How to Follow the Matching Principle in Accounting with Help from AR Automation

- 14 min read

The matching principle in accounting is essential to providing a clear and accurate picture of your financial performance.

In this blog, you’ll learn everything there is to know about this concept, as well as how AR automation software can streamline the processes that play into revenue matching.

Key takeaways

The matching principle states that expenses should be recognized in the same period as the revenues they help bring in so that the costs of doing business are appropriately associated with related income.

The matching principle has several benefits: It helps maintain consistency in financial statements and accuracy in reporting profits, allows for more effective accounting of depreciation and amortization costs, and provides insight into a company’s profitability.

Challenges of implementing the matching principle include difficulties with revenue recognition, complexity of matching long-tail costs, uncertainty in timing of transactions, and problems with accounting for non-cash elements.

Automation makes implementing the matching principle easier in a number of ways by helping businesses maintain more accurate accounting practices and reduce revenue leakage.

—

The matching principle is a cornerstone concept in accounting, as it is the essential mechanism by which businesses align their expenses with the revenues they bring in. This fundamental principle is essential in providing a clear and accurate picture of a company's financial performance.

Accurate financial reporting allows business leaders, investors, regulators, and other stakeholders to assess and manage risks, allocate capital, and guide the strategic direction of the business.

Read on to learn everything you need to know about this foundational business concept, as well as how accounts receivable automation software can streamline these processes that play into revenue matching.

Jump to a section of interest:

What is the matching principle in accounting?

The matching principle is a fundamental accounting concept that dictates how to recognize expenses in a business’ books. The main principle is that expenses should be recognized in the same period as the revenues they help bring in so that the costs of doing business are appropriately associated with related income.

Matching expenses with revenue in this way creates an accurate and transparent picture of a company's financial performance.

There are two key components of the matching principle: period costs and product costs.

1) Period costs are indirect costs that are necessary for company operations but are not directly related to the production or sale of goods and services. For example, paying for the power that keeps that lights on is necessary to create the products a company sells, but is a cost that cannot be associated with producing a specific product. These costs are recognized in the period in which the business incurs them.

2) Product costs are costs directly related to the production and sale of specific goods and services. These costs are recognized as expenses in the period when those products or services are sold.

It’s evident from the role of period and product costs that the matching principle only applies to accrual basis accounting, which recognizes revenues and expenses when they go in and out.

Revenue recognition and the matching principle

The function of the matching principle depends on a company's practices of revenue recognition, which is the process of recording and reporting income from selling goods or services. Businesses should recognize revenue when it is both earned and realized (or realizable)—that is, when the company has satisfied its obligation to the customer and has a reasonable expectation of being paid. According to the matching principle, expenses related to generating that realized income should be reported in the same period.

The importance of the matching principle

The matching principle is very important for effective and transparent accounting. It ensures that a company can:

Maintain consistency in financial statements to give an accurate picture of the company’s financial status.

Increase the accuracy in reporting profits during a given accounting period.

Allow for more effective accounting of depreciation and amortization costs.

Provide a greater understanding of the profitability of the company.

These benefits are particularly important in today’s uncertain economic environment. Business leaders need a thorough and accurate comprehension of their financial picture to assess their company’s strength in the face of a shifting market. They also need accurate financial reporting at the ready to show potential investors should the need arise.

How to apply the matching principle in accounting

There are specific procedures that govern the application of the matching principle. Accountants can follow a set series of steps to ensure they account for all expenses and revenue accurately in the appropriate periods:

1) Assign all revenues to the accounting period in which your business earned them.

2) Assess which expenses related directly to the work of generating those particular revenues, both directly and indirectly.

3) Align expenses with the revenues they helped generate and assign them to the corresponding accounting period.

4) Use your judgment to allocate expenses if they are not directly linked to a particular revenue item. There are a number of ways to do so, such as allocating a general expense to certain periods in proportion to their respective sales or production levels, or simply choosing what seems like a “fair and reasonable” allocation.

5) Adjust entries at the close of each accounting period and prepare financial statements listing net income or loss.

Examples of the matching principle at work

The matching principle may be easy or difficult to apply depending on the costs and expenditures involved. Let’s look at some tricky and simple examples of the principle that businesses commonly confront.

