High Fees? How Merchants Can Reduce Credit Card Processing Fees

- 12 min read

There are many different ways to boost your margins when accepting credit cards.

Here are seven ways to improve your effective rate and reduce those pesky fees (with insights from one of Versapay's Customer Success Managers).

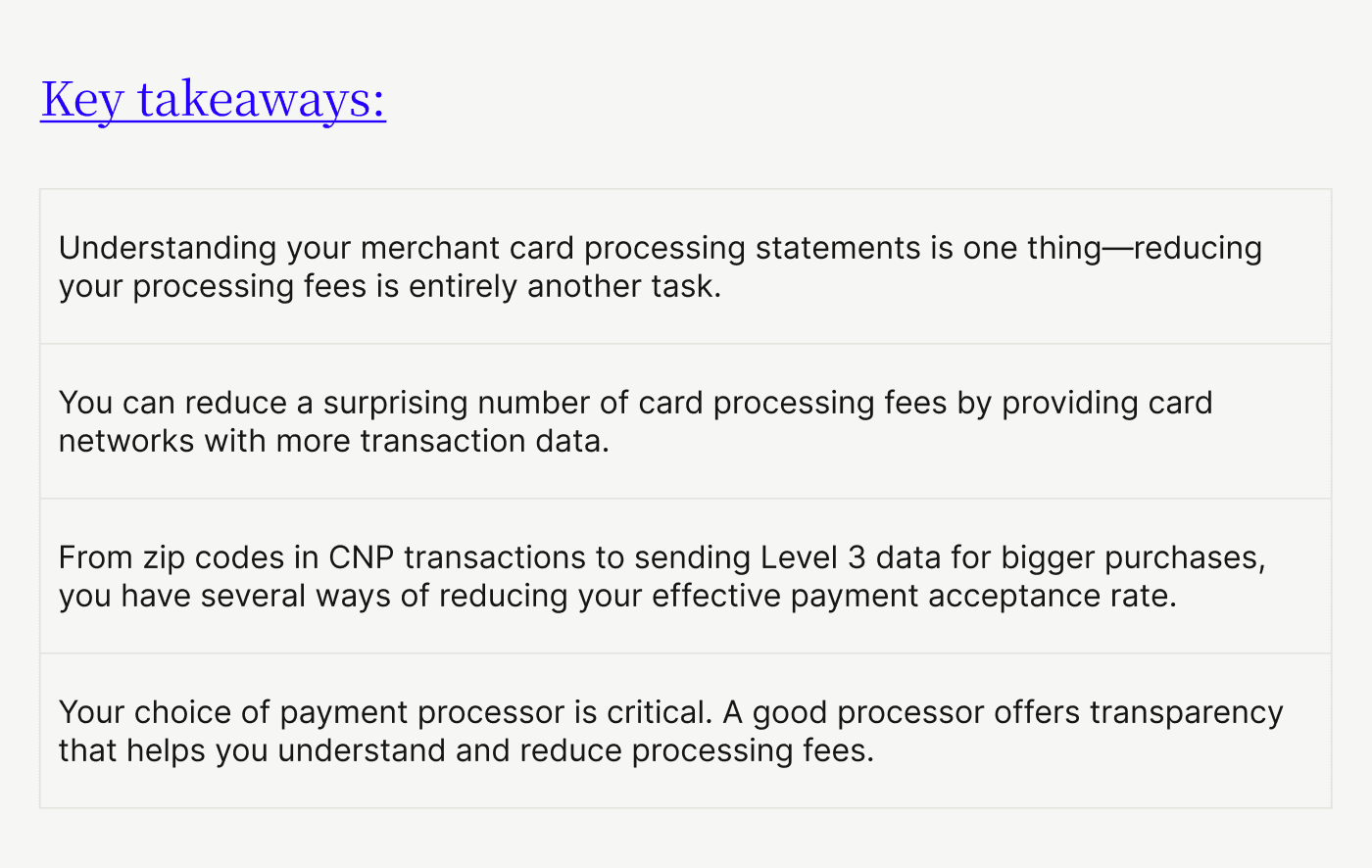

Steering your company's financial ship is hard enough before having to figure out all those fees in your merchant processing statements. And while understanding your merchant card processing fees is crucial, the real challenge lies in actively reducing these fees.

