How Automating Accounts Receivable Helped Laticrete Boost Cash Receipts by $6 Million

- 13 min read

Laticrete used Versapay to significantly improve an inefficient legacy collections process.

This increased cash receipts by $6 million year-over-year in a given month, and allowed for better data visibility, faster cash flow, happier customers, and more efficient staff.

—

Overview

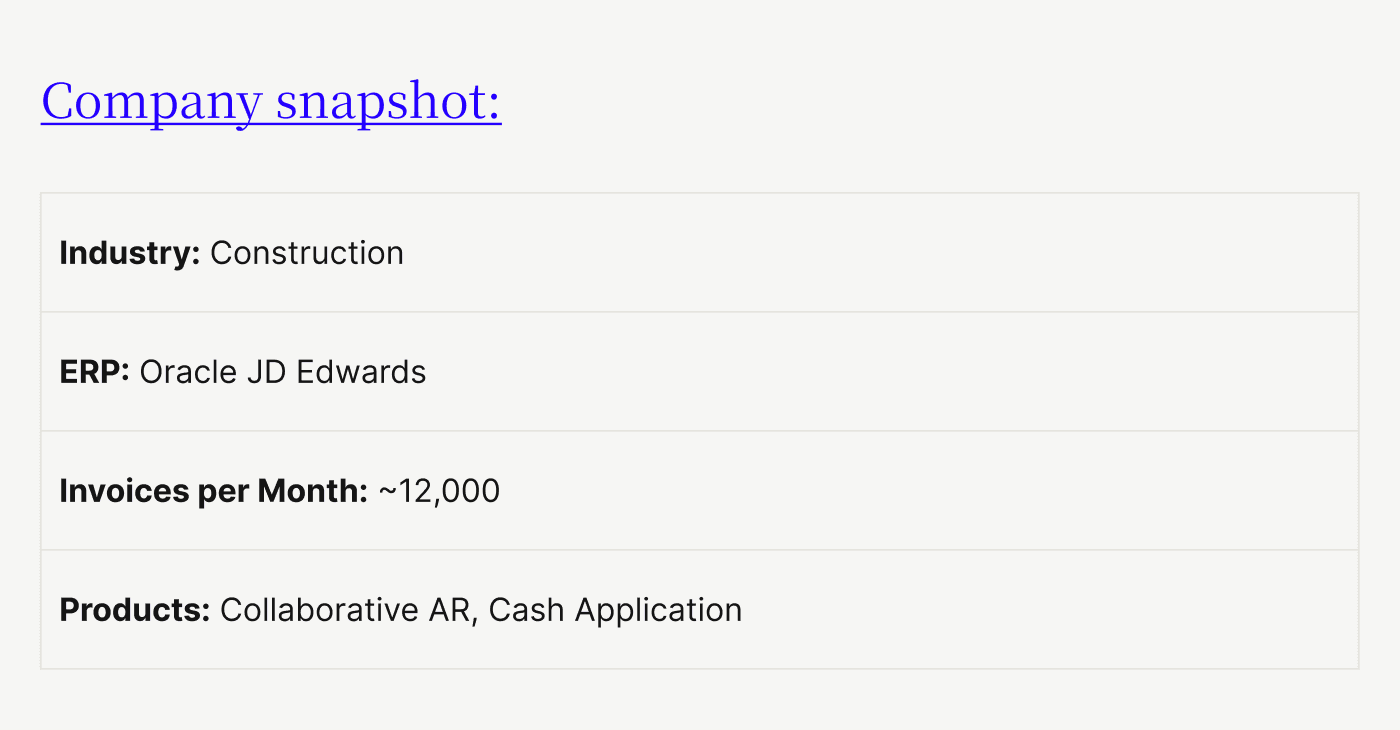

Laticrete is a provider of high-performance tile and stone installation systems and building finishing solutions. In business since 1956, the company has 2,000+ team members in more than 100 countries on six continents.

Dependance on legacy processes had burdened Laticrete with an inefficient, manual accounts receivable (AR) system. The AR team, responsible for handling as many as 12,000 invoices monthly, needed a way to automate its manual process to help the collections function contribute to business growth and progress.

“A lot of manufacturing companies think tech comes in the form of their engineering, their machinery, their logistics,” says Andrew Ceccorulli, Laticrete’s Credit and Collections Manager. “They don't think tech comes in the form of accounting.”

