What’s That Fee? Demystifying Merchant Processing Statements

- 11 min read

Merchant processing statements are tricky to decode. But they don't have to be.

Learn what a merchant processing statement is, what its key components are, how to read a credit card statement, and what to watch for.

Every business deals with its share of complicated documents, but few match the complexity of merchant processing statements. Given the opaque fees and vague descriptions most business credit card processing statements have, they might as well be in Greek for all the information they give you.

However, neglecting to review these statements is a bad idea. They help you understand the cost of credit card acceptance (also called the effective rate) and the degree of chargeback fraud you're experiencing.

So how do you read a merchant processing statement? In this article, we list the fees that could show up in your statements, what they mean, and how to troubleshoot common issues.

Table of contents

What is a merchant processing statement?

A merchant processing statement lists your company’s transactions, sales, and processing fees and is sent by your payment processor. Note that some processors may call this a credit card processing statement. In this article, we’ll use the two interchangeably.

Fees are probably the most challenging information to figure out in these statements. However, they offer a ton of information to help you increase business efficiency.

Why reviewing your merchant statement is important

Modern businesses have no choice but to accept credit card payments from customers. However, accepting card payments brings fees with it. A merchant processing statement quantifies the impact on your margin in the following ways:

Merchant processing statements list payment acceptance fees — Payment processors charge several fees to connect you to the payments landscape and protect customer information. Your processing statement helps you review and potentially reduce them, increasing your margins.

Merchant processing statements highlight chargeback fraud — Chargebacks cost you money even if your card issuing bank rules the claim in your favor. More chargebacks indicate holes in your payment acceptance and security processes. Your credit card processing statement alerts you to these gaps, helping you plug them.

Merchant processing statements simplify tax filings — Payment processing costs are a significant expense and your merchant processing statements simplify accounting. They are also valuable proof during expense audits, both internal and external.

Merchant processing statements help you spot errors — As much as we’d like them to be, payment processors aren’t infallible. Payment processing is fast-paced, and sometimes mistakes happen—such as unauthorized charges, incorrect transaction amounts, or double billings. Spotting errors gives you the opportunity to reduce payment processing fees. Merchant processing statements detail your charges, helping you calculate payment acceptance costs and giving you room to nip incorrect fees in the bud.

