Problems Accepting Virtual Cards? Versapay Virtual Card Connect Can Help

- 8 min read

You can overcome the biggest manual virtual card acceptance challenges with Versapay Virtual Card Connect.

Learn why finding new ways to accept virtual cards is important, and what an automated approach looks like.

Virtual credit cards (VCC) are increasingly popular among buyers, with more and more preferring this payment option over others. They find virtual credit cards convenient, safe, and handy for controlling business spending.

However, many buyers face frustration in paying for invoices with virtual credit cards since many sellers still don’t accept this payment method. Our recent survey of 400 finance leaders found that 80% of customers prefer buying from sellers who accept VCC payments, yet more than half of buyers have tried and failed to pay with a VCC because the seller did not accept it.

Sellers are holding back from accepting virtual credit cards because of how difficult and costly it can be for them to process these payments. But it doesn’t have to be this way. Many sellers are struggling with VCCs because they continue to process these payments manually—a labor-intensive, time-consuming, and error-prone way of handling them.

Fortunately, a readily available option can fix their problem. A virtual credit card acceptance solution like Versapay’s Virtual Card Connect helps companies overcome the challenges of accepting virtual cards by speeding up and streamlining the process using automation technology.

Table of contents

Virtual card acceptance: the traditional approach

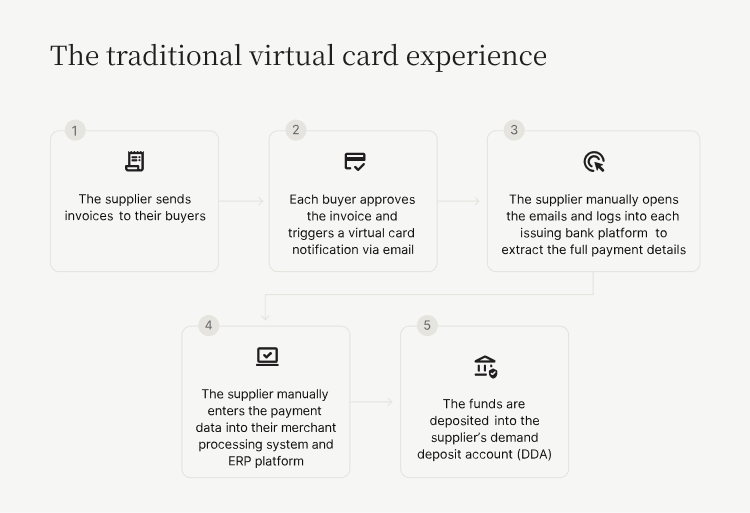

To understand why the manual method of accepting virtual credit cards can be prohibitive for sellers, let’s first look at how this process typically goes.

Step 1. A supplier sends invoices to a buyer seeking payment.

Step 2. The buyer approves the invoice and triggers a virtual card notification, which the seller receives via email.

Step 3. The seller’s accounts receivable staff opens the email and manually logs into the issuing bank platform to extract the full payment details.

Step 4. The seller’s staff manually enters the payment information into their merchant processing system and enterprise resource planning (ERP) platform.

Step 5. The funds are deposited into the seller’s demand deposit account (DDA), completing the payment.