Andrew, the collections team lead with self-proclaimed ‘infectious’ ideas, joined Laticrete with an eye toward using technology to improve their accounting, and soon had the company’s executives on board with automating accounts receivable using Versapay.

The challenge: A highly manual, low-visibility receivables system led to inefficient collections processes

Laticrete’s accounts receivable process was performed almost entirely manually. “My team did their job incredibly well [pre-Versapay]. Just not in a technically efficient way,” says Andrew. This consumed a lot of staff time, left a lot of room for error, and made viewing payment and invoice statuses near impossible. Specifically, Andrew’s team dealt with:

Tedious work and inefficiencies — Laticrete struggled with the drudgery of doing rote collections tasks, particularly sending payment reminders and dunning notes. The process was inefficient and time-consuming, keeping staff from working on more fulfilling and high-value tasks and projects.

Lack of visibility leading to unfocused outreach — The manual system’s lack of visibility into payment and invoice statuses left collections staff unsure of which customer outreach to prioritize. They needed a way of seeing at a glance which customers to prompt for payment.

Invoice deliverability problems prompting extra work — A common excuse for non-payment among Laticrete’s customers was not having received an invoice, perhaps due to invoice emails getting stuck in spam filters. Due to ERP limitations, Andrew’s team had no way to see whether an invoice had been delivered or opened, and they frequently had to reissue invoices. The team needed to somehow provide customers ongoing access to invoices and gain the ability to track their status in real time.

“We had no idea [if our invoices were arriving] because JD Edwards was autonomously sending out the PDFs with no bounce-back report. So it could have been 10% success or 100% success. Who knows?” says Andrew.

Misapplied payments causing customers dissatisfaction — Laticrete’s legacy process made it difficult to match payments to invoices, leading to occasional incorrectly applied payments. Andrew and his team would sometimes follow up on invoices they thought were unpaid but which in fact were settled, leading to customer dissatisfaction and a waste of time in solving this avoidable problem

Low receivables team morale — These challenges contributed to an inefficient collections process. And despite jobs being done well, it was felt that the accounts receivable team could be more effective. This increased the team's stress and stifled their motivation to work diligently within the flawed receivables system.

The solution: An automated accounts receivable solution to reduce rote work, increase visibility, and boost efficiency in the invoice-to-cash process

Andrew wanted an automated solution that would reduce rote work, provide greater visibility into invoicing process and customer accounts, and allow his accounts receivable team to be more proactive in accelerating cash flow.

The team found all they needed in Versapay. Laticrete implemented Versapay Collaborative AR, an automation solution that enables efficient collections processes like electronic invoicing and automated dunning notices and reminders.

The platform comes with account prioritization tools and a cloud-based collaborative payment portal. It addresses Laticrete’s issues with invoicing and payment visibility, time-consuming reminder and dunning processes, and cash misapplication problems.

Laticrete is also using Versapay Cash Application, a tool that gives its AR team the ability to accept physical check payments and decode them using optical character recognition (OCR), then automatically match them to remittance advice and open invoices using AI and machine learning. This addresses Laticrete’s cash-application needs on check payments made outside of the Collaborative AR platform.

The results: 8 ways that automating accounts receivable with Versapay helped Laticrete

The transformation of Laticrete’s collections process with Versapay has brought a range of benefits to the company, from boosting cash flow to making both customers and employees happier. Andrew speaks for the whole company when he asks, “How did we not do this before? How did we not utilize this tool for so long?”

Here are eight ways automating the AR function with Versapay helped Laticrete:

- 1) Increased cash flow

- 2) Faster payments

- 3) More working capital

- 4) Visibility to inform follow-up

- 5) Superior invoice deliverability

- 6) Revenue growth

- 7) Better customer experience

- 8) Happier employees

1. Increased cash flow

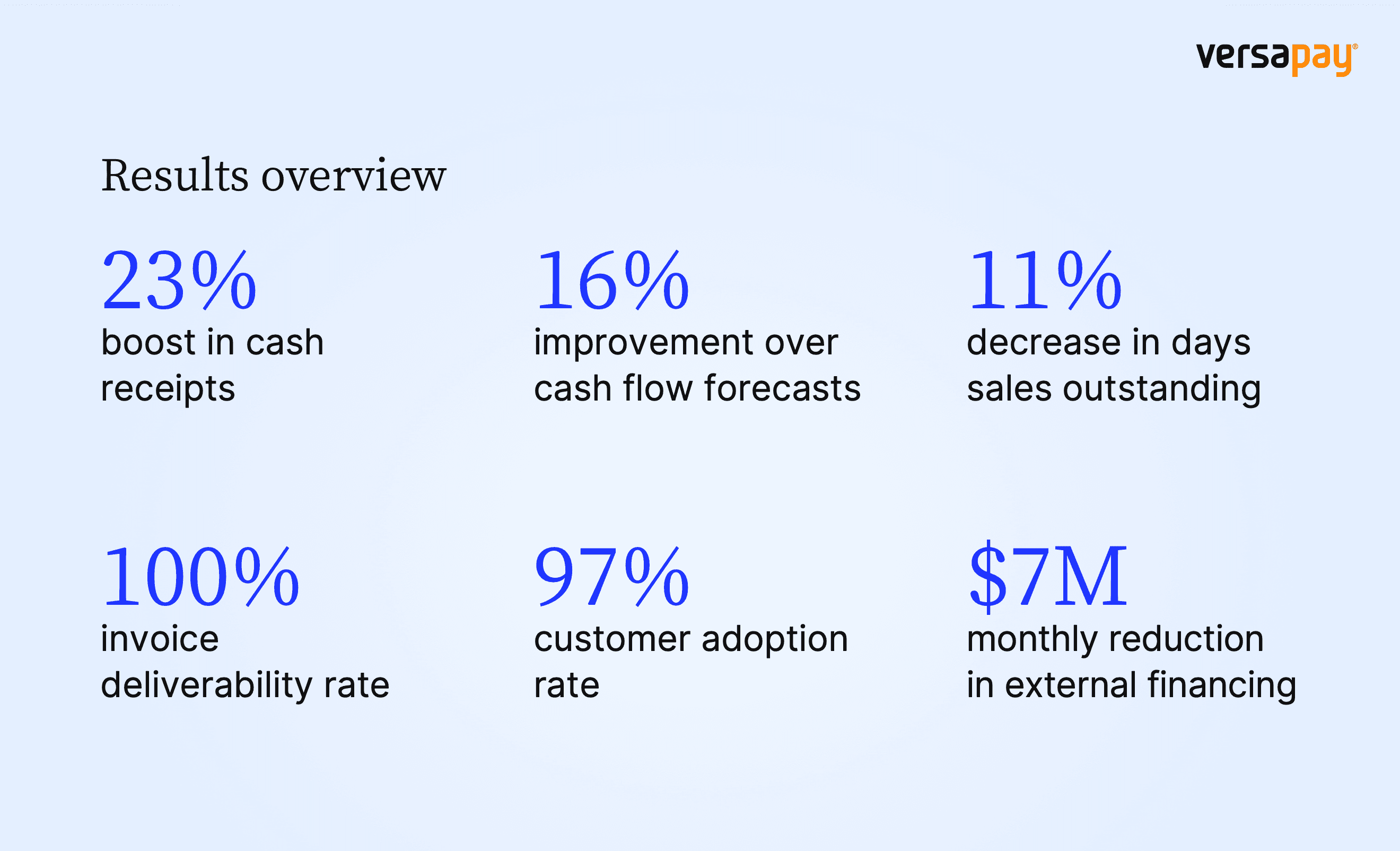

Laticrete’s cash flow improved after automation, with cash receipts in July 2024 totaling $32 million. That was $5 million higher than any previous month, $6 million more than the previous July, and 116% of the cash flow forecast for the month. The increase was in large part attributable to Versapay.

Versapay makes it easier for Andrew’s team to prompt payment from slow-paying customers, and for customers to pay with their preferred payment method through the collaborative portal. These changes combine to increase the rate at which money flows into Laticrete’s accounts.

“The only change coming from last year to this year in the business season is that we have access to this new process where customers can do this stuff,” says Andrew.

2. Faster payments

A key element of increasing cash flow is upping the speed at which each individual invoice is settled. With Versapay in place, Laticrete’s days sales outstanding (DSO) came down around 11%, from an average of 64 to 57.

“We’re more than happy with that,” notes Andrew.

