6 Top Payment Processors Reviewed: What B2B Companies Must Look For

- 13 min read

This article walks you through evaluating the top payment processors on the market and selecting the right one for your business.

Offering customers multiple payment options is standard, and a payment processor is a critical cog in enabling that. The problem is that payments are complex. From the language surrounding payments to the intricacies behind how payment processors work, understanding payments can be challenging.

In this article, we review the top payment processors you can choose from and list the criteria we used to evaluate them. We’ll begin by first looking at the qualities you must look for in a payment processor.

Want to skip ahead and read our reviews of the 6 top payment processors? Click the links below:

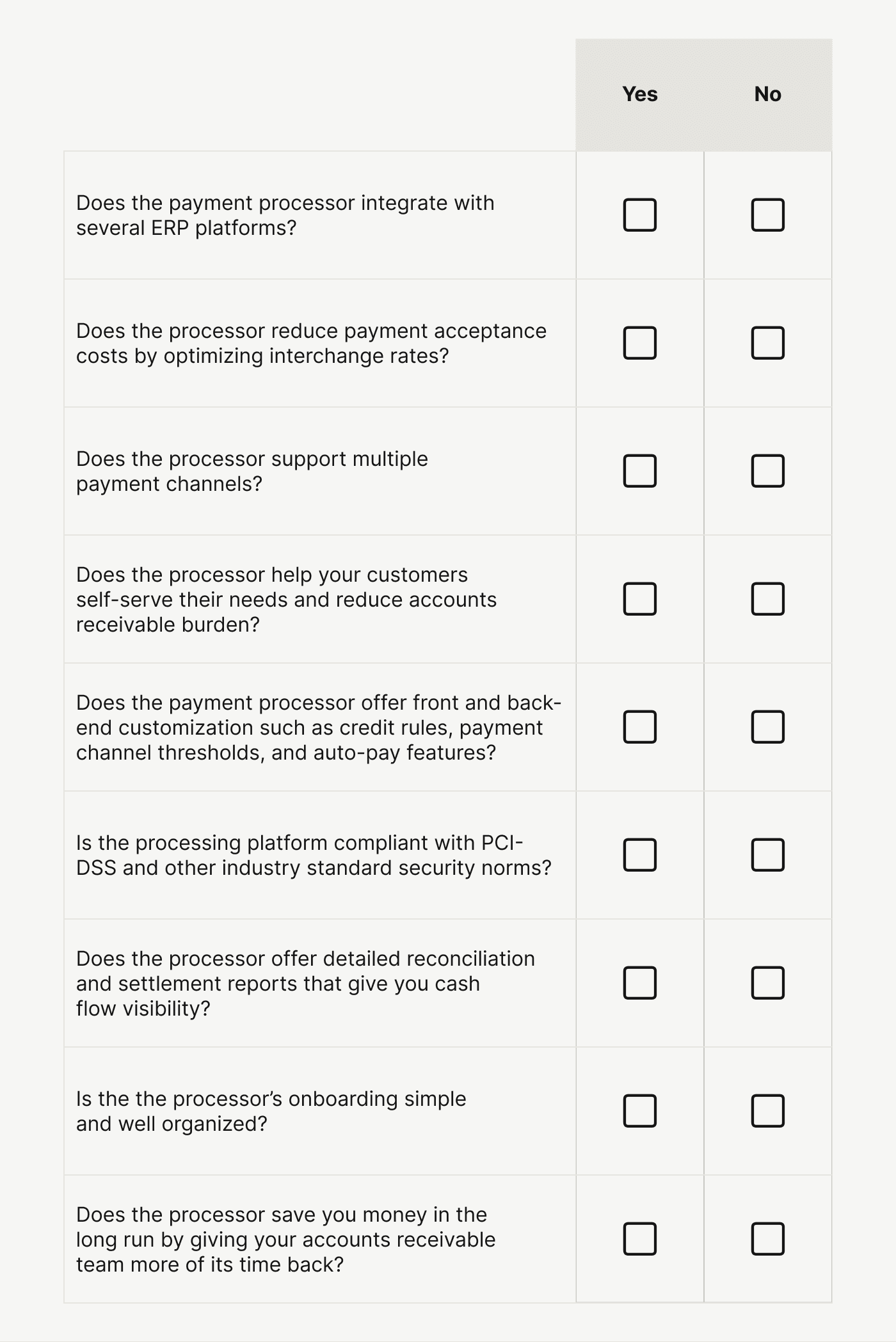

9 qualities of a top payment processor [checklist included]

Not every payment processor is alike. While every processor helps you accept payments, their additional services simplify reporting and other tasks connected to maintaining your payment workflows. Here are the most important qualities you must look for in a payment processor.

