How to Measure & Improve Your Operating Cycle (Tip: Start with Accounts Receivable)

- 13 min read

The operating cycle represents the time it takes for a company to convert its investments in inventory and other resources into cash flow from sales

Optimizing your operating cycle is a powerful way to improve your company’s financial health and support growth, and automating accounts receivable is a great place to start.

Managing cash flow and maintaining liquidity are vital for the success of any growth-oriented business. At the heart of these financial processes lies the operating cycle, a key indicator of a company's efficiency and financial health.

While the operating cycle encompasses various aspects of your business operations, one area stands out as a prime target for improvement: accounts receivable. Focusing on improving this critical function, through automation and process optimization, can help companies shorten their operating cycle, boost cash flow, and build a stronger financial foundation for greater agility.

This article explains how to measure your operating cycle and provides actionable strategies to improve it, with an emphasis on lending efficiencies to your accounts receivable function.

Table of contents:

What the operating cycle is—and what it’s not

The operating cycle represents the time it takes for a company to convert its investments in inventory and other resources into cash flow from sales. It consists of two main components:

Inventory Period — How long it takes to convert raw materials into finished goods and sell them.

Receivables Period — How long it takes to collect payment for goods or services sold.

The payables period—how long a company takes to pay its suppliers—is also an important metric in cash flow management, but it’s technically not part of the operating cycle. Instead, it’s part of a related measure called the cash conversion cycle. A shorter operating cycle—and a shorter cash conversion cycle—generally indicate better cash flow management and higher liquidity.

The critical role of accounts receivable in shortening your operating cycle

Among the components of the operating cycle, accounts receivable stands out as a key lever for positive change. Efficient accounts receivable management processes ensure that cash is collected quickly, reducing the time between making a sale and receiving payment. This directly shortens the operating cycle and improves cash flow.

Several accounts receivable issues can significantly prolong your operating cycle, including:

1. Process inefficiencies

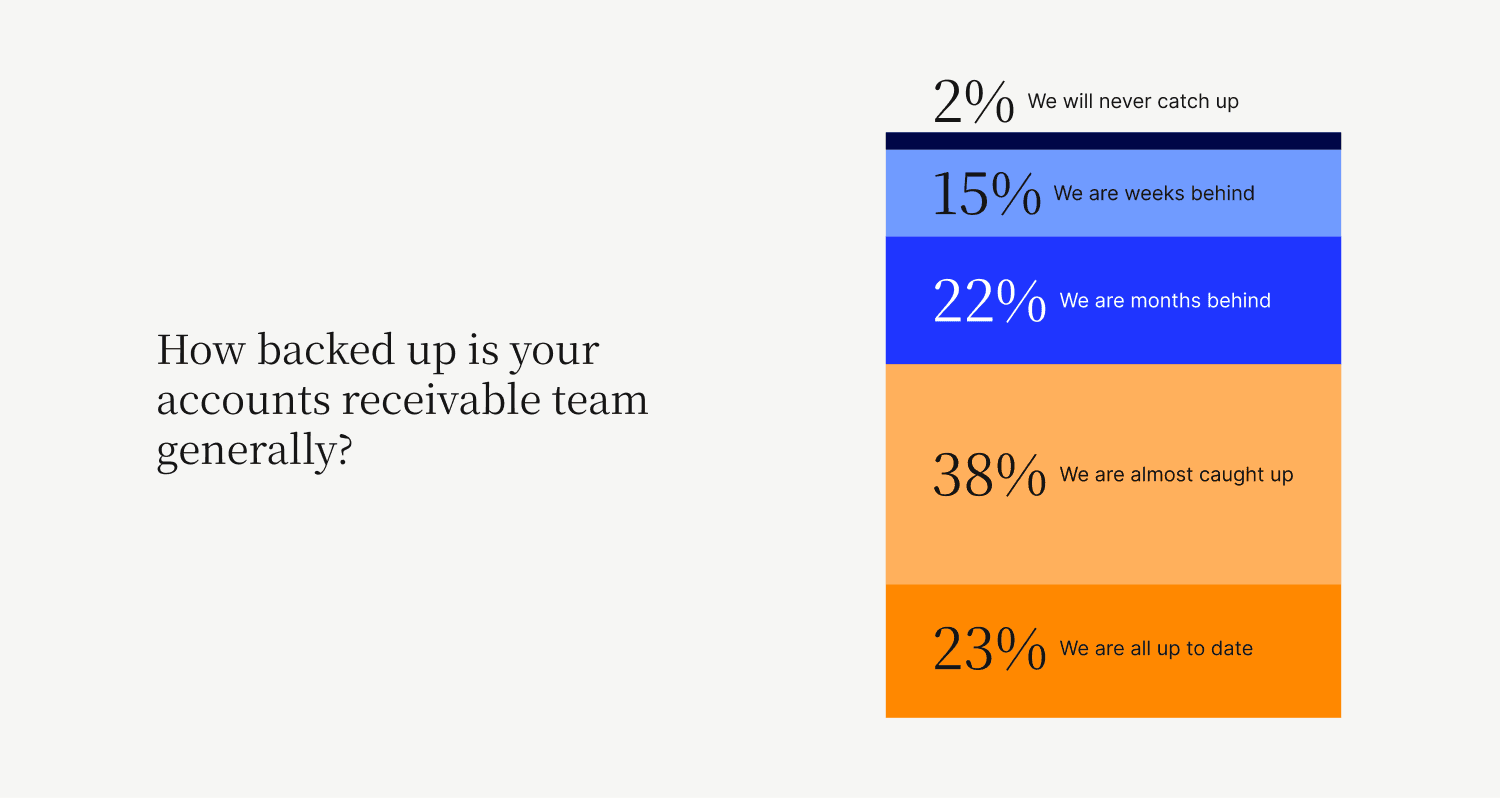

Siloed systems, manual data entry, and inconsistent collections processes create delays between invoicing and payment collection, directly extending your operating cycle. Notably, the vast majority of accounts receivable teams (77%) are delayed to some extent, and inefficient processes such as these are significant contributors.