The challenges with accepting virtual card payments manually

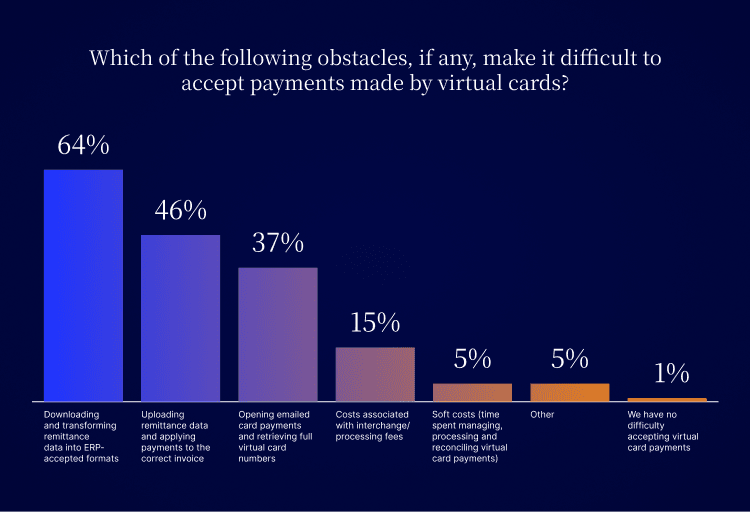

The brief description above may look innocuous, but it hides a raft of difficulties that can bog sellers’ virtual card acceptance operations down. Notably, only 1% of respondents to our survey said they have no problems with accepting virtual credit cards. The remaining 99% identified the following problems:

Issues with data transfer — According to our research, 64% of sellers say they struggle most with the fourth step in the acceptance process: They face issues with downloading and transforming remittance data into ERP-accepted formats.

Problems with data retrieval — The third step causes the second most problems: 37% of finance leaders report that opening emailed card payments and retrieving full virtual card numbers presented obstacles for their teams.

Concerns about cost — In addition to these logistical concerns, 15% of respondents said that the costs associated with interchange and processing fees were a concern that kept them from accepting VCCs. And 5% said the process comes with too many soft costs, such as the staff time spent managing, processing and reconciling virtual card payments.

Those who face difficulties with the virtual card acceptance process often cannot sustain the negative impacts on their business, such as:

Slow processing — Transcribing and keying data into ERPs is slow and tedious, wasting staff time that could be spent on other priorities.

Likelihood of human error — Addressing problems with data, such as mis-keyed entries in the ERP, requires exhaustive detective work and time-consuming customer correspondence.

More common disputes — Payment matching errors are common, often leading to disputes and causing slowdowns in revenue collection, along with dissatisfaction among customers.

Difficulty with scale — Processing payments at scale is difficult and costly, so growing companies tend to find their receivables teams’ capacities stretched to the limit.

Loss of ROI — As a company grows and the demands on AR teams increase, the pace of collections slows and ROI plummets as teams can’t keep up.

High fees — Virtual credit cards often carry high interchange fees, as card-not-present transactions are seen as riskier than regular credit card transactions.