Key components of a merchant processing statement

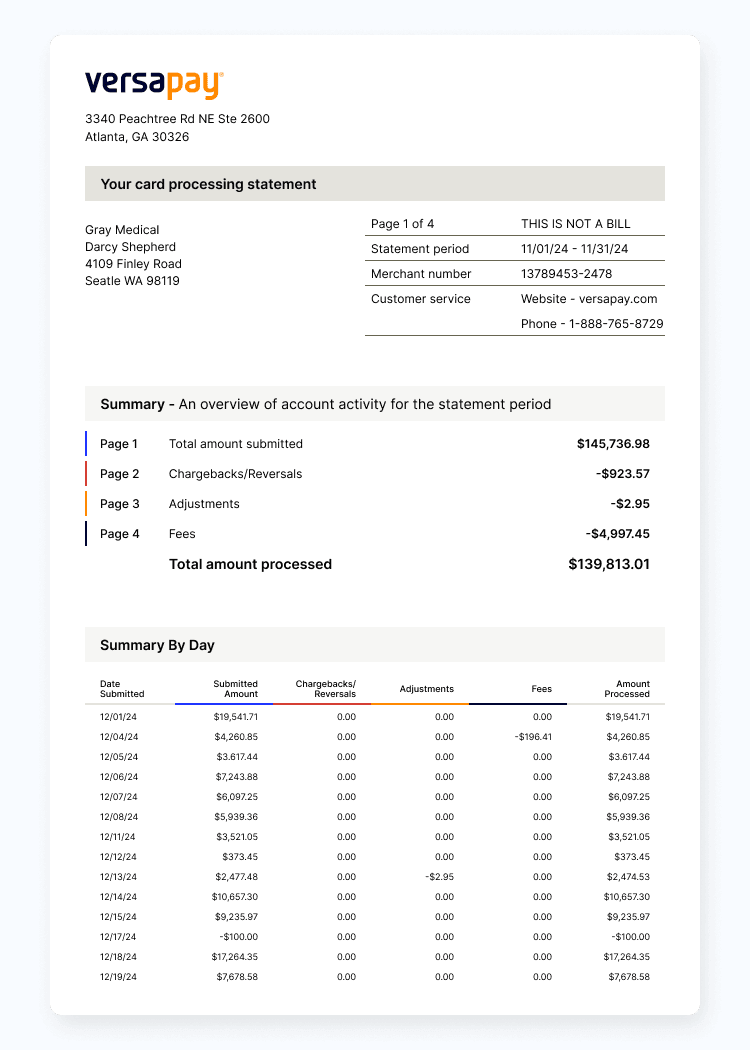

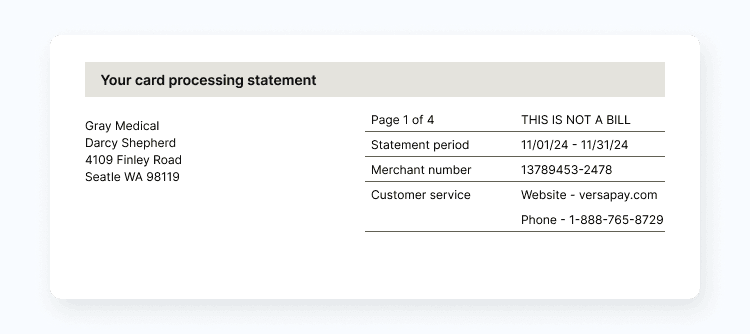

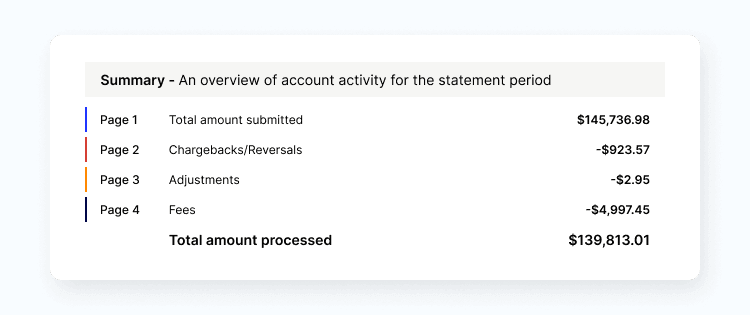

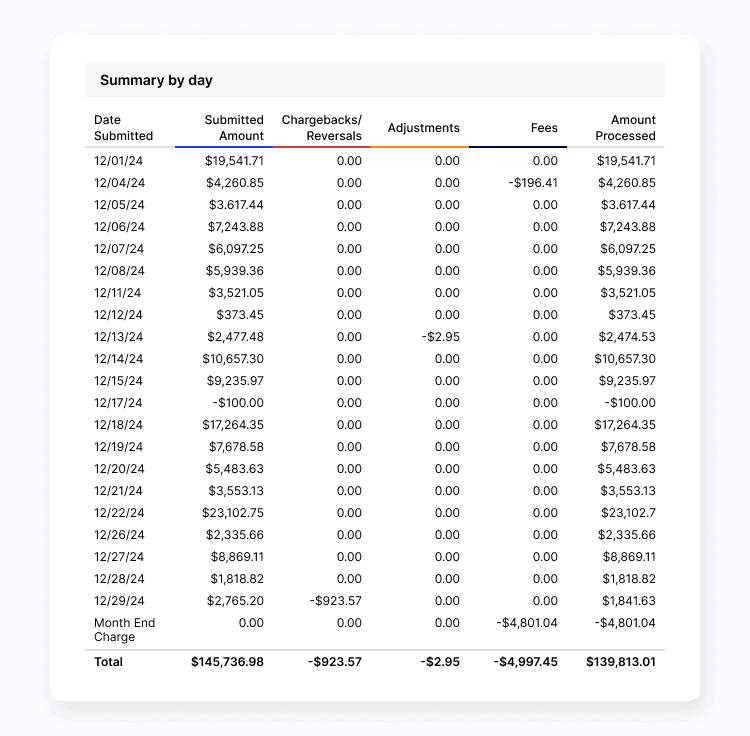

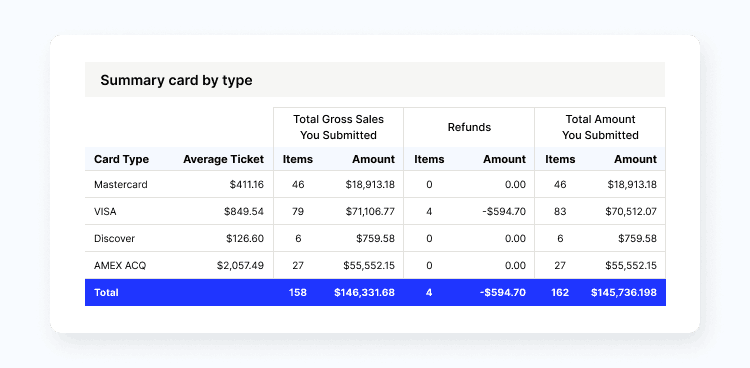

Here is a creatively reimagined sample merchant processing statement that Versapay's customers might receive.

Let's walk through the important bits.

