How a Microsoft Dynamics ERP Payment Integration Maximizes Your Business Central Investment

- 15 min read

Learn how you can extend the capabilities of your Microsoft Dynamics 365 Business Central ERP with an integrated payment processing solution built specifically for it.

Companies using Microsoft Dynamics 365 Business Central demonstrate a commitment to efficiency. But they often fail to maximize their ERP investment due to disconnected payment processing. While the platform excels in many areas, it lacks native payment gateway functionality. This gap necessitates an integrated payment processing solution that seamlessly records incoming payments in Business Central's cash receipts journal.

Without a payment integration, accounts receivable (AR) processes become unnecessarily complex, potentially undermining the efficiency gains that drove the initial MS 365 investment. The resulting disconnect between the ERP and whichever external payment systems you’re using introduces additional work, increases the risk of errors, leads to inaccurate reporting, and can cause payment delays that could otherwise be avoided.

In this article, we'll explain what to look for in a payment processing solution that integrates smoothly with Business Central. You'll learn about the importance of advanced solutions that simplify bank reconciliation and reporting, provide strict security controls, support multiple payment channels, and offer interchange optimization for significant cost savings.

By the end, you’ll have a clear understanding of how the right integrated payment solution can amplify the benefits of your Microsoft Dynamics 365 Business Central investment, streamlining your AR processes for better cash flow.

Table of contents:

7 reasons why Business Central users need integrated payment processing

Processing payments manually or using siloed third-party payment acceptance solutions creates numerous bottlenecks that slow down the entire order-to-cash process. Here are some of the challenges accounts receivable teams often face that demonstrate the need for an effective Business Central credit card processing solution:

1) Delayed payment processing and limited payment options

2) High payment processing costs

3) More frequent errors and miscommunication

4) Sub-par financial reporting

5) Security vulnerabilities and fraud risks

6) Regulatory compliance challenges

7) Inadequate payment processing support

1. Delayed payment processing and limited payment acceptance options

The fragmentation of payment systems and data across multiple platforms makes it harder to track down important information like bank reconciliation files. And you may be limited in the payment methods—like credit cards, for instance—you can accept at various touch-points, restricting your sales potential.

Without integrated payments, your payment data won’t feed into your ERP automatically, forcing your AR team to update customer records manually. These delays in applying payments to open invoices can hinder your access to working capital or ability to make sales, especially if account holds prevent customers from making additional purchases.

2. High payment processing costs

The absence of an integrated payments processor for Business Central typically means you’re paying more for your payment processing. Manual or non-integrated payment processing deprives your business of significant potential savings from interchange optimization and often requires additional resources to do the work an integrated system can perform automatically.

This inefficiency can eat into your profit margins and reduce your overall business performance.

3. More frequent errors and miscommunication

According to PYMNTS, more than 80% of executives in 2024 said they’ve lost business because of a payment process miscommunication. “Legacy systems are cumbersome and hinder effective communication between buyers and suppliers” and can lead to invoice errors and missed follow-up opportunities that can delay payments.

Manually matching and applying payments to invoices significantly increases the likelihood of errors, which require time to correct and can impact your collections efforts. Without integrated payments, your team might, for example, inadvertently reach out to a customer about a payment that's already been made or fail to follow up on a genuinely past-due invoice.

4. Sub-par financial reporting

Accounts receivable teams require access to reliable, real-time data to effectively manage invoices, customer contacts, and payment methods. When these data sources reside outside of Business Central, typically in spreadsheets, you lose the ability to maintain an accurate, real-time picture of your AR.

With inaccurate or incomplete reporting, you also limit your executive team's ability to fully understand your business’s financial health and make informed decisions.

5. Security vulnerabilities and fraud risks

Manual or non-integrated payment processing systems often fail to provide adequate protection for sensitive financial data. For example, without native integration functionality, you might have to manually export and/or import payment data—often the case when taking credit card details over the phone—likely storing it unencrypted along the way. Poor controls leave companies vulnerable to data breaches, compliance violations, and financial losses from fraudulent activities, including chargebacks.

With a tailored Microsoft Dynamics payment integration solution, you can leverage cutting-edge security measures to safeguard your operations and protect customer information. A proactive approach mitigates risks, builds customer trust, and streamlines financial processes within the Business Central environment.

6. Regulatory compliance challenges

Payment processing involves numerous, ever-changing regulations. An integrated payment solution for Microsoft Dynamics 365 Business Central can help address these challenges by centralizing data management, automating security protocols, and streamlining compliance-related reporting.

