How to Handle Delinquent Accounts in Accounts Receivable

- 12 min read

Delinquent accounts are customer accounts with unpaid invoices or balances with past due dates.

This article covers the basics of delinquent accounts and their impact on accounts receivable. It addresses management best practices and tips for streamlining AR workflows.

Managing delinquent accounts is notoriously tedious and time consuming. One traditional method involves reaching out to customers multiple times via antiquated channels—like email and telephone—regarding payment dates and terms. Not a strategy known for its efficiency. Thankfully, there are more modern strategies and solutions to effectively manage and reduce delinquent accounts.

This article will cover the basics of delinquent accounts and their impact on accounts receivable, then address management best practices and tips for streamlining AR workflows. Jump to a section of interest below:

- Delinquent account meaning

- Impact of delinquent accounts on AR

- Best practices for managing delinquent accounts

- More frequently asked questions about delinquent accounts

- Improve delinquent accounts through AR automation

What is a delinquent account?

Delinquent accounts are debts with past due dates that have not been paid on time. An account can become delinquent when a borrower or debtor fails to make a payment on loans, credit cards, or other types of debt.

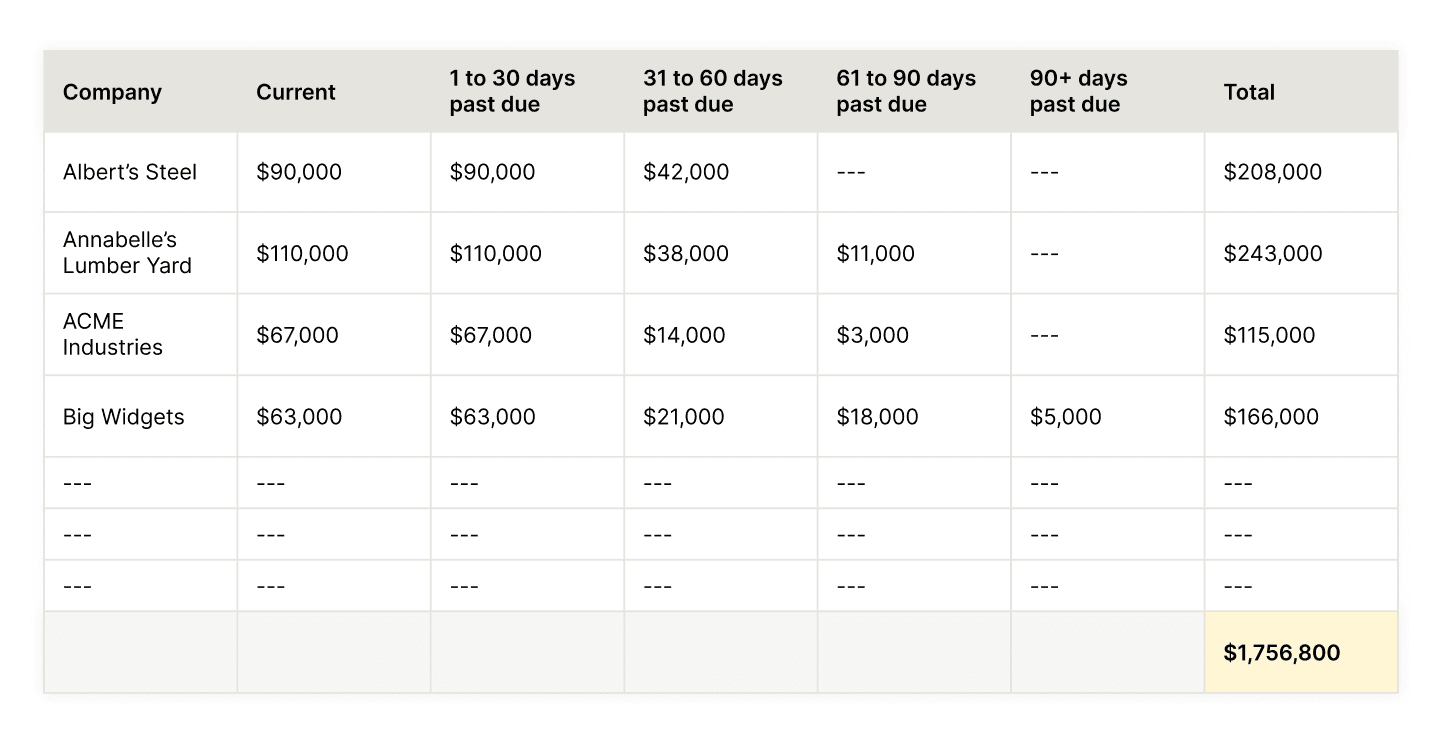

The length of time before an account is considered delinquent depends on the terms of the credit agreement in place. In most cases, collections teams will categorize delinquent accounts into buckets of 30, 60, 90, and 120+ days overdue.

