Lower Your Days Deduction Outstanding and Improve Your Cash Flow

- 7 min read

Every time a customer fails to pay an invoice in full, you have another claim to investigate and deduction to manage. Over time, deductions can have a significant impact on cash flow.

In this article, we’ll show you how to look at a metric called Days Deduction Outstanding (DDO) and understand the meaning behind it. And, if it’s too high, we’ll give you some proven tips to accelerate payments, eliminate deductions, and improve your cash flow overall.

Jump to a section of interest:

The average company has $4 million in outstanding invoices

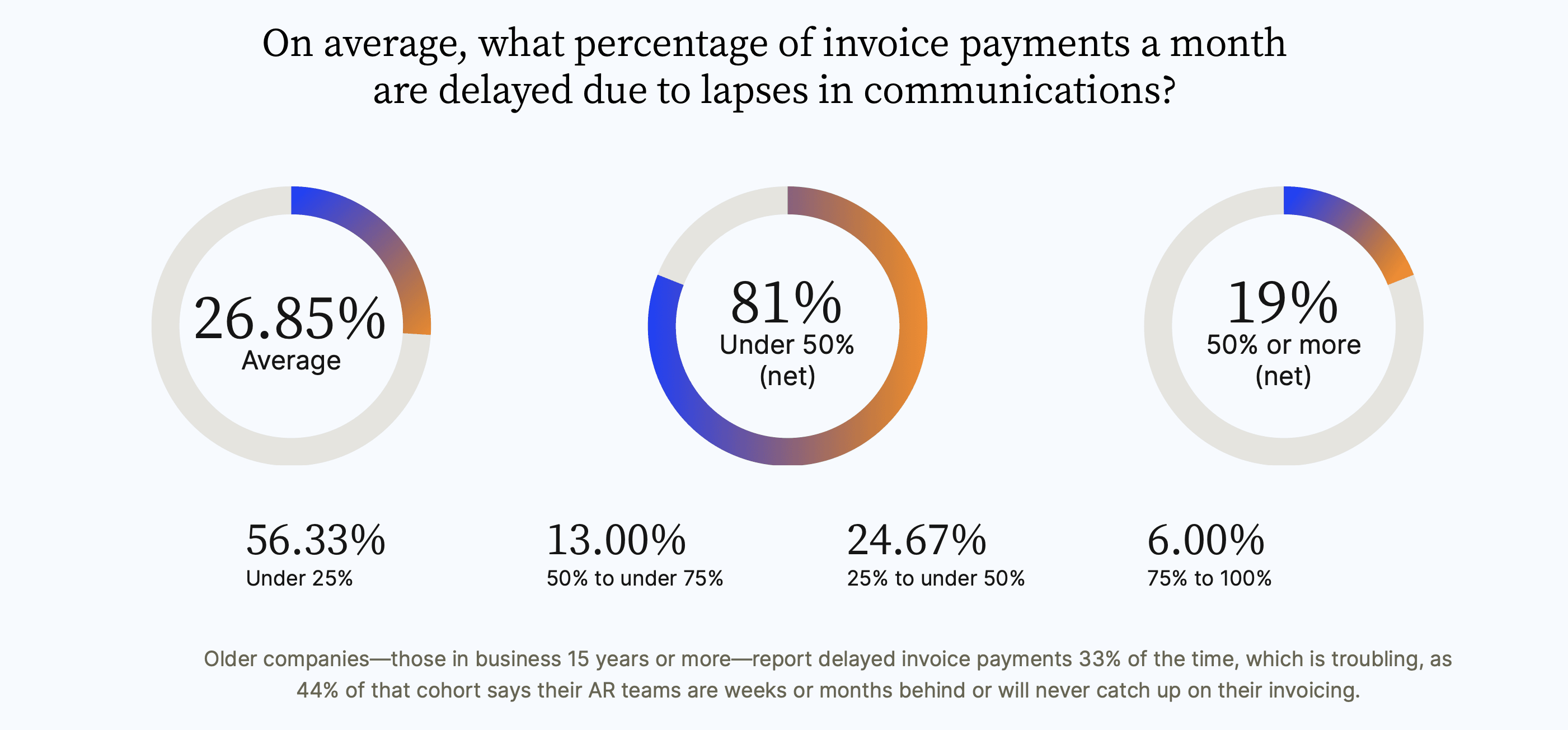

According to a survey of 300 CFOs we conducted with market research firm Wakefield, the typical mid- to upper-midsized company has approximately $4 million in outstanding invoices per month due to lapses in communication alone.

