How to Minimize Bad Debt with Efficient Accounts Receivable Collections

- 10 min read

In this blog, you’ll learn:

- How accounts receivable inefficiencies contribute to bad debt, and

- The various ways that a more efficient AR collections process reduces that debt for better cash flow

Plus, hear from Versapay's CFO, Russell Lester, on how managing bad debt boosts your financial health and lengthens your liquidity runway.

The longer past-due invoices remain unpaid, the less likely they are to be paid at all.

Bad debt represents the amount of money from unpaid invoices your business has to write off as uncollectible. This frustrating expense on your balance sheet—which can represent nearly 1.00% or more for under-performing businesses—reduces your profits, raises your cost of doing business, and can even increase your risk of insolvency.

According to a study we recently conducted with Wakefield Research, the typical upper-mid-sized company struggles with more than $4 million worth of unpaid invoices each month. And if 1.5% of that monthly $4 million becomes bad debt, it adds up to $720,000 a year. That’s real money your business could use to lengthen its liquidity runway (how long your business can operate solely on current liquid assets) or invest in product enhancements, capital improvements, and better customer experiences.

Organizations with too much bad debt often have broader workflow issues that erode the AR team’s time and add friction and frustration to customer relationships. And while some bad debt is unavoidable, a more efficient accounts receivable collections process (powered by a modern automation platform) can prevent much of it.

In this blog, we’ll explain how a more modern, collaborative approach to AR can boost your collections’ efficiency, and keep bad debt from spinning out of control and harming the financial health of your business.

Jump to a section of interest:

How accounts receivable inefficiencies increase bad debt

When your accounts receivable team works at peak efficiency, you can more confidently and accurately forecast cash flow, make better spending decisions, plan for future growth, and identify opportunities for continuous improvement.

Unfortunately, the traditional AR collections process is set up for failure in the modern era. Manual processes make it difficult for AR teams to track the status of collections. Poor communication channels (like phone and/or email) give customers too many reasons not to pay their bills on time. And not accepting digital payments (a hallmark of manual processes) results in a clunky, antiquated collections experience that neither you or your customers enjoy.