Delinquent accounts can result in a number of consequences, including late fees, damage to credit scores, a poor credit report, and other penalties. Lenders or vendors may take additional measures to recover money owed, like taking legal action to initiate collections and making reports to major credit bureaus.

The impact of delinquent accounts on accounts receivable

When looking specifically at accounts receivable (AR), delinquent accounts refer to customer accounts with unpaid invoices or balances with past due dates. While the impact of one or two delinquent accounts may not cause significant consequences for a business, the situation can become dire as that number scales.

Some of the most notable impacts that delinquent accounts can have on AR include:

- Longer order to cash cycle

- Disruption in cash flow

- Lack of funds to pay suppliers, employees, etc.

- Increased bad debt expenses

- Strained customer relationships

- Higher administrative costs

- Lower company credit scores

It’s critical for businesses to understand the potential impact of delinquent accounts on AR processes and how to avoid them through both preventive and corrective measures.

Best practices for managing delinquent accounts in AR

It’s important to define and communicate best practices so AR teams understand how to handle delinquent accounts effectively without harming customer and partner relationships.

In addition to setting clear expectations and using thoughtful communications, AR automation and collections optimization software are becoming increasingly popular methods for organizations looking to accelerate cash flow. Below are 6 best practices for managing delinquent accounts in accounts receivable:

1. Establish clear payment terms

Establishing clear payment terms can be extremely helpful in setting expectations for customers. These terms can both reduce misunderstandings and improve chances of on-time payments.

Payment terms should include important details like due dates, accepted payment methods, and any customer consequences for not paying on time. Investing time and effort to create thoughtful and clear payment terms establishes trust and transparency with customers, and can support legal attempts to collect on unpaid accounts.

Payment terms can also include a credit policy, which defines how an organization extends credit to customers and collects on delinquent payments.

