How To Structure a Modern Finance Department

- 20 min read

In this article, we explore how modern businesses structure their finance teams and share advice for building a resilient finance department.

Technology and digitization are creating new business models in every sector, and executives are realizing that to reach peak performance, every department must digitize—finance included. Change takes time, however, so while finance teams are modernizing, total digitization is still a ways away.

For example, we recently found that 96% of C-level executives believe there’s still work to do in digitizing their accounts receivable (AR) departments.

Why does this matter? Because finance teams now recognize that how they’ve long-operated no longer works. They’ve concluded that existing processes are inefficient—not to mention partially responsible for the finance talent shortage—and that embracing automation is a dire necessity.

Importantly, this change will visibly change finance department structures and roles.

This article explores the impact automation has on shaping a modern finance department; what else is driving finance department structure changes; how you should structure your finance department [with organizational charts]; and more.

Table of contents

5 business factors driving finance department structure changes

1. Emphasis on digitization and automation

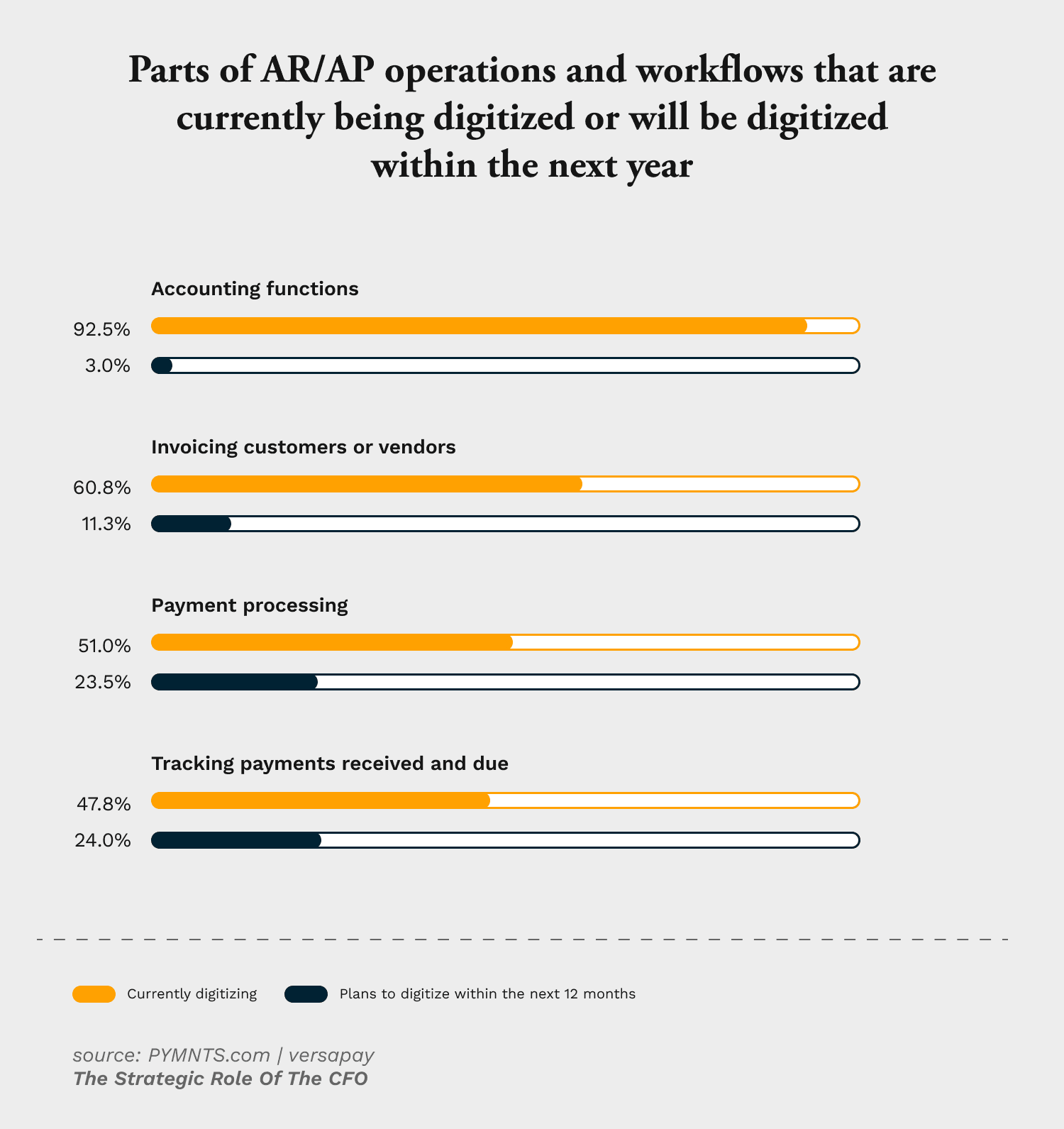

Technology has made big inroads in eliminating clerical tasks and manual processes. A report from Versapay and PYMNTS revealed that nearly 93% of US firms with at least $25 million in revenue are currently integrating digital technologies into their accounting operations. This is reassuring, as it demonstrates how those businesses who understand the importance of digitization, are in fact taking steps to address their technological gaps.

This also has a marked effect on specific finance functions like accounts receivable (AR) and accounts payable (AP), which historically involve a high degree of manual work. For this reason, future headcount in these departments may be lower, as less staff is needed to carry out day-to-day activities. Instead, finance can reallocate and concentrate its talent on more strategic planning.

