How North Atlantic International Logistics Unlocked $10 Million In Revenue

- 8 min read

North Atlantic International integrated Versapay's AR automation solution with their Sage ERP. Learn how this led to an additional $10 million in revenue, and better use of staff time, invoice management and customer experiences.

—

Overview

North Atlantic International Logistics (NAI), a leader in the transportation logistics industry based in Ontario, Canada, facilitates all aspects of freight warehousing and movement. The company’s small-but-mighty team of 18 creates a “one-stop shop” that can handle all of its clients’ logistics services around the world, 24/7.

While NAI’s team had its logistics services dialed in, its finance team of five found that its legacy collections methods were hampering its internal logistics. This team sends some 1,200 invoices monthly, and its manual receivables processes were making it hard for them to keep up. NAI turned to Versapay to streamline and expand the capabilities of its invoicing and receivables system—an essential upgrade in a competitive marketplace.

In transportation, we can’t be behind the eight ball; we always have to be in front,” says NAI Director and CEO Anthony Mestroni. “In today's market, companies can come and go, just like that. Our collections were our weakest link.

The challenge: A slow, highly manual AR system wasted staff time, hampered cash flow, and stymied pre-payment options

North Atlantic International Logistics sought out accounts receivable automation software to transform its manual, disjointed AR process into one that would:

Enable top-notch customer service

Reduce staff effort on rote tasks, and

Enable the company to expand its customer base through pre-payment invoicing.

They dealt with 4 major difficulties:

1. Manual work

A disconnect between the company’s dispatch system and its accounting software required staff to manually create spreadsheets to show the true accounts receivable information on a given day each week. This process took up an entire day of a staff member’s time weekly and was a messy process with a high potential for omissions. As this report was created intermittently, NAI did not have its AR value readily available on four of five days each week.

2. Cumbersome communication

The company’s invoicing process, based on emailing invoices and receiving payments via ACH, presented other challenges. For one, about 3% of the invoices that NAI sent were reported by customers as not received, which NAI’s AR team would discover upon making collections calls. This resulted in a lag in collecting payment, as the team would only learn of the problem after weeks of waiting for payment, and would then have to resend the invoice and wait again. Additionally, staff had to dedicate about six hours monthly to resending invoices that customers said they didn’t receive.

When payment did arrive, they typically lacked any ascertainable remittance information to enable revenue recognition. Staff spent tens of hours weekly chasing down payments and information from customers to ensure payment and accurate bookkeeping.

3. Slow payment process

These impediments to smooth AR led to annoyance among both customers and staff and slowed down the invoice and payment process. The system’s slow pace was a particular problem as NAI expanded into shipping via rail, where payment timeframes are tighter than in other areas of shipping.

4. Insufficient functionality

Working with rail, trucking, and ocean freight also meant that NAI was managing multiple different delivery timelines and billing cycles, leading to invoicing and collections complexity that needed a digital solution.

Importantly, NAI also wanted an online payment solution that would allow for pre-payment before delivery of freight to enable taking on logistics jobs for companies with poor or no credit. Its legacy system could not handle this level of complexity, preventing the company from pursuing a lucrative segment of potential customers.

Because the process of uploading shipment info into our accounting system was so manual, there was always a danger of us missing invoices and not getting paid. It was that hole that we needed to fill.

The solution: An automated AR solution to reduce manual work, improve communication and transparency, and provide new capabilities

North Atlantic International Logistics sought out a streamlined invoice presentment and payment acceptance solution that would provide the precise functionality it needed, including:

Transparency in the invoice process

A portal to share invoicing and payment information

A portal to share invoice and payment statuses with customers, and

The ability to have customers prepay for services.

They found all they needed in Versapay and worked with the Versapay team to get the system aligned with their workflow. Versapay enabled NAI’s accounts receivable team to automate its invoicing procedures, including payment reminders. The automation software also provides a digital portal through which NAI and its customers can transmit invoices, supporting data, and payment in real time without the complications of email and phone communication.

“The platform is so easy,” says Mestroni. “An email gets sent out with a PDF invoice and a hyperlink that clients can click, log in, and view their invoice online. In the portal, they can download the invoice as many times as they want, submit payment, and communicate with us in real time.”

Versapay also benefits NAI by allowing the company to view its up-to-date accounts receivable in a single location, which was not possible before. The nature of some shipments that NAI manages is that they are billed to the customer on pick-up while NAI’s accounting system does not acknowledge their invoices until delivery. Versapay has bridged that gap by integrating with NAI’s accounting software, Sage.

This integration makes revenue recognition easy and accurate, and enables company-wide transparency into the AR process and more actionable reporting.