- Account information and statement period — This section lists your business name, merchant ID, and statement period.

- Transaction summary — This section summarizes your revenue, chargebacks, adjustments, and fees.

- Daily summary — This section lists all transactions by day.

- Summary by card type — This section lists transactions per card type.

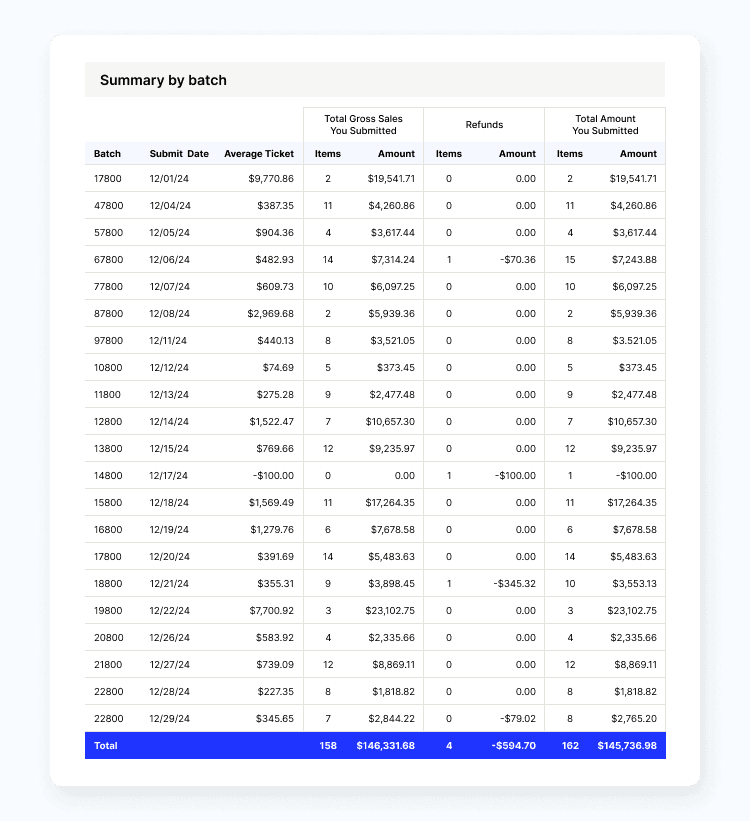

- Summary by batch — This section lists all batch settlement details during the statement period.