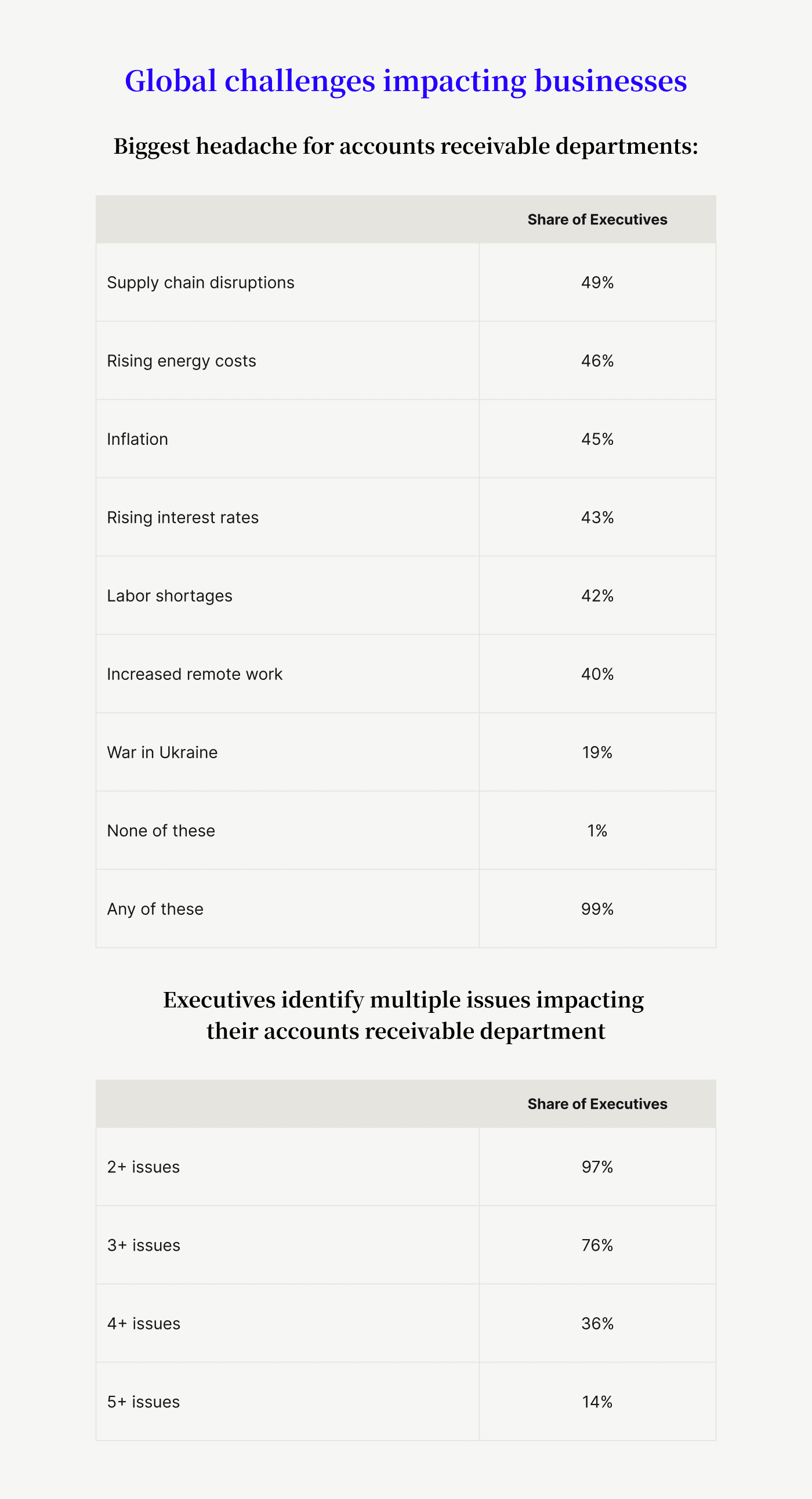

2. A need for resilience

Numerous global challenges currently impact businesses. These include difficulties like: supply chain disruptions, rising energy costs, rising interest rates, labor shortages, and increased remote work. These ‘headaches’ that finance teams face make preserving cash flow arguably more important than ever.

This has elevated the finance function as a value driver, as chief executive officers—CEOs—increasingly count on projections and forecasting from chief financial officers—CFOs—to help them navigate these complex headwinds. The accounts receivable function becomes an especially important lever for shoring up cash flow, as enabling faster collections through digital transformation can free up much-needed resources. AR and other finance functions are thus value creators.

“There’s no question that automating back-office functions in B2B payments is one of the biggest opportunities to deliver better customer service, greater efficiency, and improved shareholder value over the next five years. In particular, mid-market companies working across borders have much to gain from this process” — John Berns, Founder and Managing Partner, Accourt Payment Consulting

3. Digital skills are in high demand

The recent emphasis on digital transformation has changed finance job requirements. Modern finance teams must handle large data volumes, making basic data science skills essential. Gartner highlights skills in automation, data literacy, and advanced analytics as critical areas of focus. Finance leaders should consider data handling skills closely when screening new potential hires.

Automation, again, is shaping finance department structure and functions. Take invoice disputes, for instance. That same Versapay and Wakefield Research study found that the most significant cause of these payment-blockers are human errors:

So as digital skills become increasingly desirable, automation in turn exposes upcoming—and incumbent—finance professionals to exciting, new technologies. These technologies help workers build efficiencies and lend value more broadly, and those changes are ultimately reflected in finance department organizational charts.

4. Agile teams and flat organization structures

Finance teams have historically relied on rigid finance team structures with multiple individual contributors focused on executing manual processes. Automation has changed—and continues to change—this picture, leading to flatter and more agile finance teams. Gartner has highlighted agility and autonomy as critical qualities for finance professionals.

Previously reserved for technology and engineering functions, finance teams can stand to benefit from borrowing and adopting elements of agile workflows. With less rigid team structures, there can be more engagement between departments, particularly financial planning and analysis (FP&A), AP, and AR. This will surface crucially important data to team members who otherwise might not engage with it.

5. Customer experience is now a bigger priority

An underrated skill that accounts receivable professionals have is the ability to engage effectively with customers. Their ability to collect on outstanding invoices depends on how they communicate with customers, walking the line between managing relationships and business priorities.

Notably, there’s substantial room for improvement, and we expect finance department structures and roles to shift as CFOs prioritize delivering exceptional customer experiences. Currently, over a quarter of invoice payments monthly are delayed due to lapses in communication—and those lapses in communication are leading to nearly $4 million in outstanding invoices monthly.