Thankfully, you have different ways of boosting your margin when accepting credit cards. In this article, we'll look at seven ways to boost your effective rate and reduce those pesky fees.

Table of contents

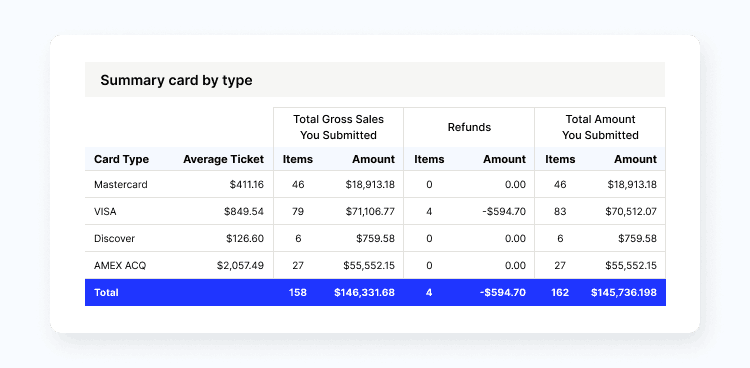

Tip 1. Consider limiting which credit cards you accept

You want to give your customers as many B2B payment options as possible, but without proper planning, these choices can cost you more money than they're worth. Some card networks charge high transaction fees that can reduce your bottom line significantly.

Each card network is different and offers unique benefits to consumers. As a result, the processing fees they charge vary as well, potentially creating lower margins for you. While accepting cards from every network can broaden your customer base, you must ask yourself whether this benefit outweighs the impact on your profit margins.

To answer this question, look at your average order size (ticket size). If you're processing a $5.00 transaction, you'll pay the following fees at the very least:

Card brand fees

Interchange fees

Transaction processing costs

These combined fees can amount to as much as $0.50 per transaction—a 10% cost of acceptance. If these small-ticket transactions form the core of your business, you probably can't afford such fees.

“Credit card processing fees usually have a percentage and fixed fee per transaction component,” says Sophia Tran, Customer Success Manager at Versapay. “The $0.50 fee on a $5 transaction can consist of interchange rate, discount rate, card brand associated fee, and account/software fees. The weighted average of all these fees results in a higher fee [percentage] on a low ticket.”

Sophia lists the following as examples of fixed fees that could add up to a significant percentage of a low ticket transaction. She notes that while these fees are more static, they can vary based on how frequently they occur:

PCI Program Fee

Software Fees

Batch Fees (vary depending on the number of batches)

Authorization Fees

Gateway Fees

Returned ACH Fees

Even if your ticket sizes are large, evaluate how much an expensive card network costs and compare it to payment volumes. You may find that your customers won't mind a narrower choice, helping you reduce credit card processing fees.

Tip 2. Send the billing address in card-not-present transactions

Modern consumers are comfortable with and prefer paying online. This is a huge opportunity for you despite the processing fees you’ll incur. Payment processors consider card-not-present (CNP) transactions—those where a merchant cannot physically verify a card's information—higher-risk situations.

The result is higher credit card processing fees to cover the risk of fraud. One simple yet effective way to mitigate these costs is by consistently including the customer's billing address and zip code in your CNP transactions.

“Merchants should always provide the billing address and ZIP code for every card-not-present transaction,” Sophia says. “Some card brands may downgrade transactions that lack this data, leading to higher interchange rates (up to 3.15%).”

Make sure your payment gateway or checkout page is set up to capture and transmit this information. If you're processing cards over the phone, train your staff to always request and input this information.

Sophia recommends adding a few additional checks to make sure customer address information always accompanies transaction data. “Ensure that the customer's ERP records have a default billing address and ZIP code,” she says. “Also, adjust Address Verification System (AVS) and Card Verification Value (CVV) settings within the payment gateway to reject transactions if the entered billing information doesn't match the card's billing details.”

Aside from ensuring lower interchange rates, she notes this measure adds a layer of security.

Tip 3. Settle transactions within two days

One crucial strategy for minimizing your fees is to settle your transactions promptly. “Settling authorizations within the required timeframes is important to avoid downgrades and higher fees,” Sophia says. “Merchants who delay shipment or fulfillment may experience downgrades due to ‘Auth Aging’, which occurs when authorizations are captured too late.”

