[Checklists] Evaluate Accounts Receivable Automation Software Vendors

- 2 min read

Easily evaluate accounts receivable automation software vendors using these 12 checklists that define exactly what to look for to find a solution that best fits your needs.

Use these checklists to compare any vendor, across 60 different evaluation criteria.

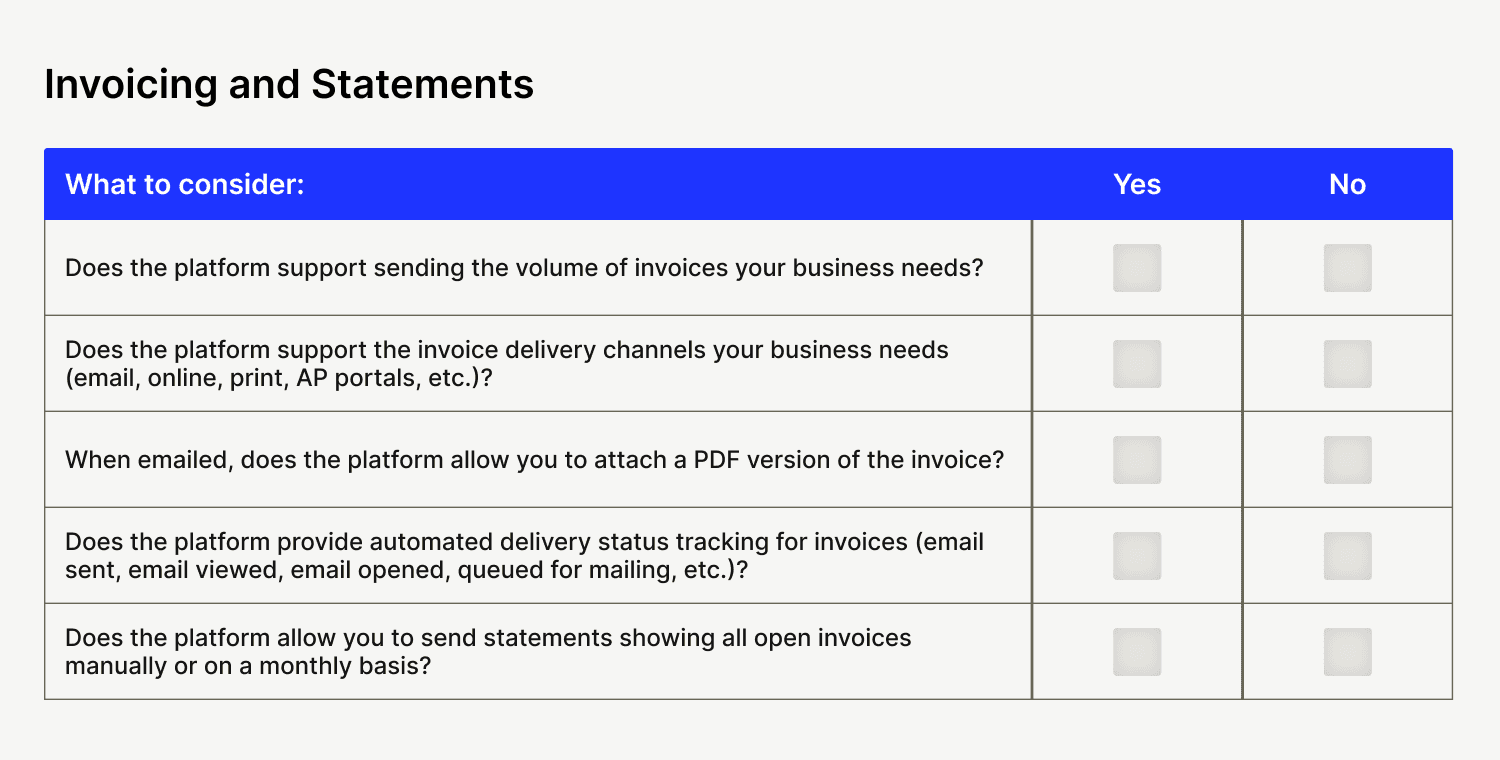

1. Invoicing and statements

Looking to automate invoice delivery across all channels? Here’s what you should look for:

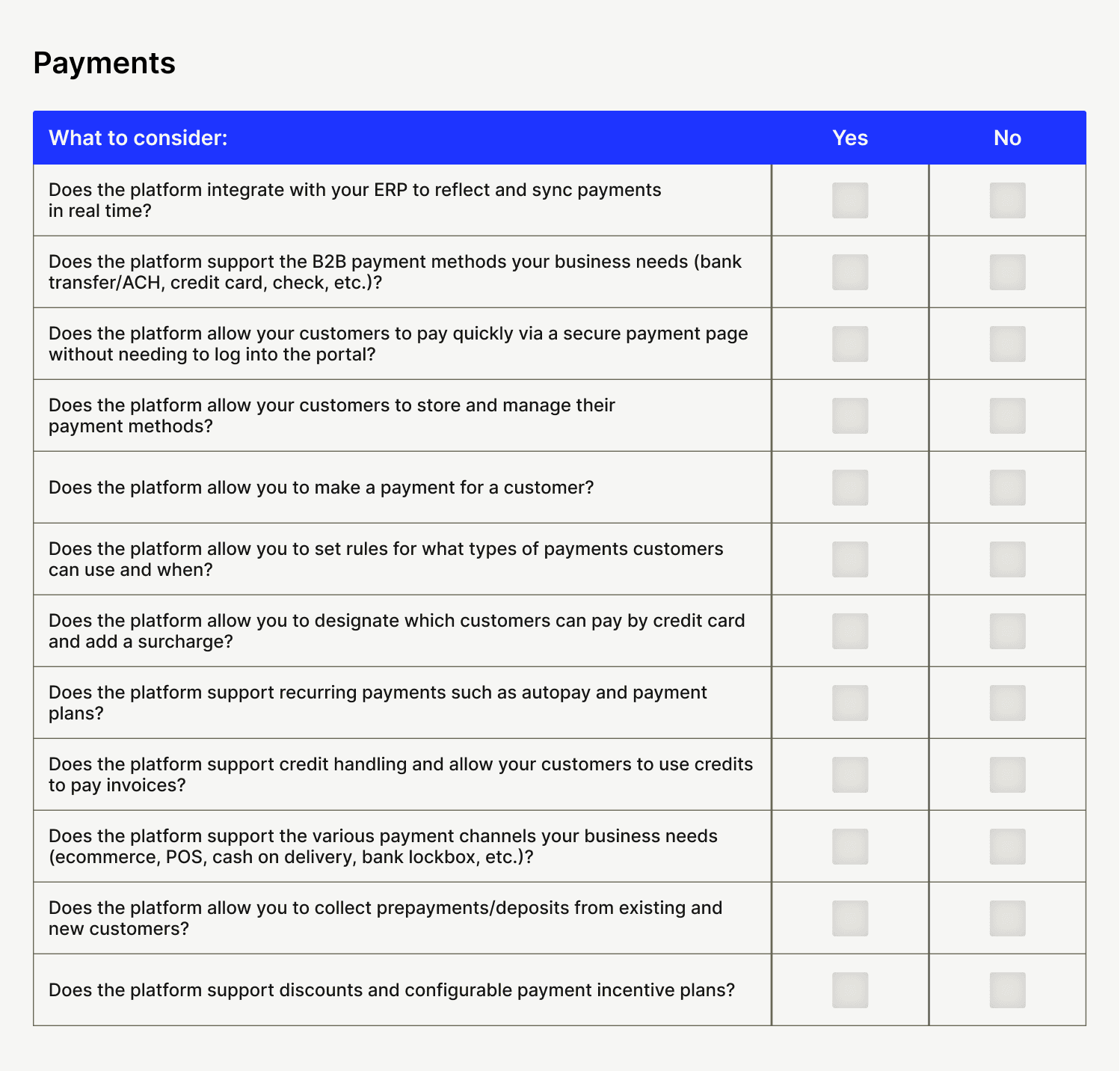

2. Payments

Looking to easily facilitate business-grade online payments and give your customers the convenient payment experience they expect? Here’s what you should look for:

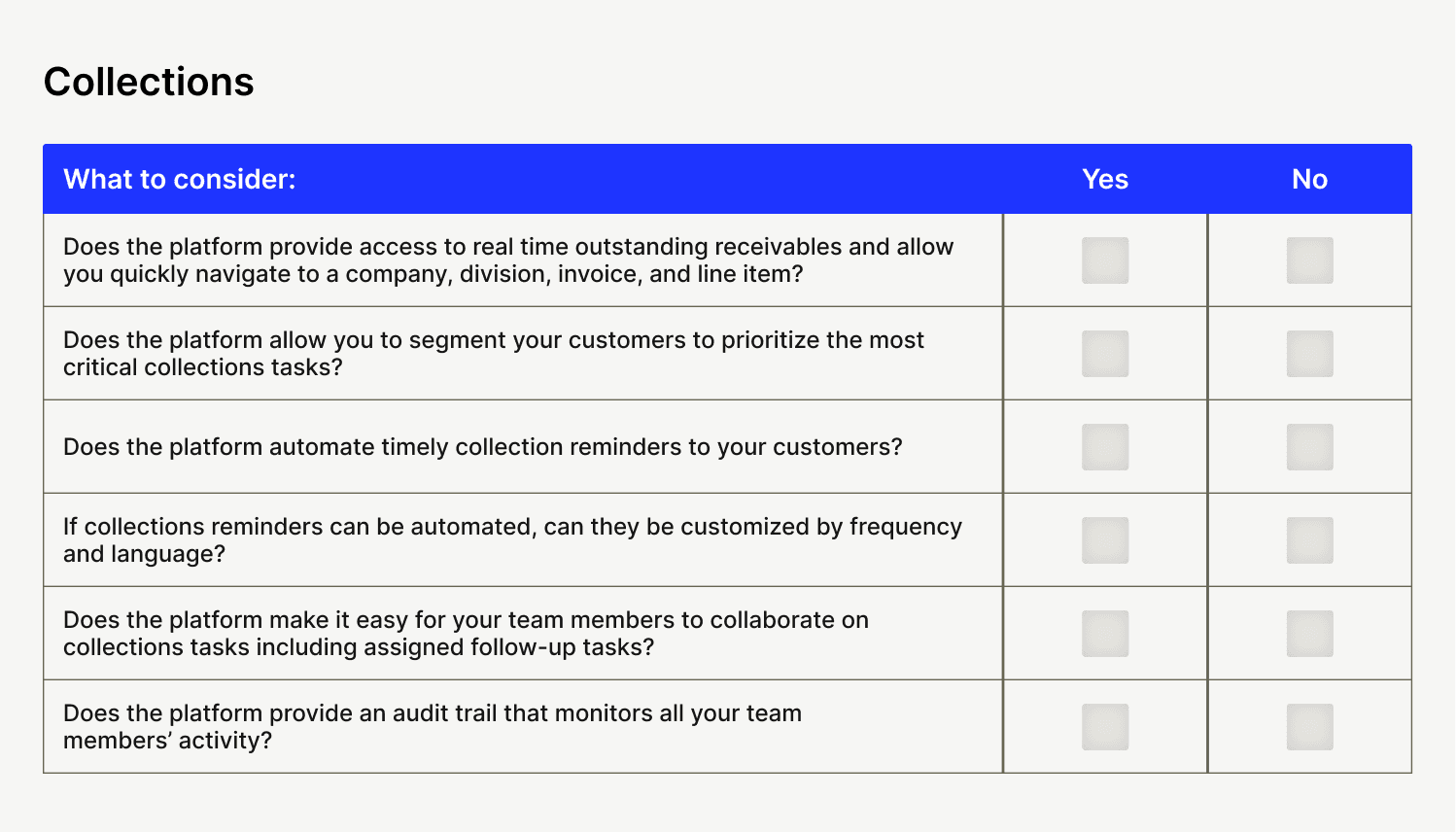

3. Collections

Looking to take the work out of accounts receivable collections? Here’s what you should look for:

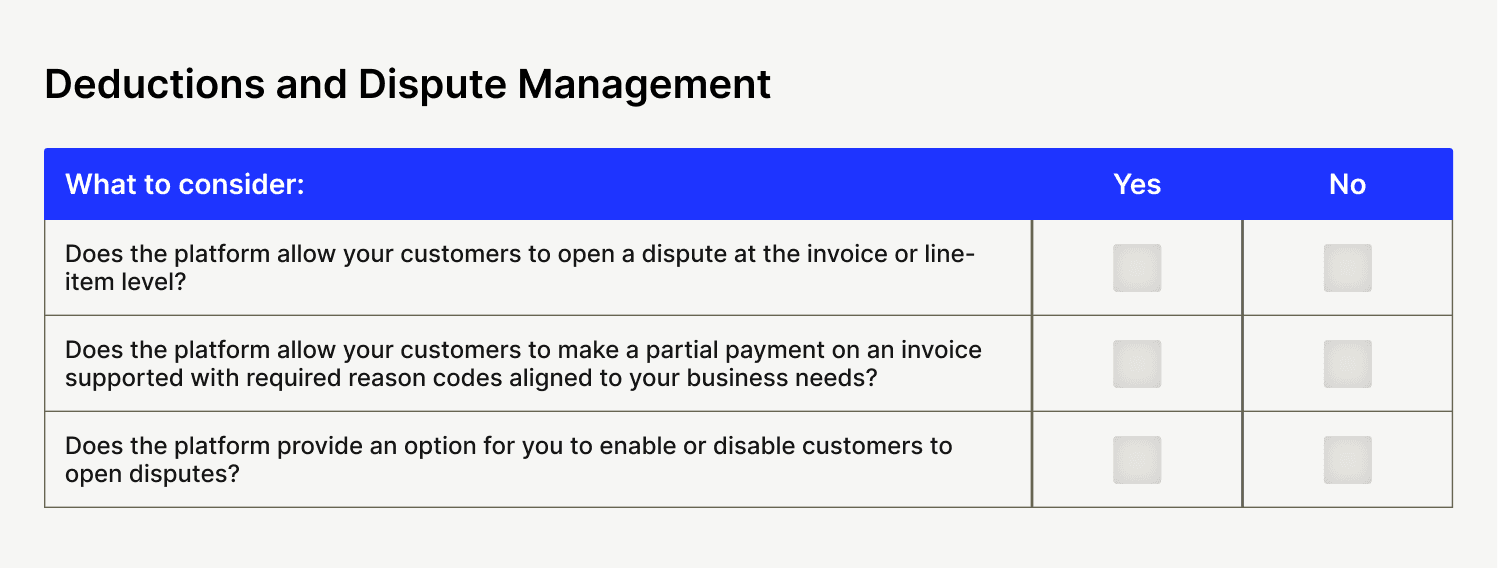

4. Deductions and dispute management

Looking to track, manage, and resolve disputes more efficiently and capture more revenue? Here’s what you should look for:

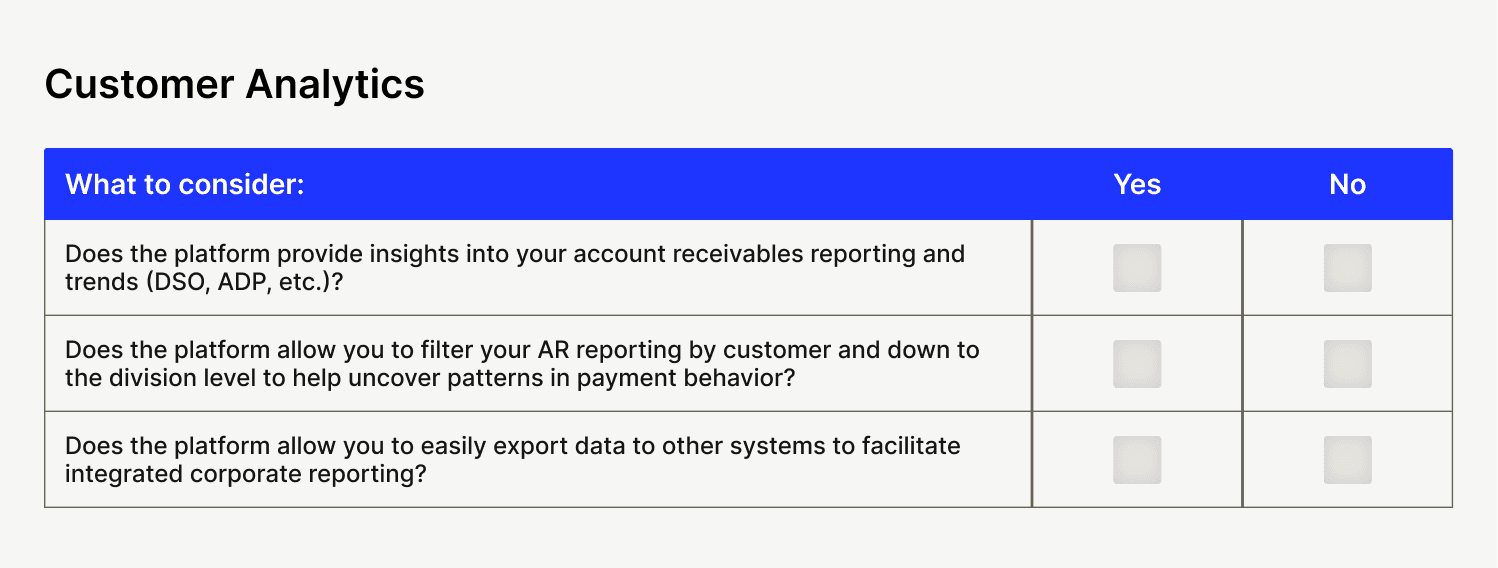

5. Customer analytics

Looking to understand your accounts receivable successes and performance and find new areas for improvement? Here’s what you should look for:

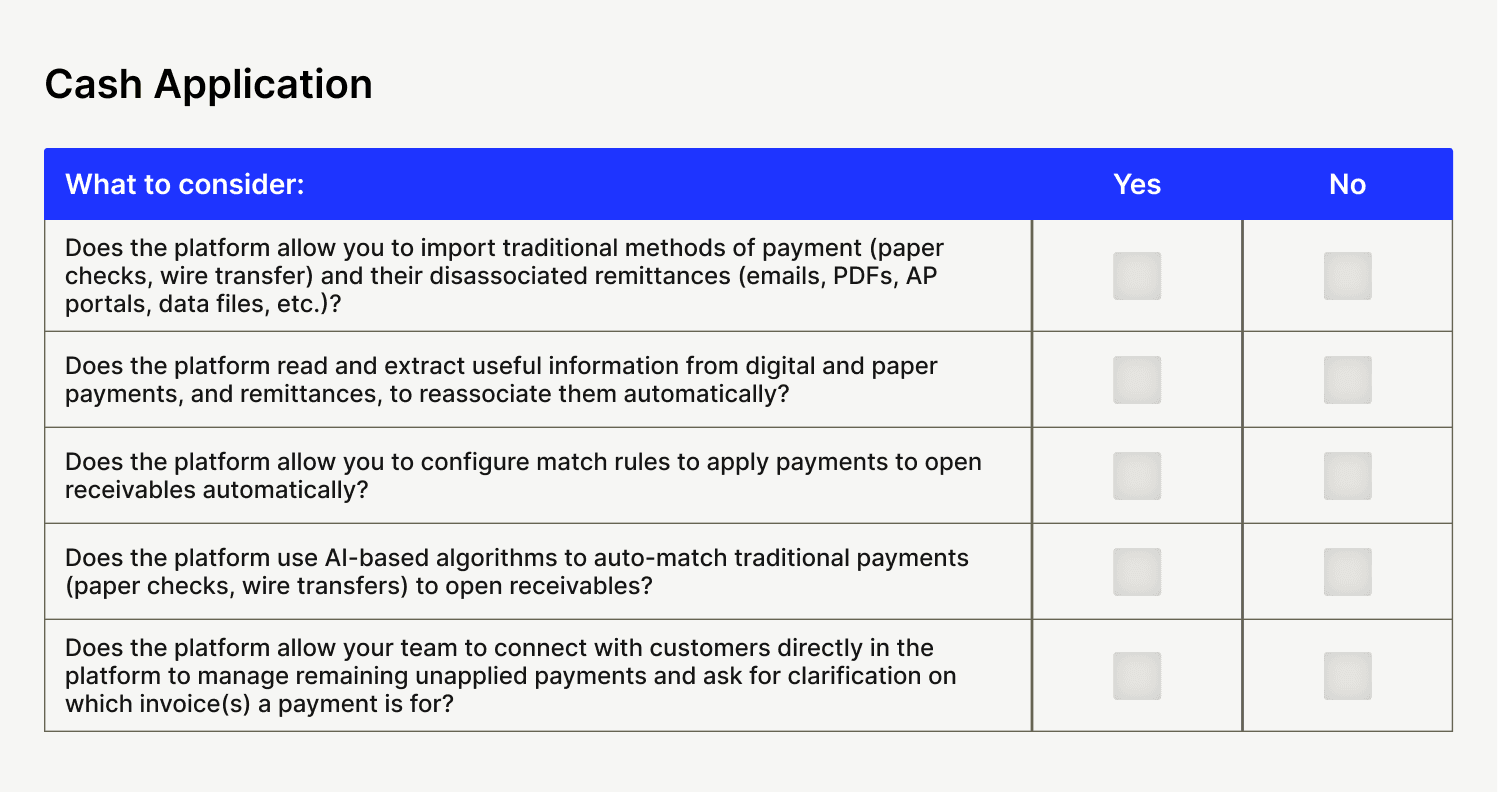

6. Cash application

Looking to automate your cash application process, easily capture and reconcile payment data, eliminate data entry errors, and speed up cash flow? Here’s what you should look for:

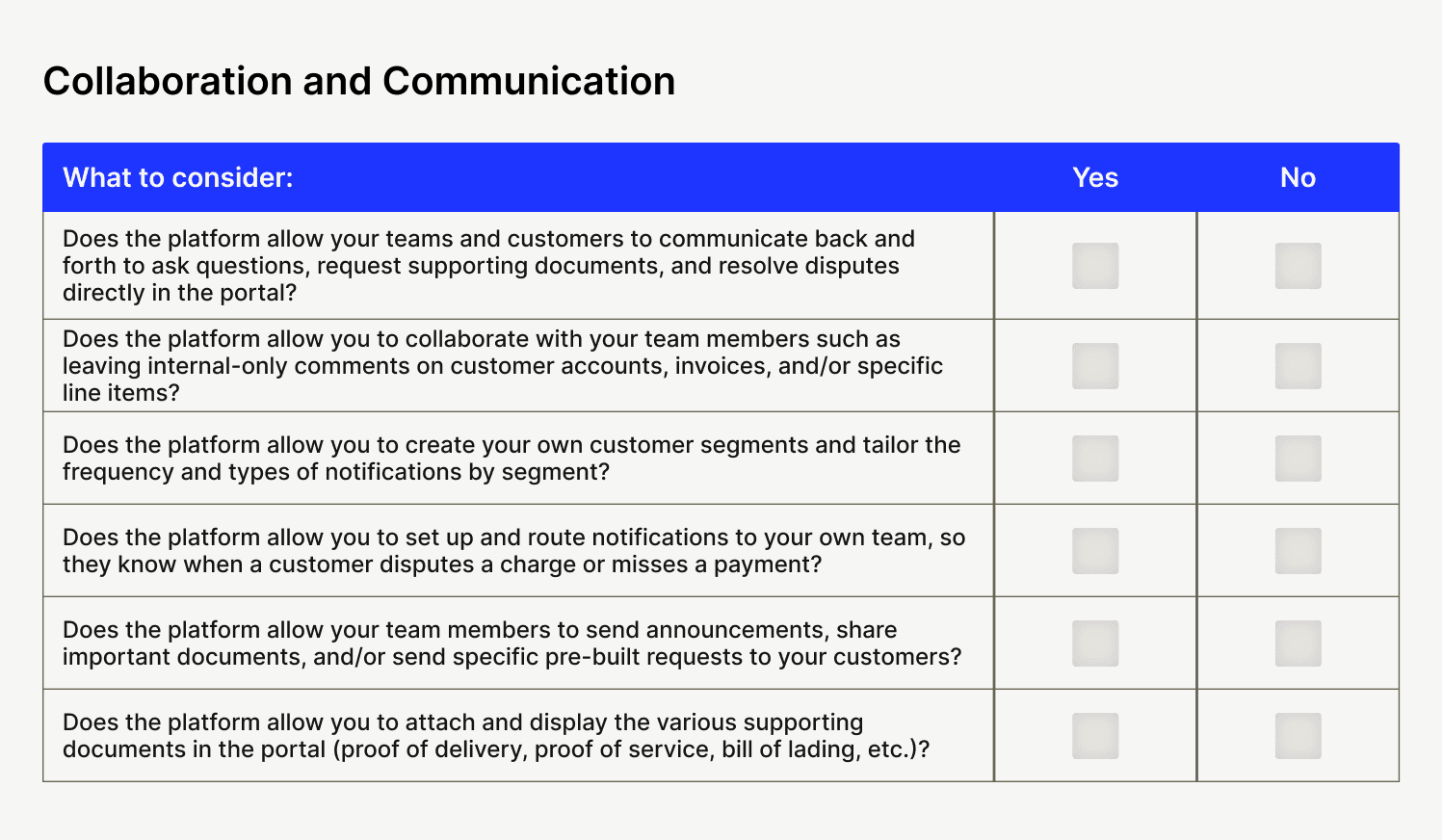

7. Collaboration and communication

Looking to engage your customers and work more collaboratively with them to accelerate payments and build extraordinary customer experiences? Here’s what you should look for:

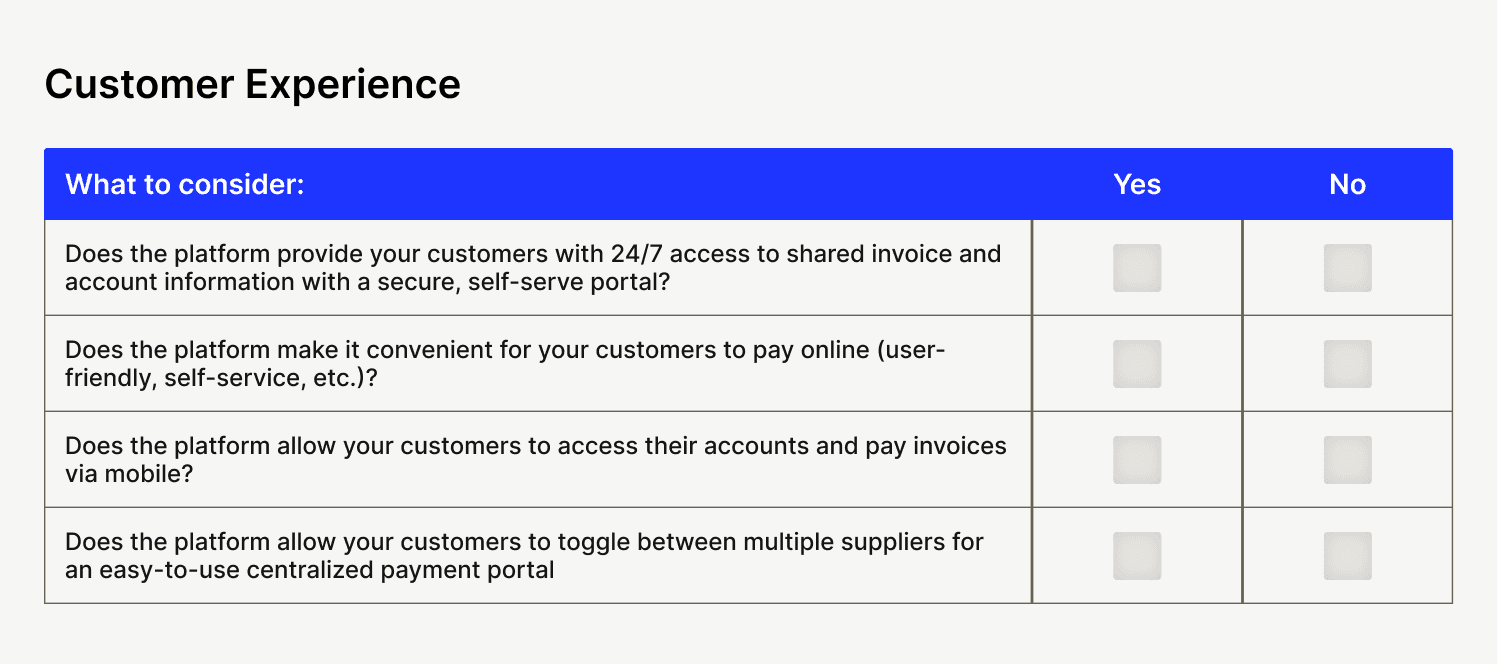

8. Customer experience

Looking to give your buyers better billing and payment experiences? Here’s what you should look for:

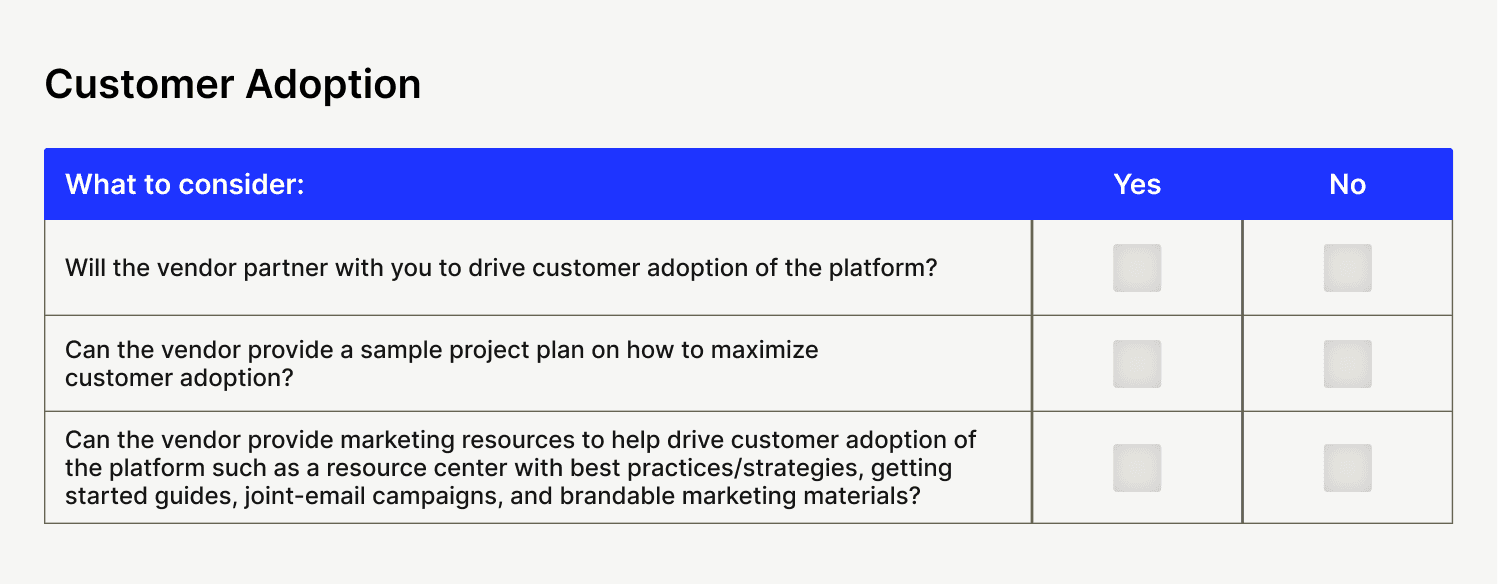

9. Customer adoption

Looking to implement an AR automation solution that’s actually used by your customers? Here’s what you should look for:

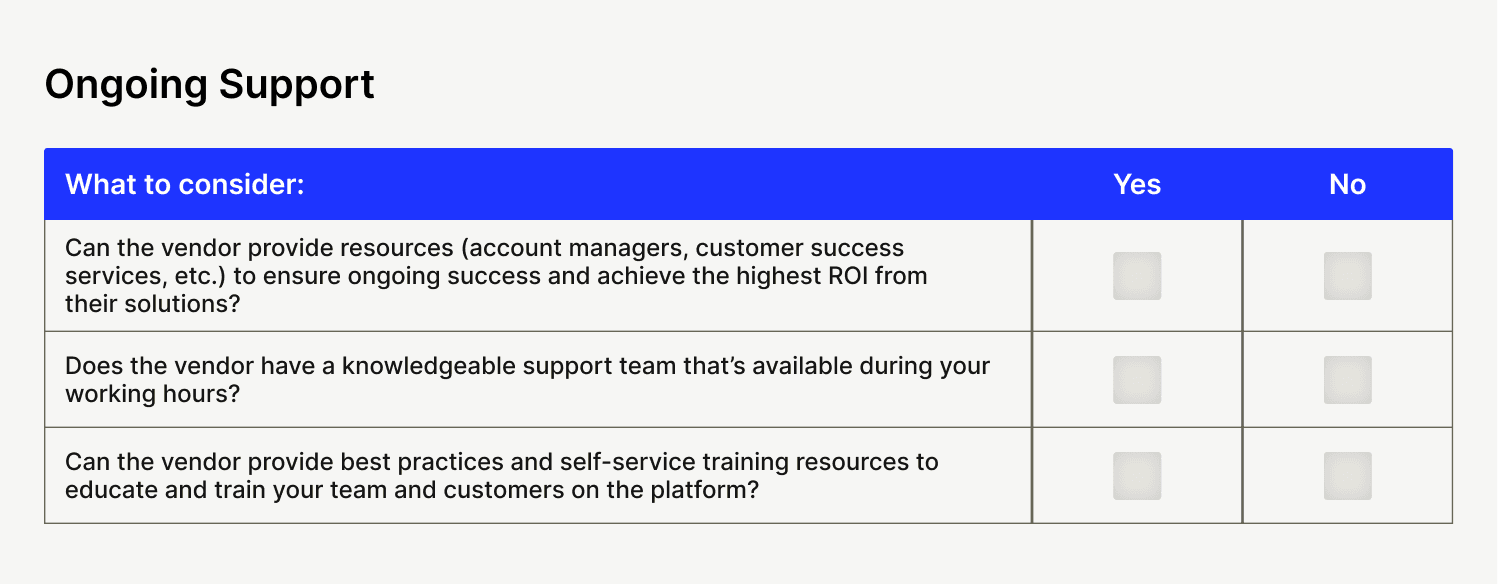

10. Ongoing support

Looking to partner with a vendor that’s committed to helping you successfully transform your accounts receivable? Here’s what you should look for:

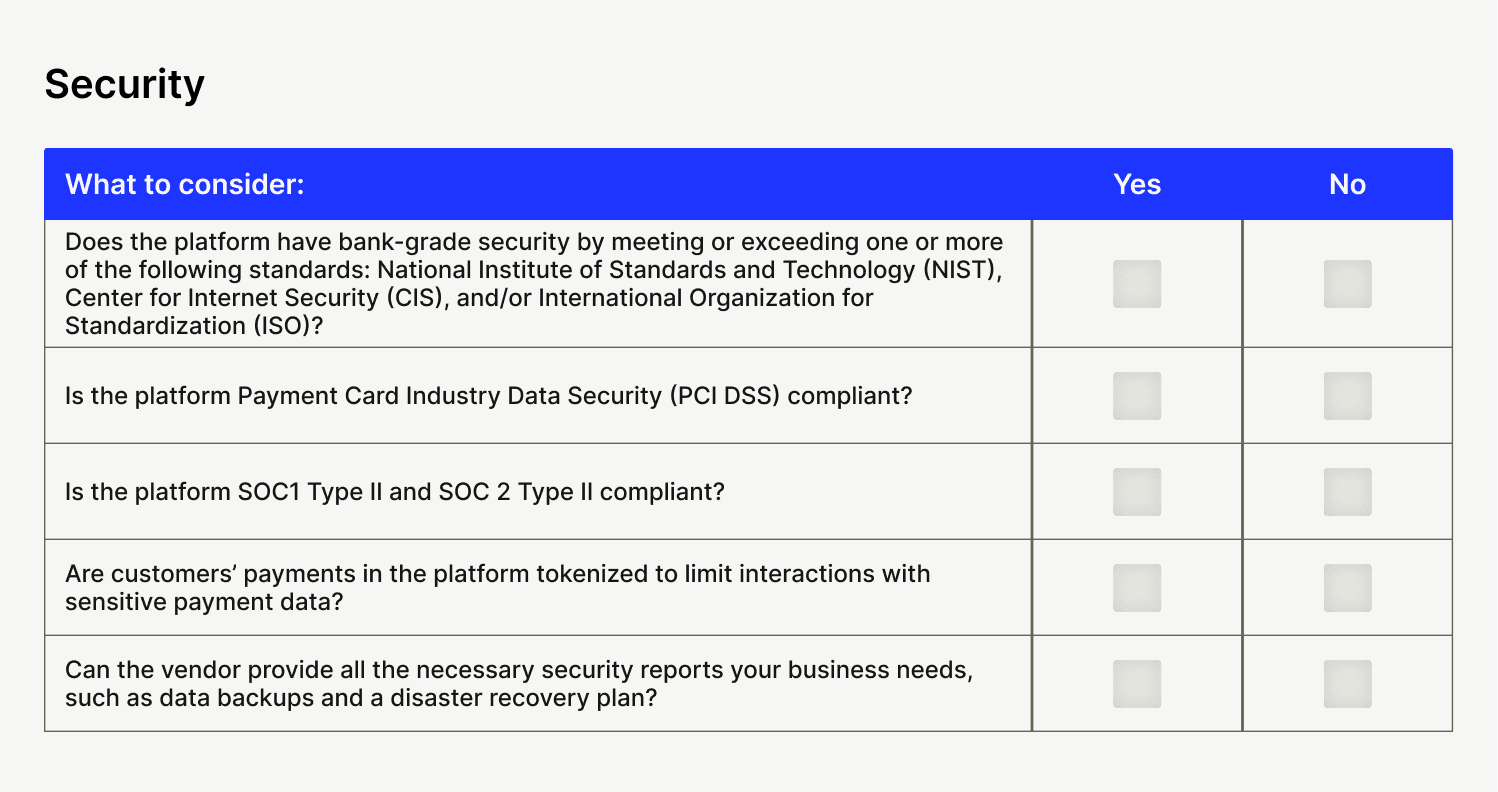

11. Security

Looking to partner with a vendor that takes security as seriously as it does automation? Here’s what you should look for:

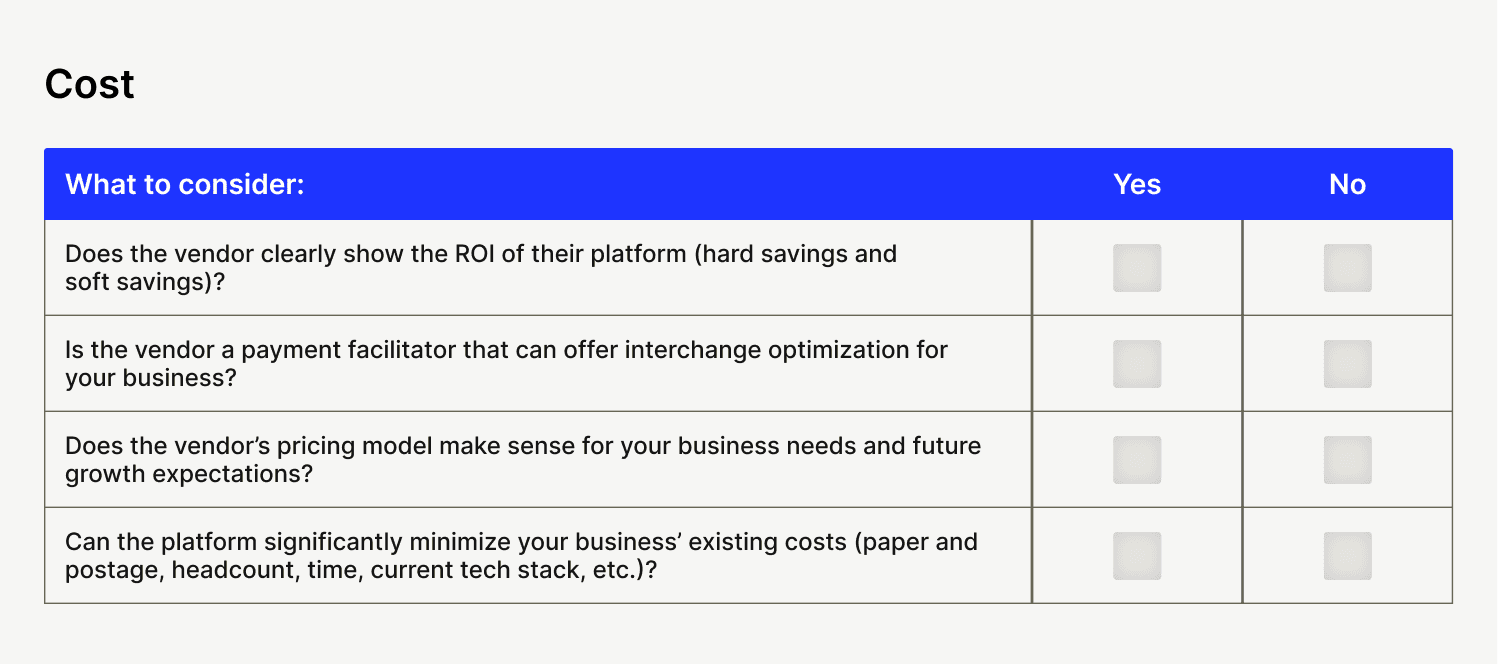

12. Cost

Looking for a solution that delivers substantial return on investment across the board? Here’s what you should look for:

—

Transforming your accounts receivable processes doesn't have to be difficult. Get your copy of our guide, How to Choose Accounts Receivable Automation Software, and:

- Learn what accounts receivable automation software is (and why you need it)

- Explore the challenges with manual accounts receivable collections

- Learn the benefits of accounts receivable automation software

- Discover how to evaluate accounts receivable automation software