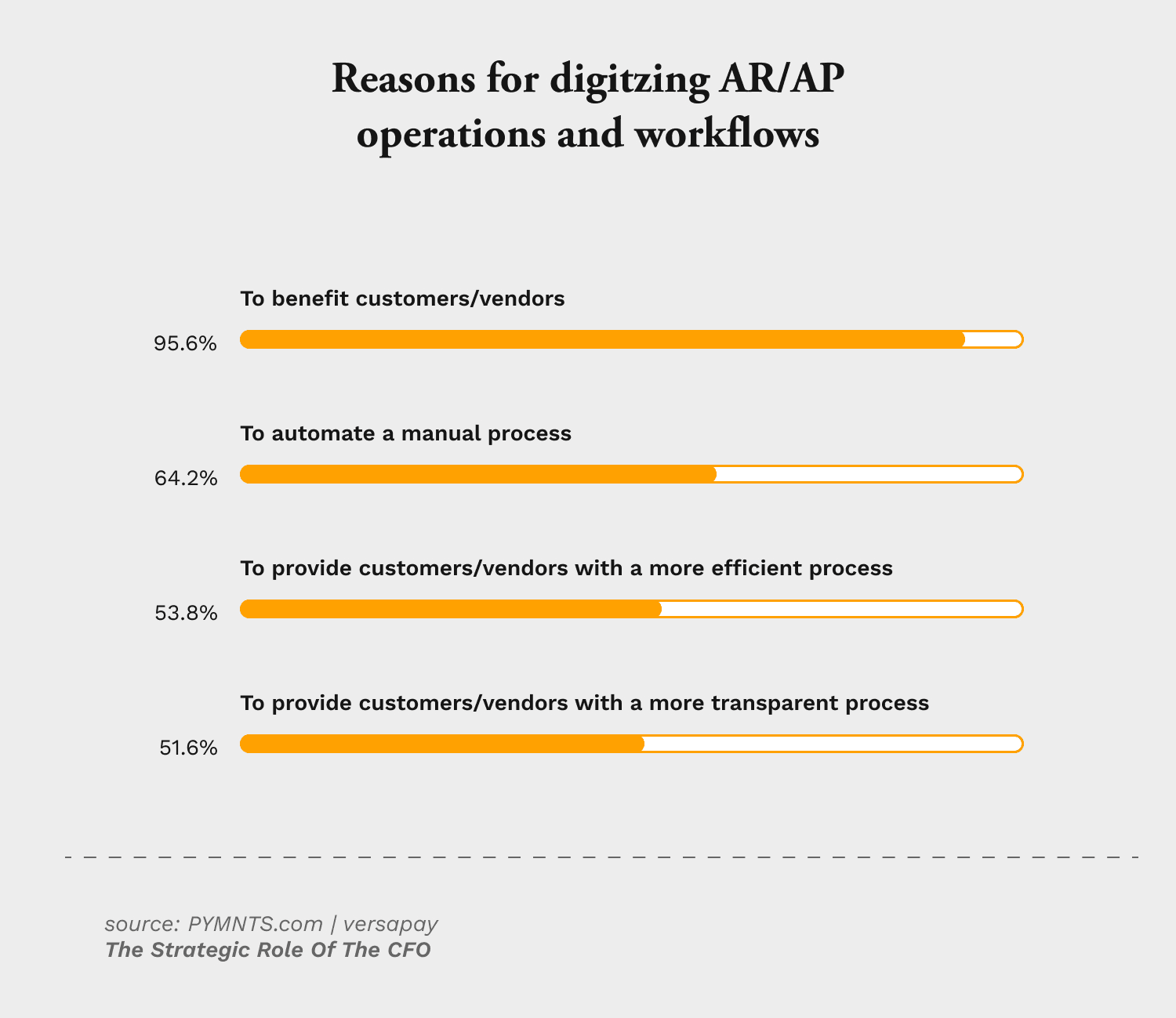

So, as finance teams further digitize accounting processes, expect them to increasingly focus on how automation benefits their customers’ experience. That is, after all, a major reason for CFOs choosing to digitize their AR and AP workflows to begin with:

Finance teams are understandably integral to delivering great customer experiences; so, CX and support skill sets may possess greater consideration in businesses hiring for finance department roles.

How many departments does the finance function have?

Finance departments can have anywhere from three to six functions. Here are the six primary departments found within a typical finance team structure:

1) Accounts payable

2) Accounts receivable

3) Corporate treasury

4) Financial planning and analysis

5) Tax

6) Executive functions

1. Accounts payable

Accounts payable handles paying company vendors and contract terms fulfillment. AP is traditionally a cost center, but data can help you transform it into a profit center. You can capture early-payment discounts and identify top-performing vendors to boost your profits. By integrating vendor management in your AP processes, you can eliminate duplicate spending and unauthorized expenses.

2. Accounts receivable

Accounts receivable handles processing and collecting customer payments. This includes issuing invoices, applying cash, reducing credit cycles, and handling disputes.

Automated accounts receivable is a key efficiency driver in modern finance departments. Having optimized, real-time insights into receivables data and performance through dedicated software can also simplify cash projections, free up working capital, and streamline budget reporting.

3. Corporate treasury

Corporate treasury handles a company's liquidity and capital levels. This function is responsible for identifying potential capital sources for new asset financing. Treasury departments also identify capital requirements and help their firms satisfy regulatory requirements. This function might have one employee or multiple, depending on the size of your firm.