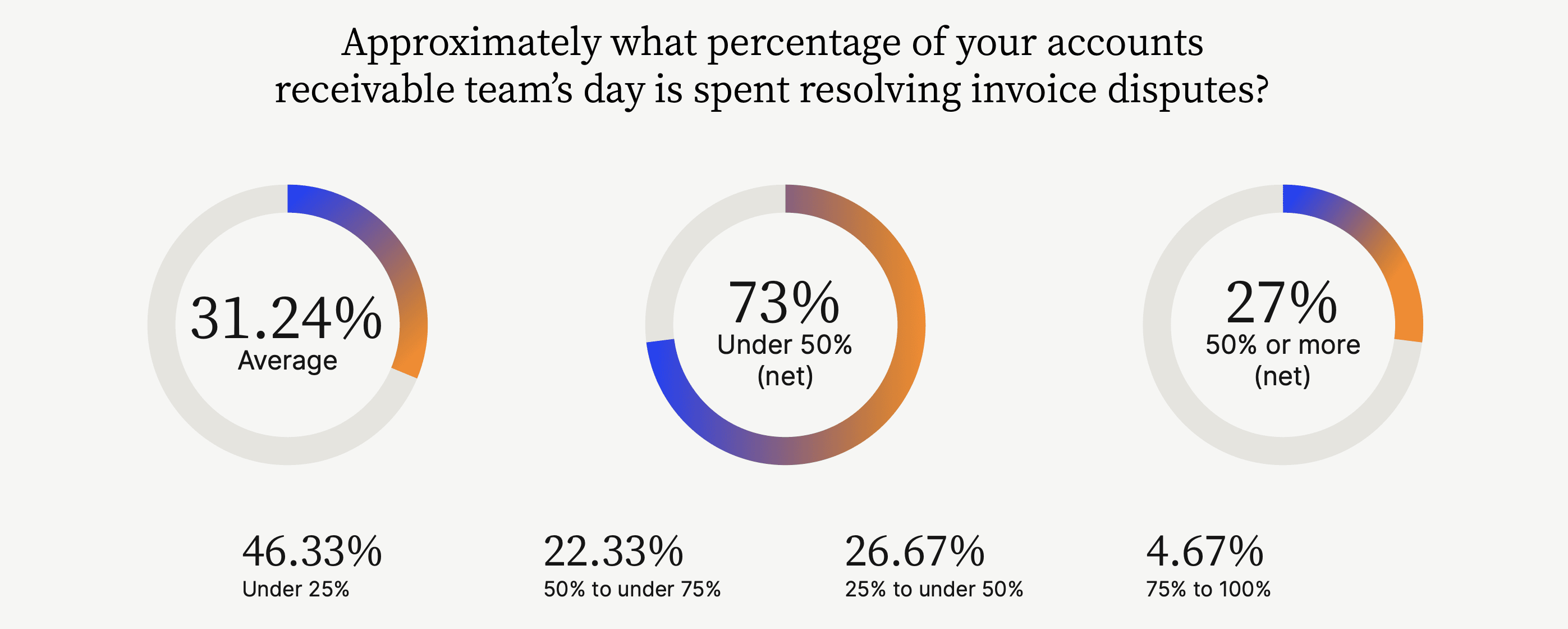

Trying to collect on these deductions takes a significant amount of time and effort. The typical accounts receivable team spends a third of its workday on dispute resolution, and escalations put an extra burden on senior management at 98% of companies.

What’s more, nearly two-thirds of executives say that an invoice dispute has resulted in the threat or initiation of a lawsuit, and one-third reports that litigation has been required to resolve invoice issues.

How to separate bad deductions from good deductions

Many deductions, such as trade promotions, co-op advertising, coupons, markdowns, and discounts for early payment are good for business because they incentivize sales and encourage prompt payment.

When companies communicate these incentives clearly, and when stakeholders (sales and AR on your side and AP on the customer side) understand the terms and benefits of these deductions, they can improve satisfaction and strengthen customer relationships.