This consolidation reduces potential weak points and improves control over payment data, minimizing legal and financial risks associated with non-compliance.

7. Inadequate payment processing support

Generic payment processors—not deeply embedded within the Microsoft Dynamics ecosystem—may not understand the unique needs of your business or how payments flow through your ERP. Inadequate support can disrupt payment processing when issues arise and slow down your cash flow even more.

3 key benefits of a Microsoft Dynamics payment integration

To overcome the hurdles highlighted above, businesses are extending the capabilities of their Microsoft ERP systems with integrated payment processing solutions tailored specifically for Business Central. With such a solution in place, your accounts receivable team can expect significant improvements across several key areas:

1) Enhanced convenience for you and your customers

2) Up to 40% savings in payment processing costs

3) Stronger payment fraud protection

1. Enhanced convenience for you and your customers

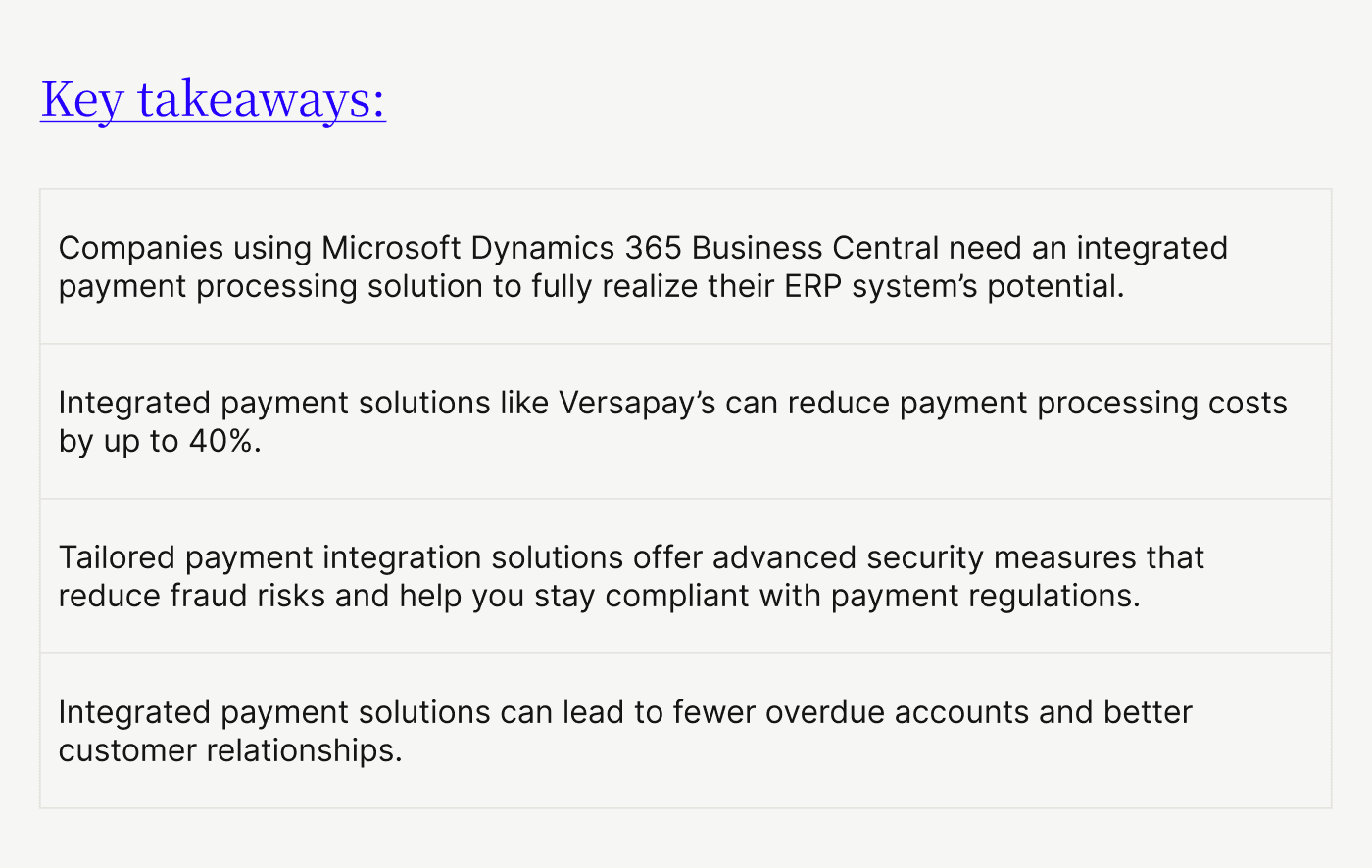

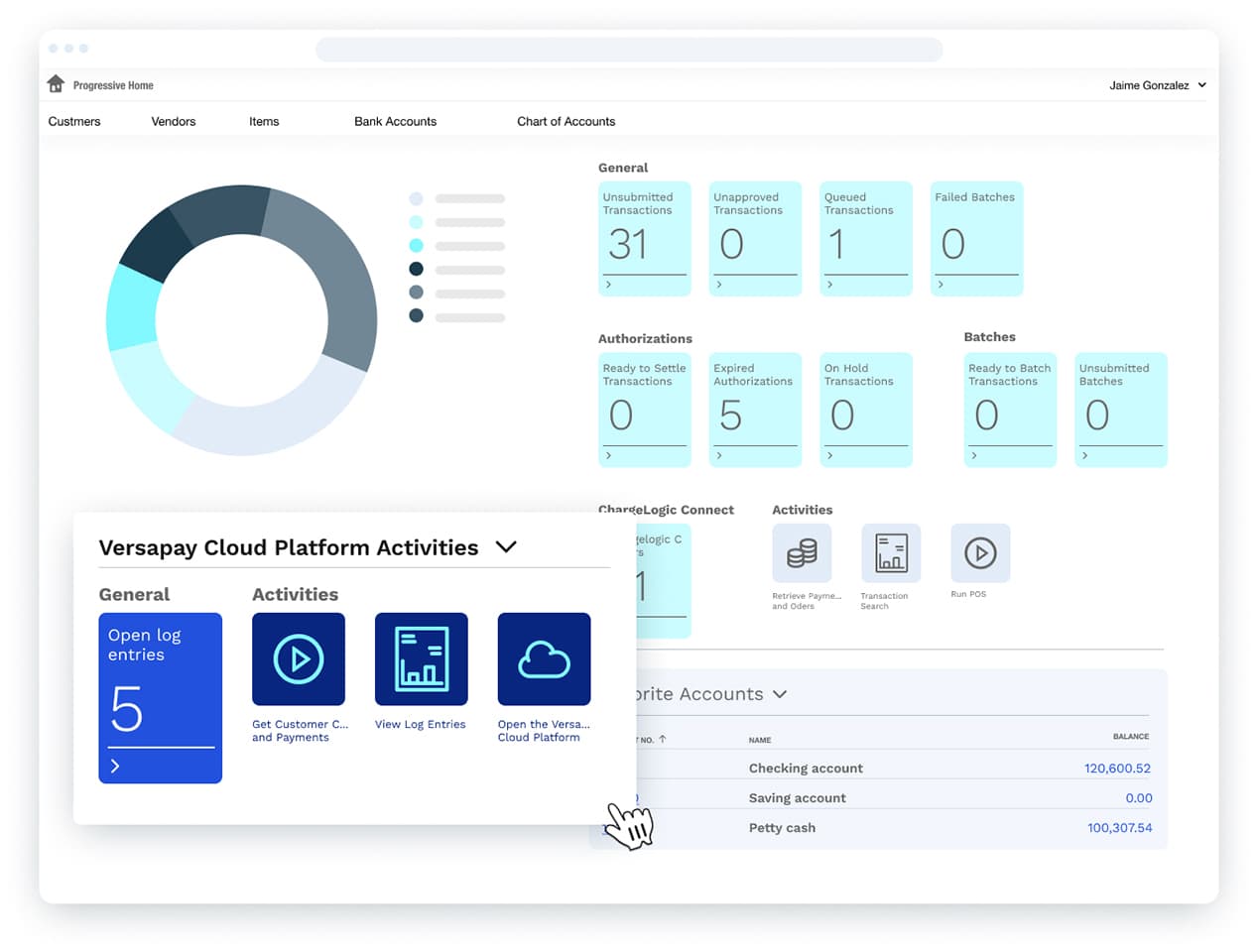

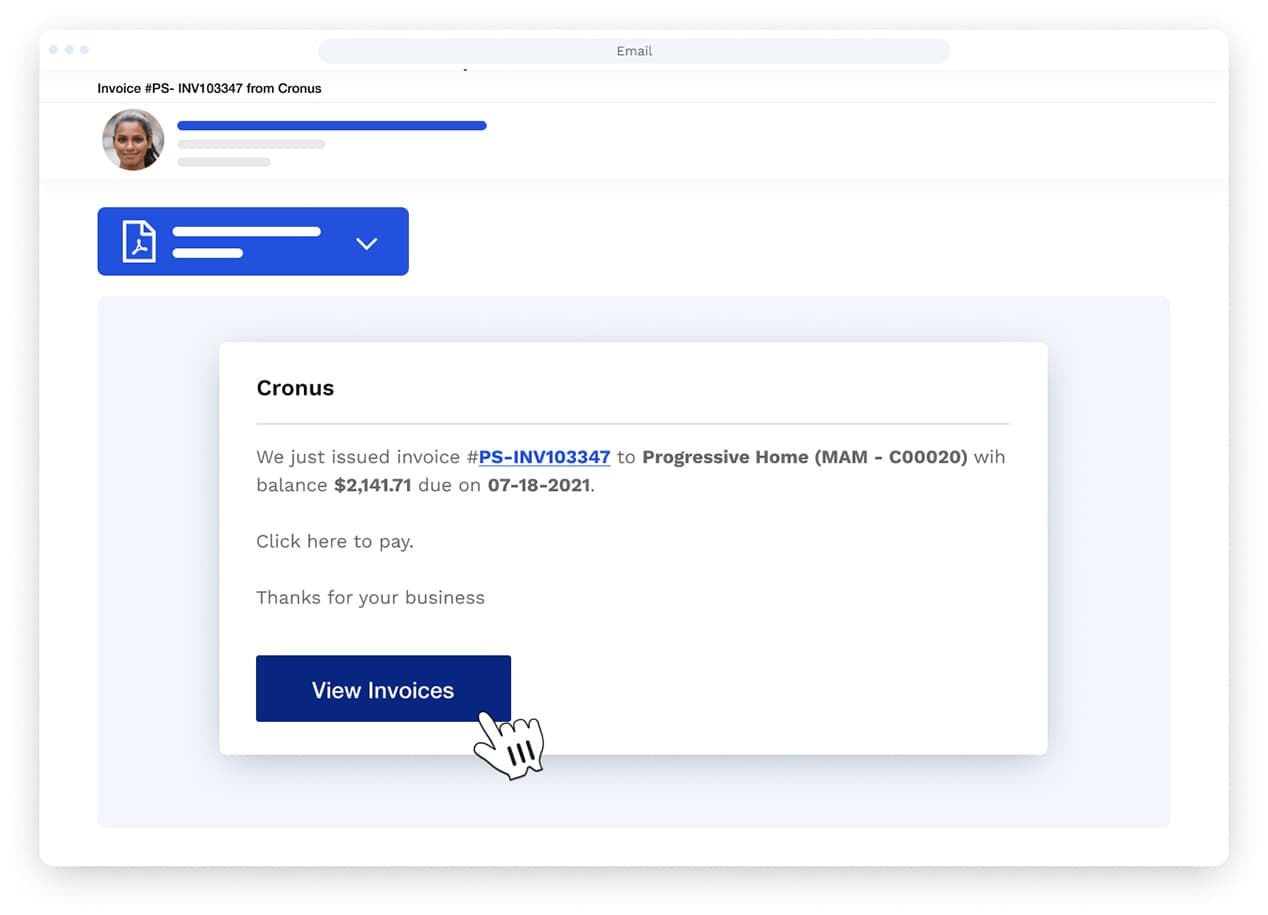

The right integrated payment solution facilitates seamless transactions across all your sales channels—ecommerce, point of sale, and accounts receivable—directly within Microsoft Dynamics 365 Business Central. For instance, Versapay supports click-to-pay invoicing, which makes it easy for your customers to pay online as soon as they receive their invoices. Their accelerated payments are then automatically posted to the open invoice and passed back to your ERP, streamlining the entire process.

But payment integration in Business Central goes beyond mere convenience. It transforms the way your AR team gets things done:

Payment collection becomes an integral part of your native ERP workflow, reducing the need for extensive training

Auto-reconciliation streamlines the entire process from payment acceptance to posting in your cash receipts journal

Centralizing payment data in your ERP streamlines research and auditing, offering a single source of truth for all transactions. This eliminates the need to cross-reference multiple systems

2. Up to 40% savings in payment processing costs

When you process payments through your ERP with an integrated solution like Versapay, you benefit from interchange optimization. With support for Level 2 and 3 data processing, you can potentially lower your payment processing costs by up to 40%.

