4 Tangible and 3 Intangible Benefits of Cash Application Automation Software

- 9 min read

Forrester Consulting surveyed our customers and helped us quantify the benefits of Versapay Cash Application.

This article covers the tangible and intangible benefits of using cash application automation software.

Streamlining cash application through automation saves your accounts receivable team time. But what is such software worth? You can intuitively understand how much time the software is saving you, but what does that mean in dollars and cents? The better you understand and quantify those benefits, the easier it is to figure out how much you should pay for cash application automation.

Forrester Consulting recently surveyed our customers and helped us quantify the benefits of Versapay Cash Application. Here are the tangible and intangible benefits they discovered.

Table of contents

4 tangible benefits of cash application software

Forrester's research identified four quantifiable benefits of adopting cash application software. The monetary savings Forrester cited in its report are based on a representative organization with revenues of $300 million, processes 750 payments daily, across multiple channels, and has physical and online outlets.

The tangible benefits are:

1) Automated cash application increases cash posting efficiency

2) Automated cash application reduces external financing needs

3) Automated cash application reduces past-due payments

4) Automated cash application increases time for value-added work

Let's look at these in more detail.

1. Automated cash application increases cash posting efficiency

Automated cash application brings significant efficiency to a company's cash posting process. Interviewees in Forrester's study said that the time required to process cash and match remittances to invoices decreased significantly, contributing to the majority of savings.

The time these companies save comes from automation streamlining their processes, removing any need to spend time manually validating each remittance entry and matching it with a corresponding payment.

The lack of manual processes also eliminates errors that usually create a time sink. AR professionals do not have to revalidate their work and can trust their data. The result is a better picture of cash flow and accurate cash projections.