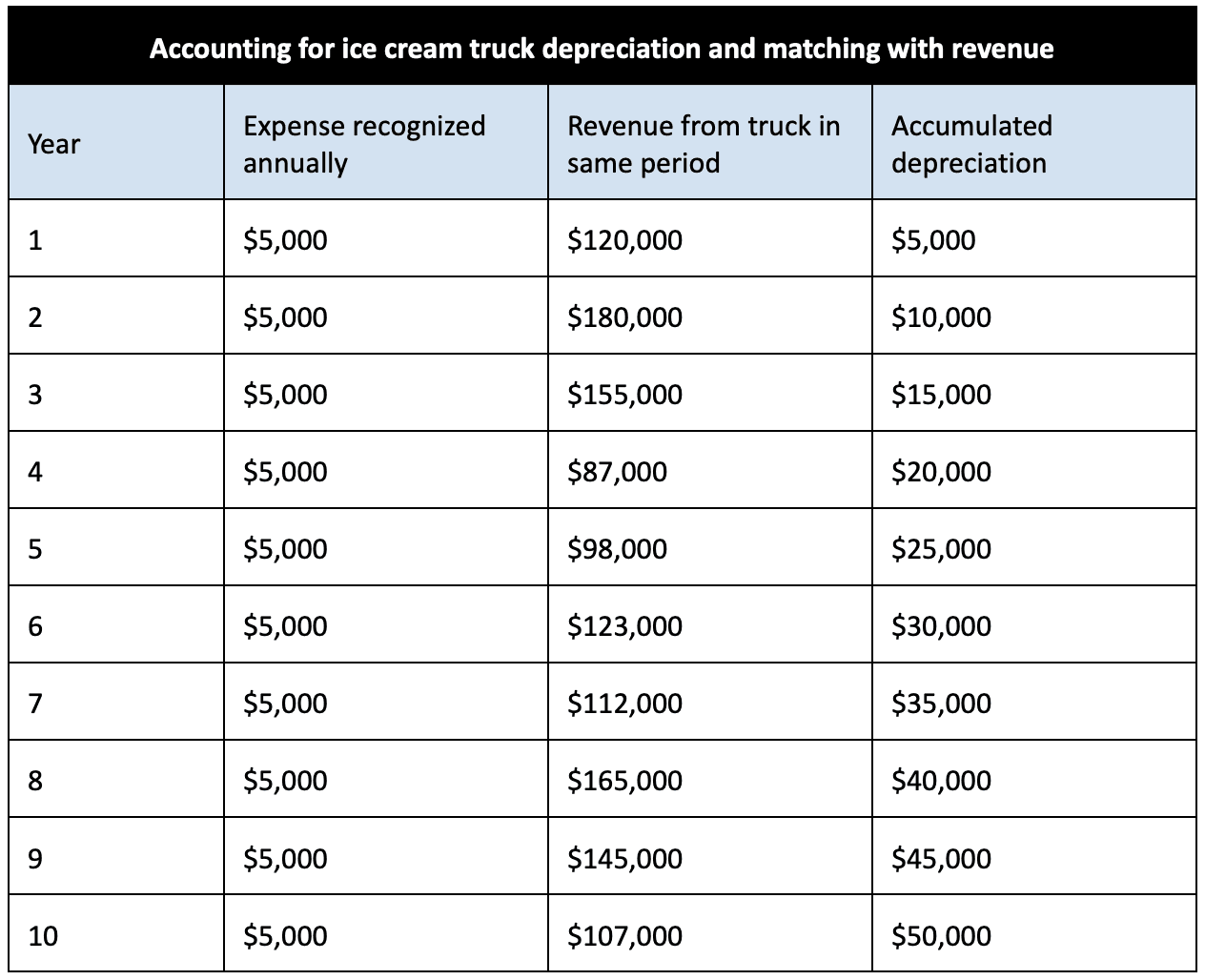

Example 1: Depreciation

Using the matching principle to account for depreciation is a bit complex because it requires matching a portion of the expense associated with a long-term asset with the revenue it helps bring in during each period.

Let’s imagine an ice cream company that purchases a new ice-cream truck for $50,000. The company expects that the truck will be useful for 10 years, after which it will have no more value—in other words, fully depreciated.

To apply the matching principle, you recognize an annual depreciation expense of $5,000 ($50,000 cost ÷ 10 years) to account for the cost of each year of the truck's useful life.

During each year for the next 10 years, you match the $5,000 annual depreciation expense to the revenues generated from selling ice cream out of it all year. You record the accumulated depreciation on the balance sheet each year, so that by year 10, the truck has depreciated by $50,000 and is no longer accounted for.

Example 2: Employee bonuses

Matching employee bonuses to particular products and services is fairly simple, as it is essentially a matter of being alert to timing. To apply the matching principle to employee bonuses, recognize the expense in the period when it’s earned by associating it with the employee’s related performance or contribution.

Let’s imagine a tech company that plans to give each of its employees a $20,000 bonus at the end of the year. You record the expense of the bonuses in the year the employees got them since they are meant to reward the workers for their efforts that year.

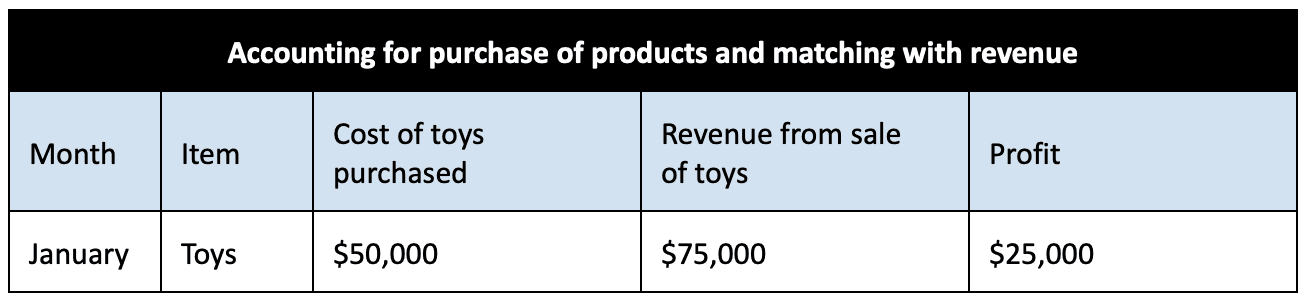

Example 3: Cost of goods sold (COGS)

Applying the matching principle to COGS is a straightforward matter. It means aligning the expenses associated with producing or purchasing goods with the revenues generated from selling those same goods.