However, sometimes sales will offer these types of discounts to customers without informing AR. When this happens, payments can get delayed as AR scrambles to get the discount approved or tries to deny the discount.

Many other deductions, however, are preventable. Such deductions can occur for a variety of reasons that are under the supplier’s control, ranging from poorly communicated price data and slow credit memo issuance to errors in order entry, shipping, and billing.

How do you know if you’re managing deductions effectively?

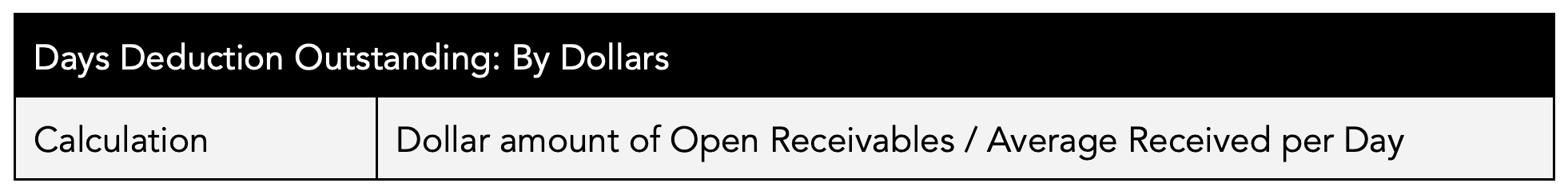

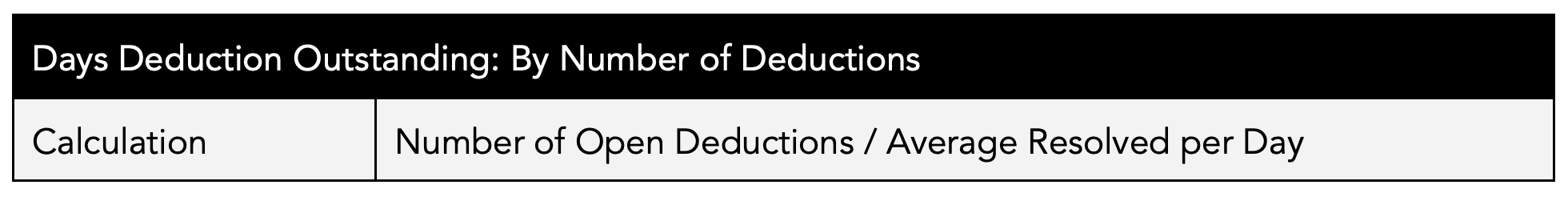

Understanding your Days Deduction Outstanding can help you determine how long it takes your AR team to resolve outstanding deductions. It can be calculated in two different ways, by dollars or number of deductions.

Both of these methods are useful. Calculating Days Deduction Outstanding by dollars can give you a better understanding of the total amount of money that’s owed to your business. This can help you budget, make forecasts, and identify any large deductions that may be taking a significant amount of time to process.

Because most companies put the most effort into the largest deductions, calculating Days Deduction Outstanding can give you a more accurate picture of the total number of deductions you have outstanding. Calculating DDO by number can help you identify areas where you may need to improve your processes in order to reduce the amount of time it takes to resolve your deductions.