But that’s just the beginning. The financial benefits of integrated payments extend across your entire payment ecosystem:

Reduce the cost of labor involved with manual payment processing

Easily accept and process payments across all sales channels—e-commerce, retail, and back office

Support various payment methods, including credit cards, debit cards, virtual cards, checks, and bank payments, with chip and PIN/EMV capabilities

3. Stronger payment fraud protection

Processing sensitive payment data through a single, integrated system reduces the number of touchpoints for that information, minimizing entry points for bad actors.

Versapay, for example, offers a comprehensive security approach that includes:

Secure processing of online orders from cart to cash, using a flexible payment gateway

Integrations with popular shopping carts and competitive merchant services

Optional checkout features to limit fraudulent chargebacks

Tokenization and encryption of payment data for greater peace of mind

Microsoft Dynamics payment integration offers a trifecta of benefits: enhanced convenience, substantial cost savings, and robust security. Together, these advantages allow your business to focus on growth and customer satisfaction rather than the intricacies of payment management.

3 real-life Microsoft Dynamics payment processing success stories

Across a wide spectrum of industries, companies using Microsoft Dynamics 365 (and other ERP systems) rely on Versapay for integrated payment processing. Here are a few examples that showcase the tangible benefits of integrated payment processing in Business Central:

Gulf Coast Panama Jack—67% reduction in DSO

After integrating Versapay's accounts receivable automation solution with its Microsoft Business Central ERP, this wholesale distributor saved 20 hours a week by eliminating manual tasks. Days sales outstanding went from 30 days to 10 days, and all check payments were replaced by credit cards or ACH transfers.

“Getting up and running with Versapay was seamless,” says Shirley Grimes, Accounts Receivable Supervisor. “Knowing we have a dedicated person at Versapay to support us was huge.”

Research and Productivity Council (RPC)—70% fewer overdue accounts

Canada’s Research and Productivity Council (RPC) uses Versapay’s integrated payment solution for Business Central to automatically generate and send invoices to customers, who pay them effortlessly through a secure link.

After quickly resolving more than $600,000 in past-due payments, the new approach resulted in a 70% reduction in the number of accounts with invoices more than 90 days past due.

Because the RPC collections team no longer has to reconcile payments manually, they have more time available for higher-level tasks. According to RPC’s Accounts Receivable Specialist Tammy Craft, using the Versapay software makes her job a lot easier. “It frees me up so I can learn more about the strategic part of management accounting,” she says. “Thanks to automation, I’ve been taking accounting courses so that I can help the financial controller with the working papers, year-end and month-ends.”

TrimaxSecure—99% decrease in check payments

This global IT services provider streamlined its entire accounts receivable process with Versapay automation. Integrating payments within Business Central led to a 10-day reduction in average DSO, and a 25% drop in staff time spent soliciting and following up on payments. What’s more, 99% of customers who previously paid by check switched to credit card payments when given the option to do so.

“Versapay has exceeded our expectations,” says Hakki Isik, CEO. “We no longer need to update payments in one system and manually update customer invoice statuses in another. Once we post an invoice, it’s automatically sent to our customers, and once they’ve paid, invoice statuses are automatically updated.”

Why Versapay shines among integrated Business Central payment processing solutions

As you can see from the real-life examples above, Versapay’s integration with Microsoft Business Central offers key advantages for companies that want to create efficiencies and modernize. Shirley Grimes at Gulf Coast Panama Jack had four goals in mind when she contacted us:

To generate and send invoices more quickly

To ensure payments are automatically processed and posted to her ERP

To make collecting payments easier and more convenient

To work with a dedicated partner, long-term

And that’s exactly what we do for her and countless other finance leaders across the country. And because our Dynamics 365 Business Central payment integration solution is custom-built for this ERP, we can get you up and running lightning-fast.

