Subledger vs. General Ledger: What You Need To Know

- 9 min read

This article examines the differences between general ledgers and subledgers, best practices for using subledgers, and the importance of general ledgers and subledgers in accounting.

Accurate bookkeeping is the foundation of business stability and a necessary precondition for growth. A single database of transactions, known as a general ledger, is usually enough for fledgling companies and startups to keep their records organized. This general ledger includes every transaction the company makes and every obligation the company maintains.

But simple ledger accounts may have a hard time keeping up with a business as it grows in complexity and scale. There may be a large volume of items to organize or complex transactions that can’t be captured as a single line item in the general ledger. Companies that maintain numerous streams of revenue and multiple debts may need a more detailed bookkeeping method.

Businesses that need more can institute subledger accounting, which is designed to capture more granular details about transactions than those that appear in the general ledger. A business can keep multiple subsidiary ledgers, each with its own purpose and all matching up with the general ledger.

In this article, we’ll explore:

- What a general ledger is

- What a subledger (or subsidiary ledger) is

- The different types of subledgers

- Why businesses use subledgers

- The key differences between a subledger vs. general ledger

- Best practices for using subledgers, and

- The importance of general ledgers and subledgers in accounting

What is a general ledger?

A general ledger is a business’s source of truth for accounting. It's a document or database that contains records of all the business’ financial transactions, both in accounts receivable (AR) and accounts payable (AP). The general ledger is divided into several accounts, called master accounts or control accounts, all of which are organized via a chart of accounts. Examples of accounts you may find in a general ledger include banking, accounts receivable, accounts payable, sales, revenue, and fixed assets.

General ledgers typically use the double-entry accounting method in which each entry into an account requires that you put an equal and opposite entry into another account. For example, if you receive a check for $500, you enter a $500 debit in the cash account and a $500 credit in the accounts receivable account.

What is a subledger (or subsidiary ledger)?

As companies scale, they may find that keeping all the detailed financial data about each transaction in the general ledger is cumbersome and unworkable. For example, if your business has 2,000 transactions in AR in a given month, your accounting clerk would need to go through all those entries to find the total. This can be a major inconvenience when looking to get a quick snapshot of your business’ financials.

Growing companies need a more sophisticated system of organizing everything that’s happening in the business so they can see the most important data at a glance while keeping track of all the granular detail. The answer is to create subsidiary ledgers, also called subledgers. These are more narrowly focused ledgers that contain more detailed information about the various master accounts in the general ledger.

Each subsidiary ledger is focused on a specific category of financial transactions, such as customer accounts, sales accounts, fixed asset transactions, or bank transactions. The listed transactions in each subsidiary ledger account connect to the general ledger accounts. Each subledger’s total is reflected in the total of the general ledger.

In the above example of the 2,000 AR transactions, all these transactions would be listed in the customer accounts subledger, the total of which would populate the accounts receivable balance in the general ledger for that month.

Common subledger examples

Not every business elects to use the same number or types of subledgers. How each company sets up their bookkeeping will depend on the business’ needs. Here are some common types of subsidiary ledgers that businesses may decide to create.

1. Customer accounts

A company might keep a subsidiary ledger for its customer accounts, each of which connects to the accounts receivable totaled in the general ledger. The cumulative total in all the customer account subledgers should equal the total accounts receivable in the general ledger.

2. Vendor accounts

A company might keep a subsidiary ledger for its vendor accounts, each of which connects to the general ledger’s accounts payable. The cumulative total of debits in all the vendor account subledgers should equal the total accounts payable in the general ledger.

3. Bank accounts

The bank accounts subledger records the cash that is available in the company’s bank accounts and short-term investments. The total of all the accounts in this subledger will indicate the amount of cash-on-hand the company has at a given moment.

4. Sales

The sales subledger lists details of sales made by the company, which can be organized or categorized in several ways, such as by region, inventory category, product, customer, or salesperson. The total of the sales listed here will populate the total for the sales master account in the general ledger.

5. Fixed asset

A fixed asset subledger is used to convey details of a company’s fixed assets, such as property, equipment, vehicles, and software. For example, the entries here can reflect the asset’s original cost, any additional costs, and possibly restatement or revaluation costs. This information can be used to analyze depreciation.

6. Revenue

A revenue subledger contains information on all transactions that created revenue for the company, including details like invoice numbers, line-items, discounts, payments, fees, refunds, and tax information. The balance of each transaction listed here contributes to the total balance of the revenue account in the general ledger.

Why do businesses use subledgers?

Subledgers help ensure the accuracy, organization, control, and financial agility a company has over its books. Subsidiary ledgers also help accountants create financial statements as necessary so they can be ready for an audit at any time. Here are some ways that companies of all sizes can use subledgers to assist in bookkeeping.

1. Accuracy and organization

Companies need accurate books, and businesses with high transaction volumes and multiple revenue streams are in danger of letting details fall through the cracks if they don’t have a thorough and organized accounting method. They can use subledgers to maintain accuracy and organization in their bookkeeping if the general ledger alone is getting too difficult to manage.