ERP payment processing

Offers interchange optimization

Supports multiple payment channels

Enables self-service

Offers deep customization

Offers high level of security

Simplifies bank reconciliation and reporting

Offers simple onboarding

Saves you money

1. ERP payment processing

ERP systems often do not reflect a company's true financial position because of a lack of real-time syncs with payment capture systems.

Modern finance teams cannot afford to waste time downloading and uploading payment data to ERPs. Given the finance talent shortage and the range of automation options available, using manual processes for clerical tasks will set your business behind.

Look for payment processors that integrate with your ERP systems, whether legacy or modern. Native integrations with Netsuite, Intacct, QuickBooks, and Microsoft Dynamics ensure cash automatically finds its way to your books under the right journal entries.

ERP integrations also help you send invoices within those systems, streamlining invoice creation and collection workflows. For instance, ESA reduced past due invoices by 73% in three months after integrating payments directly into Netsuite.

2. Offers interchange optimization

Interchange fees, or the fees card networks charge you when customers pay by card, can seem prohibitive enough to dissuade you from offering customers the option to pay by card. The good news is that your payment processor can help you lower your credit card processing fees, often by up to 40%, through interchange optimization.

Here's how it works.

Every card transaction carries data related to the payment, such as the customer's card information, bank account details, merchant details, etc. The more data your payment processor collects and passes onto the card network and the customer's bank, the lower your interchange fees are.

Processors that collect data tagged as "Level 2" or "Level 3" generate lower interchange fees for their customers. L2/L3 data offers banks more context behind a transaction, reducing the risk of fraud and a subsequent investigation.

By passing on this data, your payment processor proves they have robust security measures to process and guard sensitive data. They also prove their sensitivity to your needs and commitment to helping you keep as much of your cash as possible.

3. Supports multiple payment channels

You need ample support from your payment processor to offer multiple payment channels. Supporting several payment channels is costly and needs dedicated infrastructure. A high-quality payment processor offers several channels from which you can accept payments and regularly updates them to ensure its infrastructure remains compliant.

Look for a payment processor that offers the following payment channels at a minimum:

Automated Clearing House (ACH)

Card payments (Debit, credit, charge, virtual cards)

Wire transfers

eChecks

Cash and paper checks

A good payment processor supports different payment situations, such as payments by phone, through a point-of-sale (POS) machine, card-not-present scenarios, online payments, etc.

For instance, thanks to Versapay, Wurth Canada's sales reps collect paper checks, scan them using an app, and automatically post them to open invoices. Wurth's customers face zero disruption while its AR team spends 75% less time processing checks.

4. Enables self-service

While a good processor ensures your customers' payments go through successfully, the degree of transparency and data a processor offers around rejected payments is a mark of its quality. Visibility into payment statuses and rejection reason codes also reduces the burden on your accounts receivable team.

