Lockbox Banking: How to Make it Work for Your Accounts Receivable

- 8 min read

Lockbox banking is a service that banks employ to help companies accept check payments from customers. Benefits of lockbox banking include easier reconciliation, reduced AR workload and better data security.

Key Takeaways

- Lockbox banking is a service that banks employ to help companies accept check payments from customers.

- Lockbox reconciliation is the process of matching check payments received by the bank lockbox to open invoices.

- The benefits of lockbox banking are easier reconciliation, reduced workload, and better data security.

- The way to improve check processing as much as possible is to pair lockbox banking with cash application automation.

—

Accepting and reconciling customer payments is a major and vital task for companies of all sizes. These days, digital banking tools and digital payments make this job easy and accurate in most cases. But some customers still send paper checks, and this can present a challenge for companies in identifying which payments are from whom and in response to which invoices.

Banks have a system for helping with this, called lockbox banking, in which they receive check payments on behalf of a company and then provide information about these payments to the company to enable easier accounting.

Many companies use lockbox services, as it can seriously ease the difficulty of payment reconciliation. But just the same, businesses that use this option are often looking for ways to optimize its interface with accounts receivable. This is because the process of matching payments to open invoices can still be time-consuming, tedious, and error prone for finance teams, even if the bank is consolidating all information about incoming check payments in a single data file.

This article explores how lockbox banking works and details ways to optimize its function for your company.

Jump to a section of interest:

- How lockbox banking works

- The benefits and challenges of lockbox banking for accounts receivable

- How to handle cash application when using a lockbox

How lockbox banking works

Lockbox banking is a service that banks employ to help companies accept check payments from customers. With lockbox banking, customers send checks to a special post office box instead of to the seller’s business address, so that the bank instead of the seller receives the payments.

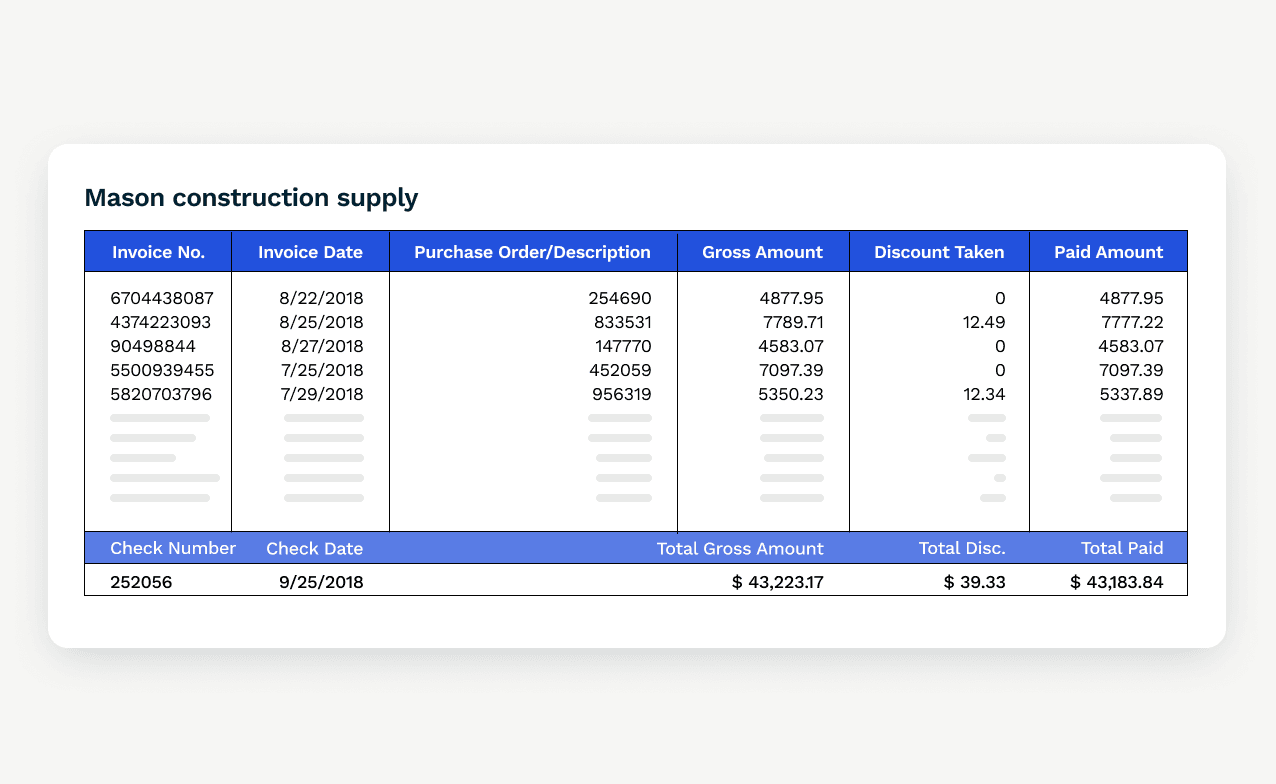

The bank then deposits the money into the company’s account and sends the company a batch file listing the payments processed and all information about them, including:

- The amount,

- The customer name, and

- An indication of the invoice the check responds to.

Getting detailed information about these payments helps the company reconcile check payments with open invoices.

What does “lockbox payment” mean?

A lockbox payment is a check that a customer sends to the company as payment via a special PO box managed by the company’s bank. Large companies may have multiple lockboxes so customers can send lockbox payments to a box in their own country or region.

What is lockbox reconciliation?

When the bank sends the seller—the company that’s using the bank’s PO box—a batch file with information about the check payments it processed, the company can import the file into its financial management system to create records of these transactions. Lockbox reconciliation is the process of matching these transactions to open invoices to assess which have been paid.

Benefits and challenges of lockbox banking for accounts receivable

Lockbox banking comes with both benefits and challenges. Most of the challenges arise when the company maintains manual processes for incorporating the information into its accounting system.

What are the benefits of lockboxes?

- Easier reconciliation: The bank’s provision of all the information about check payments in a single file makes reconciliation easier, including facilitating its automation.

- Reduced workload: The bank takes the hassle of handling check payments off the company’s hands, thus freeing up accounting staff for higher-value work like strategic planning and revenue forecasting.

- Better data security: The bank maintains back-up records about these deposits, which increases the information security related to a company’s check payments.

What are the challenges of lockboxes?

- More errors: Check payment information must be manually inputted at least once by the bank, and potentially twice if the company hasn’t automated its system. Manual data entry can introduce errors into the company’s accounting system, which can skew financial reporting and take extra legwork to correct.

- High time commitment: Accounting teams that enter payment information into the company’s AR system manually face a high time commitment and cannot dedicate more time to higher-value tasks.

- Slow processing: The timeframe for applying payments to open invoices is typically slow when the process is done manually, which can lead to confusion and misunderstanding between customers and accounts receivable staff. An example is accounts receivable sending a payment reminder letter to a customer who has already paid due to the slow updating of payment records.

Why are manual processes such an Achilles heel for processing check payments, even when the bank is providing all the remittance information in a single file via lockbox banking? It is in part because a single check can address many line items and even multiple invoices, each with its own list of charges.

This was the problem a company in the healthcare sector confronted when it saw the size of its check payments triple during the pandemic as demand for its service surged. A single check for $200,000 might arrive with more than 60 pages of remittance, which the bank running the company’s lockbox service would include in its data file for the company.

The healthcare company’s cash application team would need to work late into the night to reconcile all these line items with open invoices, a process that took far longer than necessary because the team was doing this task manually. The company had to automate the cash application process in order to scale quickly enough to meet increased demand.

How to handle cash application when using a lockbox

Companies can handle cash application from lockbox payments manually or by using cash application automation software.