The results: Access to a 10$ million untapped market, more strategic involvement from staff, and better invoice management

Implementing Versapay addressed the core challenges facing NAI’s accounts receivable process:

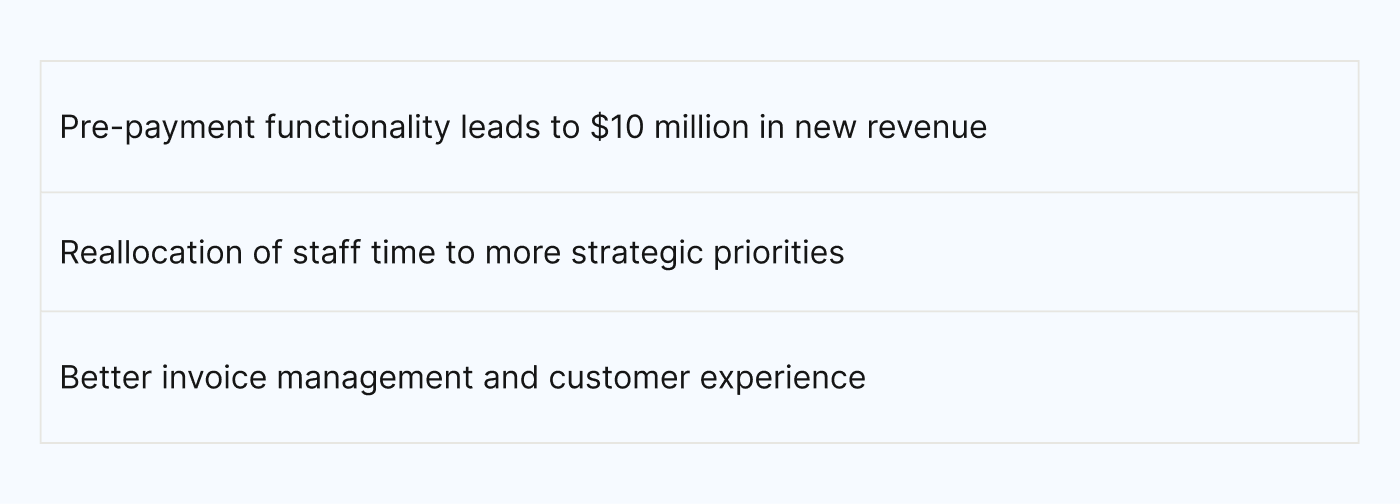

1. Ability to serve new customers

Crucially, the capability to manage pre-payments has unlocked the company’s ability to serve customers with poor or no credit, a move that resulted directly in about $2.5 million in new revenue in the last year and the likelihood of collecting $10 million in new revenues over the next two years.

“We're able to open up our view of who we can give business to,” says Mestroni. “And we've been able to open our doors to a lot, especially to transport companies.”

2. Better use of staff time

Another result of Versapay’s automation is that NAI staff are able to reallocate time to more strategic, valuable work—what Mestroni calls “constructive accounting.”

One full-time employee had previously spent most of her time on maintaining the now-obviated Excel spreadsheets needed to keep visibility into the company’s AR process. With Versapay in place, she’s now been fully redeployed to doing more useful tasks, such as managing cooperative customer relationships.

When factoring in not only the savings from spreadsheet calculations, but also the benefit of Versapay’s collections functions and payment processing, NAI is saving approximately $18,000 annually by using Versapay.

Versapay also benefits staff by enabling work-from-home capability, which was not possible using NAI’s legacy system due to technical limitations. Staff are happier with this flexibility, and AR can be done more efficiently when the team can work on time-sensitive tasks from outside the office.

Better use of staff time has financial and morale benefits to the company, too.

“Versapay has improved our bottom line, and allowed us to focus on productive business,” says Mestroni. “Instead of fighting nickel and dime with our customers, we can build relationships that are constructive.”

3. More robust invoice management

The finance team also benefits from having better visibility into their open receivables and the collections process overall; particularly with regards to invoice-specific details. They can now manage payments at the invoice level, as opposed to at the customer or account level, allowing for easier isolation of individual invoices that need attention.

4. Improved customer experience

The newly streamlined process and Versapay’s AR portal add up to a better customer experience for North Atlantic International Logistics’ clients. Customers can see what they owe and what they have paid via the portal, which results in less conflict and disagreement within the AR process.

Versapay’s portal is so transparent and visual,” says Mestroni. “It’s amazing to see that improvement for our customers.

Sage Intacct

Get more done in one place by integrating payments with your Sage Intacct.