12 Operating Cash Flow Metrics for Meeting Financial Obligations

- 8 min read

In this article, we'll look at:

- Why operating cash flow is important

- How to calculate it, and

- The 12 key metrics to monitor to keep your operating cash flow healthy

You'll also learn tips and best practices for getting more of the money you're owed, more quickly.

Because businesses use cash flow from operations—also known as operating cash flow—to pay bills and meet other financial obligations, it’s important to collect everything that’s owed in a timely manner.

However, invoice errors, not accepting digital payments, misaligned customer communication methods, and manual processes can slow invoice collection down—or even grind it to a halt.

By regularly monitoring your operating cash flow and related metrics, you can ensure that you have the liquidity you need at any given moment. Understanding how much money is coming in—and how quickly you’re receiving it—can help you:

Gain visibility into the health of your business

Better understand the quality of your financial policies

Improve your ability to forecast revenue and expenses

Make better decisions as economic conditions change

In this article, you’ll learn why operating cash flow is important, how to calculate operating cash flow and other operating cash flow metrics that impact your financial posture, and get tips and best practices for getting more of the money that’s owed to you more quickly.

Jump to a section of interest:

What is operating cash flow?

Operating cash flow is the amount of money your business generates from its primary operations, namely sales. It does not include revenue from things like interest or investments.

Businesses use the cash that comes in from operations to cover the cost of regularly occurring business expenses, such as wages, supplier payments, and overhead, as well as unexpected costs like repairs.

Calculating Operating Cash Flow

To calculate your operating cash flow, add up your net income and non-cash expenses, then subtract any working capital increases:

Operating cash flow = Net income + Non-Cash Expenses - Working Capital Increases

Non-cash expenses include depreciation costs, amortization of revenue, contract costs, stock-based expenses, and gains on strategic investments.

To determine a working capital increase, subtract current liabilities (e.g., AP, operating liabilities, unearned revenue) from current assets (e.g., net AR, costs capitalized for revenue contracts, prepaid expenses).

A simpler, more direct way to calculate operating cash flow is to take the difference between revenue cash inflows and expense cash outflows, without considering non-cash items like taxes or depreciation.

Why is operating cash flow important?

Operating cash flow is so important that it’s one of the first things you see on your business’s cash flow statement. A health operating cash flow indicates that your business is generating enough revenue to maintain and grow normal operations, without resorting to external financing.

Fluctuations in operating cash flow may reveal problems related to liquidity, profitability, and debt management. Unstable cash flow from operations can highlight issues with budgeting, spending, and cost management, as well as revenue cycles and timing of customer payments, which can impact your company’s ability to fund its operations and meet its financial obligations.