This change is also attributable to functionality within Versapay that makes it easier for staff to nudge customers for payment at appropriate times and for customers to pay with digital methods via the portal.

3. More working capital

Laticrete’s bank revolver is operating at $7 million lower on average this year because of the accelerated and boosted cash flow. Versapay’s automation features allow the company to have more cash on hand, reducing its dependence on borrowing.

Andrew says having access to more working capital relieves his stress, emphasizing the mental and emotional benefits that automating with Versapay can provide.

4. Visibility to inform follow-up

Versapay offers visibility into which customers’ payments are past due—making it easy to send prompt payment reminders—and which payments are for what invoices. Even check payments and remittance stubs are captured using Versapay Cash Application and pushed through to the collaborative payment portal where both Laticrete and their customers can see them.

This real-time information allows for accuracy in discussing missing payments with customers, and the collaborative portal allows for instant, traceable communications.

“When a customer says, ‘Oh, I paid that check’, we can say, ‘No, you didn’t,’” says Andrew. “’The data is right there, and we know what you paid.’ With Versapay, we can both actually see what was paid with each payment.”

5. More effective invoice deliverability

Before Versapay, Laticrete had no insight into which customers were receiving invoices, as the company’s ERP did not report bounce-backs of the PDF documents.

Using Versapay, Andrew’s team can deliver invoices via the portal and see if any customers have not accessed them. Since starting with the platform, only two invoices have been flagged as undelivered, in both cases because of email addresses changing due to acquisition.

“Customers are accessing and downloading invoices, seeing real-time information,” says Andrew. “Home run!”

Andrew believes that having near-perfect invoice deliverability has been a game changer. It means that his team can spend far less time following up, getting tangled in paper trails, and resending invoices deemed lost. And customers who get invoices promptly can—and do—pay them faster.

6. Growth in revenue

With Versapay, Andrew’s team is helping grow revenue, instead of serving simply as a back-office, administrative function. The visibility that Versapay enables allows Laticrete’s sales team to grant customers higher credit limits despite the increased risk doing so normally brings.

Versapay shows which customers typically pay quickly and reliably. The AR team has increased the number of customers in this category thanks to automated reminders that highlight how faster payment translates into more credit, motivating more customers to pay quickly.

7. Better customer experience

Almost all—97%—of Laticrete’s customers are using Versapay to see their account status, access open invoices and reminders, and communicate with Laticrete. This level of transparency cuts down on the amount of confusion, miscommunication, and disputes that arise in the collections process, all of which makes for happier customers.

Customers who do have a dispute can start one with a click in the portal. This method leads to faster resolutions than email, since the accounts receivable team is able to access the inquiries immediately and is motivated to act quickly in this customer-facing arrangement.

8. Happier employees doing more with less

With Versapay making their work more automated and efficient, Andrew’s team can do a lot more high-value work, such as handling claims and fixing misapplications, in addition to their usual collections workload.

They can do all this while maintaining their satisfaction on the job—feeling less like they’re scrambling to keep up and more like they’re adding value as part of a revenue-driving team.

“Our goal is to prevent having to get more employees,” says Andrew. “To me, Versapay is doing the work of three employees right now.”

Other leaders at Laticrete are also served well by using Versapay. Andrew can now do certain necessary tasks from afar, allowing for more effective remote work. And his CFO can clearly see—thanks to more accessible data— the immense value the AR team is bringing the company.

“It went from leadership wondering, ‘Why are there these problems?’ to ‘The AR team has got this covered,’” Andrew notes. “It relieved my team of stress. Without that stress from above, they could do their job better.”

About Versapay

For growing businesses that need to accomplish more with less, Versapay’s Accounts Receivable Efficiency Suite simplifies the invoice-to-cash process by automating invoicing, facilitating B2B payments, and streamlining cash application with AI. Versapay integrates natively with top ERPs, while allowing businesses to collect with a self-serve payment portal and collaborate with customers and teammates to resolve what automation alone can’t.

Distinct from solutions built for Fortune 500s, Versapay provides responsive support, fast implementations, and the flexibility to start with what you need and add more as you grow.

Owned by Great Hill Partners, Versapay’s employee base spans the U.S. and Canada with offices in Atlanta and Miami. With 10,000 customers and 5M+ companies transacting, Versapay facilitates 110M+ transactions and $170B+ in payments volume annually.