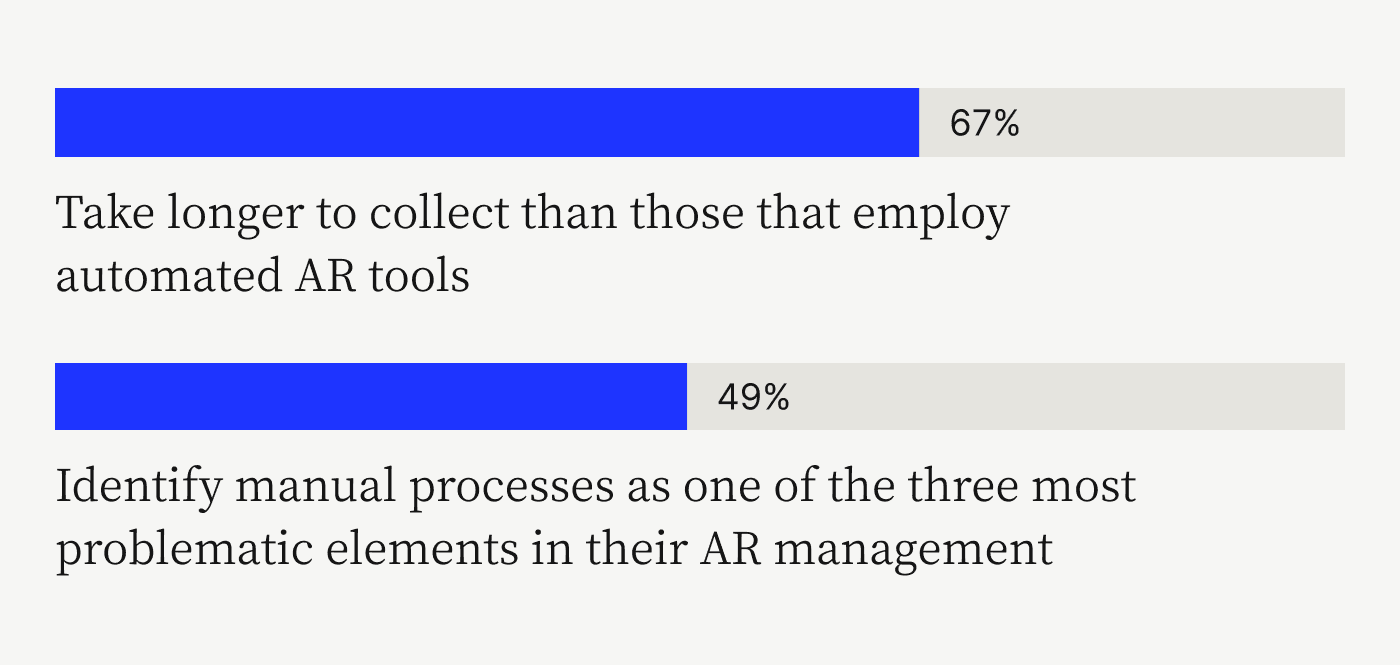

According to a study by PYMNTS.com and American Express, companies that use manual processes to follow up on overdue payments take 67% longer to collect than those that employ automated AR tools. Nearly half of firms—49%—identify manual processes as one of the three most problematic elements of AR management.

Yikes!

The best way to deal with bad debt is to prevent it from happening in the first place. One of the easiest ways to do this is by making your accounts receivable processes more efficient and collaborative.

Modernizing your AR workflow increases the amount of available cash your business can use to cover its expenses; reduces the time your staff spends chasing payments; and eliminates the need for confrontational tactics that can damage customer relationships.

In short, an efficient collections process leads to happier and more productive employees, engaged customers, and it gets cash in the door faster.

How efficient are your accounts receivable efforts?

You can track several different KPIs to determine if your AR efforts are as efficient and effective as they should be. For trouble with delinquent accounts and bad debt specifically, key metrics to follow include:

Days sales outstanding—the average number of days within a certain time period it takes for your company to get paid after making a sale on credit

Average collection period—the number of days it takes your business on average to get paid after making a sale or delivering a service

Collection effectiveness index—the percentage of receivables a company collects during a given period. A score of 80% or higher is considered a good benchmark, and anything lower could mean your AR processes need a boost.

Average days delinquent—the average number of days your invoices are delinquent

Aging reports—listings of outstanding balances, based on date ranges and dollar amounts. These reports can help identify delinquent accounts and prioritize your collection efforts.

Gaining visibility into metrics like the ones above can help you tackle collections more effectively, because you’ll have the full context of the factors that are creating payment delays. These factors can range widely, but we’ve seen two main reasons for an inability to follow through on overdue receivables.

The first is a company culture that encourages sales teams to override standard credit terms, offer unapproved discounts, and waive payment requirements to get new sales on the books.

The second massive driver—and often the root cause—of bad debt is a reliance on poor and/or manual AR collections processes. Outdated workflows force AR teams to focus on tedious work that often falls through the cracks, instead of adding value by delivering superior customer service that facilitates timely collections.

Your accounts receivable team might be facing multiple issues stemming from manual processes. Take our six-minute assessment for a personalized diagnosis of the challenges you face, along with a customized accounts receivable transformation roadmap to learn how you stack up against peers and how to set your AR team up for success.

How efficient accounts receivable collections decrease bad debt

AR automation software has profoundly transformed how businesses collect payments. Accounts receivable departments that automate their collections processes reduce past-due invoices by 30% or more and increase payment speed by 25% or more.

Here are just a few real-life examples of companies that have benefited from Versapay’s Collaborative AR automation platform:

The AR team at a leading U.S. computer and network security solution provider only had time to pursue overdue payments on invoices greater than $100,000, which left a lot of extra debt on the table. After implementing Versapay, 99% of the company’s customers paid on time through a new digital, cloud-based payment portal, tripling revenues and giving 50 hours a month back to the accounts receivable team.

The Research and Productivity Council (RPC) had $800,000 worth of invoices more than 90 days overdue, in part because the company couldn’t support multiple payment methods. After embracing AR automation, RPC slashed the number of accounts with invoices 90+ days past due by 70%.