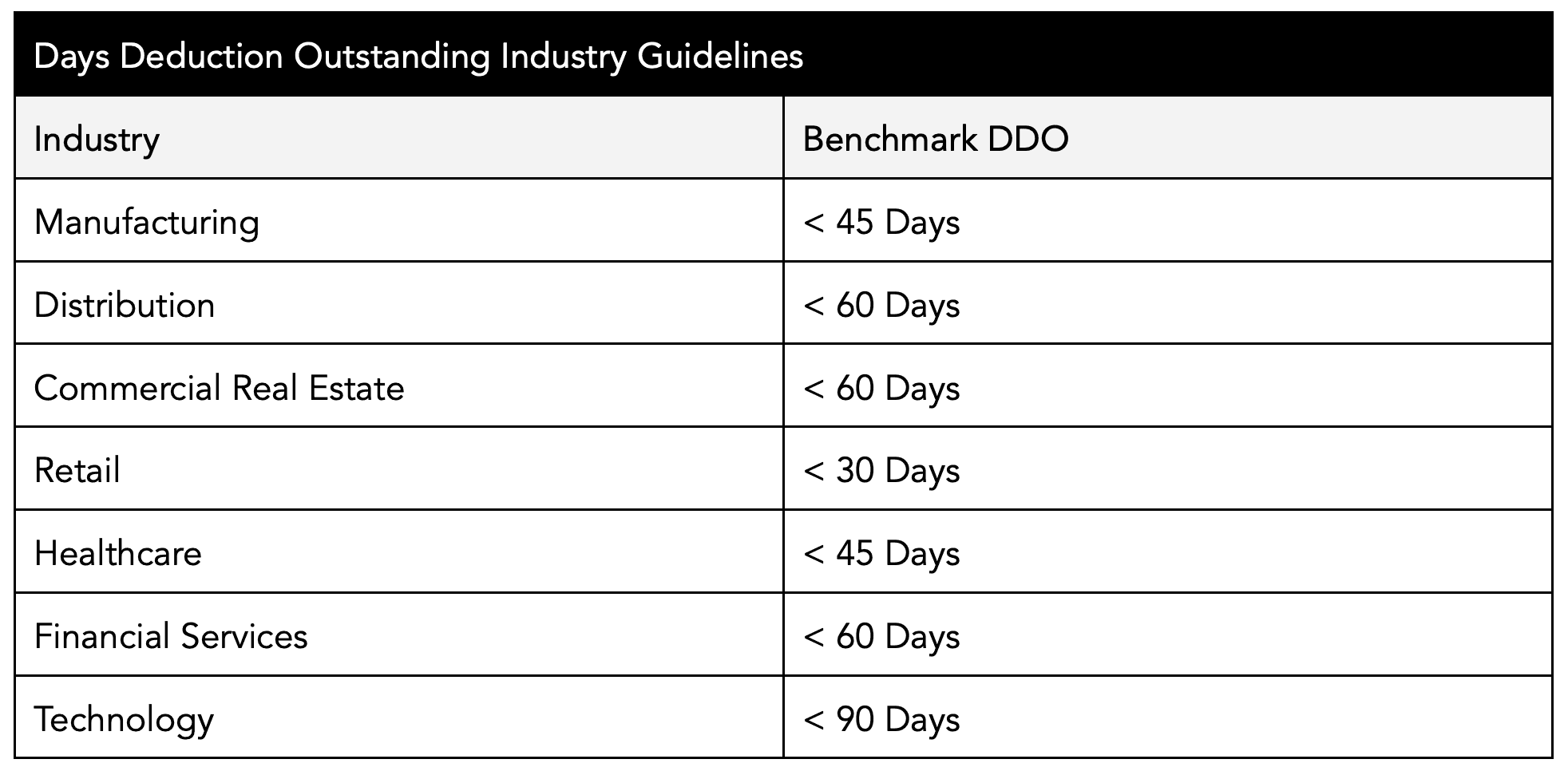

No matter which way you calculate it, a lower DDO is better than a higher DDO. The fewer days it takes you to resolve your open deductions the better. While there’s no one-size-fits-all answer to what number your Days Deduction Outstanding should be, here are some general guidelines for key industries:

Knowing your DDO—and working to reduce it as much as possible—is important for maintaining healthy cash flow and profitability, while eliminating the revenue leaks that unresolved deductions can cause.

What causes a high days deduction outstanding?

Invoicing errors and miscommunication about pricing or eligible discounts are the primary reasons why DDO is higher than it should be at many businesses. Poor product quality and delivery errors can also be factors, but those issues are outside the scope of financial professionals.

What it boils down to for finance and AR is a lack of collaboration with customers throughout the payment stage and a poor payment/collection process. Using the Gartner Peer Community platform, we found that, outside of onboarding, the payment/collection cycle creates the worst customer experience.