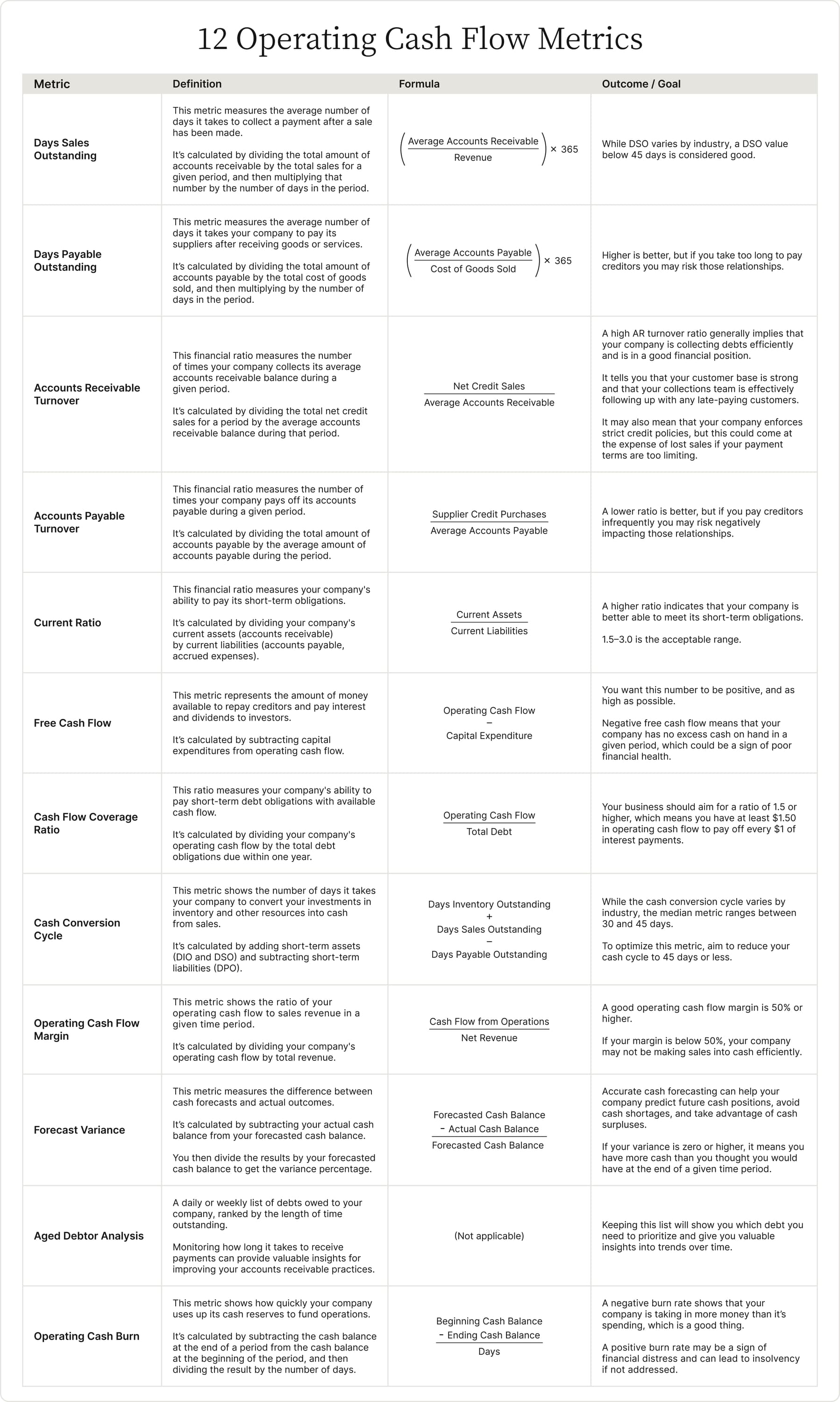

12 metrics to keep your operating cash flow healthy

Many operating cash flow metrics can provide insights for ensuring your business has sufficient liquidity to meet its expenses. The metrics you choose to track will depend on your business and your specific goals, but here are 12 indicators that are critical for most businesses.

(See below for definitions, formulas, and goals for each metric.)

Days sales outstanding (DSO)

Days payable outstanding (DPO)

Accounts receivable turnover

Accounts payable turnover

Current ratio

Free cash flow

Cash flow coverage ratio

Cash conversion cycle

Operating cash flow margin

Forecast variance

Aged debtor analysis

Operating cash burn

Keeping track of these metrics and making adjustments when needed will help your business stay financially healthy. Use them to help your teams collect payments more efficiently and keep cash on hand for as long as possible.

Click here (or on the image above) to expand the list of operating cash flow metrics

How to improve operating cash flow with accounts receivable automation

Operating cash flow and many of the related metrics outlined above are directly tied to how you manage your accounts receivable. The more money you bring in on time, the better your cash flow.

Companies that still rely on manual processes to manage accounts receivable are missing valuable opportunities to improve their operating cash flow and overall financial health. By simply automating your cash collection processes, you’re able to:

Eliminate errors that cause payment delays and invoice disputes

Drive digital payment acceptance and eliminate the need to chase down payments

More quickly match incoming payments with remittances

Free up AR teams to prioritize strategic activities

[Case study] see how Boston Properties boosts operating cash flow with a 99% on-time payment rate

Recognizing that accounts receivable has a major influence on operating cash flow, Boston Properties gave its AR department the tools it needed to automate workflows and increase efficiency.

By automating its full invoice-to-cash process through collections, payments, and cash application, the largest publicly traded owner, manager, and developer of commercial real estate in the U.S. reduced its expenses and received more cash on time—two of the key ingredients of a healthy operating cash flow.

In addition to saving $1,200 per month by eliminating the need to mail paper invoices, Boston Properties’s AR team no longer has to chase down late payments. Thanks to AR automation, the company now collects 99% of its payments digitally on time.

This is a stark contrast to their operations before they implemented their cloud-based accounts receivable solution. During that period, the company had two full-time collectors trying to get clients to pay. And if and when the late payments came in, they took an average of 4–5 months to reconcile.

—

If you want to optimize your operating cash flow—and the 12 related operating cash flow metrics described in this article—consider using accounts receivable automation to streamline your payment collection processes. Automation can help you reduce the time it takes to process payments, eliminate time-consuming and error-prone manual data entry, and provide more accurate and timely reporting you can use to monitor the metrics you’re tracking.

Automation can also reduce the amount of time you spend asking customers about overdue payments, dealing with customer disputes, and reconciling customer payments.

To learn more about how AR automation can improve your operating cash flow, download our Essential Guide to Accounts Receivable Automation or contact Versapay today.

Other FAQs about operating cash flow

Is operating cash flow the same as cash flow?

Operating cash flow refers to the amount of cash generated from a business’s primary activities. Total cash flow includes operating cash flow as well as the money generated from other activities, such as investing and financing.

What factors impact operating cash flow?

The factors that affect operating cash flow include sales, accounts receivable, accounts payable, and non-cash expenses such as depreciation and amortization.

What are some examples of the non-cash expenses that are included in the operating cash flow formula?

Non-cash expenses include depreciation costs, revenue amortization, contract costs, stock-based expenses, and gains on strategic investments.

How do I determine a working capital increase?

A working capital increase is a key component you need to calculate your operating cash flow. To determine a working capital increase, subtract your current liabilities (e.g., accounts payable, operating liabilities, unearned revenue) from your current assets (e.g., net accounts receivable, costs capitalized for revenue contracts, prepaid expenses).

About the author

Ben Snedeker