2. Allow customers to pay with their preferred payment method

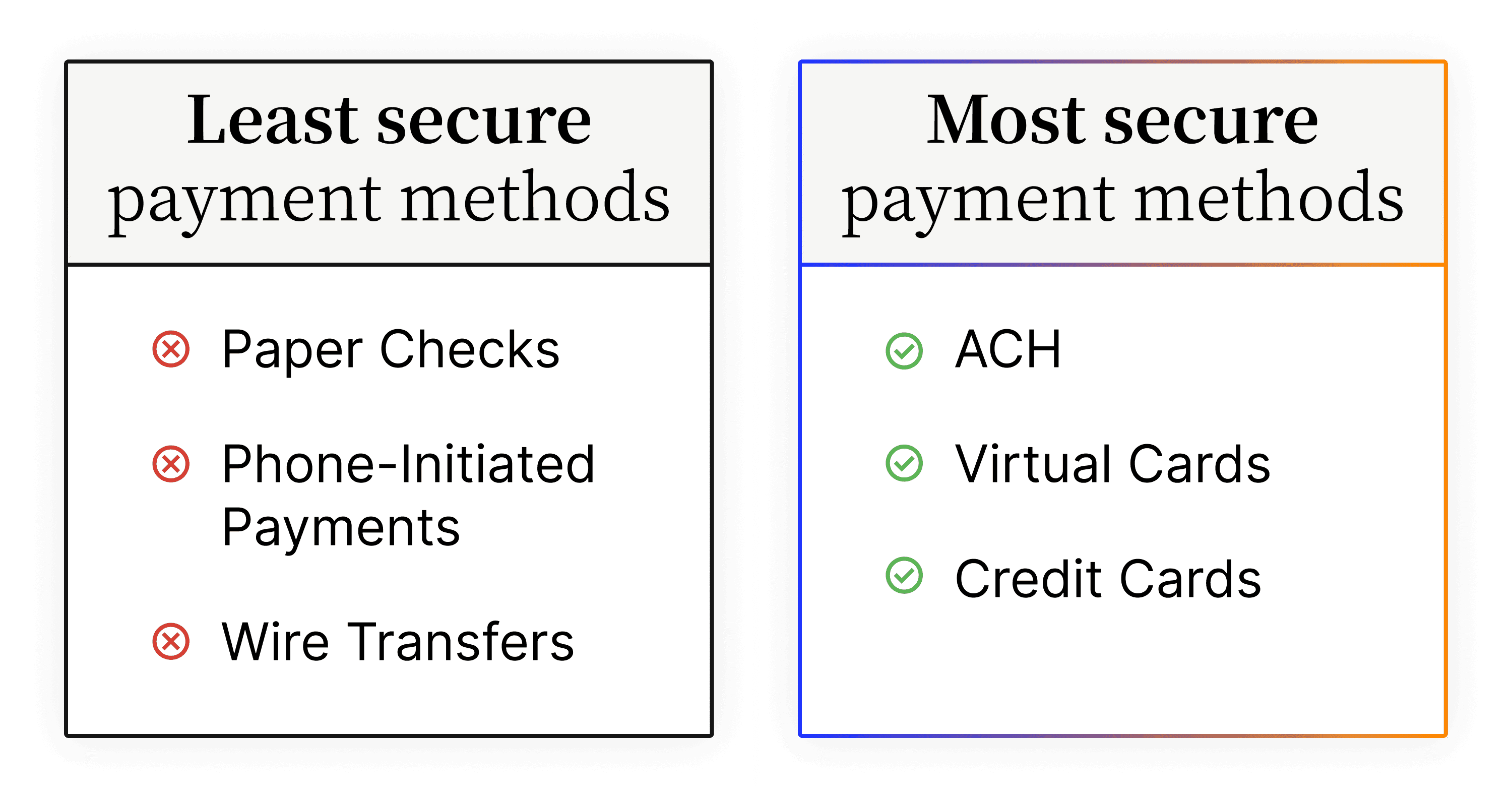

Accepted payment methods should be included in a company’s payment terms. It benefits an organization to accept as many types of payment—both digital and physical—as possible so the customer can choose how they submit their payment. This enhances customers’ payment experience and increases the company’s chances of getting paid on time.

If businesses are limited to the payment methods they can accept, adopting the most common payment methods will greatly decrease account delinquency. The most popular B2B payment methods have an increasing focus on digitalization and customer convenience. These include online payment platforms like PayPal and Venmo, as well as eChecks and digital credit cards like Apple Pay.

💡 Keep in mind that some payment methods are more secure than others.