But, what do these “downgrades” look like? Briefly, payment processors classify your transactions into three tiers:

Qualified (Qual) Rates

These are the lowest rates in a tiered pricing structure.

Typically apply only to transactions involving consumer non-reward credit cards and debit cards.

Mid-Qualified (MQual) Rates

For retail businesses, these often apply to swiped reward cards and keyed-in consumer and debit card transactions.

CNP transactions usually fall into this category.

Non-Qualified (NQual) Rates:

The highest rates in the tiered structure.

Often applied to all commercial and upper-level reward cards.

Includes keyed-in or e-commerce transactions processed without the customer's billing address.

Some processors may route all reward card transactions to this tier.

Sophia recommends capturing and settling authorizations within two calendar days to prevent your processor from routing everything into the NQual tier. She also suggests tweaking a few ERP settings to ensure timely authorization capture.

“Use NetSuite’s [for example] Authorize Aging Rule to set a short authorization period,” she says. “In NetSuite, the "authorize aging rule" determines how long an authorization remains valid before expiring. Once an authorization expires, the merchant must obtain a new authorization from the customer to process the transaction.”

This leads to a poor customer experience if funds are tied up or if a chargeback occurs. “Or if the customer sees two pending charges in their account,” Sophia adds. “Some pending authorizations may last up to 30 days!”

Businesses with delayed fulfillment timelines might find themselves automatically knocked into the NQual tier due to lengthy authorization periods. Sophia suggests an alternative payment capture process. ”Consider accepting a deposit first and charging the remaining balance later,” she says. “This can help manage authorizations and reduce the risk of downgrades.”

To optimize your settlement process and minimize fees, aim for daily settlements or adhere to the two-day rule. Ensure everyone involved in the payment process understands the importance of prompt settlement and knows how to execute it efficiently.

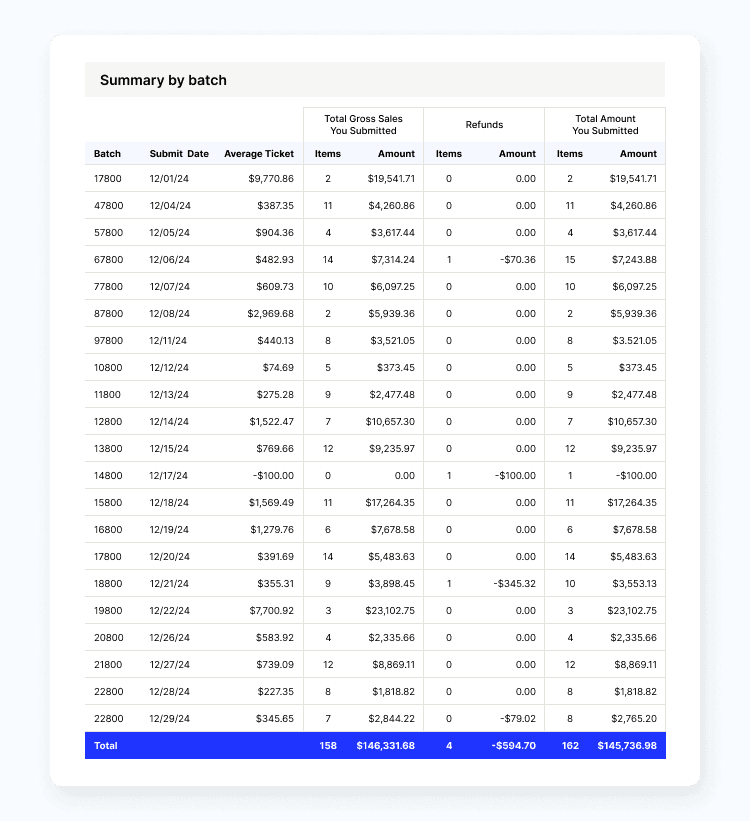

Finally, your choice of payment processor is also critical since its processes can reduce fees significantly. For instance, Versapay automatically settles customer transactions daily, ensuring the lowest processing rates. In addition, Versapay's customers can view processing data in their dashboards at all times, simplifying reconciliation.