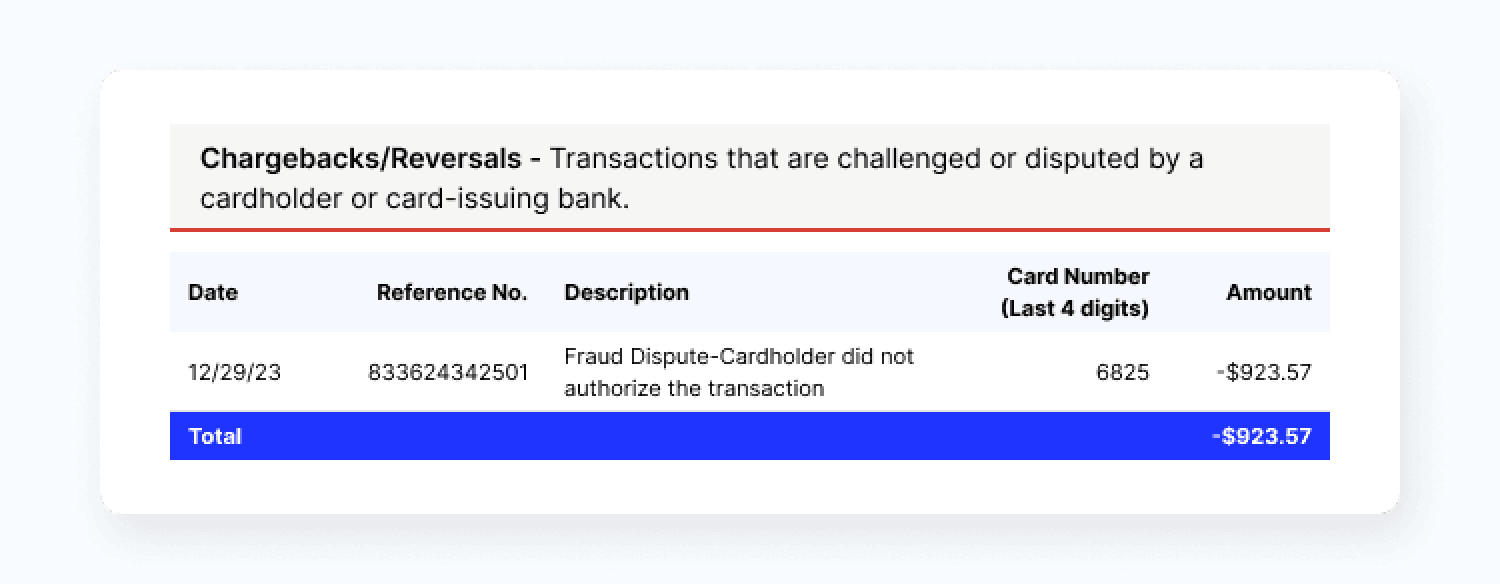

- Chargeback details — This section lists chargeback details.

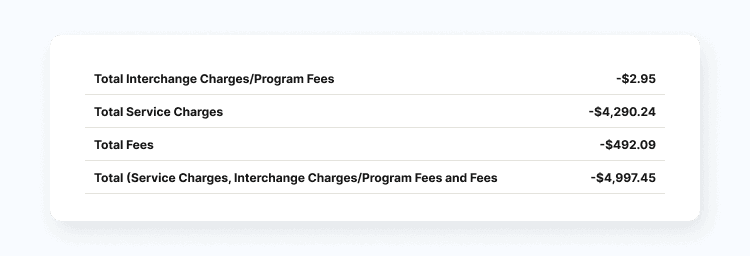

- Fees and summary of fees — Perhaps the most important of all. This section lists all fees you incurred and summarizes them based on categories.