Here’s a sneak peek into how it works:

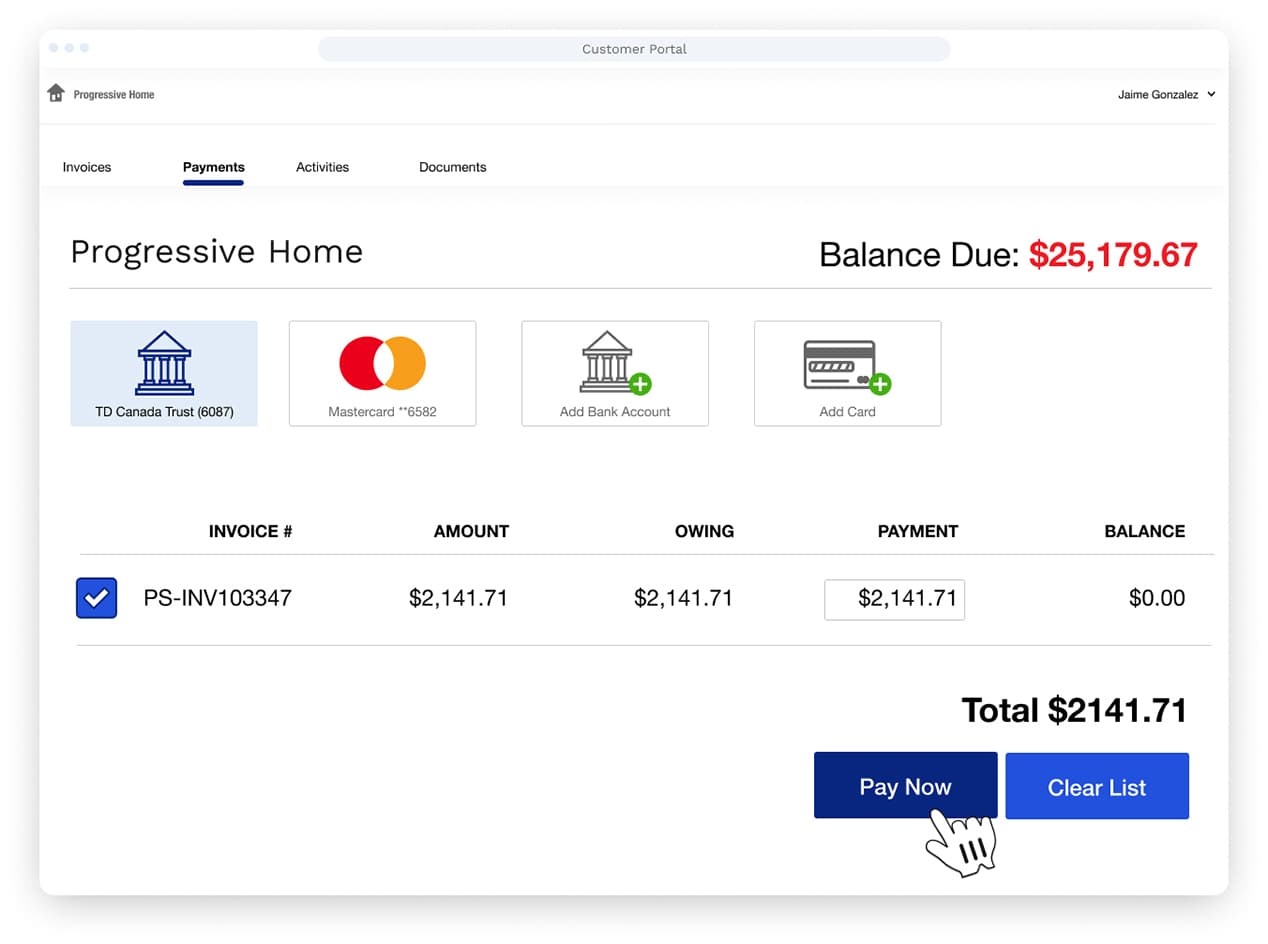

With Versapay, you can email invoices containing a button that takes your customers to a secure page where they can pay immediately. They can pay individual or multiple invoices in full or customize their payment amounts.

Customer payments are automatically posted to your cash receipts journal, which can then be posted to your customer ledger. This makes applying those transactions to the appropriate invoices much simpler. With flexible settlement options, you can choose which of your accounts the payments should go to.

Best of all, you can accept credit, debit, ACH, virtual cards, and bank payments across your sales channels. Card refunds can also be handled directly inside Microsoft Dynamics. You can also give customers the option to save their payment methods on file—with all card data tokenized and encrypted—to easily make future payments.

Get Business Central credit card processing using Versapay and build a foundation for total accounts receivable transformation

Versapay can do so much more than solve your Microsoft Dynamics payment integration problems. We can also automate your accounts receivable tasks (invoicing, collections, disputes, etc.), automate your cash application, and provide collaborative payment portals that improve customer satisfaction.

To learn more about all of Versapay’s natively integrated solutions for Microsoft Dynamics 365 Finance and Business Central, talk with an expert today.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.