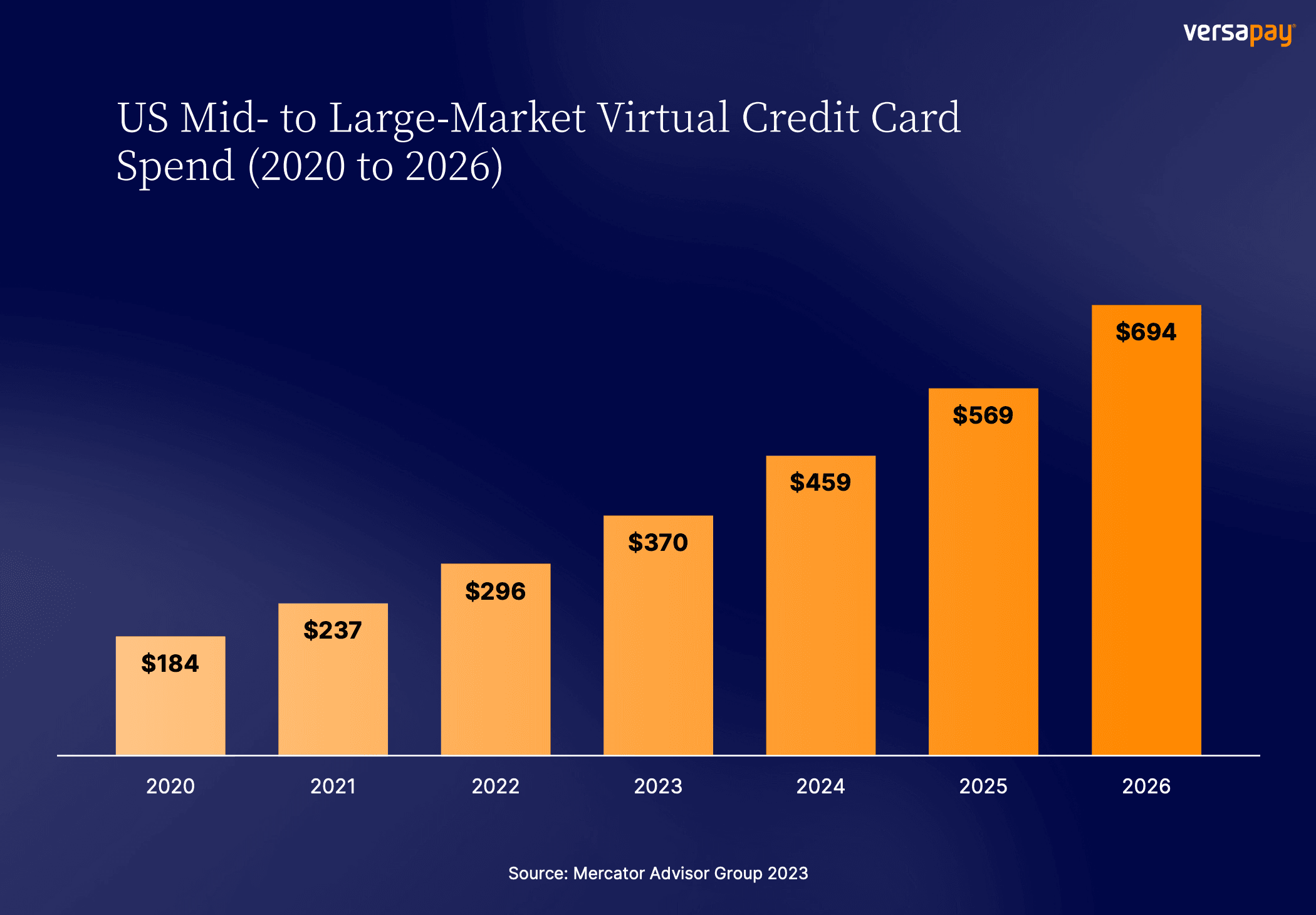

Why sellers must find new ways to accept virtual cards

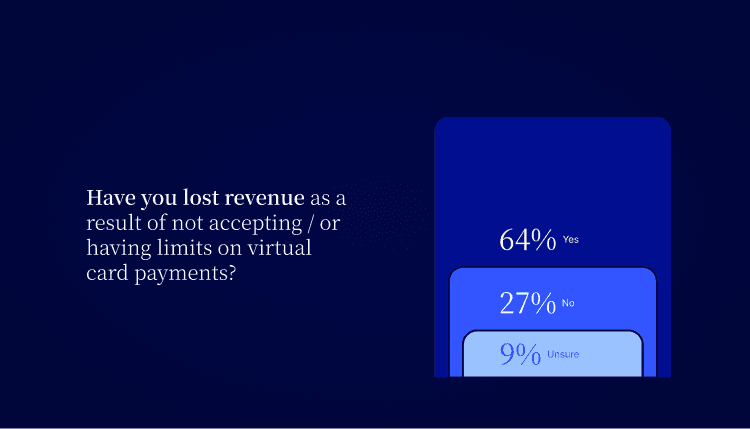

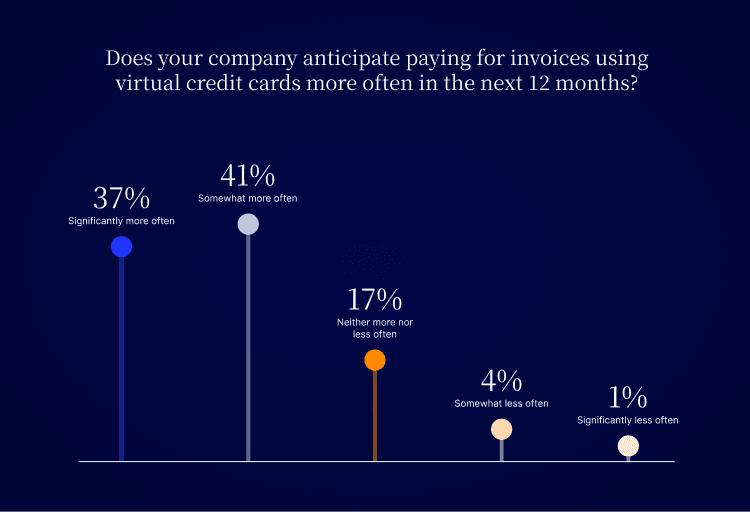

Clearly, sellers have legitimate reasons to shy away from accepting virtual credit cards, but that doesn’t mean it’s a wise business choice in the current (or future) landscape of rapidly digitizing payments. Buyers intend to continue using VCCs: Our recent research shows that 78% of buyers anticipate paying their invoices with virtual credit cards more often over the next year.

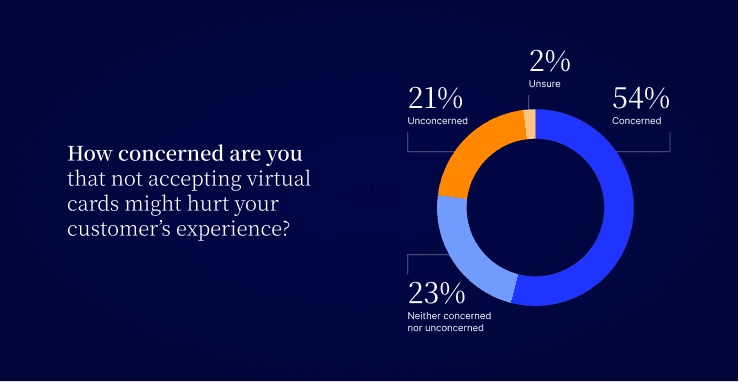

Sellers should be aware that many customers are willing to take their business elsewhere when sellers don’t accept this payment method. Our recent research shows that 80% of buyers state that they prefer working with sellers who accept virtual card payments, and 59% say they’d consider switching to a different vendor if they are not able to pay with a virtual credit card with a chosen seller.