4. Financial planning and analysis

Thanks to technology, financial planning and analysis has assumed a significant presence in finance department structures. This function evaluates trends in the company's financial data and models future needs. It considers quantitative and qualitative factors from the company's financial data.

FP&A teams also work closely with IT to prepare and deliver reports such as short-term cash flow analysis and budget versus actuals to CFOs.

Watch the video below to hear from Sam Anderson, Director, Financial Planning & Analysis, Versapay, on why modern finance departments should embrace electronic invoicing:

5. Tax

Minimizing taxes and identifying credits falls to the tax department. Typically, this department is comprised of accountants specializing in taxation. Taxation is purely an expense, but investing in the right resources within the tax department will save you money. A skilled tax accountant can identify credits and deductions, helping to lower your tax bill.

6. Executive functions

Roles like Chief Financial Officer and Chief Risk Officer—CRO; not to be confused with Chief Revenue Officer—occupy the executive functions within finance departments. At larger companies, individual business units appoint deputy CFOs who report to the organization's CFO. Finance executives provide valuable data to the CEO when plotting their organization's future course.

[Finance department organizational charts] Best practices for structuring your finance department

Whether your organization is small and scrappy or an established enterprise, your finance department can benefit from agile work principles. McKinsey & Company highlights the following characteristics as hallmarks of an agile finance organization:

Responds quickly to stakeholder actions, whether customers, competitors, or partners.

Combines a flat network of teams executing transactional and strategic tasks

Incorporates small teams working on clearly-defined project scopes in rapid sprints

Led by executives who encourage team members to act as proactive counselors to their business units

McKinsey further specifies classifying employees and new hires within the following categories:

Core members — Responsible for executing transactional activities such as accounting and balancing the company's books

Problem solvers — Team members who work on multiple project teams to solve challenges at short notice

Specialists — Employees with expertise in areas such as revenue analytics or taxation

Value leaders — These employees combine insights to define their business unit's direction. With automation eliminating the need for much of the manual work involved in accounting processes like AR and AP, this can free up more of your employees to become value leaders.

Here are four finance organizational structure examples that demonstrate what your finance team might look like depending on your company’s size.

1. High-growth startups

Startup resources vary depending on the funding they've acquired. Agility is the key here as multiple roles report directly to the CFO. Being able to quickly leverage data-driven insights is especially helpful in this case.

2. Small businesses

Creating a flat structure with employees wearing multiple hats is essential for small businesses.

3. Mid-sized businesses

Mid-sized organizations will have finance departments of varying complexity, depending on size.

4. Enterprises

Enterprises will have many finance functions with multiple sub-departments. The image below highlights one possible approach to structuring an enterprise-level finance team.

5 typical finance team roles (that all modern finance departments have)

No matter their organizational structure, modern finance departments have a few common job roles and key responsibilities. Of course, some of these roles might not be relevant to your organization based on your company's size—some might be outsourced, too. Note that these are roles found within the finance departments noted earlier.

1. CFO (or leadership function)

All finance-related activities fall under the CFO's purview. Their primary task is to provide insight and financial strategy to the CEO. Modern CFOs are attuned to the possibilities technology offers their department and recognize the role their department plays in creating positive customer experiences.

Modern CFOs seek to do more with less by improving their company's efficiency. They’re no-longer viewed as leading a back-office function, and are increasingly involved in high-level strategic decisions. The following objectives—with example targets—tend to fall under a CFOs’ scope:

Improve net margins by 10%

Reduce cost of capital by 5%

Increase return on equity (ROE) by 15%

Reduce processing costs by 5%

Improve backend integrations

2. Treasurer

The treasurer focuses on cash management, risk management, and monitoring regulatory changes. Liquidity is one of the treasurer's primary concerns. They enforce policies that ensure the company has access to adequate capital. In larger organizations, treasurers are deeply involved in maintaining banking and investor relationships, too. Having reliable access to data can simplify their task by offering insight into metrics such as:

Rate of cost of capital increase / decrease

Credit rating trends

Cash application accuracy trends

Net interest income changes

3. Controller

The financial controller is responsible for preparing the company's financial statements, general ledger, and payroll. They coordinate monthly and yearly closes with internal and external auditors. They also ensure payments from customers and debtors arrive on time. Folks in this role deal with cash flow on a daily basis and are concerned with metrics such as:

Days sales outstanding

Cost of invoice factoring

Working capital

Credit card acceptance costs

Bad debt ratios

4. Managers

Finance managers work within accounts receivable and accounts payable. Their key functions involve monitoring account statuses and increasing efficiency. Some of the metrics receivables and payables managers might track include:

Dispute resolution times

Percent of early payment discounts captured

Days sales outstanding

Late payment percentages

Average credit cycle length

5. Clerks

Clerks also work in receivables and payables departments, reporting to managers. Their duties are similar to that of managers, except clerks handle more granular daily processes. Clerks post customer checks, verify and initiate vendor payments, apply cash, and resolve disputes. Account reconciliations and producing monthly and annual account status reports are a major part of their jobs.

Modern finance departments need CFOs and CIOs to collaborate

Technology is redefining decision-making processes at the top of organizations. As a reflection of this, modern organizations are bringing their CFOs and Chief Information Officers (CIOs) closer together than ever before.

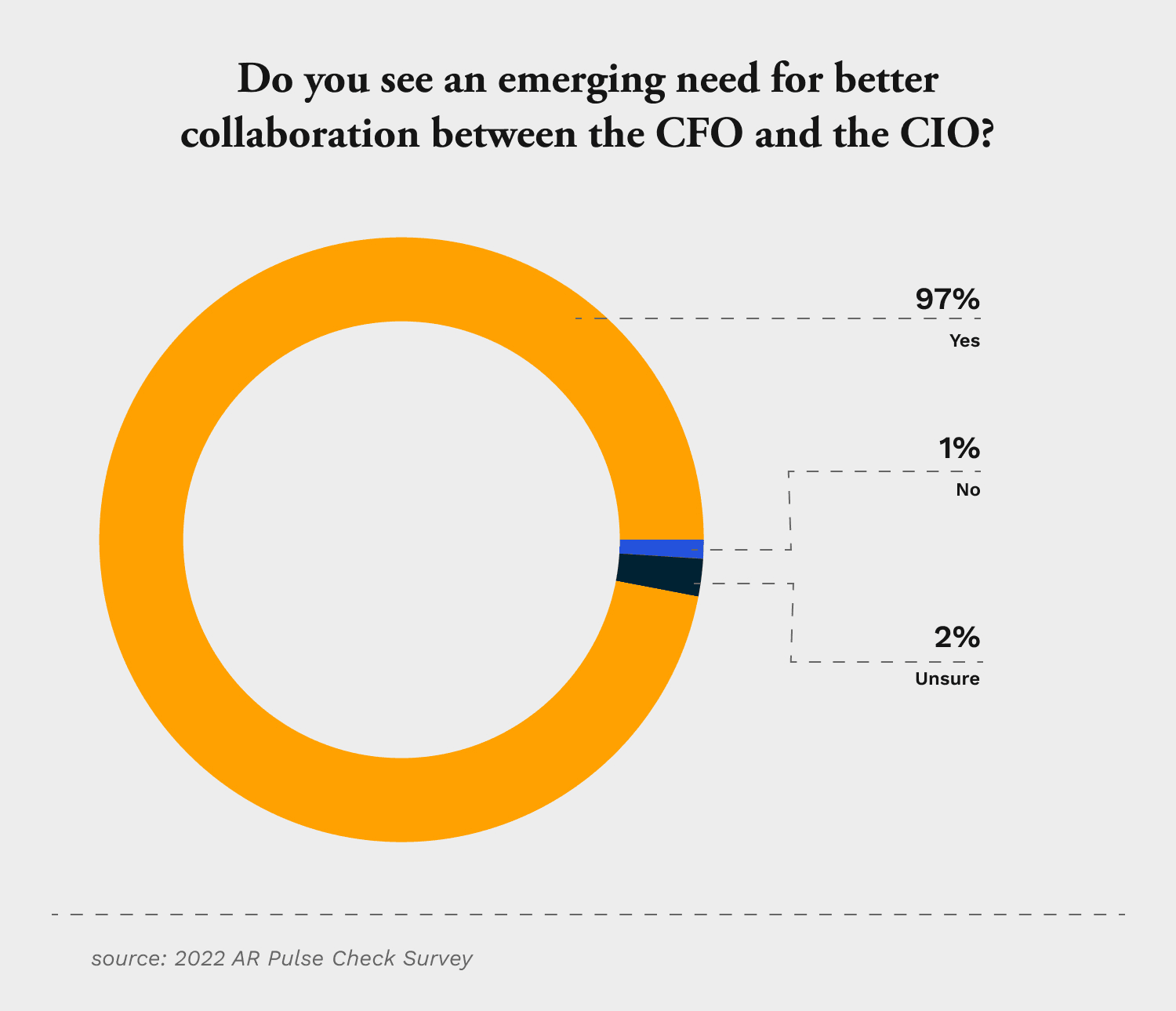

Pulse and Versapay surveyed 500 finance and IT leaders to understand the relationship between these two roles at their organizations: Our findings precede changing finance department structures and roles. Notably, we found that 97% of respondents agreed that collaboration between the CFO and CIO is critical to helping organizations identify future business needs.

As the mandate for finance teams stretches beyond basic reporting and into more complex forecasting, CFOs can especially benefit from closer collaboration with their CIO, and should shape their departments accordingly.

Plus, completing this kind of strategic analysis requires access to reliable data and time away from the humdrum of day-to-day accounting activities. This also validates why more CFOs are keen to introduce accounting automation software into their operations.

Ensuring these software implementation projects move forward successfully requires a level of technical expertise beyond the bounds of a CFO’s typical skillset. For this reason, it’s vital that CFOs engage their CIO as a strategic partner early on in these initiatives.

It’s worth considering how you’ll encourage collaboration between traditional finance roles and IT when determining your finance department structure.

5 finance team structure best practices

Here are five best practices that will help you figure out the optimal finance team structure, along with advice for hiring for those roles.

1. Align finance with business strategy

Your finance team needs to be able to consume a lot of financial information and convey its importance to stakeholders. When filling roles, it’s important that you bring in people who will be able to discern the value of data based on the business’ priorities and effectively communicate the story it tells. It’s also important you fill your finance team with employees that understand the interconnectedness of different finance functions (for example, how accounts payable and accounts receivable can support each other).