Tip 4. Enter tax details when accepting business cards

Providing detailed tax information connected to your transactions can significantly lower your credit card processing fees. This often-overlooked aspect of transaction data can lead to substantial savings if handled correctly.

Report tax amounts with every transaction. Some card types offer lower interchange rates only when tax is reported and the transaction meets specific criteria. Even if a transaction is tax-exempt, it's important to report a tax amount (even if it's zero) rather than leaving the field blank.

Ask your payment processor about each card type's tax rules. Some cards are only eligible for savings at the interchange level if the tax is a particular percentage of the transaction. Note that tax-exempt or zero-tax transactions might not qualify for these savings on some card types.

Including a purchase order or invoice number with each transaction can help qualify your transactions for better rates. If your company uses special purchasing cards (also called P-cards), sending line-item details can lead to additional savings.

Note that your ERP might change the way tax is displayed and reported. For instance, NetSuite reports tax as inclusive within charged amounts, while others report it as an exclusive amount. Send just a single number and you might find yourself hit with higher processing fees despite including tax information.

Tip 5. Consider adjusting your pricing strategy

While optimizing your processes can significantly reduce credit card processing fees, you may need to consider adjusting your pricing strategy. Especially if you're dealing with low ticket sizes that create high effective payment acceptance rates.

One strategy to consider is surcharging—passing credit card processing fees directly onto your customers. To implement surcharging, you'll need to follow specific guidelines set by card networks and comply with state laws. Communicate this policy to your customers clearly and ensure that your surcharges don't exceed your actual acceptance costs.

You can position this change positively. For instance, you might explain it as a better option compared to check or cash payments which are far more inconvenient.

Another option is raising your prices and offering a discount for ACH or wire transfer payments. This approach can incentivize customers to use payment methods that incur lower processing fees. International transactions attract higher processing fees so consider limiting card use above a threshold or implementing a surcharge. Be sure to communicate any such policies to your international customers.

Tip 6. Check PCI compliance status

Payment Card Industry Data Security Standard (PCI DSS) compliance is not just a matter of security—it can also impact your processing fees. As your business grows and evolves, so too should your approach to PCI compliance.

Card networks have established different levels of PCI compliance based on transaction volumes. These levels determine the requirements and validation procedures your business must follow to maintain compliance. As your sales volumes grow, they could push you into a different compliance category.

Without regular checks, you might not realize that you've outgrown your current compliance level, leading to higher PCI compliance fees.

While fulfilling additional requirements may seem burdensome, they're designed to protect both your business and your customers as your transaction volumes—and thus, your potential risk exposure—increase.

Regularly communicate with your payment processor to keep tabs on your PCI compliance requirements. This will help you avoid surprises or higher-than-expected fees on your merchant processing statement.

Tip 7. Consider switching payment processors

Transparency is crucial when it comes to understanding and managing your processing fees. A good processor should provide clear, detailed information about your transactions and the associated fees.

Efficiency is another key factor. For example, slower settlement times and inadequate support for different types of transactions could increase payment network fees.