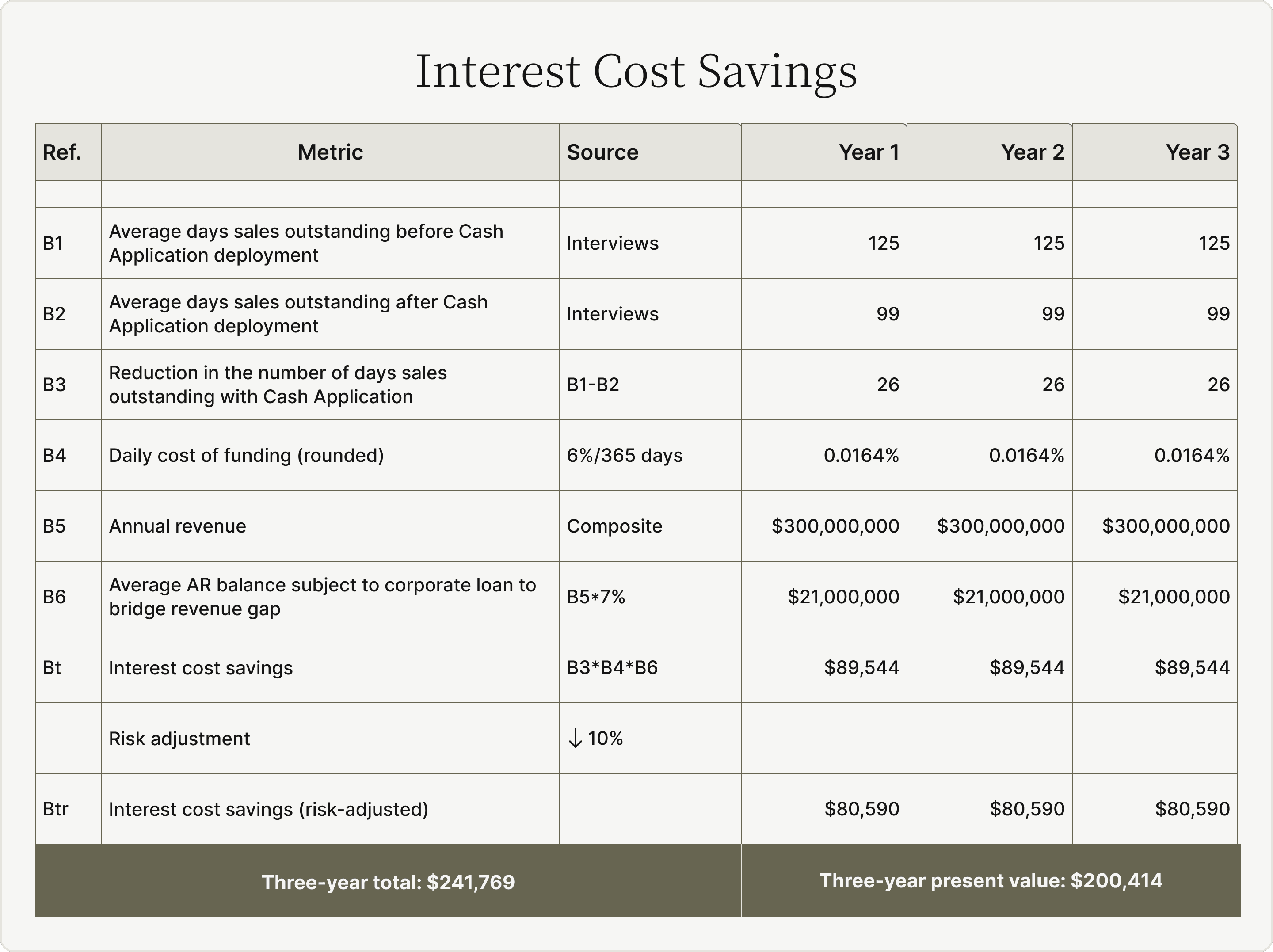

2. Automated cash application reduces external financing needs

Increased interest expenses from external financing are a side-effect of poor cash application efficiency. With cash flow levels unclear and payments taking time to make their way onto books, companies seek financing to tide over working capital holes.

Automated cash application's effect is apparent when reviewing the impact on day sales outstanding (DSO). Forrester pegs the reduction in DSO attributable to Versapay Cash Application from 125 to 99 days on average, which is almost a month.

In effect, cash application software gets you paid a month in advance compared to manual processes. With the resultant working capital boost, interest expenses reduce. Assuming a 6% annual interest rate, the savings total $200,400 over three years.