Take for instance, accounts receivable aging reports. They’re useful when determining collection efficiency, however, presenting the report as-is to a CEO doesn’t tell them much on the surface. An aging report does not quantify the impact delayed collections have on working capital or the company’s cash position. Your finance team must take that extra step and speak the CEO’s language by translating financial data to business outcomes.

Watch this video to hear from Maddie, Versapay’s Senior Accounts Payable Manager, as she explains what accounts receivable performance means to her:

2. Automate intelligently

It’s in any finance team’s best interest to automate as many manual processes as possible. In automating elements of traditionally manual processes like accounts receivable, chances are you’ll need to allocate fewer employee resources to that function.

By no longer having to spend the majority of their time on tedious and repetitive tasks like mailing invoices or manual cash application, your employees will be freed up to spend time on higher priority work. Focus on the efficiency gains automation brings, not just the cost savings. You'll deploy your employee resources better and generate greater ROI.

3. Encourage greater collaboration

While automation will ease many of your teams’ pains, it won’t fix the significant issues that arise from the communication gaps between your finance departments and your customers. Consider the roles in your finance organization that benefit most from close collaboration and how you can place them in your team structure to best enable that collaboration.

Software can also be immensely helpful towards enabling that collaboration. A collaborative accounts receivable platform, for instance, can make it easy for your staff to communicate with customers about their billing and payments in one cloud-based system. This provides you with an audit trail of all receivables-related communications with customers that your entire team can access.

4. Standardize processes

As your organization grows, so will your finance department hierarchy. This will make replicating earlier successes more challenging. Standardizing processes along with internal and external policies will result in everyone working off the same playbook. Critical tasks such as new employee onboarding and training become simple, reducing downtime.

Consider creating internal wikis and documentation that defines procedures and communication standards. They will help you as you expand your finance department.

5. Hire for the right skills

While you must hire finance professionals with the right credentials, you should also screen them for the needs of your modern business. Familiarity with data, a willingness to accept change, and creativity are extremely important in modern finance functions.

Finance employees don't have to double as IT professionals. They must, however, understand concepts like data integrity and duplicate data issues. Screen your hires for these skills, and you'll build an agile workforce that can solve problems easily.

—

You can adapt to modern business environments—and structure your finance team accordingly—by facilitating greater collaboration between the CFO and CIO, and automating rote, manual processes commonly found in accounts receivable. Talk with an expert to learn more.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.