2. Payment friction

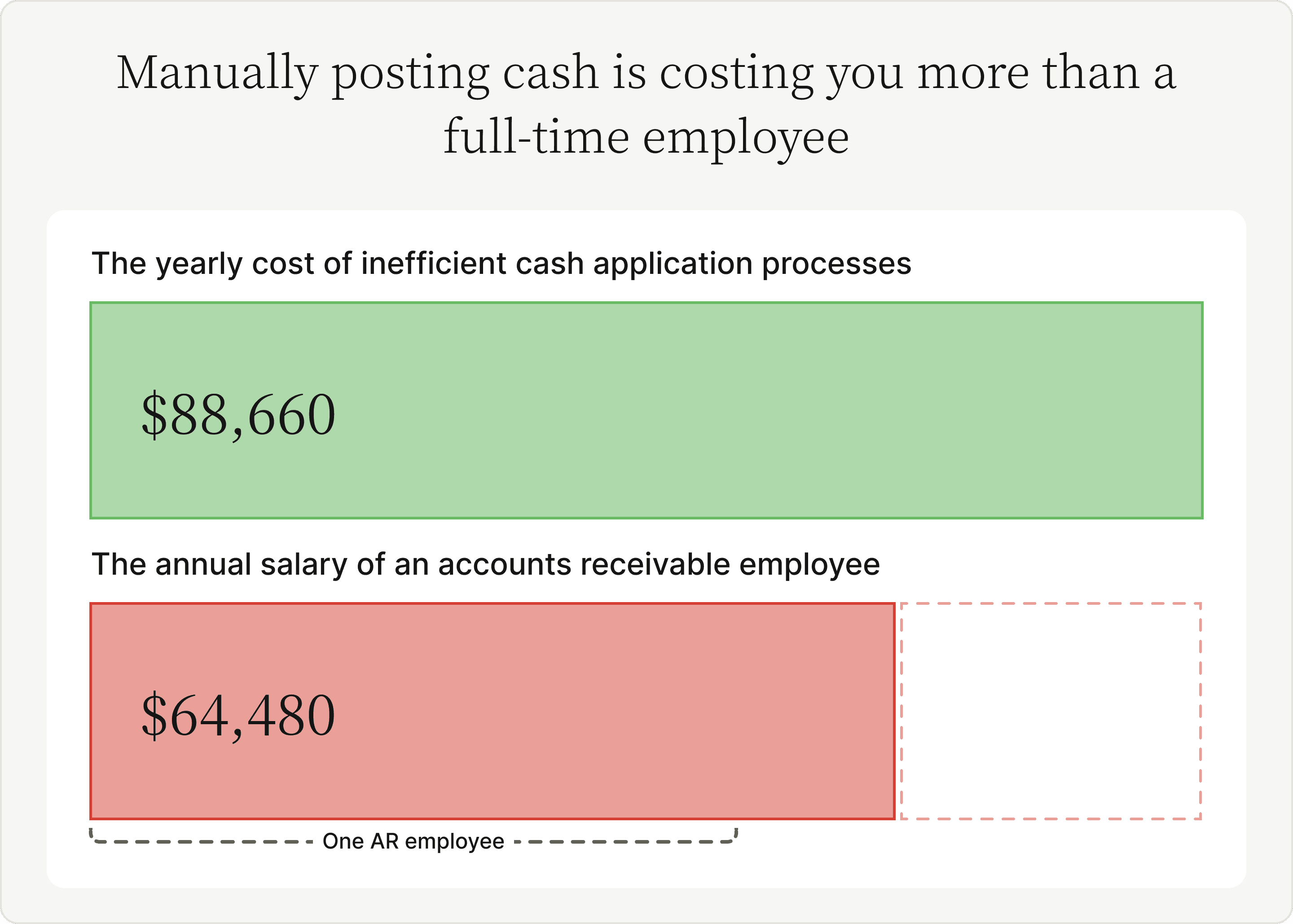

Issues with electronic payment acceptance and payment application errors make it harder for customers to pay you quickly, adding unnecessary days to your cycle. And, beyond those delays, manually posting cash costs finance teams more than a full-time employee every year. This is unfortunately a hallmark occurrence for teams who can’t accept digital payments.