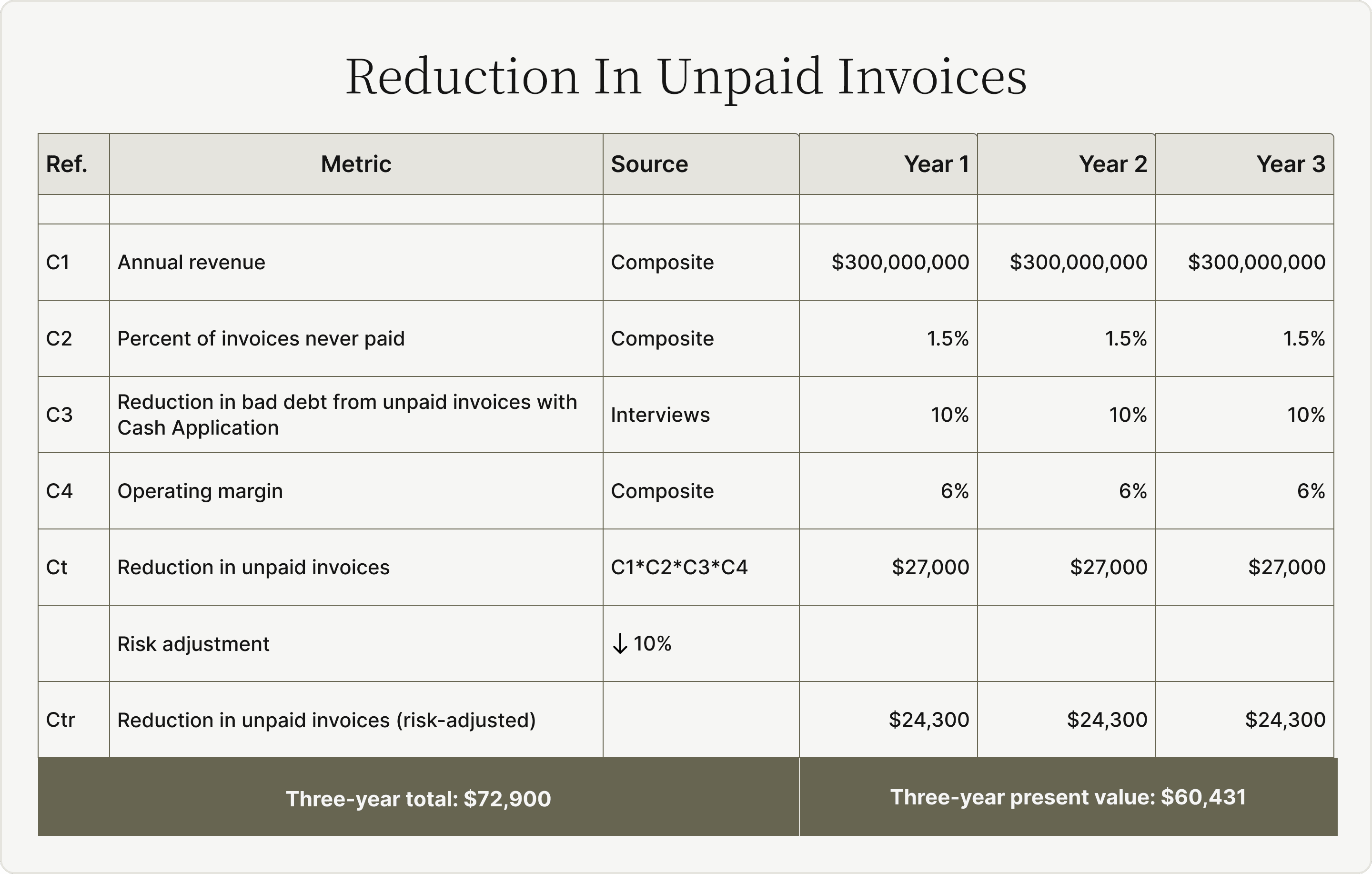

3. Automated cash application reduces past-due payments

Not every past-due payment is caused by customers not paying on time. Companies that rely on manual cash application processes often experience a backlog of unpaid invoices due to matching delays. This creates a well of outstanding receivables and a higher allowance for bad debt expenses (BDE). Forrester's study highlighted some of the challenges companies face, such as:

Lack of visibility into AR aging buckets—companies do not know which invoice payments are delayed versus unmatched.

Incorrect reports caused by delays.

Lack of trust in AR data due to delays and errors in matching.

Pairing automated cash application with a collaborative accounts receivable automation platform helped the companies Forrester surveyed reduce their past due invoices. The reductions in BDE and unpaid invoices were worth $60,400 over three years to these companies.