The different types of fees in a merchant processing statement

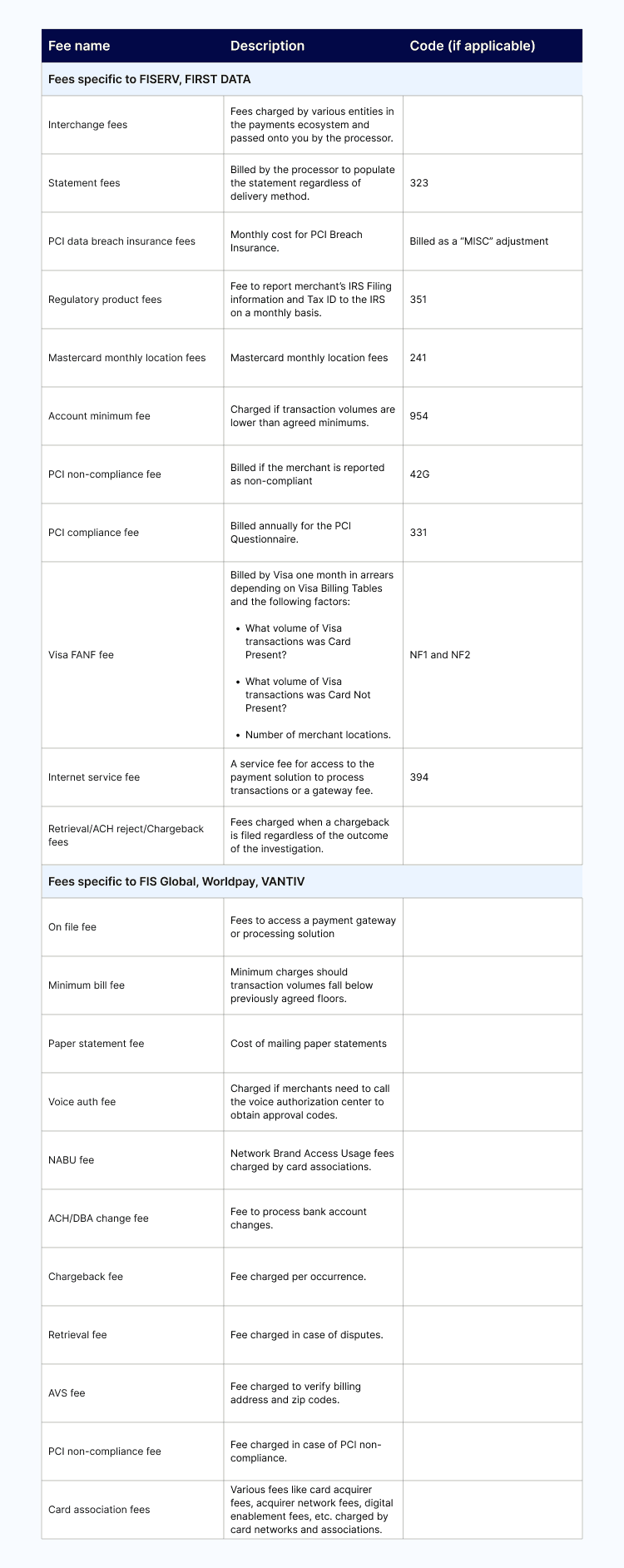

While there routinely is overlap, different payment processors do charge different fees—and define and categorize them differently. Depending on your processor—for example, FISERV or WorldPay—you might come across some unique codes in your merchant processing statement.

Here is a non-exhaustive list of some of those unique processing fees, their descriptions, and their codes, if applicable:

How to read your merchant processing statement

Disclaimer: How you read your processing statement depends on a variety of factors, including the type of pricing structure you’re on and how that information is displayed by the provider. Depending on your relationship with your processor, your statement may differ from someone else’s.

Now that you know what fees show up on a processing statement, you might think all of this is a bit overwhelming. Here is a step-by-step process that helps you zoom in on the important stuff quickly:

1) Verify your information

2) Verify your processor's pricing model

3) Verify the discount method

4) Calculate your effective rate

Step 1. Verify your information

This step might seem obvious, but payment processors could confuse merchant IDs and billing information despite being electronic systems. Always verify your information and notify your processor immediately if you spot any discrepancies.

Step 2. Verify your processor's pricing model

Every payment processor uses a different pricing model and changes in its policy can increase your fees significantly. Interchange plus, for example—adding a fee to base interchange costs—is the most common pricing model.