3. Strained relationships

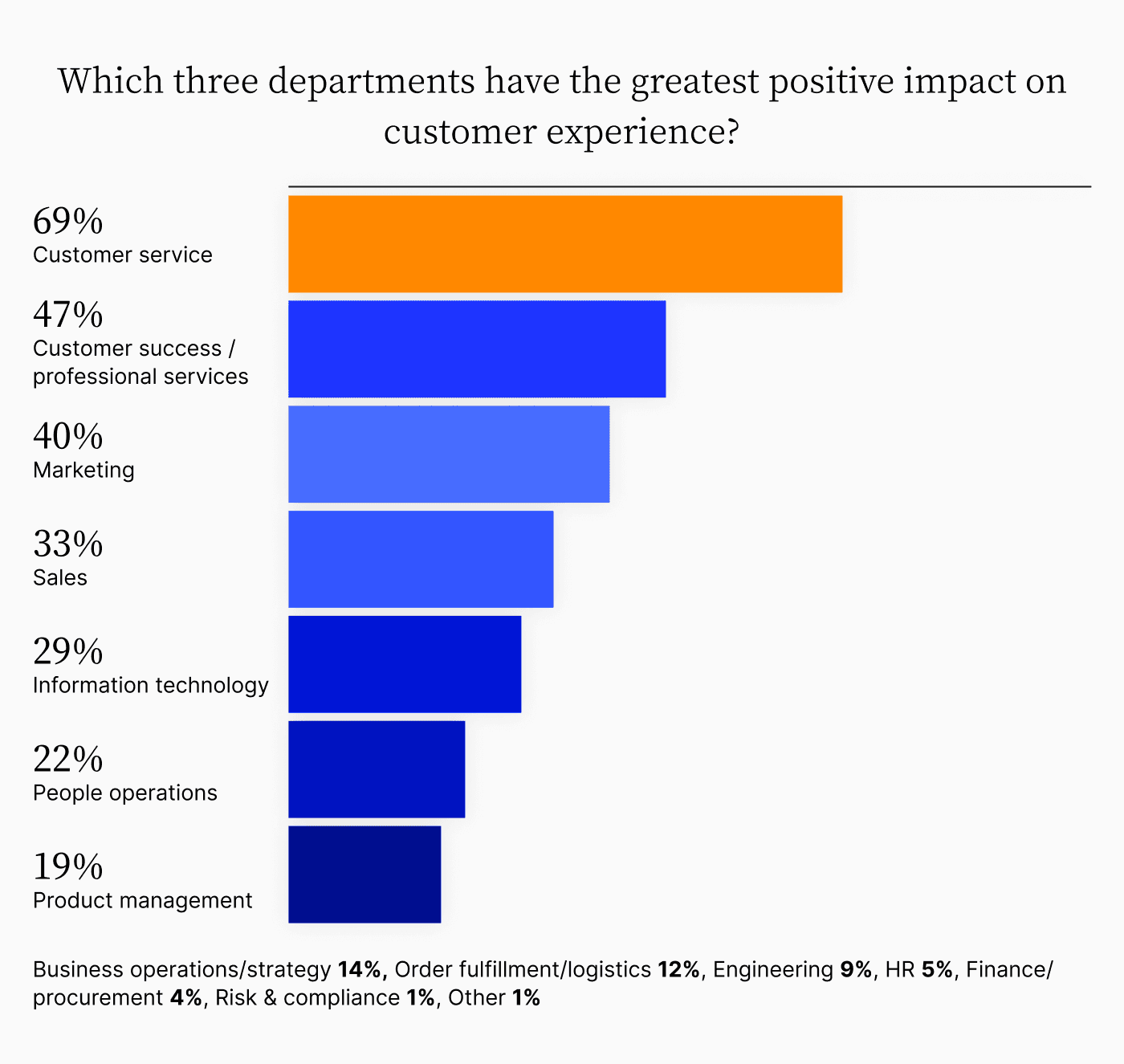

Payment disputes and the challenge of maintaining relationships while collecting from late-paying customers can stall collections and impact the length of your operating cycle. According to research from Versapay and Gartner Peer Community, a mere 4% of company leaders believe that finance/procurement has a positive impact on the customer experience.

In fact, 73% say that the invoice-to-cash cycle is a frequent source of poor customer experiences. These problems not only extend the operating cycle, but also tie up working capital and increase the risk of bad debts. Addressing these challenges, through process improvements and modern accounts receivable automation solutions, can reduce your receivables period and shorten your operating cycle.

Your operating cycle formula: A four-step guide

Before making improvements, you first need to accurately calculate your operating cycle. How long is it really taking you to get paid? Here’s a step-by-step process showing the operating cycle formula, using sample data:

Step 1: Calculate your inventory turnover:

Formula: Cost of Goods Sold / Average Inventory

Example: If your annual COGS is $40 million and average inventory is $5 million, your inventory turnover = $40 million / $5 million = 8

Step 2: Calculate your days in inventory:

Formula: 365 / Inventory Turnover

Example: 365 / 8 = 45.63 days

Step 3: Calculate your days sales outstanding (DSO):

Formula: (Accounts Receivable / Annual Revenue) × 365

Example: If your accounts receivable is $15 million and annual revenue is $100 million, your DSO = ($15 million / $100 million) × 365 = 54.75 days

Step 4: Calculate your operating cycle:

Formula: Days in Inventory + Days Sales Outstanding

Example: 45.63 + 54.75 = 100.38 days

So, what's a “good” operating cycle? Our example company’s 100-day operating cycle might sound long, but context is everything. Some retailers can turn inventory into cash in just 30 days, while manufacturers and other complex organizations often need 90 days or more.