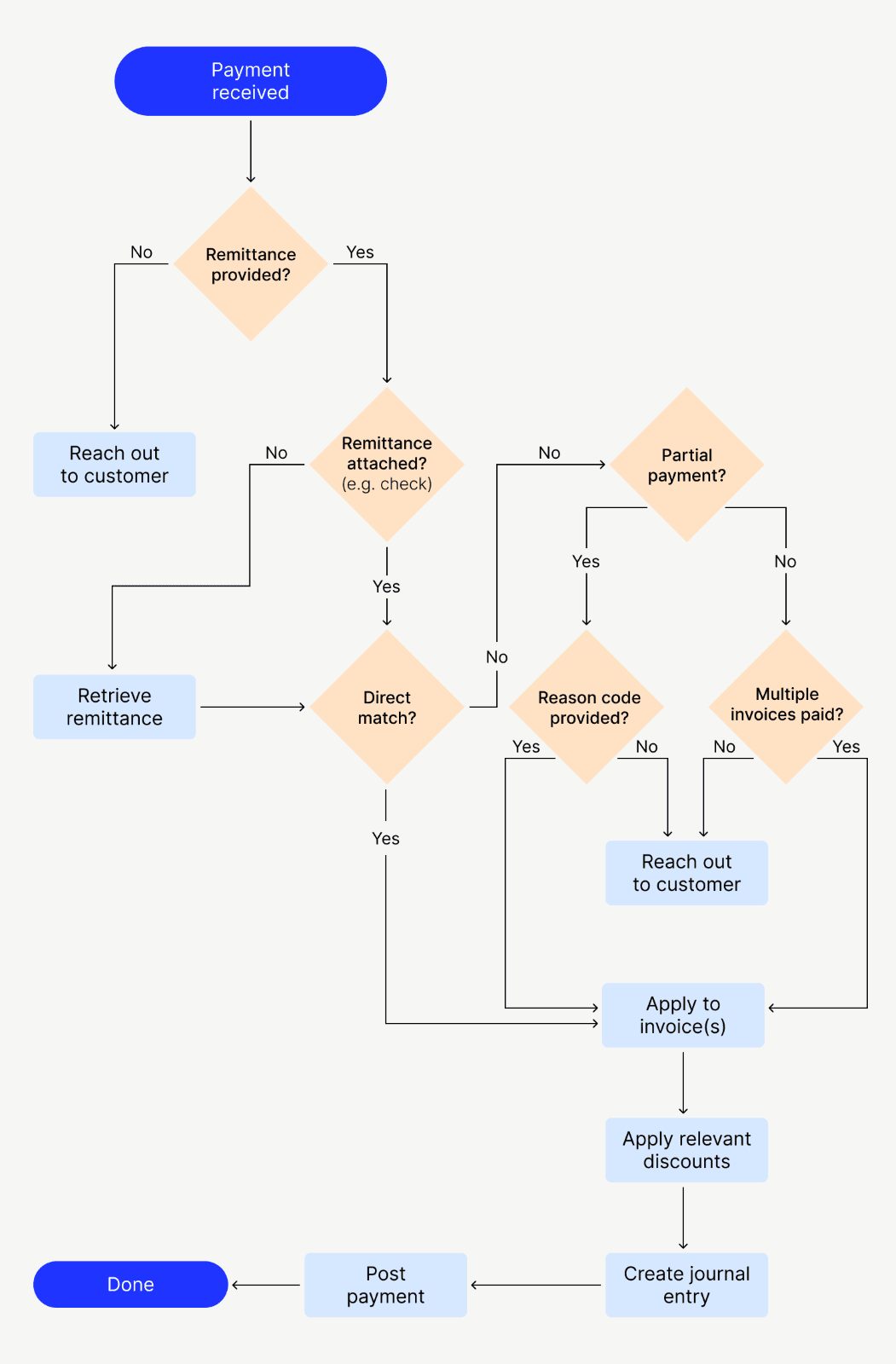

The cash application process: done manually

- A company’s accountant or cash application specialist loads the remittance information file that the bank sends into their ERP. They then manually apply the payments to invoices and update balances in the ERP.

- Below is a more thorough breakdown of the cash application process when performed manually:

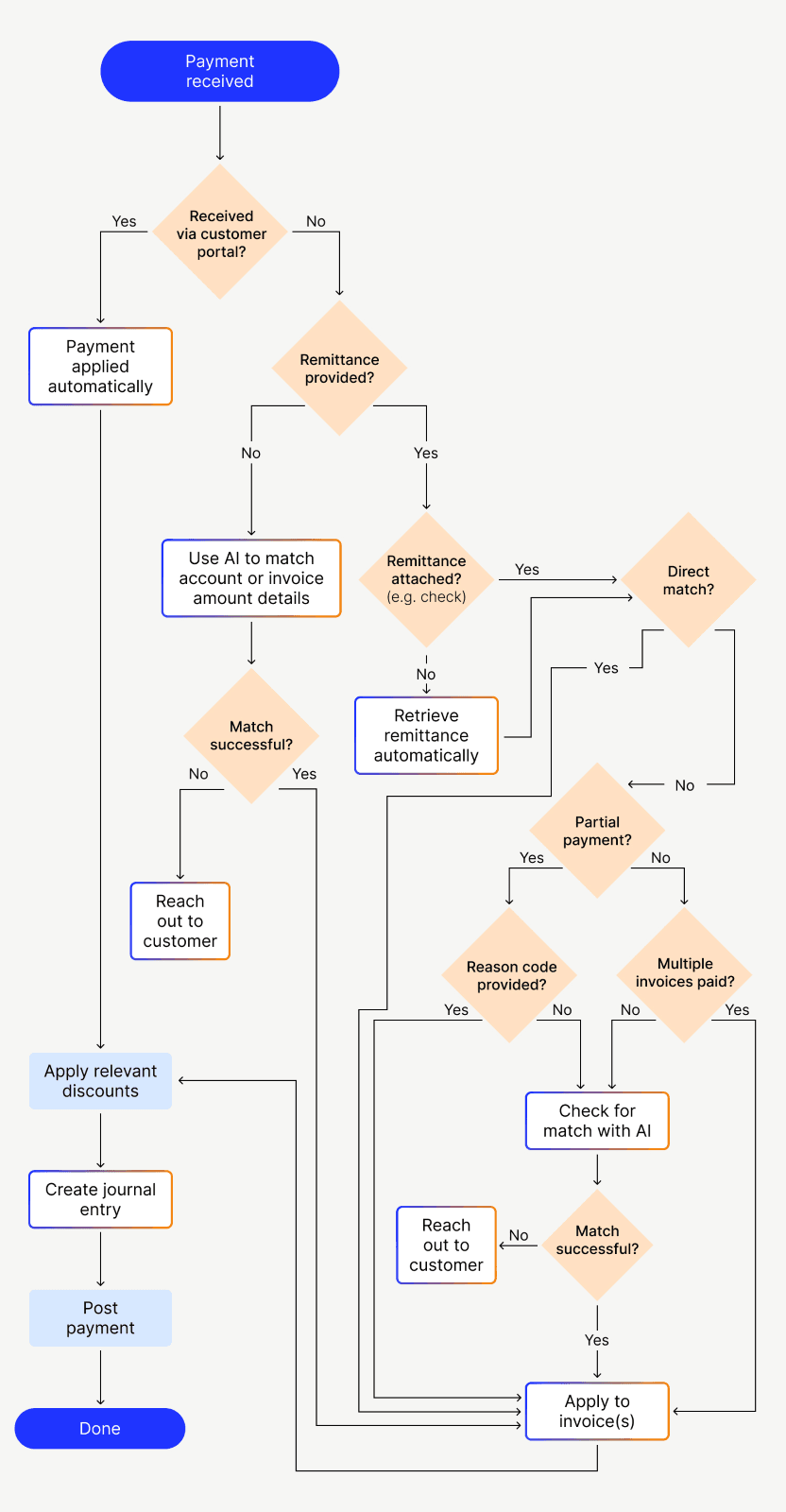

The cash application process: done using automation software

- A company’s accountant or cash application specialist loads the remittance info file directly into the accounts receivable automation system, which automatically matches and applies the payments to open invoices. The system then sends those applied payments to the ERP.

- Below is a more thorough breakdown of the cash application process which details where automation can support. Note that the boxes outlined in blue and orange gradients represent tasks that technology can automate:

Why use cash application automation software

There are several prominent reasons to use cash application automation software to handle your reconciliation process for check payments.

- Save time and money: Automation takes the manual busy-work out of the reconciliation process, allowing your accounting team to complete this process far faster. They can dedicate this time to doing tasks that benefit your business more, which makes better use of your payroll outlay.

- Increase efficiency: Manual reconciliation takes time, which means that reconciliation can lag substantially behind the receipt of payments. This time gap can cause operational inefficiencies and confusion. Automating reconciliation allows you to match payments with invoices in a matter of minutes—with an exceptionally high straight-through processing rate—creating a far more efficient workflow for your team.

- Reduce errors: Manually reconciling payments is a labor-intensive process that is likely to introduce human error into your company’s accounting. Automating the work reduces errors, ensuring higher-quality accounting data and saving staff time that might have been used remediating mistakes.

With lockbox banking, check processing doesn’t need to be onerous

In this age of digital payments, the process of managing check payments can seem forbiddingly onerous. And compared to the streamlined, automated protocols we use for much financial management these days, it does tend to be a lot more involved and manual. That’s why using lockbox banking is a good option for businesses to manage check payments. It makes the work of check processing simpler and faster.

The way to improve check processing as much as possible is to pair lockbox banking with cash application automation. Check out our complete guide to cash application to learn more about how automation can help you transform your AR operations and make check processing even easier.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.

Lockboxes

Learn how lockboxes influence accounts receivable and how they integrate with an increasingly digital world