Other payment processor pricing models include fixed / flat fee models—where you're charged a fixed fee every month—and tiered pricing models—where you pay different fees depending on transaction volumes. Keep an eye out for payment processors tinkering with fee tiers.

Briefly, processors categorize fees into three tiers:

1) Qualified or qual

2) Mid-qualified or mqual

3) Non-qualified or nqual

Qualified rates are the minimum amount a processor will charge you and apply to ordinary card transactions. Mid-qualified rates apply to transactions that need additional verification such as card-not-present or corporate transactions. Non-qualified transactions apply to transactions that pose reconciliation challenges to processors. Examples include customer billing address mismatches, late batch settlements, etc.

Qualified transactions might be pushed into one the other two tiers, resulting in more fees. If this happens, open a dialogue with your payment processor to understand why.

Step 3. Verify the discount method

The discount method defines how your payment processor charges you fees. Broadly, processors use two methods—daily and monthly. Monthly discounting is straightforward, with processors charging you fees in a single lump sum at the end of the month. Daily discounting is more complex to reconcile since you'll be charged daily and at the end of the month.

Your processor will apply qualified charges before batch settlement and charge the remainder at the end of the month. This sometimes makes reconciliation difficult, so make sure you add daily and monthly fees when calculating processing fees.

Step 4. Calculate your effective rate

Your effective rate is the price you pay to accept cards from customers. And remember, the bulk of fees you’ll incur stem from costs associated with card brands and card associations.

The effective rate formula is:

Effective rate = (Total fees / transaction volume) * 100

Track changes in your effective rate every month. Constant deviations could indicate a processor using opaque pricing or too many one-off charges to increase its margins. Alternatively, a high chargeback rate might create additional fees, indicating the need to upgrade security.

4 things to watch out for when reading your credit card processing statement

Merchant processing statements can be challenging to figure out. But as we previously mentioned, scanning them periodically is critical to maintaining a healthy card processing effective rate. Here's what you must watch out for when scanning your card processing statement:

Policy language changes

Fee changes

Occurrence of easily-avoided fees

Interchange downgrades

1. Scan for policy language changes

Reading your card processing statement's legalese might be duller than watching paint dry. Thankfully, you can use tools like Fee Navigator to scan policies and flag changes. Most processors are transparent enough to communicate specific changes beforehand.

2. Compare fees month to month

Credit card acceptance costs money, but it doesn't have to cost you an arm and a leg. Compare changes in fees month-to-month, and look for abnormal charges or deviations from the norm.

Note that your fees might deviate significantly from the amounts your processor mentioned during the sales process. This is because fee calculations are complex, with each network stipulating different rules and combinations of situations.

In such situations, a fee deviation might not be malice, but just a sign of complexity. Either way, asking your payment processor to explain those fees and ways of reducing them is a good move. A transparent processor will explain the situation well and help you understand the charges.

3. Easily-avoided fees

On the flip side, incurring easily-avoided fees is an example of an opaque processor. Excessive annual fees, confusing one-time fees, and early termination fees are examples of opacity in processor pricing. Watch out for such tactics when evaluating processors.

4. Interchange downgrades

When transactions fail to meet the criteria for the most favorable interchange rates, your processor will tag them with a downgrade, leading to higher processing fees. These downgrades often happen due to improper transaction coding, delayed batch settlements, or insufficient transaction data. For example, a card-present transaction processed as card-not-present will incur higher fees.

Regularly audit your downgrade occurrences. These often happen due to staff training issues or changes in your payment processing environment.

Choose a trusted merchant payments processor

While merchant processing statements are tough to parse, analyzing them will help you understand your processor's transparency better.

Payment processors are valued business partners. A transparent processor will reduce card payment acceptance fees and boost your margin. In addition, a good merchant payment processor implements top-notch security to prevent data leaks and other undesirable outcomes.

Learn how Versapay's payment processing software speeds up payments, reduces manual processes, accelerates cash flow, and unlocks efficiency.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.