2. Scale and control

A set of well-organized subledgers allows bookkeepers to handle scale. In fact, this system can readily organize millions of transactions. Transaction-level data can be quite comprehensive, so using multiple databases to organize and store them is necessary so as not to let your general ledger fall into chaos.

For example, sales transaction entries might include details like the item sold, customer contact information, date and time of sale, unique transaction ID, and the purchase price. All of this data is not necessary to include in the general ledger, which is intended to track your business’ total sales transactions. The general ledger can provide an overview of sales at a high-volume business while a subsidiary ledger provides the full drill-down.

3. Audit readiness

Accountants never know when their company might be audited. It’s best to always be ready to provide thorough transaction-level data to authorities in accordance with the Generally Accepted Accounting Principles (GAAP) established by the Financial Accounting Standards Board (FASB). All businesses can benefit from this readiness, but it’s particularly crucial for companies with high transaction volumes and or operate across multiple jurisdictions.

4. Financial agility and insight

Finance teams need to be able to quickly provide detailed information in documents like the income statement, balance sheet, and cash flow statement. This reporting is a critical component of the business’ strategic decision-making and cash management. Providing this insight quickly is easier when financial statements are well-organized and properly categorized into subledgers.

Subledger vs general ledger: what’s the difference?

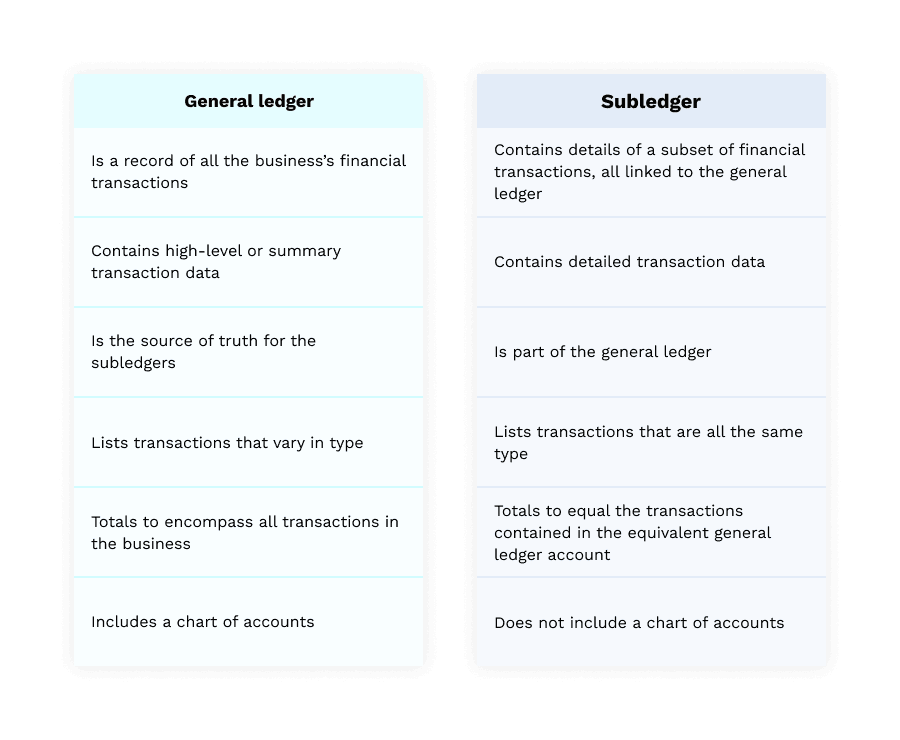

There are several differences between general ledgers and subledgers, mostly revolving around the fact that a subledger is a subsidiary data source to the general ledger. Each subsidiary ledger exists only as a support to the general ledger.

See the chart below for more a closer breakdown of the differences between the two:

What are the best practices for using a subsidiary ledger?

The key best practice when using a subsidiary ledger is to ensure that the transactions listed in the subledger match the related general ledger accounts. Through the process of account reconciliation (usually monthly), you’ll ensure these entries match up correctly. All the bookkeeping in these ledgers should be done in accordance with GAAP standards, which dictate how companies should track transactions and related data.

Companies large enough to make use of subledgers will manage their accounting in their enterprise resource management (ERP) systems or integrated accounting systems. This is the best way for finance teams to streamline their work, stay organized, reduce errors, and produce financial reporting swiftly.

The importance of subledgers and general ledgers in accounting

In the battle of ledger vs. subledger, there’s no true winner—both have their uses and can be helpful to businesses in different ways. General ledgers and subledgers are both important tools for businesses to adopt as they grow and need more detailed and controlled financial management.

Subledgers, especially, are vital for growing companies, which benefit from the organizational power they offer.

Businesses that manage their books with well-executed ledgers and subledgers from the outset will have more accurate financial records, be better positioned in the event of an audit, and remain agile and flexible as they grow.

Want to receive more tactical advice for managing accounting processes in your inbox? Sign up for our newsletter.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.