This means that merchants need to escape the laborious, unsustainable VCC-acceptance process they are struggling with in order to reap the many benefits of accepting this payment method. The benefits they can expect by doing so are the stuff business dreams are made of:

Improved customer experience that leads to ongoing loyalty

Increased revenue from buyers who prefer this method, especially larger buyers

An accelerated payment process, leading to better cash flow

Minimized risk of fraud, as VCCs are more secure than regular credit cards

Happier AR staff, when equipped with the technology to process these payments quickly

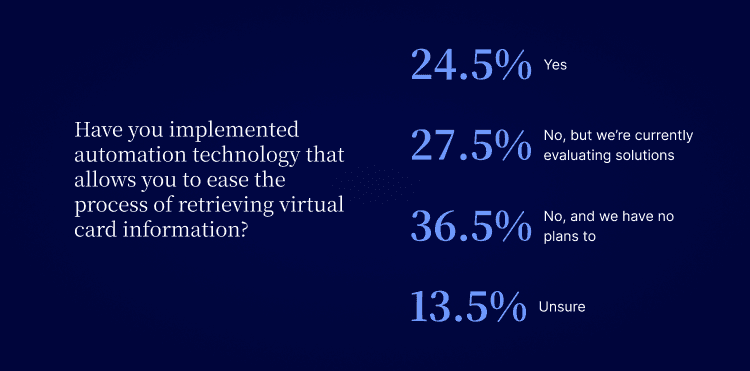

The way to get these benefits is to automate processing virtual credit cards payments. Automation solutions are readily available on the market, yet less than a quarter of finance leaders have implemented such a solution to simplify the process of retrieving VCC information and applying VCC payments to invoices.

