection tools. Compliance with standards like PCI DSS is non-negotiable for handling cardholder data.

Also consider advanced features like tokenization and hashing, which replaces sensitive data with unique identification symbols. This extra layer of security is particularly valuable for businesses that process recurring payments or store customer payment information. It’s also great for protecting sensitive data from employees who don’t have a business need to access it.

3. Seamless integration capabilities

Why choose a digital payment system that doesn’t integrate with your existing business software? Save time and improve accuracy with a solution that syncs with your ERP system. Versapay, for example, offers integrations with most ERP systems, including popular platforms like Oracle NetSuite, Sage Intacct, and Microsoft Dynamics 365.

4. Comprehensive analytics and reporting

Data-driven insights can transform your approach to payments and customer relationships. For example, Amazon uses payment history data to personalize payment options and recommendations, offering payment partner discounts or monthly instalments, both of which boost customer loyalty.

Advanced digital payment automation software offers detailed reporting on transaction volumes, payment trends, and customer behavior. These insights can help you optimize your payment strategies, identify potential issues before they become problems, and even uncover new business opportunities.

Look for systems that provide real-time dashboards, customizable reports, and the ability to drill down into specific transactions or customer accounts. The ability to track key metrics like days sales outstanding can be invaluable for managing cash flow effectively.

5. Scalability and future-proofing

As your business grows and evolves, your digital payment needs will likely change. Choose a solution that can scale with your business, and handle increasing transaction volumes and payment methods without compromising speed or reliability. Additionally, consider the provider's track record of innovation and their roadmap for future developments.

Comparing 6 top digital payment providers

While organizations have many digital payment software solutions to choose from, we analyzed six of the most popular platforms to help you make an informed decision about what might suit your needs the best:

1. HighRadius

HighRadius put accounts receivable automation on the map, helping companies improve efficiency through invoicing, collections reminders, payment processing, and reconciliation. Where HighRadius falls short is in forcing customers to buy modules separately, slow support turnaround times, and a lack of collaboration tools, not enabling messaging directly on invoices so you can resolve disputes faster and with better documentation.

2. Billtrust

Billtrust is another powerful automation platform that eliminates inefficient, manual processes. Its traditional approach fails to facilitate collaboration and communication, however, and the average customer adoption rate of its payment portal is around 30%.

3. Quadient AR by YayPay

Quadient AR by YayPay is another traditional accounts receivable automation platform but unlike others it’s not a payment facilitator. This means you have to manage more vendors to get the same control over transaction processing, billing processes, and chargeback management you can get from other solutions, including Versapay.

4. Stripe

A well-known player in payment processing, Stripe is a good choice for businesses getting started with processing payments that need a trusted name to boost customer adoption. Positive features include deep integration capabilities, easy implementation, and developer tools that facilitate customization. Because compliance mechanisms are automated, however, merchants complain about unexpected fund holds and account withdrawal restrictions.

5. EBizCharge

EBizCharge is an integrated payments provider that’s popular with mid-to-large B2B companies. Benefits include quick implementation and a wide range of ERP integrations. On the downside, EBizCharge lacks certain cost-cutting and viability features, including interchange optimization capabilities and single-sign on (SSO) for logins.

6. Versapay

Versapay is the only comprehensive digital payment solution that emphasizes the importance of excellent customer service to accelerate cash flow. Our Accounts Receivable Efficiency Suite enables you to accept electronic payments anytime from any channel directly in your ERP—right through an invoice, on your eCommerce site, and in store.

Plus, our solution provides your customers with 24/7 access to customer account information, providing unparalleled transparency, communication, and dispute resolution capabilities. Versapay’s invoice matching capabilities also use AI and ML to match payments to open receivables with 90%+ straight-through processing, which is why so many industry leaders choose Versapay to automate their accounts receivable, including:

2 of the 10 largest US food distributors

2 of the 10 largest US building material manufacturers

13 of the 100 largest US credit unions

9 of the 65 largest US banks

10+ Fortune 500 companies, including Intuit, Coldwell Banker, PepsiCo, and US Foods

What’s more, because our cloud-based, self-service customer portal needs little support and is easy to use, we boast the highest customer adoption rate in the marketplace at 82%, compared to an industry average of just 20%.

How to select the right digital payment automation software

Here's a simple guide to help you navigate this critical decision-making process:

Form a cross-functional evaluation team — Digital payment solutions affect multiple departments, so you’ll want input from finance and accounting, IT, customer service, sales, and marketing early in the process. This will help identify specific needs and potential challenges to guide the selection process.

Develop a comprehensive requirements document — Based on input from your evaluation team, you’ll want to prioritize features and define short- and long-term success metrics, such as reduced DSO or improved customer satisfaction.

Research potential partners and create a shortlist — Use your requirements document to guide your initial research, while also consulting industry reports and peer recommendations, attending relevant webinars or conferences, and engaging with vendor sales teams for high-level information.

Conduct in-depth evaluations — For each shortlisted solution, request a demo tailored to your use cases. Probe deeply into integration capabilities, especially with your critical systems, and discuss implementation timelines and resource requirements.

Assess total cost of ownership (TCO) — Look beyond the sticker price to understand the full financial impact of each solution. Forrester Consulting found that Versapay's Collaborative Accounts Receivable automation solution delivered a 305% ROI, illustrating the impact the right solution can have on your bottom line.

Make an informed decision — Consider each vendor as a potential long-term partner. Assess their financial stability and market position, investigate their customer support reputation, and consider cultural fit with your organization.

Versapay's digital payment solution could be your best choice for facilitating digital payments, reducing the burden on your accounts receivable team, and accelerating cash flow. Talk with an expert today to learn how our unique approach to payments can improve your business’s financial health.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.