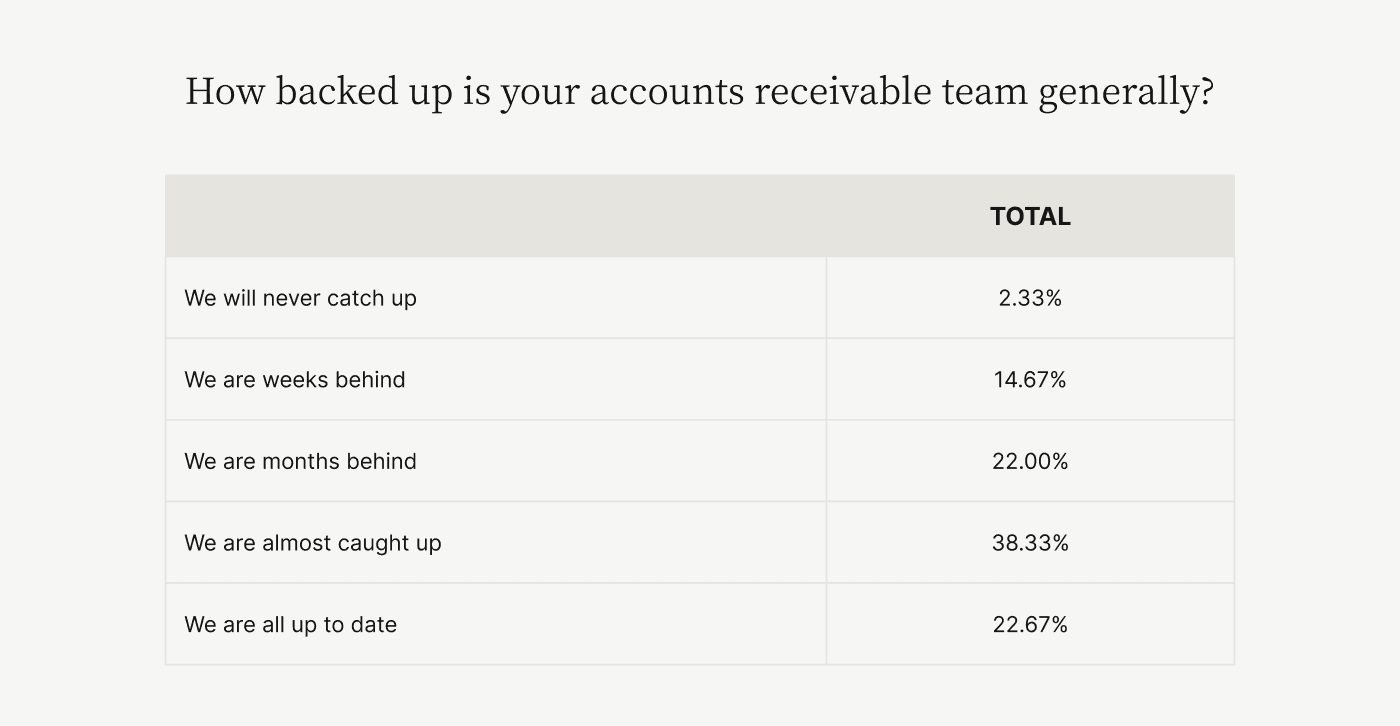

First, this data helps your team quickly check statuses and proactively address them if an error occurs. Second, your customers can view this data or receive automated alerts, removing any need for manual follow-ups with AR. In a world where accounts receivable is already backed up, self-service is the best way to reduce backlog and improve customer experiences.

5. Offers deep customization

A good processor helps you customize front and backend payment workflows. For instance, you can limit customer payments above a certain amount to specific channels like wire transfers to avoid excessive processing fees or transfer limits.

Look for processors who help you define customer credit limits, enable partial invoice payment, and offer configuration around payment plans and recurring billing.

Companies often encounter high processing costs when accepting large payments. A good processor can help you minimize this by helping you incorporate credit card surcharging. It will also help you navigate compliance laws surrounding surcharging to keep you safe.

Lastly, look for processors offering flexible settlement routing. When accepting payments from a single merchant on behalf of subsidiaries, posting cash to the right invoices and routing it to the correct accounts can be challenging. Flexible settlement routing automates this process, helping you post cash quickly and update invoice statuses for customer visibility.

6. Offers high levels of security

Payments come loaded with sensitive data, making security paramount. Security becomes even more important if your processor collects L2/L3 data for interchange optimization. Here are critical security features to look out for when evaluating processors:

Tokenization — Tokenization helps you save cardholder data but obscures it from anyone but the customer's view. This helps you offer one-click payments with maximum security.

PCI-DSS compliance — The card industry enforces PCI security levels based on transaction volumes. All good payment processors adhere to the highest level of compliance to protect consumer data and you from malicious actors.

Compliance reports — Good payment processors offer reports and analytics that help you understand payment volumes, their origin, and the conditions that indicate a likely fraudulent payment. This data helps you improve your processes and design new rules to limit fraud.

7. Simplifies bank reconciliation and reporting

Transaction settlement reports are the plumbing in your payments system. They tell you how much you processed, what fees you paid, and how much has landed in your bank.

Compiling these reconciliation reports needs a good deal of organizational expertise on your payment processor's part. It must identify and track all transactions in real time and locate every cent passing through its system. Settlement reports from top payment processors help you centralize all your payment channels and prevent you from chasing files from obscure portions of your system.

8. Offers simple onboarding no matter your use case

Simple and fast onboarding is a sign of an experienced payment processor with strong banking relationships. An inefficient processor will lack the compliance know-how to onboard merchants quickly onto its system, delaying implementation times. In contrast, an experienced processor or payment facilitator (called a PayFac) will collect the right documents, establish robust underwriting processes that satisfy its bank partners, and onboard you to a sub-account quickly.

For instance, Versapay works with Fifth Third Bank, onboarding customers to merchant sub-accounts. This ensures speedy onboarding and compliance in line with the bank's standards.