Here are just some of the reasons why:

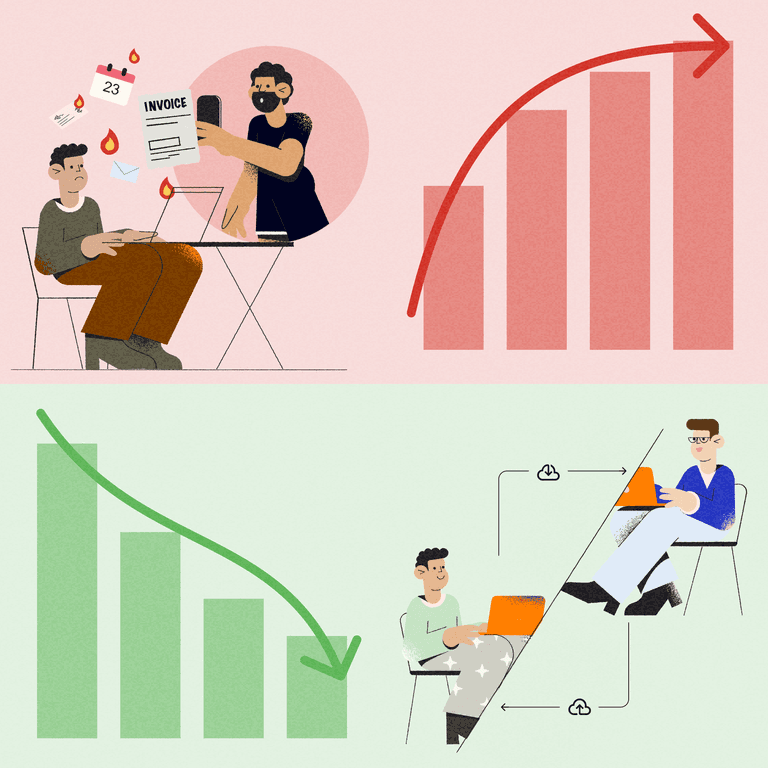

1. Manual processes lead to errors

Paper-based invoicing is tedious and inefficient and has a negative impact on cash flow:

Inaccurate or lost invoices must be manually revised and re-delivered

Calls and emails, which are often missed or forgotten, are inefficient ways to remind customers to pay their bills

Support documentation is not readily available and is more difficult to access

2. Poor communication and collaboration create negative payment experiences

In another survey we conducted with Wakefield, more than 1,000 C-level executives were very clear about the payment problems caused by poor communication between companies and customers:

78% say they encounter (at least sometimes) payment conflicts that could have been avoided with better communication; 44% say these disputes happen often or all the time

65% report that better transparency and collaboration between AR and customers would reduce the number of invoice disputes

Miscommunication can take many forms, but the most common examples include invoices being sent to the wrong person, discrepancies with no backup documentation, missing or incomplete remittance advice, and communication methods (phone and email) that make it difficult to keep track of details and conversations.

How AR automation lowers your DDO and increases profitability

If you haven’t noticed already, poor communication and manual processes are closely related. Fortunately, you can solve both problems with AR automation software that automates manual processes, increases information transparency and invoice clarity, and makes data much easier to share.

Automating invoice creation and delivery, facilitating digital payments, enabling customer portals, and sharing information from a centralized data repository can all lower your days deduction outstanding and ensure you have a healthy cash flow.

Here are just a few key features of AR automation software that can accelerate your payment process and reduce the number and amount of your open deductions:

Automatic payment reminders improve the customer experience and accelerate cash flow. Contrary to conventional wisdom, payment reminders are NOT a nuisance. Being proactive, sending payment reminders at the right time, and countering non-payment objections with data are essential components of effective reminders.

Customized deduction codes require customers to indicate the reason for a short payment from an approved list of options. Knowing why a customer isn’t paying in full at the outset makes it easier to follow up and reconcile deductions