It’s time for that to change, as buyers move toward virtual credit cards and show no sign of going back. Versapay can help—we make one of the best VCC acceptance solutions on the market.

Virtual card acceptance: the modern approach (Versapay’s Virtual Card Connect)

Modern virtual card acceptance solutions simplify payment processing and reconciliation, making it easy to meet your customers’ evolving needs and preferences. Versapay’s Virtual Card Connect gives sellers what they need to drive efficiencies and deliver better payment experiences.

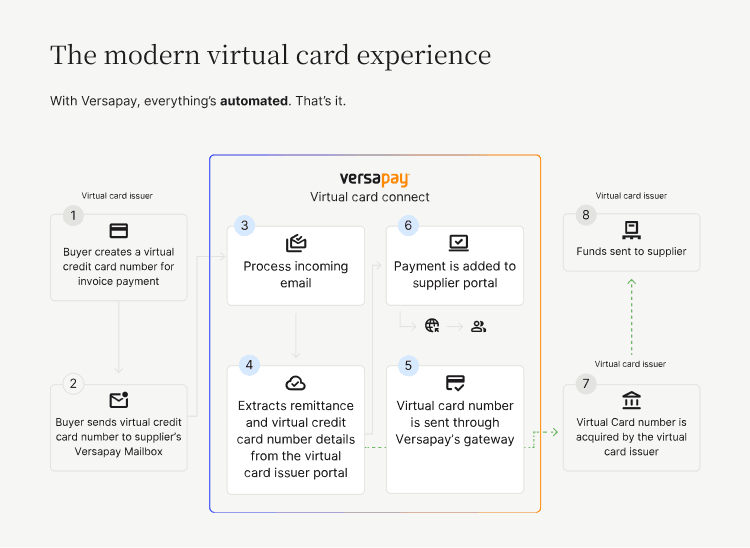

The solution works by performing the key processing tasks—like remittance extraction and reconciliation—that human accounts receivable staff typically do upon receiving a customer email with virtual credit card payment information.

Versapay Virtual Card Connect takes care of much of this manual work automatically. From parsing and extracting remittance and card number details, to straight-through processing and automated reconciliation—thanks to ERP integrations—Versapay’s Virtual Card Connect is the automation solution for your modern payment needs.

Presented with an incoming payment email, Versapay’s solution automatically extracts remittance data and virtual card number details from the virtual card issuer portal. The system then sends the virtual card number through Versapay’s gateway to the virtual card issuer, which uses that number to send the funds to the supplier. Meanwhile, Virtual Card Connect automatically adds the payment to the supplier’s accounts receivable payment portal.

Offered as a stand-alone or an integrated solution, Versapay’s Virtual Card Connect facilitates easier acceptance of virtual credit cards in four ways:

1) Automating workflows — Eliminates time-intensive processes like manually extracting VCC data and remittance details from emails, and reconciling payments with open accounts receivable.

2) Accelerating processing — Enables touch-free, straight-through payment processing at rates optimized for B2B transactions.

3) Ensuring security — Allows for securely collecting and storing sensitive payment information to remain PCI compliant.

4) Streamlining reconciliation and reporting — Provides access to detailed virtual card reporting data and automates reconciliation with Versapay’s ERP-integrated solutions.

If accounts receivable teams are not equipped with automated tools, accepting those payments could be tedious, clunky, and manual. Products that help AR teams automate acceptance and optimize interchange will save their companies time and money in the process

Get started accepting virtual cards right away

Many benefits come with using an automated solution that helps you quickly and easily process virtual card payments. You’ll see accelerated cash flow, less staff busywork, and more happy customers as payments go through quickly and easily.

Talk with one of our experts and schedule a demo to see how this solution can help your business. Read our report on virtual credit card adoption among finance leaders.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.