In addition, we work with Worldpay to manage the flow of funds and settle transactions to the merchant's bank account. The result is fast and always compliant payment acceptance capabilities for our customers.

9. Saves you money

Lastly, a good payment processor saves you money.

From lower processing fees to interchange optimization, good processors go above and beyond to help you reduce expenses and keep more cash on your books. Note that savings also occur in terms of time. A good processor will automate tedious manual tasks helping you run lean teams at reduced expense.

For instance, RPC cleared $600,000 worth of unpaid invoices thanks to offering its customers convenient payment channels while ESA reduced past-due invoice volumes by 73% thanks to streamlined collections.

6 top payment processors reviewed

Here are 6 of the best payment processors you can choose from right now. Let's review them one-by-one:

Paystand

Braintree by PayPal

Paypal

EBizCharge

Stripe

Versapay

1. Paystand

Paystand is one of the leading payment processors targeting business-to-business (B2B) companies. Per its latest releases, Paystand has over 170,000 companies transacting on its network. With features like ERP integrations, click-to-pay ability, and recurring payment functionality, B2B companies have much to like about Paystand.

It does have a few shortcomings. Paystand does not optimize interchange or support enhanced security measures like single sign-on (SSO). The platform also does not cater well to eCommerce scaling, with a lack of token migrations posing an issue. Overall, Paystand is an excellent choice, with most users reporting fast implementation and robust ERP integration.

2. Braintree by PayPal

Braintree is rapidly gaining market share, and most companies will have run into it at some point. The company promises white-glove service for B2B customers and boasts a platform that caters to international payments.

While Braintree benefits from PayPal's backing and includes almost every desirable function, its users complain of poor customer support. Merchant fraud handling calls are directed to PayPal support, which does not handle Braintree issues.

As a result, several merchants report high levels of card-not-present decline statuses without adequate explanation. Despite these flaws, Braintree offers deep reconciliation reports that plug into your cash flow analysis easily, making it a good choice for companies looking to diversify their payment processing choices.

3. PayPal

One of the oldest processors around, PayPal benefits from its years of experience in the market. It offers every desirable feature a company needs, such as credit management, easy integration, and top-notch customer experience.

PayPal does face issues concerning merchant support and an opaque decision process. Merchants complain of arbitrary accounts and payout holds without explanation or the possibility of verifying.

Accounts experiencing seasonal variations in sales will likely run into these issues since PayPal will likely freeze withdrawals citing transaction anomalies. Despite these issues, companies getting started with online payment processing will find PayPal an easy choice to work with and build trust with their customers.

4. EBizCharge

EbizCharge is a popular integrated payments provider, offering companies the ability to bill from their ERPs. Its powerful range of integrations makes it a perfect choice for mid-to-large B2B companies looking to accept payments online and offline.

Despite great reviews, EBizCharge does have some shortcomings. For one, it does not offer interchange optimization and this increases costs in the long run. It also does not offer SSO for logins, something that detracts from its viability for large organizations.

Overall, EBizCharge is a great option with fast implementation times. However, the lack of a few key features increases costs in the long run.

5. Stripe

Stripe is the biggest name of them all in the payment processing world. And like any big company, it has several positives with a few negatives that emerge due to size. For instance, Stripe offers deep integration ability and easy implementation.

The platform offers a range of developer tools that aid customization. However, its compliance mechanisms are automated, and this means merchants can fall on Stripe's wrong side without warning. Merchants complain of arbitrary fund holds and account withdrawal restrictions.

Overall, Stripe is a good choice for businesses getting started with payment processing that need a trusted name to boost customer adoption.

6. Versapay

Versapay is an accounts receivable automation platform that includes robust payment processing abilities. Critically, Versapay is a PayFac, ensuring smooth onboarding no matter how complex your payment use case is.

Our platform captures L2/L3 data and reduces your interchange in the long run, generating cost savings above low processing fees. Versapay's team has deep integration expertise, having worked with a range of companies in wholesale manufacturing, realty, logistics, and other mid-sized B2B sectors.

For instance, Versapay's automation helped TireHub save over 200 hours a week by overhauling its payment experience. In addition, the company reduced the value of outstanding receivables by half and increased payment automation by 400%.

Other key features of Versapay's payment processing platform are:

Surcharging

Native ERP integrations

Recurring billing support

Single sign-on

Self-service customer portal

—

Your choice of payment processor is critical as you scale. A good payment processor enhances customer experience and helps you build customer trust. Learn more about how Versapay’s payment processing software can help you boost cash flow and reduce costs while running lean AR teams.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.