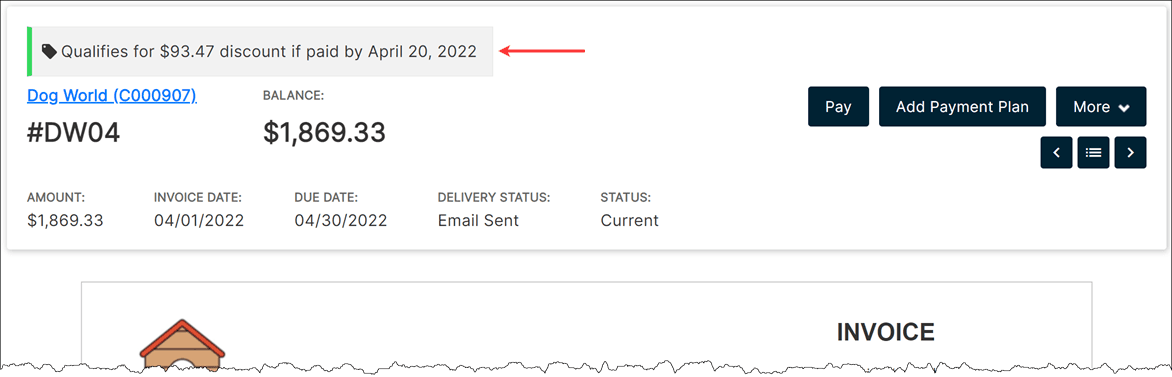

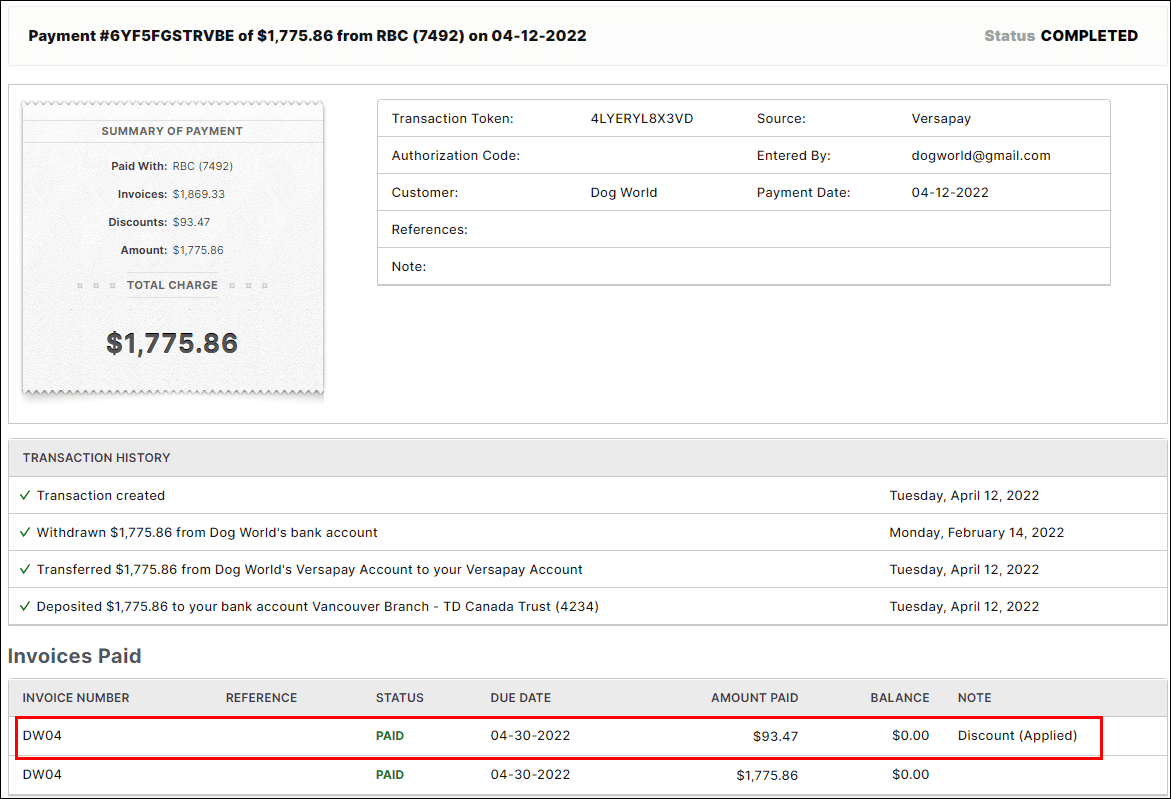

Offering early-pay discounts incentivizes customers to pay faster and increases your chances of receiving payment. An AR automation platform like Versapay lets you set payment rules, such as defining whether customers can use credit cards and ACH payments for discount-eligible invoices. Versapay also clearly shows eligible discounts on invoices, invoice listing pages, and receipts

Get on track to a lower DDO

By addressing your most pressing payment issues, Versapay’s AR automation platform will help you collect more money on time, improve your customer experience, increase your cash flow, and lower your Days Deduction Outstanding.

Contact us today to arrange a demo, and learn how we can help you address your DDO for better financial health.

About the author

Ben Snedeker