Expert Tips for Maintaining a Human Touch in Complex Collections Disputes While Embracing Automation

- 9 min read

We interviewed Versapay’s Director of Financial Operations, Elena Ma, on how to handle complex collections disputes personably, while still reaping the benefits of automation.

Here are her 5 best practices for striking a balance between automation and maintaining a human touch in dispute resolution processes

Lengthy dispute resolution in accounts receivable (AR) is a game of financial hot potato—the longer it goes on, the more likely something will get burned, whether it's your cash flow, customer goodwill, or your team's productivity.

Automation is a great way to streamline and shorten dispute timelines. In leveraging technology, you can free up valuable time for your AR team by automating clerical tasks like dunning letters and checking account statuses.

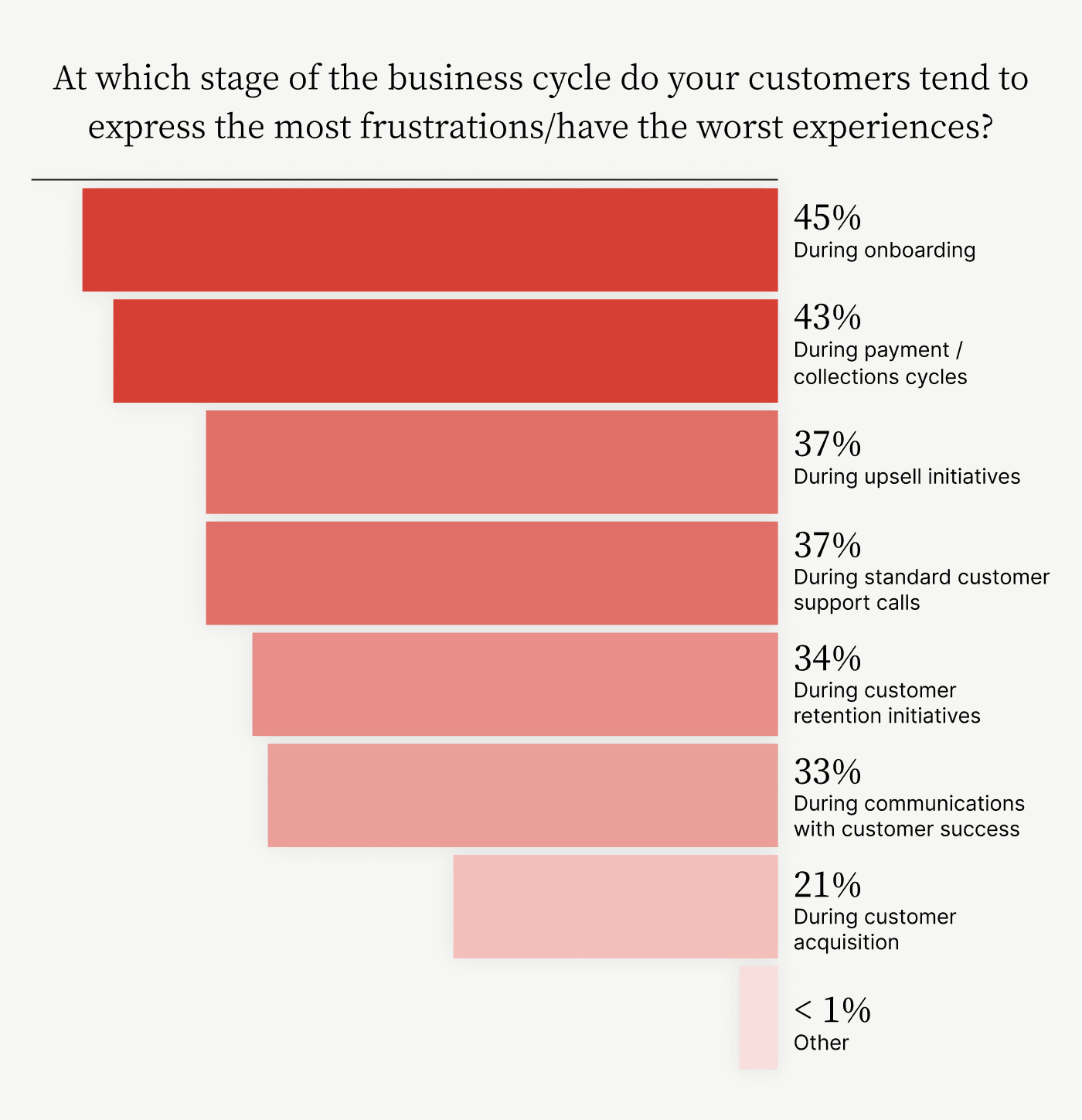

However, there's a fine line between being efficient and coming across as a robot; automation, when implemented incorrectly, might make your AR team seem disconnected from customers. The last thing finance and receivables teams need right now is to deliver a substandard customer experience. After all, collections cycles are precarious enough as it is:

Elena Ma, Director of Financial Operations at Versapay, believes in balancing automation and maintaining a human touch in dispute resolution processes. "Automation helps you address a lot of the smaller issues, a lot of the simpler tasks that you don't necessarily want to burden your team with," she says. "But then when it comes to more complex cases, you want the human involved."

Calling on years of extensive experience in financial operations and accounts receivable automation, Elena shares valuable insights with us on best practices for handling disputes personably while still reaping the benefits of automation.

Table of contents

Best practice 1: Enable self-service to give accounts receivable more of its time back

People are increasingly accustomed to self-service options and accounts receivable is no exception. "You want to empower your clients to self-serve and resolve issues when they need it," Elena says.