3. Communicate (and collaborate) with customers effectively

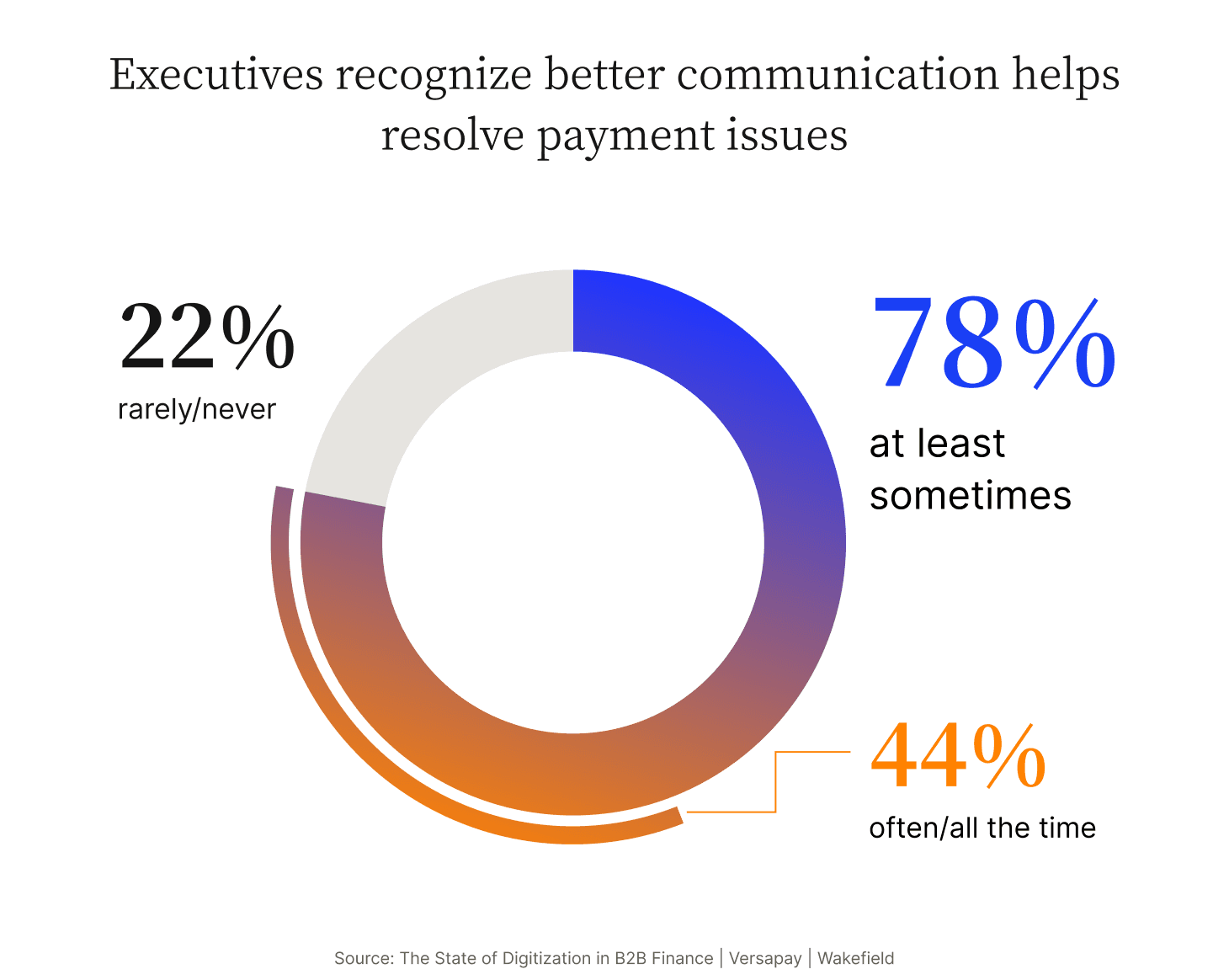

A more collaborative accounts receivable process leads to better communication between AR and AP teams and builds better customer relationships:

There are several best practices companies can implement for effective customer communication and collaboration. These include communicating regularly and transparently; offering multiple communication channels; providing options to resolve debts; and maintaining respect and empathy.

Simple steps like reminding customers when a payment due date is coming up, and then following up promptly when a due date is missed, can drastically decrease the number of delinquent accounts. Persistent follow-up is critical and lets customers know the company is serious about collecting the payment.

The State of Digitization in B2B Finance report by Versapay reveals that 85% of C-level executives report having lost revenue when invoices aren’t paid in full due to miscommunication during the payment process.

Of course, communication is a two-way street. Effective communication can’t be accomplished if the only strategy is AR teams harping on customers repeatedly until they pay. Politeness can go a long way when managing delinquent accounts. Add “please” and “thank you” to communications and try to give the benefit of the doubt.

Customers consistently late on payments should receive more direct language. When delinquent accounts transfer to collections, AR teams can improve related communication by having facts ready during calls, striking the right tone, using conversational strategies, and validating the customer’s experience.

Robust software solutions like Versapay that offer a collaborative accounts receivable portal can go a long way in streamlining communications between AR and AP teams and their customers.

4. Use software tools to track and prioritize collections efforts

Automating AR functions can have a number of positive effects on managing and reducing delinquent accounts. From automating dunning letters to inciting full-blown transformative change, accounts receivable software tools help teams track and prioritize collections efforts—and in some cases even eliminate the need for collections calls altogether.

AR automation software makes it easier to prioritize collections based on age of debt and likelihood of collecting. The best solutions possess built-in accounts receivable aging reports that segment overdue payments by debt age based on due date. Mapping both current and outstanding payments side by side gives teams a high-level AR overview they can use to make well-informed decisions.

More importantly, AR automation software can help bridge the AR Disconnect—the chasm that forms between business and customers during the payment process due to a lack of transparency into receivables, ineffective communication methods, and a reliance on manual workflows. The AR Disconnect causes miscommunications and friction that delay payments and increase delinquent accounts.

By empowering AR and AP teams to communicate effortlessly over the cloud to manage the invoice to cash process will increase collaboration and boost customer experience.

💡 Other easy-to-implement / interim strategies for improving AR management and reducing your volume of delinquent accounts include dunning letters for optimizing overdue payment communications, and collections email templates for standardizing processes to accelerate cash flow and reduce overdue invoices.

5. Regularly review and update collections policies

In addition to improving cash flow, reducing bad debt, and encouraging better customer relationships, consistent review and updates to collections policies helps organizations ensure they’re employing current strategies and solutions for effectively managing delinquent accounts.

Taking the time to audit collections and AR processes throughout the year gives teams the opportunity to identify internal areas for improvement and digitization. Another way to do this is to solicit direct feedback from both employees and customers.

