Unlocking Greater Lockbox Processing Efficiency With Automated Cash Application

- 10 min read

Learn why lockbox banking fails at scale and how cash application automation unlocks and enhances lockbox banking efficiency.

Every growing business uses lockbox banking at some point. It is the easiest way to upgrade accounts receivable processing thanks to cost savings and the time it gives your finance team to execute more valuable work.

However, something ironic happens when you use lockbox banking at scale: companies again deal with the same issues lockbox banking was supposed to eliminate. Namely, their receivables teams once more spend too much time executing clerical work, leaving them with a muddy cash flow picture.

In this article, we explore why these issues seemingly never go away and examine why automated cash application solves this lockbox processing mess.

Table of contents

3 reasons why lockbox banking fails at scale

Lockbox banking delivers immense benefits—like easier reconciliation, reduced workloads, and better data security—when companies first switch to it. But the processes underpinning lockbox banking often fail at scale, creating the very problems companies tried avoiding in the first place.

Here are three reasons why lockbox banking does not solve check processing issues at scale:

1) It does not reduce reduce errors

2) It does not free up accounts receivable’s time

3) It does not speed up processing times

1. Lockbox banking does not reduce errors

Potential time savings are a big reason companies switch to lockbox banking. While it saves time at smaller processing volumes, the manual workflows underlying lockbox check processing fall apart at scale. Lockbox banking at most companies often relies on manual data entry carried out by the bank's employees.

As invoice volumes scale, key-in entry errors compound, creating additional processing costs—a major disadvantage of the lockbox system.

Sara French, Treasury Manager at Madison Resources, has first-hand experience of this issue. "[The bank] was making key entry errors that were costing us," she says. "We would have a fee for every error they [made]. The high fee of utilizing their service just wasn't working out for us."

In short, you can expect data- and key-in entry errors (and lockbox key-in fees) to scale with your processing volumes when lockbox banking relies on manual workflows.

2. Lockbox banking does not free up accounts receivable’s time

Lockbox banking initially frees up accounts receivable’s time from collecting and depositing checks. But, a different set of disadvantages crop up at scale, creating a time sink for AR.

Batch files delivered by the bank often lack context, pushing accounts receivable to manually scan information, match payments to open invoices, and apply cash. Forrester Research's report into the Total Economic Impact™ of Versapay Cash Application highlighted the issues caused by payment complexity.

The report states, "Interviewees’ organizations also faced challenges with other accounts receivable processes, such as the need for manual input of lockbox information and difficulties in handling electronic payments with uncoupled remittances."

No matter how much time lockbox banking initially saves you, it eventually starves your receivables team of time thanks to a different set of issues at scale.This reduces the efficiency of lockbox banking for accounts receivable.

3. Lockbox banking does not speed up processing times

While lockbox banking initially delivers time savings, it does not necessarily speed up invoice processing times. The batched remittance advice banks send you are disconnected from internal reporting—pushing accounts receivable to manually match and apply cash.

At scale, matching batch files to collections data quickly gets out of hand due to errors during the reconciliation process, as Würth Canada discovered. Michael Malone, Credit Manager and Company Compliance Officer for Würth Canada says solving exceptions in reconciliation ended up taking more time than anticipated.

"We did try using bank lockbox services, but that ended up taking up more time than it saved," he says. "While we could get the money into the bank more easily, reconciliation proved more difficult. The number of exceptions generated more work to reconcile than the entire job would take in the first place.”

In short, longer processing times generate more expenses than the money lockbox banking saves. As a result, lockbox check processing becomes inefficient, slowing down cash application.

5 ways cash application automation unlocks lockbox banking efficiency

So, how can you solve the problems we've listed above? Most companies add headcount, thinking more bodies is the solution. But adding more headcount has diminishing returns. At some point, your lockbox check processing workflows will become too complex for manual processing, creating a never-ending time sink.