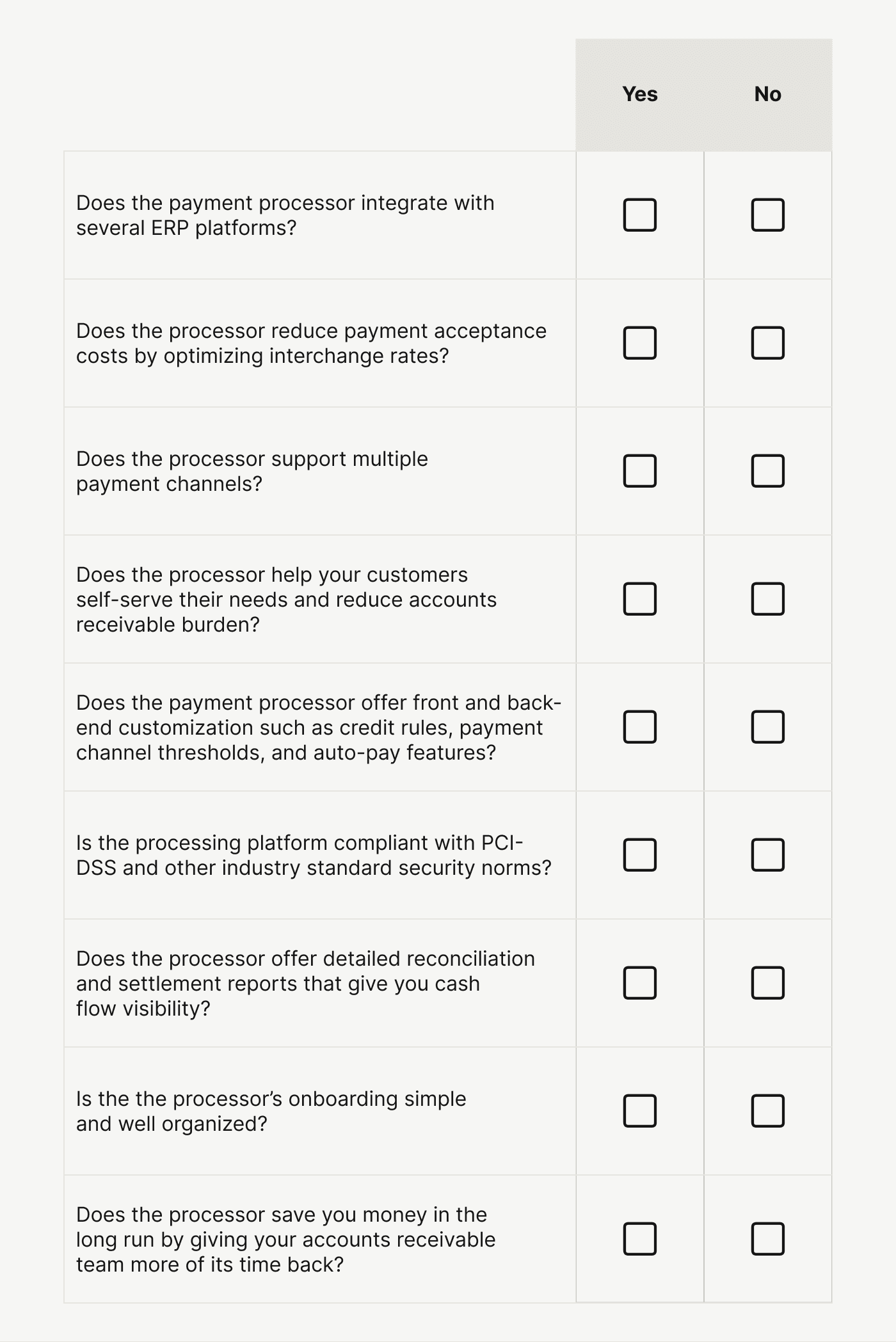

Check if your payment processor offers the following, at a minimum:

ERP payment processing: A processor that offers straight-through processing to your ERP will streamline your financial operations, reducing manual work and errors.

Interchange optimization: Look for a processor that automatically optimizes interchange on your transactions.

Supports multiple payment channels: Ensure your processor can support all the B2B payment methods your customers want.

Self-service capabilities: A good processor should offer robust self-service tools, allowing you to manage your account, run reports, and troubleshoot issues without always needing to contact customer support.

Deep customization options: Your processor should offer customization options to tailor their service to your needs.

High level of security: With cyberthreats on the rise, ensure your processor offers state-of-the-art security measures, aside from PCI-DSS compliance, to protect your and your customers' data.

Simplified bank reconciliation and reporting: Look for a processor that offers clear, comprehensive reporting and tools to simplify your reconciliation process.

Easy onboarding: Switching processors shouldn't be a headache. A good processor will offer a smooth, straightforward onboarding process to get you up and running quickly.

Cost savings: Ultimately, a new processor should save you money. This might come through lower fees, better rates, or improved efficiency that reduces operational costs.

Remember, the right payment processor should be more than just a service provider—they should be a partner in your business's financial operations.

The right processor reduces credit card processing fees

Payment processing might seem opaque, but take the time to review your processor's policies and track trends in your fees. Ultimately, a good processor must save you money by reducing fees and proactively optimizing transaction processing.

Versapay's customers reduce their payment acceptance costs by 20% on average thanks to passing L2 and L3 data to card networks. Learn how our payment processing software increases efficiency and accelerates cash flow while reducing costs.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.