It’s important that collections policies enable AR teams to effectively and accurately calculate cash collections with tools to predict the percentage of delinquent accounts the company can actually collect on.

6. Be proactive with collections efforts

The best way to manage delinquent accounts is to catch payments before they become overdue and proactively reach out to customers. Collections automation can be extremely beneficial for successfully managing proactive and effective collections efforts.

Adding functionality like electronic invoice delivery with the ability to click-to-pay directly on the invoice can streamline the payment process for customers and quickly accelerate cash flow. Furthermore, granting your customers the ability to schedule recurring payments eliminates much of the effort on their behalf, essentially guaranteeing on-time payments.

Another proactive tactic can be asking for a deposit. While this might seem like a fast way to detract buyers, it can actually have the opposite effect. Not only does this protect the business, requesting some form of payment upfront also clearly sets expectations and avoids confusion.

Incentivizing early payments and allowing installments is another great practice for avoiding delinquent accounts. Rewarding customers with discounts for paying early and accepting interest-free payment installments can encourage better customer relationships.

More frequently asked questions about delinquent accounts

What negative impact does a delinquent account have on accounts receivable?

Delinquent accounts make it difficult for businesses to convert payments into sales, extending the order-to-cash cycle and slowing down cash flow. Businesses dealing with a high number of delinquent accounts may also need to increase their allowance for doubtful accounts to anticipate greater uncollectable debts.

What are the main causes of delinquent accounts?

Delinquent accounts in accounts receivable are customers with debts having exceeded their past due dates. Your customers may become delinquent for any number of reasons including: having cash flow issues; not receiving (or misplacing) their invoices; not being able to pay their invoices using their preferred payment methods; deteriorating buyer-supplier relationships, lowering their willingness to pay; not receiving the goods or services they paid for; miscommunication in the payment process. Few delinquencies are malicious, and many can be resolved through providing a better collections process.

What happens when an account becomes delinquent?

When delinquent accounts become uncollectable, they become bad debt and are written off on financial statements. These write-offs increase bad debt expenses and create cash flow delays, making it difficult for businesses to pay their daily operational costs, suppliers, and employees on time. This can lead to strained business relationships while also driving up administrative costs. As a result, businesses have trouble accurately forecasting their future financial performance and revenue, leading to stunted business growth.

How can I properly manage overdue accounts?

If a customer misses a payment deadline, it’s best to send them a friendly reminder a few days later and establish a regular follow-up timeline. Correspond with your customer through a consistent communication channel and increase the frequency of your follow-up messages if the invoice remains unpaid. Maintain all records of your communication and invoice copies. If needed, consider restructuring the initial payment terms. If a large amount is still owed, it may be time to take legal action.

Other strategies for decreasing delinquent accounts include: optimizing the invoicing process; creating collections email templates; automating your dunning outreach; segmenting your customers and developing custom collections strategies; offering payment plans and accepting diverse payment methods; focusing on customer experience-centric communications; streamlining the invoice to cash cycle using collaborative automation solutions.

How can late payments be prevented in accounts receivable?

To mitigate late payments, communicate with customers ahead of time and send out payment reminders before the due dates. Consider incentivizing customers to pay early by offering early payment discounts. Make payments as easy as possible for customers by offering a variety of payment methods such as online payments and credit cards.

Accounts receivable must be monitored closely to identify outstanding balances. Businesses can categorize customers by their payment history to improve collections efforts. For re-occurring invoices, an automated invoicing system will help streamline the collections process and prevent future overdue accounts. It’s also important to establish a process that quickly recognizes and addresses customer invoice disputes.

Improve delinquent account management with Versapay

Streamlining the collections process can be difficult, especially for businesses that continue to perform AR operations manually and offline. One of the best things organizations can do to accelerate collections and improve management of delinquent accounts is to take a collaborative approach.

Companies that fail to adopt collaborative automation solutions to track and optimize AR processes will put themselves at a huge disadvantage. Automating the AR workflow generates a number of business benefits such as:

- Real-time invoice tracking

- Streamlined, digital payment acceptance

- Cost-effective processing options

- Detailed backup documentation available for dispute management

- Automated payment reminders for improved customer communication

- Enhanced prioritization of collection activities

- Ability to quickly identify and resolve common issues delaying payments

Instead of reactively nagging customers, AR automation and intelligent collections tools enable teams to easily target accounts for proactive reminders before they become delinquent.

About the author

Ben Snedeker