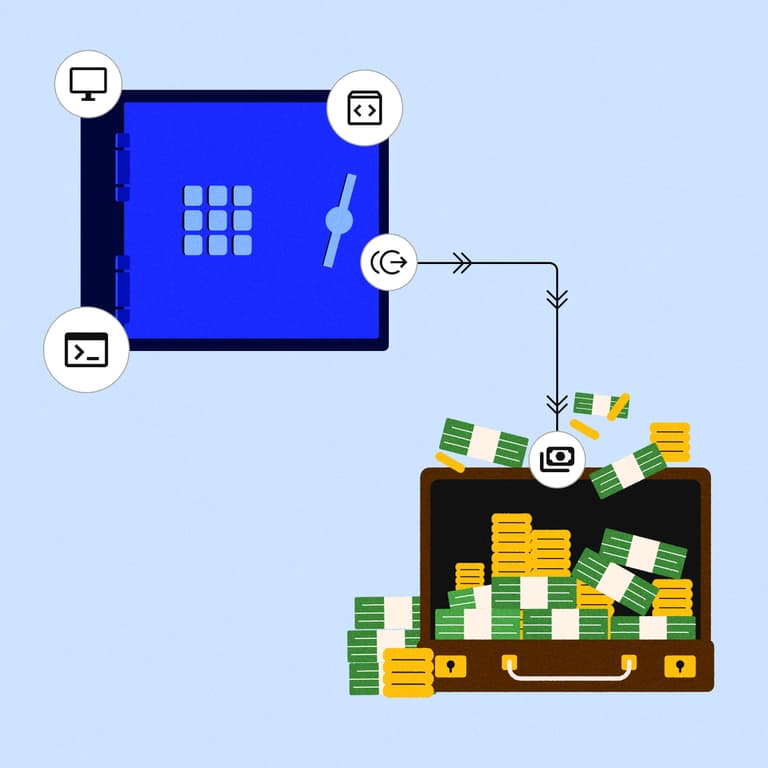

Cash application automation—software that automates large portions of your cash application process—helps you maintain accounts receivable efficiency at scale without adding headcount. It solves every issue lockbox banking presents, helping you automate lockbox processing.

Here are five ways how:

1) It automates matching

2) It eliminates errors

3) It delivers memorable customer experiences

4) It reduces payment processing costs

5) It centralizes accounts receivable data

1. Automates matching

Cash application automation solutions use advanced technology like AI and optical character recognition (OCR) to match payment remittance advice to open invoices. This means your collections or cash application team focuses on dealing only with exceptions, not the entire payment batch.

For instance, if your lockbox batch remittance report has several instances of customers making single payments toward multiple invoices, OCR automates matching and flags instances where data might be missing. Versapay Cash Application—for instance—flags unmatched invoices automatically, helping your AR team use its time efficiently while cash reaches your books faster.

Forrester's report highlights an example of this efficiency. "Soon after going live [with Versapay Cash Application], we had a 74% auto-matching rate, and it took me 22 minutes to validate 26 transactions," says an accountant at a custom fabrication firm. "One day later, we had a 78% auto-matching rate, and it took me 5 minutes and 43 seconds to validate 37 transactions. Three weeks later, we had our first day of 100% matching, where we didn’t have to manually touch any transactions.”

The benefits don't end there.

2. Eliminates errors

We quoted Madison Resources' Sara French earlier about data entry errors in lockbox batch reports creating more costs for her team. After automating cash application, Madison Resources realized the benefits of machines avoiding fatigue and needless errors.

French mentions this has led to more staffing efficiency. "Because of less time spent manually processing payments, we’ve been able to focus on more strategic work and do more with the same—or even fewer—staff because we haven’t had to replace outgoing staff in some instances," she says.

Automation has helped Madison Resources increase lockbox banking efficiency, avoid overburdening the collections team, and function optimally. It will likely do the same for your accounts receivable team.

3. Delivers memorable customer experiences

Errors emerging from lockbox banking services can harm CX. For example, a customer inquiring about account statuses or a missed payment application must wait while AR scrambles to find proof. Your company will appear disjointed and disorganized, leaving a negative impression on customers. (Worse, you might mistakenly place a credit hold on a customer, thinking they’ve not paid due to having not correctly or swiftly applied their payment.)

"Consider what constitutes the heart of great customer experience," Doug Hathaway, Versapay's VP of Engineering and Founder of Dade Systems, says. "Great CX is simple at its core—it involves presenting a human face to your customers.”

And ironically, machines can help your AR team become more human. "AI helps accounts receivable focus on solving complex customer issues that require empathy, imagination, and creativity, while AI handles document-heavy and time-consuming manual tasks like cash application," Doug explains.

AI can take over rote tasks in your lockbox banking processes, freeing up your AR team to deliver memorable CX. You won't find yourself at square one when invoice volumes scale.

4. Reduces payment processing costs

One beneficial side-effect of reducing payment processing times is lower costs: cash comes onto your books faster, reducing days sales outstanding (DSO). And as costs decrease, the ROI of cash application automation increases since your receivables team spends more time conducting value-added work instead of executing clerical tasks.

Forrester Research's report quantifies the value companies gain from better cash posting efficiencies at $209,460 over three years. This number does not include the compounding effects of value-added work such as analyzing and removing cash flow bottlenecks.

In short, automated cash application delivers value far beyond cash posting efficiency and reduced expenses in lockbox banking processes. It also automates lockbox processing, reducing errors in the long-run.

5. Centralizes accounts receivable data

Data centralization is another highly desirable side-effect of adopting automated cash application. These platforms automatically centralize AR data, giving your team instant—and highly accessible—digital audit trails. The result is speedy customer query resolution and lockbox banking efficiency.

Würth Canada's Malone, whose experiences we highlighted earlier in this article, explains centralization's impact on his organization. "Data is no longer siloed from the bank to our enterprise resource planning (ERP) system," he says. "Now, everything is consolidated in one system that’s more easily accessible by a wider variety of staff so we can more efficiently resolve customer inquiries—and ultimately provide a better customer experience.”

Malone also notes that Würth's accounts receivable team can instantly recall every payment record to aid audits and customer dispute resolution.

Automation is the key to enhancing lockbox banking

Lockbox banking is a great solution for growing companies but brings significant issues to your accounts receivable department. Manual processes underlying lockbox banking are the primary drivers of these issues and automating cash application is the best way of preventing them from overwhelming you.

Curious about how AI and machine learning can increase match rates and reduce your DSO? Learn how Versapay's cash application software can help you achieve 90% straight-through processing rates.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.