Strategies and tactics for improving your operating cycle

While accounts receivable optimization is the universal shortcut to a faster operating cycle—one that works across arguably every industry—a comprehensive operating cycle reduction strategy involves multiple components:

1. Foundational inventory management

Every business should maintain basic inventory best practices, such as demand forecasting and stock level optimization. However, your ability to significantly compress the inventory period often depends on industry-specific factors and production requirements.

2. Strategic payables management

While not part of the operating cycle itself, smart payables management affects your overall cash position. Consider how you might negotiate more favorable payment terms with suppliers, such as payment extensions or discounts for early payments, without straining vendor relationships. (Ironically, these are precisely the types of things you could be doing with your customers, too, to deliver a better collection experience and get paid faster!)

Accounts receivable optimization

Of all the ways you can improve your operating cycle, accounts receivable automation offers the greatest opportunity for reducing the time between issuing invoices and receiving payments. The key is identifying where manual processes and communication gaps are slowing you down, and then systematically addressing them through automation.

5 ways accounts receivable automation streamlines your operating cycle

Now, back to our bread-and-butter! Accounts receivable automation solutions can transform your collection processes, reducing manual labor, driving great customer experiences, and dramatically compressing your operating cycle. Here’s how:

1. Faster invoice-to-cash conversion

Automation eliminates the manual bottlenecks that typically slow down collections. Electronic invoicing, for instance, ensures customers receive bills immediately, while automated payment reminders and notifications keep cash flowing without requiring constant staff attention.

Pair that with an AI-powered cash application that automatically matches incoming payments—both digital and otherwise—with open invoices and customer accounts and posts them back to your ERP, and you’ve suddenly got a significantly shorter receivables period.

2. Reduced payment friction

By providing customers with self-service accounts receivable payment portals and multiple payment options, accounts receivable automation makes it easier for customers to pay you quickly. When you remove barriers to payment—and simultaneously make it easier for buyers to work collaboratively with you—you naturally speed up collections and shrink your operating cycle.