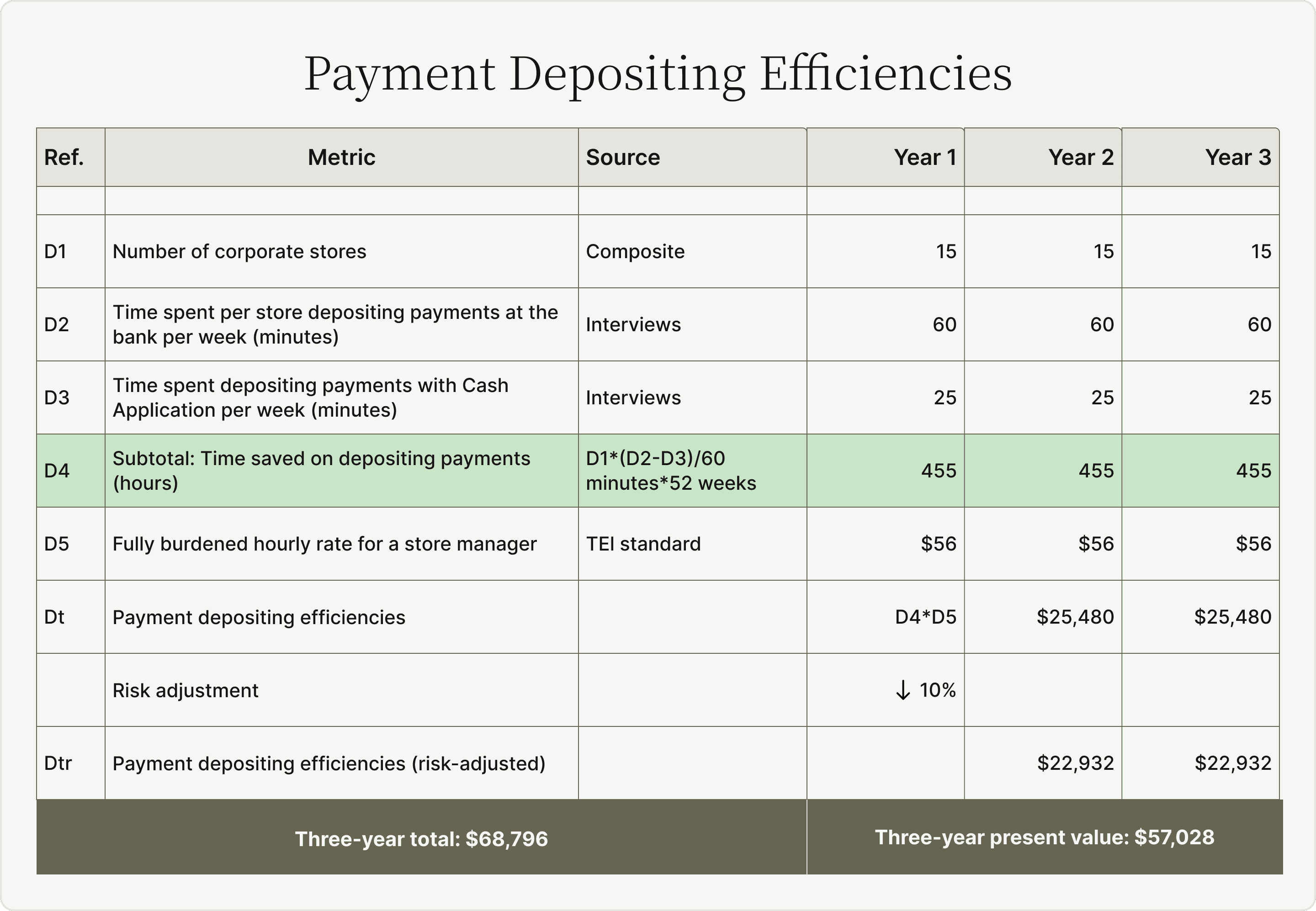

4. Automated cash application increases time for value-added work

Companies with physical outlets collecting cash face an additional cash application burden. Store managers usually fill out reports at the end of the day and deposit collections the following morning. Reconciling these deposits to reports is time-consuming for AR teams.

Store managers encounter further issues. They make copies of supporting documents, drive to bank branches, and write up deposits. Forrester's study highlighted that these tasks take an hour daily, assuming this manual workflow produces no errors.

Automated cash application paired with novel solutions like mobile check deposits save employee time, reduce errors in cash deposit data, and free AR from reconciliation burdens. Forrester pegs the time saved due to these efficiencies at $57,028 over three years.

This healthcare services provider is a great example of a company realizing greater efficiency through automated cash application. The company accepted payment across a range of channels, complicating cash application. Automating this process reduced the time spent applying cash from 6 hours to 90 minutes—a time saving of 75%.

3 intangible benefits of cash application software

Automated cash application has a few intangible benefits to go with the tangible ones highlighted previously. While their value is hard to quantify, their impact is undeniable. These benefits are:

1) Automated cash application reduces errors and missed payments

2) Automated cash application keeps employees happy

3) Automated cash application keeps customers happy

Let's dive into these in more detail.

1. Automated cash application reduces errors and missed payments

Human errors induced by stress and fatigue compound time delays in the cash application process. Errors also make it tough for companies to trust their AR data. For instance, an unpaid invoice or incorrectly recorded payment can impact a customer's credit standing. A deserving customer might be unable to access credit, leading to poor experiences that damage relationships.

Worse, errors increase at scale as a company grows, asCarter Lumber discovered. The company was forced to adopt a clunky, decentralized, manual cash application process. Automated cash application software helped the company centralize AR data. Technology like AI-driven optical character recognition helped Carter Lumber apply cash and post ERP entries seamlessly.

2. Automated cash application keeps employees happy

Manual accounts receivable workflows can exhaust your employees if you process a large number of invoices each month (Forrester’s representative organization processes 750 payments daily). In such cases, your employees spend most of their time chasing supporting documentation, scanning remittance information, and figuring out which invoice line items are paid.

Automated cash application removes these time sinks and gives your employees more time to dive deeper into your AR data. These software also give you a real-time view of your cash flow.

For instance, Wurth Canada's sales reps used to collect paper checks in person, mail them, and wait for them to clear. All this cost the company time and money, to the tune of hundreds of hours every month. Thanks to mobile check processing and automated cash application, Wurth's reps now collect payments securely.

3. Automated cash application keeps customers happy

Customer relationships are critical to your business' long-term success. Optimizing for CX is critical, but manual cash application routinely delivers poor experiences.

Customers cannot receive a real-time view of their invoice statuses, nor can your AR team quickly offer them a status update without digging through several spreadsheets. Add manual errors to these processes, and the difficulties compound.

Automated cash application combined with collaborative AR platforms like Versapay deliver memorable CX. Your customers can self-serve their needs, contact AR directly, and receive automated payment reminders. Thanks to an always-updated view of customer statuses, your AR team can proactively offer credit incentives and other discounts that increase loyalty.

The Bank of Tampa experienced these benefits by rolling out mobile deposit capture for its customers. More efficiency and greater customer satisfaction are just two of the many positives the bank has experienced as a result.

Automated cash application is the key to doing more with less

Modern business environments demand efficiency. And with finance facing a talent shortage, efficiency is the key to managing lean teams without overworking them. Automated cash application delivers memorable CX, delighting customers and employees.

Most importantly, it helps you do more with less, generating efficiency within your workflows. Learn how Versapay Cash Application boosts efficiency by 69% in Forrester Research's Total Economic Impact Report.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.