By providing customers with self-service tools to access account and payment information, review invoices, and resolve simple issues, accounts receivable teams can free up significant time for more personalized communications. Processes that lend themselves well to automation include generating and sending invoices, issuing payment reminders, and creating basic account status reports.

Elena points out that reporting is perhaps the most critical of the lot. "A lot of the time you get the question about an invoice like "What is this charge?" or "Why am I charged this much?" she says.

By automating these routine tasks, receivables teams can dedicate more time to addressing complex disputes and building customer relationships. Start by analyzing your current dispute resolution process, identifying common customer inquiries, and determining which tasks consume the most time. Look for repetitive, rule-based activities that don't require human judgment as prime candidates for automation.

By strategically automating these processes, you can create a more efficient collections operation that balances technological efficiency with personalized service.

Best practice 2: Identify complex disputes early

Automation can help you surface important metrics more easily, allowing you to determine an issue's severity quickly. Track key indicators like aging accounts, outstanding dollar values, and account statuses, and flag them when they reach critical thresholds. Once you've identified complex or high-priority disputes, involve a human in communications, even if you're automating processes behind the scenes.

"If you have an average-sized deal, you want to maintain a one-on-one relationship between aging and value [when prioritizing severity]," Elena says. "And for an account or dispute that's double the average size of your deal, you want to start getting a human involved."

To effectively balance automation with a human touch, build human involvement triggers into your automated workflows using the data you've collected. Elena offers an example.

"When automated payment reminders are sent and continually unanswered, it’s then a question of whether you have the right contact," she says. "So, determining that is a human task. If you do have the right people and the payment reminders are still not working, you then have to introduce a human touch to ensure there aren't any customer concerns that are open with other teams that are preventing invoices from getting paid."

Involving humans at predetermined thresholds within an automated dispute resolution process like this helps you balance efficiency and delivering memorable experiences.

Best practice 3: Use direct communication channels

While emails are a common form of business communication, they can often seem automated and impersonal, especially where disputes are concerned. Also, important documents attached to emails can easily get lost in crowded inboxes. Instead, use more direct and engaging communication methods for dispute resolution.

Opt for instant messaging within collaborative accounts receivable portals to facilitate real-time communication and document sharing. According to our research, this feature is one of many reasons collaborative payment portals deliver greater ROI than standard ones.

Elena highlights the benefits of such systems. "In Versapay’s Collaborative AR platform, you're able to have internal and external conversations happening on the same invoice," she says. "You can post an answer just to the teams internally and you can also post updates that are customer-facing."

To ensure effective communication, establish and clearly define service level agreements (SLAs) for your dispute resolution process. Elena emphasizes the importance of timely responses.

"I think from that [SLA] perspective, automation really helps. Especially when there’s an open dispute and the team that's most relevant to it gets automated notifications when something goes unanswered for a little while," she says.

By setting clear expectations for response times and dispute resolution processes, you can prevent misunderstandings and demonstrate your commitment to efficient dispute handling.

Best practice 4: Establish credentials and seek feedback

When handling disputes, it's crucial to let customers know that a real person is working on their issue. Include photos, job titles, and brief professional backgrounds of your accounts receivable team members in your communication channels. This humanizes the process and builds trust with your customers.

Train your collections staff to introduce themselves professionally to customers when engaging in resolving complex disputes. "The more complex the scenario is, the more collaboration is required," Elena says. "I might need additional information from the customer. I might have the customer pull in their engineering teams or other teams."

Collaborative accounts receivable payment portals can facilitate this process by easily bringing in various stakeholders, both internal and external, into disputes and other conversations.

Seek customer feedback to understand how you can improve your dispute resolution process. Elena emphasizes the value of customer engagement and says disputes are often an opportunity to build stronger relationships.

"I think it's a good sign that the customer would open a dispute because it shows engagement. It shows that they have a question and that they're willing to work with you to resolve it," she says. “This feedback loop not only helps refine your processes but also demonstrates your commitment to continuous improvement and customer satisfaction.”

Best practice 5: Personalize automated communication

Customers are increasingly adept at identifying automated messages, which can feel impersonal or irrelevant. However, you can create automated communications that feel more personalized and engaging by using customer data.

For example, refer to a customer's account status or line-item level dispute when communicating with them. Or include invoice numbers and line items when referring to outstanding payments.

To achieve this level of personalization, Elena recommends using data from a centralized source to populate customer information in your communications. "All of your interactions can happen in the same place. And then next time, when I need to refer to them, or maybe I'm reporting on an issue, all that data is in the same place," she says.

For instance, an accounts receivable automation platform that’s plugged into your ERP can pull purchase history, payment preferences, and past interactions. Without a centralized data source, you risk sending out incorrect or inconsistent communications, damaging CX. By ensuring that your automated communications are based on accurate, up-to-date information, you can maintain a positive customer relationship even when using automation.

Make collections disputes more human through automation

At first glance, balancing automation and a human touch in dispute resolution might seem challenging. Yet ironically, when implemented thoughtfully, automation can enhance the human element in accounts receivable processes. Data and technology are the keys to achieving this balance. Specifically:

A centralized collections data repository — A single source of truth makes it easy for your AR team to keep everyone on the same page.

Self-service reporting — Customers solve simple requests, giving your team more time to solve complex issues.

Collaborative technology — Involve the right people, at the right time to solve customer issues.

Embracing automation in accounts receivable doesn't mean sacrificing the human element. Rather, automation enhances it by freeing accounts receivable professionals to focus on high-value, relationship-building interactions.

Learn how Versapay's accounts receivable automation software helps you streamline collection workflows and prioritize collaboration when handling disputes.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.

Dispute and Deduction Management

Learn how automation and collaboration lets you track and resolve disputes faster.