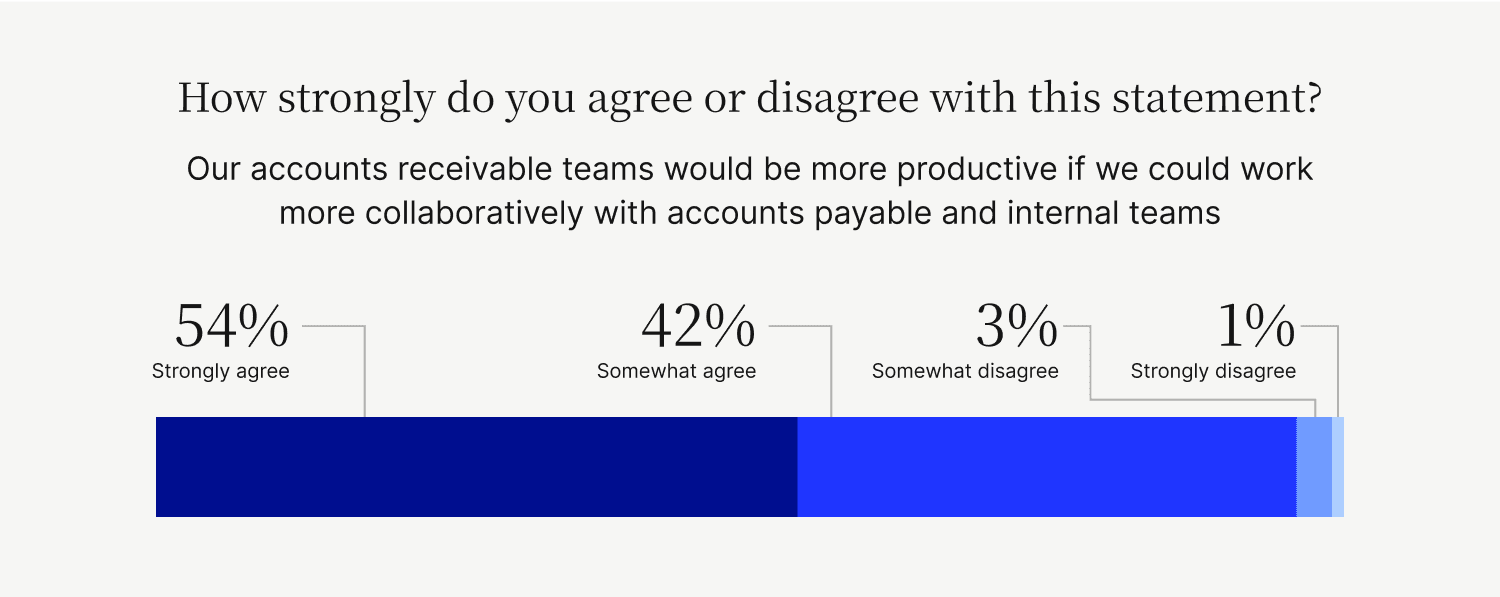

In fact, CFO’s nearly unanimously agree that their accounts receivable teams would be more productive if they could work more collaboratively with customers’ accounts payable teams.

3. Enhanced accuracy and dispute prevention

Automated collection systems reduce the errors stemming from manual receivable processes that so often lead to payment delays—or worse, invoice disputes.

We’ve previously likened lengthy dispute resolution in accounts receivable to a game of financial hot potato: the longer it goes on, the more likely something will get burned, whether it's your cash flow, customer goodwill, or your team's productivity.

But with automation in the mix, those risks are mitigated. Once-frequent data entry concerns are removed, finance teams are granted access to up-to-date and accurate account information, and disruptions like disputes arising from data discrepancies are quickly resolved and instead turned into touchpoints that’ll now delight customers.

4. Better customer relationships

Self-service collections tools give your customers more control over their accounts, while systems that encourage collaborative communication ensure consistent, professional, transparent interactions. When invoicing or payment disputes do arise, you and your customers will both have complete payment histories and documentation at your fingertips for quick resolution.