Let’s imagine a toy store that purchases $50,000 worth of toys from suppliers in a given month and resells them for a total of $75,000. You align the cost of the toys as a direct cost related to generating the $75,000 income, and for that reason record the income brought in by those toys in the same period as the expense of buying them.

4 challenges of implementing the matching principle

Implementing the matching principle isn’t always easy, as there are a number of challenges bookkeepers may face, from problems with cash leakage to confusion about how to account for non-cash items.

1. Difficulties with revenue recognition

Revenue recognition can be complex, especially when projects take a long time to complete and when contracts change. CFOs strive to eliminate “revenue leak”—that is, not actually realizing the revenue your books have officially recognized. Revenue leakage can arise in a number of ways:

Manual processes that introduce errors and oversights

Delayed sales cycles that elongate the revenue-realization timeframe

Poor data centralization that causes confusion and omissions

Customer churn that changes revenue realization dynamics

2. Complexity of matching long-tail costs

Costs that are accrued over a long time span, such as marketing campaigns, sales efforts, and research and development, are difficult to match accurately to specific revenue.

3. Uncertainty in timing of transactions

When issues arise with transactions, such as legal problems with a sale, it becomes more difficult to match the potential revenue from that transaction with the costs associated with it.

4. Problems with accounting for non-cash elements

Line items such as depreciation, amortization, and stock-based compensation can be difficult to match to particular revenues.

More frequently asked questions about the matching principle

How does the matching principle ensure accurate financial reporting in accounts receivable?

The matching principle requires revenue and related expenses to be reported in the same period to ensure an accurate picture of a company’s financial performance over a specific amount of time. This prevents companies from recognizing expenses at the wrong time, misstating profits, and distorting their financial statements and net income data.

What happens if the matching principle is not followed for accounts receivable?

If a company fails to follow the matching principle for accounts receivable, its financial statements can become inaccurate and inconsistent. For instance, if a company reports expenses earlier than they should, its profits will be understated for a given period. Alternatively, expenses that are recognized too late will result in inflated profit figures because they won’t be properly matched with the generated revenue. These mistakes will cause a company to have an unclear understanding of its true financial performance and profitability, negatively impacting its decision-making.

What is the difference between accrual and matching principle?

The main difference between accrual accounting and the matching principle is the timing. Accrual accounting records expenses and revenue whenever they are incurred or earned regardless of when payment was received. Matching principal records expenses in the same period as its related revenue. For instance, with accrual accounting, if a company makes a sale in March but payment is received in April, the company records the revenue in March. For matching principle, if a company sells a product in June but incurred related expenses in May, the expense will be recorded for June.

What is the matching principle in GAAP?

The matching principle in GAAP (Generally Accepted Accounting Principles), dictates that any business expenses a company incurs should be recorded in the same accounting period as the revenue it generated. This provides a more accurate and reliable understanding of a company’s profitability during a specific period. The matching principle is based on the cause-and-effect relationship between the money that a company spends and earns.

What is the difference between the matching principle and the expense recognition principle?

The expense recognition principle is the more formal wording for the matching principle in accounting. It follows the same concept of recording business expenses in the same period as the related revenue it earned for more accurate financial statements.

How accounts receivable automation software can help match revenues with expenses

Automation makes implementing the matching principle easier in a number of ways. Accounts receivable (AR) automation software can help businesses maintain more accurate, transparent accounting practices, which helps them match expenses to revenues. Here’s how:

Better revenue recognition

AR automation software speeds up cash collection, making it easier to predict when recognized revenue will be captured after provision of a project or service.

Smoother timing and predictability

AR automation software can streamline the dispute-resolution process and make collecting cash against invoices faster and more predictable. This alleviates concerns around predicting transaction outcomes due to potential legal disputes.

More transparency

AR automation software can create better access to and transparency in financial data. Automation here helps companies generate better financial reports and forecasts, and optimize cash flow, both of which can affect revenue recognition.

The bottom line

The matching principle is a foundational accounting concept that helps ensure an accurate and transparent depiction of a company's financial performance. It is vital for maintaining consistency in financial statements, accurately reporting profits, accounting for depreciation and amortization costs, and gaining a better understanding of a company's profitability.

Accounts receivable automation software can assist in aligning revenues with expenses, improving revenue recognition, ensuring smoother timing, enhancing transparency, and optimizing financial reporting and forecasting. Learn more from our recent on-demand webinar:

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.