TireHub, a distribution logistics company, was established in 2018 as a last-mile service provider for tire manufacturing giants Goodyear and Bridgestone. The new company inherited a huge customer base and a lot of problems staying on top of receivables. After encouraging digital payments through a customer portal, TireHub cut the value of severely overdue accounts in half and saved 200 hours of paid contract support every week.

As you can see, AR automation can have a dramatic impact on reducing bad debt and increasing collection performance. That’s because automation:

Gets the right information to the right people at the right time

Makes it easier for customers to pay

Improves communication for a better customer experience

Enables personalized client communications

Creates a standardized, intelligent workflow

1. Automation gets the right information to the right people at the right time

Through integration with your company’s ERP system, an AR automation platform reduces invoicing errors by eliminating the need for manual data entry. And because everything is digital, you no longer have to deal with the time, expense, and uncertainty of sending invoices by mail.

Customers can receive invoices through their preferred channels and pay you conveniently through a digital payment portal, which also enables them to quickly access documentation if they have any questions about an invoice.

Faster, more accurate invoice delivery—along with a transparent, single source of truth—is critical for accelerating payments and preventing bad debt. It’s an important way that accounts receivable automation satisfies a priority among CFOs for greater data transparency. Transparency decreases invoice disputes and provides your customers’ AP teams with the info they need to quickly pay invoices in one accessible place.

2. Automation makes it easier for customers to pay

Digital tools facilitate rapid payments by empowering customers to pay by credit card, ACH, or wire transfer. When customers can choose the payment method that works best for their needs, the convenience empowers them to pay faster.

Plus, digital payments are instantaneous, where traditional payments (like those made by check) are unwieldy to initiate, prone to security breaches, and take ages to receive and process.

3. Automation improves communication for a better customer experience

A recurring problem behind collection issues is something we call the AR Disconnect, the communication gap between your AR department and your customers.

According to the Wakefield study mentioned above, 78% of executives recognize that better communication helps resolve payment issues. When customers feel that they are being respected, involved, and communicated with effectively, they are more likely to cooperate in resolving an outstanding bill.

Because the inability to open a dialog about billing creates a frustrating dynamic for customers that often leads to delayed payments, we’ve developed an automated approach that engages customers through the entire invoice-to-payment lifecycle. Key elements of this approach include:

Direct communication on each digital invoice, with options to ask questions, resolve disputes, and attach documentation.

A collaborative, cloud-based payment portal for real-time, two-way communication between customers and AR teams. Versapay’s payment portal boasts an average adoption rate greater than 80%, compared to 20% for standard payment portals.

Automated, proactive payment reminders—sent before an invoice becomes overdue—can eliminate the need to pester delinquent clients. Waiting to communicate with customers only when payment is overdue does little to foster a positive, cooperative relationship.

4. Automation enables personalized client communications

Other benefits of improved communication, personalization, and omnichannel invoice delivery are improved customer experiences and increased cash flow.

Automation platforms enable accounts receivable teams to tailor invoices to specific clients and optimize invoice delivery. When you know your customer’s invoice approval workflow and the people who are part of it, you can copy key people—like the manager whose team is using your product or service—on your invoices to eliminate payment bottlenecks.

5. Automation creates a standardized, intelligent workflow

A delay in customers’ receipt of their invoice delays their payment terms. A delay in applying payments can mean customers’ credit doesn’t get replenished, preventing them from making more purchases. With AR automation software enabling efficient, zero-touch collection efforts, your team can easily:

Create and distribute more accurate invoices

Send reminders before accounts become delinquent

Track collection steps for each client and automatically assign tasks to accounts receivable team members and customers

This predictability and consistency not only benefits your internal AR team, but it also creates greater confidence among your customers that your team is buttoned up and on top of any issues that might lead to a dispute or late payment.

Reduce your bad debt with accounts receivable automation

An ounce of prevention is worth a pound of cure when it comes to getting paid faster and preventing late invoices from turning into bad debt.

AR automation is the kind of proactive, preventative measure you need to optimize your collection efforts through best practices around invoicing, customer communication, and collections.

To learn more about how AR automation can reduce your bad debt and improve your AR collections efforts, contact Versapay today. We also invite you to hear our CFO, Russell Lester, discuss the importance of reducing bad debt in this informative, entertaining webinar.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.