5. Real-time visibility and control

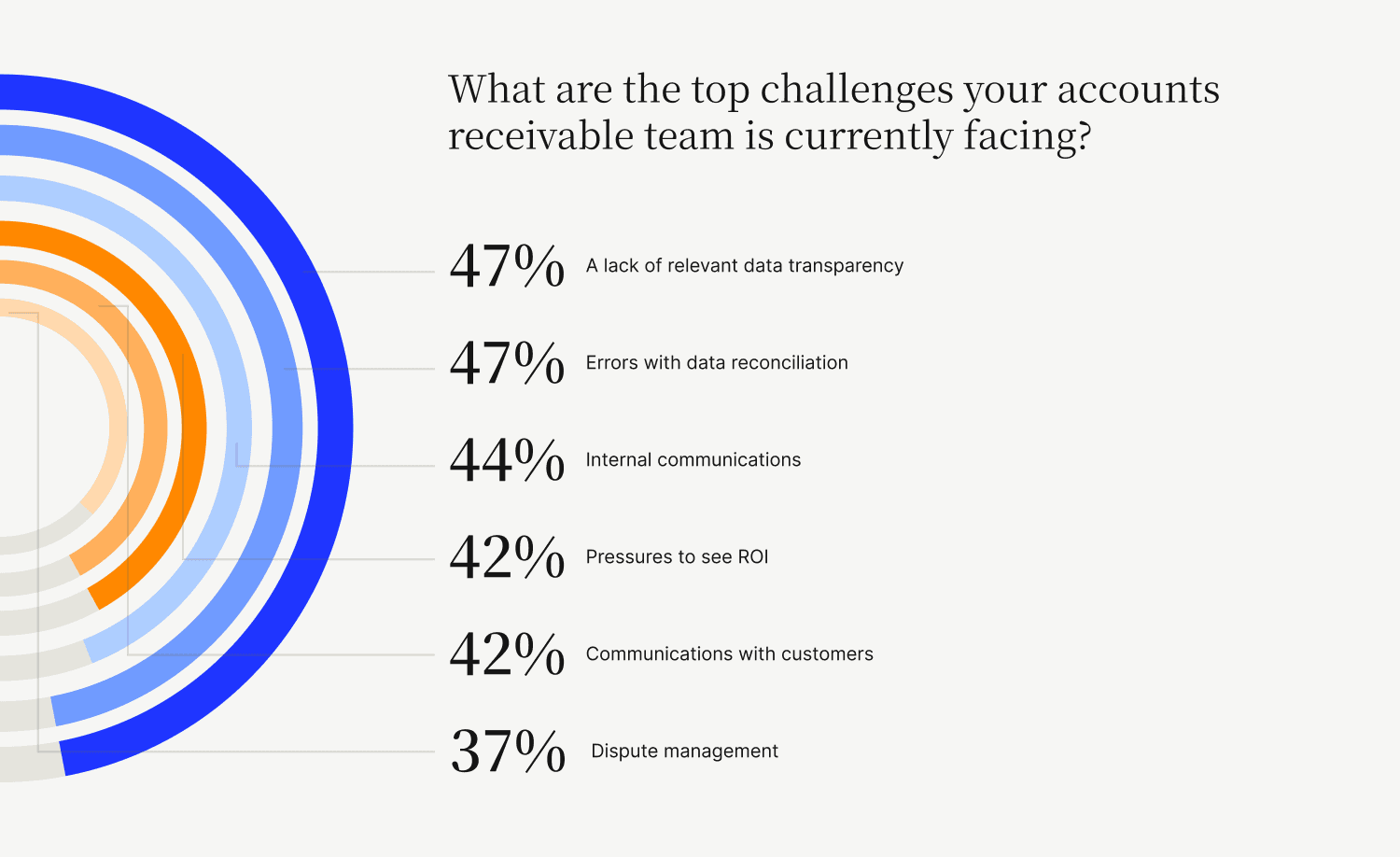

We recently surveyed 300 CFOs to learn about their invoicing practices, and while they face a variety of pressing challenges, their number one reported difficulty is having a lack of relevant data transparency:

So—perhaps most importantly—accounts receivable automation solutions streamline the operating cycle and solve this issue by providing complete visibility into your collections processes. With accurate and complete reporting capabilities, you can:

Track key metrics in real time

Identify non-payment bottlenecks quickly

Spot payment behaviors and trends

Make data-driven decisions to optimize your operating cycle

Continuous operating cycle improvement is within reach

Managing cash flow and maintaining liquidity is key to the success of any growth-minded business. And at the heart of these financial processes lies the operating cycle, an important indicator of your company's efficiency and financial health.

Optimizing your operating cycle is a powerful way to improve those vitals, yet while a comprehensive approach is necessary, focusing on bettering accounts receivable through automation and process improvements can deliver some substantial returns.

From inefficiencies to payment friction to strained relationships, the traditional collections process is stained with unpleasant attributes. Overcoming those is crucial, and doing so using automation technologies will have an incredibly positive bearing on your operating cycle.

Talk with a Versapay expert today and find out how our industry-leading platform can shorten your operating cycle, accelerate cash flow, and transform the way your business manages accounts receivable.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.